Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Comstock Mining Inc. | v236954_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Comstock Mining Inc. | v236954_ex99-1.htm |

COMSTOCK MINING REPORTS A 94% INCREASE IN

MEASURED, INDICATED AND INFERRED RESOURCES

Virginia City, NV (October 11, 2011) — Comstock Mining Inc. (“Comstock Mining” or the “Company”) (NYSE Amex: LODE) announced today the highlights of its third National Instrument 43-101 (NI 43-101) technical report (the “2011 Report”) authored by Behre Dolbear & Company (USA), Ltd. (“Behre Dolbear”), of Denver Colorado. The 2011 Report declared a mineral resource estimate for the Comstock Mine Project in Storey and Lyon Counties, Nevada, of Measured and Indicated Resources containing 1,780,000 gold equivalent ounces1, and an estimate of an Inferred Resource containing an additional 990,000 gold equivalent ounces. The total of 2,770,000 Measured, Indicated, and Inferred gold equivalent ounces is a 94% increase over the estimate reported in the Company’s previous NI 43-101 technical report, published in August 2010. The 2011 Report also includes an additional 200,000 gold equivalent ounces outside of the modeled area, in the Historical Resource Category.

|

COMSTOCK MINE PROJECT RESOURCE SUMMARY

|

||||||||||||||||||||

|

Tonsi

|

Au

(opt)

|

Ag

(opt)

|

Total Au

(ounces)

|

Total Ag

(ounces)

|

||||||||||||||||

|

Measured Resource

|

27,610,000 | 0.030 | 0.314 | 828,000 | 8,660,000 | |||||||||||||||

|

Indicated Resource

|

23,650,000 | 0.029 | 0.241 | 680,000 | 5,700,000 | |||||||||||||||

|

Total Measured and Indicated ii

|

51,260,000 | 0.029 | 0.280 | 1,508,000 | 14,360,000 | |||||||||||||||

|

Inferred Resource

|

33,580,000 | 0.026 | 0.179 | 881,000 | 6,030,000 | |||||||||||||||

|

|

i.

|

Resource total based on a gold cutoff of 0.007 ounces per ton

|

|

|

ii.

|

Rounding differences may occur

|

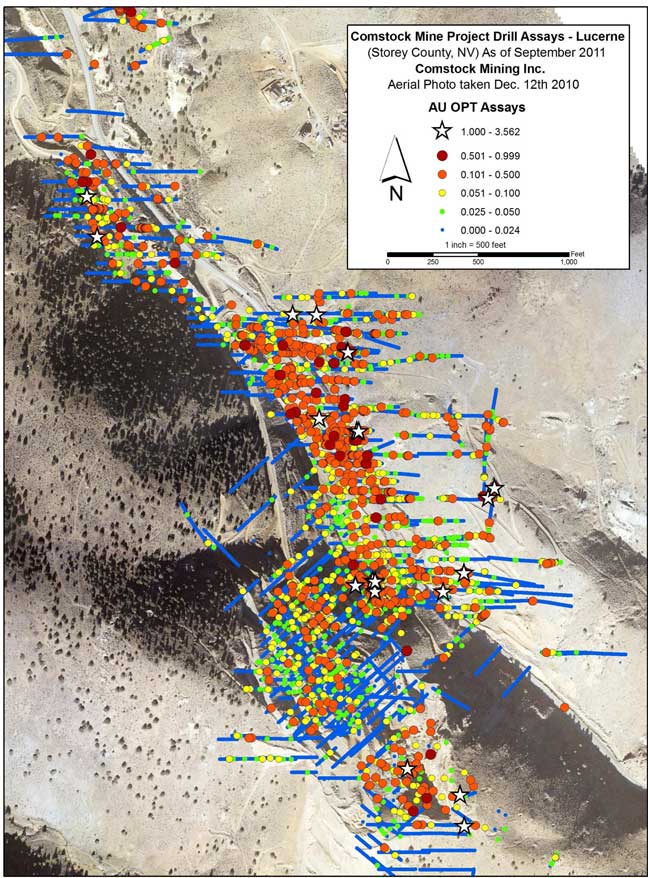

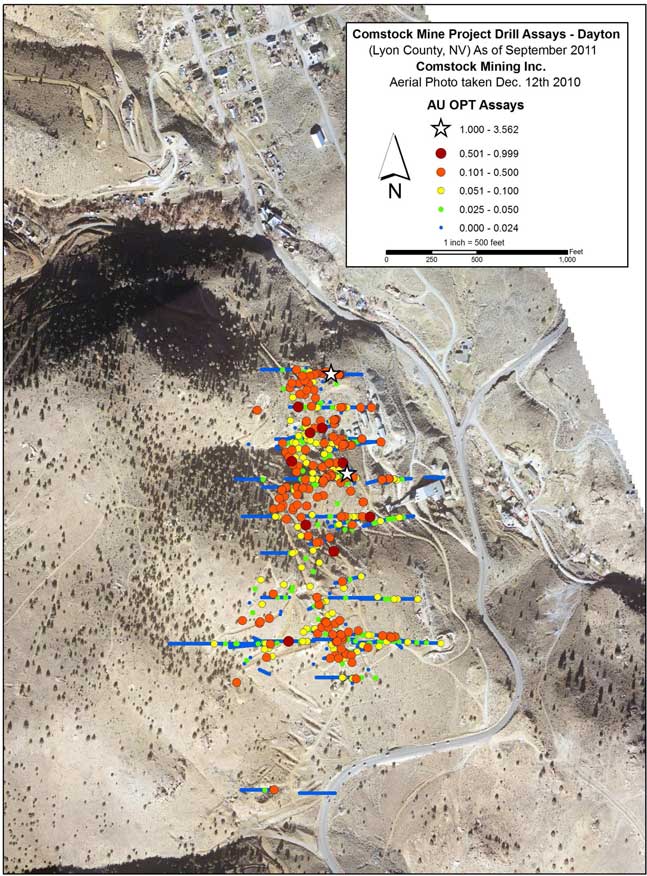

The 2011 Report incorporates the results of the Company’s recently completed drilling program, which ran from October 25, 2010 through August 19, 2011. The program focused on infill and development drilling in the Lucerne and Dayton Resource areas, and completed 389 holes, totaling 132,294 feet. The totals included 374 reverse circulation (RC) holes, totaling 128,711 feet, and 15 core holes, totaling 3,583 feet. The drilling program, designed by our geological team also included specific drilling recommendations by Behre Dolbear from the previous technical report. The total cost of the program was $4.32 million, with an average cost per foot of $32.67.

“Validating 2.4 million ounces of gold and over 20 million ounces of silver is a significant step for our team,” stated Corrado De Gasperis, the Company’s Chief Executive Officer“ and represents the most efficient drilling program in our Company’s history, with a discovery cost of just $6 per gold-equivalent resource ounce, a truly exceptional result.”

1 Gold equivalent ounces were calculated using September 30, 2011 London PM prices of $1,620.00 per ounce of gold and $30.45 per ounce of silver, as published by kitco.com. This resulted in a ratio of 53.20 ounces of silver per equivalent ounce of gold, without taking into consideration the relative recoveries of gold and silver.

|

PO Box 1118 · 1200 American Flat Rd · Virginia City, NV 89440

|

Investors (775) 847-4755 · Facsimile (800) 750-5740

|

The 2011 Report also refers to the results of the completed metallurgical testing and process redesign that the Company used as the basis for a complete redesign of the processing facility. The Company estimates that the heap leach recovery will average over 70% for gold and over 45% for silver.

Lucerne Area Details

The Lucerne Resource Area includes the Billie the Kid, Hartford, and Lucerne pits, and extends northeasterly to the area of the historic Woodville bonanza, and north to the historic Justice and Keystone mines. Drilling in the Lucerne Resource Area included 276 infill holes in the Hartford, Justice and Lucerne starter-pit areas. These holes have provided the information for a detailed geological model for the final starter-mine plan. The Lucerne Resource Area drilling also included 40 development holes in the East-Side target. That target was specifically mentioned by Behre Dolbear in the August, 2010 technical report with the conclusion that, “Exploration drilling should continue with expectations of expanding resources along the northeast-striking structures.” That expectation was met, including the highest-grade gold assay to date, 5 feet grading 3.562 ounces per ton of gold (121.99 g/t) and 5.200 ounces per ton of silver (178.08 g/t), contained in a 30 foot interval grading 1.257 ounces per ton of gold (43.05 g/t) and 2.114 ounces per ton of silver (72.40 g/t). The East-Side target is discussed in a May 24, 2011 press release: http://www.comstockmining.com/news/press-releases/155-tuesday-may-24-2011.

|

PO Box 1118 · 1200 American Flat Rd · Virginia City, NV 89440

|

Investors (775) 847-4755 · Facsimile (800) 750-5740

|

Page 2 of 8

|

PO Box 1118 · 1200 American Flat Rd · Virginia City, NV 89440

|

Investors (775) 847-4755 · Facsimile (800) 750-5740

|

Page 3 of 8

The updated resource estimate for the Lucerne Resource Area incorporates these new results, and now totals 42,930,000 tons of Measured and Indicated Resources, containing 1,270,000 ounces of gold and 12,590,000 ounces of silver.

|

LUCERNE RESOURCE AREA SUMMARY

|

||||||||||||||||||||

|

Tonsi

|

Au

(opt)

|

Ag

(opt)

|

Total Au

(ounces)

|

Total Ag

(ounces)

|

||||||||||||||||

|

Measured Resource

|

25,000,000 | 0.030 | 0.319 | 750,000 | 7,980,000 | |||||||||||||||

|

Indicated Resource

|

17,930,000 | 0.029 | 0.257 | 520,000 | 4,610,000 | |||||||||||||||

|

Total Measured and Indicated ii

|

42,930,000 | 0.030 | 0.293 | 1,270,000 | 12,590,000 | |||||||||||||||

|

Inferred Resource

|

24,990,000 | 0.027 | 0.196 | 675,000 | 4,900,000 | |||||||||||||||

|

|

i.

|

Resource total based on a gold cutoff of 0.007 ounces per ton

|

|

|

ii.

|

Rounding differences may occur

|

Dayton Area Details

The 2011 Report also includes an update of the Company’s mineral resource estimate for the Dayton Resource Area. This area, south of the Lucerne Resource Area, includes the historic Dayton, Alhambra, Kossuth, Cherokee, and Metropolitan mines. The historic Dayton mine was the last major underground operation in the Comstock District, before being closed by the War Act in 1942. The Company acquired these mineral properties, including the results from 252 previously drilled holes, in two separate transactions in July 2011. The recent drilling added 64 holes totaling 28,752 feet. The holes were planned specifically to confirm the previous results, adding holes on east-west drill fences spaced 600 feet apart to confirm the continuation of the mineralized zone along strike and to depth, and then adding infill holes on sections spaced 200 feet apart, to confirm the continuity of gold and silver grades. Results announced previously by the Company include the highest-grade interval encountered to-date at the Dayton: 10 feet (3.05 m) grading 1.121 ounces per ton of gold (38.39 g/t) and 2.279 ounces per ton of silver (78.05 g/t), contained in an interval of 135 feet (41.15 m) grading 0.218 ounces per ton of gold (7.47 g/t) and 0.685 ounces per ton of silver (23.46 g/t). Full results of the successful Dayton drilling programs are discussed in a September 7, 2011 press release: http://www.comstockmining.com/news/press-releases/179-wednesday-september-7-2011.

|

PO Box 1118 · 1200 American Flat Rd · Virginia City, NV 89440

|

Investors (775) 847-4755 · Facsimile (800) 750-5740

|

Page 4 of 8

|

PO Box 1118 · 1200 American Flat Rd · Virginia City, NV 89440

|

Investors (775) 847-4755 · Facsimile (800) 750-5740

|

Page 5 of 8

The new resource estimate for the Dayton Resource Area totals 8,330,000 tons of Measured and Indicated Resources, containing 238,000 ounces of gold and 1,770,000 ounces of silver. The new drilling and geological modeling set the stage for a phase of infill drilling to develop a mine plan for the Dayton Resource Area.

|

DAYTON RESOURCE AREA SUMMARY

|

||||||||||||||||||||

|

Tonsi

|

Au

(opt)

|

Ag

(opt)

|

Total Au

(ounces)

|

Total Ag

(ounces)

|

||||||||||||||||

|

Measured Resource

|

2,610,000 | 0.030 | 0.261 | 78,000 | 680,000 | |||||||||||||||

|

Indicated Resource

|

5,720,000 | 0.028 | 0.191 | 160,000 | 1,090,000 | |||||||||||||||

|

Total Measured and Indicated ii

|

8,330,000 | 0.029 | 0.213 | 238,000 | 1,770,000 | |||||||||||||||

|

Inferred Resource

|

8,590,000 | 0.024 | 0.131 | 206,000 | 1,130,000 | |||||||||||||||

|

|

i.

|

Resource total based on a gold cutoff of 0.007 ounces per ton

|

|

|

ii.

|

Rounding differences may occur

|

“Four years ago, we began an exploration program that combined innovative geological concepts with reconciliation of historic Comstock data. Our exploration team worked together to develop a geological model that targeted specific structures with favorable volcanic host rocks,” stated Larry Martin, the Company’s Vice President of Exploration and Mine Development. “The historic Comstock Lode was a world class deposit; our modern exploration success to date, validating nearly 3 million gold equivalent ounces, is restoring the Comstock to its original, monumental stature.”

The 2011 Report includes other specific recommendations, including additional core drilling, additional metallurgical and geotechnical testing, and acceleration of the project’s permitting activities. The 2011 Report also recommends a preliminary feasibility study, which is the final step to allowing the Company to calculate reserves that conform to the NI 43-101 Technical Report requirements. The 2011 Report will be posted on the Company’s website, http://www.comstockmining.com/properties/technical-reports this month.

The Company is currently focused on commencing commercial mining production activities in late 2011 for full production in 2012. The continuing technical program includes completing the final mine and production plans for the Lucerne Resource Area starter mine, and continuing infill drilling, metallurgical testing, and geotechnical testing for a second mine in the Dayton Resource Area. In addition, the Company is designing a new phase of exploration drilling to include its highest-potential targets, including fully-developing the East-Side target in the Lucerne Resource Area, and the continuation of the mineralization from the Dayton Resource Area into both the Spring Valley and Oest target areas.

Mr. De Gasperis concluded, “Quantifying almost 3 million gold equivalent ounces in such a short period of time, with over 2.2 million gold equivalent ounces in the Lucerne Area alone, is foundational for our company. The doubling of the Dayton’s resource to half a million gold equivalent ounces previews substantially more potential for that resource and ultimate mine plan.”

|

PO Box 1118 · 1200 American Flat Rd · Virginia City, NV 89440

|

Investors (775) 847-4755 · Facsimile (800) 750-5740

|

Page 6 of 8

About Comstock Mining Inc.

Comstock Mining Inc. is a Nevada-based gold and silver mining company with extensive, contiguous property in the Comstock District. The Company began acquiring properties in the Comstock District in 2003. Since then, the Company has consolidated a significant portion of the Comstock District, amassed the single largest known repository of historical and current geological data on the Comstock region, secured permits, built an infrastructure and brought the exploration project into test mining production. The Company continues acquiring additional properties in the district, expanding its footprint and creating opportunities for exploration and mining. The goal of its strategic plan is to deliver stockholder value by validating qualified resources (at least measured and indicated) and reserves (probable and proven) of 3,250,000 gold equivalent ounces by 2013, and commencing commercial mining and processing operations in 2011, with annual production rates of 20,000 gold equivalent ounces.

Forward-Looking Statements

This press release and any related calls or discussions may contain forward-looking statements. All statements, other than statements of historical facts, are forward-looking statements. Forward-looking statements include statements about matters such as: future prices and sales of and demand for our products; future industry market conditions; future changes in our exploration activities, production capacity and operations; future exploration, production, operating and overhead costs; operational and management restructuring activities (including implementation of methodologies and changes in the board of directors); future employment and contributions of personnel; tax and interest rates; capital expenditures and their impact on us; nature, timing and accounting for restructuring charges, gains or losses on debt extinguishment, derivative liabilities and the impact thereof; productivity, business process, rationalization, restructuring, investment, acquisition, consulting, operational, tax, financial and capital projects and initiatives; contingencies; environmental compliance and changes in the regulatory environment; offerings, sales and other actions regarding debt or equity securities; and future working capital, costs, revenues, business opportunities, debt levels, cash flows, margins, earnings and growth.

The words "believe," "expect," "anticipate," "estimate," "project," "plan," "should," "intend," "may," "will," "would," "potential" and similar expressions identify forward-looking statements, but are not the exclusive means of doing so. These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties that could cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors set forth in our SEC filings and the following: the current global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, including risks of diminishing quantities or grades of qualified resources and reserves; operational or technical difficulties in connection with exploration or mining activities; contests over our title to properties; potential dilution to our stockholders from our recapitalization and balance sheet restructuring activities; potential inability to continue to comply with government regulations; adoption of or changes in legislation or regulations adversely affecting our businesses; business opportunities that may be presented to or pursued by us; changes in the United States or other monetary or fiscal policies or regulations; interruptions in our production capabilities due to unexpected equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, copper, diesel fuel, and electricity); changes in generally accepted accounting principles; geopolitical events; potential inability to implement our business strategies; potential inability to grow revenues organically; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies and equipment raw materials due to credit or other limitations imposed by vendors; assertion of claims, lawsuits and proceedings against us; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the SEC; potential inability to list our securities on any securities exchange or market; and work stoppages or other labor difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. We undertake no obligation to publicly update or revise any forward-looking statement.

|

PO Box 1118 · 1200 American Flat Rd · Virginia City, NV 89440

|

Investors (775) 847-4755 · Facsimile (800) 750-5740

|

Page 7 of 8

Neither this press release nor any related calls or discussions constitutes an offer to sell or the solicitation of an offer to buy any securities.

Contact information for Comstock Mining Inc.:

P.O. Box 1118

Virginia City, NV 89440

info@comstockmining.com

http://www.comstockmining.com

|

Doug McQuide

|

Joanna Longo

|

|

Director of Marketing and Public Relations

|

Investor Relations

|

|

Tel (775) 847-7376

|

Tel (416) 238-1414 x233

|

|

mcquide@comstockmining.com

|

jlongo@terrepartners.com

|

|

PO Box 1118 · 1200 American Flat Rd · Virginia City, NV 89440

|

Investors (775) 847-4755 · Facsimile (800) 750-5740

|

Page 8 of 8