Attached files

| file | filename |

|---|---|

| EX-95 - EXHIBIT 95 - Comstock Mining Inc. | a10k-2016xexx95.htm |

| EX-32.2 - EXHIBIT 32.2 - Comstock Mining Inc. | a10k-2016xexx322.htm |

| EX-32.1 - EXHIBIT 32.1 - Comstock Mining Inc. | a10k-2016xexx321.htm |

| EX-31.2 - EXHIBIT 31.2 - Comstock Mining Inc. | a10k-2016xex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Comstock Mining Inc. | a10k-2016xexx311.htm |

| EX-23 - EXHIBIT 23 - Comstock Mining Inc. | a10k-2016xexx23.htm |

| EX-21 - EXHIBIT 21 - Comstock Mining Inc. | a10k-2016xexx21.htm |

| EX-3.1 - EXHIBIT 3.1 - Comstock Mining Inc. | a10k-2016xexx31articles.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________________________________

FORM 10-K

_______________________________________________________________________

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from to

Commission File No. 001-35200

COMSTOCK MINING INC.

(Exact name of registrant as specified in its charter)

Nevada | 1040 | 65-0955118 |

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

P.O. Box 1118

Virginia City, NV 89440

(775) 847-5272

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

Securities Registered pursuant to Section 12(b) of the Act: Common Stock, par value $.000666 per share

Securities Registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No ý

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period of time that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ | ||

Non-accelerated filer | ¨ | Smaller reporting company | x | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No ý

The aggregate market value of the 128,786,430 shares of voting stock held by non-affiliates of the registrant based on the closing price on the NYSE MKT on June 30, 2016 was $20,605,829.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

Shares Outstanding | ||

Title of Class | March 6, 2017 | |

Common Stock | 187,400,075 | |

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

Cautionary Notice Regarding Forward-Looking Statements

Certain statements contained in this report on Form 10-K or incorporated by reference into this Form 10-K may constitute forward-looking statements within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Forward-looking statements include statements about matters such as: future prices and sales of, and demand for, our products; future industry market conditions; future changes in our mine planning, exploration activities, production capacity and operations; future exploration, production, operating and overhead costs; operational and management restructuring activities; future employment and contributions of personnel; tax and interest rates; capital expenditures and their impact on us; nature and timing of restructuring charges and the impact thereof; productivity, business process, rationalization, investment, acquisition, consulting, operational, tax, financial and capital projects and initiatives; contingencies; environmental law and regulation compliance and changes in the regulatory environment; remediation costs; and future working capital, costs, revenues, business opportunities, debt levels, cash flows, margins, earnings and growth.

The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements, but are not the exclusive means of doing so. These statements are based on assumptions and assessments made by management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control, and could cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors discussed in Item 1A, “Risk Factors” and the following: adverse effects of climate changes or natural disasters; global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, including risks of diminishing quantities or grades of qualified resources; operational or technical difficulties in connection with exploration or mining activities; contests over our title to properties; potential dilution to our stockholders from our stock issuances, recapitalization and balance sheet restructuring activities; potential inability to comply with applicable government regulations or law; adoption of or changes in legislation or regulations adversely affecting our businesses; permitting constraints or delays, business opportunities that may be presented to, or pursued by, us; changes in the United States or other monetary or fiscal policies or regulations; interruptions in our production capabilities due to capital constraints, equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, zinc, cyanide, water, diesel fuel, and electricity); changes in generally accepted accounting principles; adverse effects of terrorism and geopolitical events; potential inability to implement our business strategies; potential inability to grow revenues; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies and equipment raw materials due to credit or other limitations imposed by vendors; assertion of claims, lawsuits and proceedings against us; potential inability to satisfy debt and lease obligations; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the SEC; potential inability to list our securities on any securities exchange or market; and work stoppages or other labor difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Glossary

“assay” means to test minerals by chemical or other methods for determining the amount of metals contained therein.

“claim” means a mining interest giving its holder the right to prospect, explore for and exploit minerals within a defined area.

“feasibility study” means a comprehensive study undertaken to determine the economic feasibility of a project; typically to determine if a construction and/or production decision can be made.

“grade” means the amount of precious metal in each ton of ore, expressed as troy ounces per ton.

“heap leaching” means a process whereby gold and silver are extracted by “heaping” crushed ore onto impermeable leach pads and applying a weak cyanide solution that dissolves the gold and silver from the ore into a precious metal-laden solution for further recovery.

“lode” is a vein-like deposit or rich supply of or source of gold or other minerals.

“mineralized material” is a body that contains mineralization that has been delineated by appropriately spaced drilling and/ or underground sampling to estimate a sufficient tonnage and average grade of metal(s). Such a deposit does not qualify as a reserve until a comprehensive evaluation based upon unit cost, grade, recoveries, and other material factors conclude legal and economic feasibility of extraction at the time of reserve determination.

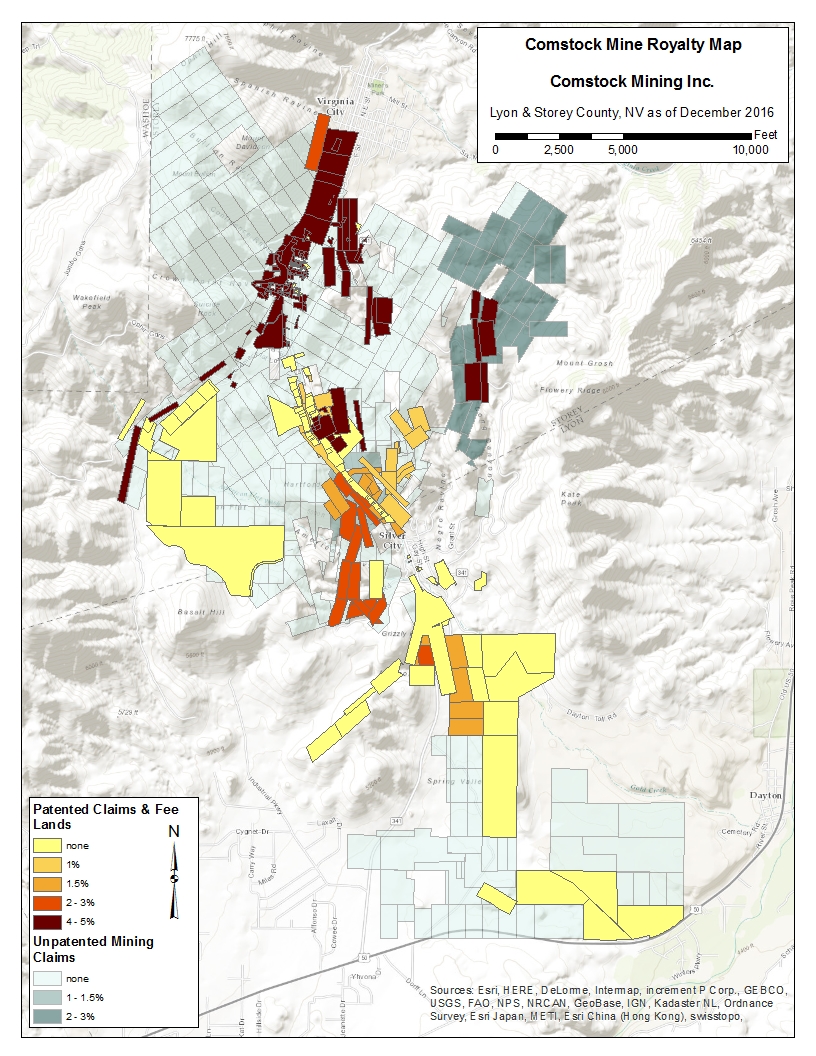

“NSR” means net smelter return royalty.

“ore” means a mineral-bearing rock, which may be rich enough to be mined at a profit.

“placer” means alluvial deposit containing particles or larger pieces of gold or other minerals.

“probable reserves” means reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

“proven reserves” means reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth, and mineral content of reserves are well-established.

“quartz” is one of the most common of all rock-forming minerals and one of the most important constituents of the earth’s crust. Quartz may be transparent, translucent, or opaque; it may be colorless or colored.

“recovery” means that portion of the metal contained in the ore that is successfully extracted by processing, can also be expressed as a percentage.

“reserves” or “ore reserves” mean that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination.

“stripping ratio” or “strip ratio” means the ratio of waste tons to ore tons mined.

“tailings” means refuse materials resulting from the washing, concentration, or treatment of ore.

“ton” means a short ton (2,000 pounds).

“vein” is a deposit of non-sedimentary origin, which may or may not contain valuable minerals; lode.

“waste” means rock or other material lacking sufficient grade and/or other characteristics to be economically processed or stockpiled as ore and which is often necessary to access an ore deposit.

PART I

Item 1. Business

OUR COMPANY

Unless the context otherwise indicates, the terms “Comstock,” “we,” “us,” “our,” “our Company” or “the Company” mean Comstock Mining Inc. and its consolidated subsidiaries.

The Company is a Nevada-based, gold and silver mining company with extensive, contiguous property in the historic Comstock and Silver City mining districts (collectively, the “Comstock District”). The Comstock District is located within the western portion of the Basin and Range Province of Nevada, between Reno and Carson City. The Company began acquiring properties and developing projects in the Comstock District in 2003. Since then, the Company has consolidated a substantial portion of the historic Comstock District, secured permits, built an infrastructure and brought exploration projects into production.

Because of the Comstock District’s historical significance, the geology is well known and has been extensively studied by the Company, our advisors and many independent researchers. We have expanded our understanding of the geology of the project area through vigorous surface mapping and drill hole logging. The volume of geologic data is immense, and thus far the reliability has been excellent, particularly in the various Lucerne Mine areas. We have amassed a large library of historic data and detailed surface mapping of Comstock District properties and continue to obtain historic information from private and public sources. We use such data in conjunction with information obtained from our current mining operations, to target geological prospective exploration areas and plan exploratory drilling programs, including expanded surface and underground drilling.

Our Lucerne Resource area is located in Storey County, Nevada, approximately three miles south of Virginia City and 30 miles southeast of Reno. Our Dayton Resource area is located in Lyon County, Nevada, approximately six miles south of Virginia City. Access to the properties is by State Route 341/342, a paved road.

The Company continues evaluating and acquiring properties, expanding its footprint and exploring all of our existing and prospective opportunities for further exploration, development and mining. The near-term goal of our business plan is to maximize intrinsic stockholder value realized, per share, by continuing to acquire mineralized and potentially mineralized properties, exploring, developing and validating qualified resources (measured, indicated and inferred) and reserves (proven and probable) that enable the commercial development of our operations through extended, long-lived mine plans that are economically feasible and socially responsible, including both the Lucerne and Dayton Mine plans, with both surface and underground development opportunities. We also plan to develop longer-term exploration plans for the remaining areas, which include the Spring Valley, the Northern Extension, Northern Targets and Occidental areas, subsequent to and in the case of the Spring Valley, concurrent with the exploration and development of Lucerne and Dayton.

The Company achieved initial production and held its first pour of gold and silver on September 29, 2012. The Company produced approximately 22,925 gold equivalent ounces in 2015, the Company’s second full year in production and 5,099 gold equivalent ounces in 2016. That is, the Company produced 19,601 ounces of gold and 222,416 ounces of silver in 2015 and 4,086 ounces of gold and 75,657 ounces of silver in 2016.

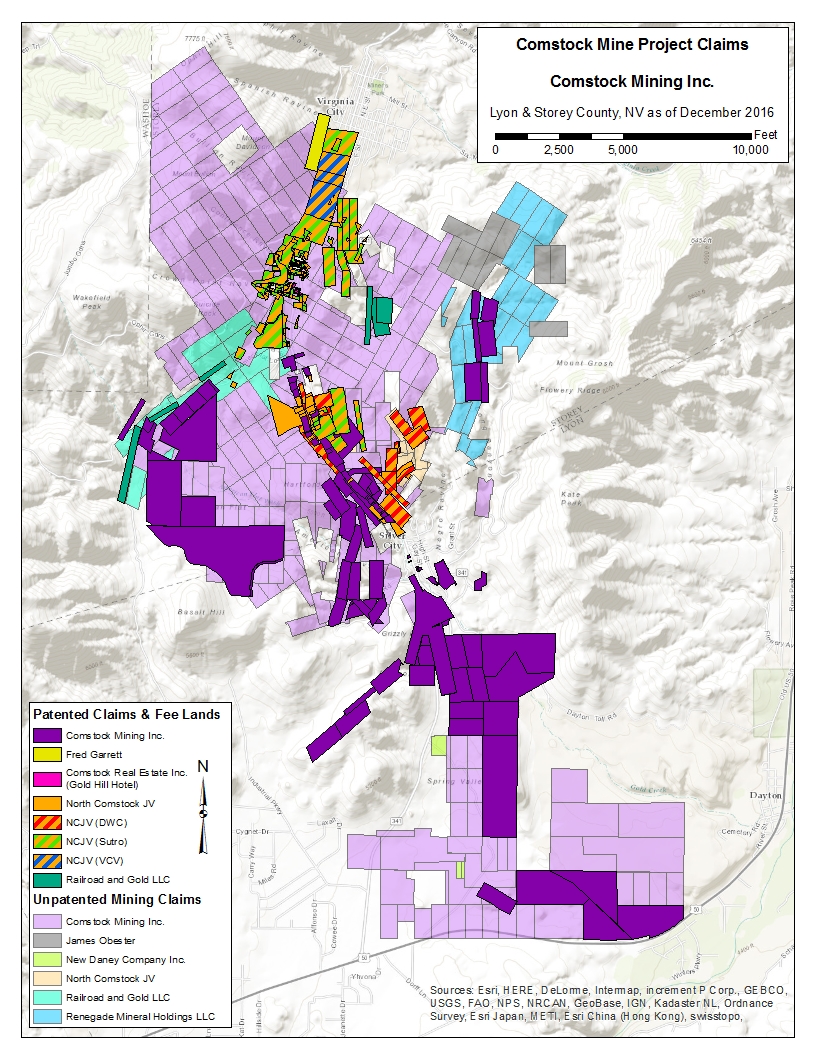

The Company’s headquarters, mine operations and heap leach processing facility are in Storey County, Nevada, at 1200 American Flat Road and 117 American Flat Road, approximately three miles south of Virginia City, Nevada and 30 miles southeast of Reno, Nevada. The Company continues acquiring additional properties in the Comstock District, expanding its footprint and creating opportunities for further exploration, development and mining. The Company now owns or controls approximately 8,631 acres of mining claims and parcels in the Comstock and Silver City Districts. The acreage is comprised of approximately 2,266 acres of patented claims (private lands), surface parcels (private lands), and approximately 6,365 acres of unpatented mining claims, which the Bureau of Land Management (“BLM”) administers.

The Company’s real estate segment owns significant non-mining properties, including the Gold Hill Hotel, the Daney Ranch, 98-acre Silver Springs property, including senior water rights and other lands, homes and cottages. The Gold Hill Hotel consists of an operating hotel, restaurant and a bar. In 2015, the Company entered into an agreement to lease the Gold Hill Hotel to independent operators while retaining ownership. The initial term of the lease agreement was effective on April 1, 2015, and ends in March 2020. The tenant may renew the lease for two extended terms of five years each. Lease payments are due in monthly installments.

Financial information for each of our segments is disclosed in Note 13 to the consolidated financial statements.

5

Current Projects

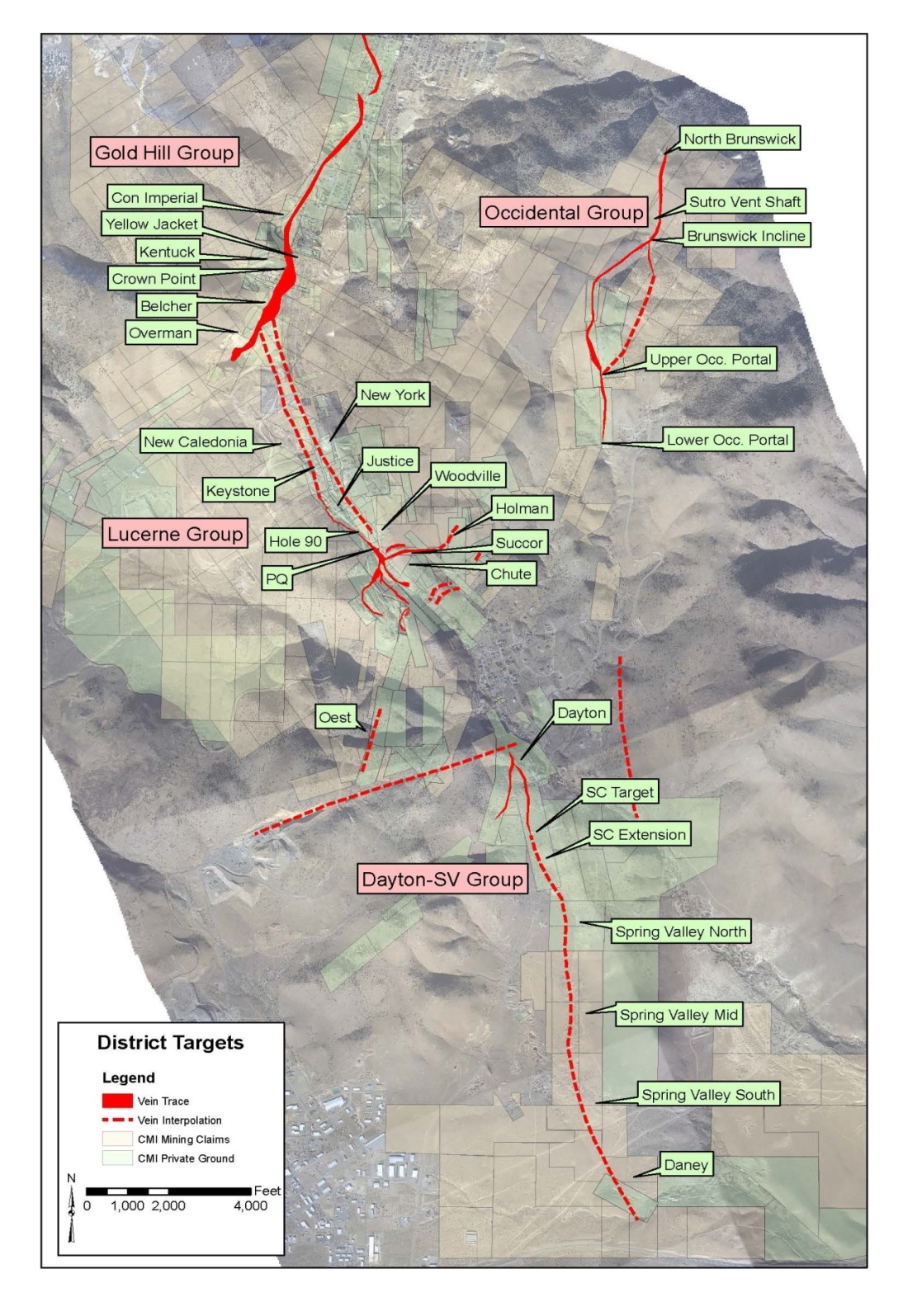

The Company has identified six distinct target areas on its land holdings and has focused, to date, solely on the Lucerne Resource area (including surface and underground) and the Dayton Resource area. We anticipate developing exploration plans for the remaining areas, which include the Spring Valley, Northern Extension, Northern Targets, and Occidental Target areas, subsequent to the exploration and development of Lucerne and Dayton. The Company’s existing heap leach processing facility for gold and silver was redesigned and expanded in late 2013 and again in the fourth quarter of 2014, to accommodate future production plans.

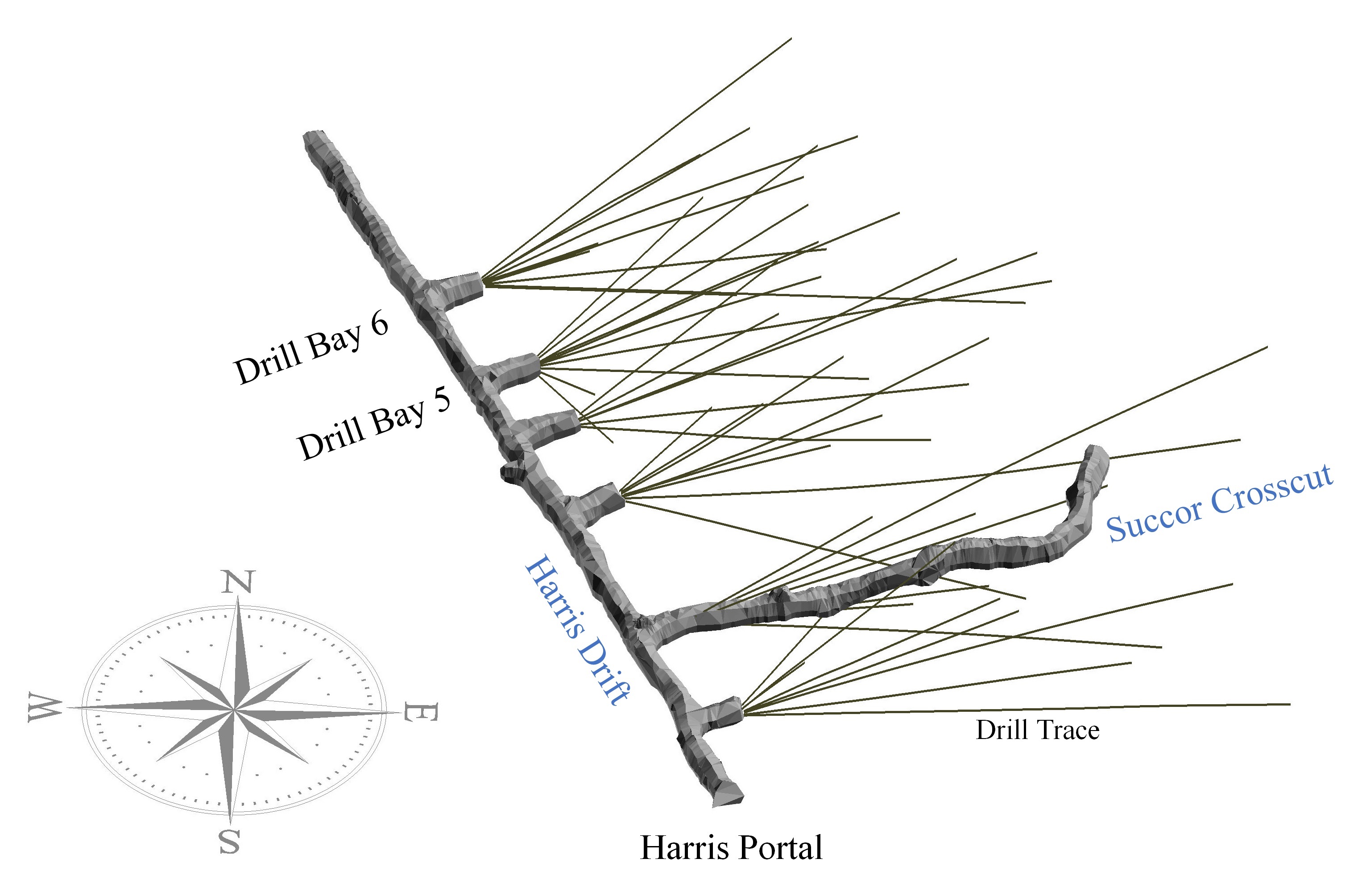

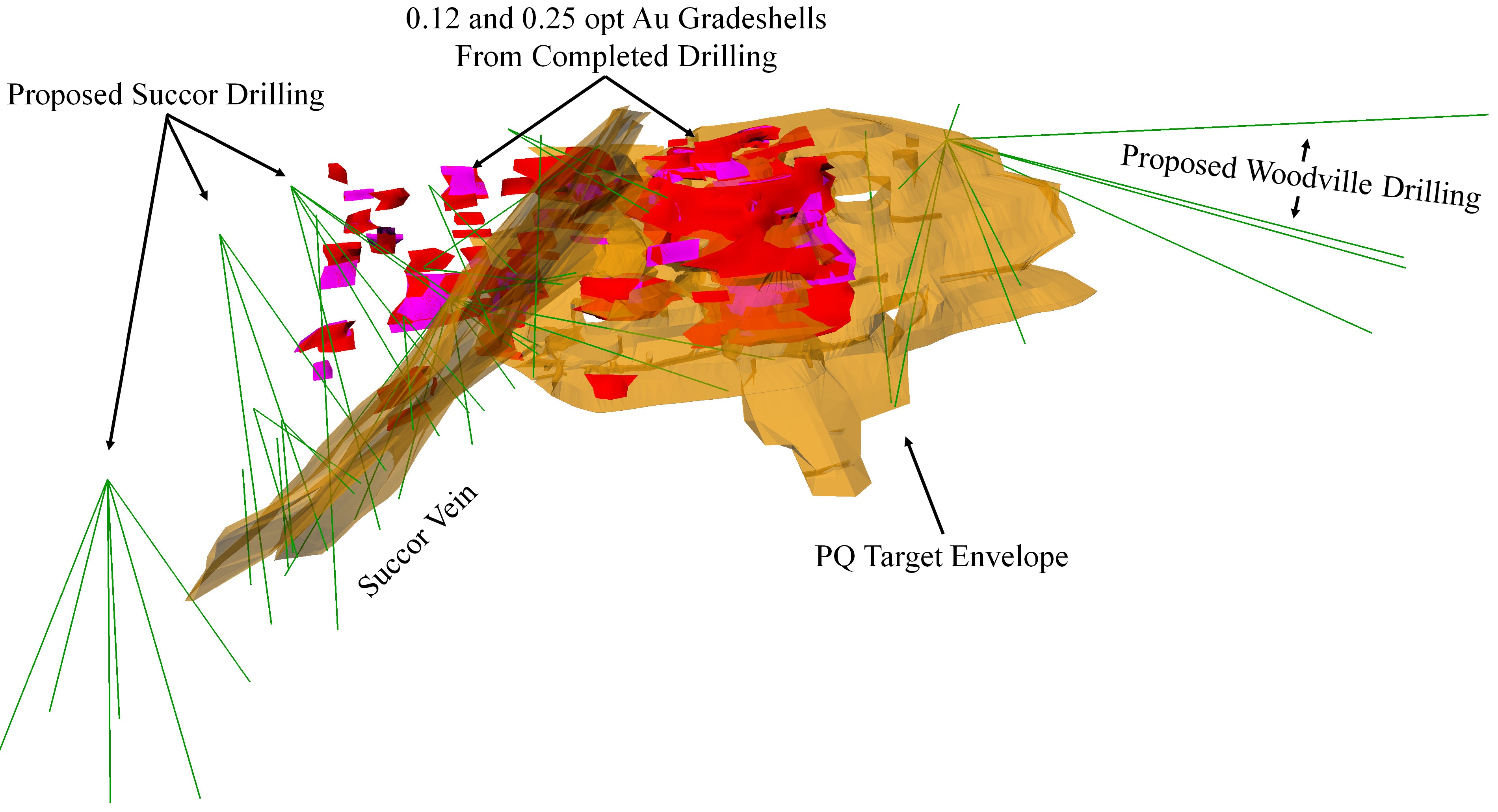

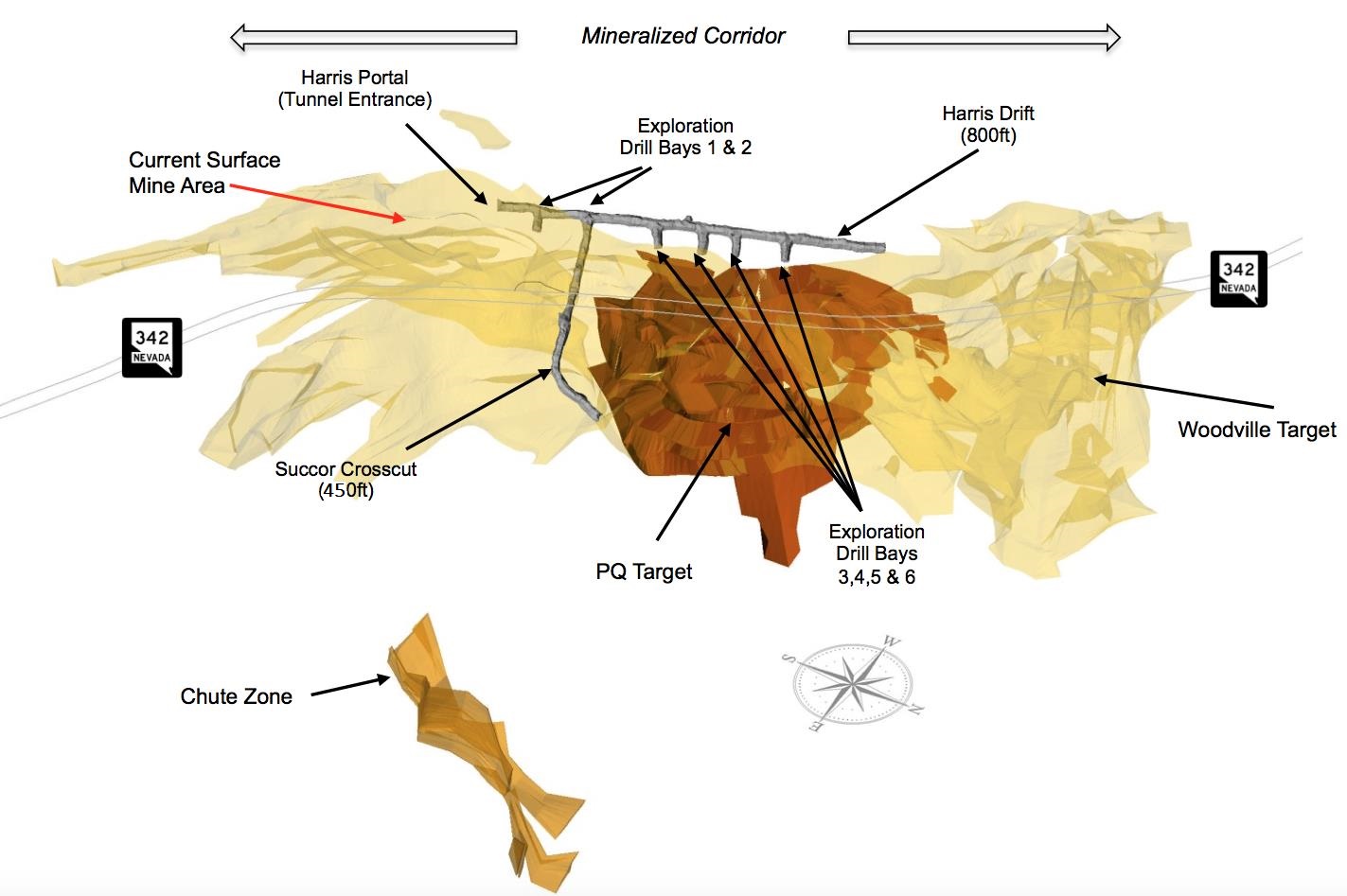

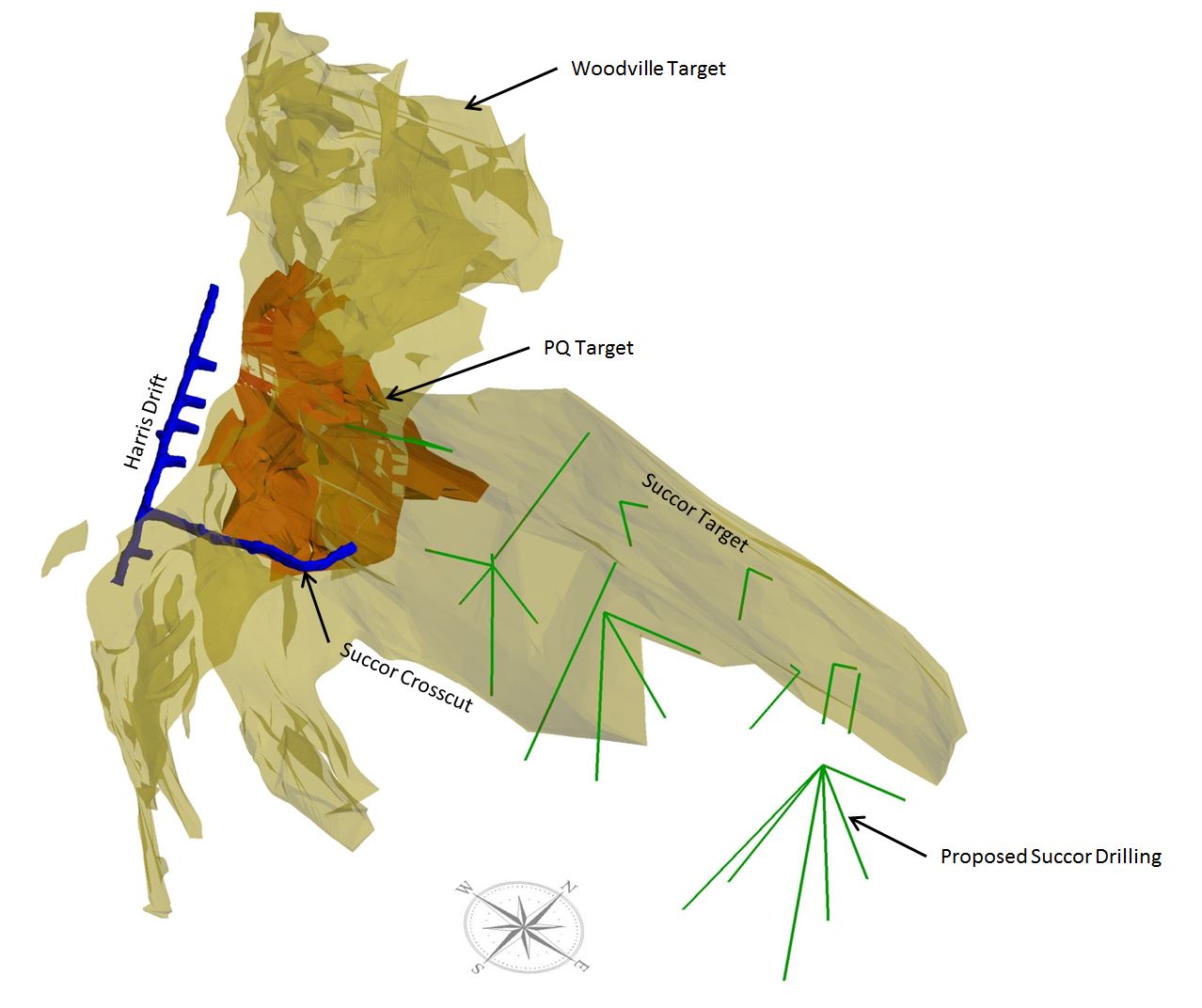

The Lucerne Resource area has been the primary focus of the Company’s exploration and development efforts since 2007. It includes the previously mined Billie the Kid, Hartford and Lucerne mining claims, and extends east and northeasterly to the area of the historic Woodville bonanza, Succor and Lager Beer claims and north to the historic Justice and Keystone mines. The Company has the key mining permits required for mining this area. The Lucerne Resource area is approximately 5,000 feet long, with an average width of 600 feet, representing less than three percent of the land holdings controlled by the Company and is the site of our current production activities and ongoing exploration and development program.

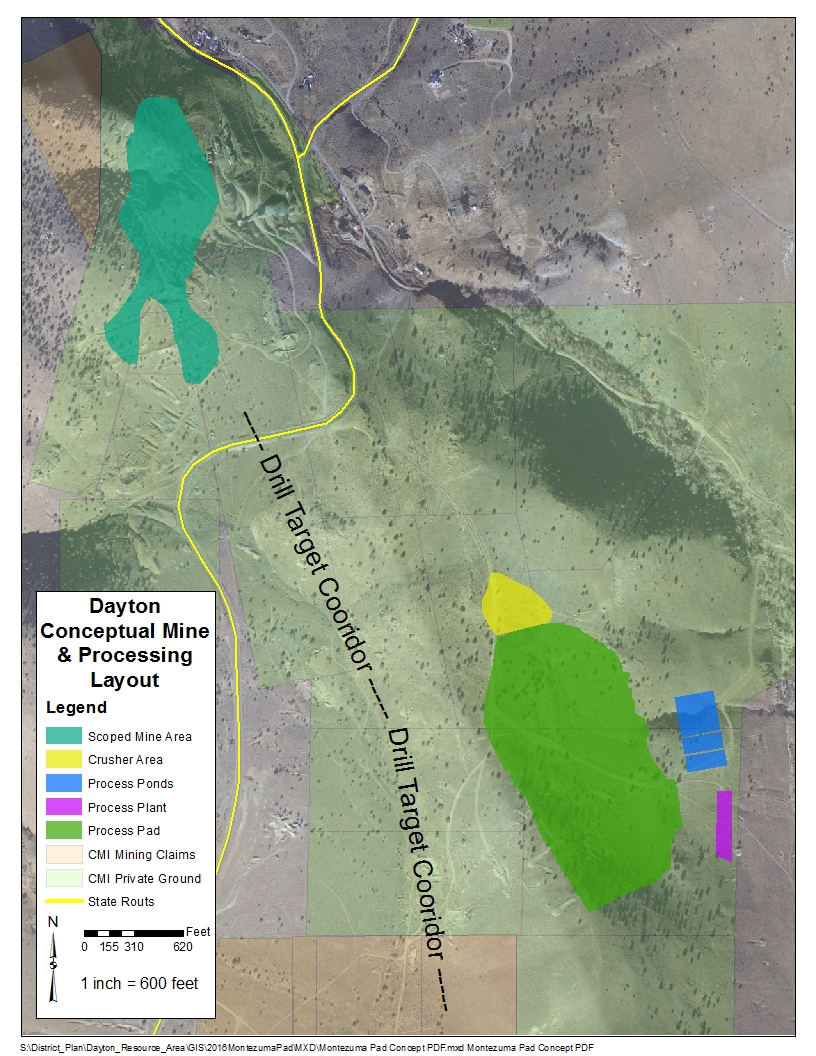

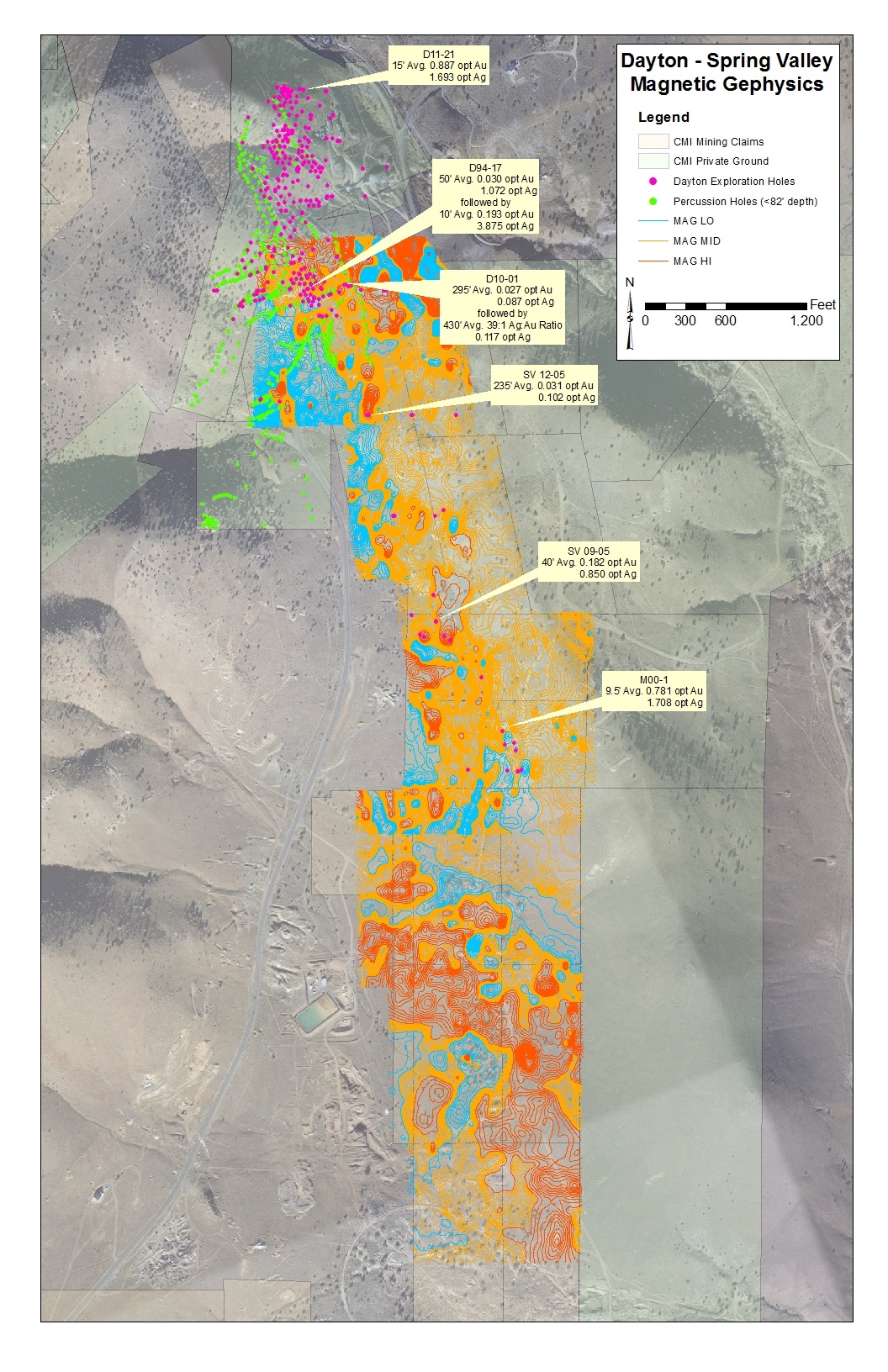

The Dayton Resource area is southwest of Silver City in Lyon County, Nevada. It generally includes the Dayton, Kossuth and Alhambra claims, including the old Dayton Consolidated mine workings, south to where the Kossuth claim crosses State Route 341. The historic Dayton mine was the last major underground mining operation in the Comstock District, before being closed after the War Production Board promulgated Limitation Order L-208, 7 F. R. 7992 on October 8, 1942, that closed down all gold mining operations in the United States and its territories. The Dayton Resource area ranks as one of the Company’s top exploration and potential mine production targets. In January 2014, the Lyon County Board of Commissioners approved a strategic master plan and zoning changes on the Dayton, Kossuth and Alhambra mining claims and other properties located in the Dayton Resource area, enabling a more practical, comprehensive feasibility study for mining. Geological studies and development planning are currently underway utilizing data from the 30,818 feet of drilling completed in 2015, and data from prior drill programs.

The Spring Valley exploration target lies at the southern end of the Comstock District, where the mineralized structures lie mostly concealed beneath a veneer of sediment gravels. The area includes the Kossuth patented claim south of State Route 341, the Dondero patented property, the Daney patented claim, the New Daney lode mining claims, and the Company’s placer mining claims in Spring Valley and Gold Canyon.

The Northern Extension, Northern Targets and Occidental areas represent longer-term exploration target areas that contain many historic mining operations, including the Overman, Con Imperial, Caledonia, and Yellow Jacket mines. We believe that our consolidation of the Comstock District has provided us with opportunities to utilize the historical information available to identify drilling targets with significant potential.

6

Figure-1 Comstock Mining’s Claims in Storey and Lyon Counties, Nevada

7

Our Comstock exploration activities include open pit gold and silver test mining. As defined by the Securities Exchange Commission (“SEC”) Industry Guide 7, we have not yet established any proven or probable reserves at our Comstock Lode Project.

Employees

As of December 31, 2016, we have 10 full-time employees and 2 part-time employees, inclusive of our general and administrative function.

Available Information

The Company maintains a website at comstockmining.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 (“Exchange Act”) are made available through our website as soon as reasonably practical after we electronically file or furnish the reports to the SEC. Also available on our website are the Company’s Governance Guidelines and Code of Conduct, as well as the charters of the audit, compensation and nominating committees of the Board of Directors. Information on our website is not incorporated into this report. Stockholders may request free copies of these documents from:

Comstock Mining Inc.

Attention: Judd Merrill, Principal Financial Officer and Principal Accounting Officer

PO Box 1118

Virginia City, NV 89440

Principal Markets

We sell our production on world markets at prices established by commodity markets. These prices are not within our control. We had revenues of $4.9 million in our fourth full year of production in our mining segment and $0.1 million of revenues in our real estate segment during the year ended December 31, 2016. We had operating losses of $10.2 million and $0.1 million in our mining and real estate segments, respectively, during the year ended December 31, 2016. We had total assets of $27.8 million and $6.0 million in our mining and real estate segments, respectively, as of December 31, 2016. We did not have a real estate segment for any period prior to fiscal year 2011. See Note 13 to our audited consolidated financial statements for additional information regarding our segments.

Government Regulation

Mining operations and exploration activities are subject to various national, state, and local laws and regulations in the United States, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances, and other matters. We have obtained or have pending applications for substantially all of those licenses, permits, and other authorizations currently required for our mining, exploration and other development programs. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and regulations. Capital expenditures relating to compliance with laws and regulations that regulate the discharge of materials into the environment, or otherwise relating to the protection of the environment, comprise a substantial part of our historical capital expenditures and our anticipated future capital expenditures. For example, we incur certain expenses and liabilities associated with our reclamation obligations. See “Reclamation” section below.

Reclamation

We are generally required to mitigate long-term environmental impacts by stabilizing, contouring, re-sloping, and re-vegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts are conducted in accordance with plans reviewed and approved by the appropriate regulatory agencies.

The Nevada Revised Statutes (NRS) 519A to 519A.280 and Nevada Administrative Code (NAC) 519A.010 to 519A.415 promulgated by the Nevada State Environmental Commission and the Nevada Division of Environmental Protection (“NDEP”), Bureau of Mining and Reclamation (“BMRR”) require a surety bond to be posted for mining projects so that after completion of the work on such mining projects, the sites are left safe, stable and capable of providing for a productive post-mining use. Over the past four years, the Company has provided a reclamation surety bond, through the Lexon Surety Group (“Lexon”), with the BMRR. The BMRR, with concurrence from Storey County, has approved our most recent reclamation

8

plan, as revised, and our estimated total costs related thereto of approximately $7.7 million, including, $7.1 million for BMRR and $0.6 million of additional reclamation surety bonding primarily with Storey County. For the years ended December 31, 2015, and 2014, the Company had provided estimates and surety bonds in the amounts of $11.6 million and $8.6 million, respectively.

As part of the surety agreement, the Company agreed to pay a 2.0% annual bonding fee and has signed a corporate guarantee. The cash collateral percentage held on deposit by Lexon is typically 25.0% or less of the current bond amount. The current bond amount with the State and County is $7.7 million and at December 31, 2016, $2.5 million of collateral was held on deposit.

Competition

We compete with other mineral exploration and mining companies in connection with the acquisition of gold and other mineral properties and the attraction and retention of human capital. Such competitors may have substantially greater financial resources than we do.

History

The Company began acquiring properties and developing projects in the Comstock District in 2003. The Company produced over 12,000 ounces of gold and over 53,000 ounces of silver from 2004-2006 from our existing Lucerne mine and American Flat heap leach processing facilities. Our test mining activities were concluded in January 2007, when based on our longer-term production plans, we prioritized land consolidation and mine planning. The Company restarted mining operations in the third quarter of 2012 and resumed pouring doré bars of silver and gold in September 2012. The Company produced over 59,454 ounces of gold and over 734,492 ounces of silver from September 2012 through December 2016, achieving annual rate of 22,925 gold equivalent ounces in 2014. The Company completed leaching from its existing leach pads in December 2016, and has transitioned to exploration and development activities, primarily in the Lucerne and Dayton Resource areas.

Customers

Substantially all mining revenues recorded to date relate to the same customer. As gold can be sold through numerous gold market traders worldwide, the Company is not economically dependent on a limited number of customers for the sale of its product. The real estate segment has numerous customers and is not dependent on any one customer.

Financing Events

In March and April 2016, the Company completed two equity financing transactions totaling $4.0 million (approximately $3.5 million, net of issuance costs). The proceeds were used to accelerate certain prerequisites, including interim mine planning and expanded exploration and development activities for the next phase of Dayton drilling and development and general corporate purposes.

During 2016, the Company entered into a sales agreement with respect to an at-the-market offering program (“ATM Agreement”) pursuant to which the Company may offer and sell, from time to time at its sole discretion, shares of its common stock, having an aggregate offering price of up to $5.0 million. During the year ended December 31, 2016, the Company issued 1,835,300 shares of common stock through the Company’s at-the-market offering program. Gross proceeds from the issuance of shares totaled approximately $0.5 million.

9

Item 1A. Risk Factors

An investment in our securities involves risk. You should carefully consider the following risk factors, in addition to those discussed elsewhere in this report, in evaluating our Company, its business, its industry and prospects. The risks described below are not the only ones facing us. Additional risks not presently known to us, or that we currently deem immaterial, may also have a material adverse effect on us. The following risks could cause our business, financial condition, results of operations or cash flows to be materially and adversely affected. In that case, the market price of our securities could decline, and you could lose part or all of your investment.

You may lose all or part of your investment.

If we are unable to find, mine and sell adequate quantities of gold and silver ore, it is unlikely that the cash generated from our internal operations will suffice as a source of the liquidity necessary for anticipated working capital requirements. There is no assurance that the Company’s initiatives to improve its liquidity and financial position will be successful. Accordingly, there is substantial risk that the Company will be unable to continue as a going concern. In the event of insolvency, liquidation, reorganization, dissolution or other winding up of the Company, the Company’s creditors would be entitled to payment in full out of the Company’s assets before holders of common stock would be entitled to any payment, and the claims on such assets may exceed the value of such assets.

We have a limited operating history.

We have a limited operating history. The success of our Company is significantly dependent on the uncertain events of the discovery and exploitation of mineralized materials on our properties or selling the rights to exploit those materials. If our business plan is not successful and we are not able to operate profitably, then our securities may become worthless and investors may lose all of their investment in our Company.

Because we may never earn significant revenues from our mine operations, our business may fail.

We recognize that if we are unable to generate significant revenues from the exploration and exploitation of our mineralized materials in the future, we will not be able to earn profits or continue operations. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate significant revenues or ever achieve profitability. If we are unsuccessful, our business will fail and investors may lose all of their investment in our Company.

Transportation difficulties and weather interruptions may affect and delay proposed mining operations and impact our business plans.

Our mining properties are accessible by road. The climate in the area is hot and dry in the summer but cold and subject to snow in the winter, which could, at times, hamper accessibility depending on the winter season precipitation levels. As a result, our exploration and mining plans could be delayed for several months each year. Such delays could affect our anticipated business operations and increase our expenses.

Moreover, extreme weather events (such as increased frequency or intensity of hurricanes or prolonged drought, flooded or frozen terrain) have the potential to disrupt operations at our projects. Extended disruptions to supply lines due to extreme weather could result in interruption of activities at the project sites, delay or increase the cost of construction of the projects, or otherwise adversely affect our business.

Supplies and equipment needed for exploration may not always be available. If we are unable to secure exploration supplies we may have to delay our anticipated business operations.

Competition and unforeseen limited sources of supplies needed for our proposed exploration work could result in occasional shortages of supplies of certain products, equipment or materials. There is no guarantee we will be able to obtain certain products, equipment and/or materials as and when needed, without interruption, or on favorable terms, if at all. Such delays could affect our anticipated business operations and increase our expenses.

10

We have invested capital in high-risk mineral projects where we have not conducted sufficient exploration and engineering studies.

We have invested capital and have otherwise been involved in various mineral properties and projects in the Comstock District where we have not conducted sufficient exploration and engineering studies to minimize the risk of project failure. Our mineral projects involve high risks because we have not invested sufficiently in the characterization of mineralized material, geologic analysis, metallurgical testing, mine planning and economic analysis. Standard industry practice calls for a mining company to prepare a formal mine plan and mining production schedule and have these documents reviewed and validated by a third party specialist. We have not had a formal mine plan and mining production schedule economically validated by a third party specialist.

We will not be successful unless we recover precious metals and sell them for a profit.

Our success depends on our ability to recover precious metals, process them, and successfully sell them for more than the cost of production. The success of this process depends on the market prices of metals in relation to our costs of production. We may not be able to generate a profit on the sale of gold or other minerals because we have limited control over our costs and have no ability to control the market prices. The total cash costs of production at any location are frequently subject to great variation from year to year as a result of a number of factors, such as the changing composition of ore grade or mineralized material production, and metallurgy and exploration activities in response to the physical shape and location of the ore body or deposit. In addition, costs are affected by the price of commodities, such as fuel and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production unprofitable. A material increase in production costs or a decrease in the price of gold or other minerals could adversely affect our ability to earn a profit on the sale of gold or other minerals.

We do not have proven or probable reserves, and there is no assurance that the quantities of precious metals we produce will be sufficient to recover our investment and operating costs.

We do not have proven or probable reserves. Substantial expenditures are required to acquire existing gold properties with established reserves or to establish proven or probable reserves through drilling and analysis. Any sums expended for additional drilling and analysis may not establish proven or probable reserves on our properties. We drill in connection with our mineral exploration and mining activities and not with the purpose of establishing proven and probable reserves. While we estimate the amount of mineralized material we believe exists on our properties, our calculations are subject to uncertainty due to several factors, including the quantity and grade of ore, metal prices and recoverability of minerals in the mineral recovery process. There is a great degree of uncertainty attributable to the calculation of any mineralized material, particularly where there has not been significant drilling, mining and processing. Until the mineralized material located on our properties is actually mined and processed, the quantity and quality of the mineralized material must be considered as an estimate only. In addition, the estimated value of such mineralized material (regardless of the quantity) will vary depending on metal prices. Any material change in the estimated value of mineralized material may negatively affect the economic viability of our properties. In addition, there can be no assurance that we will achieve the same recoveries of metals contained in the mineralized material as in small-scale laboratory tests or that we will be able to duplicate such results in larger scale tests under on-site conditions or during production. There can be no assurance that our exploration activities will result in the discovery of sufficient quantities of mineralized material to recover our investment and operating costs.

The cost of our exploration and acquisition activities is substantial, and there is no assurance that the quantities of minerals we discover or acquire will justify commercial operations or replace reserves (to the extent reserves are established in the future).

Mineral exploration, particularly for gold and other precious metals, is highly speculative in nature and frequently is nonproductive. There can be no assurance that our exploration and acquisition activities will be commercially successful. If gold mineralization is discovered, it may take a number of years from the initial phases of drilling until production is possible, during which time the economic feasibility of production may change. Substantial expenditures are required to acquire existing gold properties, to establish ore reserves through drilling and analysis, to develop metallurgical processes to extract metal from the ore, and in the case of new properties, to develop the processing facilities and infrastructure at any site chosen for mineral exploration. There can be no assurance that any gold reserves or mineralized material that may be discovered or acquired in the future, if any, will be in sufficient quantities or of adequate grade to justify commercial operations or that the funds required for mineral production operation can be obtained on a timely or reasonable basis, if at all. Mining companies must continually replace mineralized material or reserves depleted by production. There can be no assurance that we will be successful in replacing any reserves or mineralized material acquired or established in the future.

11

The price of gold and silver fluctuate on a regular basis and a downturn in price could negatively impact our operations and cash flow.

Our operations will be significantly affected by changes in the market price of gold and silver if we are able to produce gold or other minerals. Gold and silver prices can fluctuate widely and may be affected by numerous factors, such as expectations for inflation, levels of interest rates, currency exchange rates, purchases and sales by governments and central banks, monetary policies employed by the world’s major central banks, fiscal policies employed by the world’s major industrialized economies, forward selling or other hedging activities, demand for precious metals, global or regional political and economic crises and production costs in major gold-producing regions, such as but not limited to South Africa and the former Soviet Union. The aggregate effect of these factors, all of which are beyond our control, is impossible for us to predict. If gold or silver prices decline substantially, it could adversely affect the realizable value of our assets and potentially, future results of operations and cash flow.

We plan to pursue opportunities to acquire properties with gold or silver reserves or mineralized material with exploration potential. The price that we pay to acquire these properties will be influenced, in large part, by the price of gold and silver at the time of the acquisition. We expect our potential future revenues to be derived from the production and sale of gold and silver from these properties or from the sale of some of these properties. The value of any mineralized material, and the value of any potential mineral production therefrom, will vary in direct proportion to variations in those mineral prices. The price of gold and silver has fluctuated widely as a result of numerous factors beyond our control. The effect of these factors on the price of gold and silver, and therefore the economic viability of our projects, cannot accurately be predicted. Any drop in the price of gold or silver would negatively affect our asset values, cash flows, potential revenues and profits.

The use of hedging instruments may not prevent losses being realized on subsequent price decreases or may prevent gains being realized from subsequent price increases.

We may from time to time sell some future production of gold pursuant to hedge positions. If the gold price rises above the price at which future production has been committed under these hedge instruments, we will have an opportunity loss. If the gold price falls below that committed price, we may experience losses if a hedge counterparty defaults under a contract when the contract price exceeds the gold price. As of December 31, 2016, we have no open hedge positions.

We compete with other mineral exploration and mining companies which could lead to the loss of opportunities.

We compete with other mineral exploration and mining companies or individuals, including large, established mining companies with substantial capabilities and financial resources, to acquire rights to mineral properties containing gold and other minerals. There is a limited supply of desirable lands available for claim staking, lease or other acquisition. There can be no assurance that we will be able to acquire such properties when competing against competitors with substantially greater financial resources than we have.

The estimation of the ultimate recovery of gold and silver, is subjective. Actual recoveries may vary from our estimates.

We utilize the heap leach process to extract gold and silver from ore. The heap leach process extracts gold and silver by placing ore on an impermeable pad and applying a diluted cyanide solution that dissolves a portion of the contained gold and silver, which are then recovered in metallurgical processes. We use several integrated steps in the process of extracting gold and silver to estimate the metal content of ore placed on the leach pad. The final amounts are not determined until a third-party smelter converts the doré and determines final ounces of gold and silver available for sale. We then review this end result and reconcile it to the estimates we developed and used throughout the production process. Based on this review, we adjust our estimation procedures when appropriate. Due to the complexity of the estimation process and the number of steps involved, among other things, actual recoveries can vary from estimates, and the amount of the variation could be significant and could have a material adverse impact on our financial condition and results of operations.

Resource and other mineralized material calculations are estimates only, and are subject to uncertainty due to factors including metal prices, inherent variability of the ore and recoverability of metal in the mining process.

The calculation of mineral resources, other mineralized material and grading are estimates and depend upon geological interpretation and statistical inferences or assumptions drawn from drilling and sampling analysis, which may prove to be unpredictable. There is a degree of uncertainty attributable to the calculation of mineral resources and corresponding grades. Until mineral resources and other mineralized materials are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of mineral resources and other mineralized materials and ore may vary depending on metal prices. Any material change in the quantity of mineral resources, other mineralized materials, mineralization, grade or stripping ratio may affect the economic viability of our properties. In addition, we can provide no

12

assurance that gold recoveries or other metal recoveries experienced in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Our mining production depends on the availability of sufficient water supplies.

Our mining operations require significant quantities of water for mining, ore processing and related support facilities. Most of our mining operations are in areas where water is scarce and competition among users for continuing access to water is significant. Continuous production at our mines is dependent on our ability to maintain our water rights and claims, and the continuing physical availability of the water supplies.

Cost estimates and timing of new projects are uncertain, which may adversely affect our expected production and profitability.

The capital expenditures and time required to develop and explore our properties, including the Lucerne Mine and the Dayton Resource area, are considerable and changes in costs, construction schedules or both, can adversely affect project economics and expected production and profitability. There are a number of factors that can affect costs and construction schedules, including, among others:

• | availability of labor, energy, transportation, equipment, and infrastructure; |

• | changes in input commodity prices and labor costs; |

• | fluctuations in currency exchange rates; |

• | availability and terms of financing; |

• | changes in anticipated tonnage, grade and metallurgical characteristics of the ore to be mined and processed; |

• | recovery rates of gold and other metals from the ore; |

• | difficulty of estimating construction costs over a period of a year; |

• | delays in completing any environmental review or in obtaining environmental or other government permits; |

• | weather and severe climate impacts; and |

• | potential delays related to social, political and community issues. |

We may experience increased costs or losses resulting from the hazards and uncertainties associated with mining.

The exploration for natural resources and the development and production of mining operations are activities that involve a high level of uncertainty. These can be difficult to predict and are often affected by risks and hazards outside of our control.

These factors include, but are not limited to:

• | environmental hazards, including discharge of metals, concentrates, pollutants or hazardous chemicals; |

• | industrial accidents, including in connection with the operation of mining transportation equipment, milling equipment and/or conveyor systems and accidents associated with the preparation and ignition of large-scale blasting operations, milling, processing and transportation of chemicals, explosives or other materials; |

• | surface or underground fires or floods; |

• | unexpected geological formations or conditions (whether in mineral or gaseous form); |

• | ground and water conditions; |

• | fall-of-ground accidents in underground operations; |

• | failure of mining pit slopes and tailings dam walls; |

• | seismic activity; and |

• | other natural phenomena, such as lightning, cyclonic or tropical storms, floods or other inclement weather conditions. |

Our activities are inherently hazardous and any exposure may exceed our insurance limits or may not be insurable.

Mineral exploration and operating activities are inherently hazardous. Operations in which we have direct or indirect interests will be subject to all the hazards and risks normally incidental to exploration and production of gold and other metals, any of which could result in work stoppages, damage to property and possible environmental damage. The nature of these risks is such that liabilities might exceed any applicable liability insurance policy limits. It is also possible that the liabilities and hazards might not be insurable, or we could elect not to insure ourselves against such liabilities because of the high premium costs, in which event, we could incur significant costs that could have a material adverse effect on our financial condition.

13

Our ability to execute our strategic plans depends upon our success in obtaining a variety of required governmental approvals that may be opposed by third-parties.

We do not possess all of the governmental approvals necessary to conduct the full extent of the operations contemplated by our strategic plan. Those operations will be delayed, hindered or prevented to the extent that we are unable to obtain the necessary permits and approvals in a timely fashion or at all. This inability may occur due to a variety of factors, including opposition by third parties, such as members of the public or environmental groups. We expect that future permit and approval applications and issuances will meet with similar opposition. We may encounter delays and added costs if permits and approvals are challenged.

Mining companies are increasingly required to consider and provide benefits to the communities in which they operate.

As a result of public concern about the real or perceived detrimental effects of economic globalization and global climate impacts, businesses generally, and corporations in natural resource industries, face increasing public scrutiny of their activities. These businesses are under pressure to demonstrate that, as they seek to generate satisfactory returns on investment to shareholders, other stakeholders, including employees, governments, and communities surrounding operations benefit and will continue to benefit from their commercial activities. Such pressures tend to be particularly focused on companies whose activities are perceived to have a high impact on their social and physical environment. The potential consequences of these pressures include reputational damage, legal suits, increasing social investment obligations and pressure to increase taxes and royalties payable to governments and communities.

Our operations are subject to strict environmental laws and regulations, which could result in added costs of operations and operational delays.

Our operations are subject to strict environmental regulations, which could result in additional costs and operational delays. All phases of our operations are subject to environmental regulation. Environmental legislation is evolving in the United States generally, and Nevada specifically, in a manner that may require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors, and employees. There is no assurance that any future changes in environmental regulation will not negatively affect our projects.

At the state level, mining operations in Nevada are regulated by NDEP. Nevada state law requires our Nevada projects to hold Nevada water pollution control permits, which dictate operating controls and closure and post-closure requirements directed at protecting surface and ground water. In addition, we are required to hold Nevada reclamation permits required under Nevada law. These permits mandate concurrent and post-mining reclamation of mines and require the posting of reclamation bonds sufficient to guarantee the cost of mine reclamation. Other Nevada regulations govern operating and design standards for the construction and operation of any source of air contamination and landfill operations. Any changes to these laws and regulations could have a negative impact on our financial performance and results of operations by, for example, requiring changes to operating constraints, technical criteria, fees or surety requirements.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs which could have a material adverse effect on our business.

Our business is an energy-intensive undertaking, resulting in a significant carbon footprint. A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to the potential impacts of climate change that are viewed as the result of emissions from the combustion of carbon-based fuels. Legislation and increased regulation and requirements regarding climate change could impose increased costs on us and our suppliers, including increased energy, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Until the timing, scope and extent of any future requirements becomes known, we cannot predict the effect on our financial condition, financial position, results of operations and ability to compete.

14

Because our land holdings are within the Carson River Mercury Superfund Site, our operations are subject to certain soil sampling and potential remediation requirements, which may result in added costs and delays; and we are also potentially subject to further costs as the result of on-going government investigation and future remediation decisions.

Substantially all of our land holdings are within the Carson River Mercury Superfund Site (CRMS) Study Area and portions are within the risk area boundaries identified by NDEP and the United States Environmental Protection Area (USEPA). These risk areas have been defined due to the known or suspected presence of certain contaminants of concern, including mercury, arsenic and lead. To comply with the agencies’ requirements in these areas, the Company conducts soil sampling pursuant to a plan that has been approved by NDEP. This sampling is intended to demonstrate the absence of contamination before mining, processing or other operations in that area. If contamination above agency-established levels of concern is encountered, the Company intends to excavate and process such materials for metals recovery wherever feasible. If metals recovery is not feasible, the Company may avoid or defer excavating in that area, remove the materials for disposal, or cover the area with clean fill material. Through this sampling program and, if necessary, removal of contaminated materials, the Company intends to enable NDEP and USEPA to better define the Carson River Superfund Site and the currently designated risk areas so as to eventually exclude our land holdings from such areas and from the Site itself to the maximum extent feasible. NDEP and USEPA are continuing to study the ecological and human health risks that may be presented by contaminated sediments in certain portions of the Carson River watershed and downstream areas. The agencies’ studies indicate that these contaminants are primarily associated with historic mining tailings that have been redistributed into these waterways. The agencies have not adopted a remedial plan for these sediments nor have they decided whether remediation will be undertaken. Thus, there is no assurance that the Company will not be asked to undertake additional investigatory or remediation activities or to pay for such activities by the agencies or that future changes in CRMS-related requirements will not negatively affect our operations.

Our insurance and surety bonds for environmental-related issues are limited.

Our insurance and surety bonds against environmental risks are limited as to the maximum protection against potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production. Further, there is no assurance that insurance carriers or surety bond providers will be able to meet their obligations under our arrangements with them. In the event that our environmental liabilities and costs exceed the coverage provided by our insurance carriers and surety bond providers or such parties are unable to meet their obligations, we would have limited funds available to us to remedy such liabilities or costs or for future operations. If we are unable to fund the cost of remedying an environmental problem, we also might be required to enter into an interim compliance measure pending completion of the required remedy.

We are subject to federal and state laws that require environmental assessments and the posting of bonds, which add significant costs to our operations and delays in our projects.

Mining companies must post a bond or other surety to guarantee the cost of post-mining reclamation. These requirements could add significant additional cost and delays to any mining project undertaken by us. Our mineral exploration operations are required to be covered by reclamation bonds deemed adequate by regulators to cover these risks.

BLM requires that mining operations on lands subject to its regulation obtain an approved plan of operations subject to environmental impact evaluation under the National Environmental Policy Act. Any submission or significant modification to a plan of operations may also require the completion of an environmental assessment or Environmental Impact Statement prior to approval.

The Company’s costs of close- down, reclamation, and rehabilitation could be higher than expected.

Close-down and reclamation works to return operating sites to the community can be extensive and costly. Estimated costs are provided for, and updated annually, over the life of each operation but the provisions might prove to be inadequate due to changes in legislation, standards and the emergence of new, or increases in the cost of, reclamation techniques. In addition, the expected timing of expenditure could change significantly due to changes in the business environment that might vary the life of an operation.

15

We may be subject to litigation.

We may be subject to legal proceedings. Due to the nature of our business, we may be subject to a variety of regulatory investigations, claims, lawsuits and other proceedings in the ordinary course of our business. The results of these legal proceedings cannot be predicted with certainty due to the uncertainty inherent in litigation, including the effects of discovery of new evidence or advancement of new legal theories, the difficulty of predicting decisions of judges and juries and the possibility that decisions may be reversed on appeal. There can be no assurances that these matters will not have a material adverse effect on our business.

Title claims against our properties could require us to compensate parties making such claims, if successful, and divert management’s time from operations.

There may be challenges to our title in the properties in which we hold material interests. If there are title defects with respect to any of our properties, we might be required to compensate other persons or perhaps reduce our interest in the affected property. The validity of unpatented mineral claims, which constitute most of our holdings in the United States, is often uncertain and may be contested by the federal government and other parties. The validity of an unpatented mineral claim, in terms of both its location and its maintenance, depends on strict compliance with a complex body of federal and state, statutory and decisional law. Although we have attempted to acquire satisfactory title to our properties, we have not obtained title opinions or title insurance with respect to the acquisition of the unpatented mineral claims. The investigation and resolution of title issues would divert management’s time from ongoing exploration programs.

Our business depends on a limited number of key personnel, the loss of who could negatively affect us.

Our officers and employees are important to our success. If any of them becomes unable or unwilling to continue in their respective positions, and we are unable to find suitable replacements, our business and financial results could be materially negatively affected.

Our business may be adversely affected by information technology disruptions.

Cybersecurity incidents are increasing in frequency, evolving in nature and include, but are not limited to, installation of malicious software, unauthorized access to data and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise protected information and the corruption of data. We believe that we have implemented appropriate measures to mitigate potential risks. However, given the unpredictability of the timing, nature and scope of information technology disruptions, we could be subject to manipulation or improper use of our systems and networks or financial losses from remedial actions, any of which could have a material adverse effect on our financial condition and results of operations.

We rely on contractors to conduct a significant portion of our operations and construction projects.

A significant portion of our operations and construction projects are currently conducted in whole or in part by contractors. As a result, our operations are subject to a number of risks, some of which are outside our control, including:

• | negotiating agreements with contractors on acceptable terms; |

• | the inability to replace a contractor and its operating equipment in the event that either party terminates the agreement; |

• | reduced control over those aspects of operations which are the responsibility of the contractor; |

• | failure of a contractor to perform under its agreement; |

• | interruption of operations or increased costs in the event that a contractor ceases its business due to insolvency or other unforeseen events; |

• | failure of a contractor to comply with applicable legal and regulatory requirements, to the extent it is responsible for such compliance; and |

• | problems of a contractor with managing its workforce, labor unrest or other employment issues. |

In addition, we may incur liability to third parties as a result of the actions of our contractors. The occurrence of one or more of these risks could adversely affect our results of operations and financial position.

16

Our business requires substantial capital investment and we may be unable to raise additional funding on favorable terms.

The construction and operation of potential future projects and various exploration projects will require significant funding. Our operating cash flow and other sources of funding may become insufficient to meet all of these requirements, depending on the timing and costs of development of these and other projects. As a result, new sources of capital may be needed to meet the funding requirements of these investments and fund our ongoing business activities. Our ability to raise and service significant new sources of capital will be a function of macroeconomic conditions, future gold and silver prices, our operational performance and our current cash flow and debt position, among other factors. In the event of lower gold and silver prices, unanticipated operating or financial challenges, or a further dislocation in the financial markets as experienced in recent years, our ability to pursue new business opportunities, invest in existing and new projects, fund our ongoing operations and retire or service all of our outstanding debt could be significantly constrained.

Our substantial indebtedness and payment obligations under capital leases could adversely affect our operations, financial condition, cash flow, and operating flexibility.

Our significant amount of outstanding indebtedness and lease payment obligations, and the covenants contained in our debt agreements and documents governing such obligations could have a material adverse effect on our operations and financial condition. The size and terms of certain of our agreements limits our ability to obtain additional debt financing to fund future working capital, acquisitions, capital expenditures, engineering and product development costs, and other general corporate requirements. Other consequences for our operations could include:

• | making it more difficult for us to satisfy our obligations with respect to our other indebtedness, which could in turn result in an event of default on such other indebtedness; |

• | impairing our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes; |

• | requiring us to dedicate a substantial portion of our cash flow from operations to debt service payments, thereby reducing the availability of cash for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes; |

• | limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and |

• | placing us at a competitive disadvantage compared to our competitors that have proportionately less debt. |

Our ability to make required payments of principal and interest on our debt and lease payments under our capital leases will depend on our future performance and the other cash requirements of our business. Our performance is subject to general economic, political, financial, competitive, and other factors that are beyond our control in addition to challenges that are unique to the Company. We cannot provide any assurance that our business will generate sufficient cash flow from operations or that future borrowings will be available in an amount sufficient to enable us to service our indebtedness and lease obligations.

Our debt and lease agreements contain certain restrictive covenants and customary events of default. These restrictive covenants limit our ability to take certain actions, such as, among other things: make restricted payments; incur additional debt and issue certain preferred stock; create liens; engage in mergers or consolidations or transfer all or substantially all of our assets; make certain dispositions and transfers of assets; place limitations on the ability of our restricted subsidiaries to make distributions; enter into transactions with affiliates; and guarantee indebtedness. One or more of these restrictive covenants may limit our ability to execute our preferred business strategy, take advantage of business opportunities, or react to changing industry conditions.

Upon an event of default, if not waived by our financing parties, our financing parties may declare all amounts outstanding as due and payable, which may cause cross-defaults under our other obligations. If our current financing parties accelerate the maturity of our indebtedness or obligations, we may not have sufficient capital available at that time to pay the amounts due to our financing parties on a timely basis, and there is no guarantee that we would be able to repay, refinance, or restructure the payments on such debt and lease obligations. Further, the financing parties would have the right to foreclose on certain of our assets, which could have a material adverse effect on our Company.

17

Our stock is a penny stock and trading of our stock may be restricted by the SEC’s penny stock regulations, which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. Rule 3a51-1 generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers that sell to persons other than established customers and “accredited investors.” The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 (excluding one’s primary residence) or annual income exceeding $200,000 individually or $300,000 jointly with their spouse. The penny stock rules (including Rule 15g-9) require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock. The Financial Industry Regulatory Authority (FINRA) sales practice requirements may also limit a stockbroker’s ability to buy or sell our stock.

In addition to the “penny stock” rules promulgated by the SEC, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives, and other information. Under interpretation of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy or sell our stock and have an adverse effect on the market for our shares.

If we are unable to maintain the listing standards of the NYSE MKT, our common stock may be delisted, which may have a material adverse effect on the liquidity and value of our common stock.

Our common stock is traded on the NYSE MKT. To maintain our listing on the NYSE MKT, we must meet certain financial and liquidity criteria. The market price of our common stock has been and may continue to be subject to significant fluctuation as a result of periodic variations in our revenues and results of operations. If we fail to meet any of the NYSE MKT’s listing standards, we may be delisted. In the event of delisting, trading of our common stock would most likely be conducted in the over the counter market on an electronic bulletin board established for unlisted securities, which could have a material adverse effect on the market liquidity and value of our common stock.

The price of the Company’s common stock may fluctuate significantly, which could negatively affect the Company and holders of its common stock.

The market price of the Company’s common stock may fluctuate significantly from time to time as a result of many factors, including:

• | investors’ perceptions of the Company and its prospects; |

• | investors’ perceptions of the Company’s and/or the industry’s risk and return characteristics relative to other investment alternatives; |

• | investors’ perceptions of the prospects of the mining and commodities markets; |

• | difficulties between actual financial and operating results and those expected by investors and analysts; |

• | our inability to obtain permits or otherwise fail to reach Company objectives; |

• | changes in our capital structure; |

• | trading volume fluctuations; |

• | actual or anticipated fluctuations in quarterly financial and operational results; |

• | volatility in the equity securities market; and |

• | sales, or anticipated sales, of large blocks of the Company’s common stock. |

18

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our common stock will depend in part on the research and reports that securities or industry analysts publish about us or our business. We have relatively little research coverage by securities and industry analysts. If no additional industry analysts commence coverage of the Company, the trading price for our common stock could be negatively impacted. If one or more of the analysts who cover us downgrades our common stock or publishes inaccurate or unfavorable research about our business, our stock price would likely decline. If one or more of these analysts cease coverage of us or fail to publish reports on us regularly, demand for our common stock could decrease, which could cause our stock price and trading volume to decline.

We do not expect to pay any cash dividends for the foreseeable future.

We currently expect to retain all available funds and future earnings, if any, for use in the operation and growth of our business and do not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our Board, subject to compliance with applicable law, our organizational documents and any contractual provisions, including under agreements for indebtedness we may incur, that restrict or limit our ability to pay dividends, and will depend upon, among other factors, our results of operations, financial condition, earnings, capital requirements and other factors that our Board deems relevant. Investors seeking cash dividends in the foreseeable future should not purchase our common stock.

The concentrated beneficial ownership of our common stock and the ability it affords to control our business may limit or eliminate other shareholders' ability to influence corporate affairs.

Based on filings made with the SEC, Mr. John V. Winfield, and entities that he controls (the “Winfield Group”) own 48,165,201 shares of the Company’s common stock and Van Den Berg Management, Inc. owns 30,189,136 shares of the Company’s common stock. Collectively, such shareholders own 78,354,337 shares, or approximately 41.8% of the Company’s outstanding common stock as of December 31, 2016. Because of this concentrated stock ownership, the Company’s largest shareholders will be in a position to significantly influence the election of our board of directors and all other decisions on all matters requiring shareholder approval. As a result, the ability of other shareholders to determine the management and policies of the Company is significantly limited. The interests of these shareholders may differ from the interests of other shareholders with respect to the issuance of shares, business transactions with or sales to other companies, selection of officers and directors and other business decisions. This level of control may also have an adverse impact on the market value of our shares because our largest shareholders may institute or undertake transactions, policies or programs that may result in losses, may not take any steps to increase our visibility in the financial community and/or may sell sufficient numbers of shares to significantly decrease our price per share.

Restrictions imposed by the 2015 Stockholders' Agreement may inhibit growth.

The 2015 Stockholders’ Agreement limits the ability of the Company to incur debt, among other things. Such restrictions could significantly impact the Company’s ability to take certain actions that potentially could enhance shareholder value. Refer to Part III, Item 13 for more information about the Stockholder’s Agreement.

The terms of the Operating Agreement of Northern Comstock LLC require significant cash payments and may significantly dilute the ownership interests of the common stock.

The Operating Agreement of Northern Comstock LLC requires that the Company make monthly cash capital contributions of $30,000 to Northern Comstock LLC and annual capital contributions in the amount of $482,500 payable in common stock or cash, at the Company's option, unless the Company has cash and cash equivalents in excess of $10,500,000 on the date of such payments, wherein the Company would then be required to pay in cash. The number of shares to be delivered is calculated by dividing the amount of the capital contribution by the volume-weighted average closing price of the Company’s common stock on its primary trading market for the previous 20 consecutive trading days prior to such capital contribution. The Operating Agreement also provides for a one-time acceleration of $812,500 of the capital contributions payable when the Company receives net cash proceeds from sources other than operations that exceed $6,250,000. The agreement also includes an ongoing acceleration of the Company’s capital contribution obligations equal to 3% of the net smelter returns generated by the properties subject to the Northern Comstock LLC joint venture. The Operating Agreement also provides that if the Company defaults in its obligation to make the scheduled capital contributions, then the remaining capital contribution obligations may be converted into the principal amount of a 6% per annum promissory note payable by the

19

Company on the same schedule as the capital contributions, secured by a mortgage on the properties subject to the Northern Comstock LLC joint venture. The operating agreement requires that these capital contributions, totaling $9.75 million, commence in October 2015, and end in September 2027, unless prepaid by the Company.