Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSEMBLY BIOSCIENCES, INC. | v234574_8k.htm |

Exhibit 99.1

1 This material contains estimates and forward - looking statements. The words “believe,” “may,” “might,” “will,” “aim,” “estimate,” “continue,” “would,” “anticipate, ”“intend,” “expect,” “plan” and similar words are intended to identify estimates and forward - looking statements. Our estimates and forward - looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or might affect our businesses and operations. Although we believe that these estimates and forward - looking statements are based upon reasonable assumptions, they are subject to many risks and uncertainties and are made in light of information currently available to us. Our estimates and forward - looking statements may be influenced by the following factors, among others: our ability to obtain FDA approval of our product candidates; differences between historical studies on which we have based our planned clinical trials and actual results from our trials; our anticipated capital expenditures and our estimates regarding our capital requirements; our liquidity and working capital requirements; our expectations regarding our revenues, expenses and other results of operations; our ability to sell any approved products and the price we are able realize; our need to obtain additional funding and our ability to obtain future funding on acceptable terms; our ability to retain and hire necessary employees and to staff our operations appropriately; our ability to compete in our industry and innovation by our competitors; our ability to stay abreast of and comply with new or modified laws and regulations that currently apply or become applicable to our business; estimates and estimate methodologies used in preparing our financial statements; and the future trading prices of our common stock and the impact of securities analysts’ reports on these prices. Estimates and forward - looking statements involve risks and uncertainties and are not guarantees of future performance. As a result of known and unknown risks and uncertainties, including those described above, the estimates and forward - looking statements discussed in this material might not occur and our future results and our performance might differ materially from those expressed in these forward - looking statements due to, including, but not limited to, the factors mentioned above. Estimates and forward - looking statements speak only as of the date they were made, and, except to the extent required by law, we undertake no obligation to update or to review any estimate and/or forward - looking statement because of new information, future events or other factors. Forward Looking Statements

2 Company Overview » A Phase III biopharmaceutical company focused exclusively on gastroenterology; specifically, anal disorders - a neglected area of drug development » Products address large, underserved, and untapped markets » Late - stage products being studied for 3 of the top 10 GI disorders » Near - term milestones with 2 pivotal Phase III read - outs expected in 1H 2012 Clinical Phase Program (Pathway) Indication I II III Potential NDA Filing Next Milestone Commercial Rights VEN 309 Iferanserin (NCE) Hemorrhoids 2014 Pivotal Phase III data read- out in 1Q 2012 World Wide VEN 307 Diltiazem (505(b)2) Anal Fissures 2013 Pivotal Phase III data read- out in 2Q 2012 North America VEN 308 (505(b)2) Fecal Incontinence 2015 Commence development in 2012 North America

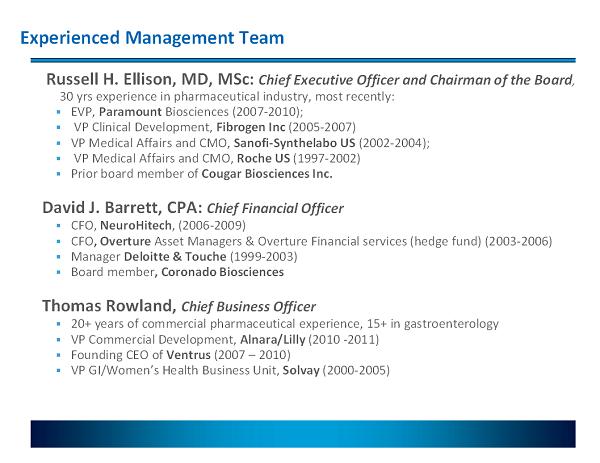

Russell H. Ellison, MD, MSc : Chief Executive Officer and Chairman of the Board , 30 yrs experience in pharmaceutical industry, most recently: ▪ EVP, Paramount Biosciences (2007 - 2010); ▪ VP Clinical Development, Fibrogen Inc (2005 - 2007) ▪ VP Medical Affairs and CMO, Sanofi - Synthelabo US (2002 - 2004); ▪ VP Medical Affairs and CMO, Roche US (1997 - 2002) ▪ Prior board member of Cougar Biosciences Inc. David J. Barrett, CPA: Chief Financial Officer ▪ CFO, NeuroHitech , (2006 - 2009) ▪ CFO , Overture Asset Managers & Overture Financial services (hedge fund) (2003 - 2006) ▪ Manager Deloitte & Touche (1999 - 2003) ▪ Board member , Coronado Biosciences Thomas Rowland, Chief Business Officer ▪ 20+ years of commercial pharmaceutical experience, 15+ in gastroenterology ▪ VP Commercial Development, Alnara/Lilly (2010 - 2011) ▪ Founding CEO of Ventrus (2007 – 2010) ▪ VP GI/Women’s Health Business Unit, Solvay (2000 - 2005) Experienced Management Team

VEN 309: Iferanserin NCE for Hemorrhoids

5 Hemorrhoids: Market Opportunity Symptoms » Bleeding, pain, itching, swelling, tenderness & difficult defecation Patients » Approx 12.5 million patients in U.S. FDA-Approved Rx Drugs » None Current Treatment Options » Invasive procedures (e.g., banding, sclerosing agents, surgery for prolapsed hemorrhoids) » 20-22 million 1,2 OTC units sold annually in U.S. (e.g., “Preparation H”) – combinations of protective ointments, low-strength steroid, topical anaesthetics » > 4 million prescriptions of non-approved and non- DESI intra-anal steroids 3 » Current products are not reimbursed Drugs in Pipeline » No other known drugs in development in U.S. 1. Nielsen Homescan and retail scan July 2011 2. IMS 2003 3. IMS 2009

6 Hemorrhoids: Market Opportunity Highly prevalent, solution - seeking market with excellent demographics In the last 52 weeks ending July 2 nd 2011 1 » 9.5 million unique households purchased 1 or more OTC hemorrhoid preps ▪ Representing 1 in 12 households » On average each purchasing household bought 1.7 units per year ▪ 30% of purchasing households bought 2 or more units per year ( ie : chronic or recurrent use); average time for repeat purchases was 2 months » 77% of purchasers were 45 years old or older ▪ 55% of all ambulatory care visits are for patients 45 years of age or older - ( ie 600 mio . visits/yr, 5 visits/person) 2 » 55% of households had income >$50,000/year 1. Nielsen Homescan July 2011 2. Schappert SM. Ambulatory medical care utilization estimates for 2007. National Center for Health Statistics. Vital Health Sta t 1 3(169). 2011.

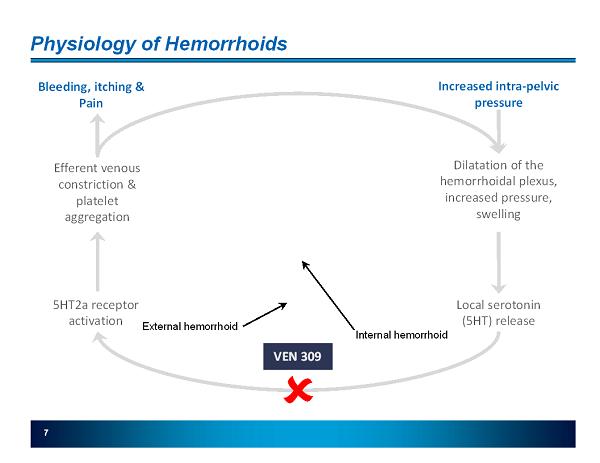

7 Physiology of Hemorrhoids Increased intra - pelvic pressure Dilatation of the hemorrhoidal plexus, increased pressure, swelling Local serotonin (5HT) release 5HT2a receptor activation Efferent venous constriction & platelet aggregation Internal hemorrhoid External hemorrhoid Bleeding, itching & Pain VEN 309

8 VEN 309 (Iferanserin) Summary Mechanism of Action » Selective 5HT2a antagonist » Does not cross the blood brain barrier except at doses much higher than to be used therapeutically Preclinical Safety » Systemic exposure is < 10% » Therapeutic ratio is > 17x Clinical Pharmacology » Metabolized by CYP2D6 in liver » No accumulation of the drug on twice daily dosing Clinical Data » Seven clinical trials in 359 subjects (220 exposures) » No SAEs, limited AEs (mainly GI), similar AE profile vs placebo » Significant improvements in symptoms related to hemorrhoids including bleeding, pain and itching Rights » World-wide rights paying royalties between 1% and 4% (pending close of $12 mio asset purchase 11/2011 contingent on PH III safety profile) Market and Data Exclusivity » Filed a new concentration range patent (August 2010) » Composition of matter expires August 2015 in the U.S. - 5 years and 10 years of data exclusivity in the U.S. and E.U. under Hatch-Waxman Act, respectively » Topical GI Product with low bioavailability Topical rectal ointment applied intra - anally BID (with proprietary single - use applicator)

9 VEN 309 Clinical Data: Efficacy Phase II Proof of Concept Study (Racemate) Arizona Early Phase II (S-isomer) Japan Late Phase II (S-isomer) Japan Dosing and Administration » 1% TID vs. placebo » 0.25% vs. 0.5% vs. 1% BID » 0.25% vs. 0.5% vs. 1% BID Number of Patients » 26 patients » 72 patients » 104 patients Duration of Therapy » 5 days » 14 days » 28 days Results and Clinical Benefits » Significant improvement in symptoms, including bleeding » Rapid onset, effects maintained » 0.5% significantly better than other concentrations » Improvements in symptoms and size, rapid onset » 0.5% and 1.0% consistent improvements in symptoms

10 VEN 309 Clinical Data: Efficacy Phase IIb » 5 sites in Germany, conducted in 2003/2004 121 patients randomized to Iferanserin 0.5% BID vs. placebo ointment x 14 days Baseline and weekly visits for 2 week treatment; follow - up at 45 days Symptoms recorded in daily diaries (scale of 1 - 10; 1 = no symptoms) » Endpoints Primary - bleeding scale at Day 7 and Day 14; 111 evaluable patients Secondary - itching and pain scales at Day 7 and Day 14; 60 evaluable patients with itching, 40 evaluable patients with pain Other - tenderness, fullness, throbbing, gas, difficulty in defecation and physician’s assessment

11 VEN 309 Clinical Data: Efficacy Phase IIb » Primary endpoint Bleeding: rapid sustained effect Day 7 VEN 309 vs. placebo p<0.0001 Day 14 VEN 309 vs. placebo p < 0.0075 1 2 3 4 5 6 7 M e a n ( B l e e d ) 0 1 2 3 4 5 6 7 8 9 1011121314 Day VEN 309 PLACEBO Mean (Bleed) BLEEDING (n=111 patients) P < 0.05

12 1 2 3 4 5 6 7 M e a n ( P a i n ) 0 1 2 3 4 5 6 7 8 9 1011 12 13 14 Day VEN 309 Clinical Data: Efficacy Phase IIb Secondary endpoints: rapid, sustained effect 1 2 3 4 5 6 7 M e a n ( I t c h ) 0 1 2 3 4 5 6 7 8 9 1011121314 Day * = P < 0.05 * ITCHING (n=60 patients) PAIN (n=40 patients) P < 0.05 DAY 7 P < 0.0008; DAY 14 P < 0.02 * VEN 309 PLACEBO Mean (Itch) Mean (Pain)

13 EFFICACY ENDPOINTS FOR PHASE III » Primary endpoint: no bleeding Day 7 - Day 14 (2nd week of treatment). » Secondary endpoints: no pain, no itching Day 7 - Day 14 Unusual for symptomatic drugs – usually reduction in a scale – ie mitigation vs cessation Clearly clinically relevant (FDA) Compelling for patients and physicians vs OTC products (marginal transient effect) or intra - anal steroids (no data) » Proposed by FDA

14 Modeling of Phase IIb Data for Phase III Endpoints * Absence of symptom Day 7 through Day 14 n = 111 with bleeding, n = 60 with itching; n = 40 with pain, at entry Majority of responders in the treatment arm respond by Day 3 *Post hoc » Secondary Endpoints Itching: 59% vs. 32% p<0.034 Pain: 50% vs. 18% p<0.032 57% 20% 0% 10% 20% 30% 40% 50% 60% Iferanserin Placebo P = ≤ 0.0001 PRIMARY ENDPOINT: No Bleeding from Day 7 to Day 14 (2nd week of Treatment) Response

15 First Pivotal Phase III Trial Initiated » Initiated on schedule August 2011, double blind data anticipated Q1 2012 Approximately 600 patients (> 99% power for primary and >95% for secondary endpoints) 3 - arm study (200 patients/arm), double blind, b.i.d : Placebo ointment vs Iferanserin 0.5% x 14 days vs Iferanserin 0.5% x 7 days Approximately 70 sites (U.S.): 65 sites are active; screening and enrollment 14 days treatment with follow-up at 28 days; all patients roll over to 12 month extension follow-up to assess recurrence (open label treatment with Iferanserin if recurrence) Endpoints collected by daily patient diaries (IVRS system) » Inclusion criteria Symptomatic grade I to III internal hemorrhoids Bleeding from hemorrhoids 2 consecutive days immediately prior to randomization, with pain or itching accompanying the bleeding for the 2 days » Primary endpoint: no bleeding Day 7 - Day 14 (2nd week of treatment). Secondary endpoints: no pain, no itching Day 7 - Day 14 » Discussion with FDA on all major elements of the protocol

16 Development Plan » Chronic repeated use product (FDA definition – may or may not be the case in Japan and EU) » 1,500 subjects needed for complete safety profile (US and possibly EU) » Two pivotal Phase III trials (and one double blind Phase III recurrence trial to determine safety/efficacy and treatment for recurrence for the US) » Clinical pharmacology program including: DDI, intensive PK, QTc and special populations (to start Q4 2011) » Preclinical: 2 species 6 & 9 mo. Chronic tox Carcinogenicity studies in two species exposed for 104 weeks and dose ranging study and chronic tox in rats and dogs (only for FDA?) Carcinogenicity is critical path for NDA , clinical trials can be done serially without losing time » Potential FDA approval 2015 (if no carc required, ROW 2014)

VEN 307: Diltiazem Cream Novel Treatment for Anal Fissures

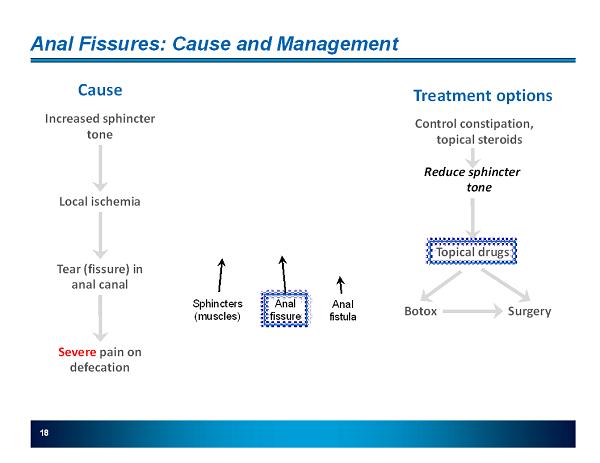

18 Anal Fissures: Cause and Management Increased sphincter tone Local ischemia Tear (fissure) in anal canal Cause Severe pain on defecation Treatment options Control constipation, topical steroids Reduce sphincter tone Topical drugs Botox Surgery Sphincters (muscles) Anal fissure Anal fistula

19 Anal Fissures: Medical Need and Market Opportunity Anal Fissures Symptoms Ischemic tears in the anus Severe pain Market 1.1 million office visits per year FDA-Approved Rx Drugs Rectiv (GTN Topical) FDA approved 6/22/2011 but not launched yet Relaxes anal sphincter; effective in pain relief Systemic exposure gives > exposure as an anti anginal dose Flushing and headaches limit use; o US PI: 938 headaches in 79 patients o overall headache rate (US PI; SMPC) > 60% Current Drug Treatments Fiber, sitz baths, steroids first line Compounded Diltiazem, Nifedipine, and some GTN are already used by specialists and PCP’s Medical associations’ guidelines have consistently directed physicians to topical Diltiazem over GTN as 1st line therapy o The Association of Coloproctology of Great Britain and Ireland (2008) (1) o The American Gastroenterology Association (2003) (2) Drugs in Pipeline RDD Pharma completed a Phase Ib clinical trial of Nifedipine for the treatment of chronic anal fissures (1) Cross, KLR., et al., (2008) The Management of Anal Fissure: ACPGBI Position Statement . Colorectal Disease, 10 (Suppl. 3), 1 - 7. (2) Madoff, RD., & Fleshman, JW. (2003) AGA Technical Review on the Diagnosis and Care of Patients With Anal Fissure . Gastroenterology, 124, 235 – 245

20 VEN 307 (Diltiazem) Summary Mechanism of Action » Calcium channel blocker Relaxes the internal anal sphincter, reducing pain and increasing tissue blood flow Preclinical Safety » Preclinical topical safety with 2% Diltiazem twice daily for ninety days Clinical Pharmacology » Topical has < 10% systemic exposure as oral dose but significantly greater effect on sphincter tone – i.e., blood levels do not predict activity. Low exposure = better tolerability than oral Diltiazem Clinical Data » Ten clinical trials in 453 individuals » Infrequent mild AEs reported » Similar or better reduction in pain, significantly better tolerability than GTN Rights » North American rights paying mid to upper single digit royalties Market and Data Exclusivity » Method of use patent expires Feb 2018 » Topical GI product; systemic levels do not predict efficacy and will not guarantee generic drug approval Topical Diltiazem cream applied peri - anally TID

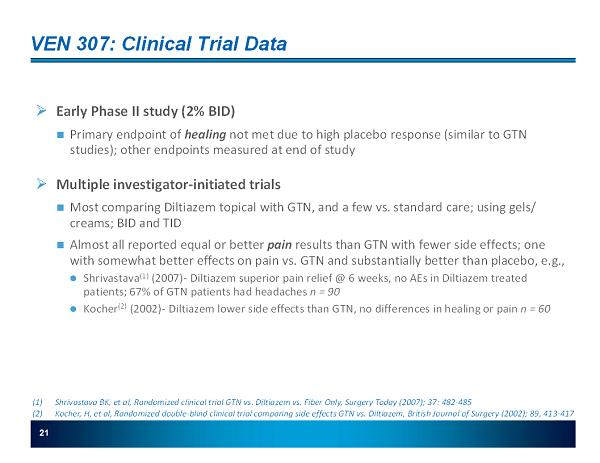

21 VEN 307: Clinical Trial Data » Early Phase II study (2% BID) Primary endpoint of healing not met due to high placebo response (similar to GTN studies); other endpoints measured at end of study » Multiple investigator - initiated trials Most comparing Diltiazem topical with GTN, and a few vs. standard care; using gels/ creams; BID and TID Almost all reported equal or better pain results than GTN with fewer side effects; one with somewhat better effects on pain vs. GTN and substantially better than placebo, e.g., Shrivastava (1) (2007) - Diltiazem superior pain relief @ 6 weeks, no AEs in Diltiazem treated patients; 67% of GTN patients had headaches n = 90 Kocher (2) (2002) - Diltiazem lower side effects than GTN, no differences in healing or pain n = 60 (1) Shrivastava BK, et al, Randomized clinical trial GTN vs. Diltiazem vs. Fiber Only, Surgery Today (2007); 37: 482 - 485 (2) Kocher, H, et al, Randomized double - blind clinical trial comparing side effects GTN vs. Diltiazem, British Journal of Surgery (2 002); 89, 413 - 417

22 VEN 307: First Pivotal Phase III Trial Initiated » FDA (analgesia division) pre - IND meeting conducted in August 2007 Confirmed Phase III multi - dose plan; 505b(2) status Achieved clarity on primary endpoint: reduction in pain Confirmed safety database and tox requirement » Phase III trial recently initiated (November) with data anticipated in 2Q 2012 Licensor (SLA) is conducting trial 465 patients in 30 sites in Europe; initiated in November 2010 Treated for 2 months: randomized 1:1:1 double blind; fiber plus 2%, 4% VEN 307, and placebo; primary endpoint at 1 month NRS scale, daily diaries 1 week observation to ensure sufficient pain prior to randomization Primary endpoint: reduction in pain on defecation using a validated scale (Likert, NRS) » Planned Second Phase III trial(s): We conduct enabling toxicity We may compare with Rectiv for AEs in PH III or PH IV Could be 2 trials with extended release formulation or 1 with original

Market Strategy, Financial Overview

24 Commercialization Strategy » Specialty sales force can be highly effective Diltiazem is the established gold - standard treatment for anal fissures among GIs and the launch of Rectiv will allow cost effective targeting of prescribers, with the AE advantage of VEN 307 and already established preference Highly selective specialty sales force targeting of prescribers of the 4 million prescriptions of steroids for hemorrhoids using IMS data to convert these to VEN 309 No data to support the use of intra anal steroids as effective treatment; not approved » Partnerships We intend to seek a marketing partner for VEN 309 for ex - U.S. territories Co - promotion opportunities exist for broader PCP coverage of VEN 309 and VEN 307 » Pricing and Reimbursement VEN 309: No other drugs in class or indication: Medicare Part D and managed care implications VEN 307: Expect major share of existing compounded Rx plus additional patients The nature of the markets we target provide Ventrus with optimal strategic flexibility

(000’s) Cash & Equivalents @ June 30, 2011 $11,369 Cash Proceeds July 2011 Raise $47,500 VTUS has sufficient cash into 2014 Dilutive Securities (millions) Common Stock 12.4 Warrants ($1.24 - $66.46) (1) .9 Options ($6.30) (2) 1.9 Total 15.2 Summary Financial Overview 25 (1) Range of exercise prices.at June 30 2011 (2) Weighted average exercise price. at June 30 2011

26 Expected Milestones 4Q 2011 /1Q 2012 1Q / 2Q 2012 H2 2012 » Completion of Phase III trial enrollment » Publication of German PH IIB trial and preclinical pharmacology review » Data read - out from first pivotal Phase III trial (1Q 2012) » Data from clin. pharm program » Recurrence read - out from 1st pivotal; data read - outs from pharmacology program; launch of second pivotal and/or recurrence trial VEN 309 VEN 307 » Selection of a new Diltiazem extended release formulation with extended IP (3Q/4Q 2011) » Completion of enrollment of European Phase III » Data read - out from first pivotal Phase III trial (2Q 2012) » Launch of second pivotal(s)

27 Key Takeaways » The Products VEN 309 believed to be the first and ONLY FDA - approved Rx drug for hemorrhoids, with a market of approximately 12.5 million patients in the US and proportional markets in ROW VEN 307 believed to be a superior product to the only approved drug for anal fissures (Rectiv), with a market of approximately 1.1 million office visits per year VEN 309 and 307: validated Phase III endpoint that has already demonstrated efficacy in multiple Phase II trials Good safety profile - limited side effects from topical administration » The Company 2 high - value pivotal data read - outs expected in H1 2012 Cash sufficient through Q1 2014 under most scenarios Multiple scenarios are possible for further development and commercialization of the products after the data read - outs Experienced team with a history of success