Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mondelez International, Inc. | d8k.htm |

| EX-99.1 - KRAFT FOODS INC. PRESS RELEASE, DATED SEPTEMBER 7, 2011. - Mondelez International, Inc. | dex991.htm |

Kraft

Foods Barclays Capital

Back-to-School Conference

September 7, 2011

Exhibit 99.2 |

Irene

Rosenfeld Chairman and CEO |

Forward-looking statements

This

slide

presentation

contains

a

number

of

forward-looking

statements.

The

words

“believe,”

“expect,”

“anticipate,”

“optimistic,”

“intend,”

“plan,”

“goals,”

“may,”

“aim,”

“will”

and similar

expressions

are

intended

to

identify

our

forward-looking

statements.

Examples

of

forward-

looking statements include, but are not limited to, statements we make regarding being

well- positioned for sustainable growth; two distinct portfolios poised for peak

performance; top-line growth; 2011 guidance; top-tier organic revenue growth;

EPS growth; North America Grocery business description and performance; position within

the new reality of the U.S. food industry; Global Snacks business description, ranking,

geographic profile and performance; benefits from creating two independent entities;

and what’s next. These forward-looking statements involve

risks and uncertainties, many of which are beyond our control, and important factors that

could cause actual results to differ materially from those in the forward-looking

statements include, but are not limited to, increased competition, pricing actions,

continued volatility and increases in commodity costs, increased costs of sales, our

indebtedness and our ability to pay our indebtedness, risks from operating globally,

our failure to successfully execute in emerging markets,

our

failure

to

create

two

success

independent

companies

and

tax

law

changes.

For

additional information on these and other factors that could affect our forward-looking

statements, see our risk factors, as they may be amended from time to time, set forth

in our filings with the SEC, including our most recently filed Annual Report on Form

10-K and subsequent reports on Forms 10-Q and 8-K.

We disclaim and do not undertake any obligation

to update or revise any forward-looking statement in this slide presentation, except as

required by applicable law or regulation.

3 |

Why now?

•

Well-Positioned for Sustainable Growth

•

Two Distinct Portfolios Poised for Peak

Performance

4 |

Three key

ingredients to sustainable growth •

Fix our base

–

Rewire the organization

–

Rejuvenate our brands

5

Kraft

Foods

Base

Business

(1)

% of Products Preferred to Competition

(1)

Excludes Cadbury.

Source: Kraft Foods. |

Three key

ingredients to sustainable growth •

Fix our base

•

Transform the portfolio

–

Strengthen North American

business

–

Build a global snacks

powerhouse

6 |

Three key

ingredients to sustainable growth •

Fix our base

•

Transform the portfolio

•

Make Virtuous Cycle

work in each region

–

Sustainable, top-tier growth

7

Focus on Power

Brands,

Categories,

Markets

Drive Top-Tier

Growth

Reduce Costs

Leverage Overheads

Reinvest in

Growth |

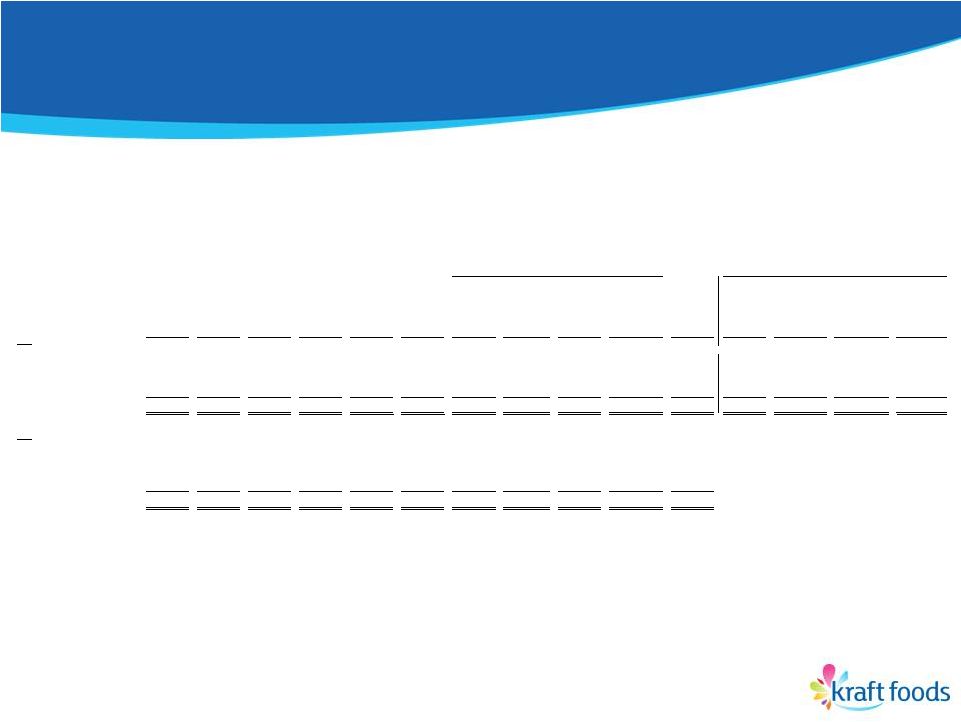

Top-line

growth accelerating in each region 8

Organic Net Revenue Growth*

North America

Developing Markets

Europe

*

For 2010, reflects Combined Organic Net Revenue growth. Reported Net Revenue growth for

2010 were as follows: North America, 8.8%; Europe, 32.6%; Developing Markets,

71.1%. Reported Net Revenue growth for H1 2011 were as follows: North America,

3.4%; Europe, 18.9%; Developing Markets, 23.1%. See GAAP to Non-GAAP reconciliation

at the end of this presentation. 1.1%

3.1%

2010

H1 2011

9.5%

11.6%

2010

H1 2011

2.3%

5.4%

2010

H1 2011 |

Strong H1

operating momentum in each geography

•

Executed necessary pricing

–

Quickly responded to higher input costs

•

Winning with consumers

–

Focused brand investments, innovation and improved

marketing

–

Solid share performance while pricing earlier than competition

•

Grew profit dollars versus difficult comparisons

–

Driving End-to-End Cost Management

–

Funding strong increase in A&C

9 |

Snacks

portfolio up more than 6% in H1 *

•

Global Biscuits +7% through H1

*

–

Developing Markets up strong double-digits

–

Oreo

+22%,

Chips

Ahoy!

+18%,

Club

Social

+35%

•

Global Chocolate +9% through H1

*

–

Developing Markets up low-to-mid teens

–

Cadbury

Dairy

Milk

+13%,

Lacta

+18%,

Cadbury

Flake

+13%

•

Global Gum & Candy +2% through H1

*

–

Developing Markets up high single-digits

–

Fixing developed markets through advertising, innovation

and price points

10

* Reflects H1 2011 Organic Net Revenue Growth. Reported H1 2011 Net Revenue growth was

16.7% for Snacks, 10% for Biscuits and 22.5% for Confectionery, which is

comprised of 26.2% for Chocolate, 24.3% for Gum & Candy and (37.1)% for Other

Confectionery. See GAAP to Non-GAAP reconciliation at the end of this presentation. |

Increased 2011

guidance with Q2 results •

Organic Net Revenue growth of at least 5%

–

Taking additional pricing to address climbing input costs

•

Operating EPS of at least $2.25

–

Delivering strong operating results

–

Reflecting year-to-date currency benefit

11 |

Delivering

top-tier organic revenue growth 12

1

ConAgra

9.5%

1

General Mills

8.5%

1

Danone

6.9%

1

Danone

6%-8%

2

Danone

8.4%

2

ConAgra

7.7%

2

Hershey

6.1%

2

PepsiCo

6%-8%

3

Nestlé

8.3%

3

Heinz

5.5%

3

Coca-Cola

6.0%

3

Nestlé

6%

4

General Mills

8.2%

4

Nestlé

4.1%

4

Nestlé

6.0%

4

Hershey

~6%

5

Heinz

6.9%

5

Coca-Cola

4.0%

5

General Mills

4.0%

5

Coca-Cola

5%-6%

6

Kraft Foods

6.7%

6

Hershey

4.0%

6

Kraft Foods

3.5/3.7%

6

Kraft Foods

5%+

7

PepsiCo

6.6%

7

PepsiCo

4.0%

7

PepsiCo

3.5%

7

Sara Lee

4.9%

8

Coca-Cola

5.7%

8

Danone

3.2%

8

Heinz

2.1%

8

Kellogg

4%-5%

9

Kellogg

5.4%

9

Campbell

3.0%

9

ConAgra

(0.8)%

9

General Mills

2.0%

10

Sara Lee

4.6%

10

Kellogg

3.0%

10

Kellogg

(1.3)%

10

Heinz

1.9%

11

Hershey

3.4%

11

Sara Lee

2.7%

11

Campbell

(2.0)%

11

ConAgra

1.1%

12

Campbell

3.0%

12

Kraft Foods

1.5%

12

Sara Lee

(2.8)%

12

Campbell

(2.0)%

(1)

Reported Net Revenue growth was 27.0%; Combined Organic Net Revenue Growth was 3.5%; Kraft

Foods Base Organic Net Revenue

growth

was

3.7%.

See GAAP to Non-GAAP reconciliation at the end of this presentation.

(2)

Per company reports.

(3)

PepsiCo reflects the company’s medium-term target. Coca-Cola reflects the

company’s long-term target. (4)

As reported.

Organic Revenue Growth (Fiscal Year)

*

2008

2009

2010

2011E

(2)

(1)

(4)

(4)

(4)

(4)

(3)

(3)

* Source: Thomson First Call. |

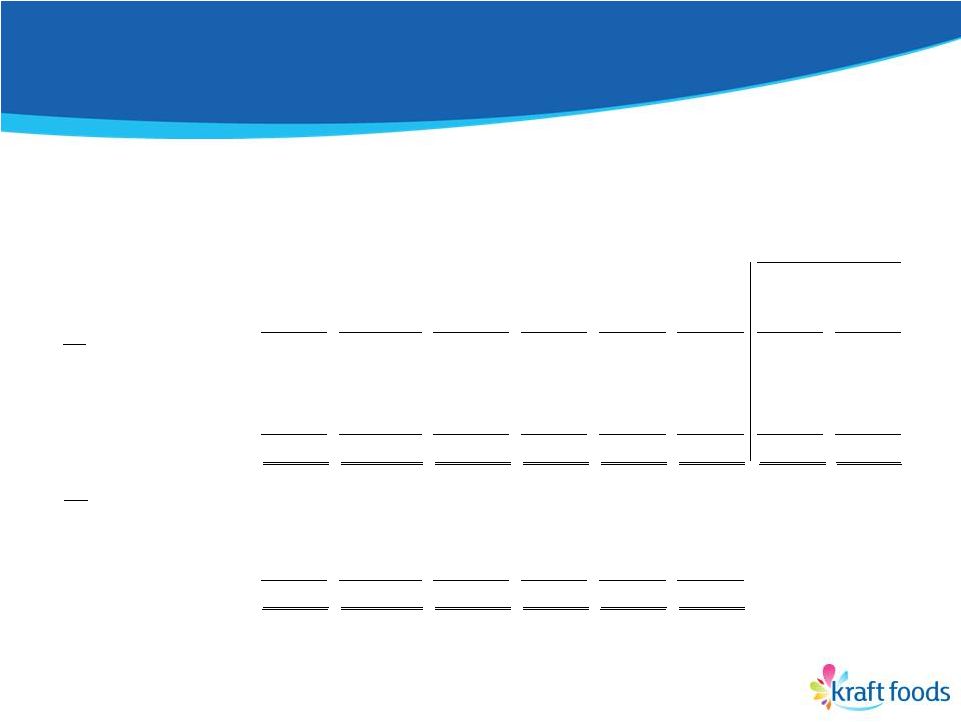

Poised to

improve EPS growth versus peers 13

1

ConAgra

32.9%

1

Hershey

15.4%

1

Hershey

17.5%

1

Kraft Foods

11.4%+

2

Sara Lee

19.3%

2

General Mills

13.1%

2

General Mills

15.6%

2

Coca-Cola

11.2%

3

Coca-Cola

16.7%

3

Heinz

10.3%

3

ConAgra

14.5%

3

Hershey

11.0%

4

General Mills

10.7%

4

Kraft Foods

8.0%

4

Coca-Cola

14.1%

4

Danone

10.3%

5

Heinz

10.5%

5

Campbell

6.2%

5

PepsiCo

11.3%

5

General Mills

7.8%

6

PepsiCo

8.9%

6

Kellogg

5.7%

6

Campbell

11.3%

6

PepsiCo

7.7%

7

Kellogg

8.3%

7

PepsiCo

0.8%

7

Nestlé

7.4%

7

Heinz

7.3%

8

Campbell

7.2%

8

Nestlé

0.7%

8

Danone

5.4%

8

Kellogg

5.8%

9

Nestlé

4.0%

9

Danone

(0.8)%

9

Kraft Foods

4.7%

9

Sara Lee

2.6%

10

Kraft Foods

3.3%

10

Coca-Cola

(2.9)%

10

Kellogg

4.4%

10

Campbell

0.8%

11

Danone

1.2%

11

Sara Lee

(15.2)%

11

Heinz

(1.0)%

11

ConAgra

0.6%

12

Hershey

(9.6)%

12

ConAgra

(20.0)%

12

Sara Lee

(9.5)%

12

Nestlé

(7.8)%

2008

2009

2010

2011E

Operating EPS Growth

(1)

(2)

(4)

(4)

(4)

(4)

(3)

(1)

Source: Thomson First Call.

(2)

Represents Operating EPS. Reported Diluted EPS declined 23.8%. See GAAP to

Non-GAAP reconciliation at the end (3)

Based on Operating EPS guidance of at least $2.25. (4)

As reported.

of this presentation. |

Well-positioned to deliver top-tier growth

14

Focus on Power

Brands, Categories,

Markets

Drive Top-Tier Growth

Reduce Costs

Leverage Overheads

Reinvest in Growth |

Why now?

•

Well-Positioned for Sustainable Growth

•

Two Distinct Portfolios Poised for Peak

Performance

15 |

Significant

differences in operating models of NA Grocery and Global Snacks

16

North American

Grocery

Global

Snacks

Categories/Brands

Regional

Global

Products

Everyday Staples

Ubiquitous,

Discretionary

Store Presence

Center of Store

Snacking Aisle,

End Caps, Hot Zone

Sales & Distribution

Warehouse

DSD, High Touch

Cost Structure

Low,

Variable

High,

Fixed

Selling Costs

Modest

High |

17

Two strong portfolios with unique drivers

of success

North American

Grocery

Global

Snacks |

North American

Grocery will be a major force in the industry

18

U.S.

Beverages

17%

$16 Billion in Revenues

*

U.S. Cheese

22%

U.S.

Convenient

Meals

19%

U.S. Grocery

22%

Canada &

NA Foodservice

20%

Significant scale across categories

—

#3 in size to Nestle and PepsiCo

#1 in ~80% of categories

—

Four $1B+ brands…

Kraft, Maxwell

House,

Oscar Mayer, Philadelphia

—

Three $500MM-$1B brands

—

Fourteen $100MM-$500MM brands

Biggest and best grocery sales

force in U.S.

—

Highest rated in Cannondale and

Kantar

—

Gaining share with key customers

* Based on 2010 reported net revenues adjusted for accounting calendar changes and

divestitures, including the Starbucks CPG business. |

Well-positioned within the new reality

of the U.S. food industry

19

* Excludes Cookies, Crackers and Snack Nuts

Source: Nielsen.

’07-’09

CAGR

2010

5.3%

1.9%

Kraft Foods Categories

*

’07-’09

CAGR

2010

5.0%

0.3%

Total U.S. Food & Beverage |

North American

Grocery will deliver consistent growth, significant free cash flow

20

•

Moderate growth in line with categories

–

Innovation and marketing excellence

–

Disciplined portfolio management

–

Grocery channel scale

•

Strong margins with upside opportunity

–

Trade spend optimization

–

Lean Six Sigma

–

Negative overhead growth

–

High dividend payout, growing dividend over time

Substantial

free

cash

generation

• |

Global Snacks

will be the pre-eminent player in snacking worldwide

21

#1 player in global snacks

—

#1 in Biscuits

—

#1 in Chocolate

—

#2 in Gum

Strong stable of global and

local icons

—

Eight $1B+ brands …

Cadbury,

Jacobs,

LU,

Milka, Nabisco, Oreo, Tang, Trident

—

Six $500MM-$1B brands

—

Nearly 40 $100MM-$500MM brands

Beverages to drive strong growth

with high margins

* Based on 2010 reported net revenues adjusted for accounting calendar changes and

divestitures. ** Includes salted snacks

Chocolate

26%

$32 Billion in Revenues

*

Gum &

Candy

16%

Biscuits

**

33%

Beverages

16%

Cheese &

Grocery

9%

•

•

• |

(1)

Global Snacks will rank among the leading

CPG players in developing markets

22 Avon

Percentage of Revenues from Developing Markets

Colgate

P&G

Danone

Kimberly

Clark

Heinz

PepsiCo

Coca-

Cola

Campbell

Soup

Nestlé

Clorox

Sara Lee

Unilever

Kellogg

General

Mills

68%

53%

50%

49%

42%

39%

35%

34%

32%

31%

23%

21%

17%

14%

11%

8%

(1)

Reflects the percentage of revenues from Developing Markets of the proposed Global Snacks

company.

Source: Company reports and presentations, reflecting the following: Avon -

Emerging & developing markets per CAGNY 2011 presentation; Unilever -

Emerging markets per 2010 annual report; Colgate - Emerging markets per CAGNY 2011

presentation; Danone - Emerging markets pro forma for Unimilk per 2010 results

presentation; Nestle - Emering markets approaching 40% of sales per full year 2010 results roadshow; P&G - Developing markets per fiscal

2011 10-K; Coca-Cola - Pacific, Latin America, Eurasia & Africa excluding

Bottling Investments; Kimberly-Clark - Asia, Latin America and Other; PepsiCo -

Emerging markets pro forma for Wimm-Bill-Dann per CAGNY 2011 presentation; Heinz -

Emerging markets per Q1 2012 earnings release; Campbell - Australia/Asia

Pacific, Other; Sara Lee - Other; Kellogg - Latin America, Asia Pacific; General Mills - Asia Pacific, Latin America.

|

23

Latin

America

CEEMA

Asia

Pacific

Europe

36%

North

America

22%

Developing

Developing

Markets

Markets

42%

42%

$32 Billion in Revenues

*

Well-balanced Developing

Markets presence

—

Scale and profitable growth in key

developing markets

Strong presence, prospects in

Europe

—

Significant synergies, whitespace

opportunities

Lower-than-average exposure

to North America

—

Instant Consumption Channel

expansion

* Based on 2010 reported net revenues adjusted for accounting calendar changes and

divestitures. •

•

•

Global Snacks’

geographic profile is

unique within consumer products |

Global Snacks

will deliver exceptional growth 24

•

Industry-leading growth

–

Global product platforms

–

Developing Market presence

–

Instant Consumption Channels

–

Whitespace opportunities

•

Leverage cost structure to drive margin gains

–

Volume growth and improved product mix

Reinvest to support future growth

Top-tier EPS growth plus a modest dividend

•

• |

Several

important benefits from creating two independent entities

•

Enable focus on distinct strategic priorities

–

Customize operating models, cultures, organizational

structures

•

Optimize resource allocation and capital deployment

–

North American Grocery resources dedicated to the

Grocery business

•

Increase transparency for shareholders

–

Value each business versus respective peer set

–

Expand shareholder base

25 |

What’s

Next •

Continue to report as one company

•

Tax Rulings by early Q2

•

Initial Form 10 filing during Q2

•

Complete transaction no later than Dec. 31, 2012

26 |

27

Summary

•

Strong business momentum

•

Virtuous cycle at work in every region

•

Taking next logical step in evolution of Kraft Foods |

|

29

GAAP to Non-GAAP Reconciliation

As Reported

(GAAP)

Impact of

Divestitures

Impact of

Acquisitions

Impact of

Integration

Program

Impact of

Currency

Base Kraft

Foods

Organic

(Non-GAAP)

Impact of

Acquisitions -

Cadbury

(1)

Divestitures -

Cadbury's

Poland and

Romania

Operations

(1)

Impact of

Currency -

Cadbury

(1)

Cadbury

Organic

(Non-GAAP)

(1)

Combined

Organic

(Non-GAAP)

As Reported

(GAAP)

Base Kraft

Foods Organic

(Non-GAAP)

Cadbury

Organic

(Non-GAAP)

(1)

Combined

Organic

(Non-GAAP)

2010

Kraft Foods North America

23,966

$

(21)

$

(1,498)

$

-

$

(251)

$

22,196

$

1,498

$

-

$

(35)

$

1,463

$

23,659

$

8.8%

1.1%

0.8%

1.1%

Kraft Foods Europe

11,628

-

(2,892)

-

267

9,003

2,892

-

91

2,983

11,986

32.6%

2.9%

0.7%

2.3%

Kraft Foods Developing Markets

13,613

-

(4,753)

1

15

8,876

4,753

(105)

(302)

4,346

13,222

71.1%

11.8%

5.1%

9.5%

Kraft Foods

49,207

$

(21)

$

(9,143)

$

1

$

31

$

40,075

$

9,143

$

(105)

$

(246)

$

8,792

$

48,867

$

27.0%

3.7%

2.9%

3.5%

2009

Kraft Foods North America

22,030

$

(80)

$

-

$

-

$

-

$

21,950

$

1,452

$

-

$

-

$

1,452

$

23,402

$

Kraft Foods Europe

8,768

(15)

-

-

-

8,753

2,961

-

-

2,961

11,714

Kraft Foods Developing Markets

7,956

(14)

-

-

-

7,942

4,341

(207)

-

4,134

12,076

Kraft Foods

38,754

$

(109)

$

-

$

-

$

-

$

38,645

$

8,754

$

(207)

$

-

$

8,547

$

47,192

$

(1)

Net Revenues to Combined Organic Net Revenues

For the Twelve Months Ended December 31,

($ in millions, except percentages) (Unaudited)

Add back:

% Change

Kraft Foods acquired Cadbury plc on February 2, 2010. Cadbury data, shown above, is for February

through December 2010 and 2009, adjusted from IFRS to U.S. GAAP and translated to US$ from local countries' currencies.

Cadbury 2009 data is presented on a combined company, pro forma basis.

|

30

GAAP to Non-GAAP Reconciliation

As Reported

(GAAP)

Impact of

Divestitures

(1)

Impact of

Acquisitions

(2)

Impact of

Accounting

Calendar

Changes

Impact of

Currency

Organic

(Non-GAAP)

As Reported

(GAAP)

Organic

(Non-GAAP)

2011

Kraft Foods North America

12,254

$

(91)

$

(117)

$

-

$

(92)

$

11,954

$

3.4%

3.1%

Kraft Foods Europe

6,541

-

(201)

(226)

(364)

5,750

18.9%

5.4%

Kraft Foods Developing Markets

7,656

-

(379)

(90)

(352)

6,835

23.1%

11.6%

Kraft Foods

26,451

$

(91)

$

(697)

$

(316)

$

(808)

$

24,539

$

12.2%

5.9%

2010

Kraft Foods North America

11,849

$

(258)

$

-

$

-

$

-

$

11,591

$

Kraft Foods Europe

5,502

-

-

(45)

-

5,457

Kraft Foods Developing Markets

6,220

(80)

-

(18)

-

6,122

Kraft Foods

23,571

$

(338)

$

-

$

(63)

$

-

$

23,170

$

(1)

Impact of divestitures includes Starbucks CPG business.

(2)

Impact of acquisitions reflects the incremental January 2011 operating results from

our Cadbury acquisition. Net Revenues to Organic Net Revenues

For the Six Months Ended June 30,

($ in millions, except percentages) (Unaudited)

% Change |

31

GAAP to Non-GAAP Reconciliation

As Reported

(GAAP)

Impact of

Divestitures

Impact of

Acquisitions

(2)

Impact of

Accounting

Calendar

Changes

Impact of

Currency

Organic

(Non-GAAP)

As Reported

(GAAP)

Organic

(Non-GAAP)

2011

Biscuits

5,776

$

-

$

-

$

(99)

$

(128)

$

5,549

$

10.0%

6.9%

Confectionery

Chocolate

4,513

-

(285)

(43)

(259)

3,926

26.2%

9.4%

Gum & Candy

2,710

-

(379)

15

(131)

2,215

24.3%

1.6%

Other Confectionery

178

-

(5)

(3)

(6)

164

(37.1)%

(14.6)%

7,401

-

(669)

(31)

(396)

6,305

22.5%

5.8%

Snacks

(1)

13,177

$

-

$

(669)

$

(130)

$

(524)

$

11,854

$

16.7%

6.3%

2010

Biscuits

5,252

$

-

$

-

$

(59)

$

-

$

5,193

$

Confectionery

Chocolate

3,577

11

-

-

-

3,588

Gum & Candy

2,180

-

-

-

-

2,180

Other Confectionery

283

(91)

-

-

-

192

6,040

(80)

-

-

-

5,960

Snacks

(1)

11,292

$

(80)

$

-

$

(59)

$

-

$

11,153

$

(1)

Snacks is defined as the combination of the Biscuits sector, which includes cookies,

crackers and salted snacks, and the Confectionery sector, which includes

chocolate, gum & candy and other confectionery. (2)

Impact of acquisitions reflects the incremental January 2011 operating results from

our Cadbury acquisition. Net Revenues to Organic Net Revenues by Consumer

Sector For the Six Months Ended June 30,

($ in millions, except percentages) (Unaudited)

Kraft Foods

% Change |

32

GAAP to Non-GAAP Reconciliation

As Reported

(GAAP)

Integration

Program

Costs

(1)

Acquisition-

Related

Costs

(2)

and Financing

Fees

(3)

U.S. Health

Care Legislation

Impact on

Deferred Taxes

Operating

(Non-GAAP)

As Reported

EPS Growth

from

Continuing

Operations

(GAAP)

Operating

EPS Growth

(Non-GAAP)

2010

Diluted EPS

-

Continuing operations

1.44

$

0.29

$

0.21

$

0.08

$

2.02

$

(23.8)%

4.7%

-

Discontinued operations

0.95

-

Net earnings attributable to Kraft Foods

2.39

$

2009

Diluted EPS

-

Continuing operations

1.89

$

-

$

0.04

$

1.93

$

-

Discontinued operations

0.14

-

Net earnings attributable to Kraft Foods

2.03

$

(1)

Integration Program costs are defined as the costs associated with combining the

Kraft Foods and Cadbury businesses, and are separate from those costs associated with

the acquisition.

(2)

Acquisition-related costs include transaction advisory fees, UK stamp taxes and

the impact of the Cadbury inventory revaluation. (3)

Acquisition-related financing fees include hedging and foreign currency impacts

associated with the Cadbury acquisition and other fees associated with the

Cadbury bridge facility. % Growth

Diluted Earnings per Share to Operating EPS

For the Twelve Months Ended December 31,

(Unaudited) |