Attached files

Acquisition of

Temple Inland

Acquisition of

Temple Inland

September 2011

September 2011

Exhibit 99.1 |

2

Forward-Looking Statements

Forward-Looking Statements

All statements included or incorporated by reference in these slides other than

statements or characterizations of historical fact, are forward-looking

statements. These slides and statements made during this presentation

contain forward-looking statements. These statements reflect

management's current views and are subject to risks and uncertainties that could

cause actual results to differ materially from those expressed or implied in

these statements. Factors which could cause actual results to differ relate

to: (i) the receipt of Temple-Inland shareholder and regulatory

approvals for the transaction and the successful fulfillment or waiver of all other

closing conditions without unexpected delays or conditions; (ii) The failure to

realize synergies and cost savings from the transaction or delay in

realization thereof; (iii) increases in interest rates; (iv) industry

conditions, including but not limited to changes in the cost or availability of raw

materials,

energy

and

transportation

costs,

competition

we

face,

cyclicality

and

changes

in

consumer preferences, demand and pricing for our products; (v) global economic

conditions and political changes, including but not limited to the

impairment of financial institutions, changes in currency exchange rates,

credit ratings issued by recognized credit rating organizations, the amount

of our future pension funding obligation, changes in tax laws and pension and health

care costs; (vi) unanticipated expenditures related to the cost of compliance with

existing and new environmental and other governmental regulations and to

actual or potential litigation; and (vii) whether we experience a material

disruption at one of our manufacturing facilities and risks inherent in

conducting business through a joint venture. We undertake no obligation to publicly

update

any

statements

or

information

relating

to

these

slides

or

the

offer

described

above,

whether as a result of new information, future events or otherwise. These and other

factors that could

cause

or

contribute

to

actual

results

differing

materially

from

such

forward

looking

statements are discussed in greater detail in the company's SEC filings.

|

3

Additional Information

In connection with the proposed merger, Temple-Inland will file a proxy

statement with the Securities and Exchange Commission (the “SEC”).

Investors and security holders are advised to read the proxy statement

when it becomes available because it will contain important

information

about

the

merger

and

the

parties

to

the

merger.

Investors

and

security holders may obtain a free copy of the proxy statement (when available) and

other documents

filed

by

Temple-Inland

at

the

SEC

website

at

http://www.sec.gov.

The

proxy

statement

and

other

documents

also

may

be

obtained

(after

it

has

been

filed

with

the

SEC)

for

free from International Paper by directing such request to International Paper,

Investor Relations, telephone (800) 678-8715.

CERTAIN INFORMATION REGARDING PARTICIPANTS

International Paper and certain of its respective directors and executive officers

may be deemed to be participants in the proposed transaction under the rules

of the SEC. Security holders may obtain information regarding the names,

affiliations and interests of International Paper's directors and executive

officers in the International Paper's Annual Report on Form 10--K for the

year ended December 31, 2010 which was filed with the SEC on February 25, 2011, and

its proxy statement for the 2011 Annual Meeting, which was filed with the

SEC on April 8, 2011. Additional information regarding the interests of

participants in the solicitation of proxies in connection with the merger

will be included in the proxy statement that Temple-Inland intends to

file

with

the

SEC.

These

documents

can

be

obtained

free

of

charge

from

the

sources

indicated

above. |

4

Statements Relating to Non-GAAP

Financial Measures

Statements Relating to Non-GAAP

Financial Measures

During the course of this presentation, certain

non-U.S. GAAP financial information will be

presented.

A reconciliation of those numbers to U.S. GAAP

financial measures is available on the

company’s

website

at

internationalpaper.com

under Investors. |

5

Transaction Overview

Transaction Overview

International Paper has agreed to acquire Temple-

Inland, the third-largest North American corrugated

packaging manufacturer

Purchase price of $32.00/share

Total purchase consideration of $4.3 Billion,

including Temple-Inland net debt of $600 Million as

of 12/31/11 |

6

Consistent with IP’s focus on paper & packaging and

achieving and sustaining cost of capital returns

Makes a good N.A. corrugated packaging business

an excellent one

-

Compelling strategic and industrial logic

-

Shared focus on low-cost mills; complementary converting

systems; high level of box integration

-

Powerful cash flow engine

Significant synergy savings

Accretive year one, highly accretive over time

IP is a proven outstanding operator with

demonstrated track record of success integrating

acquisitions

Compelling Strategic Acquisition

Compelling Strategic Acquisition |

7

2011 Sales

(1)

of $4.0 Billion

2011 EBITDA

(1)

of $446 Million

4 Million Tons of

Containerboard Capacity

7 Containerboard Mills

59 Box Plants

14 Building Products Plants

2010 Segment Assets

Temple-Inland at a Glance

Predominately a Corrugated Packaging Company

Temple-Inland at a Glance

Predominately a Corrugated Packaging Company

(1)

I/B/E/S First Call FY11 filtered mean(s) as of 9/2/2011

Corrugated

82%

Building

Products

18% |

8

Transaction Highlights

Transaction Highlights

Consideration

$32.00 per TIN share, all cash

Synergies

$300 Million of annual run-rate synergies, to be achieved

within 24 months of close

Timing

Expected close in the first calendar quarter of 2012,

subject to shareholder vote and regulatory and other

customary approvals

Financing

Committed financing from a UBS-led bank syndicate

|

9

Purchase Price Overview

Purchase Price Overview

Purchase Price

$4.3B

EBITDA

(1)

Multiple

7.4x

Synergies at Full Run Rate

$300M

EBITDA

(1)

Multiple

(with Synergies)

4.9x

(1)

I/B/E/S First Call FY12 filtered mean as of 9/2/2011

|

10

Financing Overview

Financing Overview

Financing

Cash

$1.5B

Debt Rollover

~

$0.6B

New Debt

~

$2.2B

•

Committed financing

•

Rapid repayment of debt

•

Debt / EBITDA ~3.0x |

11

Strengthening International Paper

Combination Strongly Cash Accretive

Strengthening International Paper

Combination Strongly Cash Accretive

IP FY11

(1)

TIN FY11

(1)

IP + TIN

w/Run Rate

Synergies

Sales

($ Billion)

$26.6

$4.0

$30.6

EBITDA

($ Billion)

$3.75

$0.45

$4.50

(3)

EBITDA

Margin

14.1%

11.3%

14.7%

(3)

Free Cash Flow

(2)

($ Billion)

$1.90

$0.18

$2.25

(3)

(1)

I/B/E/S First Call FY11 as of 9/2/2011

(excludes special items)

(2)

FCF = Total Funds From Ops –

CapEx (First Call FCF modified to exclude impact of dividends to

be consistent with IP historical

reporting) ; IP+TIN FCF reduced by incremental interest expense, net of

taxes (3)

Includes $300 Million in run rate synergies, FCF synergies are net of taxes

|

12

Strategic Rationale

Strengthening Our Packaging Business

Strategic Rationale

Strengthening Our Packaging Business

IP North

American

Industrial

Packaging

(1)

TIN

Packaging

Business

(1)

Run Rate

Synergies

IP NA PKG

+ TIN

w/ Run Rate

Synergies

2011 Sales

($ Billion)

$8.7

$3.3

$12.0

2011 EBITDA

($ Billion)

$1.5

$.42

$0.30

$2.22

2011 EBITDA

Margin

17%

13%

19%

Capacity

(000 TPY)

10,000

4,000

14,000

(1)

1H11 actual results annualized (excluding special items)

|

13

External Environment

Timing is right

External Environment

Timing is right

U.S. Box Demand flat –

feels like 0-1% GDP growth

U.S. Box Demand not expected to return to pre-

crisis levels until 2015

Global Containerboard markets are strong and

expected to continue to grow |

14

2011 -

Demand Still Recovering

2011 -

Demand Still Recovering

Source: Fibre Box Association

2011 1H Run Rate

2011-2015 2.2% CAGR (RISI)

U.S. Box Shipments

373

378

390

396

405

401

380

379

380

391

391

395

390

374

345

357

357

363

374

384

390

250

275

300

325

350

375

400

425

RISI Fcst. |

15

Significant Targeted Synergies

$300 Million Run Rate

Significant Targeted Synergies

$300 Million Run Rate

S G & A

Eliminate Duplication

IT Integration

Mills

Grade / Machine Mix Optimization

Efficiency Improvements

Supply Chain

Logistics Optimization

Purchasing Consolidation

Box Plants

System Streamlining

Customer and Segment Optimization |

16

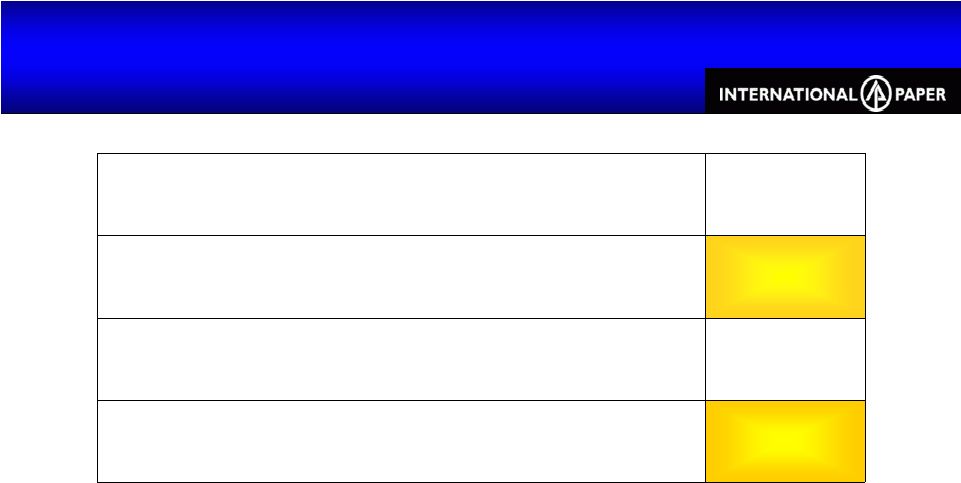

Acquisition Assessment

Acquisition Assessment

Creates Shareholder Value

Consistent with Strategy

Improves Core Business

Cost of Capital Returns

Significant Synergies

Greater Cash Flow Generation

Low Integration Risk

Bogalusa & Guaranty Due Diligence |

17

Path Forward

Path Forward

Attain Regulatory Approval

Obtain Temple-Inland Shareholder Approval

Develop IP’s Internal Integration Plan

Remain Focused on Day to Day Business

Operations |

18

Acquisition Summary

Acquisition Summary

Consistent with strategy

Financially attractive

-

Accretive in year one

-

Returns exceed cost of capital

Strengthens IP’s portfolio

Makes a good Industrial Packaging business an

excellent one

Significant synergy opportunities

Creates shareholder value |