Attached files

| file | filename |

|---|---|

| 8-K - 8-K COVER PAGES - Frontier Communications Parent, Inc. | ipcover8k.htm |

Investor Presentation

September 2011

2

Safe Harbor Statement

Forward-Looking Language

This document contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in

the financial statements. Statements that are not historical facts are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Words such as “believe,” “anticipate,” “expect” and similar expressions are intended to identify forward-looking statements. Forward-looking statements

(including oral representations) are only predictions or statements of current plans, which we review continuously. Forward-looking statements may differ from actual future results

due to, but not limited to, and our future results may be materially affected by, potential risks or uncertainties. You should understand that it is not possible to predict or identify all

potential risks or uncertainties. We note the following as a partial list: our ability to successfully integrate the operations and systems of the acquired business into Frontier’s

existing operations; the risk that the growth opportunities and cost synergies from the transaction may not be fully realized or may take longer to realize than expected; our

indemnity obligation to Verizon for taxes which may be imposed upon them as a result of changes in ownership of our stock may discourage, delay or prevent a third party from

acquiring control of us during the two-year period ending July 2012 in a transaction that stockholders might consider favorable; the effects of increased expenses incurred due to

activities related to the integration of the acquired business; most of the Acquired Business operates on systems acquired in the Transaction, which may not continue to function

properly following the first group of conversions to our legacy systems; our ability to maintain relationships with customers, employees or suppliers; the effects of greater than

anticipated competition requiring new pricing, marketing strategies or new product or service offerings and the risk that we will not respond on a timely or profitable basis;

reductions in the number of our access lines that cannot be offset by increases in High-Speed Internet (HSI) subscribers and sales of other products and services; the effects of

ongoing changes in the regulation of the communications industry as a result of federal and state legislation and regulation, or changes in the enforcement or interpretation of such

legislation and regulation; the effects of any unfavorable outcome with respect to any current or future legal, governmental or regulatory proceedings, audits or disputes; the effects

of changes in the availability of federal and state universal funding to us and our competitors; the effects of competition from cable, wireless and other wireline carriers; our ability

to adjust successfully to changes in the communications industry and to implement strategies for growth; continued reductions in switched access revenues as a result of

regulation, competition or technology substitutions; our ability to effectively manage service quality in our territories and meet mandated service quality metrics; our ability to

successfully introduce new product offerings, including our ability to offer bundled service packages on terms that are both profitable to us and attractive to customers; changes in

accounting policies or practices adopted voluntarily or as required by generally accepted accounting principles or regulations; our ability to effectively manage our operations,

operating expenses and capital expenditures, and to repay, reduce or refinance our debt; the effects of changes in both general and local economic conditions on the markets that

we serve, which can affect demand for our products and services, customer purchasing decisions, collectability of revenues and required levels of capital expenditures related to

new construction of residences and businesses; the effects of technological changes and competition on our capital expenditures and product and service offerings, including the

lack of assurance that our network improvements will be sufficient to meet or exceed the capabilities and quality of competing networks; the effects of increased medical, retiree

and pension expenses and related funding requirements; changes in income tax rates, tax laws, regulations or rulings, or federal or state tax assessments; the effects of state

regulatory cash management practices that could limit our ability to transfer cash among our subsidiaries or dividend funds up to the parent company; our ability to successfully

renegotiate union contracts expiring in 2011 and thereafter; changes in pension plan assumptions and/or the value of our pension plan assets, which would require us to make

increased contributions to the pension plan in 2012 and beyond; the effects of customer bankruptcies and home foreclosures, which could result in difficulty in collection of

revenues and loss of customers; adverse changes in the credit markets or in the ratings given to our debt securities by nationally accredited ratings organizations, which could limit

or restrict the availability, or increase the cost, of financing; limitations on the amount of capital stock that we can issue to make acquisitions or to raise additional capital until July

2012; our ability to pay dividends on our common shares, which may be affected by our cash flow from operations, amount of capital expenditures, debt service requirements,

cash paid for income taxes and liquidity; and the effects of severe weather events such as hurricanes, tornados, ice storms or other natural or man-made disasters. These and

other uncertainties related to our business are described in greater detail in our filings with the Securities and Exchange Commission, including our reports on Forms 10-K and 10-

Q, and the foregoing information should be read in conjunction with these filings. We undertake no obligation to publicly update or revise any forward-looking statements or to

make any other forward-looking statement, whether as a result of new information, future events or otherwise unless required to do so by securities laws.

the financial statements. Statements that are not historical facts are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Words such as “believe,” “anticipate,” “expect” and similar expressions are intended to identify forward-looking statements. Forward-looking statements

(including oral representations) are only predictions or statements of current plans, which we review continuously. Forward-looking statements may differ from actual future results

due to, but not limited to, and our future results may be materially affected by, potential risks or uncertainties. You should understand that it is not possible to predict or identify all

potential risks or uncertainties. We note the following as a partial list: our ability to successfully integrate the operations and systems of the acquired business into Frontier’s

existing operations; the risk that the growth opportunities and cost synergies from the transaction may not be fully realized or may take longer to realize than expected; our

indemnity obligation to Verizon for taxes which may be imposed upon them as a result of changes in ownership of our stock may discourage, delay or prevent a third party from

acquiring control of us during the two-year period ending July 2012 in a transaction that stockholders might consider favorable; the effects of increased expenses incurred due to

activities related to the integration of the acquired business; most of the Acquired Business operates on systems acquired in the Transaction, which may not continue to function

properly following the first group of conversions to our legacy systems; our ability to maintain relationships with customers, employees or suppliers; the effects of greater than

anticipated competition requiring new pricing, marketing strategies or new product or service offerings and the risk that we will not respond on a timely or profitable basis;

reductions in the number of our access lines that cannot be offset by increases in High-Speed Internet (HSI) subscribers and sales of other products and services; the effects of

ongoing changes in the regulation of the communications industry as a result of federal and state legislation and regulation, or changes in the enforcement or interpretation of such

legislation and regulation; the effects of any unfavorable outcome with respect to any current or future legal, governmental or regulatory proceedings, audits or disputes; the effects

of changes in the availability of federal and state universal funding to us and our competitors; the effects of competition from cable, wireless and other wireline carriers; our ability

to adjust successfully to changes in the communications industry and to implement strategies for growth; continued reductions in switched access revenues as a result of

regulation, competition or technology substitutions; our ability to effectively manage service quality in our territories and meet mandated service quality metrics; our ability to

successfully introduce new product offerings, including our ability to offer bundled service packages on terms that are both profitable to us and attractive to customers; changes in

accounting policies or practices adopted voluntarily or as required by generally accepted accounting principles or regulations; our ability to effectively manage our operations,

operating expenses and capital expenditures, and to repay, reduce or refinance our debt; the effects of changes in both general and local economic conditions on the markets that

we serve, which can affect demand for our products and services, customer purchasing decisions, collectability of revenues and required levels of capital expenditures related to

new construction of residences and businesses; the effects of technological changes and competition on our capital expenditures and product and service offerings, including the

lack of assurance that our network improvements will be sufficient to meet or exceed the capabilities and quality of competing networks; the effects of increased medical, retiree

and pension expenses and related funding requirements; changes in income tax rates, tax laws, regulations or rulings, or federal or state tax assessments; the effects of state

regulatory cash management practices that could limit our ability to transfer cash among our subsidiaries or dividend funds up to the parent company; our ability to successfully

renegotiate union contracts expiring in 2011 and thereafter; changes in pension plan assumptions and/or the value of our pension plan assets, which would require us to make

increased contributions to the pension plan in 2012 and beyond; the effects of customer bankruptcies and home foreclosures, which could result in difficulty in collection of

revenues and loss of customers; adverse changes in the credit markets or in the ratings given to our debt securities by nationally accredited ratings organizations, which could limit

or restrict the availability, or increase the cost, of financing; limitations on the amount of capital stock that we can issue to make acquisitions or to raise additional capital until July

2012; our ability to pay dividends on our common shares, which may be affected by our cash flow from operations, amount of capital expenditures, debt service requirements,

cash paid for income taxes and liquidity; and the effects of severe weather events such as hurricanes, tornados, ice storms or other natural or man-made disasters. These and

other uncertainties related to our business are described in greater detail in our filings with the Securities and Exchange Commission, including our reports on Forms 10-K and 10-

Q, and the foregoing information should be read in conjunction with these filings. We undertake no obligation to publicly update or revise any forward-looking statements or to

make any other forward-looking statement, whether as a result of new information, future events or otherwise unless required to do so by securities laws.

3

Non-GAAP Financial Measures

The Company uses certain non-GAAP financial measures in evaluating its performance. These include free cash flow, EBITDA or “operating cash flow”, which

we define as operating income plus depreciation and amortization (“EBITDA”), and Adjusted EBITDA; a reconciliation of the differences between EBITDA and

free cash flow and the most comparable financial measures calculated and presented in accordance with GAAP is included in the appendix. The non-GAAP

financial measures are by definition not measures of financial performance under generally accepted accounting principles and are not alternatives to operating

income or net income reflected in the statement of operations or to cash flow as reflected in the statement of cash flows and are not necessarily indicative of

cash available to fund all cash flow needs. The non-GAAP financial measures used by the Company may not be comparable to similarly titled measures of

other companies.

we define as operating income plus depreciation and amortization (“EBITDA”), and Adjusted EBITDA; a reconciliation of the differences between EBITDA and

free cash flow and the most comparable financial measures calculated and presented in accordance with GAAP is included in the appendix. The non-GAAP

financial measures are by definition not measures of financial performance under generally accepted accounting principles and are not alternatives to operating

income or net income reflected in the statement of operations or to cash flow as reflected in the statement of cash flows and are not necessarily indicative of

cash available to fund all cash flow needs. The non-GAAP financial measures used by the Company may not be comparable to similarly titled measures of

other companies.

The Company believes that the presentation of non-GAAP financial measures provides useful information to investors regarding the Company’s financial

condition and results of operations because these measures, when used in conjunction with related GAAP financial measures, (i) together provide a more

comprehensive view of the Company’s core operations and ability to generate cash flow, (ii) provide investors with the financial analytical framework upon

which management bases financial, operational, compensation and planning decisions and (iii) presents measurements that investors and rating agencies

have indicated to management are useful to them in assessing the Company and its results of operations. Management uses these non-GAAP financial

measures to plan and measure the performance of its core operations, and its divisions measure performance and report to management based upon these

measures. In addition, the Company believes that free cash flow and EBITDA, as the Company defines them, can assist in comparing performance from period

to period, without taking into account factors affecting cash flow reflected in the statement of cash flows, including changes in working capital and the timing of

purchases and payments.

condition and results of operations because these measures, when used in conjunction with related GAAP financial measures, (i) together provide a more

comprehensive view of the Company’s core operations and ability to generate cash flow, (ii) provide investors with the financial analytical framework upon

which management bases financial, operational, compensation and planning decisions and (iii) presents measurements that investors and rating agencies

have indicated to management are useful to them in assessing the Company and its results of operations. Management uses these non-GAAP financial

measures to plan and measure the performance of its core operations, and its divisions measure performance and report to management based upon these

measures. In addition, the Company believes that free cash flow and EBITDA, as the Company defines them, can assist in comparing performance from period

to period, without taking into account factors affecting cash flow reflected in the statement of cash flows, including changes in working capital and the timing of

purchases and payments.

The Company has shown adjustments to its financial presentations to exclude certain costs because investors have indicated to management that such

adjustments are useful to them in assessing the Company and its results of operations. These adjustments are detailed in the Appendix for the reconciliation

of free cash flow and operating cash flow.

adjustments are useful to them in assessing the Company and its results of operations. These adjustments are detailed in the Appendix for the reconciliation

of free cash flow and operating cash flow.

Management uses these non-GAAP financial measures to (i) assist in analyzing the Company’s underlying financial performance from period to period, (ii)

evaluate the financial performance of its business units, (iii) analyze and evaluate strategic and operational decisions, (iv) establish criteria for compensation

decisions, and (v) assist management in understanding the Company’s ability to generate cash flow and, as a result, to plan for future capital and operational

decisions. Management uses these non-GAAP financial measures in conjunction with related GAAP financial measures. These non-GAAP financial measures

have certain shortcomings. In particular, free cash flow does not represent the residual cash flow available for discretionary expenditures, since items such as

debt repayments and dividends are not deducted in determining such measure. EBITDA has similar shortcomings as interest, income taxes, capital

expenditures, debt repayments and dividends are not deducted in determining this measure. Management compensates for the shortcomings of these

measures by utilizing them in conjunction with their comparable GAAP financial measures. The information in this document should be read in conjunction with

the financial statements and footnotes contained in our documents filed with the U.S. Securities and Exchange Commission.

evaluate the financial performance of its business units, (iii) analyze and evaluate strategic and operational decisions, (iv) establish criteria for compensation

decisions, and (v) assist management in understanding the Company’s ability to generate cash flow and, as a result, to plan for future capital and operational

decisions. Management uses these non-GAAP financial measures in conjunction with related GAAP financial measures. These non-GAAP financial measures

have certain shortcomings. In particular, free cash flow does not represent the residual cash flow available for discretionary expenditures, since items such as

debt repayments and dividends are not deducted in determining such measure. EBITDA has similar shortcomings as interest, income taxes, capital

expenditures, debt repayments and dividends are not deducted in determining this measure. Management compensates for the shortcomings of these

measures by utilizing them in conjunction with their comparable GAAP financial measures. The information in this document should be read in conjunction with

the financial statements and footnotes contained in our documents filed with the U.S. Securities and Exchange Commission.

4

Frontier Introduction

• Frontier Communications (NYSE: FTR) was

founded in 1935 as Citizens Utilities and

became a pure-play telecom network

operator in 2004

founded in 1935 as Citizens Utilities and

became a pure-play telecom network

operator in 2004

• Frontier is the largest communications

company focused on rural America

company focused on rural America

• A transformational acquisition of properties

from Verizon tripled Frontier’s business

size on July 1, 2010

from Verizon tripled Frontier’s business

size on July 1, 2010

5

Investment Summary

|

Opportunity

|

|

• Manage the acquired properties with Frontier’s proven Local

Engagement Model and innovative marketing • Bring margins up towards Legacy levels

• Harness economics of scale from business that is 3x its

former size |

|

|

|

|

|

Markets

|

|

• Expand broadband availability in new markets towards

Legacy Frontier’s 91% • Rural profile, less competition, less regulatory reform

exposure • Business & Broadband are 64% of customer revenues

|

|

|

|

|

|

Returns

|

|

• Revenue upside from increased product penetration

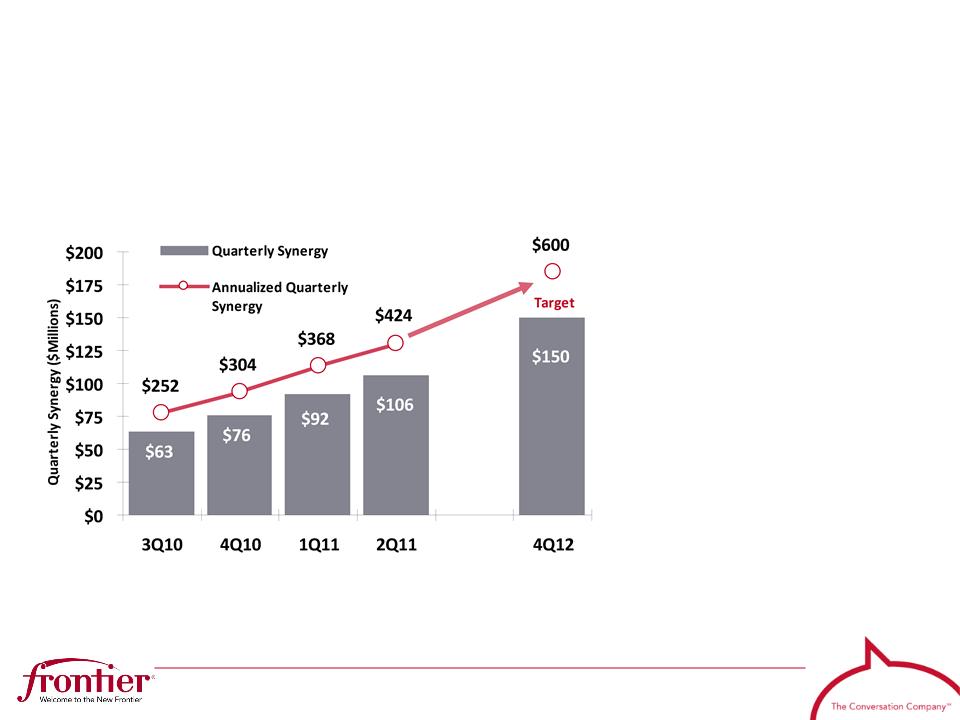

• $600 million operating expense synergy target by end of 2012

• Consistent execution, solid free cash flow, stable dividend

|

|

|

|

|

|

Credit

Quality |

|

• Significantly deleveraged on July 1, 2010

• Target leverage of 2.5x or below

• Attractive maturity schedule

|

6

Frontier Local Engagement

Local Area Manager

|

Residential

|

|

• High Speed Internet (DSL

& FTTP) • Voice

• Video (Satellite & FiOS)

• Wireless Data (WiFi mesh)

• Online backup

• 24/7 U.S. Tech Support

|

|

Business

|

|

• Managed IP VPN

• VoIP systems

• High-Capacity fiber data

• Metro Ethernet

• Wireless backhaul

• Managed router

|

• Over 120 Local Area Managers at the community level respond to unique

customer needs in each market across Frontier’s 27 states

customer needs in each market across Frontier’s 27 states

• Employees live in the markets they serve, and put the customer first

• Innovative marketing, 2-hour appointment windows, exceptional service

levels

levels

7

Robust Local Network

2,700 Central offices

● 2,700 Central offices

National high-capacity

fiber backbone connects

all 27 states

fiber backbone connects

all 27 states

● National high-capacity

fiber backbone connects

all 27 states

fiber backbone connects

all 27 states

Deploying ROADM in the

middle mile

middle mile

● Deploying ROADM in the

middle mile

middle mile

Broadband expansion to

drive penetration

drive penetration

● Broadband expansion to

drive penetration

drive penetration

FCC Commitments for

Acquired Properties:

Acquired Properties:

● FCC Commitments for

Acquired Properties:

Acquired Properties:

- 3Mbps to 85% by 12/31/13

- 3Mbps to 85% by 12/31/13

- 4Mbps to 85% by 12/31/15

- 4Mbps to 85% by 12/31/15

Notes: (1) Total company downlink product availability as of 6/30/11; loop length availability is higher in each tier.

8

Attractive Revenue Base

Frontier generates 64% of

its customer revenue from

Business and Broadband

sources

its customer revenue from

Business and Broadband

sources

● Frontier generates 64% of

its customer revenue from

Business and Broadband

sources

its customer revenue from

Business and Broadband

sources

Our business capabilities

are very broad and include:

are very broad and include:

● Our business capabilities

are very broad and include:

are very broad and include:

- Advanced IP switching

- Advanced IP switching

- VoIP systems

- VoIP systems

- High-capacity fiber data systems

- High-capacity fiber data systems

- Wireless cell site backhaul

- Wireless cell site backhaul

- Ethernet

- Ethernet

For the quarter ended 6/30/11

9

Minimizing Regulatory Risk

The acquired

properties reduced

Frontier’s Regulatory

Revenue exposure

from 15.5% at 2Q10 to

11.9% at 2Q11, or

10.0% excluding

surcharges

properties reduced

Frontier’s Regulatory

Revenue exposure

from 15.5% at 2Q10 to

11.9% at 2Q11, or

10.0% excluding

surcharges

● The acquired

properties reduced

Frontier’s Regulatory

Revenue exposure

from 15.5% at 2Q10 to

11.9% at 2Q11, or

10.0% excluding

surcharges

properties reduced

Frontier’s Regulatory

Revenue exposure

from 15.5% at 2Q10 to

11.9% at 2Q11, or

10.0% excluding

surcharges

We continue to

replace this uncertain

revenue stream with

Customer Revenue

replace this uncertain

revenue stream with

Customer Revenue

● We continue to

replace this uncertain

revenue stream with

Customer Revenue

replace this uncertain

revenue stream with

Customer Revenue

For the quarter ended 6/30/11

Notes: Numbers may not sum due to rounding

10

Consistent Execution

Stability of Revenues

ü Driving recurring customer revenues

ü Delivering reliable, quality products

and services at a good price

and services at a good price

ü Reducing churn with bundles

ü Maintaining strong

Business/Enterprise presence

Business/Enterprise presence

Notes: Pro forma for all periods prior to 3Q10. Customer revenue is defined as total revenue less access services revenue. Access

services include switched network access and subsidies. Please see Appendix for Non-GAAP Reconciliations.

services include switched network access and subsidies. Please see Appendix for Non-GAAP Reconciliations.

Stability of Cash Flows

ü Focus on expense reduction;

competitively fit and flexible

competitively fit and flexible

ü Capital expenditures expected to

decline in 2013 as network build out is

completed

decline in 2013 as network build out is

completed

ü Margin benefit from synergy targets

ü High conversion rate of EBITDA into

free cash flow (FCF)

free cash flow (FCF)

11

Revenue Opportunity

Satellite TV Penetration

Access Line Decline

HSI Penetration

Note: As of the quarter ended 6/30/11; percentage changes are year-over-year. HSI Penetration is percentage of

total access lines. Satellite TV Penetration is percentage of Residential access lines.

total access lines. Satellite TV Penetration is percentage of Residential access lines.

Note: As of the quarter ended 6/30/11; percentage changes are year-over-year. HSI Penetration is percentage of

total access lines. Satellite TV Penetration is percentage of Residential access lines.

total access lines. Satellite TV Penetration is percentage of Residential access lines.

Broadband Availability

Our goal is to

migrate the

acquired properties

to Frontier’s

performance

metrics

migrate the

acquired properties

to Frontier’s

performance

metrics

● Our goal is to

migrate the

acquired properties

to Frontier’s

performance

metrics

migrate the

acquired properties

to Frontier’s

performance

metrics

Key drivers:

● Key drivers:

25% expansion of

broadband homes

broadband homes

- 25% expansion of

broadband homes

broadband homes

Local Engagement

- Local Engagement

12

Cost Synergy Overview

Significant savings

from reducing cash

operating expenses

from reducing cash

operating expenses

● Significant savings

from reducing cash

operating expenses

from reducing cash

operating expenses

Numerous projects

underway; synergy

estimates include:

underway; synergy

estimates include:

● Numerous projects

underway; synergy

estimates include:

underway; synergy

estimates include:

Network savings

- Network savings

Outside

contractors

contractors

- Outside

contractors

contractors

IT savings from

conversion

conversion

- IT savings from

conversion

conversion

Real estate

savings

savings

- Real estate

savings

savings

Operations

- Operations

13

Quarterly Update: 2Q11

Building traction

on strong HSI and

video bundles

on strong HSI and

video bundles

● Building traction

on strong HSI and

video bundles

on strong HSI and

video bundles

Metric and

revenue trend

improving

revenue trend

improving

● Metric and

revenue trend

improving

revenue trend

improving

Total cash opex

down $32 million

sequentially

down $32 million

sequentially

● Total cash opex

down $32 million

sequentially

down $32 million

sequentially

FCF reflecting

network

expansion capex

network

expansion capex

● FCF reflecting

network

expansion capex

network

expansion capex

Notes: $ Millions; Units 000s. Comparisons to amounts prior to 7/1/10 are pro forma for the Acquired Properties. (1) Annualized

quarterly dividends into trailing last 12-month Free Cash Flow.

quarterly dividends into trailing last 12-month Free Cash Flow.

14

Systems Integration Plan

|

West Virginia

|

|

Frontier 13

|

|

● Successful conversion despite a

firm July 1 deadline ● Billing cycles kept within days of

prior scheduled dates, and all systems functional out of the gate ● Backlog managed downward

with “bubble workforce” and current levels within normal range |

|

● System mapping and analysis in

process ● Systems are identical across all

13 states; processes on the first conversions will be replicated ● First 4 states (MI, IN, NC, SC)

targeted early 4Q11; remaining states in the first half of 2012 |

Frontier converted West Virginia, which utilized BellAtlantic

systems, on July 1, 2010

systems, on July 1, 2010

Frontier converted West Virginia, which utilized BellAtlantic

systems, on July 1, 2010

systems, on July 1, 2010

The remaining 13 states of the acquired properties (detailed in the

appendix) scheduled to be converted off Verizon (GTE) systems

onto existing Frontier systems by June 2012

appendix) scheduled to be converted off Verizon (GTE) systems

onto existing Frontier systems by June 2012

The remaining 13 states of the acquired properties (detailed in the

appendix) scheduled to be converted off Verizon (GTE) systems

onto existing Frontier systems by June 2012

appendix) scheduled to be converted off Verizon (GTE) systems

onto existing Frontier systems by June 2012

15

Financing Overview

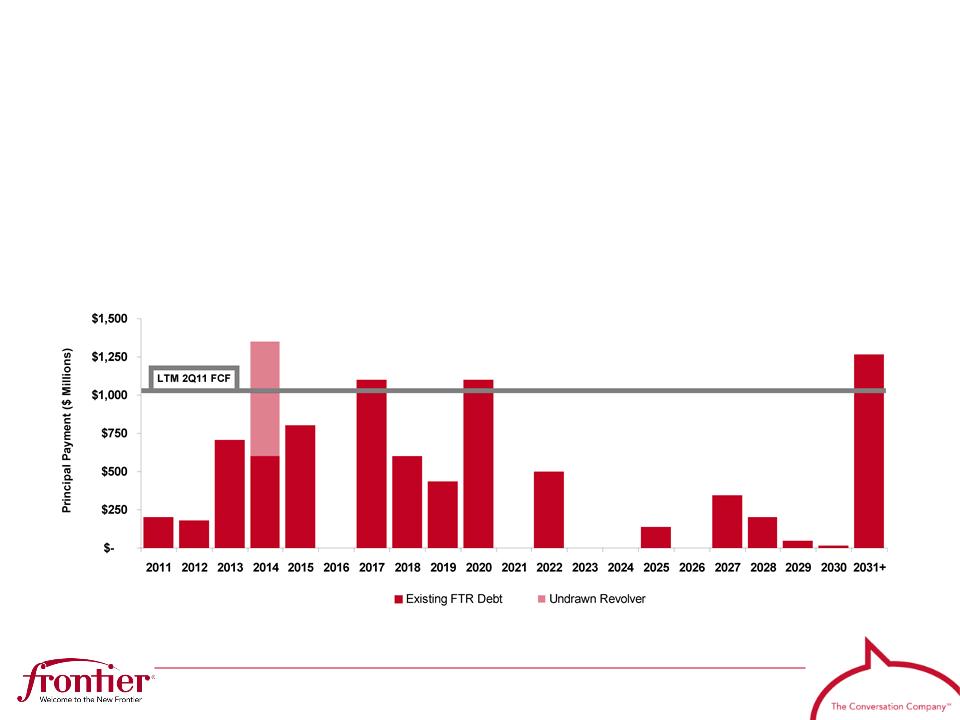

● Deleveraged from 4.0x (6/30/10) to 3.1x (6/30/11)

● Strong $1.0 billion liquidity objective, including an undrawn

$750M R/C

$750M R/C

● Maturity schedule is well balanced

16

Industry Comparisons

EBITDA Margin (2)

Notes: Data for the 3-months ended 6/30/11. CTL pro forma for Qwest acquisition. (1) Represents the yr/yr change in the combined ending

base of access lines and HSI subscribers (2) Adjusted EBITDA; excludes wireless; Cable is network operations only.

base of access lines and HSI subscribers (2) Adjusted EBITDA; excludes wireless; Cable is network operations only.

Source: SEC filings; Wall Street research; Frontier.

Improvement in the Acquired

Properties

Properties

● Improvement in the Acquired

Properties

Properties

Margins remains strong and are

improving

improving

● Margins remains strong and are

improving

improving

Focusing on: i) implementing

local engagement; ii) selling &

retaining customers; iii) getting

the expenses out; and iv)

building and improving the

network

local engagement; ii) selling &

retaining customers; iii) getting

the expenses out; and iv)

building and improving the

network

● Focusing on: i) implementing

local engagement; ii) selling &

retaining customers; iii) getting

the expenses out; and iv)

building and improving the

network

local engagement; ii) selling &

retaining customers; iii) getting

the expenses out; and iv)

building and improving the

network

FTR

17

Doing What We Say…

|

Goal

|

Status

|

|

Regulatory approval with appropriate conditions

|

|

|

Completion of financing within expected cost

|

|

|

Distribution of shares with minimal market disruption

|

|

|

Completion of West Virginia systems conversion

|

|

|

Continued delivery of solid Legacy Frontier results

|

|

|

Customer metric improvement and synergy

realization of acquired properties

|

In Process

|

|

Conversion of Frontier 13 systems to Legacy

|

In Process

|

P

P

P

P

P

P

P

P

P

P

18

Appendix

19

Access Lines by State

Notes: Numbers may not sum due to rounding

20

Reconciliation of Non-GAAP Financial Measures

Notes: Numbers may not sum due to rounding.

Notes: Numbers may not sum due to rounding.

Notes: Please refer to our Pro Forma Combined Historical and Operating data, filed as an 8-K, for explanatory notes which are an integral part of

the pro forma combined historical financial data. The unaudited pro forma financial information makes certain assumptions for illustrative

purposes and is subject to change

the pro forma combined historical financial data. The unaudited pro forma financial information makes certain assumptions for illustrative

purposes and is subject to change

Notes: Please refer to our Pro Forma Combined Historical and Operating data, filed as an 8-K, for explanatory notes which are an integral part of

the pro forma combined historical financial data. The unaudited pro forma financial information makes certain assumptions for illustrative

purposes and is subject to change

the pro forma combined historical financial data. The unaudited pro forma financial information makes certain assumptions for illustrative

purposes and is subject to change

21

Reconciliation of Non-GAAP Financial Measures

Notes: Numbers may not sum due to rounding.

Notes: Numbers may not sum due to rounding.

Notes: Please refer to our Pro Forma Combined Historical and Operating data, filed as an 8-K, for explanatory notes which are an integral part of

the pro forma combined historical financial data. The unaudited pro forma financial information makes certain assumptions for illustrative

purposes and is subject to change

the pro forma combined historical financial data. The unaudited pro forma financial information makes certain assumptions for illustrative

purposes and is subject to change

Notes: Please refer to our Pro Forma Combined Historical and Operating data, filed as an 8-K, for explanatory notes which are an integral part of

the pro forma combined historical financial data. The unaudited pro forma financial information makes certain assumptions for illustrative

purposes and is subject to change

the pro forma combined historical financial data. The unaudited pro forma financial information makes certain assumptions for illustrative

purposes and is subject to change

22

Frontier Values

● Put the customer first

● Treat one another with respect

● Keep our commitments; be accountable

● Be ethical in all of our dealings

● Be innovative; Take the initiative

● Be team players

● Be active in our communities

● Do it right the first time

● Continuously improve

● Use resources wisely

● Use Frontier products and services

● Have a positive attitude

Frontier Communications Corp.

(NYSE: FTR)

Investor Relations

Investor Relations

Frontier Communications Corp.

Frontier Communications Corp.

3 High Ridge Park

3 High Ridge Park

Stamford, CT 06905

Stamford, CT 06905

203.614.4606

203.614.4606

IR@FTR.com

IR@FTR.com