Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to ___________

Commission file number 001-11001

FRONTIER COMMUNICATIONS CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

06-0619596 |

|

|

(State or other jurisdiction of |

(I.R.S. Employer Identification No.) |

|

|

incorporation or organization) |

|

|

|

|

|

|

|

401 Merritt 7 |

|

|

|

Norwalk, Connecticut |

|

06851 |

|

(Address of principal executive offices) |

|

(Zip Code) |

|

|

|

|

Registrant's telephone number, including area code: (203) 614-5600

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.25 per share |

|

The NASDAQ Stock Market LLC |

|

Series A Participating Preferred Stock Purchase Rights 11.125% Mandatory Convertible Preferred Stock, Series A |

|

The NASDAQ Stock Market LLC The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes _X_ No ___

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No __

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X No __

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ☒ Accelerated Filer ☐ Non-Accelerated Filer ☐

Smaller Reporting Company ☐ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X

The aggregate market value of common stock held by non-affiliates of the registrant on June 30, 2017 was $1,358,686,000 based on the closing price of $17.40 per share (on a post-split basis) on such date. The number of shares outstanding of the registrant's common stock as of February 10, 2018 was 78,408,000.

DOCUMENT INCORPORATED BY REFERENCE

Portions of the Proxy Statement for Frontier’s 2018 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

TABLE OF CONTENTS

|

PART I |

Page No. |

|

|

|

|

Item 1. Business |

2 |

|

|

|

|

Item 1A. Risk Factors |

12 |

|

|

|

|

Item 1B. Unresolved Staff Comments |

23 |

|

|

|

|

Item 2. Properties |

23 |

|

|

|

|

Item 3. Legal Proceedings |

23 |

|

|

|

|

Item 4. Mine Safety Disclosures |

23 |

|

|

|

|

PART II |

|

|

|

|

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer |

|

|

24 |

|

|

|

|

|

Item 6. Selected Financial Data |

27 |

|

|

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of |

|

|

28 |

|

|

|

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk |

52 |

|

|

|

|

52 |

|

|

|

|

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial |

|

|

53 |

|

|

|

|

|

Item 9A. Controls and Procedures |

53 |

|

|

|

|

Item 9B. Other Information |

53 |

|

|

|

|

PART III |

|

|

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance |

54 |

|

|

|

|

Item 11. Executive Compensation |

55 |

|

|

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related |

|

|

55 |

|

|

|

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence |

55 |

|

|

|

|

55 |

|

|

|

|

|

PART IV |

|

|

|

|

|

56 |

|

|

|

|

|

61 |

|

|

|

|

|

F-1 |

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

PART I

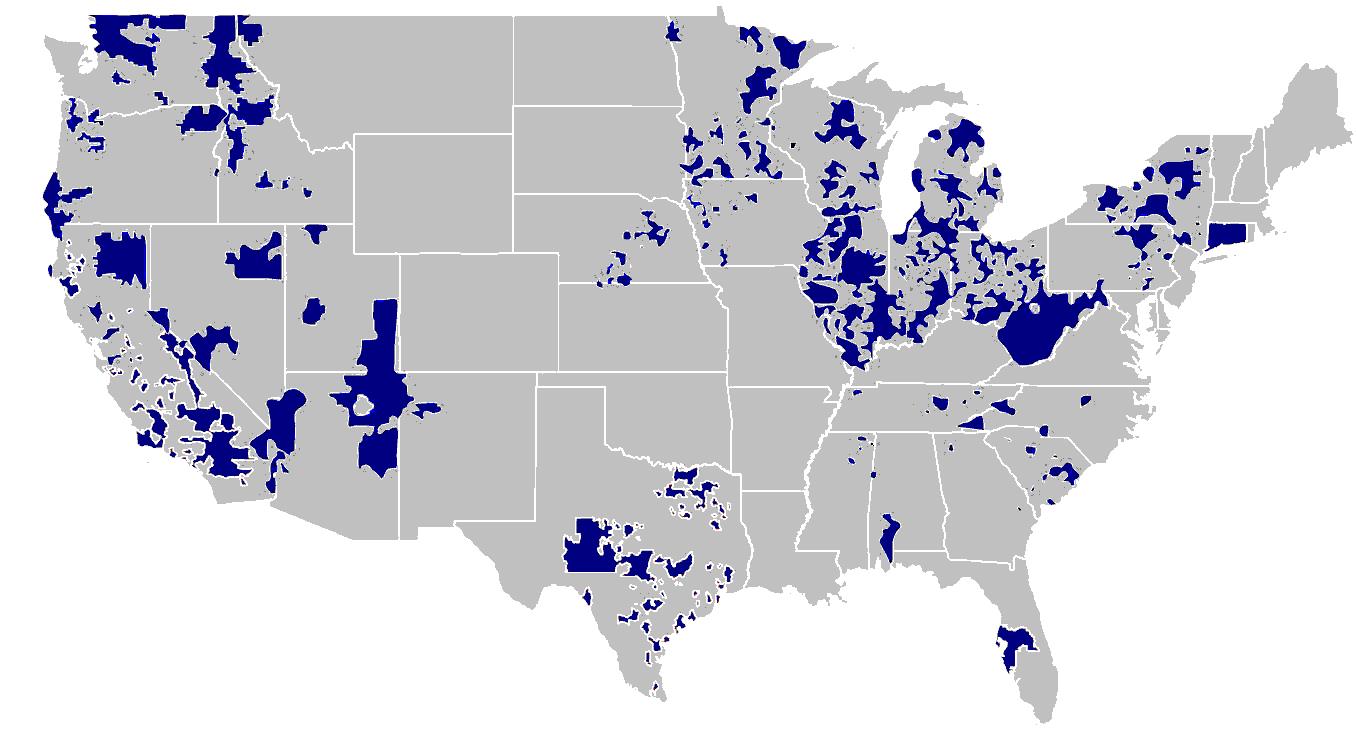

Frontier Communications Corporation (Frontier) is a provider of communications services in the United States, with approximately 4.9 million customers, 3.9 million broadband subscribers and 22,700 employees, operating in 29 states. In recent years, Frontier has completed multiple acquisitions. On April 1, 2016, we acquired the wireline operations of Verizon Communications, Inc. in California, Texas and Florida for a purchase price of $10,540 million in cash and assumed debt.

Frontier’s Service Territories

How We Serve Our Customers

We conduct business with both consumer and commercial customers.

Consumer. We provide broadband, video, voice and other services and products to our consumer customers. We deliver these services generally over a combination of fiber and copper-based networks.

Commercial (small, medium and large enterprise business (SME) as well as wholesale customers).

Commercial. We provide a broad range of services to our SME customers, including broadband service, Ethernet service, traditional circuit-based services (TDM services) and voice services. We also offer advanced hardware and network solutions and services.

|

o |

Larger Enterprise: Fortune 1000, multi-location companies, large government entities, large educational institutions, and non-profits. |

|

o |

Medium Business: Single or multi-location companies and mid-sized government entities, educational institutions and non-profits. |

|

o |

Small Business: Mostly single-location businesses, the smaller of which have purchase patterns similar to consumer customers. |

2

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

|

o |

Wholesale: Wholesale customers are often referred to as carriers or service providers and include national operators such as AT&T and Verizon; Local Exchange Companies that need to access locations within Frontier’s footprint to offer local services; and wireless carriers and integrated carriers that offer a variety of services across all of these categories. Wholesale customers buy both voice and data services to supplement their own network infrastructure. |

Services and Products

We offer a broad portfolio of communications services for consumer and commercial customers. These services are offered on either a standalone basis or in a bundled package, depending on each customer’s needs.

Data and Internet services. We offer a comprehensive range of broadband and networking services. The principal consumer service we provide is broadband internet service. Commercial services include a complete portfolio of Ethernet services, dedicated internet, software defined wide area network (SDWAN), multiprotocol label switching (MPLS), time division multiplexing (TDM) data transport services and optical transport services. These services are all supported by 24/7 technical support and an advanced network operations center. We also offer wireless broadband services (using unlicensed spectrum) in select markets utilizing networks that we own or operate.

Video services. We offer video services under FiOS® brand in portions of California, Texas, Florida, Indiana, Oregon and Washington, and the VantageTM brand in portions of Connecticut, North Carolina, South Carolina, Minnesota, Illinois, New York, and Ohio. We also offer satellite TV video service to our customers under an agency relationship with DISH® in all of our markets.

Voice services. We provide voice services, including data-based VoIP, long-distance and voice messaging services, to consumer and commercial customers in all of our markets. These services are billed monthly in advance. Long-distance service to and from points outside our operating properties are provided by interconnection with the facilities of interexchange carriers. Our long-distance services are billed in advance for unlimited use service, and billed in arrears for services on a per minute-of-use basis.

We also offer packages of communications services. These packages permit customers to bundle their products and services, including voice service, video and Internet services, and other product offerings.

Access services. We offer a range of access services. Our switched access services allow other carriers to use our facilities to originate and terminate their local and long-distance voice traffic. These services are generally offered on a month-to-month basis and the service is billed primarily on a minutes-of-use basis. Switched access charges are based on access rates filed with the Federal Communications Commission (FCC) for interstate services and with the respective state regulatory agency for intrastate services. See “Regulatory Environment” below.

Advanced Hardware and Network Solutions. We offer our SME customers various hardware and network solutions utilizing cloud functionality and Customer Premise Equipment (CPE). We offer third-party communications equipment tailored to their specific business needs by partnering with Mitel, Cisco, Ingram Micro, Airbus, Avaya, Hewlett Packard, Adtran and other equipment manufacturers. CPE is typically sold in conjunction with voice, data and Internet services, and may also be sold on a standalone basis.

Frontier Operating Strategies

Consumer Business

Improve Customer Experience and Retention. We provide multiple service and product options to our consumer customers. Our strategy is to foster relationships and loyalty throughout the customer lifecycle in order to improve experiences, reduce churn and grow revenue. Our plan to retain customers includes providing easier access to account services and trouble-shooting options through online portals and user interfaces. We incorporate and utilize customer feedback to improve our product offerings with the goal of improving the overall customer experience for our subscribers. We focus and refine our marketing strategy for sales and retention to drive further improvement in the business.

New Customer Acquisition. We focus on broadband as the core growth component of our service offerings, either bundled with our voice and/or video services, or on a standalone basis. We seek to attract and retain a greater number of customers and increase average revenue per customer (ARPC). We are committed to

3

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

growing our customer base through providing higher broadband speeds and capacity that will enable us to reach new markets, target new customers, and grow the business while maximizing our full footprint.

Improve Revenue Trends. As we expand the range of services we offer customers, increase the capabilities of our networks, and increase the penetration of our services, we increase our revenue opportunity and are better positioned to increase the average amount of revenue we can receive from a customer.

Commercial Business

Improve Revenue Trends. Our strategy is to achieve revenue growth in our Commercial business through the acquisition of new customers, increasing the penetration of services with existing customers, and improved retention of existing customers.

Offer a Competitive Product Portfolio. We offer both traditional services as well as an expanding range of advanced, packet-based services, such as Ethernet, SDWAN, Unified Communication as a Service (UCaaS) cloud-based connectivity for our large enterprise customers, and more cost-effective integrated voice and data services for our medium and small business customers.

New Customer Acquisition. We have increased our sales force with an emphasis on adding new customers and increasing penetration of existing customers, particularly in areas where we have a robust fiber network.

Improve Customer Experience and Retention. We plan to grow our revenues in the commercial sector through increased retention and deepening of existing customer relationships. The proper alignment of our sales force, service personnel, and resources will enable us to provide excellent service to our existing enterprise, medium and small business customers, while obtaining the greatest opportunities for revenue growth and expansion.

Company-Wide

Invest in our Network through Capital Expenditures. Our investment focus is the enhancement of our existing network and the expansion of fiber-based infrastructure in our network. We continue to upgrade network hardware, expand transport capacity of our middle-mile and data backbone, and enhance our video capabilities. Similarly, we are focused on enhancing our premium Ethernet service offerings across our network for our commercial customers.

Improve Productivity and Operational Efficiency. We continuously engage in productivity initiatives with a focus on simplifying our processes, eliminating redundancies and further reducing our cost structure while improving our customer service capabilities. We continue to migrate our network and systems to common operating platforms in order to increase efficiency and we have been migrating traffic to a common architecture to eliminate duplication.

Network Architecture and Technology

Our local exchange carrier networks consist of host central office and remote sites, primarily equipped with digital and Internet Protocol switches. The outside plant consists of transport and distribution delivery networks connecting our host central office with remote central offices and ultimately with our customers. We own fiber optic and copper cable, which have been deployed in our networks and are the primary transport technologies between our host and remote central offices and interconnection points with other incumbent carriers.

We have expanded and enhanced our fiber optic and copper transport systems to support increasing demand for high bandwidth transport services. We routinely enhance our network and upgrade with the latest Internet Protocol Transport and routing equipment, Reconfigurable Optical Add/Drop Multiplexers (ROADM) transport systems, Very High Bit-Rate Digital Subscriber Line (VDSL) broadband equipment, and VoIP switches. These systems support advanced services such as Ethernet, Dedicated Internet, Multiprotocol Label Switching (MPLS) transport, VoIP, and SDWAN. The network is designed with redundancy and auto-failover capability on our major circuits.

We connect to households and business locations in our service territory using a combination of fiber optic and copper technologies. In some cases we provide direct fiber into a residence or a business premises. In other cases a location is served with a hybrid combination of fiber and copper. Residences in our service territory are served by fiber-to-the-home (FTTH) and by fiber-to-the-node (FTTN), meaning fiber carries the traffic to an intermediate location where the

4

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

signals are converted to copper wire for the final delivery to the household. We provide data, video, and voice services to customers over both of these architectures. Additionally, fixed wireless broadband (FWB) will play an important part of our future broadband strategy and could be deployed for some business Ethernet services. FWB is delivered by the use of an antenna on a Frontier base location and another antenna at the customer location.

Rapid and significant changes in technology are occurring in the communications industry. Our success will depend, in part, on our ability to anticipate and adapt to technological changes. We believe that our next generation network architecture strategy will enable us to respond to these ongoing technological changes efficiently. In addition, we anticipate reducing costs through the sharing of best practices across operations, centralization or standardization of functions and processes, and deployment of technologies and systems that provide for greater efficiencies and profitability. We will continue to make strategic enhancements to our network, with a focus on higher return investments.

Competitive Positioning

Competition for consumer customers comes from cable operators, wireless carriers and online video providers, among others.

|

- |

Cable operators: In a majority of our markets, cable operators offer high speed Internet, video and voice services similar to ours, and compete with us aggressively on speed and price by marketing their offerings with significant promotional period pricing. |

|

- |

Wireless carriers: Wireless operators primarily compete with us for broadband, video, and voice services in our markets by offering increasingly larger data packages to mobile customers. The percentage of homes with a landline telephone has been declining, a trend we expect will continue. |

|

- |

Online video providers: Many consumers are opting for internet-delivered video services (Over the Top, or OTT) through online service providers rather than traditional, multi-channel video. In response, we have made investments in our network to deliver OTT video content to consumers who might not opt for traditional video services. The percentage of homes with a video product has been declining, a trend we expect will continue. |

Many consumer customers prefer to bundle their voice, data, Internet and video services with a single provider. In areas where we do not directly offer a network-based video service, we offer satellite TV video service through DISH. This can positively impact acquisition of new customers and retention of existing customers, representing a critical factor for the attachment of video, broadband and voice products. As of December 31, 2017, 50% of our consumer customers subscribed to at least two service offerings, and 17% subscribed to at least three service offerings.

Competition for commercial customers comes from telecommunications providers, cable operators, Competitive Local Exchange Companies and other enterprises, some of which are substantially larger than us. As compared to our consumer customers, these customers often require more sophisticated and more data-centered solutions (e.g., IP PBX, E911 networks, Ethernet and SIP trunking).

In order to remain competitive, we continue to evolve our product offerings to stay current with the changing needs of the market, to provide strong customer service and support, to invest in our network so we maintain adequate capacity and can deliver new capabilities as needed, and to package our offerings to make them attractive to customers.

5

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Regulatory Environment

Some of our operations are subject to regulation by the FCC and various state regulatory agencies, often called public service or utility commissions. We expect federal and state lawmakers, the FCC and the state regulatory agencies to continue to revise the statutes and regulations governing communications services.

Regulation of our business

We are subject to federal, state and local regulation and we have various regulatory authorizations for our regulated service offerings. At the federal level, the FCC generally exercises jurisdiction over information services, interstate or international telecommunications services and over facilities to the extent they are used to provide, originate or terminate interstate or international services. State regulatory commissions generally exercise jurisdiction over intrastate telecommunications services and the facilities used to provide, originate or terminate those services. Most of our local exchange companies operate as incumbent carriers in the states in which they operate and are certified in those states to provide local telecommunications services. Certain federal and state agencies, including attorneys general, monitor and exercise oversight related to consumer protection issues. In addition, local governments often regulate the public rights-of-way necessary to install and operate networks and may require service providers to obtain licenses or franchises regulating their use of public rights-of-way. Municipalities and other local government agencies also may regulate other limited aspects of our business, by requiring us to obtain cable franchises and construction permits and to abide by applicable building codes.

Some states’ regulatory agencies have substantial oversight over incumbent telephone companies, and their interconnection with competitive providers and provision of non-discriminatory network access to certain network elements to them. Under the Federal Telecommunications Act of 1996, state regulatory commissions have jurisdiction to arbitrate and review interconnection disputes and agreements between incumbent telephone companies and competitive local exchange carriers, in accordance with rules set by the FCC. The FCC and some state regulatory commissions also impose fees on providers of telecommunications services to support state universal service programs. Many of the states in which we operate require prior approvals or notifications for certain acquisitions and transfers of assets, customers, or ownership of regulated entities.

Additionally, in some states we are subject to operating restrictions and minimum service quality standards. Failure to meet such restrictions may result in penalties. We also are required to report certain financial information. At the federal level and in a number of the states in which we operate, we are subject to price cap or incentive regulation plans under which prices for regulated services are capped. Some of these plans have limited terms and, as they expire, we may need to renegotiate with various states. These negotiations could impact rates, service quality and/or infrastructure requirements, which could also impact our earnings and capital expenditures. In other states in which we operate, we are subject to rate of return regulation that limits levels of earnings and returns on investments. Approximately 19% of our total access lines at December 31, 2017 are in state jurisdictions under the rate of return regulatory model. We continue to advocate for no or reduced regulation with various regulatory agencies in those states. In some of the states we operate in we have already been successful in reducing or eliminating price regulation on end-user services.

Federal Regulatory Environment

Frontier, along with all telecommunications providers, is subject to FCC rules governing privacy of specified customer information. Among other things, these rules obligate carriers to implement procedures to: protect specified customer information from inappropriate disclosure; obtain customer permission to use specified information in marketing; authenticate customers before disclosing account information; and annually certify compliance with the FCC’s rules. Although most of these regulations are generally consistent with our business plans, they may restrict our flexibility in operating our business.

Some regulations are, or could in the future be, the subject of judicial proceedings, legislative hearings and administrative proposals or challenges that could change the manner in which the entire industry operates. Neither the outcome of any of these developments, nor their potential impact on us, can be predicted at this time. Regulation can change rapidly in the communications industry, and such changes may have an adverse effect on us.

The current status of material regulatory initiatives is as follows:

6

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Federal High-Cost Subsidies: The FCC has adopted rules changing the eligibility requirements for federal subsidies offered to wireline carriers providing service to high-cost, low-density markets, as well as the amounts of such subsidies, as follows:

Connect America Fund (CAF): On November 18, 2011, the FCC adopted the Universal Service Fund (USF)/Intercarrier Compensation (ICC) Report and Order (the 2011 Order), which changed how federal subsidies are calculated and disbursed, and began the transition of the high-cost component of the Federal USF, which supported voice services in high-cost areas, to the CAF, which supports broadband deployment in high-cost areas. Frontier received $133 million from 2012 through 2014 across two rounds of CAF Phase I funding to make broadband available to approximately 194,600 previously unserved or underserved locations. We completed deployment of broadband service to the first round of CAF Phase I households in 2015 and to the second round of CAF Phase I locations in March 2017 as required by the FCC rules.

On April 29, 2015, the FCC released offers of support to price cap carriers under the CAF Phase II program. The intent of these offers is to provide long-term support for carriers for establishing and providing broadband service with at least 10 Mbps downstream/1 Mbps upstream speeds in high cost areas unserved by a competitor. Frontier accepted the CAF Phase II offer in 29 states, including our CTF properties, which provides for $332 million in annual support through 2020, and a commitment to make broadband available to approximately 774,000 households. CAF Phase II support is a successor to the approximately $156 million in annual USF frozen high cost support that Frontier had been receiving prior to the CTF acquisition, and the $42 million in annual transitional USF frozen high cost support that Verizon had been receiving in California and Texas. In addition to the annual support levels, these amounts also include frozen support phasedown amounts in states where the annual CAF II funding is less than the prior annual frozen high cost support funding. The frozen support phasedown support was $17 million in 2017 and is expected to be $9 million in 2018.

In 2017, the FCC adopted a competitive bidding process to distribute approximately $200 million per year in CAF Phase II funding in those high-cost areas where price cap carriers declined the FCC’s offer of support, possibly presenting a new support and deployment opportunity. The FCC released the eligible areas in December 2017 but the competitive bidding process has not yet been fully finalized. Therefore, Frontier is unable to determine whether it will participate in any competitive bid process at this time.

Intercarrier Compensation: In the 2011 Order, the FCC also reformed Intercarrier Compensation, which is the payment framework that governs how carriers compensate each other for the exchange of interstate switched traffic, and began a multi-year transition to the new rates. The 2011 Order provided for the gradual elimination of effectively all terminating traffic charges by July 2017. Frontier’s switched access revenue declined sequentially in the third quarter of 2017, reflecting the rate reductions mandated by the 2011 Order, and we anticipate that we have experienced nearly all of the rate decline related to the 2011 Order. Frontier has been able to recover a significant portion of those lost revenues through end user rates and other replacement support mechanisms, a trend we expect will continue. There are no longer any active Intercarrier Compensation-related challenges to the 2011 Order. However, the 2011 Order did not resolve all questions on originating access rates. The FCC continues to consider the possibility of a transition of originating access rates, although the impact on Frontier, if any, is unknown at this time. Our total revenue for Intercarrier Compensation was $7 million for the year ended December 31, 2017.

Special Access: In April 2016, the FCC released a Notice of Proposed Rulemaking on special access or “business data” services. It sought comment on proposed changes to the way the FCC regulates traditional special access services based on market competition, and on a proposal to adopt pricing rules for Ethernet services in markets that are found to be “noncompetitive.” In August 2017, the FCC’s decision in this proceeding, which deregulates the market for end user special access services where the market is determined to be competitive and deregulates the transport market nationwide, became effective. This decision is generally favorable in that it gives Frontier more flexibility to operate its business in a deregulated fashion like its competitors in the market. Frontier is in the process of implementing various aspects of this decision and otherwise adjusting its rates on select business data service elements in response to market conditions. Some aspects of the decision are under appeal by stakeholders, including Frontier. Whether the appeals will be successful on any grounds is unknown.

Intrastate Services: Some state regulatory commissions regulate some of the rates ILECs charge for intrastate services, including originating switched access rates for intrastate access services paid by providers of intrastate long-distance services. Some states also have their own open proceedings to address reform to originating intrastate access charges and other intercarrier compensation and state universal service funds. Although the FCC has pre-empted state jurisdiction on most access charges, some states could consider moving forward with their proceedings.

7

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

We cannot predict when or how these matters will be decided or the effect on our subsidy or switched access revenues. Our total revenue for Intrastate switched access services was $53 million for the year ended December 31, 2017, spread across all the states we serve.

Current and Potential Internet Regulatory Obligations and Privacy: In December 2017 the FCC voted to overturn the FCC’s 2015 decision in which it had asserted jurisdiction over broadband service, declared broadband a “Title II” telecommunications service, and imposed rules to “preserve a Free and Open Internet” (i.e., net neutrality). Specifically, the FCC voted to eliminate explicit bans on blocking, throttling and paid prioritization in favor of requiring Internet service providers (ISPs) to be fully transparent about their practices. Both the FCC and Federal Trade Commission (FTC) will now have a role in ensuring that the ISPs are managing their network in the manner in which they publicly state they are.

The December 2017 decision also puts ISPs on an equal footing with other online web companies with respect to privacy rules, with the FTC being the lead agency on privacy enforcement. This decision follows Congress’s March 2017 action under the Congressional Review Act to vacate the 2015 rules that created a separate and more onerous privacy regime for ISPs than other online web companies. Frontier’s Internet service will now be subject to the same privacy rules as online web companies, including disclosure of its practices to consumers, which is Frontier’s current practice.

The December 2017 ruling is not yet effective and will likely be appealed in court. Meanwhile, the 2015 ruling is still under appeal, though it now appears moot. Frontier continues to comply with the existing regulatory requirements, and it is unclear whether the pending or future appeals will have any impact on the regulatory structure.

Video programming

Federal, state and local governments extensively regulate the video services industry. Our FiOS and Vantage video services are subject to, among other things: subscriber privacy regulations; requirements that we carry a local broadcast station or obtain consent to carry a local or distant broadcast station; rules for franchise renewals and transfers; the manner in which program packages are marketed to subscribers; and program access requirements.

We provide video programming in some of our markets in California, Connecticut, Florida, Illinois, Indiana, Minnesota, New York, North Carolina, Ohio, Oregon, South Carolina, Texas and Washington pursuant to franchises, permits and similar authorizations issued by state and local franchising authorities. Most franchises are subject to termination proceedings in the event of a material breach. In addition, most franchises require payment of a franchise fee as a requirement to the granting of authority.

Many franchises establish comprehensive facilities and service requirements, as well as specific customer service standards and monetary penalties for non-compliance. In many cases, franchises are terminable if the franchisee fails to comply with material provisions set forth in the franchise agreement governing system operations. We believe that we are in compliance and meeting all material standards and requirements. Franchises are generally granted for fixed terms of at least ten years and must be periodically renewed. Local franchising authorities may resist granting a renewal if either past performance or the prospective operating proposal is considered inadequate.

Environmental regulation

The local exchange carrier subsidiaries we operate are subject to federal, state and local laws and regulations governing the use, storage, disposal of, and exposure to hazardous materials, the release of pollutants into the environment and the remediation of contamination. As an owner and former owner of property, we are subject to environmental laws that could impose liability for the entire cost of cleanup at contaminated sites, including sites formerly owned by us, regardless of fault or the lawfulness of the activity that resulted in contamination. We believe that our operations are in substantial compliance with applicable environmental laws and regulations.

Segment Information

We currently operate in one reportable segment.

Financial Information about Foreign and Domestic Operations and Export Sales

We have no foreign operations.

8

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

General

The dollar amount of our order backlog is not a significant consideration in our business and is not a meaningful metric for us. We have no material contracts or subcontracts that may be subject to renegotiation of profits or termination at the election of the federal government.

Intellectual Property

We believe that we have the trademarks, trade names and intellectual property licenses that are necessary for the operation of our business.

We own or have the rights to use various trademarks, service marks and trade names referred to in this report. Solely for convenience, we refer to trademarks, service marks and trade names in this prospectus without the ™, SM and ® symbols. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted by law, our rights to our trademarks, service marks and trade names. Other trademarks, trade names or service marks appearing in this report are the property of their respective owners.

Employees

As of December 31, 2017, we had approximately 22,700 employees, as compared to approximately 28,300 employees as of December 31, 2016. During 2017, reduction in workforce activities resulted in the severance of approximately 1,300 employees. Approximately 16,000 of our total employees are represented by unions as of December 31, 2017. The number of employees covered by a collective bargaining agreement that expired in 2017, but have been extended and are still effective for 2018, is approximately 1,400. The number of employees covered by collective bargaining agreements that expire in 2018 is approximately 4,300. We consider our relations with our employees to be good.

Available Information

We are subject to the informational requirements of the Securities Exchange Act of 1934 (the Exchange Act). Accordingly, we file periodic reports, proxy statements and other information with the Securities and Exchange Commission (SEC). These reports, proxy statements and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements and other information regarding Frontier and other issuers that file electronically.

We make available, free of charge on our website, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as practicable after we electronically file these documents with, or furnish them to, the SEC. These documents may be accessed through our website at www.frontier.com under “Investor Relations.” The information posted or linked on our website is not part of, or incorporated by reference into, this report. We also make our Annual Report available in printed form upon request at no charge.

We also make available on our website, as noted above, or in printed form upon request, free of charge, our Corporate Governance Guidelines, Code of Business Conduct and Ethics, Specific Code of Business Conduct and Ethics Provisions for Certain Officers, and the charters for the Audit, Compensation, and Nominating and Corporate Governance committees of the Board of Directors. Stockholders may request printed copies of these materials by writing to: 401 Merritt 7, Norwalk, Connecticut 06851 Attention: Corporate Secretary.

9

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Forward-Looking Statements

This Annual Report on Form 10-K contains "forward-looking statements," related to future events. Forward-looking statements address our expected future business and financial performance and financial condition, and contain words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "may," “will,” "would," or "target." Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include:

|

· |

competition from cable, wireless and wireline carriers, satellite, and OTT companies, and the risk that we will not respond on a timely or profitable basis; |

|

· |

our ability to successfully adjust to changes in the communications industry, including the effects of technological changes and competition on our capital expenditures, products and service offerings; |

|

· |

our ability to implement organizational structure changes successfully; |

|

· |

risks related to the operation of our properties, including our ability to retain or obtain customers in our Legacy markets and those acquired from Verizon; |

|

· |

our ability to realize anticipated cost savings and our ability to meet commitments made in connection with the Verizon acquisition; |

|

· |

reductions in revenue from our voice customers that we cannot offset with increases in revenue from broadband and video subscribers and sales of other products and services; |

|

· |

our ability to maintain relationships with customers, employees or suppliers; |

|

· |

the effects of governmental legislation and regulation on our business, such as the repeal of net neutrality, including costs, disruptions, possible limitations on operating flexibility and changes to the competitive landscape resulting from such legislation or regulation; |

|

· |

the impact of regulatory, investigative and legal proceedings and legal compliance risks; |

|

· |

government infrastructure projects (such as highway construction) that impact our capital expenditures; |

|

· |

continued reductions in switched access revenues as a result of regulation, competition or technology substitutions; |

|

· |

the effects of changes in the availability of federal and state universal service funding or other subsidies to us and our competitors; |

|

· |

our ability to meet our remaining CAF II funding obligations on a timely basis, it could be subject to penalties or obligations to return certain CAF II funds; |

|

· |

our ability to effectively manage service quality in our territories and meet mandated service quality metrics; |

|

· |

our ability to successfully introduce new product offerings; |

|

· |

the effects of changes in accounting policies or practices, including potential future impairment charges with respect to our intangible assets; |

|

· |

our ability to effectively manage our operations, operating expenses, capital expenditures, debt service requirements and cash paid for income taxes and liquidity; |

10

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

|

· |

the effects of changes in both general and local economic conditions in the markets that we serve; |

|

· |

the effects of increased medical expenses and pension and postemployment expenses; |

|

· |

the effects of changes in income tax rates, tax laws, regulations or rulings, or federal or state tax assessments, including the risk that such changes may benefit our competitors more than us; |

|

· |

our ability to successfully renegotiate union contracts; |

|

· |

changes in pension plan assumptions, interest rates, discount rates, regulatory rules and/or the value of our pension plan assets, which could require us to make increased contributions to the pension plan in 2018 and beyond; |

|

· |

adverse changes in the credit markets; |

|

· |

adverse changes in the ratings given to our debt securities by nationally accredited ratings organizations; |

|

· |

the availability and cost of financing in the credit markets; |

|

· |

covenants in our indentures and credit agreements that may limit our operational and financial flexibility as well as our ability to access the capital markets in the future; |

|

· |

the effects of state regulatory cash management practices that could limit our ability to transfer cash among our subsidiaries or dividend funds up to the parent company; |

|

· |

the effects of severe weather events or other natural or man-made disasters, which has, and may in the future, increase our operating and capital expenses or adversely impact customer revenue; and |

|

· |

the impact of potential information technology or data security breaches or other disruptions. |

Any of the foregoing events, or other events, could cause our results to vary from management’s forward-looking statements included in this report. You should consider these important factors, as well as the risks set forth under Item 1A. “Risk Factors,” in evaluating any statement in this report or otherwise made by us or on our behalf. We have no obligation to update or revise these forward-looking statements and do not undertake to do so.

Investors should also be aware that while we do, at various times, communicate with securities analysts, it is against our policy to disclose to them selectively any material non-public information or other confidential information. Accordingly, investors should not assume that we agree with any statement or report issued by an analyst, irrespective of the content of the statement or report. To the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not our responsibility.

11

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Before you make an investment decision with respect to any of our securities, you should carefully consider all the information we have included in this Annual Report on Form 10-K and our subsequent filings with the SEC. In particular, you should carefully consider the risk factors described below and the risks and uncertainties related to “Forward-Looking Statements,” any of which could materially adversely affect our business, operating results, financial condition and the actual outcome of matters as to which forward-looking statements are made in this annual report. The risks and uncertainties described below are not the only ones facing Frontier. Additional risks and uncertainties that are not presently known to us or that we currently deem immaterial or that are not specific to us, such as general economic conditions, may also adversely affect our business and operations. The following risk factors should be read in conjunction with the balance of this annual report, including the consolidated financial statements and related notes included in this report.

Risks Related to Our Business

We have experienced declining revenues and may experience further declines in our revenues going forward.

We have experienced declining revenues as a result of declining voice services revenues, lower switched and nonswitched access revenues and declining video and data services revenues. Such declines have been driven primarily by customer losses, changing technology and consumer behavior (such as wireless displacement of wireline use, e-mail use, instant messaging and increasing use of VoIP), increased competition, regulatory constraints and financial decisions by governmental authorities. There can be no assurances that we will be able to stabilize or increase our revenues in the future. Future declines in our revenues could materially and adversely impact our ability to execute on our business strategy, comply with our financial covenants, repay our debts as they become due, negotiate with third parties or attract and retain employees.

We may be unable to stabilize or grow our revenues and cash flows despite the initiatives we have implemented.

We must produce adequate revenues and operating cash flows that, when combined with cash on hand and funds available under our revolving credit facility and other financings, will be sufficient to service our debt, fund our capital expenditures, pay our taxes, and fund our pension and other employee benefit obligations. We have experienced revenue declines in 2017 and 2016 as compared to prior years. While we have identified potential areas of opportunity and implemented several revenue and cost initiatives, we cannot assure you that these efforts will be successful or that these initiatives will improve our financial position or our results of operations.

We face intense competition.

The communications industry is extremely competitive. Through mergers and various service expansion strategies, service providers are striving to provide integrated solutions both within and across geographic markets. Our competitors include competitive local exchange carriers, Internet service providers, wireless companies, OTT, VoIP providers and cable companies, some of which may be subject to less regulation than we are. These entities may provide services competitive with the services that we offer or intend to introduce. For example, our competitors may seek to introduce networks in our legacy markets that are competitive with or superior to our copper-based networks in those markets. We also believe that wireless and cable providers have increased their penetration of various services in our markets. We expect that competition will remain robust. Our revenue and cash flow will be adversely impacted if we cannot reverse our customer losses or continue to provide high-quality services.

We cannot predict which of the many possible future technologies, products or services will be important in order to maintain our competitive position or what expenditures will be required to develop and provide these technologies, products or services. Our ability to compete successfully will depend on the effectiveness of capital expenditure investments in our properties, our marketing efforts, our ability to anticipate and respond to various competitive factors affecting the industry, including a changing regulatory environment that may affect our business and that of our competitors differently, new services that may be introduced, changes in consumer preferences, or habits, demographic trends, economic conditions and pricing strategies by competitors. Increasing competition may

12

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

reduce our revenues and increase our marketing and other costs as well as require us to increase our capital expenditures and thereby decrease our cash flows.

Some of our competitors have superior resources, which may place us at a disadvantage.

Some of our competitors have market presence, engineering, technical, marketing and financial capabilities, substantially greater than ours. In addition, some of these competitors are able to raise capital at a lower cost than we are able to. Consequently, some of these competitors may be able to develop and expand their communications and network infrastructures more quickly, adapt more swiftly to new or emerging technologies and changes in customer requirements, take advantage of acquisition and other opportunities more readily and devote greater resources to the marketing and sale of their products and services than we will be able to. Additionally, the greater brand name recognition of some competitors may require us to price our services at lower levels in order to retain or obtain customers. Finally, the cost advantages and greater financial resources of some of these competitors may give them the ability to reduce their prices for an extended period of time if they so choose. Our business and results of operations may be materially adversely impacted if we are not able to effectively compete.

Weak economic conditions may decrease demand for our services or necessitate increased discounts.

We could be adversely impacted by weak economic conditions or their effects. Downturns in the economy and competition in our markets have in the past, and could in the future, cause some of our customers to reduce or eliminate their purchases of our basic and enhanced voice services, broadband and video services and make it difficult for us to obtain new customers or retain existing customers. In addition, if economic conditions are depressed or further deteriorate, our customers may delay or discontinue payment for our services or seek more competitive pricing from other service providers, or we may be required to offer increased discounts in order to retain our customers, which could have a material adverse effect on our business or results of operations.

Disruption in our networks, infrastructure and information technology may cause us to lose customers and/or incur additional expenses.

To attract and retain customers, we must provide reliable service. Some of the risks to our networks, infrastructure and information technology include physical damage, security breaches, capacity limitations, power surges or outages, software defects and other disruptions beyond our control, such as natural disasters and acts of terrorism. From time to time in the ordinary course of business, we experience disruptions in our service due to factors such as cable damage, theft of our equipment, inclement weather and service failures of our third-party service providers. We could experience more significant disruptions in the future. We could also face disruptions due to capacity limitations if changes in our customers’ usage patterns for our broadband services result in a significant increase in capacity utilization, such as through increased usage of video or peer-to-peer file sharing applications. We could also face disruptions in our networks if third-party providers elect not to continue doing business with us or put their services up for auction and we are not able to retain their services as a result. Disruptions may cause interruptions in service or reduced capacity for customers, either of which could cause us to lose customers, or increase our operating expense, all of which could adversely affect our business, revenues and cash flows.

Our business is sensitive to the creditworthiness of our wholesale customers.

We have substantial business relationships with other communications carriers for which we provide service. While bankruptcies or insolvency of these carriers have not had a material adverse effect on our business in recent years, future bankruptcies or insolvencies in the industry could result in the loss of significant customers, as well as cause more price competition and an increased allowance for doubtful accounts receivable. Such bankruptcies and insolvencies may be more likely in the future if economic conditions stagnate. As a result, our revenues and results of operations could be materially and adversely affected.

A significant portion of our workforce is represented by labor unions.

As of December 31, 2017, we had approximately 22,700 employees. Approximately 16,000 of our total employees were represented by unions and were subject to collective bargaining agreements. As of December 31, 2017, we had approximately 1,400 employees covered by a collective bargaining agreement that expired in 2017, but have been extended and are still effective for 2018. Of the union-represented employees as of December 31, 2017, approximately 4,300, or 27%, of the unionized workforce are covered by collective agreements that expire in

13

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

2018 and approximately 7,600, or 48%, of the unionized workforce are covered by collective bargaining agreements that expire in 2019.

We cannot predict the outcome of negotiations of the collective bargaining agreements covering our employees. If we are unable to reach new agreements or renew existing agreements, employees subject to collective bargaining agreements may engage in strikes, work slowdowns or other labor actions, which could materially disrupt our ability to provide services. New labor agreements or the renewal of existing agreements may impose significant new costs on us, which could adversely affect our financial condition and results of operations in the future.

If we are unable to hire or retain key personnel, we may be unable to operate our business successfully.

Our success will depend in part upon the continued services of our management. We cannot guarantee that our key personnel will not leave or compete with us. The loss, incapacity or unavailability for any reason of key members of our management team could have a material impact on our business. In addition, our financial results and our ability to compete will suffer if we are unable to attract or retain other qualified personnel in the future.

We may be unable to realize the anticipated benefits of recent acquisitions.

In recent years, we have completed multiple acquisitions. We cannot assure you that we will be able to realize the full benefit of any anticipated growth opportunities or cost synergies from such acquisitions or that these benefits will be realized within the expected time frames.

We have a significant amount of goodwill and other intangible assets on our balance sheet. We recorded goodwill impairments in 2017 and if our goodwill or other intangible assets become further impaired, we may be required to record additional non-cash charges a non-cash charge to earnings and reduce our stockholders’ equity.

Under generally accepted accounting principles, intangible assets are reviewed for impairment on an annual basis or more frequently whenever events or circumstances indicate that their carrying value may not be recoverable. Frontier monitors relevant circumstances, including general economic conditions, enterprise value EBITDA multiples for other providers of communications services, our overall financial performance, and the market prices for our stock, and the potential impact that changes in such circumstances might have on the valuation of Frontier’s goodwill or other intangible assets. As a result of the continued decline in the share price of our common stock in each of the four quarters in 2017, we tested goodwill for impairment. Our second and fourth quarter quantitative assessments indicated that the carrying value of the enterprise exceeded its fair value and, therefore, an impairment existed. We recorded goodwill impairments totaling $2,748 million for 2017.If our goodwill or other intangible assets are determined to be further impaired in the future, we may be required to record a non-cash charge to earnings during the period in which the impairment is determined, which would reduce our stockholders’ equity.

We may complete a future significant strategic transaction that may not achieve intended results or could increase the number of our outstanding shares or amount of outstanding debt.

We continuously evaluate and may in the future enter into additional strategic transactions. Any such transaction could happen at any time, could be material to our business and could take any number of forms, including, for example, an acquisition, merger or a sale of certain of our assets.

Evaluating potential transactions and integrating completed ones may divert the attention of our management from ordinary operating matters. The success of these potential transactions will depend, in part, on our ability to realize the anticipated growth opportunities and cost synergies through the successful integration of the businesses we acquire with our existing business. Even if we are successful in integrating acquired businesses, we cannot assure you that these integrations will result in the realization of the full benefit of any anticipated growth opportunities or cost synergies or that these benefits will be realized within the expected time frames. In addition, acquired businesses may have unanticipated liabilities or contingencies.

If we complete an acquisition, investment or other strategic transaction, we may require additional financing that could result in an increase in the number of our outstanding shares of stock or the aggregate amount and/or cost of our debt, which may result in an adverse impact to our ratings. The number of shares of our stock or the

14

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

aggregate principal amount of our debt that we may issue may be significant. Moreover, the terms of any debt financing may be expensive or adversely impact our results of operations.

We have in the past and may in the future consider disposing of certain assets or asset groups. We may not be able to dispose of such assets on terms that are attractive to us, or at all. To the extent we consummate such a transaction, we may experience operational challenges in segregating such assets.

In the past, we have disposed of assets for a variety of reasons, and we may, from time to time, consider disposing of other assets or asset groups in the future. We may not be able to dispose of any such assets on terms that are attractive to us, or at all, which could adversely impact our financial condition or results of operation. In addition, to the extent we consummate an agreement for the sale and disposition of an asset or asset group, we may experience operational difficulties segregating them from our retained assets and operations, which could impact the execution or timing for such dispositions and could result in disruptions to our operations and/or claims for damages, among other things.

Negotiations with the providers of content for our video systems may not be successful, potentially resulting in our inability to carry certain programming channels on our FiOS and Vantage video systems, which could result in the loss of subscribers. Alternatively, because of the power of some content providers, we may be forced to pay an increasing amount for some content, resulting in higher expenses and lower profitability.

We must negotiate with the content owners of the programming that we carry on our multichannel video systems (marketed as FiOS video and Vantage video). These content owners are the exclusive provider of the channels they offer. If we are unable to reach a mutually-agreed contract with a content owner, including pricing and carriage provisions, our existing agreements to carry this content may not be renewed, resulting in the blackout of these channels. The loss of content could result in our loss of customers who place a high value on the particular content that is lost. In addition, many content providers own multiple channels. As a result, we typically have to negotiate the pricing for multiple channels rather than one, and carry and pay for content that customers do not value, in order to have access to other content that customers do value. Some of our competitors have materially larger scale than we do, and may, as a result, be better positioned than we are in such negotiations. As a result of these factors, the expense of content acquisition may continue to increase, and this could result in higher expenses and lower profitability.

Risks Related to Liquidity, Financial Resources and Capitalization

We currently have a significant amount of indebtedness, including secured indebtedness, and are contractually permitted to incur substantial additional indebtedness and grant substantial additional liens in the future. Such debt and debt service obligations may adversely affect us.

We have a significant amount of indebtedness, which amounted to $17.9 billion outstanding at December 31, 2017, of which $3.6 billion was secured. We also have access to a $850 million secured Revolving Credit Facility, which currently is undrawn.

The terms of our indentures and credit facilities allow us to incur substantial additional indebtedness and grant substantial additional liens in the future. In addition, these terms do not prevent us or our restricted subsidiaries from incurring various types of obligations that do not constitute “indebtedness” under these terms.

If we incur any additional indebtedness that ranks equally with our senior notes and debentures, the holders of that new debt will be entitled to share ratably with holders of our senior notes and debentures in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding up of Frontier. If any such additional indebtedness is secured, it will be effectively senior to our unsecured senior notes and debentures to the extent of the collateral securing such indebtedness. This may have the effect of reducing the probability of payment, or the amount of proceeds paid, to holders of our senior notes and debentures.

In addition, to the extent other new debt is added to our and our subsidiaries’ current debt levels, the substantial leverage risks described below would increase.

15

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

The potential significant negative consequences on our financial condition and results of operations that could result from our substantial debt include:

|

· |

limitations on our ability to obtain additional debt or equity financing on favorable terms or at all; |

|

· |

instances in which we are unable to comply with the covenants contained in our indentures and credit agreements or to generate cash sufficient to make required debt payments, which circumstances have the potential of accelerating the maturity of some or all of our outstanding indebtedness; |

|

· |

the possibility that we may trigger the springing maturity provisions in our credit agreements; |

|

· |

the allocation of a substantial portion of our cash flow from operations to service our debt, thus reducing the amount of our cash flows available for other purposes, including capital expenditures and dividends that would otherwise improve our competitive position, results of operations or stock price; |

|

· |

requiring us to issue debt or equity securities or to sell some of our core assets, possibly on unfavorable terms, to meet payment obligations; |

|

· |

compromising our flexibility to plan for, or react to, competitive challenges in our business and the telecommunications industry; and |

|

· |

the possibility of our being put at a competitive disadvantage with competitors who, relative to their size, do not have as much debt as we do, and competitors who may be in a more favorable position to access additional capital resources. |

In addition, our senior notes and debentures are rated below “investment grade” by independent rating agencies. This has resulted in higher borrowing costs for us. We cannot assure that these rating agencies will not lower our debt ratings further, if in the rating agencies’ judgment such an action is appropriate. A further lowering of a rating would likely increase our future borrowing costs and reduce our access to capital. Our negotiations with vendors, customers and business partners can be negatively impacted if they deem us a credit risk as a result of our credit rating.

The indentures and agreements governing our debt, including our senior notes and debentures and our credit facilities, contain covenants that impose restrictions on us and certain of our subsidiaries that may affect our ability to operate our business, make payments on our debt, and pay dividends.

The indentures and agreements governing our existing indebtedness contain covenants that, among other things, limit our ability and the ability of certain of our subsidiaries to:

|

· |

incur additional indebtedness, guarantee indebtedness or issue preferred stock; |

|

· |

create liens; |

|

· |

enter into mergers or consolidations, or transfer or sell all or substantially all of our assets; |

|

· |

pay dividends on, or make distributions in respect of, or redeem or repurchase, capital stock, make certain investments or make other restricted payments; |

|

· |

make certain asset sales; |

|

· |

enter into agreements that might prevent certain of our subsidiaries from making distributions, loans or advances to us or other subsidiaries; and |

|

· |

engage in transactions with affiliates. |

In addition, our credit facilities require us to comply with additional covenants, including financial ratios. Any future indebtedness may also require us to comply with similar or other covenants. These restrictions on our ability to operate our business could seriously harm our business by, among other things, limiting our ability to take advantage of financings, mergers, acquisitions and other corporate opportunities.

16

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Various risks, uncertainties and events beyond our control could affect our ability to comply with these covenants. Failure to comply with any of the covenants in our existing or future financing indentures and agreements could result in a default under those documents and under other agreements containing cross-default provisions. A default would permit lenders to accelerate the maturity of the debt and to foreclose upon any collateral securing the debt. Under these circumstances, we might not have sufficient funds or other resources to satisfy all of our obligations. In addition, the limitations imposed by indentures and credit agreements on our ability to incur additional debt and to take other actions might significantly impair our ability to obtain other financing.

Frontier is primarily a holding company and, as a result, we rely on the receipt of funds from our subsidiaries in order to meet our cash needs and service our indebtedness, including our senior notes and debentures.

Frontier is primarily a holding company and its principal assets consist of the shares of capital stock or other equity instruments of its subsidiaries. As a holding company, we depend on dividends, distributions and other payments from our subsidiaries to fund our obligations, including those arising under our senior notes and debentures, and meet our cash needs. We cannot assure you that the operating results of our subsidiaries at any given time will be sufficient to make dividends, distributions or other payments to us in order to allow us to make payments on our indebtedness, including our senior notes and debentures. In addition, the payment of these dividends, distributions and other payments, as well as other transfers of assets, between our subsidiaries and from our subsidiaries to us may be subject to legal, regulatory or contractual restrictions. Some state regulators have imposed and others may consider imposing on regulated companies, including us, cash management practices that could limit the ability of such regulated companies to transfer cash between subsidiaries or to the parent company. While none of the existing state regulations materially affects our cash management, any changes to the existing regulations or imposition of new regulations or restrictions may materially adversely affect our ability to transfer cash within our consolidated companies.

Our senior notes and debentures are structurally subordinated to liabilities of our subsidiaries.

Our subsidiaries have not guaranteed our senior notes and debentures. As a result, holders of such securities will not have any claim as a creditor against our subsidiaries. Accordingly, all obligations of our subsidiaries (including any liens granted by our subsidiaries on any of their assets to secure any of our obligations) will have to be satisfied before any of the assets of such subsidiaries would be available for distribution, upon a liquidation or otherwise. In addition, our subsidiaries may be able to incur $1.4 billion of additional debt (including secured debt), subject to the contractual limitations in our debt instruments applicable to such subsidiaries. Holders or our senior notes and debentures would be structurally subordinated to any such future debt as well.

Our senior notes and debentures are unsecured and subordinated to any secured indebtedness.

Our senior notes and debentures are unsecured and therefore are subordinated to our existing and future secured indebtedness, to the extent of the value of the assets securing such indebtedness. At December 31, 2017, our secured indebtedness consisted of obligations under the JPM Credit Agreement, the CoBank Credit Agreements, the Revolving Credit Agreement, Term Loan B and the Continuing Agreement for Standby Letters of Credit between Frontier and Deutsche Bank AG New York Branch and Bank of Tokyo – Mitsubishi UFJ, LTD, each of which is secured by the security package under the JPM Credit Agreement which includes pledges of the equity interests in certain Frontier subsidiaries and guaranties by certain Frontier subsidiaries. In the event of a bankruptcy or similar proceeding, the assets that serve as collateral for our secured indebtedness will be available to satisfy the obligations under the secured indebtedness before any payments are made on the senior notes and debentures from the proceeds of such assets. The indentures governing our senior notes and debentures permit us, subject to specified limitations, to incur a substantial amount of additional secured debt.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase.

17

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

At December 31, 2017, approximately 20% of our total debt is subject to variable rates of interest. Borrowings under our credit facilities are at variable rates of interest and expose us to interest rate risk. If interest rates were to increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income and cash flows, including cash available for servicing our indebtedness, would correspondingly decrease. In the future, we may enter into interest rate swaps that involve the exchange of floating for fixed rate interest payments in order to reduce interest rate volatility. However, we might not maintain interest rate swaps with respect to all of our variable rate indebtedness, and any swaps we enter into might not fully mitigate our interest rate risk.

We may not have sufficient funds to repurchase our senior notes upon a change of control triggering event.

The terms of our senior notes require us to make an offer to repurchase the notes upon the occurrence of a Change of Control and Ratings Decline (as defined in the indentures governing the notes) at a purchase price equal to 101% of the respective principal amounts of the notes plus accrued and unpaid interest to, but not including, the date of the purchase. It is possible that we would not have sufficient funds at the time of such a change of control triggering event to make the required repurchase of the applicable series of notes and would be required to obtain third party financing to do so. We may not be able to obtain this financing on commercially reasonable terms, or on terms acceptable to us, or at all. In addition, the occurrence of certain change of control events may constitute an event of default under the terms of our credit facilities. Such an event of default would entitle the lenders under our credit facilities to, among other things, cause all outstanding debt thereunder to become due and payable.

Any future payment of dividends on our capital stock will be at the sole discretion of our Board of Directors and subject to certain important limitations, including legal and contractual restrictions.

The amount and timing of future dividend payments, if any, on our common stock and Series A Preferred Stock will be made at the sole discretion of our Board of Directors based on factors such as cash flow and cash requirements, capital expenditures requirements, financial condition, covenants in our debt instruments and legal restrictions. Under Delaware law, our Board of Directors may only declare and pay dividends on shares of our capital stock out of our statutory “surplus” (which is the amount equal to total assets minus total liabilities, in each case at fair market value, minus statutory capital), or if there is no such surplus, out of our net profits for the then current or immediately preceding fiscal year. In addition, our ability to declare and pay dividends is restricted by our existing financing arrangements and may be restricted by future financing arrangements. For example, our credit agreements prohibit us from using proceeds from our revolving credit facility to fund dividend payments if the undrawn amount under the revolver is less than $250 million, and we may not pay dividends on our common stock in excess of $2.40 per share in any fiscal year. As such, there can be no assurances that we will declare and pay any future dividends on our capital stock.

We expect to make contributions to our pension plan in future years, the amount of which will be impacted by volatility in asset values related to Frontier’s pension plan and/or changes in pension plan assumptions.

Frontier made contributions of $75 million, net of the Differential payment received (See note 17), and $28 million to its pension plan in 2017 and 2016, respectively, and we expect to continue to make contributions in future years. Volatility in our asset values, liability calculations, or returns may impact the costs of maintaining our pension plan and our future funding requirements. Any future material contribution could have a negative impact on our liquidity by reducing cash flows.

Significant changes in discount rates, rates of return on pension assets, mortality tables and other factors could adversely affect our earnings and equity and increase our pension funding requirements.

Pension costs and obligations are determined using actual results as well as actuarial valuations that involve several assumptions. The most critical assumptions are the discount rate, the long-term expected return on assets and mortality tables. Other assumptions include salary increases and retirement age. Some of these