Attached files

| file | filename |

|---|---|

| 8-K - OHA Investment Corp | v232467_8-k.htm |

Exhibit 99.1

NGP Capital Resources Company

(NASDAQ: NGPC)

NGPC

Growth Capital for the Energy Industry

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

EnerCom - The Oil & Gas Conference 2011

Forward Looking Statements

This presentation may contain forward-looking statements. These forward-looking statements are subject to various risks and uncertainties, which could cause actual results and conditions to differ materially from those projected, including the uncertainties associated with the timing of transaction closings, changes in interest rates, availability of transactions, the future operating results of our portfolio companies, changes in regional, national, or international economic conditions and their impact on the industries in which we invest, or changes in the conditions of the industries in which we invest, and other factors enumerated in our filings with the Securities and Exchange Commission.

Words such as "anticipates," "believes," "expects," "intends," "will," "should," "may" and similar expressions may be used to identify forward-looking statements. Undue reliance should not be placed on such forward-looking statements as such statements speak only as of the date on which they are made. We do not undertake to update our forward-looking statements unless required by law.

Persons considering an investment in NGP Capital Resources Company should consider the investment objectives, risks, and charges and expenses of the company carefully before investing. Such information and other information about the company is available in our annual report on Form 10-K, our quarterly reports on Form 10-Q and in prospectuses we issue from time to time in connection with our offering of securities. Such materials are filed with the SEC and copies are available on the SEC's website, www.sec.gov. Prospective investors should read such materials carefully before investing. Past performance is not indicative of future results.

NGPC

NGP Capital Resources Company

Page 2

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

Agenda

Company Overview

Investment Criteria

Portfolio Highlights

Partnering with NGPC

NGPC

NGP Capital Resources Company

Page 3

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

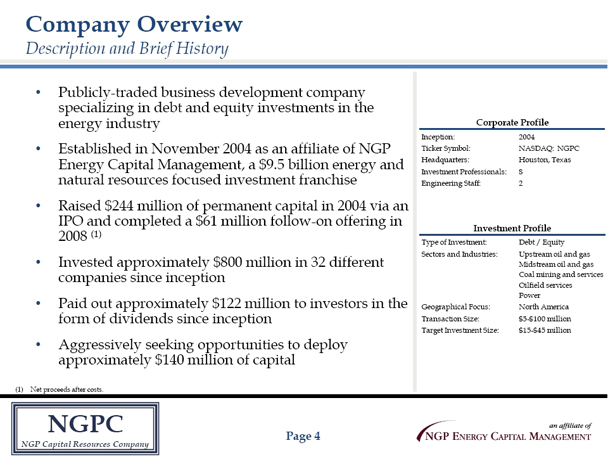

Company Overview Description and Brief History

Publicly-traded business development company specializing in debt and equity investments in the energy industry

Established in November 2004 as an affiliate of NGP Energy Capital Management, a $9.5 billion energy and natural resources focused investment franchise

Raised $244 million of permanent capital in 2004 via an IPO and completed a $61 million follow-on offering in 2008 (1)

Invested approximately $800 million in 32 different companies since inception

Paid out approximately $122 million to investors in the form of dividends since inception

Aggressively seeking opportunities to deploy approximately $140 million of capital

Corporate Profile

Inception: 2004

Ticker Symbol: NASDAQ: NGPC

Headquarters: Houston, Texas Investment Professionals: 8

Engineering Staff: 2

Investment Profile

Type of Investment: Sectors and Industries:

Geographical Focus: Transaction Size: Target Investment Size:

Debt / Equity

Upstream oil and gas Midstream oil and gas Coal mining and services Oilfield services Power

North America

$5-$100 million $15-$45 million

(1) Net proceeds after costs.

NGPC

NGP Capital Resources Company

Page 4

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

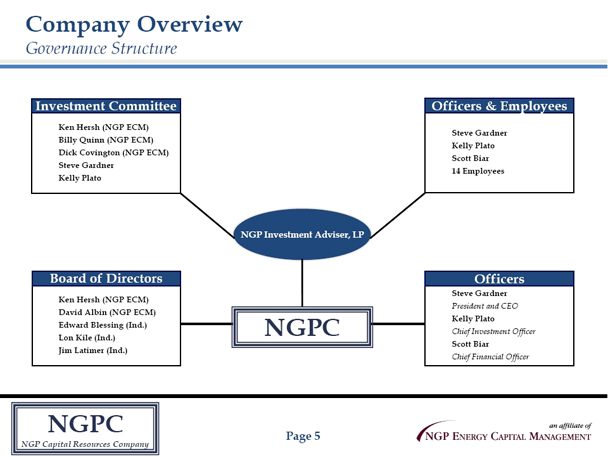

Company Overview

Governance Structure

Investment Committee

Officers & Employees

Ken Hersh (NGP ECM) Billy Quinn (NGP ECM) Dick Covington (NGP ECM) Steve Gardner Kelly Plato

Steve Gardner Kelly Plato Scott Biar 14 Employees

NGP Investment Adviser, LP

Board of Directors

Ken Hersh (NGP ECM) David Albin (NGP ECM) Edward Blessing (Ind.) Lon Kile (Ind.) Jim Latimer (Ind.)

NGPC

Officers

Steve Gardner President and CEO Kelly Plato

Chief Investment Officer Scott Biar

Chief Financial Officer

NGPC

NGP Capital Resources Company

Page 5

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

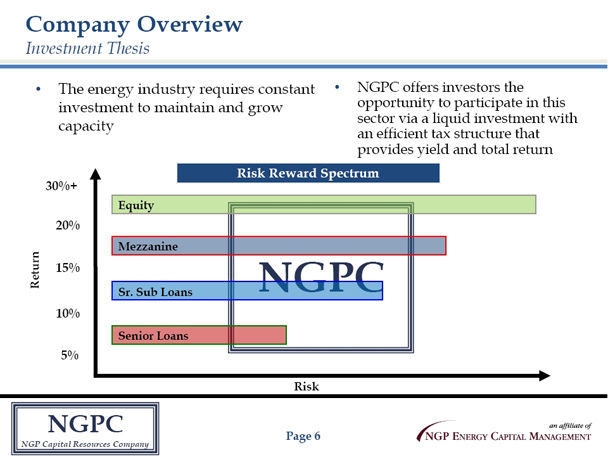

Company Overview

Investment Thesis

The energy industry requires constant

investment to maintain and grow

capacity

Equity

30%+

NGPC offers investors the

opportunity to participate in this

sector via a liquid investment with

an efficient tax structure that

provides yield and total return

Risk Reward Spectrum

20%

15%

10% 5%

Mezzanine

Sr. Sub Loans

Senior Loans

Risk

NGPC

NGPC

NGP Capital Resources Company

Page 6

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

Agenda

Company Overview

Investment Criteria

Portfolio Highlights

Partnering with NGPC

NGPC

NGP Capital Resources Company

Page 7

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

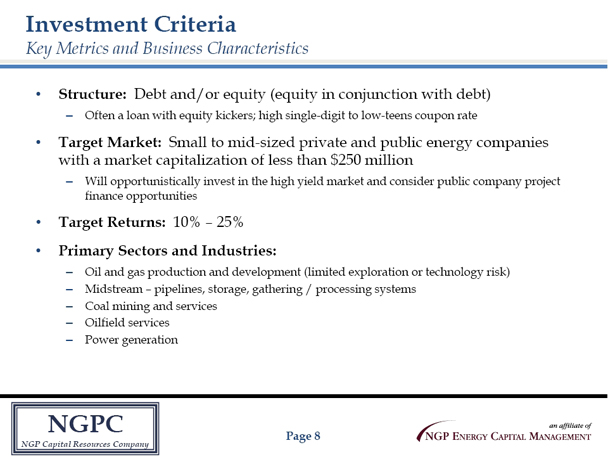

Investment Criteria

Key Metrics and Business Characteristics

Structure: Debt and/or equity (equity in conjunction with debt)

- Often a loan with equity kickers; high single-digit to low-teens coupon rate

Target Market: Small to mid-sized private and public energy companies

with a market capitalization of less than $250 million

- Will opportunistically invest in the high yield market and consider public company project finance opportunities

Target Returns: 10% - 25% Primary Sectors and Industries:

- Oil and gas production and development (limited exploration or technology risk) - Midstream - pipelines, storage, gathering / processing systems - Coal mining and services

- Oilfield services

- Power generation

NGPC

NGP Capital Resources Company

Page 8

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

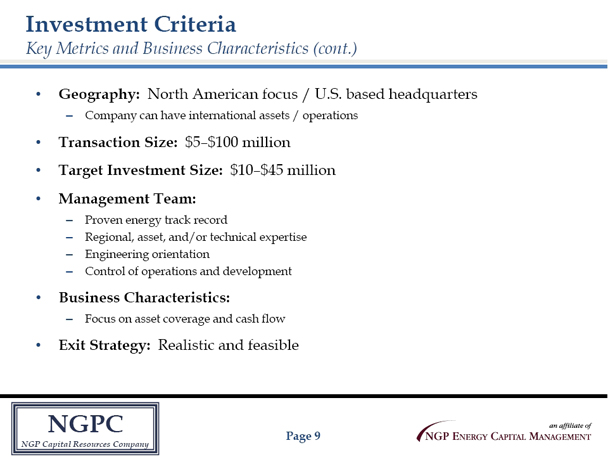

Investment Criteria

Key Metrics and Business Characteristics (cont.)

Geography: North American focus / U.S. based headquarters

- Company can have international assets / operations

Transaction Size:

$5-$100 million

Target Size: $10-$45 million

Investment

Management Team:

- Proven energy track record

- Regional, asset, and/or technical expertise

- Engineering orientation and development

- Control of operations

Business Characteristics:

- Focus on asset coverage and cash flow

Exit Strategy: Realistic and feasible

NGPC

NGP Capital Resources Company

Page 9

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

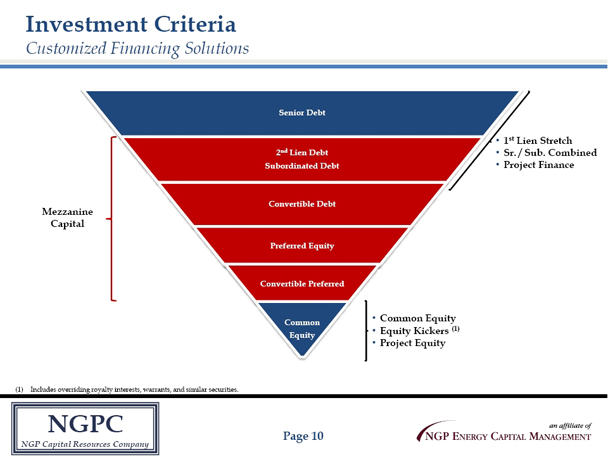

Investment Criteria

Customized Financing Solutions

Senior Debt

2nd Lien Debt

Subordinated Debt

1st Lien Stretch

Sr. / Sub. Combined

Project Finance

Convertible Debt

Mezzanine

Capital

(1) Includes overriding royalty interests, warrants, and similar securities.

Preferred Equity

Convertible Preferred

Common Equit

Common Equity

Equity Kickers (1)

Project Equity

NGPC

NGP Capital Resources Company

Page 10

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

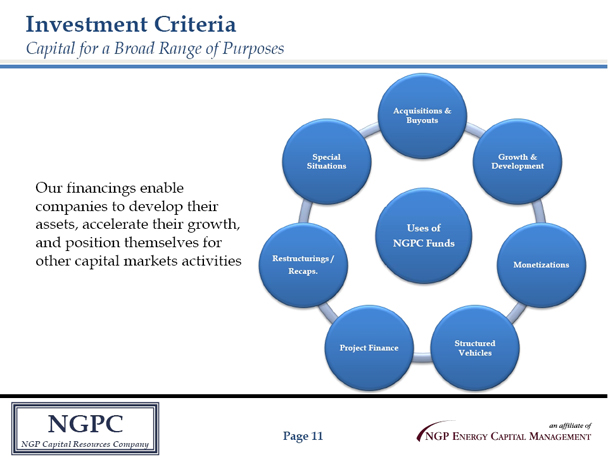

Investment Criteria

Capital for a Broad Range of Purposes

Our financings enable companies to develop their assets, accelerate their growth, and position themselves for other capital markets activities

NGPC

NGP Capital Resources Company

Page 11

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

Agenda

Company Overview

Investment Criteria

Portfolio Highlights

Partnering with NGPC

NGPC

NGP Capital Resources Company

Page 12

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

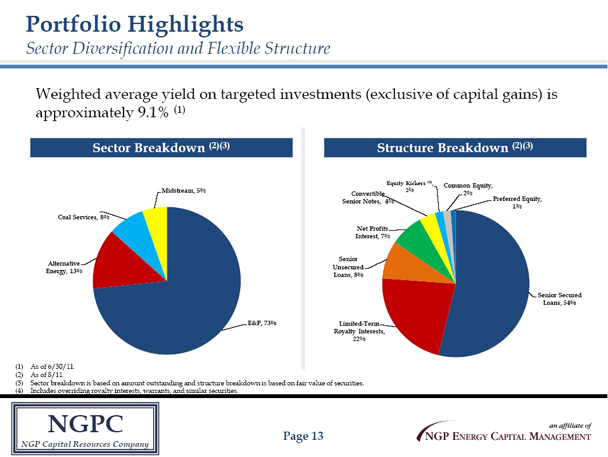

Portfolio Highlights

Sector Diversification and Flexible Structure

Weighted average yield on targeted investments (exclusive of capital gains) is

approximately 9.1% (1)

Sector Breakdown (2)(3)

Structure Breakdown (2)(3)

(1) As of 6/30/11.

(2) As of 8/11.

(3) Sector breakdown is based on amount outstanding and structure breakdown is based on fair value of securities. (4) Includes overriding royalty interests, warrants, and similar securities.

NGPC

NGP Capital Resources Company

Page 13

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

Agenda

Company Overview

Investment Criteria

Portfolio Highlights

Partnering with NGPC

NGPC

NGP Capital Resources Company

Page 14

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

Partnering with NGPC

Why Partner with NGPC?

Actively seeking to deploy $140 million of permanent and established capital

Long-term capital partner

Depth of energy, engineering, and financial experience and expertise

Customized financing solutions - "One-Stop Shop"

Pricing and structure tailored to the risk assumed

Management assistance

Speed of commitment and closing

Underwriting capability

Ability to leverage resources from NGP Energy Capital Management

NGPC

NGP Capital Resources Company

Page 15

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT

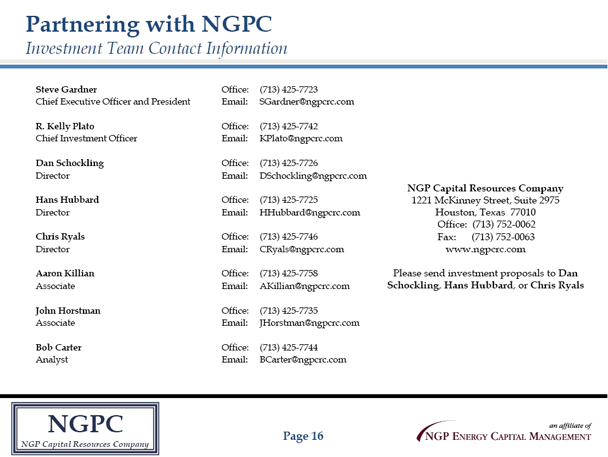

Partnering with NGPC

Investment Team Contact Information

Steve Chief Executive Office: (713) 425-7723

Gardner Email: SGardner@ngpcrc.com

Officer and President

R. Kelly Chief Investment Office: (713) 425-7742

Plato Email: KPlato@ngpcrc.com

Officer

Director Dan Schockling Office: (713) 425-7726 NGP Capital Resources Company

Email: DSchockling@ngpcrc.com

Director Hans Hubbard Office: (713) 425-7725 1221 McKinney Street, Suite 2975

Email: HHubbard@ngpcrc.com Houston, Texas 77010

Office:

Chris Ryals Office: (713) 425-7746 (713) 752-0062

Director Email: CRyals@ngpcrc.com Fax:

(713) 752-0063

Aaron Killian Office: (713) 425-7758

Associate Email: AKillian@ngpcrc.com www.ngpcrc.com

Associate John Horstman Office: (713) 425-7735 Please send investment proposals to Dan

Email: JHorstman@ngpcrc.com Schockling, Hans Hubbard, or Chris Ryals

Bob Carter Office: (713) 425-7744

Analyst Email: BCarter@ngpcrc.com

NGPC

NGP Capital Resources Company

Page 16

an affiliate of

NGP ENERGY CAPITAL MANAGEMENT