Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED AUGUST 15, 2011 - Aegion Corp | form8k08152011.htm |

INVESTOR PRESENTATION

August 2011

Safe Harbor Statement

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward looking statements. The Company

makes forward-looking statements in this Investor Presentation that represent the Company’s beliefs or expectations about

future events or financial performance. These forward-looking statements are based on information currently available to the

Company and on management’s beliefs, assumptions, estimates and projections and are not guarantees of future events or

results. When used in this presentation, the words “anticipate,” “estimate,” “believe,” “plan,” “intend,” “may,” “will” and similar

expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements.

Such statements are subject to known and unknown risks, uncertainties and assumptions, including those referred to in the “Risk

Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, as filed with the

Securities and Exchange Commission on February 28, 2011. In light of these risks, uncertainties and assumptions, the forward-

looking events discussed may not occur. In addition, our actual results may vary materially from those anticipated, estimated,

suggested or projected. Except as required by law, we do not assume a duty to update forward-looking statements, whether as

a result of new information, future events or otherwise. Investors should, however, review additional disclosures made by the

Company from time to time in its periodic filings with the Securities and Exchange Commission. Please use caution and do not

place reliance on forward-looking statements. All forward-looking statements made by the Company in this presentation are

qualified by these cautionary statements.

makes forward-looking statements in this Investor Presentation that represent the Company’s beliefs or expectations about

future events or financial performance. These forward-looking statements are based on information currently available to the

Company and on management’s beliefs, assumptions, estimates and projections and are not guarantees of future events or

results. When used in this presentation, the words “anticipate,” “estimate,” “believe,” “plan,” “intend,” “may,” “will” and similar

expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements.

Such statements are subject to known and unknown risks, uncertainties and assumptions, including those referred to in the “Risk

Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, as filed with the

Securities and Exchange Commission on February 28, 2011. In light of these risks, uncertainties and assumptions, the forward-

looking events discussed may not occur. In addition, our actual results may vary materially from those anticipated, estimated,

suggested or projected. Except as required by law, we do not assume a duty to update forward-looking statements, whether as

a result of new information, future events or otherwise. Investors should, however, review additional disclosures made by the

Company from time to time in its periodic filings with the Securities and Exchange Commission. Please use caution and do not

place reliance on forward-looking statements. All forward-looking statements made by the Company in this presentation are

qualified by these cautionary statements.

In addition, some of the market and industry date and forecast included in this Investor Presentation are based upon

independent industry sources. Although we believe that these independent sources are reliable we have not independently

verified the accuracy and completeness of this information.

independent industry sources. Although we believe that these independent sources are reliable we have not independently

verified the accuracy and completeness of this information.

Insituform®, the Insituform® logo, InsituMain®, United Pipeline Systems®, Bayou Companies™, Corrpro® and our other

trademarks referenced herein are the registered and unregistered trademarks of Insituform Technologies, Inc. and its affiliates.

trademarks referenced herein are the registered and unregistered trademarks of Insituform Technologies, Inc. and its affiliates.

2

ENERGY & MINING

•Grew significantly in size and contribution through

service and geographic expansion

service and geographic expansion

3

Strength in Numbers

NORTH AMERICAN SEWER

REHABILITATION (NAR)

REHABILITATION (NAR)

•Manufacturing optimization and growth in third-party tube

sales were primary drivers to 2010 increased profitability

sales were primary drivers to 2010 increased profitability

•In 2011, market challenges have led to significant decline

in profitability; focused on improving crew efficiency and

project management to turn around performance

in profitability; focused on improving crew efficiency and

project management to turn around performance

ASIA-PACIFIC AND EUROPEAN SEWER

REHABILITATION

REHABILITATION

•We continue to push into new markets in Asia-Pacific

and expand our footprint in Australia and other parts of

Asia

and expand our footprint in Australia and other parts of

Asia

•We made significant progress in European profitability

and returns through right-sizing of contracting operations

and increasing our focus on manufacturing

and returns through right-sizing of contracting operations

and increasing our focus on manufacturing

FINANCIAL HIGHLIGHTS

(IN THOUSANDS, EXCEPT PER SHARE DATA) FOR THE YEARS ENDED DECEMBER 31

Revenues

Gross Profit

Operating Income

Income from Continuing Operations

Income from Continuing Operations,

excluding restructuring charges and

acquisition-related expenses (Non-GAAP) 1

Net Income

Diluted Earnings Per Share:

Income from Continuing Operations

Income from Continuing Operations,

excluding restructuring charges and

acquisition-related expenses (Non-GAAP)1

Net Income

$921,173

208,715

65,111

46,882

47,133

47,110

$ 1.19

1.19

1.19

$914,975

229,580

87,035

60,562

60,562

60,462

$ 1.54

1.54

1.53

$726,866

190,591

49,117

30,241

38,926

26,171

$ 0.81

1.04

0.70

$536,664

129,597

33,882

24,076

24,076

21,640

$ 0.86

0.86

0.77

$495,570

99,108

13,530

12,866

12,866

2,543

$ 0.47

0.47

0.09

(1) For the 2009 Financial Reconciliation (Non-GAAP), see page A-1

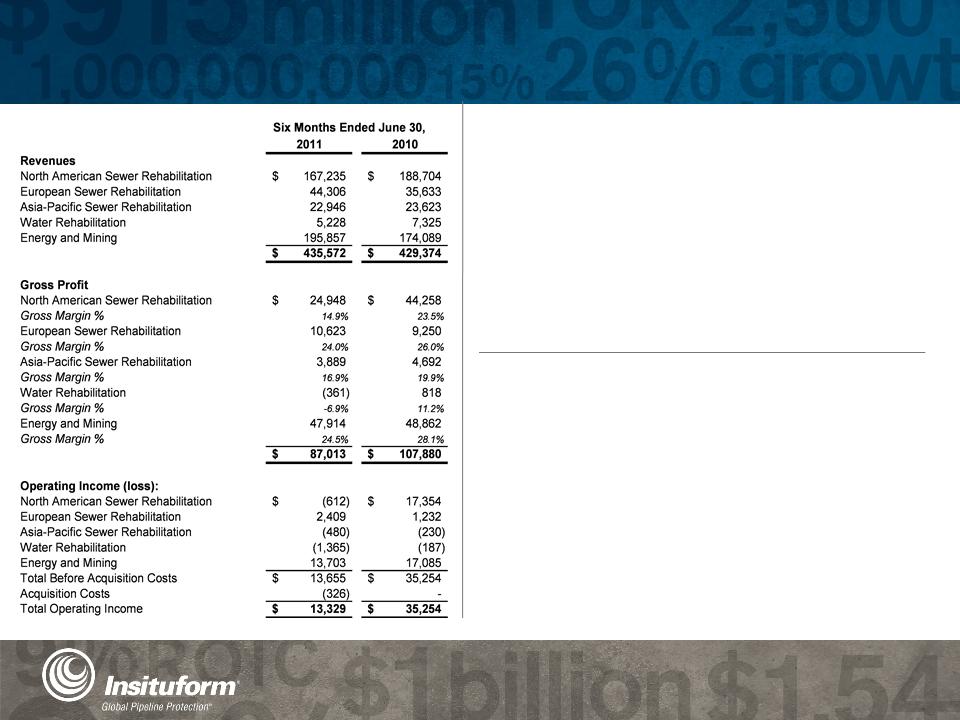

• Decline in NAR gross margins resulting from difficult market conditions

impacted project performance, magnified by a significant shift to small

diameter sizes pressured project management and crew operations

impacted project performance, magnified by a significant shift to small

diameter sizes pressured project management and crew operations

• Energy & Mining gross margin declined to 24.5% versus 28.1% in the

first half of 2010 as much of the revenue growth came from

regions/areas with lower project margins

first half of 2010 as much of the revenue growth came from

regions/areas with lower project margins

• Asia-Pacific gross profit declined as a result of weak margins of 16.9%

versus 19.9% in the same period of 2010 as older Indian projects

continued at low margins; this was partially offset by strong results in

Australia

versus 19.9% in the same period of 2010 as older Indian projects

continued at low margins; this was partially offset by strong results in

Australia

• Project bidding and release issues along with extreme weather

throughout the US significantly impacted NAR 2011 revenue,

contributing to the $21.5 million shortfall when compared to 2010

throughout the US significantly impacted NAR 2011 revenue,

contributing to the $21.5 million shortfall when compared to 2010

• Europe exceeded prior year results by 24.3% on strong results in the

Netherlands, Spain and European manufacturing offset by lower

revenue in the United Kingdom

Netherlands, Spain and European manufacturing offset by lower

revenue in the United Kingdom

• Energy & Mining increased $21.8 million when compared to the same

period of 2010 on strong growth in UPS and Corrpro

period of 2010 on strong growth in UPS and Corrpro

$87.0M

2011 YTD Review

4

$435.6M

Revenue

Gross Profit

5

Key Business Initiatives

SEWER REHABILITATION

• North America - Turn around

profitability through better disciplined

project management, estimating, bidding

and execution capabilities (both

manufacturing and contracting

businesses) and continued growth of

third-party product sales

profitability through better disciplined

project management, estimating, bidding

and execution capabilities (both

manufacturing and contracting

businesses) and continued growth of

third-party product sales

• Europe - Focus on improving

• profitability through optimizing

•installation businesses, expanding

•third-party tube sales throughout

•Europe and selectively targeting new

•lining products and services

• profitability through optimizing

•installation businesses, expanding

•third-party tube sales throughout

•Europe and selectively targeting new

•lining products and services

• Asia-Pacific - Continue growth in

Australia, Singapore, India and Hong

Kong and other parts of Asia and

expand third-party tube sales

expand third-party tube sales

through development of certified

installer program throughout Asia

ENERGY & MINING

• Expand service offering selectively

•through joint ventures and partnerships

• - specialty linings, robotic joint coating,

•through joint ventures and partnerships

• - specialty linings, robotic joint coating,

insulation coatings, double joint

welding, etc.

• Focus on selective geographic

•expansion (Middle East, Asia)

•expansion (Middle East, Asia)

• Continue investment in building

•business development opportunities for

•comprehensive service platform

•business development opportunities for

•comprehensive service platform

• Become well-positioned in key spend

•areas - Gulf of Mexico, Canadian Oil

•Sands, Middle East

•areas - Gulf of Mexico, Canadian Oil

•Sands, Middle East

OTHER INFRASTRUCTURE

• Develop broader infrastructure platform

to capitalize on growing infrastructure

needs globally with particular emphasis

on leveraging our North American

platform

to capitalize on growing infrastructure

needs globally with particular emphasis

on leveraging our North American

platform

• Build out a return-driven infrastructure

services platform to create leverage from

our existing businesses

services platform to create leverage from

our existing businesses

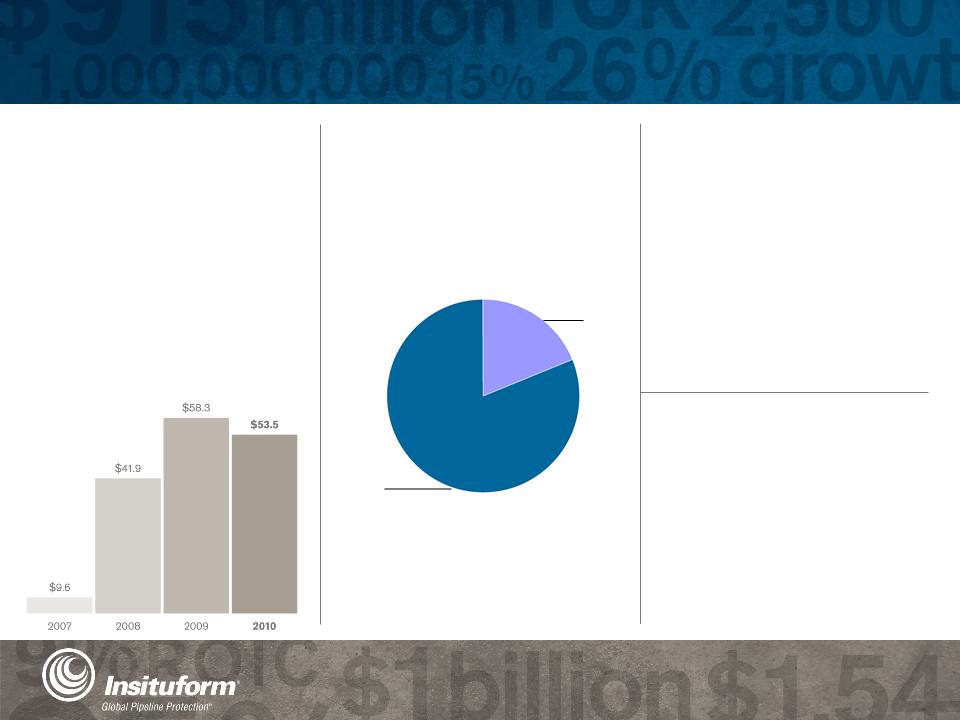

Financial Performance Trend

6

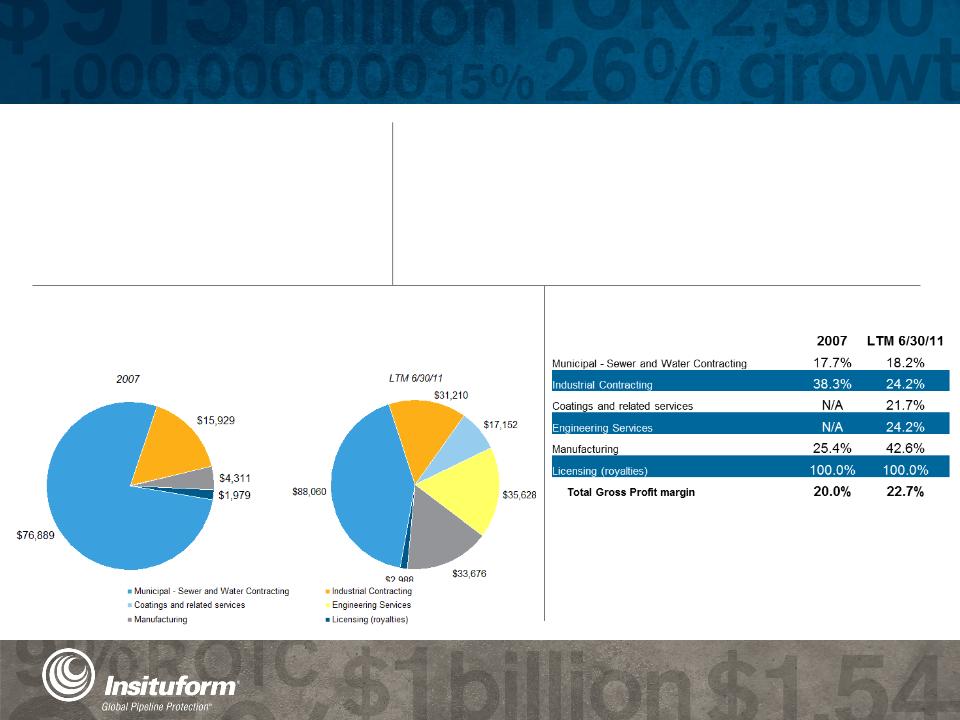

While municipal contracting remains Insituform's largest line of business, other

higher margin products and services are growing in prominence on our expanded

business platform

higher margin products and services are growing in prominence on our expanded

business platform

While Insituform's gross profit margin has improved compared

to previous years, we are focused on offering higher-margin

products and services to drive greater returns to our

stockholders. Insituform's overall LTM gross profit margin was

22.7%, a 14% increase over 2007

to previous years, we are focused on offering higher-margin

products and services to drive greater returns to our

stockholders. Insituform's overall LTM gross profit margin was

22.7%, a 14% increase over 2007

GROSS MARGIN BY PRODUCT

22.7%

LTM June 30, 2011 Gross Profit

Margin

LTM June 30, 2011 Gross Profit

Margin

GROSS PROFIT BY PRODUCT

(in thousands)

$209M

LTM June 30, 2011 Gross Profit

LTM June 30, 2011 Gross Profit

Focus on Returns

7

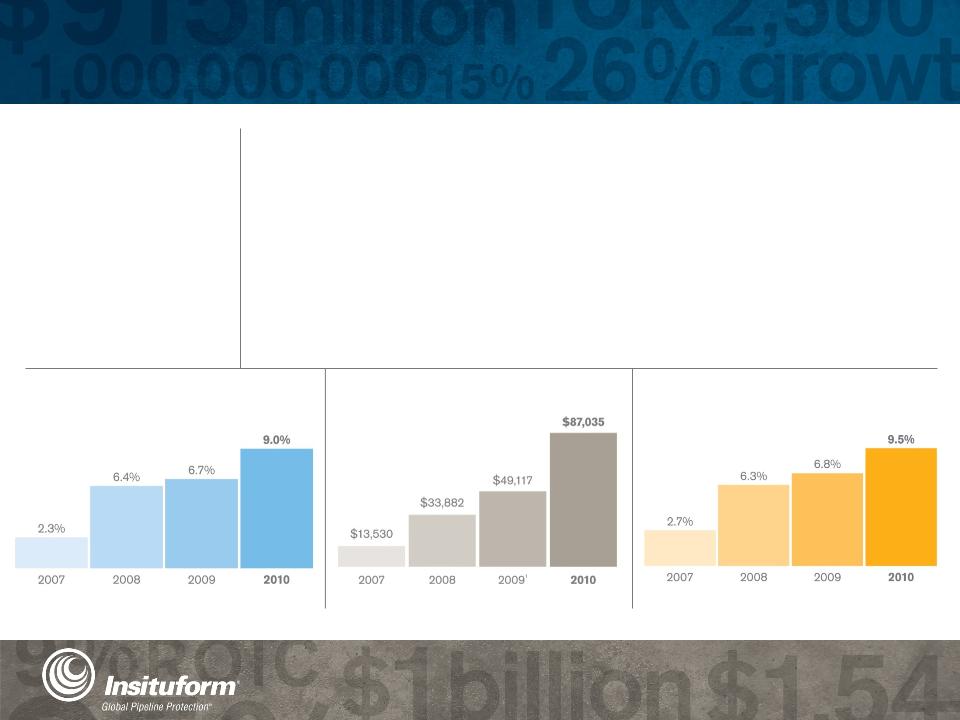

OPERATING INCOME

(in thousands)

INSITUFORM OPERATING MARGIN

OPERATING MARGIN UP 252% SINCE 2007

INSITUFORM ROIC

ROIC UP 291% SINCE 2007

• We have moved a long way towards our goal of achieving a 15% return on invested

• capital and 15% operating margin in 2012, but we have more work to do

• capital and 15% operating margin in 2012, but we have more work to do

• We anticipate achieving this target through:

15%

Target Return on Invested

Capital and Operating

Margin by 2012

Capital and Operating

Margin by 2012

- Driving profitable growth in our international markets through our Energy & Mining Platform (offshore

Gulf of Mexico, Canadian Oil Sands, Middle East and other high growth international markets)

Gulf of Mexico, Canadian Oil Sands, Middle East and other high growth international markets)

- Acquisition of higher margin, higher return profile businesses (CRTS, Fyfe and Hockway)

- Improve NAR’s execution capability and expand higher margin manufacturing

- profitability. We will continue to evaluate our contracting markets for appropriate risk/reward

- relationships

- profitability. We will continue to evaluate our contracting markets for appropriate risk/reward

- relationships

- Leveraging our operating cost structure

OPERATING INCOME UP 543% SINCE 2007

(1) For the 2009 Financial Reconciliation (Non-GAAP), see Page A-1

8

Business Units

Individually, these businesses apply their

specialized expertise to solving pipeline

challenges for the sewer, water, oil, gas and

mining industries. Collectively, they give

Insituform the comprehensive capabilities and

experience needed to serve the world’s pipeline

infrastructure. Given the synergies that exist

among them, they create a whole that is greater

than the sum of their parts

specialized expertise to solving pipeline

challenges for the sewer, water, oil, gas and

mining industries. Collectively, they give

Insituform the comprehensive capabilities and

experience needed to serve the world’s pipeline

infrastructure. Given the synergies that exist

among them, they create a whole that is greater

than the sum of their parts

The following slides detail the

accomplishments of our primary

accomplishments of our primary

business units:

• Energy & Mining

• North American Sewer Rehabilitation

• European Sewer Rehabilitation

• Asia-Pacific Sewer Rehabilitation

The strength of Insituform’s performance is a

direct reflection of the contributions made by the

business units we operate.

direct reflection of the contributions made by the

business units we operate.

Energy & Mining

9

$404M

LTM June 30, 2011

LTM June 30, 2011

Energy & Mining Revenues

|

($ in “000”)

|

LTM

6/30/11 |

2010

|

2009(1)

|

2008

|

2007

|

|

Revenue

|

$ 404,013

|

$382,246

|

$ 241,678

|

$ 60,567

|

$ 41,606

|

|

Gross profit

|

104,361

|

105,309

|

67,185

|

18,250

|

15,929

|

|

Gross margin %

|

25.8%

|

27.5%

|

27.8%

|

30.1%

|

38.3%

|

|

Operating income

|

36,041

|

41,121

|

18,472

|

10,896

|

9,120

|

|

Operating margin %

|

8.9%

|

10.8%

|

7.6%

|

18.0%

|

21.9%

|

|

Backlog

|

168,156

|

146,095

|

180,178

|

18,703

|

26,225

|

2010 Performance Highlights

• Corrpro Companies and United Pipeline Systems (UPS)

experienced record revenues in 2010

experienced record revenues in 2010

• The Bayou Companies’ revenues significantly increased

due to expanded service offerings

due to expanded service offerings

• Backlog in the South American operation of our UPS

business increased to $20 million at December 30, 2010.

UPS’ North American operations also increased revenue by

35.2% to $37.3 million. UPS also opened an office in Oman

early in 2010

business increased to $20 million at December 30, 2010.

UPS’ North American operations also increased revenue by

35.2% to $37.3 million. UPS also opened an office in Oman

early in 2010

2011 Outlook

• For 2011 we anticipate robust growth in all of our

• Energy & Mining markets around the world

• Energy & Mining markets around the world

• Bayou’s Canadian pipe coating operation exceeded our 2010

• expectations, and we expect continued growth in 2011

• expectations, and we expect continued growth in 2011

• UPS is on track to continue the momentum of 2010 with

very strong YTD performance in 2011, with record backlog and

growing strength in South America, Australia and

very strong YTD performance in 2011, with record backlog and

growing strength in South America, Australia and

the Middle East

• Corrpro expects to grow revenues by more than 10%

(1) See Financial Reconciliation on Page A-2

2011 Outlook

• We expect municipal sewer markets to continue to be stable,

but bid table will improve in the second half of the year

but bid table will improve in the second half of the year

• We will turn around performance through:

- improve bidding and execution discipline

- Improve our project management capability

- Improve our crew deployment discipline

- focus on larger projects where risk / rewards are more

favorable

favorable

- increase efficiency of operating expenses

• We expect continued growth of our third-party tube sales

• through more aggressive market penetration

• through more aggressive market penetration

North American Sewer Rehabilitation (NAR)

10

|

($ in “000”)

|

LTM 6/30/11

|

2010

|

2009

|

2008(1)

|

2007(1)

|

|

Revenue

|

$ 379,169

|

$ 400,638

|

$ 354,418

|

$ 340,296

|

$ 348,085

|

|

Gross profit

|

73,770

|

93,078

|

91,346

|

75,435

|

58,890

|

|

Gross margin %

|

19.5%

|

23.2%

|

25.8%

|

22.2%

|

16.9%

|

|

Operating income

|

24,063

|

42,029

|

38,357

|

17,041

|

(3,367)

|

|

Operating margin %

|

6.3%

|

10.5%

|

10.8%

|

5.0%

|

-1.0%

|

|

Backlog

|

167,543

|

155,631

|

180,858

|

150,808

|

159,974

|

2010 Performance Highlights

• Operating income grew due to manufacturing profitability, increased

third-party tube sales and lower operating costs

third-party tube sales and lower operating costs

• First half 2011 results severely impacted by extreme weather

conditions along with delayed bid table; project release delays have

impacted project management and crew productivity dramatically

conditions along with delayed bid table; project release delays have

impacted project management and crew productivity dramatically

• Expect second half recovery with improved backlog and better

execution while project sizes and trend towards small diameter

projects will continue to impact margins to a certain extent

execution while project sizes and trend towards small diameter

projects will continue to impact margins to a certain extent

(1) See Financial Reconciliation on Page A-2

North American Sewer Rehabilitation (NAR)

11

Business Challenges

• Smaller project sizes (approximately $300K)

• Increased percentage of small diameter

projects (+85% ) - most competitive portion of

the market

projects (+85% ) - most competitive portion of

the market

• Volatile project / work releases

• Municipal customers constrained due to

continued economic headwinds

continued economic headwinds

Initiatives

• Improve estimating / bidding discipline

- project preparation, market intelligence and

margin thresholds

• Intense review of crew deployment

- ensure adequate production in front of crews

(reduce number of non-productive hours)

• Continuous improvement of project management talent

- better subcontractor management and project

close-out (improve cash flow)

• Vigilant review of support structure to ensure business

is competitive in a “commodity” market

is competitive in a “commodity” market

• More aggressive sales effort for third-party product

sales

sales

European Sewer Rehabilitation

12

44%

2010 Operating Income

Improvement over 2009

2010 Operating Income

Improvement over 2009

|

($ in “000”)

|

LTM 6/30/11

|

2010

|

2009(1)

|

2008(1)

|

2007

|

|

Revenue

|

$ 82,723

|

$74,050

|

$85,993

|

$104,225

|

$100,658

|

|

Gross profit

|

21,899

|

20,526

|

22,774

|

23,228

|

23,300

|

|

Gross margin %

|

26.5%

|

27.7%

|

26.5%

|

22.3%

|

23.1%

|

|

Operating income

|

6,293

|

5,116

|

3,561

|

964

|

5,368

|

|

Operating margin %

|

7.6%

|

6.9%

|

4.1%

|

0.9%

|

5.3%

|

|

Backlog

|

22,152

|

23,309

|

37,195

|

25,150

|

39,011

|

2010 Performance Highlights

• Gross margin increased from 26.5% in 2009 to 27.7% in 2010

• We achieved significant cost savings and increased

• margins through our 2009 restructuring initiative

• margins through our 2009 restructuring initiative

• Operating margins increased from 4.1% in 2009 to 6.9% for 2010

• We initiated production of the InsituMain® System, our

• cured-in-place pipe (CIPP) solution for pressure pipelines

• cured-in-place pipe (CIPP) solution for pressure pipelines

• We successfully tested a glass-fiber reinforced CIPP

• product, which will be manufactured in our UK facility

• product, which will be manufactured in our UK facility

2011 Outlook

• We anticipate growth in the Netherlands, in third-party tube

sales, and a slight recovery in the United Kingdom and France

sales, and a slight recovery in the United Kingdom and France

• We anticipate increasing second half margins through improved

• productivity and execution, lower operating costs and a mix

• shift that favors product sales over contracting revenues

• productivity and execution, lower operating costs and a mix

• shift that favors product sales over contracting revenues

• We will continue to expand our portfolio of trenchless products

• and services, including the full commercialization of our glass-

• fiber reinforced CIPP product

• and services, including the full commercialization of our glass-

• fiber reinforced CIPP product

(1) See Financial Reconciliation on Page A-2

Asia-Pacific Sewer Rehabilitation

13

323%

Revenue Growth since 2008

Revenue Growth since 2008

|

($ in “000”)

|

LTM 6/30/11

|

2010

|

2009(1)

|

2008

|

2007

|

|

Revenue

|

$ 42,816

|

$ 43,493

|

$ 33,256

|

$ 10,129

|

$ 973

|

|

Gross profit

|

9,306

|

10,108

|

9,032

|

2,938

|

544

|

|

Gross margin %

|

21.7%

|

23.2%

|

27.2%

|

29.0%

|

55.9%

|

|

Operating income

|

(146)

|

105

|

3,441

|

1,639

|

(507)

|

|

Operating margin %

|

(0.3)%

|

0.2%

|

10.3%

|

16.2%

|

-52.1%

|

|

Backlog

|

62,754

|

79,825

|

57,423

|

46,238

|

34,362

|

Performance Highlights

• We expanded our presence in Australia

• We reorganized our venture in India to become a specialty

contractor performing only lining (improved risk profile and

better cash flow)

contractor performing only lining (improved risk profile and

better cash flow)

• To promote tube sales in small-diameter markets, we

have continued our Certified Installer Program™ in

Singapore, Malaysia and China

have continued our Certified Installer Program™ in

Singapore, Malaysia and China

2011 Outlook

• Overall market growth in 2011 is expected to be strong throughout

the Asia-Pacific region. The Indian market should return to normal

conditions (recent project wins), and we anticipate achieving further

expansion into Australia and other newer markets, including Malaysia

the Asia-Pacific region. The Indian market should return to normal

conditions (recent project wins), and we anticipate achieving further

expansion into Australia and other newer markets, including Malaysia

• Demand for maintenance contracts will likely grow as more

municipalities learn of our services. Sewer pipes are generally older

and in worse condition in this region than in many parts of the world

municipalities learn of our services. Sewer pipes are generally older

and in worse condition in this region than in many parts of the world

(1) See Financial Reconciliation on Page A-2

Financial Strength

14

OPERATING CASH FLOW

$53.5MILLION

Insituform has historically produced strong operating

cash flows, and has increased it from $9.6 million in

2007 to $53.5 million in 2010. Operating cash flow

decreased slightly in 2010 compared to 2009 due to

an increase in our collection cycle as a result of the

global economic downturn. In 2010, many of our

customers, primarily municipalities, increased their

payment cycle

cash flows, and has increased it from $9.6 million in

2007 to $53.5 million in 2010. Operating cash flow

decreased slightly in 2010 compared to 2009 due to

an increase in our collection cycle as a result of the

global economic downturn. In 2010, many of our

customers, primarily municipalities, increased their

payment cycle

OPERATING CASH FLOW

(in millions)

INSITUFORM’S CURRENT

DEBT-TO-EQUITY 6/30/11

19%

Insituform’s debt-to-equity ratio is a sign of the

company’s financial strength. It also indicates we have

the flexibility to generate additional growth

company’s financial strength. It also indicates we have

the flexibility to generate additional growth

Total operating cash flow in 2010

UNRESTRICTED CASH

$108.0MILLION

Total unrestricted cash at

June 30, 2011

June 30, 2011

Unrestricted cash represents a company’s instant

monetary reserves. We increased Insituform’s

unrestricted cash to $108.0 million at June 30, 2011,

up from $79.0 million at year-end 2007. This 36.7%

increase in cash, together with our low debt, provides

us flexibility to pursue organic and inorganic growth

opportunities

monetary reserves. We increased Insituform’s

unrestricted cash to $108.0 million at June 30, 2011,

up from $79.0 million at year-end 2007. This 36.7%

increase in cash, together with our low debt, provides

us flexibility to pursue organic and inorganic growth

opportunities

STRONG

• A conservative capital structure and strong cash

position have enabled us to grow in uncertain

economic times

position have enabled us to grow in uncertain

economic times

• We now have the flexibility to use our balance

sheet strength to pursue growth opportunities,

including strategic acquisitions that will help us to

reach and exceed our return targets

sheet strength to pursue growth opportunities,

including strategic acquisitions that will help us to

reach and exceed our return targets

19%

Debt

81%

Equity

Growth Initiatives

15

WE ARE PURSUING OPPORTUNITIES

TO EXPAND CAPABILITY:

TO EXPAND CAPABILITY:

• Expand Energy and Mining presence in high growth geographies,

including the Middle East

including the Middle East

• Bolster our platform within infrastructure technologies and services

• Broader linings capabilities and insulation products in high spend

geographies - Gulf of Mexico, Canadian Oil Sands

geographies - Gulf of Mexico, Canadian Oil Sands

• Continue to broaden our Asia-Pacific platform positioning our

product/services to take advantage of theatre growth

product/services to take advantage of theatre growth

Acquisitions Overview:

16

CRTS, Inc. Acquisition Summary

Strategic Highlights

• Potential cross selling opportunities between Bayou, CCSI &

UPS - South America

UPS - South America

• Expands the OD Coating service line and footprint of CCSI

• Brings valuable technology, robotic capabilities, and IP

• Opportunity to bring custom coating to new customer base

in Tulsa

in Tulsa

• Possible catalyst for Bayou entry into foreign markets (i.e.

Middle East, South America)

Middle East, South America)

17

Acquisition Summary

• Stock purchase of Tulsa based business

• Transaction value $39 million ($24 million in cash at

closing and $15 million earnout opportunity)

closing and $15 million earnout opportunity)

• Closing Purchase Price was 5.7x 2010 CRTS audited

EBITDA: $4.2 million

EBITDA: $4.2 million

• Transaction closed June 30, 2011

• Awarded $48.4 million contract in Saudi Arabia in

July 2011

July 2011

Market Position

• The best proprietary robotic

coating technology in the industry

coating technology in the industry

• Experience and relationships -

CRTS has a long resume of

successful projects including $12.0

million Saudi contract completed in

2010

CRTS has a long resume of

successful projects including $12.0

million Saudi contract completed in

2010

Acquisition Summary

• Asset Purchase of Hockway Ltd. (UK Company)

• Stock Purchase of Hockway ME FZC (UAE Company)

• Purchase Price 6.5x 2010 Hockway audited EBITDA: $0.9 million

• $4.6 million cash at closing (75% of Purchase Price)

• Earnout: $1.5 million deferred as earnout (25% of Purchase Price)

• Based upon the attainment of business plan

• Additional Earnout: Seller may receive an additional 25% of Gross

Profit in excess of business plan

Profit in excess of business plan

• Closing date August 3, 2011

Hockway Acquisition Summary

18

• Strategic Highlights

• A catalyst to growth in the Middle East market.

• “Natural fit” with Corrpro operations in the United Kingdom and Middle East, will accelerate sales volume from

the region.

the region.

• Hockway's ATEX certified rectifier (explosion proof for use in hazardous areas) to be distributed worldwide

through Corrpro distribution channels.

through Corrpro distribution channels.

• Hockway’s relationships provides access to accounts and geographies that would be unattainable for Corrpro

alone in the near term (e.g. Iraq)

alone in the near term (e.g. Iraq)

• Strong ROIC - Good Backlog - Solid Reputation - Conduit to New Geographies ($140 million market).

Acquisition Summary

• Asset purchase of Fibrwrap Construction

US and Canada (installation entities)

with stock purchase of Fyfe Co

(manufacturing and engineering)

US and Canada (installation entities)

with stock purchase of Fyfe Co

(manufacturing and engineering)

• On July 26, 2011 signed definitive

agreement for to purchase Fyfe Group’s

North American operations for $115.8

million - anticipated closing August 31,

2011

agreement for to purchase Fyfe Group’s

North American operations for $115.8

million - anticipated closing August 31,

2011

• One-year option to buy Fyfe Group’s

international operations (Europe, Latin

America, Asia, Hong Kong) after

completion of satisfactory due diligence.

Anticipate closing transaction prior to

year-end 2011.

international operations (Europe, Latin

America, Asia, Hong Kong) after

completion of satisfactory due diligence.

Anticipate closing transaction prior to

year-end 2011.

FYFE Acquisition Summary

19

Highlights

• Market leader in North American FRP market and

holds 40+ patents worldwide

holds 40+ patents worldwide

• Significant barriers to entry including experience, IP,

testing, and certifications

testing, and certifications

• Good fit with existing ITI acumen - vertically

integrated fabric and resin experience

integrated fabric and resin experience

• Solution for large-diameter pressure pipe

applications

applications

• Opens new addressable markets in infrastructure

rehab - buildings, bridges, blast, waterfront, and

industrial

rehab - buildings, bridges, blast, waterfront, and

industrial

Appendix

Financial Reconciliation

(GAAP to Non-GAAP Information)

(GAAP to Non-GAAP Information)

|

2009 Financial Reconciliation (Non-GAAP)

(In thousands, except earnings per share [EPS] data)

|

|||

|

|

|

Amount

|

EPS

|

|

Income from continuing operations (as reported)

|

$ 30,241

|

$0.81

|

|

|

Restructuring charges

|

3,796

|

0.10

|

|

|

Acquisition-related expenses (credits)

|

4,889

|

0.13

|

|

|

Income from Continuing Operations, excluding

restructuring charges and acquisition-related expenses |

$ 38,926

|

$1.04

|

|

The following is a reconciliation of Insituform's financial information as shown in

presentation (GAAP to Non-GAAP) on Page 3:

presentation (GAAP to Non-GAAP) on Page 3:

A-1

|

European Sewer Rehabilitation

|

|||

|

($ in”000”)

|

As Reported 2009

|

Adjustment

|

Adjusted 2009

|

|

Revenue

|

$ 85,933

|

$ -

|

$ 85,993

|

|

Gross profit

|

22,774

|

-

|

22,774

|

|

Operating expense

|

20,430

|

(1,217)

|

19,213

|

|

Restructuring charges

|

3,349

|

(3,349)

|

-

|

|

Operating income

|

(1,005)

|

4,566

|

3,561

|

The following is a reconciliation of Insituform's financial information as shown in presentation (GAAP to Non-GAAP)

on Pages 10 through 13:

on Pages 10 through 13:

|

Asia-Pacific Sewer Rehabilitation

|

|||

|

($ in”000”)

|

As Reported 2009

|

Adjustment

|

Adjusted 2009

|

|

Revenue

|

$ 33,256

|

$ -

|

$ 33,256

|

|

Gross profit

|

9,032

|

-

|

9,032

|

|

Operating expense

|

5,591

|

-

|

5,591

|

|

Acquisition-related expenses

|

22

|

(22)

|

-

|

|

Operating income

|

3,419

|

22

|

3,441

|

|

Energy & Mining

|

|||

|

($ in”000”)

|

As Reported 2009

|

Adjustment

|

Adjusted 2009

|

|

Revenue

|

$ 241,678

|

$ -

|

$ 241,678

|

|

Gross profit

|

67,185

|

-

|

67,185

|

|

Operating expense

|

48,713

|

-

|

48,713

|

|

Restructuring charges

|

676

|

(676)

|

-

|

|

Acquisition-related expenses

|

6,872

|

(6,872)

|

-

|

|

Operating income

|

10,924

|

7,548

|

18,472

|

A-2

|

North American Sewer Rehabilitation (NAR)

|

|||

|

($ in”000”)

|

As Reported 2007

|

Adjustment

|

Adjusted 2007

|

|

Revenue

|

$ 348,085

|

$ -

|

$ 348,085

|

|

Gross profit

|

58,890

|

-

|

58,890

|

|

Operating expense

|

62,257

|

-

|

62,257

|

|

Settlement of litigation

|

(4,500)

|

4,500

|

-

|

|

Operating income

|

1,133

|

(4,500)

|

3,367

|

|

North American Sewer Rehabilitation (NAR)

|

|||

|

($ in”000”)

|

As Reported 2008

|

Adjustment

|

Adjusted 2008

|

|

Revenue

|

$ 340,296

|

$ -

|

$ 340,296

|

|

Gross profit

|

75,435

|

-

|

74,435

|

|

Operating expense

|

60,094

|

-

|

60,094

|

|

Proxy-related expenses

|

-

|

(1,700)

|

(1,700)

|

|

Operating income

|

15,341

|

1,700

|

17,041

|

|

European Sewer Rehabilitation

|

|||

|

($ in”000”)

|

As Reported 2008

|

Adjustment

|

Adjusted 2008

|

|

Revenue

|

$ 112,225

|

$ (8,000)

|

$ 104,225

|

|

Gross profit

|

31,228

|

(8,000)

|

23,228

|

|

Operating expense

|

23,564

|

-

|

23,564

|

|

Settlement of litigation

|

-

|

1,300

|

(1,300)

|

|

Operating income

|

7,664

|

(6,700)

|

964

|

Financial Reconciliation

(GAAP to Non-GAAP Information)

(GAAP to Non-GAAP Information)