Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OMEGA PROTEIN CORP | d8k.htm |

Investor Presentation

CJS Securities 11th Annual New Ideas

Summer Conference

August 2011

NEWS

EXHIBIT 99.1 |

Forward Looking Statements

2

The information presented herein may contain projections, predictions, estimates

and other forward- looking statements within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the

Securities

Exchange

Act

of

1934.

Forward-looking

statements

will

use

words

like

“may,”

“may

not,”

“believes,”

“do not believe,”

“expects,”

“do not expect,”

“anticipate,”

“does not anticipate,”

and other

similar expressions.

Although the Company believes that its expectations are based on reasonable

assumptions, we can give no assurance that these expectations will be realized.

Important factors that could cause actual results to differ materially from

those included in these forward looking statements include: (1) our ability

to meet our raw material requirements through our annual menhaden harvest,

which is subject to fluctuations due to natural conditions over which we have no

control, such as varying

fish

population,

fish

oil

yields,

adverse

weather

conditions,

oil

spill

impacts

and

disease;

(2)

the

impact of laws and regulations that may be enacted that may restrict our operations

or the sale of products; (3) the impact of worldwide supply and demand

relationships on prices for our products; (4)

our expectations regarding demand and pricing for our products proving to be

incorrect; (5) fluctuations in the Company’s quarterly operating

results due to the seasonality of our business and our deferral of inventory

sales based on worldwide prices for competing products, (6) the impact of the

uncertain economic conditions, both in the United States and globally; (7)

the effect of the Deepwater

Horizon

oil

spill

on

our

business,

operations

and

fish

catch,

both

short-term

and

long-term;

(8)

the

business, operations, potential or prospects for our new Cyvex subsidiary, the

dietary supplement market

or

the

human

health

and

wellness

segment

generally;

and

(9)

the

amount,

if

any,

of

future

reimbursements

from

the

Deepwater

Horizon

defendants

or

the

GCCF

for

damages

caused

by

the

Deepwater Horizon oil spill. |

Our

Business Fuels Healthy Living 3

Omega Protein

Corporation

Human Nutrition

Ingredients

Animal Nutrition

Ingredients

Plant Nutrition

Ingredients

Nutraceuticals

Functional Foods

Aquaculture Feed

Pet Food

Livestock Feed

Organic

Fruits and Vegetables |

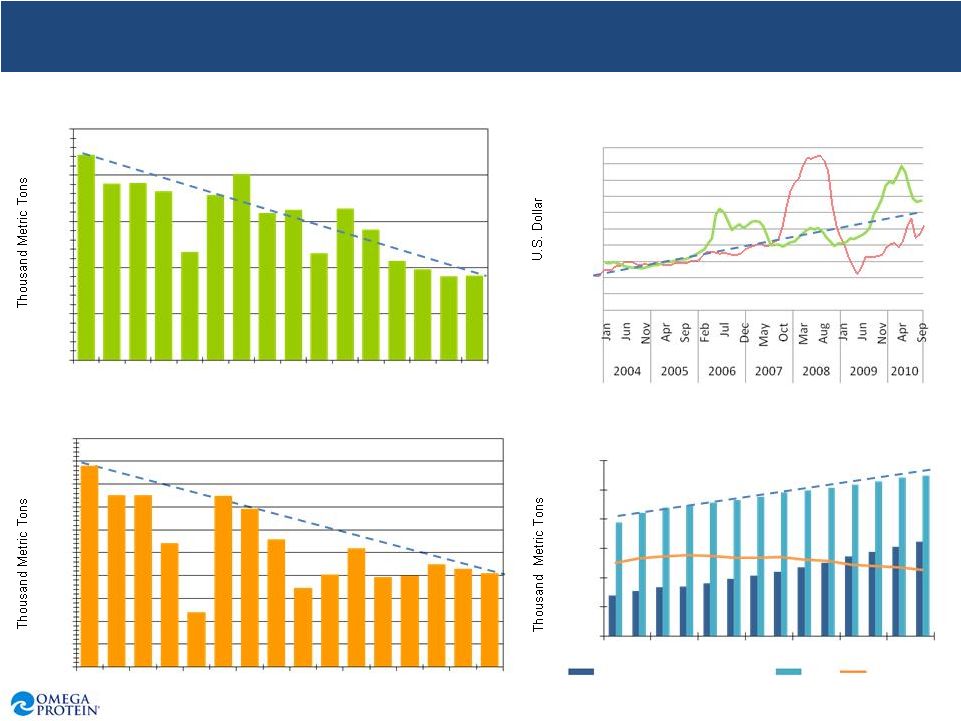

World

Supply/Demand Imbalance 4

Global Fish Meal Production

Global Fish Oil Production

Average Fish Meal Prices (FOB from Peru )

Average Fish Oil Prices (FOB from Netherlands)

Global Demand for Seafood

3,000

4,000

5,000

6,000

7,000

8,000

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

0

2,000

4,000

6,000

8,000

10,000

12,000

1994

1996

1998

2000

2002

2004

2006

Global Aquaculture Consumption

Total

Wild Catch

600

700

800

900

1,000

1,100

1,200

1,300

1,400

1,500

1,600

1994

1996

1998

2000

2002

2004

2006

2008

1994

1996

1998

2000

2002

2004

2006

2008

Fish Meal

---

Fish Oil

--- |

5

Focus on research and development

enhance production

improve health benefits of end

products

develop novel new products

Leverage customer relationships

Allocate funds based on return on capital

Expand participation in the value chain

Additional product lines

Increase presence in human nutrition

Access opportunities in new markets

Add new customers in existing markets

Organic Growth

Organic Growth

Acquisitions

Acquisitions

How We Plan to Grow

Leverage existing protein and fatty acid platform to

expand line of nutritional ingredients

Leverage existing protein and fatty acid platform to

expand line of nutritional ingredients |

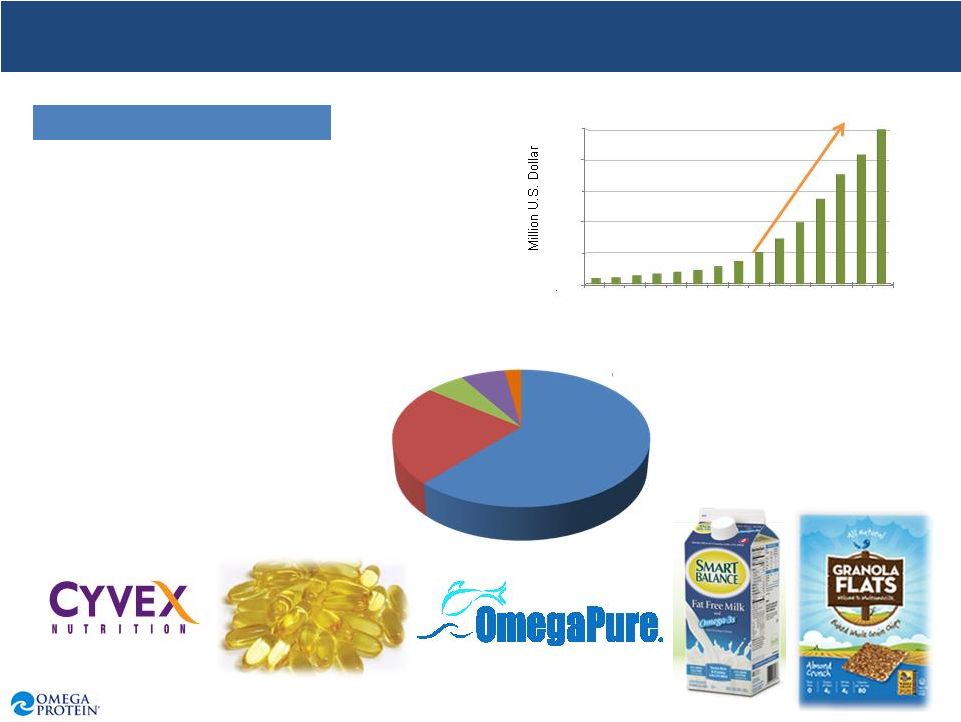

Human

Nutrition: Greatest Growth Potential Nutraceutical Ingredients

•

Diverse product set of

nutritional ingredients

•

Supply the dietary

supplement

and functional

food

markets

•

Supports good health and

well-being

•

Sales today represent a

fraction of the market

U.S. Omega-3

Dietary

Supplement

Sales

End Use Applications

of EPA and DHA Oils

(Metric Tons)

Source:

“Global

Nutrition

Industry.”

Nutrition

Business

Journal.

March,

2010.

1995

1997

1999

2001

2003

2005

2007

2009

$40

$1,000

$-

$200

$400

$600

$800

$1,000

Supplements

62%

Functional

Foods

24%

Infant/Clinical

6%

Animal Feed

6%

Pharma

2%

6 |

Strong First Half 2011 Performance

7

•

Net income up 874% (292% excluding settlements)

–

$29 million, $1.45 per diluted share

–

$12 million, $0.58 per diluted share excluding $27 million pretax settlement for

claims related to the Gulf oil spill and an insurance settlement

–

Compares to $3.0 million, $0.16 in first half 2010

•

Total revenue increased 47%

–

$101 million

compared to revenues of

$69 million

–

Composition: 69% fish meal, 23% fish oil, 6% specialty nutraceutical ingredients,

2% fish solubles

–

Increase in fish meal sales volumes and fish oil sales prices

–

Acquisition of Cyvex added $7 million

•

Operating income and margins up

–

$46 million on an 46.1% operating margin

–

$19 million on an 19.3% operating margin excluding $27 million settlements

–

Compares to $6 million with a 8.8% operating margin for first half 2010

•

Strong Balance Sheet: $47 million cash; $33 million total debt |

Why

OME? Compelling fundamentals

Growing populations and standards of living

Increased demand for high quality protein

Supply/demand imbalance for fish meal and fish oil

Opportunities for organic growth

Expand products for human nutrition

R&D-driven new product development / enhancements

Production improvements

Focus on acquisitions

Potential to add new product lines

Target new products or markets

Strong balance sheet

8 |