Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CFS BANCORP INC | f8k_080911.htm |

EXHIBIT 99.1

Investor Presentation

August 2011

August 2011

FORWARD LOOKING STATEMENTS

2

This presentation contains certain forward-looking statements, as that term is defined in U.S.

federal securities laws. Generally, these statements relate to our business plans or strategies,

projections involving anticipated revenues, earnings, profitability, or other aspects of

operating results, or other future developments in our affairs or the industry in which we

conduct business. Forward-looking statements may be identified by reference to a future

period or periods or by the use of forward-looking terminology such as “anticipate,” “believe,”

“expect,” “intend,” “plan,” “estimate,” “would be,” “will,” “intend to,” “project,” or

similar expressions or the negative thereof, as well as statements that include future events,

tense or dates, or are not historical or current facts. These forward-looking statements include

but are not limited to statements regarding our ability to successfully execute our strategy and

Strategic Growth and Diversification Plan, the level and sufficiency of our current regulatory

capital and equity ratios, our ability to continue to diversify the loan portfolio, our efforts at

deepening client relationships, increasing our levels of core deposits, lowering our non-

performing asset levels, managing and reducing our credit-related costs, increasing our

revenue growth and levels of earning assets, the effects of general economic and competitive

conditions nationally and within our core market area, the sufficiency of the levels of provision

for the allowance for loan losses and amounts of charge-offs, loan and deposit growth, interest

on loans, asset yields and cost of funds, net interest income, net interest margin, non-interest

income, non-interest expense, interest rate environment, and other factors including those set

forth in “Part I. Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended

December 31, 2010. Such forward-looking statements are not guarantees of future

performance. The Company does not intend to update these forward-looking statements to

reflect occurrences or unanticipated events or circumstances unless required to do so under

the federal securities laws.

federal securities laws. Generally, these statements relate to our business plans or strategies,

projections involving anticipated revenues, earnings, profitability, or other aspects of

operating results, or other future developments in our affairs or the industry in which we

conduct business. Forward-looking statements may be identified by reference to a future

period or periods or by the use of forward-looking terminology such as “anticipate,” “believe,”

“expect,” “intend,” “plan,” “estimate,” “would be,” “will,” “intend to,” “project,” or

similar expressions or the negative thereof, as well as statements that include future events,

tense or dates, or are not historical or current facts. These forward-looking statements include

but are not limited to statements regarding our ability to successfully execute our strategy and

Strategic Growth and Diversification Plan, the level and sufficiency of our current regulatory

capital and equity ratios, our ability to continue to diversify the loan portfolio, our efforts at

deepening client relationships, increasing our levels of core deposits, lowering our non-

performing asset levels, managing and reducing our credit-related costs, increasing our

revenue growth and levels of earning assets, the effects of general economic and competitive

conditions nationally and within our core market area, the sufficiency of the levels of provision

for the allowance for loan losses and amounts of charge-offs, loan and deposit growth, interest

on loans, asset yields and cost of funds, net interest income, net interest margin, non-interest

income, non-interest expense, interest rate environment, and other factors including those set

forth in “Part I. Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended

December 31, 2010. Such forward-looking statements are not guarantees of future

performance. The Company does not intend to update these forward-looking statements to

reflect occurrences or unanticipated events or circumstances unless required to do so under

the federal securities laws.

Agenda

§ CFS Bancorp Overview

§ Strategic Growth & Diversification Plan

§ Outlook

3

CFS Bancorp Overview

CFS Bancorp Overview

§ Headquartered in Munster, IN

— 22 full service branch locations in Northwest

IN and South Suburban Chicago

IN and South Suburban Chicago

— CFS Bancorp formed in 1998

— Citizens Financial Bank founded in 1934

§ $1.1B Total Assets at June 30, 2011

§ $738m Total Loans

§ $965m Total Deposits

— 96% Deposit Funded

— 59% Core Deposits

— No Brokered Deposits

§ $116m Tangible Common Equity

— 10.3% TCE Ratio

— No Holding Company debt

— No TruPS

— No TARP

§ NASDAQ: CITZ

5

CFS Bancorp Overview

§ Ongoing

— NPA remediation efforts

— Sales culture with regional partnerships

— Comprehensive performance & incentive programs

— Focus on C&I, CRE-Owner Occupied, Multifamily

offerings

offerings

— Deposit acquisition and deleveraging

— Capital management

§ Discontinued / Deemphasized

— Commercial participations

— Commercial construction & land development loans

6

Strategic Growth

& Diversification Plan

& Diversification Plan

Strategic Growth & Diversification Plan

§ Board approved in late 2007

— Implementation commenced in 2008

§ Four key long-term objectives

— Reduce non-performing assets

— Grow while diversifying by targeting small and mid-

sized business owners for relationship banking

opportunities

sized business owners for relationship banking

opportunities

— Expand and deepen the Company’s relationships with

its clients

its clients

— Align costs with anticipated future asset base

8

Investing in Talent to Drive Business Results

§ 40 new senior and middle managers installed since 2007

§ 4 of 5 Named Executive Officers new since 2007

9

Strategic Growth & Diversification Plan

§ Execution Status

— We continue to execute the plan

— Progress made on reducing non-performing assets

— Loan portfolio diversification continues

— Strong core deposit growth results achieved

— Major investments in people and infrastructure

complete

complete

— Performance management system fully

implemented in the sales business units

implemented in the sales business units

— Investor presentations conducted with current

and prospective shareholders, and all employees

and prospective shareholders, and all employees

10

Goal = Top Quartile

Peer Group Financial Performance

Peer Group Financial Performance

11

Source: SNL Financial and CFS Bancorp, Inc.

Peer Group includes nationwide banks & thrifts with total assets between $1B and $3B.

MOST RECENT QUARTER PERFORMANCE RANKINGS

Strategic Growth & Diversification Plan

§ Reduce non-performing assets

§ Grow & diversify loan portfolio

§ Expand and deepen client relationships

§ Manage expenses

12

Reduce Non-Performing

Assets

Assets

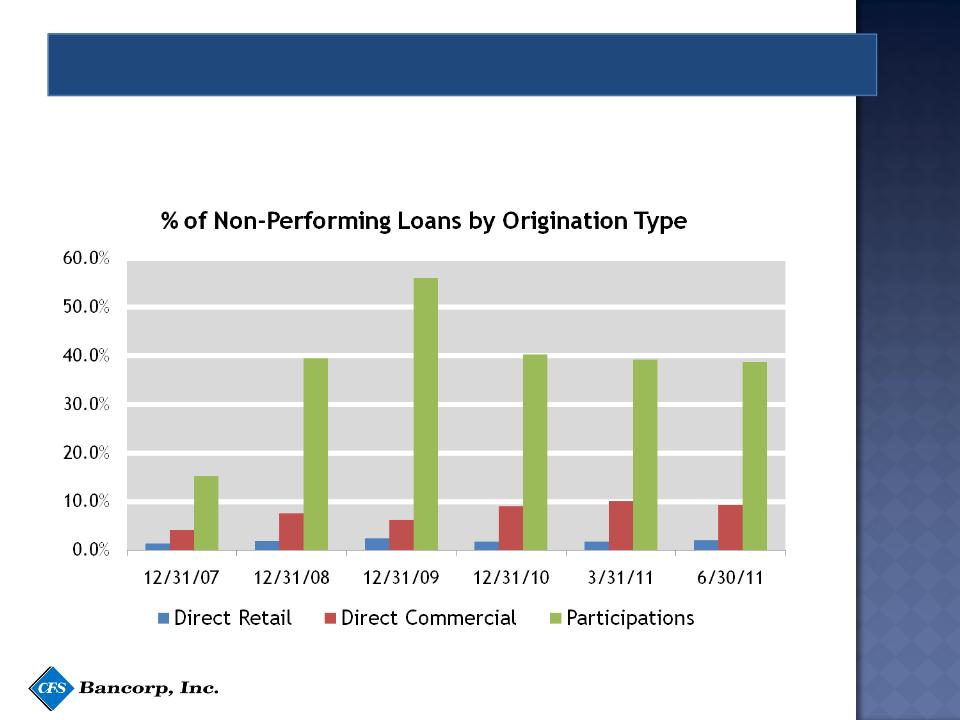

Commercial Participations Drag

§ Commercial participations have created significant problems

— Represent only 3% of gross loan portfolio

— Account for 14% of all NPLs and 61% of OREO

— 39% of participations are non-performing

— Breakdown at 6/30/11 = $5.3 million CRE-NOO, $2.9 million Commercial CL&D

§ New purchases ceased in 2Q07 but impact lingers

14

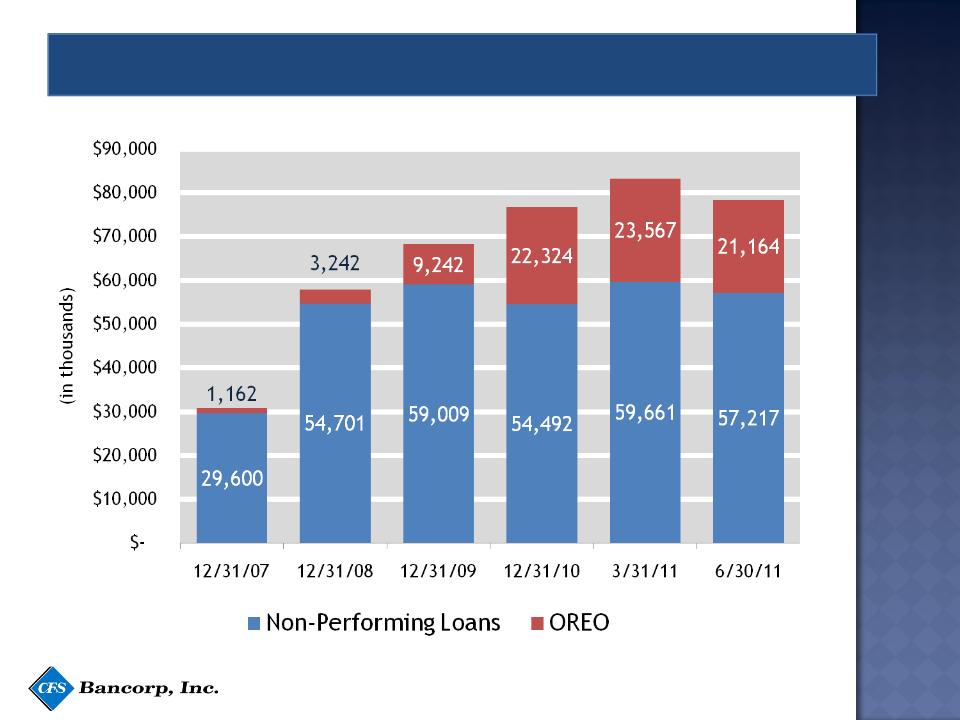

Non-Performing Assets

15

Non-Performing Loans and OREO

16

Non-Performing Loans

§ Retail & Commercial direct originations have held up well

§ Never originated Subprime, Alt-A, or Option ARMs

17

Commercial Participation Loans

18

Commercial Construction and Land Loans

Reserve Position

§ Have conservatively applied ASC 310-10 (FAS 114) on NPLs

§ ALLL/NPL depressed due to written-down impaired loans in NPLs

— $7.4 million of partial charge-offs on impaired collateral dependent loans

— $8.0 of specific reserves on other NPLs in ALLL

§ OREO is carried at 53.5% of original loan value

19

Ongoing NPA Remediation

§ Proactive problem asset management

— Weekly review of delinquencies by Asset Management

Committee

Committee

— Action plan review for all loans graded watch or worse

— Impairment analysis prepared quarterly on all substandard

loans > $750,000

loans > $750,000

— Loan grade review for all loans 30-days+ past due

— All performing past due loans reviewed

— Monthly management reports prepared for Board of

Directors

Directors

20

Ongoing NPA Remediation

§ Upgraded underwriting process & criteria

— Hired new SVP-Senior Credit Officer in December 2007

— Hired new VP-Credit Manager in July 2008

— 4 new credit analysts added since December 2007

— New Credit Policy implemented in early 2008

— Developed new loan grading matrix utilizing objective

attribute analysis in mid-2009

attribute analysis in mid-2009

21

NPAs for Loans Originated Prior to 1/1/08

22

NPAs for Loans Originated After 1/1/08

Origination Volume for the period = $514.6 million

Grow While Diversifying

Growth Results in Targeted Segments

§ 46% increase in targeted growth segments since 12/31/07

— C&I increased 39%

— CRE-Owner Occupied increased 24%

— Multifamily increased 102%

§ 7.2% annualized loan growth in 2nd quarter of 2011

24

Strategic Shift in Portfolio

§ 29% reduction in targeted shrinkage segments since 12/31/07

— Commercial participation loans reduced 74%

— Commercial construction & development loans (CLD) decreased 60%

25

Results of Commercial Loan Portfolio

Diversification Plan

Diversification Plan

§ Targeted aggressive growth segments (C&I, CRE

Owner Occupied, and Multifamily) are up from 36% at

12/31/07 to 53% of the portfolio at 6/30/11

Owner Occupied, and Multifamily) are up from 36% at

12/31/07 to 53% of the portfolio at 6/30/11

§ Targeted shrinkage segments are down from 28% at

12/31/07 to 9% of the portfolio at 6/30/11

12/31/07 to 9% of the portfolio at 6/30/11

§ Targeted moderate growth segment (CRE Non-Owner

Occupied) has remained stable at approximately 37%

of the portfolio

Occupied) has remained stable at approximately 37%

of the portfolio

26

Expand and Deepen Relationships

Focus on Business Relationships

§ Business Banking Group reorganized to drive growth

— New EVP Sales Management hired in 2008

— 14 new Relationship Managers hired

— Average banking industry experience of 20+ years

— Expertise in C&I and Multifamily lending

§ Regional partnerships formed between Retail and

Business Banking teams with shared goals and

incentives

Business Banking teams with shared goals and

incentives

28

Performance Management Program

§ Power of Personal Performance (PoPP)

§ Primary focus on sales activities and behaviors

§ Utilization of balanced scorecards to track activities

§ Coaching sessions, check-ins, skill builders, and skip

coaching

coaching

§ Improved outcomes, and client and employee

satisfaction

satisfaction

— Chicago Tribune Top Workplace - 2010

— Northwest Indiana Times Best Workplace - 2010

— Northwest Indiana Times Best Client Service by a

Financial Institution - 2010

Financial Institution - 2010

29

Focus on Business Relationships

§ Focus on small and medium-sized businesses

— Aggressively grow C&I, multifamily, and owner

occupied CRE relationships as a share of commercial

loans

occupied CRE relationships as a share of commercial

loans

§ Increase business deposits to generate relationships

and fund growth

and fund growth

§ IT platform provides competitive advantage in Cash

Management opportunities

Management opportunities

30

Focus on Business Relationships

§ Proactive prospecting

— Feet on the street - experienced teams now in their

markets

markets

— Trusted Advisor approach vs. transactional lending

— Incentives are equally weighted between deposit

gathering and loan production

gathering and loan production

31

Non-Municipal Business Deposits

32

Total Deposits

33

Total Borrowed Funds

34

Deposit Growth Reduces Reliance on

Wholesale Funding

Wholesale Funding

35

Deposit Growth Reduces Reliance on

Wholesale Funding

Wholesale Funding

36

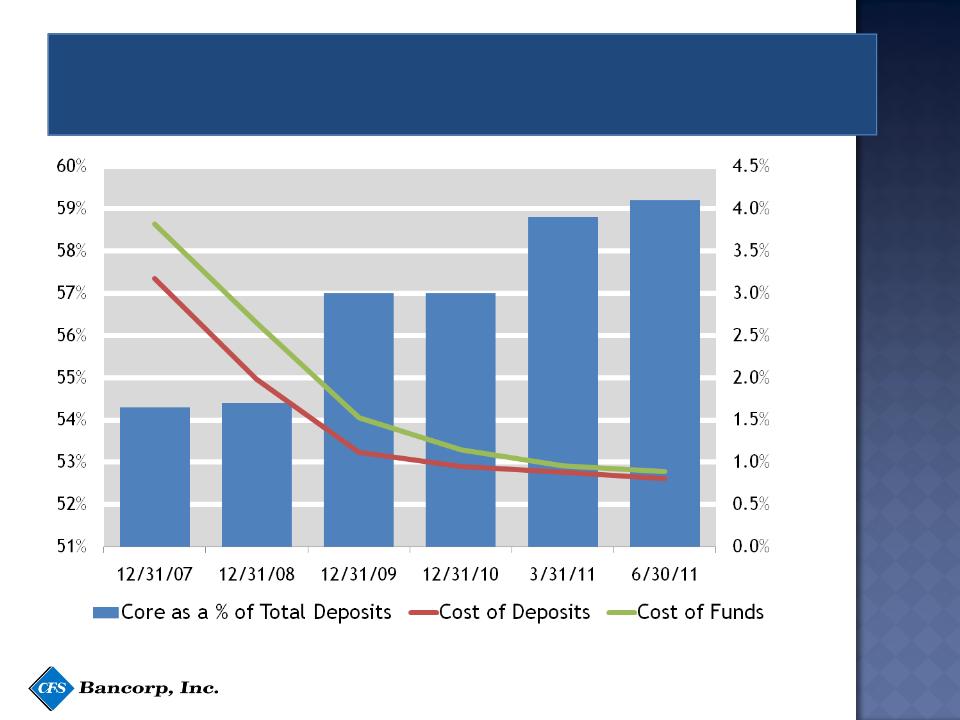

Expanding & Deepening Client Relationships

Drive Improved NIM

Drive Improved NIM

§ NIM expansion driven by client relationships and deleveraging

— Increase in core deposits

— Increase in non-interest bearing deposits

— Disciplined deposit and CD pricing

— Reduced FHLB borrowings

37

Manage Expenses

Improve Efficiency Ratio

§ Overall FTE headcount reduced from 360 in 2006 to

314 currently

314 currently

§ Salary freeze throughout 2010, lifted in 2011

§ Reduce drag from NPAs ($50M x 5% = $2.5M), credit

related costs ($1.75M), and too large investment

portfolio ($50M x 2% = $1M)

related costs ($1.75M), and too large investment

portfolio ($50M x 2% = $1M)

§ Capacity for balance sheet growth based on current

infrastructure, expense base, and capital

infrastructure, expense base, and capital

§ Construction of three new branches postponed

§ Ongoing efficiency review and initiatives

§ Review opportunities for additional ancillary fee

income sources (e.g. mortgage banking, wealth

management)

income sources (e.g. mortgage banking, wealth

management)

39

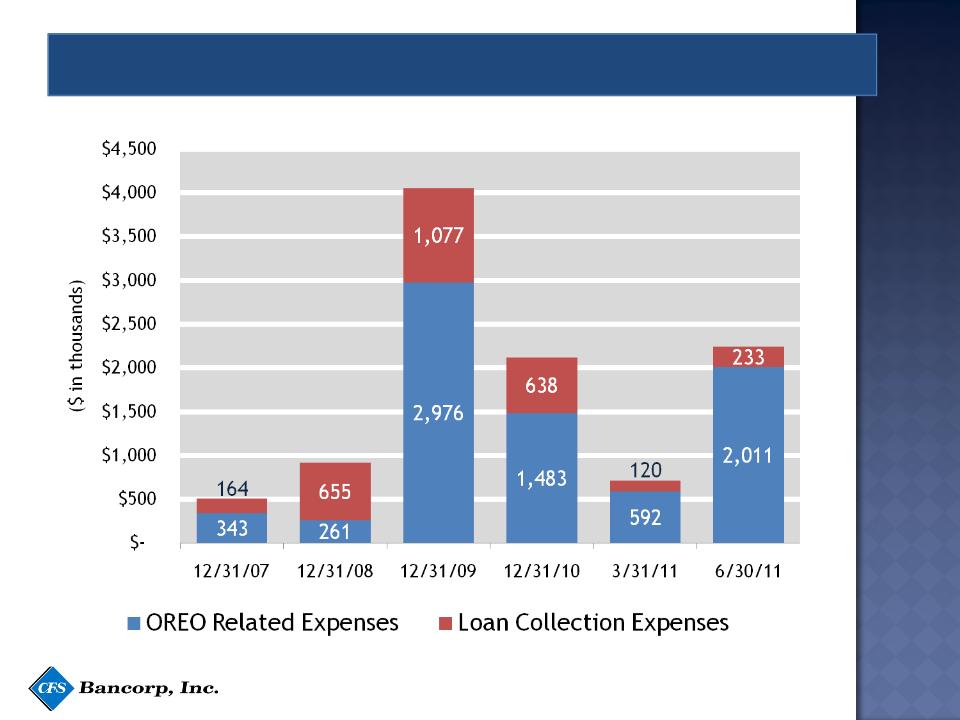

Non-Interest Expense Drivers

40

Non-Interest Expense Drivers (cont.)

41

Non-Interest Expense Drivers (cont.)

42

Non-Interest Expense Drivers (cont.)

43

|

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

For the year ended

|

|

|

|

||

|

|

|

2007

|

|

2010

|

|

Change

|

|

|

Total Non-Interest Expense

|

33,459

|

|

37,775

|

|

4,316

|

|

|

|

|

|

|

|

|

|

|

|

|

Less-Controllable Expenses:

|

|

|

|

|

|

|

|

|

|

Total Credit Related Costs

|

(507

|

)

|

(2,121

|

)

|

(1,614

|

)

|

|

|

Professional Fees

|

(1,284

|

)

|

(2,283

|

)

|

(999

|

)

|

|

|

FDIC Premiums & OTS Fees

|

(373

|

)

|

(2,551

|

)

|

(2,178

|

)

|

|

Total Less-Controllable Expenses

|

(2,164

|

)

|

(6,955

|

)

|

(4,791

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Non-Interest Expense

|

31,295

|

30,820

|

(475

|

)

|

|||

|

|

|

|

|

|

|

||

Path Forward

§ Continue execution of Strategic Growth &

Diversification Plan

Diversification Plan

— Focus on Northwest Indiana and South Suburban

Chicago markets

Chicago markets

§ Experienced senior management, sales, and credit

teams in place

teams in place

§ Improving reputation in our markets as Business

Bankers

Bankers

§ Ongoing banking consolidation provides growth

opportunities

opportunities

44

Investment Highlights

§ Business transformation well underway

— New management team in place

— Executing on Strategic Growth & Diversification Plan

— Asset quality stabilizing

— Improved net interest margin

§ Significant insider ownership aligned with shareholders

— NEOs & Directors: 16.2%, including PL Capital (9.7%)

— 401(k) Plan: 8.8%

§ Valuation opportunity

— Substantial discount to tangible book value

45

Appendix

Financial Highlights

47

|

($ in millions)

|

|

2007

|

|

|

|

2008

|

|

|

|

2009

|

|

|

|

2010

|

|

|

|

3/31/11

|

|

|

|

6/30/11

|

|

||

|

Balance Sheet

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Total Assets

|

$

|

1,150

|

|

|

$

|

1,122

|

|

|

$

|

1,082

|

|

|

$

|

1,122

|

|

|

$

|

1,144

|

|

|

$

|

1,128

|

|

|

|

|

Total Loans

|

|

793

|

|

|

|

750

|

|

|

|

762

|

|

|

|

733

|

|

|

|

724

|

|

|

|

738

|

|

|

|

|

Deposits

|

|

863

|

|

|

|

824

|

|

|

|

850

|

|

|

|

946

|

|

|

|

981

|

|

|

|

965

|

|

|

|

|

Loans / Deposits

|

|

92

|

%

|

|

|

91

|

%

|

|

|

90

|

%

|

|

|

77

|

%

|

|

|

74

|

%

|

|

|

76

|

%

|

|

|

|

Total Equity

|

$

|

130

|

|

|

$

|

112

|

|

|

$

|

110

|

|

|

$

|

113

|

|

|

$

|

114

|

|

|

$

|

116

|

|

|

|

|

Tangible Equity

|

|

129

|

|

|

|

112

|

|

|

|

110

|

|

|

|

113

|

|

|

|

114

|

|

|

|

116

|

|

|

|

Capital

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Equity / Assets

|

|

11.2

|

%

|

|

|

10.0

|

%

|

|

|

10.2

|

%

|

|

|

10.2

|

%

|

|

|

9.9

|

%

|

|

|

10.3

|

%

|

|

|

|

Tier 1 Capital Ratio

|

|

13.1

|

|

|

|

12.0

|

|

|

|

11.2

|

|

|

|

12.3

|

|

|

|

12.2

|

|

|

|

12.2

|

|

|

|

|

Total Capital Ratio

|

|

13.9

|

|

|

|

13.2

|

|

|

|

12.4

|

|

|

|

13.3

|

|

|

|

13.2

|

|

|

|

13.3

|

|

|

|

Asset Quality

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

NPLs / Total Loans

|

|

3.7

|

%

|

|

|

7.3

|

%

|

|

|

7.7

|

%

|

|

|

7.4

|

%

|

|

|

8.2

|

%

|

|

|

7.8

|

%

|

|

|

|

NPAs / total Assets

|

|

2.7

|

|

|

|

5.2

|

|

|

|

6.3

|

|

|

|

6.9

|

|

|

|

7.3

|

|

|

|

7.0

|

|

|

|

|

NCOs / Average Gross Loans (4)

|

|

0.7

|

|

|

|

2.5

|

|

|

|

1.2

|

|

|

|

0.8

|

|

|

|

0.6

|

|

|

|

0.6

|

|

|

|

|

ALL / Total Gross Loans

|

|

1.0

|

|

|

|

2.1

|

|

|

|

2.6

|

|

|

|

2.3

|

|

|

|

2.4

|

|

|

|

2.3

|

|

|

|

|

ALL / NPLs

|

|

27.1

|

|

|

|

28.4

|

|

|

|

33.0

|

|

|

|

31.5

|

|

|

|

28.7

|

|

|

|

29.8

|

|

|

|

|

Provision / Average Gross Loans (4)

|

|

0.3

|

|

|

|

3.5

|

|

|

|

1.7

|

|

|

|

0.5

|

|

|

|

0.5

|

|

|

|

0.5

|

|

|

|

|

Provision / NCOs

|

|

42.4

|

|

|

|

140.1

|

|

|

|

144.9

|

|

|

|

62.9

|

|

|

|

91.5

|

|

|

|

94.7

|

|

|

|

|

Texas Ratio (NPAs / (Equity + ALL))

|

|

22.2

|

|

|

|

45.5

|

|

|

|

52.6

|

|

|

|

59.0

|

|

|

|

63.6

|

|

|

|

58.8

|

|

|

|

Profitability

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Net Interest Margin

|

|

3.0

|

%

|

|

|

3.3

|

%

|

|

|

3.7

|

%

|

|

|

3.7

|

%

|

|

|

3.6

|

%

|

|

|

3.6

|

%

|

|

|

|

Non-Interest Income / Total Revenue (1)

|

|

25.2

|

|

|

|

13.9

|

|

|

|

23.4

|

|

|

|

20.1

|

|

|

|

21.7

|

|

|

|

33.1

|

|

|

|

|

Efficiency Ratio (2)

|

|

74.2

|

|

|

|

76.4

|

|

|

|

81.9

|

|

|

|

83.7

|

|

|

|

92.4

|

|

|

|

81.7

|

|

|

|

|

Reported Net Income

|

$

|

7.5

|

|

|

$

|

(11.3

|

)

|

|

$

|

(0.5

|

)

|

|

$

|

3.5

|

|

|

$

|

0.5

|

|

|

$

|

1.2

|

|

|

|

|

Earnings from Core Operations (PTPP) (3)

|

|

12.7

|

%

|

|

|

12.7

|

%

|

|

|

13.3

|

%

|

|

|

10.2

|

%

|

|

|

1.5

|

%

|

|

|

2.5

|

%

|

|

|

|

PTPP ROAE

|

$

|

9.8

|

|

|

$

|

10.0

|

|

|

$

|

11.8

|

|

|

$

|

9.0

|

|

|

$

|

5.5

|

|

|

$

|

8.6

|

|

|

|

|

PTPP ROAA

|

|

1.1

|

|

|

|

1.1

|

|

|

|

1.2

|

|

|

|

0.9

|

|

|

|

0.6

|

|

|

|

0.9

|

|

|

|

|

(1)

|

Total Revenue defined as Net Interest Income plus Non-Interest Income.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

(2)

|

Defined as Non-Interest Expense divided by the sum of Net Interest Income plus Non-Interest Income, excluding net gain

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

on sales of investment securities and impairment of investment securities.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

(3)

|

See Non-GAAP financial information on the following page.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4)

|

Annualized, If applicable.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation to Non-GAAP Metrics

48

|

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

|

|

Six months ended

|

||

|

|

|

2007

|

2008

|

2009

|

2010

|

|

6/30/10

|

6/30/11

|

|

6/30/10

|

6/30/11

|

|

Income (loss) before taxes

|

9,835

|

(19,968)

|

(2,805)

|

4,167

|

|

1,159

|

1,658

|

|

1,966

|

2,096

|

|

|

Provision for loan losses

|

2,328 |

26,296 |

12,588 |

3,877 |

|

817 |

996 |

|

2,527 |

1,899 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-tax, pre-provision earnings

|

12,163

|

6,328

|

9,783

|

8,044

|

|

1,976

|

2,654

|

|

4,493

|

3,995

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Net gain on sale of investments

|

(536) |

(69) |

(1,092) |

(689) |

|

-

|

(173) |

|

(456) |

(692) |

|

|

Net (gain) loss on sale of OREO

|

(22) |

(30) |

9 |

154 |

|

(11) |

(2,238) |

|

(12) |

(2,233) |

|

|

OREO related expenses

|

343 |

261 |

2,976 |

1,483 |

|

255 |

2,011 |

|

886 |

2,603 |

|

|

Loan collection expenses

|

164 |

655 |

1,077 |

638 |

|

153 |

233 |

|

322 |

353 |

|

|

Severance and early retirement expense

|

643 |

-

|

37 |

545 |

|

437 |

-

|

|

440 |

-

|

|

|

FDIC - special assessment

|

-

|

-

|

495 |

-

|

|

-

|

-

|

|

-

|

-

|

|

|

Impairment on investment securities

|

-

|

4,334 |

-

|

-

|

|

-

|

-

|

|

-

|

-

|

|

|

Goodwill impairment

|

-

|

1,185 |

-

|

-

|

|

-

|

-

|

|

-

|

-

|

|

|

Total Adjustments:

|

592

|

6,336

|

3,502

|

2,131

|

|

834

|

(167)

|

|

1,180

|

31

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-tax, pre-provision earnings

from core operations

|

12,755 |

12,664 |

13,285 |

10,175 |

2,810 |

2,487 |

5,673 |

4,026 |

|||