Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ISTA PHARMACEUTICALS INC | d8k.htm |

Lauren

Silvernail CFO

and

VP

Corporate

Development

Exhibit 99.1 |

ISTA PHARMACEUTICALS

2

Safe Harbor Statement

Safe Harbor Statement

Certain statements contained herein are “forward-looking”

statements (as such term is defined in the Private Securities

Litigation Reform Act of 1995). Because such statements include

risks and uncertainties, actual results may differ materially from

those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially from those

expressed or implied by such forward-looking statements include,

but are not limited to, failure to initiate clinical studies, failure to

achieve positive results in clinical trials, failure to receive market

clearance from regulatory agencies, and those risks and

uncertainties discussed in filings made by ISTA Pharmaceuticals,

Inc.,

with the Securities and Exchange Commission. |

ISTA PHARMACEUTICALS

3

3

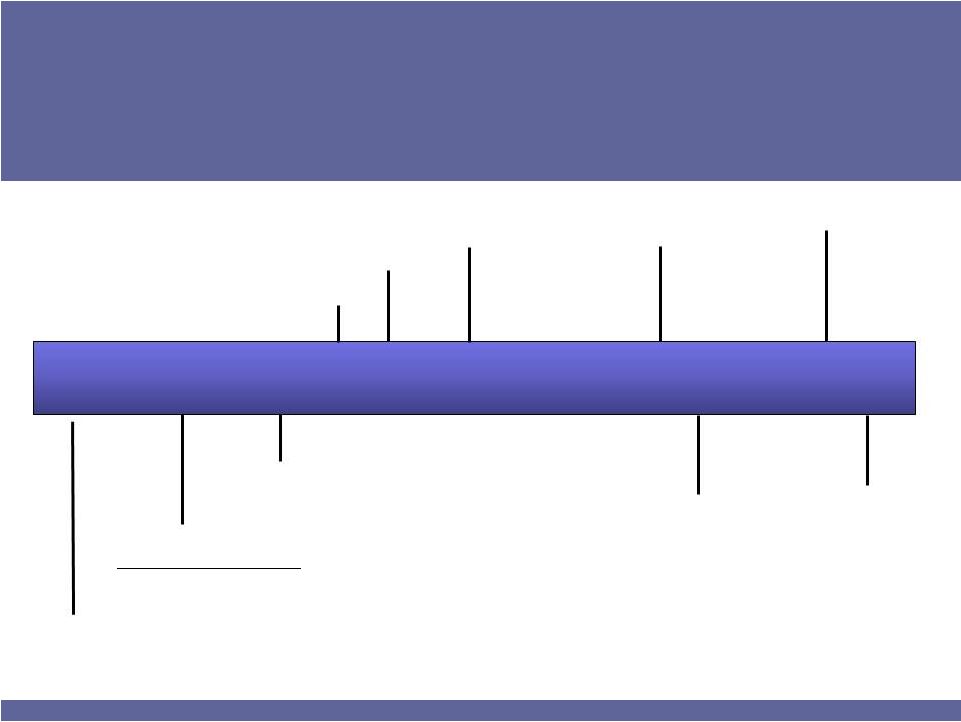

Company Timeline

Company Timeline

1992

2000

2002

2004

2005

2009

2010

Founded as Advanced

Corneal Systems

Acquired ISTALOL & XIBROM

Name change

to

ISTA Pharmaceuticals, Inc.

IPO on NASDAQ –

“ISTA”

ISTALOL®

VITRASE®

XIBROM™

BEPREVE®

Revenue

>$100 million

BROMDAY™

ISTA

Profitable*

* On an adjusted cash net income basis |

ISTA PHARMACEUTICALS

4

ISTA’s Track Record

of Success

ISTA’s Track Record

of Success

•

Obtained 5 Rx product approvals in 6 years

–

ISTALOL®, VITRASE®, XIBROM™, BEPREVE®, BROMDAY™

•

Attained top market share positions

•

Built deep new product R&D pipeline

•

Assembled experienced management team, formidable

specialty sales force: ~ 330 employees

•

Converted business from 2/3 revenues from XIBROM

(Q3 ‘10) to 2/3 from BROMDAY and BEPREVE ( June ‘11)

|

ISTA PHARMACEUTICALS

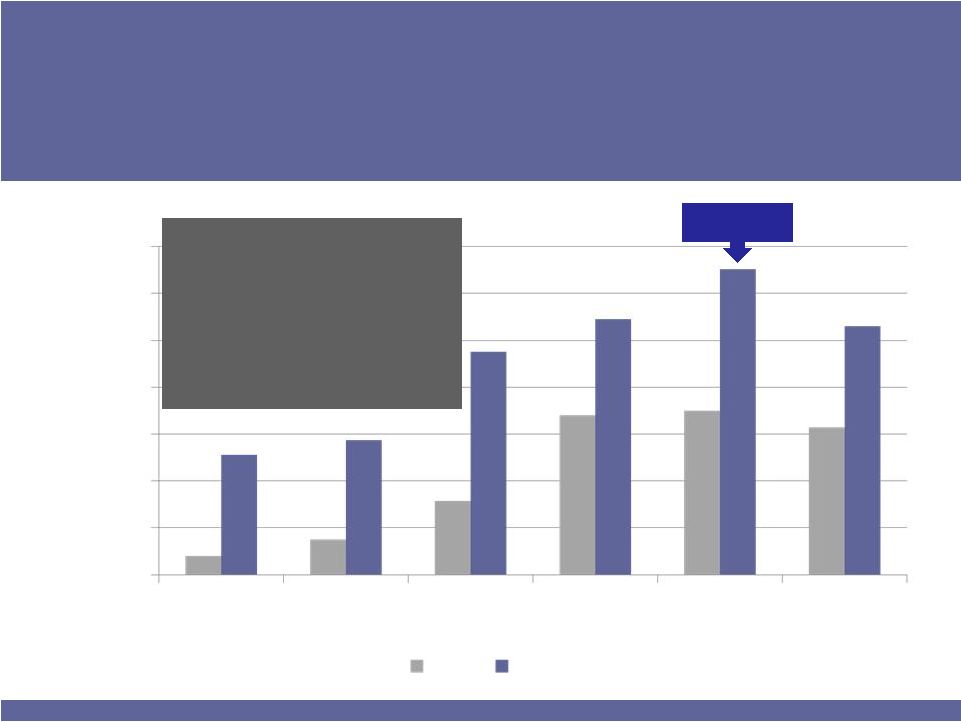

First Half Revenue Results

First Half Revenue Results

5

1H ’11

1H ’10

%

BROMDAY/XIBROM

$36.6

$41.4

(12%)

BEPREVE

$16.4

$ 6.7

145%

ISTALOL

$14.2

$ 9.7

46%

VITRASE

$ 6.7

$ 5.6

20%

NET REVENUES

$73.9

$63.4

17%

Tracking

to

our

guidance:

40%

1

st

half

/

60%

2

nd

half

of

year |

ISTA PHARMACEUTICALS

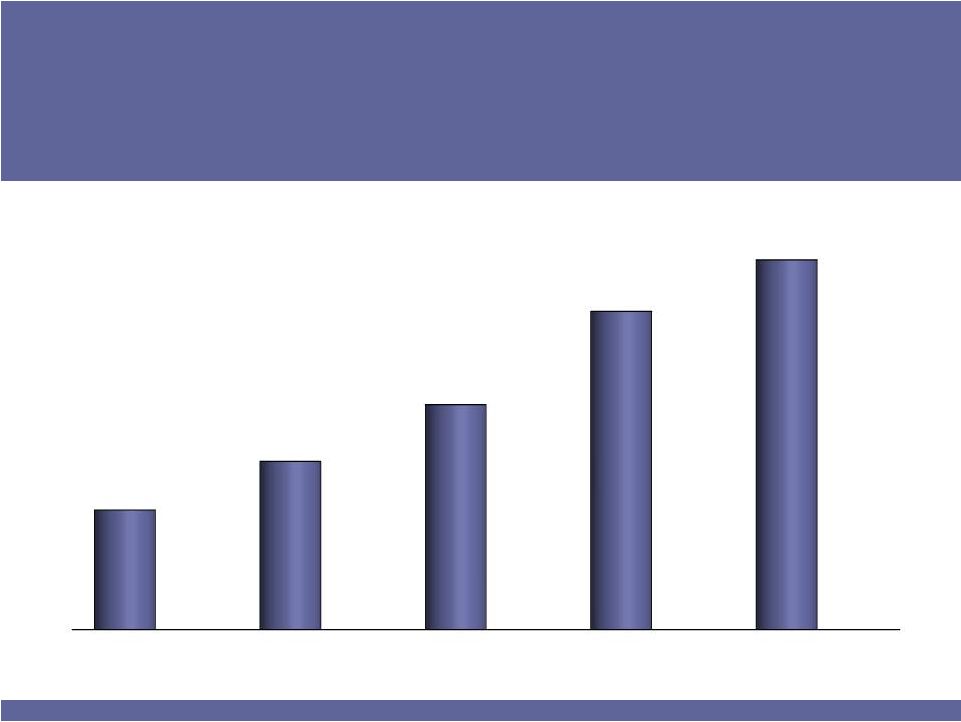

ISTA

Fast-Growing, Niche Pharmaceutical Company

ISTA

Fast-Growing, Niche Pharmaceutical Company

Outlook

$175–

$190

2007

2008

2009

2010

2011

(F)

$59

$83

$111

$157

Net Revenues

(in $millions) |

ISTA PHARMACEUTICALS

7

ISTA’s 2011 Financial Guidance

ISTA’s 2011 Financial Guidance

2011 Net Revenues

$175 -

$190 million

Gross Margin*

75% -

77%

R&D*

18% -

22%

SG&A*

44% -

48%

Operating Income

$13 -

$16 million

Adjusted Cash Net Income**

$13 -

$16 million

Adjusted Cash EPS** (50 mm shares)

$0.26 –

$0.32 per share

Cash at 12/31/11***

$80 -

$90 million

* % of Net Sales

** Adjusted Cash Net Income and EPS excludes non-cash warrant expense, non-cash

interest expense and non-cash stock-based compensation expense *** After debt

payments of $21m and including reserves for XIBROM/BROMDAY royalties and bank line

Growing revenues and improving SG&A ratio |

ISTA PHARMACEUTICALS

8

Key Financial Notes for 2011

Key Financial Notes for 2011

•

Impact of healthcare reform: revenues $3m-$5m lower

•

Tax Rate: 2%-5% based on utilization of net loss carry

forwards

•

Warrants reduced by 8.1 million of 15 million shares in

first half

•

Debt: First of three annual ~$21 million principal

repayments made August 2011 from cash on-hand |

ISTA PHARMACEUTICALS

9

BROMDAY

™

Once-Daily

(bromfenac ophthalmic solution) 0.09%

BROMDAY

™

Once-Daily

(bromfenac ophthalmic solution) 0.09%

•

First and only approved once-daily

Rx NSAID

–

For postoperative inflammation and reduction of ocular pain in patients

who have undergone cataract extraction

•

Rapid, successful switch from twice-daily XIBROM™

•

Fast-growing, market-leading $100+ million franchise

–

8

largest U.S. branded prescription eye product in 2010

•

$350 million U.S. market

•

No generic to BROMDAY until Oct 2013

–

Low-concentration BROMDAY in Phase 3 studies, patent pending 2024

th |

ISTA PHARMACEUTICALS

BROMDAY

First Half Results

BROMDAY

First Half Results

•

Prescriptions (TRx) up 6.5%; revenues down 12% over first half ‘10

•

Why?

–

Impact from XIBROM to BROMDAY conversion

•

Lower average price per script due to single, smaller bottle size

•

Lower refill rate for newly launched product

•

Wholesalers moderated BROMDAY inventories in Q2 after initial stocking for launch in

Q4/Q1. Meanwhile, no shipments of XIBROM in Q2

–

Generic twice-daily bromfenac launched in May garnered 13% of total RXs

of franchise

10 |

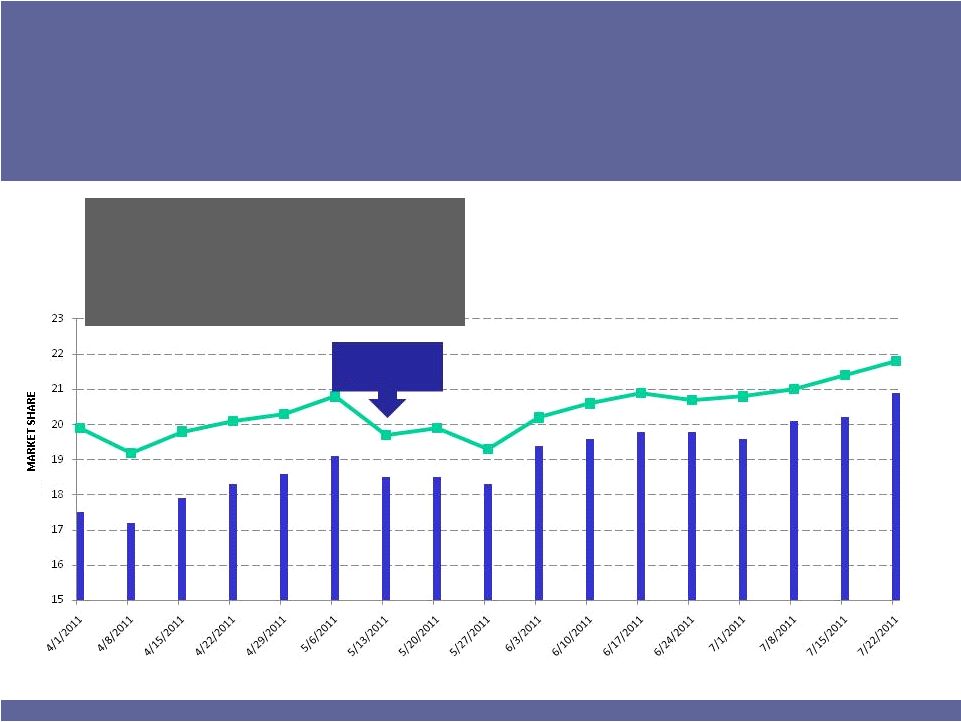

ISTA PHARMACEUTICALS

BROMDAY

Outlook Strong

Scripts Continue to Grow

BROMDAY

Outlook Strong

Scripts Continue to Grow

11

•

Continuing to build NRx and TRx share on a weekly basis

•

Sales force re-focused on BROMDAY post-allergy season

•

Generic to XIBROM stalled at ~3% market share

•

Major

new

managed

care

account

win

–

effective

July

1

•

Planning larger volume product for later this year

Generic to

XIBROM

launched

Source –

IMS Health Weekly NPA –

All MDs

BROMDAY

WEEKLY MARKET SHARE |

ISTA PHARMACEUTICALS

12

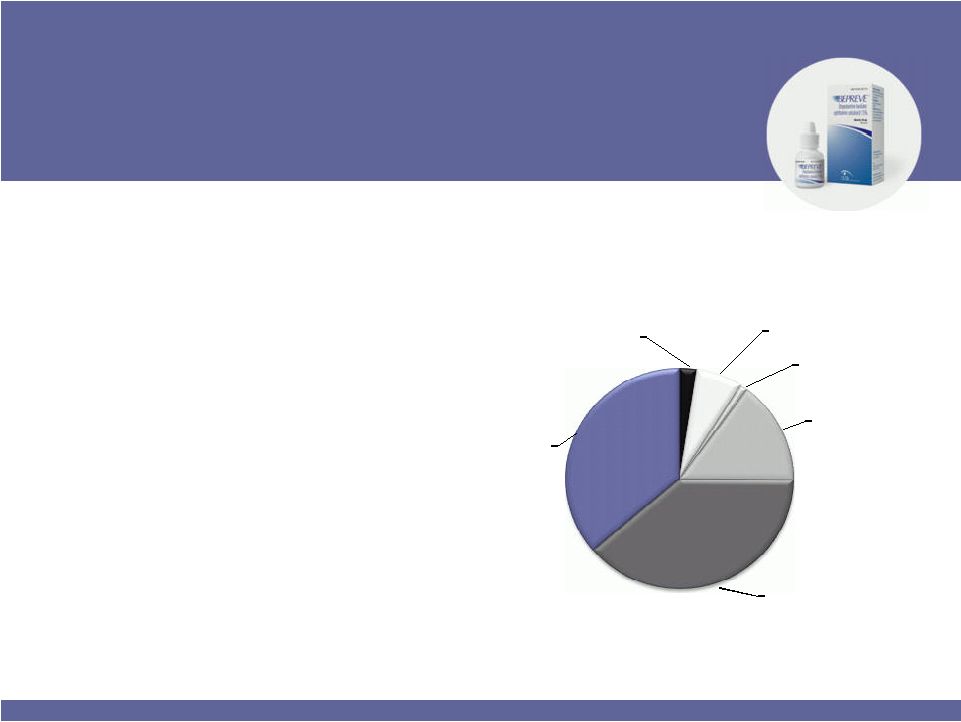

BEPREVE

®

(bepotastine besilate ophthalmic solution) 1.5%

BEPREVE

®

(bepotastine besilate ophthalmic solution) 1.5%

•

For ocular itching associated

with allergic conjunctivitis

•

Launched Oct 2009

•

$16 million revenues in 2010

•

Estimated 2011 U.S. market

value: $740 million

•

Achieved #2 in NRx$ behind

Patanol/Pataday

•

Patent protection expected

through 2019, pending patent

expiring in 2023

*6/30/2011 NPA data.

Elestat, Lastacaft, Patanol and Pataday

are

trademarks of their respective

owners. U.S. Prescription Allergy

Eye Competitors

NRx$$ 6/30/11

Lastacaft

2%

BEPREVE

7%

Elestat

1%

All Others

15%

Pataday

39%

Patanol

36% |

ISTA PHARMACEUTICALS

BEPREVE

®

YTD Prescription Growth Strong

BEPREVE

®

YTD Prescription Growth Strong

Source –

IMS Health Monthly NPA –

All MDs

•

YTD June ‘11 TRx up 114%, TRx $$ up 195%.

Market share growth from 1.6% to 3.8%.

•

In its target audience, BEPREVE has 9.8% share.

•

An Rx of BEPREVE generates between 35-60%

more revenues than its competitors because of

the larger package size.

•

On track to at least double 2010 revenues

BEPREVE TRx

Peak Allergy

Season

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

Jan

Feb

March

April

May

June

2010

2011

13 |

ISTA PHARMACEUTICALS

14

Currently Approved Products Can Drive ISTA

to >$300 Million in Annual Revenues

Currently Approved Products Can Drive ISTA

to >$300 Million in Annual Revenues

BEPREVE®

Twice-daily prescription

eye drop for ocular

itching associated with

allergic conjunctivitis

ISTALOL®

Once-daily eye drop for

the treatment of

glaucoma

VITRASE®

A spreading agent used

to enhance absorption

and dispersion of other

injected drugs

BROMDAY™

Once-daily prescription eye

drop for postoperative

inflammation and

reduction of ocular pain in

patients who have

undergone cataract

extraction |

ISTA PHARMACEUTICALS

15

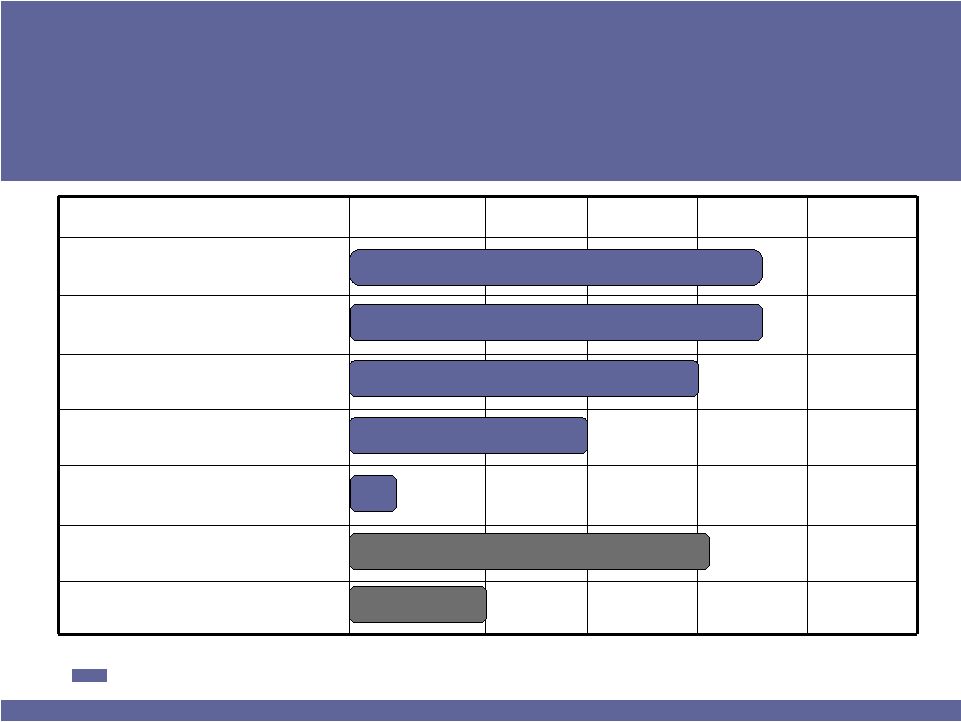

ISTA’s Near-Term Pipeline

Key Approvals Can

Take

Revenue to $500 million by 2015

ISTA’s Near-Term Pipeline

Key Approvals Can

Take

Revenue to $500 million by 2015

Candidates*

Formulation

Phase 1

Phase 2

Phase 3

NDA

Low-concentration

BROMDAY™

REMURA™

(bromfenac for dry eye)

Bepotastine Nasal

Bepotastine Nasal/Combo

Antihistamine/steroid

Bromfenac Adjunct

for AMD

T-PRED™

Antibiotic/steroid

Strong Steroid

Dry Eye

Allergic Rhinitis

Ocular Inflammation / Infection

Drug Candidates with 2011 Milestones

* Does not include all pre-clinical candidates

Ocular Inflammation & Pain

Inflammation

AMD

Allergic Rhinitis |

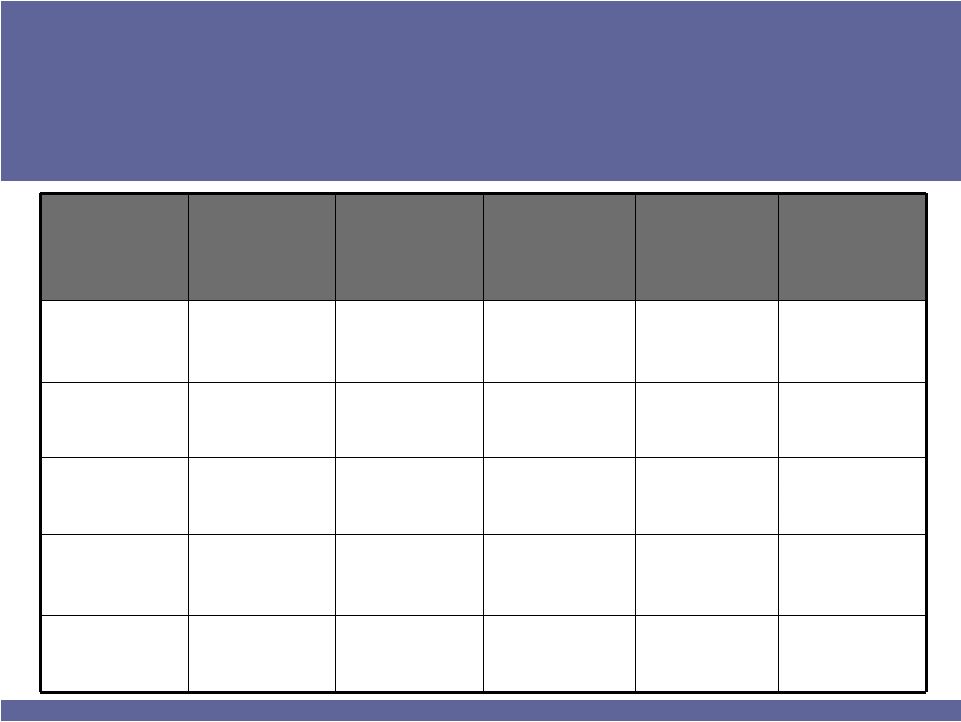

ISTA PHARMACEUTICALS

16

Drug Candidate

Active Ingredient

Rx Indication

Current

Stage/Status

2015 Market

Potential

Exclusivity

Low-concentration

BROMDAY™

Lower

concentration,

new formulation

bromfenac

Inflammation &

pain post cataract

surgery

Initiated Phase 3

study,

preliminary results

Q4 2011

$400 MM

3-year Hatch

Waxman. Pending

patents 2024

REMURA™

Lower

concentration,

new formulation

bromfenac

Dry eye

Phase 3 efficacy

studies. WEST

completed, EAST

results due Q4 2011

$1+ billion

3-year Hatch

Waxman. Pending

patents 2024

Bepotastine Nasal

Spray

Bepotastine

Nasal symptoms of

allergic rhinitis

Positive Phase 2

results

1H 2011

>$250 million

3-year Hatch

Waxman. Patented

thru 2017. Pending

patent 2023

Bepotastine/

Steroid Nasal

Spray

Combination

bepotastine +

steroid

Nasal symptoms of

allergic rhinitis

Initiate

Phase

2

2H 2011 or 1H 2012

~ $2+ Billion

3-year Hatch

Waxman. Patented

thru 2017. Pending

patent 2023

Bromfenac Adjunct

Bromfenac

Adjunct with

Lucentis or Avastin

for AMD

Proof of concept

complete, dose-

ranging Phase 2/3

next step

$400-800 million

3-year Hatch

Waxman. Pending

patents expiring

2024 & 2028

Active Pipeline Summary

Active Pipeline Summary |

ISTA PHARMACEUTICALS

17

Low-Concentration BROMDAY™

Phase 3 Efficacy Studies Initiated May 2011

Low-Concentration BROMDAY™

Phase 3 Efficacy Studies Initiated May 2011

•

Two Studies: East/West, 400 patients, 40 sites

–

1x daily for 16 days

–

1 dose prior to surgery, 1 dose day of surgery, 1 dose per day for 14 days

•

Primary outcome: cleared ocular inflammation

–

Defined as summed ocular inflammation score (SOIS) of grade 0 at

any visit prior to

Day 15

•

Secondary outcome: proportion of patients pain-free at Day 1

–

Grading of “None”

on Ocular comfort grading assessment

•

Anticipate reporting data Q4 2011

•

Expands value of bromfenac franchise

–

Launch expected 1H 2013 |

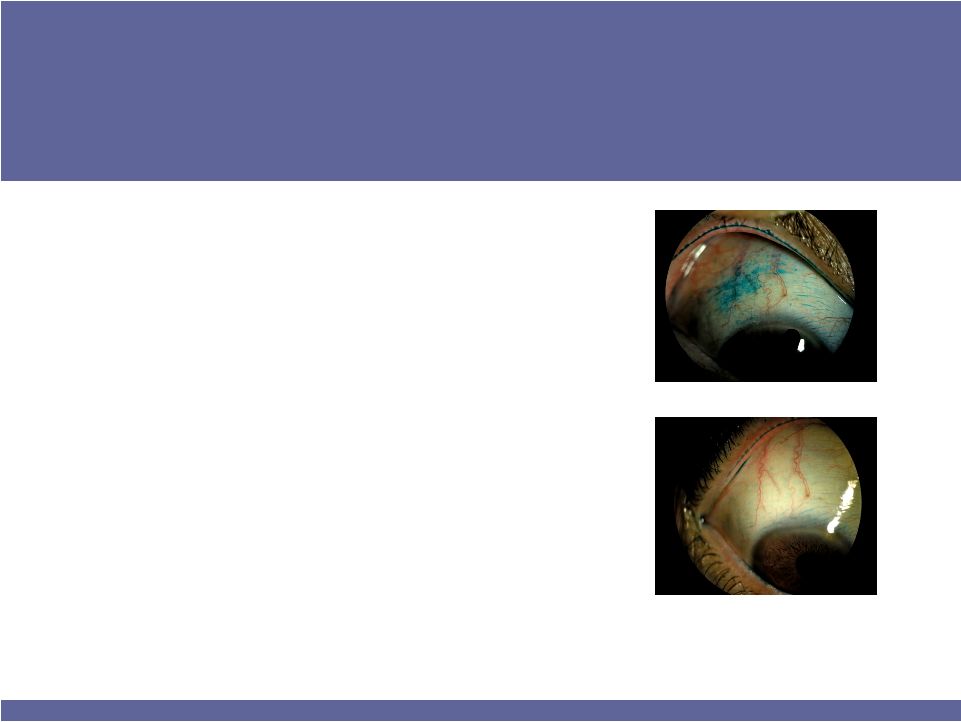

ISTA PHARMACEUTICALS

REMURA™

for Dry Eye

Underserved, $700 million market in 2011

REMURA™

for Dry Eye

Underserved, $700 million market in 2011

Baseline

After six weeks (BID)

•

Targets inflammatory component

•

Future market potential >$2 billion

•

Strong Phase 2 results (at right)

–

70% of patients responded

–

30% reduction in ocular surface disease index (OSDI)

•

Two Phase 3 efficacy studies

–

~1,000 patients, 2x daily, 42 days

–

Signs of conjunctival staining measured using Lissamine Green

–

Symptoms measured using Ocular Surface Disease Index (OSDI)

–

WEST study results: While REMURA was highly effective in

treating a sign and symptom of dry eye, it was not statistically

significantly better than placebo (vehicle)

–

EAST study fully enrolled. Amending statistical plan. Anticipate

reporting data Q4 2011

•

Pending patents expiring 2024 |

ISTA PHARMACEUTICALS

19

Bepotastine Nasal Spray

Positive Phase 2 Study Results, April 2011

Bepotastine Nasal Spray

Positive Phase 2 Study Results, April 2011

•

600 patients, multi-sites in Texas

–

Patients presenting allergic rhinitis caused by Mountain Cedar Pollen

•

3 concentrations dosed 2x day for 14 days

–

Patients graded both individual nasal and ocular symptoms on a daily basis

•

Primary outcome: Efficacy of any of the 3 doses of bepotastine nasal spray

in individuals with seasonal allergic rhinitis

–

Statistically significant results for all three concentrations

–

Statistically significant results seen from Day 1

•

Secondary outcome: Safety & tolerability of 3 doses of bepotastine nasal

spray

–

Safety similar to placebo & other antihistamine nasal sprays

•

Next Steps

–

Pursuing combination bepotastine/steroid nasal spray

–

Initiate Phase 2 study for bepotastine/steroid combination either before end of 2011 or

early 2012. |

ISTA PHARMACEUTICALS

20

ISTA: Strategy for Long-Term Success ISTA:

Strategy for Long-Term Success

Marketed

Products

Product

Pipeline

Business

Development

•

Bepotastine

-

Nasal spray/combo

•

Acquire OTC

business platform

•

Add bolt-on deals

> $300 million annual revenues

> $500 million annual revenues

~$1 billion annual revenues

•

Low-concentration

BROMDAY™

•

REMURA™

for dry eye

•

T-PRED™

•

Strong steroid

•

Acquire marketed products

•

License late stage (Phase 3)

•

Acquire marketed products

•

Partner for access to

primary care physicians

and consumer branding

Rx Eye

Rx Allergy &

Respiratory

OTC Eye

and Allergy |

ISTA PHARMACEUTICALS

21

21

ISTA's 2011

Milestones

to Drive Shareholder Value

ISTA's 2011

Milestones

to Drive Shareholder Value

Product / Candidates

Milestone

Timing

BROMDAY once-daily

Complete switch from XIBROM

DONE Q1

Low-concentration BROMDAY

for inflammation and pain assoc

with cataract extraction

Initiate Phase 3

Prelim Phase 3 results

Done Q2

Q4

REMURA for dry eye

Prelim Phase 3 efficacy results:

WEST Study

EAST Study

DONE Q3

Q4

Bromfenac adjunct for AMD

Data publication

2H

Bepotastine spray for nasal allergies

Prelim Phase 2 results

DONE Q2

Bepotastine / steroid combination

spray for nasal allergies

Initiate Phase 2 study

2H ‘11 or

1H ‘12 |

ISTA PHARMACEUTICALS

22

ISTA’s Strategic Vision

“5 in 5”

ISTA’s Strategic Vision

“5 in 5”

•

Become one of top 3 branded Rx eye care companies in the U.S.

•

Achieve #1 or #2 position in each product market

•

Deliver EPS* of $1.00 by 2013 (based on 50 million shares)

•

Generate $500 million in revenue in 5 years

–

Develop products for larger markets

•

Obtain 5 new product approvals in next 5 years

–

Rx Eye and Rx Allergy

•

Accelerate growth in sales via organic growth, partnering and

acquisitions

–

Target: $1 billion in revenues

* Adjusted Cash EPS excludes non-cash warrant expense, non-cash interest expense and

non-cash stock-based compensation expense |

|