Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SPORT CHALET INC | sportchalet_8k-080311.htm |

EXHIBIT 99.1

NEWS RELEASE

| For Immediate Release |

Contact: Howard Kaminsky, Chief Financial Officer

(818) 949-5300 ext. 5728

|

SPORT CHALET REPORTS FIRST QUARTER FISCAL 2012 RESULTS

|

-

|

Comparable store sales increased 2.3%

|

|

-

|

Grew online sales by 66%

|

|

-

|

9th straight quarter of sequential profitability improvement

|

|

-

|

Lowered bank loan balance by 12% or $5.9 million

|

Los Angeles, California – (August 3, 2011) – Sport Chalet, Inc. (Nasdaq: SPCHA, SPCHB) today announced financial results for its first quarter ended July 3, 2011.

First Quarter Results

Sales increased 3.9% to $82.8 million for the first quarter of fiscal 2012 from $79.7 million for the first quarter of fiscal 2011, primarily due to a comparable store sales increase of 2.3%, an online sales increase of 66%, and a calendar shift increase of $1.3 million, partially offset by a change in Action Pass redemption activity. The calendar shift resulted in the Fourth of July holiday weekend being included in the first quarter of fiscal 2012 compared to the second quarter in fiscal 2011.

Gross profit as a percent of sales increased to 28.8% from 28.3% for the first quarter of last year primarily due to a decrease in rent expense as a percent of sales, partially offset by the change in Action Pass redemption activity. Selling, general and administrative expenses as a percent of sales decreased to 26.1% from 26.5% in the same period last year, primarily due to the leverage provided by the increase in sales and a decrease in workers’ compensation expense, partially offset by incentive payments primarily for store employees.

The Company’s net loss for the quarter ended July 3, 2011 decreased by $1.1 million, or 58%, to $0.8 million, or $0.06 per share, from a net loss of $1.9 million, or $0.14 per share, for the quarter ended June 27, 2010.

Craig Levra, Chairman and CEO, stated, “During the first quarter, we continued to experience positive trends in comparable store sales, online sales and inventory productivity. We are excited about the considerable improvement of our results and continue to implement our strategies to return to profitability.”

Liquidity

On July 3, 2011, the Company’s bank credit facility had a borrowing capacity of $65.0 million, of which the Company utilized $47.1 million (including a letter of credit of $2.6 million) and had $16.2 million in availability. The Company reduced its borrowings under the bank credit facility by 12%, or $5.9 million, to $44.5 million at July 3, 2011 from $50.4 million at June 27, 2010.

About Sport Chalet, Inc.

Sport Chalet, founded in 1959 by Norbert Olberz, is a leading, full service specialty retailer with 55 stores in California, Nevada, Arizona and Utah; Sport Chalet online at sportchalet.com; and a Team Sales division. The Company offers over 50 services for the sports enthusiast, including climbing, backcountry skiing, ski mountaineering, avalanche education, and mountain trekking instruction, car rack installation, snowboard and ski rental and repair, Scuba training and certification, Scuba boat charters, team sales, custom golf club fitting, racquet stringing, and bicycle tune-up and repair at its store locations.

Forward-Looking Statements

Except for historical information contained herein, the statements in this release are forward- looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, including, but not limited to, the ability to strengthen the Company’s liquidity, manage expenses and inventory position, improve operating efficiencies, and navigate through the current challenging environment, involve known and unknown risks and uncertainties that may cause the Company's actual results in future periods to differ materially from forecasted results. Those risks include, among other things, the negative effect of the economic downturn on the Company’s sales, limitations on borrowing under the Company’s bank credit facility, the Company’s ability to control operating expenses and costs, the competitive environment in the sporting goods industry in general and in the Company’s specific market areas, inflation, the challenge of maintaining its competitive position, changes in costs of goods and services, the weather and economic conditions in general and in specific market areas. These and other risks are more fully described in the Company's filings with the Securities and Exchange Commission.

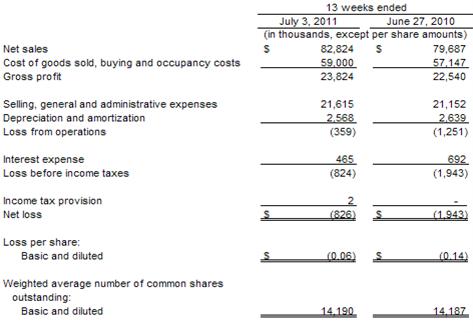

Sport Chalet, Inc.

Consolidated Statements of Operations (Unaudited)

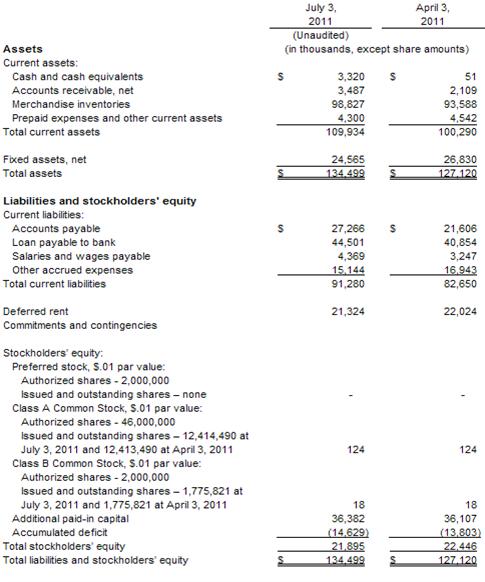

Sport Chalet, Inc.

Consolidated Balance Sheets

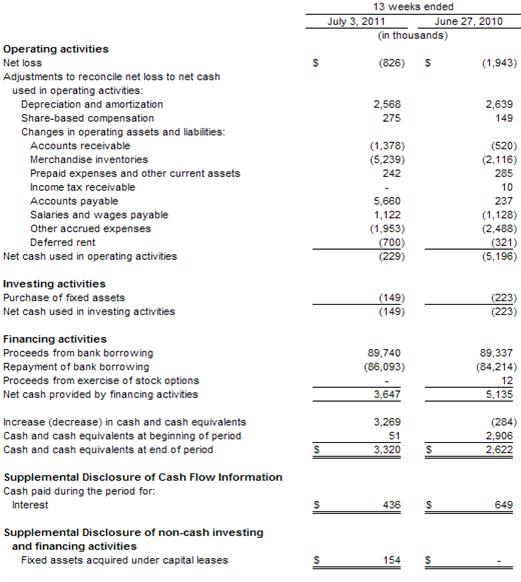

Sport Chalet, Inc.

Consolidated Statements of Cash Flows (Unaudited)