Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONCEPTUS INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - CONCEPTUS INC | dex991.htm |

Second Quarter of 2011

August 4, 2011

Conceptus, Inc.

Conceptus, Inc.

Quarterly Results

Quarterly Results

Exhibit 99.2

©

2011 Conceptus, Inc. All rights reserved. |

Except for the historical information contained herein, the matters discussed in this

presentation include forward-looking statements, the accuracy of which is

subject to risks and uncertainties. These forward- looking statements

include discussions regarding: projected net sales and adjusted earnings

before interest, taxes, depreciation, amortization and stock- based

compensation (“adjusted EBITDA”) for the full year 2011, and the

expected impact of ongoing macroeconomic and insurance pressures on our growth in 2011,

trends in and market share related to competitive trialing, our continued success in

defending our physician accounts against competitive trialing, our ability to

expand physician market penetration, our ability to improve sales force

productivity, our ability to increase utilization of Essure through the

promotion of a compatible endometrial ablation product, our ability to market

effectively to physicians and prospective patients, our ability to

secure government reimbursement in foreign countries, our ability to make

strategic investments in our business, the impact to our business of permanent birth

control being covered under the Patient Protection and Affordable Care Act of 2010

(PPACA), and the expected attainment of strategic initiatives intended to grow

the business and make the Essure procedure the “Standard of

Care” in the permanent birth control market.

These discussions and other forward-looking statements included herein may differ

significantly from actual results. Such differences may be based upon factors

such as changes in strategic planning decisions by management,

re-allocation of internal resources, changes in the impact of domestic and

global macroeconomic pressures, reimbursement decisions by insurance companies and

domestic and foreign governments, scientific advances by third parties,

litigation risks, attempts to repeal all or part of the

PPACA,

and

the

introduction

of

competitive

products,

as

well

as

those

factors

set

forth

in

the

Company's most recent Annual Report on Form 10-K and most recent Quarterly Report

on Form 10-Q, and other filings with the Securities and Exchange

Commission. These forward-looking statements speak

only

as

to

the

date

on

which

the

statements

were

made.

We

undertake

no

obligation

to

update

or

revise publicly any forward-looking statements, whether as a result of new

information, future events, or otherwise.

Safe Harbor

Safe Harbor

2

©

2011 Conceptus, Inc. All rights reserved. |

Q2’11

Q2’11

Highlights

Highlights

Mark Sieczkarek,

President and

Chief Executive Officer

©

2011 Conceptus, Inc. All rights reserved. |

1.

Defend against

competitive

trialing

2.

Create

foundation to

increase

Essure

utilization

3.

Resume

expanding the

market for

Essure

POSITION FOR LONG-TERM GROWTH

Macro-economy: continuing unemployment and higher

insurance premiums, deductible and co-pays

Progress on Execution

Progress on Execution

Key areas of focus in 2011:

4

©

2011 Conceptus, Inc. All rights reserved. |

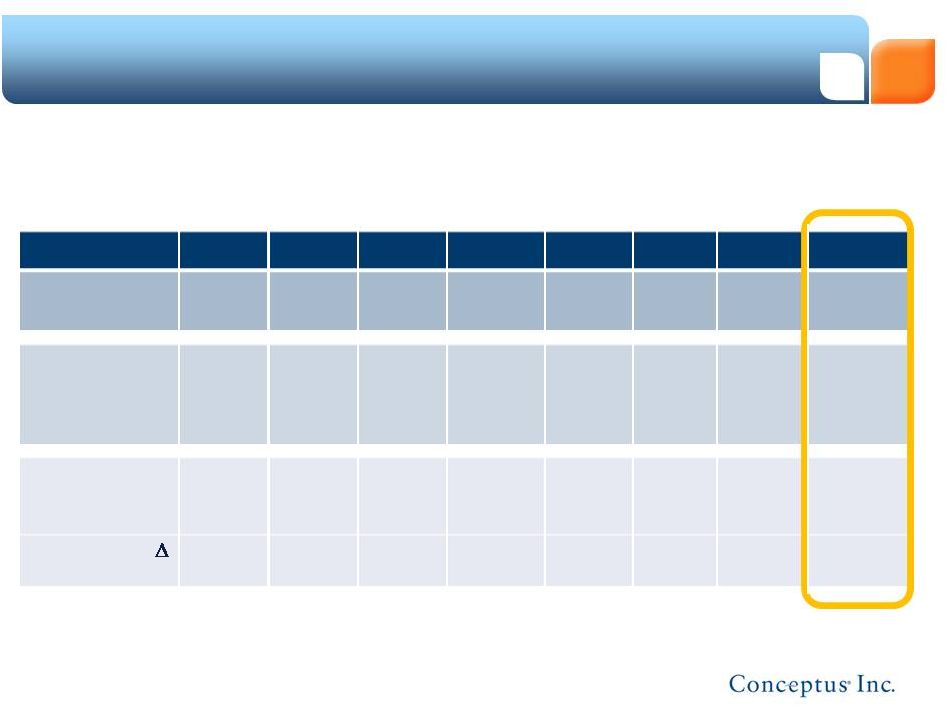

OB/GYN office visits improved Q/Q

OB/GYN

Patient

office

visits

in

millions

% change in select periods:

OB/GYN Office Visit Trends

OB/GYN Office Visit Trends

Source: IMS data provided by Credit Suisse Healthcare Team

5

Period:

2010

vs 2009

2 Years:

Q2’11

vs Q2’09

1 Year:

Q2’11

vs Q2’10

Sequential:

Q2’11

vs Q1’11

-15%

-20%

-2%

9%

OB/GYN |

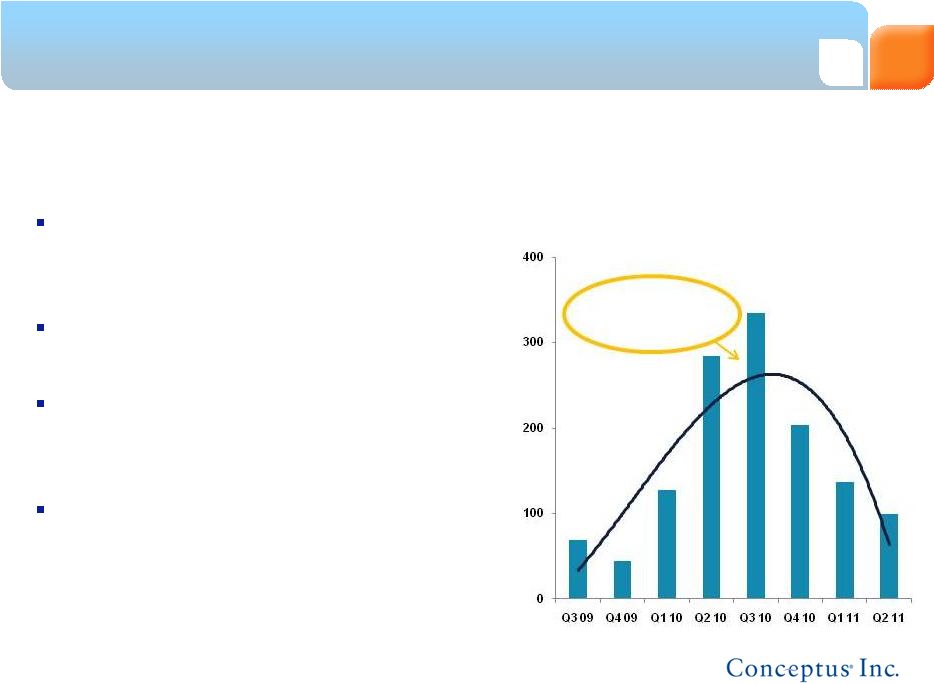

Market Growth Trends

Market Growth Trends

Worldwide hysteroscopic sterilization market declined slightly Y/Y

in Q2’11 but improved Q/Q

(1)

Competitor’s national sales launch in April 2010

(2)

Competitor’s estimated net sales

6

©

2011 Conceptus, Inc. All rights reserved.

In $ millions

Q3 09

Q4 09

Q1 10

Q2 10

(1)

Q3 10

Q4 10

Q1 11

Q2 11

Total CPTS

Sales

$34.2

$37.0

$33.4

$36.8

$33.9

$36.5

$26.6

$33.8

Competitor’s

Estimated

Sales

(2)

$0.6

$1.5

$2.1

$3.8

$5.2

$5.3

$5.3

$5.6 -

$5.8

Hysteroscopic

Sterilization

Market

$34.8

$38.5

$35.5

$40.6

$39.1

$41.8

$31.9

$39.4 -

$39.6

Y/Y

31%

35%

31%

23%

12%

9%

(10%)

(2%) -

(3%) |

In

total

~500

accounts

were

covered

by

1-3

year Essure preferred vendor agreements

by the end of Q2’11

~1,300 accounts have trialed to date out of

up to ~1,800 accounts anticipated to trial

Trialing expected to last ~1 year at a rate of

~100 accounts entering trialing per quarter

+ one year to trial

FDA approved nickel contraindication on

Essure IFU reduced to warning; further

improves our competitive positioning

We continue to successfully defend our accounts

Sales Force

Redeployment

Number of Essure accounts that entered

competitive trialing by quarter

Competitive Trialing Declines

Competitive Trialing Declines

7

©

2011 Conceptus, Inc. All rights reserved. |

Market Share Stable

Market Share Stable

(1)

Competitor’s national sales launch in April 2010

(2)

Competitor’s estimated net sales

8

©

2011 Conceptus, Inc. All rights reserved.

Worldwide hysteroscopic sterilization market:

Conceptus remains market leader

In $ millions

Q3 09

Q4 09

Q1 10

Q2 10

(1)

Q3 10

Q4 10

Q1 11

Q2 11

Total CPTS

Sales

$34.2

$37.0

$33.4

$36.8

$33.9

$36.5

$26.6

$33.8

Competitor’s

Estimated

Sales

(2)

$0.6

$1.5

$2.1

$3.8

$5.2

$5.3

$5.3

$5.6 -

$5.8

Competitor’s

Market

Share

1.8%

3.8%

5.8%

9.4%

13.2%

12.6%

16.6%

14.2% -

14.6% |

Increase Essure Utilization

Increase Essure Utilization

(1)

Permanent birth control

(2)

Global

endometrial

ablation

(GEA)

product

manufactured

for

and

marketed

by

ETHICON™

Women’s

Health

&

Urology,

a

division of Ethicon, Inc.

9

>2,000 physicians

committed to trial

~680 physicians

trialed through

Q2’11

©

2011 Conceptus, Inc. All rights reserved.

Essure = medically necessary link between PBC

(1)

and GEA

Capture

share

of

in-office

GYNECARE

THERMACHOICE

®

III

(2)

patients

requiring PBC to potentially double annual market for Essure

GYNECARE

THERMACHOICE

®

III

Physician trials

GEA opportunity to

increase ~1 Essure

procedure per

account per month

interval tubal ligation

opportunity

Incremental

Essure Procedures |

10

Marketing To Drive Growth

Marketing To Drive Growth

(1)

9.3

million

women

in

the

U.S.

whose

families

are

complete

and

are

still

using

temporary

birth

control per

the 2006-08 CDC report, data from the National Survey of Family Growth,

published May 2010 Further develop key marketing strategies to increase

adoption of Essure and drive long-term growth

Direct-to-Consumer (DTC)

Publication Planning

Own unique in-office sales franchise

Physician Segmentation

Consumer Segmentation

©

2011 Conceptus, Inc. All rights reserved.

Target

underpenetrated

U.S. market for

Essure of 9.3M

women

(1) |

Integrate Value Proposition

Integrate Value Proposition

Consumer

Point of

Care

Physician

•

Resident, new-user and in-

office training

•

Clinician education

•

Reimbursement support

•

Essure candidate identification

tools for physicians

•

Patient support and

counseling through

all points of Essure

procedure

•

New Essurance Promise™

Program

•

New Essure FlexPay™

Plan

•

New Essure branding and

website

•

Launch new DTC marketing

campaign

Integrate patient and physician value proposition to increase

Essure utilization at point of care

11

©

2011 Conceptus, Inc. All rights reserved. |

Direct-to-Consumer Planned

Direct-to-Consumer Planned

Launch new DTC marketing campaign in Q3’11

Build upon our previous DTC experience

Leverage experience in temporary birth control advertising

National focus

Invest resources across the most cost-effective mediums

Segment potential patient base and target message accordingly

Maintain campaign into 2012 to drive a consistent message

12

©

2011 Conceptus, Inc. All rights reserved. |

Greg Lichtwardt

Executive Vice President, Operations

and Chief Financial Officer

Q2’11

Q2’11

Financials

Financials

©

2011 Conceptus, Inc. All rights reserved. |

Net

Sales ($M)

Gross Margin

(%)

Diluted GAAP

EPS

Operating

Exp. ($M)

Q2’10

Q2’11

$36.8

80.2%

81.9%

$33.8

$28.1

$25.8

($0.01)

$0.01

$5.2

(1)

Adjusted earnings before interest, taxes, depreciation, amortization

and stock-based compensation. See reconciliation in Appendix

$5.8

Q2’10

Q2’11

Q2’10

Q2’11

Q2’10

Q2’11

Q2’10

Q2’11

Q2’11 Snapshot

Q2’11 Snapshot

14

©

2011 Conceptus, Inc. All rights reserved.

Adj. EBITDA

(1)

($M) |

Q2’11 Net Sales (in $ millions)

Q2’11 Units (in

thousands): $36.8

Q2’10

Q2’11

$28.0

(76%)

$33.8

$24.8

(73%)

33.3

Q2’10

Q2’11

20.1

(60%)

13.2

(40%)

29.4

Domestic

International

$9.0

(27%)

$8.9

(24%)

Worldwide Sales

Worldwide Sales

17.8

(61%)

11.6

(39%)

15

©

2011 Conceptus, Inc. All rights reserved.

Columns may not add due to rounding |

Q2’11

Q1’11

(1)

Q4’10

(1)

Q3’10

(1)

Q2’10

(1)

Current Period Activity:

Physicians entering preceptorship

538

388

380

380

425

Physicians becoming certified

290

200

427

334

368

Physicians transitioning to in-office

110

89

202

185

163

Physician Base:

13,553

13,015

12,627

12,247

11,867

Physician Metrics Pipeline Grew

Physician Metrics Pipeline Grew

We returned to expanding the market for Essure in Q2’11

16

©

2011 Conceptus, Inc. All rights reserved.

Office-based procedures were ~69% of total volume in Q2’11

(1)

Includes adjustments made to the categories of physicians entering preceptorship,

physicians becoming certified and physician base due to an adjustment in our

data gathering process on these items. |

In

$ millions except for EPS (1)

Adjusted earnings before interest, taxes, depreciation, amortization and

stock-based compensation. See appendix. (2)

Net loss after taxes includes a net income tax benefit of $2.3 million.

Q2’11 Highlights

Q2’11 Highlights

17

©

2011 Conceptus, Inc. All rights reserved. |

Q2’11 Adjusted EBITDA

Q2’11 Adjusted EBITDA

Adjusted

EBITDA

$5.85

Amortization

of

intangibles

Stock-

based

compensation

$0.45

Net income

See reconciliation in appendix

Interest

and other

income

(expense)

net

$ millions

Depreciation

expense

Benefit

from

income

taxes

$1.63

($0.17)

$0.82

$1.73

$1.39

18

©

2011 Conceptus, Inc. All rights reserved. |

Balance Sheet

Balance Sheet

Cash & cash equivalents

Investments

Accounts receivable

Inventories & other assets

PP&E

Intangibles

Goodwill

Deferred tax asset

Total assets

ASSETS

25.8

69.8

19.6

9.8

10.4

22.8

17.4

81.7

257.3

6/30/11

A/P & other accrued ST

liabilities

Notes payable

(1)

Other accrued LT liabilities

Total Equity

Total liabilities & equity

LIABILITIES &

EQUITY

12/31/10

17.0

83.3

2.5

154.5

257.3

18.4

72.5

20.4

10.4

10.1

24.1

16.0

78.8

250.7

6/30/11

12/31/10

15.8

81.0

2.4

151.5

250.7

$ millions

19

©

2011 Conceptus, Inc. All rights reserved.

(1) Notes payable is a current liability

Columns may not add due to rounding |

Guidance

Guidance

Net Sales

$135M to

$140M

$141M

Gross Profit Margin

81.9% to

82.2%

80.9%

Operating

Expenses

$103M to

$105M

$104M

Adjusted EBITDA

(1)

$23M to

$26M

$25M

FY’11E

as of 8/4/11

FY’10

Actual

(1) See appendix

20

©

2011 Conceptus, Inc. All rights reserved. |

2011:

2011:

Strategic Plan

Strategic Plan

Update

Update

Mark Sieczkarek,

President and

Chief Executive Officer

©

2011 Conceptus, Inc. All rights reserved. |

Strategic Plan Goals

Strategic Plan Goals

Goals

Environment

Response

•

Navigate current

economy and

make Essure

“Standard of

Care”

in PBC

market

•

Drive long-term

growth

•

Challenging macroeconomic and

insurance trends continue

•

Patient utilization rates remain

low for non-urgent procedures

like Essure

•

HHS

(1)

decision to include

permanent birth control under

PPACA

(2)

at no cost to patients

beginning in 2013 represents a

key inflection point in our future

business

•

Continue to execute our

strategic plan and control

what we can

•

New DTC to build

consumer awareness

•

Launched innovative

offerings like the Essure

FlexPay Plan to make

patient deductible

payments for Essure

more affordable

We remain committed to our strategic plan to drive long-

term revenue growth across the world

22

©

2011 Conceptus, Inc. All rights reserved.

(1)

U.S. Department of Health and Human Services

(2)

Patient Protection and Affordable Care Act of 2010

TM |

Strategic Plan Update

Strategic Plan Update

Strategy

Details

Status

1. Minimize

impact of

competition

and gain back

market share

•

Defend our existing accounts

against competitive trialing

•

Filed with FDA to remove

contraindication of nickel

hypersensitivity in Essure IFU

•

Expanded sales force

•

Continue to educate

physicians on Essure’s

superior efficacy

•

Succeeded in reducing nickel

contraindication to a warning in

Essure IFU, which enhances

competitive positioning

•

Pace of competitive trialing in

Essure accounts continues to

slow

23

©

2011 Conceptus, Inc. All rights reserved. |

Strategic Plan Update

Strategic Plan Update

Strategy

Details

Status

2. Increase

Essure

utilization

•

Leverage in-office channel

strength to promote

GYNECARE

THERMACHOICE

®

III

to

U.S.

physician

offices

•

PBC is medically necessary for

GEA patients, doubles Essure

market opportunity

•

Secure trials and convert

physicians to using

GYNECARE

THERMACHOICE

®

III

in

the

office

setting

•

Capture PBC opportunity with

converted physicians’

GEA

patients

•

Launched GYNECARE

THERMACHOICE

®

III

promotion

efforts in Q1’11

•

>2,000 physicians have

committed to trialing

•

~670 physicians have trialed;

work to get conversions

•

Will focus on increasing

Essure utilization in these

accounts

24

©

2011 Conceptus, Inc. All rights reserved. |

Strategic Plan Update

Strategic Plan Update

Strategy

Details

Status

3. Drive

adoption of

Essure through

strategic,

integrated

marketing

•

Growth strategies include

physician and consumer

segmentation, owning the

in-office sales process,

publication planning and DTC

•

Integrate patient and physician

value proposition to increase

Essure utilization at point of

care

•

Re-initiate DTC campaign and

run continuously nationwide

•

Expanded marketing

organization now in place

•

Launched Essure FlexPay

Plan to make patient

deductible payments for

Essure more affordable

•

Launched new

www.essure.com website

•

Launched Essurance

Promise

Program

•

Piloting patient education

system to help physicians

identify Essure candidates

25

©

2011 Conceptus, Inc. All rights reserved.

TM

TM |

Strategic Plan

Update Strategic Plan Update

Strategy

Details

Status

4. Expand

international

presence

•

Europe

•

France

•

U.K.

•

Brazil

•

Emerging markets

•

Europe: have launched

targeted PR campaigns in

various countries

•

France: working to reinstate

reimbursement for <40 market;

increased targeting of

40

market

•

U.K.: in discussions to

increase fee schedule of

hysteroscopic sterilization

•

Brazil: reimbursement focus

•

China and India: moving

forward on approval process

26

©

2011 Conceptus, Inc. All rights reserved. |

Strategic Plan Update

Strategic Plan Update

Strategy

Details

Status

5. Washington

DC focus and

reimbursement

issues

•

Include contraception under

the PPACA guidelines

•

Medicaid reimbursement and

cost saving issues

•

Seek ACOG recommendation

of hysteroscopic sterilization

as “Standard of Care”

•

HHS mandated inclusion of

permanent birth control under

PPACA at no cost to patients –

represents a key inflection

point in our future business

•

35 states provide adequate

Essure Medicaid fee-for-

service office reimbursement

as of 6/30/11

•

Continuing discussions with

ACOG; AAGL to write a

position statement

27

©

2011 Conceptus, Inc. All rights reserved. |

Strategic Plan Update

Strategic Plan Update

Strategy

Details

Status

6. Create a

pipeline of

women’s

health products

and services

•

Designed to accelerate

adoption of Essure

•

Provide more diversified

offerings

•

Ongoing review of potential

high-growth synergistic

opportunities

•

Prefer in-office setting

7. Product

enhancements

•

Develop next generation

Essure procedure

•

Seek FDA approval of

transvaginal ultrasound (TVU)

for U.S. Essure confirmation

instead of HSG

•

Hired new EVP of research

and development

•

Received conditional approval

from the FDA to conduct an

IDE clinical study to replace

the HSG confirmation test

currently required in the U.S.

with TVU

28

©

2011 Conceptus, Inc. All rights reserved. |

Key

Take-Aways Key Take-Aways

We are dedicated to making Essure the “Standard of

Care”

in the PBC market, even as macroeconomic and

insurance challenges remain

The competitive threat appears to be stabilized and we

will sharpen our focus on increasing utilization and

growing the market for Essure

Strategic marketing initiatives, including a new DTC

campaign, are expected to increase consumer adoption

of Essure and return the market to double-digit growth

29

©

2011 Conceptus, Inc. All rights reserved. |

Appendix

Appendix

©

2011 Conceptus, Inc. All rights reserved. |

Use

of Non-GAAP Financial Measures Use of Non-GAAP Financial

Measures The

Company

has

supplemented

its

GAAP

net

income

/

(loss)

with

a

non-GAAP

measure of adjusted earnings before interest, taxes, depreciation, amortization

and stock-based compensation (“adjusted EBITDA”).

Management believes that this non-GAAP financial measure provides useful

supplemental information to management and investors regarding the performance

of the Company’s business operations, facilitates a better comparison of

results for current periods with the Company’s previous operating

results, and assists management in analyzing future trends, making strategic

and business decisions and establishing internal budgets and forecasts.

A reconciliation of non-GAAP adjusted EBITDA to GAAP net income / (loss)

in the most directly comparable GAAP measure, is provided in the below

schedule. There are limitations in using this non-GAAP financial measure

because it is not prepared in accordance with GAAP and may be different from

non-GAAP financial measures used by other companies. This

non-GAAP financial measure

should

not

be

considered

in

isolation

or

as

a

substitute

for

GAAP

financial measures. Investors and potential investors should consider

non- GAAP financial measures only in conjunction with the Company’s

consolidated financial statements prepared in accordance with GAAP and the

reconciliations of the non-GAAP financial measure provided in the below

schedules. 31

©

2011 Conceptus, Inc. All rights reserved. |

GAAP to Non-GAAP Reconciliation

32

©

2011 Conceptus, Inc. All rights reserved.

2011

2010

2011

2010

Net Income (Loss), as reported

454

$

(291)

$

(2,474)

$

(2,642)

$

Adjustments to net income (loss):

Interest and other income (expense), net (a)

1,626

1,585

3,173

3,044

Provision (benefit) for income taxes

(165)

123

(2,468)

257

Amortization of intangibles (b)

819

808

1,632

1,627

Stock-based compensation (c)

1,727

1,802

3,422

3,531

Depreciation expense (d)

1,388

1,144

2,631

2,241

Adjustments to net income (loss)

5,395

5,462

8,390

10,700

Adjusted EBITDA

5,849

$

5,171

$

5,916

$

8,058

$

(a) Consists of interest from available-for-sale securities, interest expense associated with

our convertible debt and foreign exchange currency transactions

(b) Consists of amortization of intangible assets, primarily licenses and customer relationships

(c) Consists of stock-based compensation in accordance with ASC 718

(d) Consists of depreciation, primarily on property, plant and equipment

Conceptus, Inc.

(Unaudited)

Reconciliation of Net Income (loss) to Adjusted Earnings Before Interest, Taxes, Depreciation,

Amortization and Stock-Based Compensation (Adjusted EBITDA)

(In thousands)

June 30,

Three Months Ended

Six Months Ended

June 30, |

GAAP to Non-GAAP Reconciliation

33

©

2011 Conceptus, Inc. All rights reserved.

From

To

Net Income Guidance

560

$

2,297

$

Estimated Non-GAAP Guidance

Interest and other income (expense), net (a)

6,300

6,300

Provision for income taxes

333

1,596

Amortization of intangibles (b)

3,261

3,261

Stock-based compensation (c)

7,116

7,116

Depreciation expense (d)

5,430

5,430

Adjustments to net income

22,440

$

23,703

$

Adjusted EBITDA

23,000

$

26,000

$

(a) Consists of interest from available-for-sale securities, interest expense associated with

our convertible debt and foreign exchange currency transactions

(b) Consists of amortization of intangible assets, primarily licenses and customer

relationships (c) Consists of stock-based compensation in accordance with ASC 718

(d) Consists of depreciation, primarily on property, plant and equipment

December 31, 2011

Conceptus, Inc.

Financial Measures To Projected GAAP Net Income

(Unaudited)

Twelve Months Ending

Reconciliation of Forward-Looking Guidance For Non-GAAP |

Revolutionizing women’s healthcare

with innovative solutions

Conceptus, Inc.

Conceptus, Inc.

NASDAQ: CPTS

NASDAQ: CPTS

©

2011 Conceptus, Inc. All rights reserved.

CC-2847 4AUG11

F |