Attached files

| file | filename |

|---|---|

| 8-K - OVERSEAS SHIPHOLDING GROUP INC | earn2q2011.htm |

| EX-99 - OVERSEAS SHIPHOLDING GROUP INC | earn2q2011ex99.htm |

Exhibit 99.2

Second Quarter Fiscal 2011 Earnings

Conference Call

Conference Call

August 2, 2011

page 2

This presentation contains forward-looking statements regarding the Company's prospects, including the outlook

for tanker and articulated tug barge markets, changing oil trading patterns, anticipated levels and timing of

newbuilding and scrapping, prospects for certain strategic alliances and investments, the prospects for, and

amounts of, future dividends, estimated TCE rates achieved for the third quarter of 2011, projected scheduled

drydock and off hire days for the two remaining fiscal quarters of 2011, projected locked-in charter revenue and

locked-in time charter days for the remaining six months of 2011 and 2012 through 2015 and thereafter,

forecasted 2011 vessel expenses, charter hire expenses, depreciation and amortization, general and

administrative expenses, interest expense, and levels of equity income and capital expenditures, the profitability

in 2011 of certain business units, ability to access capital markets, including Title XI financing, prospects of

OSG’s strategy of being a market leader in the segments in which it competes and the forecast of world

economic activity and oil demand. These statements are based on certain assumptions made by OSG

management based on its experience and perception of historical trends, current conditions, expected future

developments and other factors it believes are appropriate in the circumstances. Forward-looking statements

are subject to a number of risks, uncertainties and assumptions, many of which are beyond the control of OSG,

which may cause actual results to differ materially from those implied or expressed by the forward-looking

statements. Factors, risks and uncertainties that could cause actual results to differ from the expectations

reflected in these forward-looking statements are described in the Company’s Annual Report for 2010 on Form

10-K and those risks discussed in the other reports OSG files with the Securities and Exchange Commission.

for tanker and articulated tug barge markets, changing oil trading patterns, anticipated levels and timing of

newbuilding and scrapping, prospects for certain strategic alliances and investments, the prospects for, and

amounts of, future dividends, estimated TCE rates achieved for the third quarter of 2011, projected scheduled

drydock and off hire days for the two remaining fiscal quarters of 2011, projected locked-in charter revenue and

locked-in time charter days for the remaining six months of 2011 and 2012 through 2015 and thereafter,

forecasted 2011 vessel expenses, charter hire expenses, depreciation and amortization, general and

administrative expenses, interest expense, and levels of equity income and capital expenditures, the profitability

in 2011 of certain business units, ability to access capital markets, including Title XI financing, prospects of

OSG’s strategy of being a market leader in the segments in which it competes and the forecast of world

economic activity and oil demand. These statements are based on certain assumptions made by OSG

management based on its experience and perception of historical trends, current conditions, expected future

developments and other factors it believes are appropriate in the circumstances. Forward-looking statements

are subject to a number of risks, uncertainties and assumptions, many of which are beyond the control of OSG,

which may cause actual results to differ materially from those implied or expressed by the forward-looking

statements. Factors, risks and uncertainties that could cause actual results to differ from the expectations

reflected in these forward-looking statements are described in the Company’s Annual Report for 2010 on Form

10-K and those risks discussed in the other reports OSG files with the Securities and Exchange Commission.

Forward-Looking Statements

page 3

1 Based on Singapore 380 cst high sulfur fuel oil price

Financial Highlights

< Second quarter fiscal 2011 results reflected, in particular, continued weakness in

our International Crude markets

our International Crude markets

• TCE revenues were $207M, down 11% from $232M in 2Q2010 and flat with 1Q2011

• Reported net loss of $37.3M or $1.24 per diluted share

• Adjusted net loss of $36.1M or $1.20 per diluted share

< International Crude spot rates remained under pressure in Q2

• 2Q2011 Crude TCE revenues down 39% vs. 2Q2010 on 2% fewer revenue days

• 2Q2011 realized spot TCEs 28 - 62% lower vs. 2Q2010 for all Crude classes except

Lightering (+16%)

Lightering (+16%)

- VLCC 2Q2011 TCE: $20,400/day, - 54% vs. $44,399/day in 2Q2010

• Average Q2 fuel oil price 1: $660/mt, + 43% vs. 2Q2010 - has eaten more deeply into

TCEs

TCEs

< MRs: Q2 spot TCE of $15,153/day was up 30% on 2Q2010 and 18% sequentially

< U.S. Flag - continued improvement in revenue and operating income performance

< Continued containment of vessel expenses and G&A

page 4

Market Backdrop

< Downturn in Crude markets continues

• Supply absorption has slowed as demand surprises have all been negative in 2011

• Japanese earthquake in early March closed refineries and reduced crude imports in Q2

into Q3

into Q3

• Shut-in of Libyan crude exports hit Aframax market immediately

- Expected benefit to VLCCs and Suez on increased longer haul movements into Europe has not

materialized due to refinery maintenance and reduced crack spreads / refinery runs

materialized due to refinery maintenance and reduced crack spreads / refinery runs

• SPR release to reduce Q3 seaborne crude and products movements to OECD

• U.S. long-haul crude imports remain low - a linchpin to any recovery

• Increased Asian imports of cheaper Mideast sour crudes at expense of West African

crudes - negative tonne-mile impact

crudes - negative tonne-mile impact

< International Products markets remain volatile - Transatlantic trade impacted by:

- Mississippi River flooding in April/May

- Refinery maintenance in Atlantic basin

- European SPR release of products reduced local crack spreads and refinery runs

hindering U.S. diesel exports to Europe, European gasoline exports to U.S.

< Q3 spot TCEs booked to date are mostly below Q2 rates

• VLCC: Q3 booked to date is $16,500/day, vs. $20,400/day in 2Q2011 (down 19%)

• Aframax: Q3 booked to date is $9,000/day, vs. $10,390/day in 2Q2011 (down 13%)

• MR: Q3 booked to date is $12,000/day, vs. $15,153/day in 2Q2011 (down 21%)

page 5

Dividend Reduction Effective With 4th Quarter

Payment

Payment

< The Board has taken the following actions on the dividend:

• Reduced the annual dividend rate to $0.875 per share from $1.75

• Declared a quarterly dividend of $0.21875 per share payable on November 22, 2011 to

shareholders of record on November 7, 2011

shareholders of record on November 7, 2011

< The quarterly dividend of $0.4375 per share declared on June 7, 2011 is payable

on August 25, 2011 to shareholders of record on August 11, 2011

on August 25, 2011 to shareholders of record on August 11, 2011

< Revised dividend rate strikes the right balance among our goals of preserving

balance sheet strength, investing for long-term growth and returning cash to

shareholders

balance sheet strength, investing for long-term growth and returning cash to

shareholders

< OSG dividend remains competitive and reflects what we believe is an appropriate

level in today’s market

level in today’s market

< Dividend reduction is NOT lender-driven - we have comfortable liquidity and

covenant headroom

covenant headroom

< Economic and political uncertainty has grown throughout the year, increasing the

importance of prudent action-taking

importance of prudent action-taking

page 6

1 Includes all expenses, including allocated G&A.

What has NOT changed?

< We remain committed to reducing shoreside G&A and controlling cost at sea

• We expect to exceed the stretch G&A reductions we set for ourselves at the beginning of the year

• We continue to improve the economics of our chartered-in vessel portfolio by returning ships to their owners

and reducing rates on others

and reducing rates on others

• The fleet renewal program is virtually completed this year

• Vessel OPEX are well contained and we continue to improve operational metrics

< The Company remains committed to paying a dividend that is competitive and appropriate for the

markets we are in

markets we are in

• OSG has paid a dividend for 150 consecutive quarters

< Our view that the International Products market is in a cyclical upswing, with favorable supply and

demand economics, has not changed

demand economics, has not changed

• We expect rates to trend upward but with considerable volatility

• We expect a better contribution from this unit this year than last, with even better results over the next

several years

several years

< We continue to believe that our U.S. Flag business has turned the corner and is on course for a

steady improvement led by secular growth in coastwise demand and restrained supply of new

tonnage

steady improvement led by secular growth in coastwise demand and restrained supply of new

tonnage

• Positive contribution expected in 2011 compared with a $35M 1 operating loss in 2010

< We will continue to be patient on the acquisition front and not chase assets or swing for the fences

• Patience has served us well over the last 4 years - the market should present us with opportunities that stem

from other owners’ distress

from other owners’ distress

< Everyone in the Company remains focused on executing all those things within their control and

their efforts are paying off

their efforts are paying off

page 7

2010 Health, Safety and Environmental Report

is now posted on our website (on the SQ&E page)

is now posted on our website (on the SQ&E page)

page *

Financial Review

Myles Itkin, CFO

page 9

Reflects impact of lower spot rates and increase in spot

market exposure (from 74% of revenue days in 2Q2010

to 81% in 2Q2011) and higher bunker costs ($11.6M

higher quarter-over-quarter)

market exposure (from 74% of revenue days in 2Q2010

to 81% in 2Q2011) and higher bunker costs ($11.6M

higher quarter-over-quarter)

Both FSOs fully employed for quarter and continued to

earn service level bonuses. OSG’s share of FSO JV

income was $1.5M compared with a loss of $5.4M in

earn service level bonuses. OSG’s share of FSO JV

income was $1.5M compared with a loss of $5.4M in

2010 and reflects a $1.7M reduction in the

mark-to-market loss associated with the FSO Africa

interest rate swaps. (2011: LNG - $1.9M; ATC - $0.6M)

Reflects 284 more charter-in days during 2Q2011,

primarily in U.S. Flag Product Carriers, MRs and

Suezmax Tankers.

primarily in U.S. Flag Product Carriers, MRs and

Suezmax Tankers.

Reflects reductions of $0.7M in compensation costs

and $1.8M in legal and consulting fees; offset by

unfavorable F/X rates

Reflects costs associated with growth in U.S. Flag

operating fleet and return to service of OSG 209 from

layup. Average daily vessel expenses remain flat to

operating fleet and return to service of OSG 209 from

layup. Average daily vessel expenses remain flat to

down

Impairment charges on non-double hull vessels

($12.5M in U.S. Flag and $12.7M in Crude Lightering)

Financial Review - Income Statement

page 10

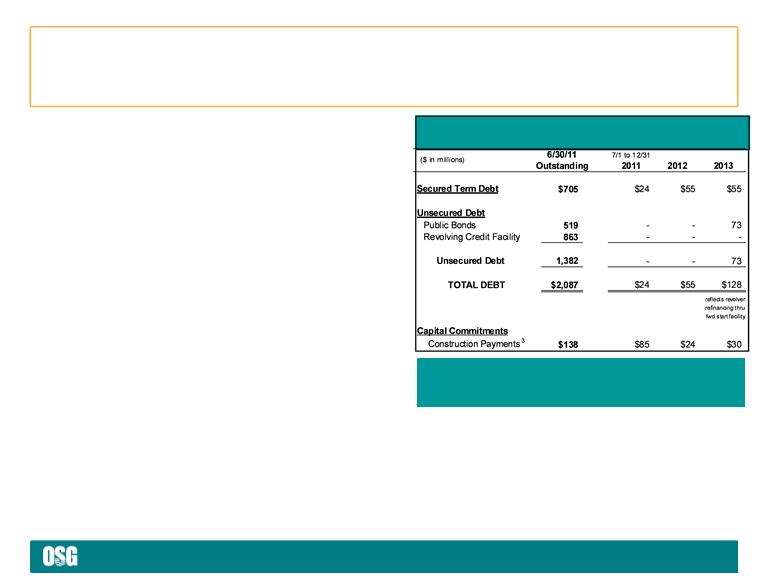

Reflects $117M drawn under revolving credit facility

and CEXIM facility, offset by $109M in expenditures

and CEXIM facility, offset by $109M in expenditures

for vessels and $27M in dividends paid to

shareholders

Overseas New Orleans delivered to buyers during

1Q2011

1Q2011

Decrease reflects $41M tax refund received in

January 2011

1 Short term investments consists of time deposits with maturities greater than 3 months

Includes CIP of $452M for 7 vessels and one tug

Includes deferred costs associated with forward start

facility (and other investments designed to offset the

mark-to-market movement in unfunded pension

obligations)

facility (and other investments designed to offset the

mark-to-market movement in unfunded pension

obligations)

Financial Review - Balance Sheet

page 11

|

Covenants on $1.8B facility 4

|

||

|

Covenant 2Q2011 Capacity

|

||

|

Maximum Leverage 5

< 60% |

45%

|

$1.7B add’l debt

|

|

Minimum Tangible Net Worth

³ $1.2B

|

$2.4B

|

$1.2B in losses

|

|

Minimum

Unencumbered Assets 6

³ 150%

|

224%

|

$0.7B new secured

debt on $1.0B of vessels |

1 Liquidity consists of Cash & Cash Equivalents, Short Term Investments and undrawn commitment under revolving credit facility (commitment reduced to $1.65B in February 2011).

2 Long-term debt reduced by Cash and Equivalents, Short Term Investments and Capital Construction Fund. 3 Reflects July amendments to certain construction contracts.

2 Long-term debt reduced by Cash and Equivalents, Short Term Investments and Capital Construction Fund. 3 Reflects July amendments to certain construction contracts.

4Prminary figures. 5 Funded indebtedness to total capitalization. 6 Unencumbered tangible assets to unsecured debt; capacity assumes 70% advance ratio.

Debt Repayment and Capital Commitments

Enduring financial flexibility

< Strong liquidity and balance sheet

profile

profile

• $1.0B in liquidity 1

• Liquidity-adjusted debt 2 to capital =

51.4%

51.4%

• Manageable debt and refinancing

obligations over next two years

obligations over next two years

• Future construction commitments of

$138M 3 are fully funded

$138M 3 are fully funded

• Ample room within covenants

< Large unsecured asset base

• 70% of Vessel NBV is unsecured

< Superior access to capital markets

• $900M forward start facility in place

• First Title XI application ($211M)

approved

approved

• Second Title XI application

(~$215M) in approval process

(~$215M) in approval process

page 12

1 Reflects July amendments to certain construction contracts.

2011 Guidance

§ Estimated vessel expenses $290M to $305M

updated from $295M to $310M due to

delays in shipyard deliveries

< Time and bareboat charter hire expenses $380M to $395M

< Depreciation and amortization $180M to $190M

updated from $185M to $195M due to delays in

updated from $185M to $195M due to delays in

shipyard deliveries and timing of planned drydockings

< G&A $95M to $100M

< Equity income of affiliated companies $20M to $25M

< Interest expense $80M to $90M

updated from $90M to $100M due to

delay in Title XI, now expected late Q4

< Capital expenditures

– Drydock costs $46M for full year

(Q3 $24M and Q4 $11M on 22 vessels)

– Newbuild progress payments, vessel $197M for full year

improvements and capitalized interest 1 (Q3 $45M and Q4 $43M)

page *

Appendix

page 14

Special Items Affecting Net Loss

Set forth below are significant items of income and expense that affected the Company’s results for the three and six months ended June 30,

2011 and 2010, all of which are typically excluded by securities analysts in their published estimates of the Company’s financial results.

2011 and 2010, all of which are typically excluded by securities analysts in their published estimates of the Company’s financial results.

1 The U.S. Flag asset impairment charges have been tax effected from the pre-tax charge of $25.2 million.

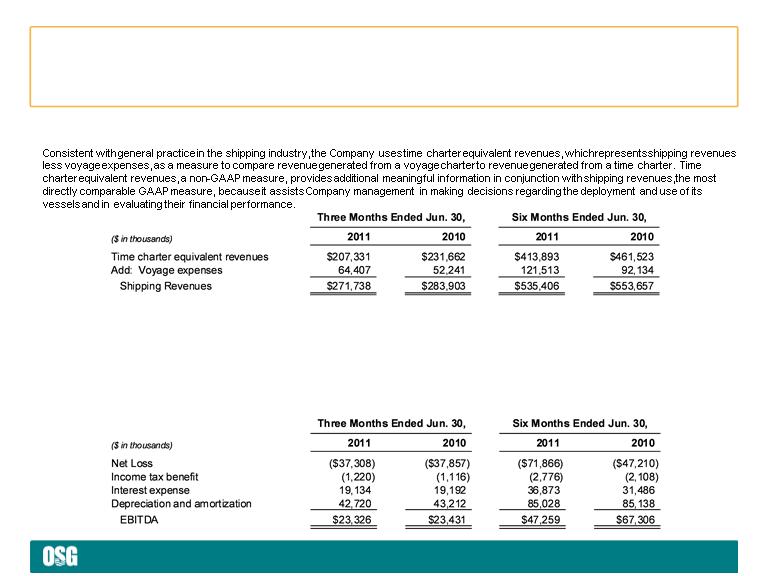

Reconciling Items

page 15

EBITDA

EBITDA represents operating earnings before interest expense and income taxes, plus other income/(expense) and depreciation and

amortization expense. EBITDA is presented to provide investors with meaningful additional information that management uses to monitor ongoing

operating results and evaluate trends over comparative periods. EBITDA should not be considered a substitute for net income / (loss) or cash

flow from operating activities prepared in accordance with accounting principles generally accepted in the United States or as a measure of

profitability or liquidity. While EBITDA is frequently used as a measure of operating results and performance, it is not necessarily comparable to

other similarly titled captions of other companies due to differences in methods of calculation.

amortization expense. EBITDA is presented to provide investors with meaningful additional information that management uses to monitor ongoing

operating results and evaluate trends over comparative periods. EBITDA should not be considered a substitute for net income / (loss) or cash

flow from operating activities prepared in accordance with accounting principles generally accepted in the United States or as a measure of

profitability or liquidity. While EBITDA is frequently used as a measure of operating results and performance, it is not necessarily comparable to

other similarly titled captions of other companies due to differences in methods of calculation.

TCE Revenues

Reconciling Items (cont’d)

page 16

|

|

Owned

|

Chartered-in

|

Total

|

Newbuild

|

Total

|

|

VLCC

|

10

|

5

|

15

|

1

|

16

|

|

FSO

|

2

|

-

|

2

|

-

|

2

|

|

Suezmax

|

-

|

2

|

2

|

-

|

2

|

|

Aframax

|

6

|

3

|

9

|

2

|

11

|

|

Panamax

|

9

|

-

|

9

|

-

|

9

|

|

Lightering

|

2

|

4

|

6

|

-

|

6

|

|

Total Crude

|

29

|

14

|

43

|

3

|

46

|

|

LR1

|

4

|

2

|

6

|

1

|

7

|

|

MR *

|

15

|

20

|

35

|

3

|

38

|

|

Total Products

|

19

|

22

|

41

|

4

|

45

|

|

Product Carrier

|

2

|

10

|

12

|

-

|

12

|

|

Clean ATB

|

7

|

-

|

7

|

-

|

7

|

|

Lightering ATB

|

4

|

-

|

4

|

-

|

4

|

|

Total U.S. Flag

|

13

|

10

|

23

|

-

|

23

|

|

Total Gas

|

4

|

-

|

4

|

-

|

4

|

|

TOTAL

|

65

|

46

|

111

|

7

|

118

|

* Products MR operating fleet Includes 2 owned U.S. Flag MRs that trade internationally and a car carrier; Products MR newbuild fleet includes a

chemical tanker.

chemical tanker.

Fleet Composition - As of July 28, 2011

page 17

Off Hire and Scheduled Drydock

In addition to regular inspections by OSG personnel, all vessels are subject to periodic drydock, special survey and other scheduled or known

maintenance and repairs. The table below sets forth actual days off hire for the first and second quarters of 2011 and anticipated days off hire

for the above-mentioned events by vessel class for the third and fourth quarters of 2011.

maintenance and repairs. The table below sets forth actual days off hire for the first and second quarters of 2011 and anticipated days off hire

for the above-mentioned events by vessel class for the third and fourth quarters of 2011.

1 Includes one time chartered-in vessel that was off-hire for purposes of TCE revenue and charter hire expense until April termination of

charter-in commitment. 2 Includes conversion of Overseas Chinook to shuttle tanker. 3 Includes layup days on vessels sold in 1Q2011.

Off Hire Schedule

page 18

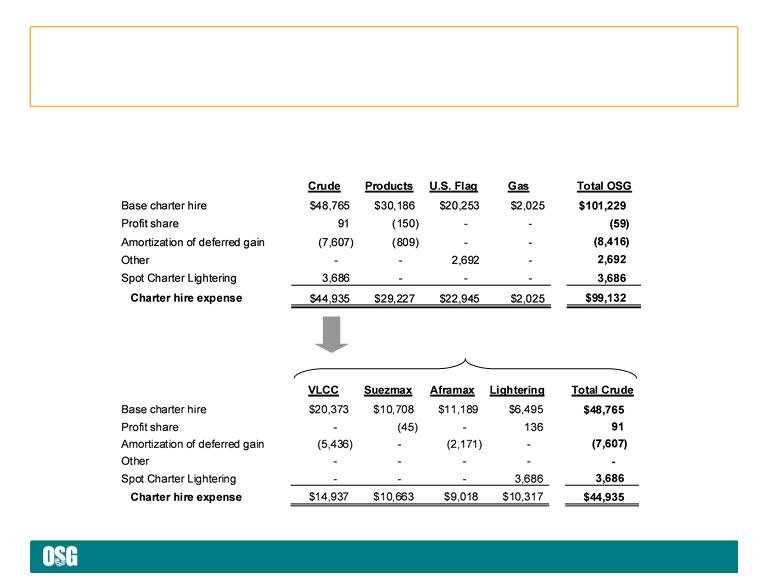

For the Quarter Ended June 30, 2011

($ in thousands)

Note: Vessels chartered-in for less than one year are not on the Company’s fleet list.

Charter Hire Expense by Segment

page 19

Locked-in Time Charter

Days by Segment

Days by Segment

Locked-in Time Charter

Revenue by Segment

Revenue by Segment

($ in 000)

Locked-in

Charter Revenue

Charter Revenue

($ in 000)

Note: Locked-in time charter days for 2011 are as of 6/30/11 and will differ from a more current date used in Appendices 3 and 4 in

the quarterly earnings press release.

Future Revenue $/Days by Segment - As of 6/30/11

page *

www.osg.com