Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ALLIANCE FINANCIAL CORP /NY/ | d8k.htm |

Keefe, Bruyette & Woods

12

th

Annual Community Bank Investor Conference

August 2011

NASDAQ Global Market: ALNC

www.alliancefinancialcorporation.com

Exhibit 99.1 |

2

Forward Looking Statements

This

presentation

contains

certain

“forward-looking

statements”

(within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995)

with

respect

to

the

financial

conditions,

results

of

operations

and

business

of

Alliance.

The

words

“may,”

“could,”

“should,”

“would,”

“believe,”

“anticipate,”

“estimate,”

“expect,”

“intend,”

“plan”

and similar expressions are intended to identify forward-looking

statements. These forward-looking statements involve certain risks

and uncertainties. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include,

among others, the following:

changes in the interest rate environment that reduce margins;

changes in the regulatory environment;

the highly competitive industry and market area in which we operate;

general economic conditions, either nationally or regionally, resulting in, among

other things, a deterioration in credit quality; changes in business

conditions and inflation; changes in credit market conditions;

changes in the securities markets which affect investment management revenues;

increases in FDIC deposit insurance premiums and assessments could adversely

affect our financial condition; changes in technology used in the banking

business; the

soundness

of

other

financial

services

institutions

which

may

adversely

affect

our

credit

risk;

certain of our intangible assets may become impaired in the future;

our controls and procedures may fail or be circumvented;

new line of business or new products and services which may subject us to

additional risks; changes in key management personnel which may adversely

impact our operations; the effect on our operations of recent legislative and

regulatory initiatives that were or may be enacted in response to the ongoing financial

crisis;

severe weather, natural disasters, acts of war or terrorism and other external

events which could significantly impact our business; and other factors

detailed from time to time in our Securities and Exchange Commission filings

Additional factors that could cause actual results to differ materially from those

expressed in the forward-looking statements are discussed under the

caption

“Risk

Factors”

in

Alliance’s

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

December

31,

2010

and

in

subsequent

filings

with

the

Securities and Exchange Commission and available at the SEC’s Internet site (www.sec.gov). Although we believe that the

expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from the

results discussed in these forward-looking statements. You are cautioned

not to place undue reliance on these forward-looking statements, which speak

only as of the date hereof. We do not undertake any obligation to republish

revised forward-looking statements to reflect events or circumstances after

the date hereof or to reflect the occurrence of unanticipated events.

Source Information

Information

throughout

this

presentation

whose

description

includes

reference

to

“SNL”

was

derived

from

SNL

Financial.

Final

peer

information

as

of

and

for the period ended June 30, 2011 is based on filings through July 28, 2011.

|

3

Snapshot of Alliance Financial

Capital

Asset Quality

Earnings

Shareholder Value

* As

measured

by

return

on

equity

vs.

SNL

banks

with

assets

between

$1B

-

$5B

•

Consistent internal capital generation through earnings

retention

•

Regulatory capital ratios comfortably exceed well- capitalized

thresholds

•

Tangible common equity ratio 7.0% at 6/30/11 •

Fourth consecutive year of record net income in 2010

•

2011 YTD significantly better than peer averages*

•

Diverse revenue stream – 30% from non-interest sources

•

Conservative lending and investing philosophy

•

Asset quality metrics superior to peer averages

•

Average net charge-offs 2008 – 2010 = 0.49%

•

Average net charge-offs first half 2011 = 0.08%

•

Nonperforming assets 0.63% of total assets at 6/30/11 •

Share price outperformed SNL index of $1B - $5B banks over 1, 3 and 5

year periods

•

Three year total return of 46%

•

Six consecutive years of dividend

increases |

| 4

Summary Statistics –

June 30, 2011

Assets:

$1.5 Billion

Loans:

$883.2 Million

Deposits:

$1.1 Billion

Tangible Common Equity:

$101.1 Million

Tangible Common Book Value per Share:

$21.31

Shares Outstanding:

4,745,291

Banking Offices:

29

Market Capitalization (at July 28, 2011):

$152.9 Million |

5

Alliance Bank, N.A.

Experienced and Seasoned Senior Management Team

Title

Age

Years in

Banking

Years with

Alliance

Jack H. Webb

President & CEO

59

37

12

John H. Watt, Jr.

Executive Vice

President

52

27

8

J. Daniel Mohr

Executive Vice

President & CFO

46

15

5

James W. Getman

Executive Vice

President & Senior

Loan Officer

63

41

12

Steven G. Cacchio

Senior Vice President

47

20

13 |

6

Alliance Growth History: Seamless Integrations

Alliance has been successful in complementing organic growth with

acquisitions and de-novo expansion.

Acquisitions

•

Q4 2006 –

Bridge Street Financial Corporation

$252 million fair value of assets acquired

$173 million fair value of deposits assumed

7 Branches

Contiguous to existing footprint

Bridge Street cost reductions exceeded 40%

•

Q1 2005 –

HSBC Trust Portfolio

$560MM

Portfolio

of

managed

assets

–

Buffalo,

NY

Office

Non-interest sensitive revenue from HSBC acquisition key to

diversification De-novo expansion

•

Onondaga County, NY

2000

to

2006

–

Opened

8

branches

in

the

greater

Syracuse

area |

| 7

Alliance Investment Management

•

Alliance

Investment

Management,

a

division

of

Alliance

Bank

with

trust

powers,

had

$852.8 million of assets under management at 6/30/11.

•

21 investment and trust professionals managing more than 2,000 client

accounts. •

Year to date investment management revenue is $3.9 million. Total 2010 revenue

was $7.3 million.

•

Non-interest income = 30% of total revenue in 2010.

|

8

Alliance Bank N.A. Branch Franchise |

9

Deposit Market Share

Syracuse MSA

Rank

Bank

Total Deposits

(000’s)

Market Share

1

Key

$ 2,384,656

21.8%

2

M&T

2,167,251

19.8%

3

HSBC

1,209,694

11.1%

4

Alliance

844,622

7.7%

5

JP Morgan Chase

648,021

5.9%

6

Bank of America

588,197

5.4%

Cortland MSA

Rank

Bank

Total Deposits

(000’s)

Market Share

1

Alliance

$ 243,027

41.3%

2

First Niagara

146,554

24.9%

3

Key

57,447

9.8%

4

HSBC

47,071

8.0%

5

Tompkins Trust

26,617

4.5%

6

M&T

22,737

3.9%

Leading Community Bank in Central New York

Source: SNL Financial |

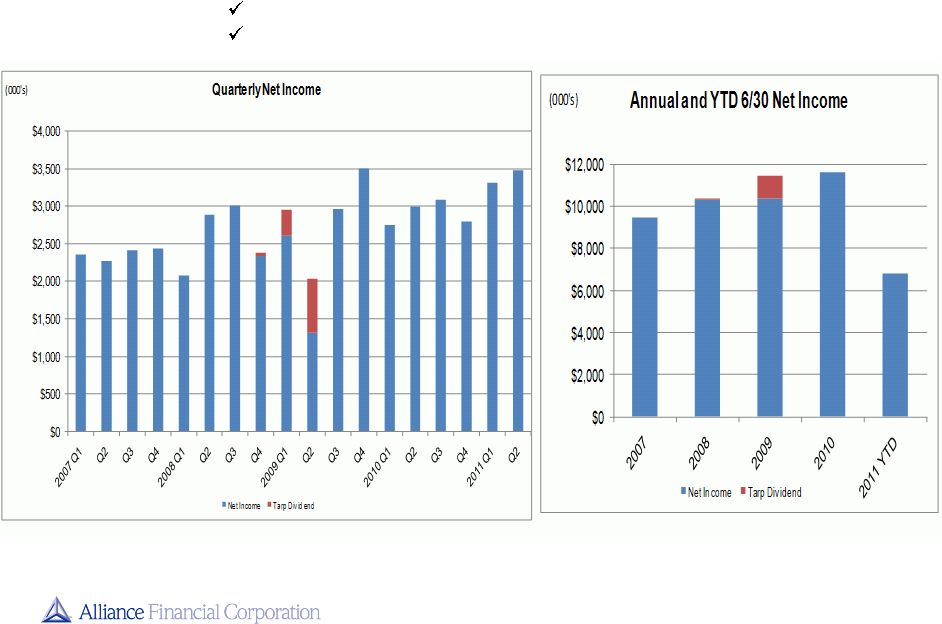

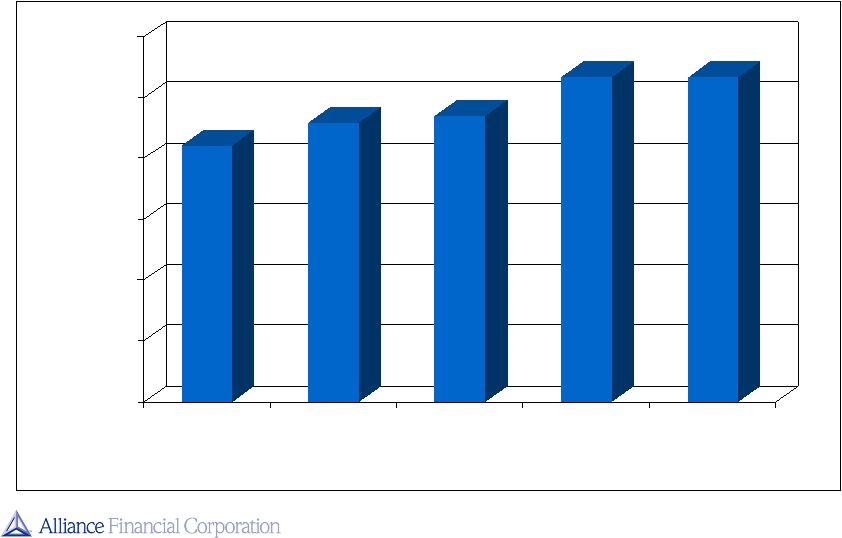

10

Net Income

Four consecutive years of record net income

First half 2011 net income 18% higher than first half 2010

|

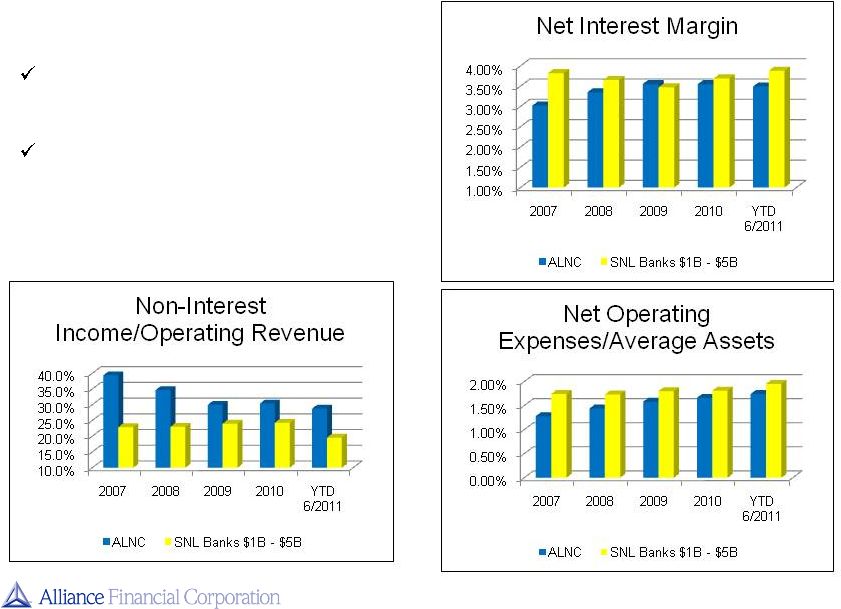

11

Key Operating Ratios

Diverse revenue stream helps to

reduce volatility of earnings in different

economic cycles

Net operating expenses favorable to

peers

Source: SNL Financial

Peer 2011 YTD information based on filings as of July 28, 2011

|

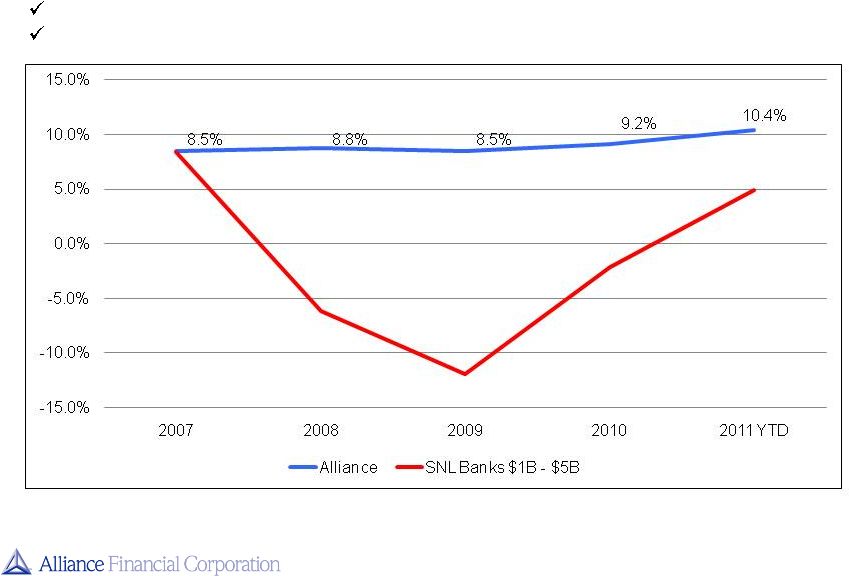

12

Disciplined community banking philosophy delivers relatively stable return on

equity Performance superior to peers

Return on Average Equity

Source: SNL Financial

Peer 2011 YTD information based on filings as of July 28, 2011

|

13

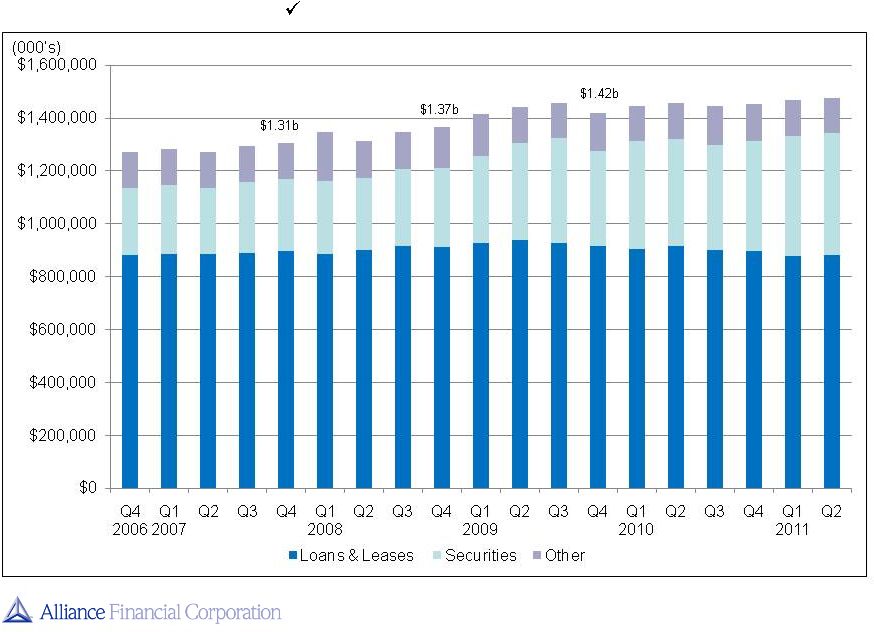

Total Assets

Prudently managed asset growth

$1.45b $1.48b

$1.27b |

14

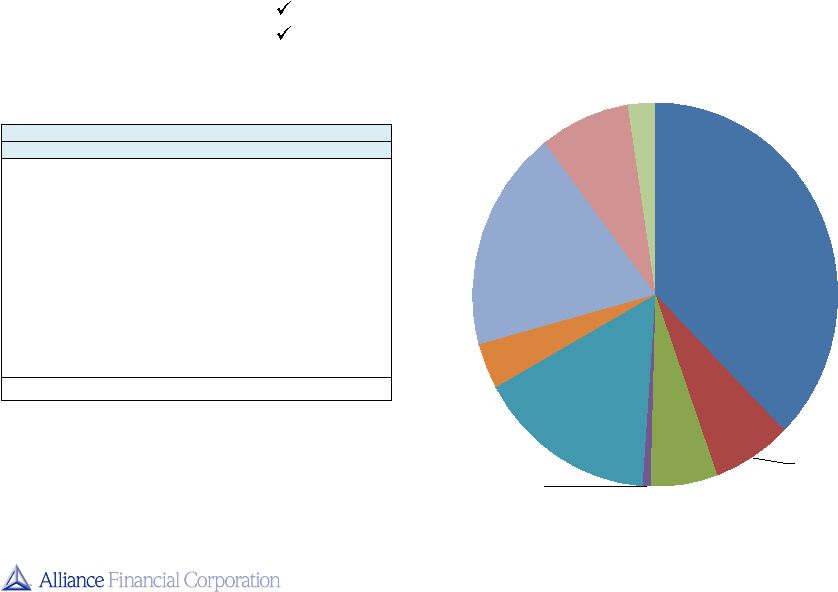

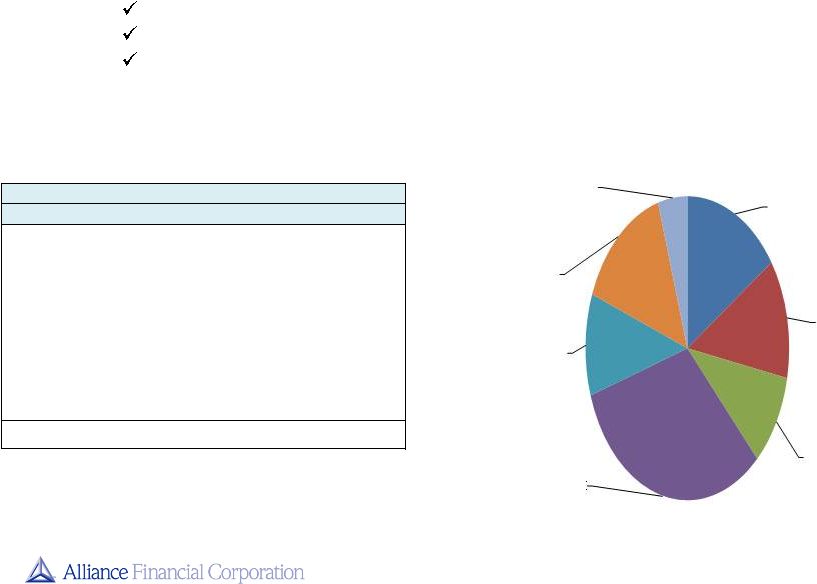

(Dollars in Thousands)

June 30, 2011

Deposit Type

Amount

% of Total

Residential Mortgage

330,059

$

37.5%

Owner Occupied CRE

61,583

7.0%

Non-Owner Occupied CRE

51,508

5.9%

Commercial Construction

6,537

0.7%

Commercial and Industrial

140,264

15.9%

Leases, Net

33,591

3.8%

Indirect Auto

165,440

18.8%

Home equity LOC

70,086

8.0%

Consumer

20,835

2.4%

Total

879,903

$

100.0%

Residential

Mortgage

37.5%

Owner

Occupied

CRE

7.0

Non-Owner

Occupied

CRE

5.9%

Commercial

Construction

0.7%

Commercial

and

Industrial

15.9%

Leases, Net

3.8%

Indirect Auto

18.8%

Home equity

LOC

8.0%

Consumer

2.4%

Diverse loan portfolio

Emphasis on quality

Loan Portfolio by Type |

15

Asset quality consistently better than peer averages

Reflects disciplined underwriting, relatively stable regional economy and real

estate market Asset Quality

2008

2009

2010

June 30, 2011

30 Days past due

11,124

$

7,883

$

6,711

$

5,893

$

60 days past due

4,736

$

2,271

$

1,083

$

1,788

$

90 days past due and still accruing

126

$

-

$

19

$

78

$

Non-accrual

4,352

$

8,582

$

8,474

$

8,262

$

Total non-performing loans and leases

4,478

$

8,582

$

8,493

$

8,340

$

ORE and repossessed assets

657

$

445

$

652

$

945

$

Total non-performing assets

5,135

$

9,027

$

9,145

$

9,285

$

Non-performing loans/total loans

0.49%

0.94%

0.95%

0.95%

Non-performing assets/total assets

0.38%

0.64%

0.63%

0.63%

SNL Banks $1B - $5B

2.72%

4.31%

4.05%

3.33%

Allowance for credit losses

9,161

$

9,414

$

10,683

$

10,683

$

Allowance/total loans

1.01%

1.03%

1.19%

1.21%

Allowance/NPL's

205%

110%

126%

128%

SNL Banks $1B - $5B (Allow./NPA's)

47%

39%

41%

49%

Net charge-offs

4,767

$

5,847

$

2,816

$

360

$

Net charge-offs/average loans

0.53%

0.63%

0.31%

0.08%

SNL Banks $1B - $5B

0.95%

2.04%

1.81%

1.31%

Provision/net charge-offs

115%

104%

145%

100%

SNL Banks $1B - $5B

158%

130%

107%

78%

Source: SNL Financial

Peer June 30, 2011 information based on filings as of July 28, 2011

|

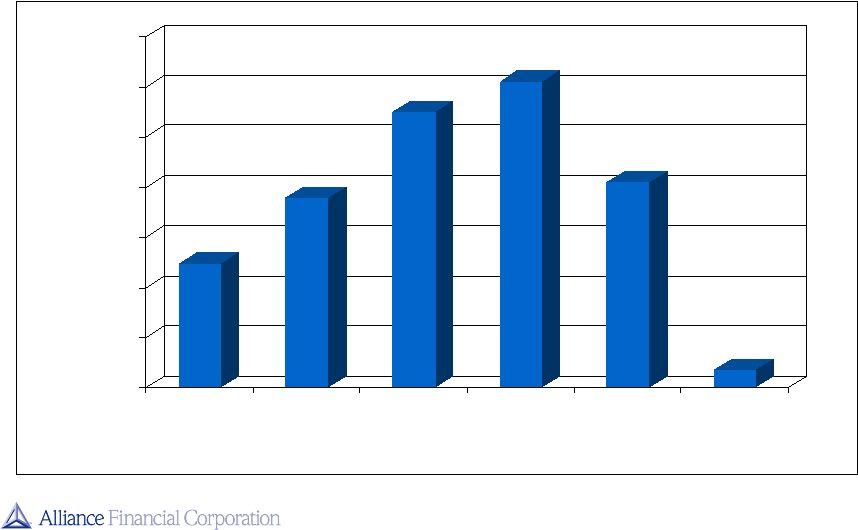

16

Provision for Credit Losses

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

2006

2007

2008

2009

2010

2011

YTD

$ in Thousands |

17

Allowance for Credit Losses

Allowance Coverage/Total Loans & Leases

0

2,000

4,000

6,000

8,000

10,000

12,000

2007

2008

2009

2010

Q2 2011

YTD

$ in Thousands

0.94%

1.01%

1.03%

1.19%

1.21% |

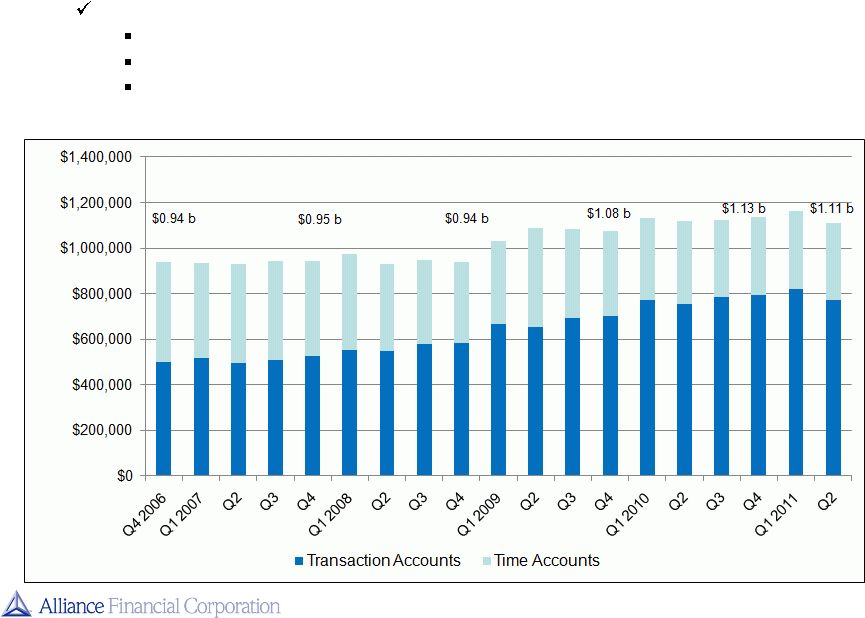

18

Deposits

Record high transaction account balances:

Strong balance sheet and earnings performance

High awareness of Alliance brand

Upgraded treasury management and internet banking platform

(000’s) |

19

(Dollars in Thousands)

June 30, 2011

Deposit Type

Amount

% of Total

Noninterest Bearing Demand

173,325

$

15.6%

Interest Bearing Demand

143,716

12.9%

Savings

109,739

9.9%

Money Market

347,184

31.3%

CD's, $100,000 or more

139,059

12.5%

CD's, Less than $100,000

154,700

13.9%

Brokered CD's

42,842

3.9%

Total

1,110,565

$

100.0%

Diversified deposit base

Branch incentive programs focused on demand account growth

Commercial lending strategy includes selling cash management services

and obtaining deposit relationship

Deposit Composition

Noninterest

Bearing Demand

15.6%

Interest Bearing

Demand

12.9%

Savings

9.9%

Money Market

31.3%

CD's >=

$100,000

12.5%

CD's < $100,000

13.9%

Brokered CD's

3.9% |

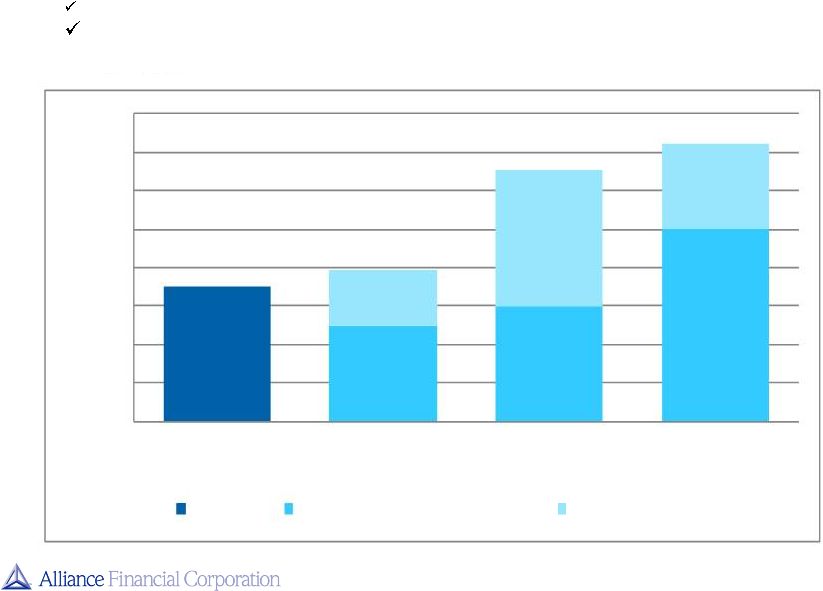

20

Strong Capital Ratios

Strong balance sheet supported by ample tangible common equity

Regulatory capital ratios at June 30, 2011 comfortably above

well-capitalized thresholds

14.4%

13.1%

7.9%

7.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

TCE/TA

Tier 1 Leverage

Tier 1 RB Capital

Total RB Capital

TCE/TA

Well Capitalized Minimum

Excess Over WC |

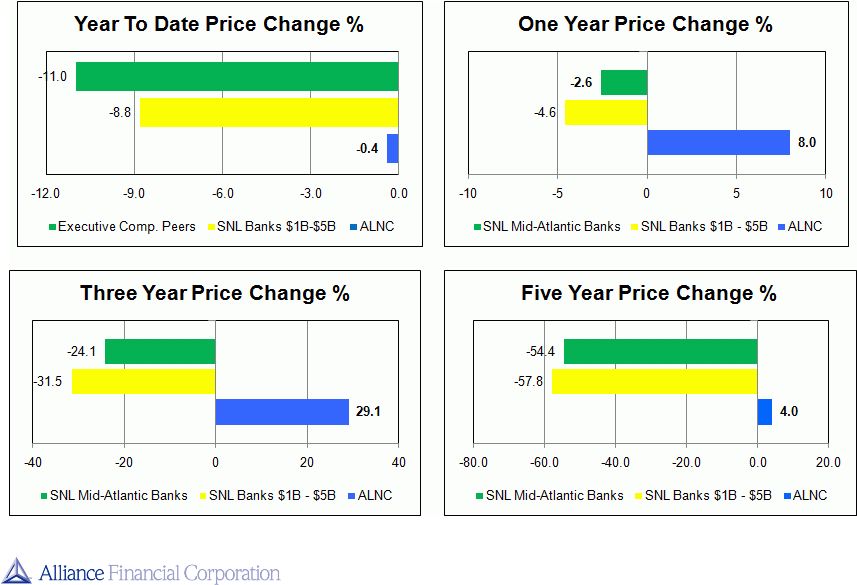

21

Stock Performance*

* As of July 28, 2011 Source: SNL Financial

|

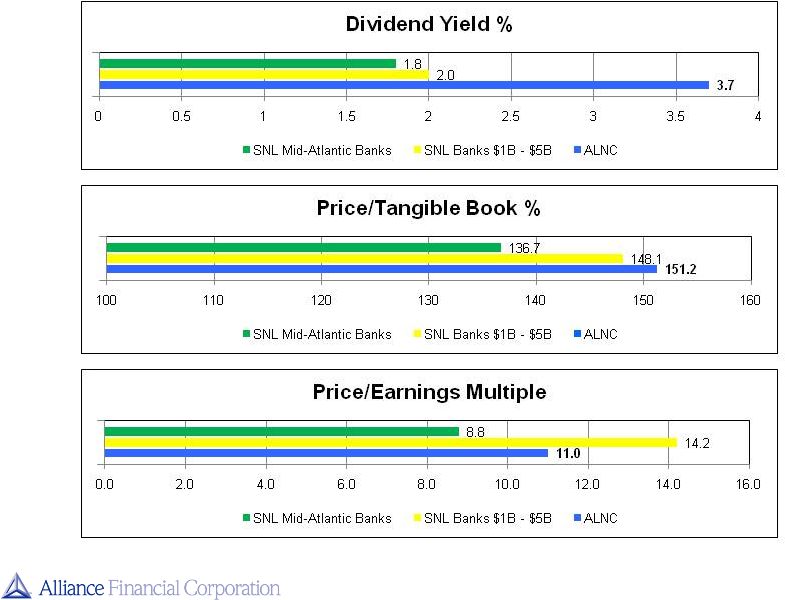

22

Stock Price Metrics*

* As of July 28, 2011 Source: SNL Financial |

23

Challenges and Opportunities

Low interest rate environment, difficult credit cycle and costs of increased

regulation will weigh on industry earnings generally

Our opportunities for continued success:

Capitalize on dislocation of competitive market, particularly in commercial

lending Continued adherence to our long-standing and disciplined credit

underwriting Leverage strength of Alliance brand

Build on existing customer relationships

Competitive electronic banking platform

Strong balance sheet, infrastructure and human capital to support growth

organically and via acquisition |

| 24

•

Experienced Management Team

•

Disciplined Credit Culture

•

Strong Asset Quality, Capital Ratios, and Liquidity

•

Strong Earnings Performance; Diversified Revenue Stream

•

Emphasis on Core Deposits and Relationship Banking

•

Controlled Organic Growth With Continued Opportunity to Exploit Competitive

Market Dislocation

•

Leading Community Bank in our Footprint, with Strong Brand Recognition

•

Insider

Commitment:

Substantially

all

Directors’

Fees

Deferred

to

Purchase

Alliance

Common Stock

•

Proven Ability to Execute Acquisitions

Why Invest in Alliance Financial Corporation |

Keefe, Bruyette & Woods

12

th

Annual Community Bank Investor Conference

August 2011

NASDAQ Global Market: ALNC

www.alliancefinancialcorporation.com |