Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - WAYNE SAVINGS BANCSHARES INC /DE/ | form8k-117456_wayne.htm |

| EX-99.2 - EXHIBIT 99.2 - WAYNE SAVINGS BANCSHARES INC /DE/ | ex99-2.htm |

Business

Overview

Overview

1

Rod Steiger, President & CEO

MISSION & VISION

2

• To Excel in Customer Service,

Operate Profitably, and be

Community Minded

Operate Profitably, and be

Community Minded

• To Be the Best Financial

Institution Possible

Institution Possible

STRATEGIC GOAL

• To Position Wayne Savings

As the Area’s Premier

Community-Minded Bank

As the Area’s Premier

Community-Minded Bank

3

• Focus: Loan Growth,

Risk Management,

Shareholder Value

4

• Strong Name Brand Recognition

• Excellent Reputation

• Safety & Soundness

• Local Decision Making

• Personal Attention to Customers

Investor Joseph Stilwell, et.al.

5

Recently acquired an additional 96,920 shares and

went from 6.49% ownership to 9.70%

went from 6.49% ownership to 9.70%

Quote from SNL Financial article (June 2011):

“Any bank that sticks to… its local community

and really works at it hard does OK, or better.

The people who are doing it right focus on

banking, and they make decisions irrespective, so

to speak, of their own personal well-being.”

“Any bank that sticks to… its local community

and really works at it hard does OK, or better.

The people who are doing it right focus on

banking, and they make decisions irrespective, so

to speak, of their own personal well-being.”

We live here, work hard, and agree with him.

6

WSCB Web Video

An Eventful Year

7

• Phil Becker Retired; New CEO

• New Director: Debra Marthey

• New Dodd-Frank Reform Bill

- Durbin Amendment - July 21st

2000 pages & 300 new regulations

- New Consumer Financial Protection Bureau

(CFPB) and Financial Stability Oversight

Council (FSOC)

• New CFPB will have wide-sweeping authority

• State-Chartered Thrift - Not a commercial

bank, but in many ways we act and look like

one

bank, but in many ways we act and look like

one

8

• Office of Thrift Supervision (OTS) was

replaced by the Federal Deposit Insurance

Corporation (FDIC) and will regulate Wayne

Savings Community Bank along with the

Ohio Department of Financial Institutions

(ODFI).

replaced by the Federal Deposit Insurance

Corporation (FDIC) and will regulate Wayne

Savings Community Bank along with the

Ohio Department of Financial Institutions

(ODFI).

9

• Federal Reserve Bank (FRB) will now

regulate Wayne Savings Bancshares Inc.

(WSBI), Holding Company

regulate Wayne Savings Bancshares Inc.

(WSBI), Holding Company

• OTS - ODFI - SEC

• FDIC - ODFI - FRB

CFPB - SEC

FDIC, ODFI, FRB,

CFPB, FSOC, SEC

EPS, ROE,

ROA, NIM,

Stock Value

Independence,

Take-overs,

Mergers

Future of

Community

Banking

Technology

Customer

Satisfaction

Satisfaction

Government

Regulations

& Mandates

Regulations

& Mandates

Loans -

Delinquencies,

C/O

Delinquencies,

C/O

CEO Concerns or….

What Keeps Me Up at Night

What Keeps Me Up at Night

My Vision

11

• A Place Customers Want to Come

• A Place People Want to Work

• A Place Investors Want to Invest

• Corporate Community Citizen

• Profitable

• Independent

1

LENDING

1

Joel Beckler, SVP, Senior Lender

2007 - $ 249,056

2008 - $ 247,038

2009 - $ 259,716

2010 - $ 252,760

2011 - $ 244,029

* Dollars in Thousands/all data as of March 31.

Total Loans

2

1-to-4 Family Residential Loans

2007 - $155,002

2008 - $155,363

2009 - $159,257

2010 - $159,140

2011 - $162,435

* Dollars in Thousands/all data as of March 31

3

Non-Residential Real Estate

Land Loans

2007 - $ 66,304

2008 - $ 65,789

2009 - $ 75,521

2010 - $ 70,167

2011 - $ 62,508

•Dollars in Thousands/all data as of March 31

4

Non-Performing Assets

As of March 31

2010 2011

(dollars in thousands)

Total Non-Performing Loans 4,319 5,157

Loans Deemed Impaired 2,185 5,827

Total Non-Performing and 6,504 10,984

Impaired Loans

Total Real Estate Owned 2,888 2,214

Total Non-Performing and 9,932 13,198

Impaired Assets

5

Non-Performing & Impaired Assets

to Total Assets at March 31

2007 - 0.23%

2008 - 0.49%

2009 - 1.43%

2010 - 2.31%

2011 - 3.24%

6

Allowance for Loan Losses

to Total Loans at March 31

2007 - 0.63%

2008 - 0.73%

2009 - 0.97%

2010 - 1.13%

2011 - 1.32%

7

Commercial Lending

Sector Exposures (data as of March 31, 2011)

SECTOR

1) Investment Rental $22.9 million

Properties

2) Manufacturing & Warehousing

Facilities $10.9 million

3) Commercial Office & Retail $12.3 million

4) Automotive Related Real Estate $ 6.6 million

BALANCE

OUTSTANDING

OUTSTANDING

8

TRUST

SERVICES

SERVICES

9

Wendy Blosser, SVP, Senior Trust Officer

Trust Department

Trusts offer an excellent means of

increasing a bank’s fee income.

increasing a bank’s fee income.

10

Financial Benefits

• Source of off-balance sheet

income to boost profitability

• Revenue stream that is not affected

by Net Interest Margin

- Average account life = 20 years

- Can continue for generations

11

Non-Financial Considerations

Customer needs

Retirement/Estate planning

Investment management

Trust services

Expanded customer relationships

Allows loan and deposit customers to also utilize

investment management and trust services

investment management and trust services

Customer retention

By offering all the services from one provider

Competition from banks and other providers

Market perception - full service provider

12

Target Market

Baby Boomers and their parents

-Elderly segment of population rapidly

expanding

-As longevity increases, many people depend

on fiduciaries to manage their wealth

-Massive shift of wealth from one generation to

the next

13

Year Six Results (as of March 31, 2011)

82 Accounts

Aggregate Market Value of

$41.5 Million

$41.5 Million

14

Account Details (data as of March 31, 2011)

|

41 Personal

Trusts/Estates |

$18 million

market value

|

|

14 IMAs

|

$4 million

market value

|

|

15 Rollover IRAs

|

$3.5 million

market value

|

|

12 Custody Accounts

|

$16 million

market value

|

15

Annual Fees

3/31/2006 3/31/2007 3/31/2008 3/31/2009 3/31/2010 3/31/2011

$187,520

$179,646

$197,799

16

$220,800

Looking Ahead

Total Potential Additional Market

Value approximately $30 million

Value approximately $30 million

Many unfunded accounts

Many successor accounts

Attorney referrals

17

RETAIL

BANKING &

OPERATIONS

OPERATIONS

1

Steve Dimos, EVP, Retail

Banking / Operations

Banking / Operations

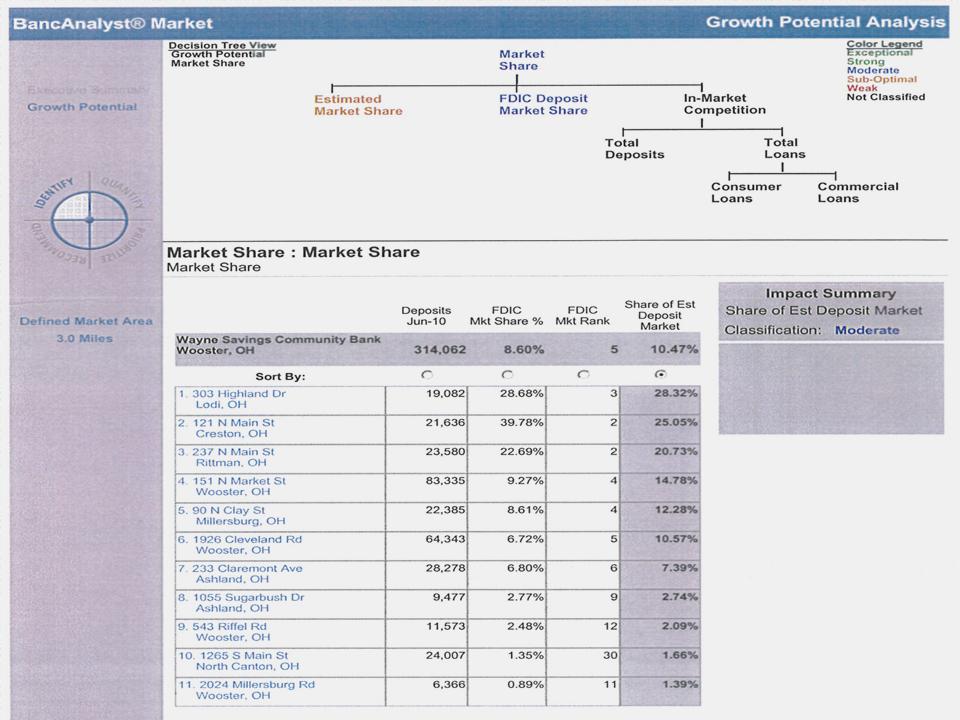

Branch Operations

This resource will help evaluate

our branch system.

our branch system.

Bank Intelligence Solutions:

2

FINANCIAL

HIGHLIGHTS

HIGHLIGHTS

1

Myron Swartzentruber, SVP, CFO

Wayne Savings Bancshares, Inc.

Annual Net Income

($ in millions)

Annual Net Income

($ in millions)

2

Wayne Savings Bancshares, Inc.

Net Interest Income

($ in millions)

Net Interest Income

($ in millions)

3

Wayne Savings Bancshares, Inc.

Return on Equity (%)

Return on Equity (%)

4

Wayne Savings Bancshares, Inc.

Shareholders Equity as a

Shareholders Equity as a

Percent of Total Assets / Capital

5

Wayne Savings Bancshares, Inc.

Dividend Payout Ratio

Dividend Payout Ratio

6

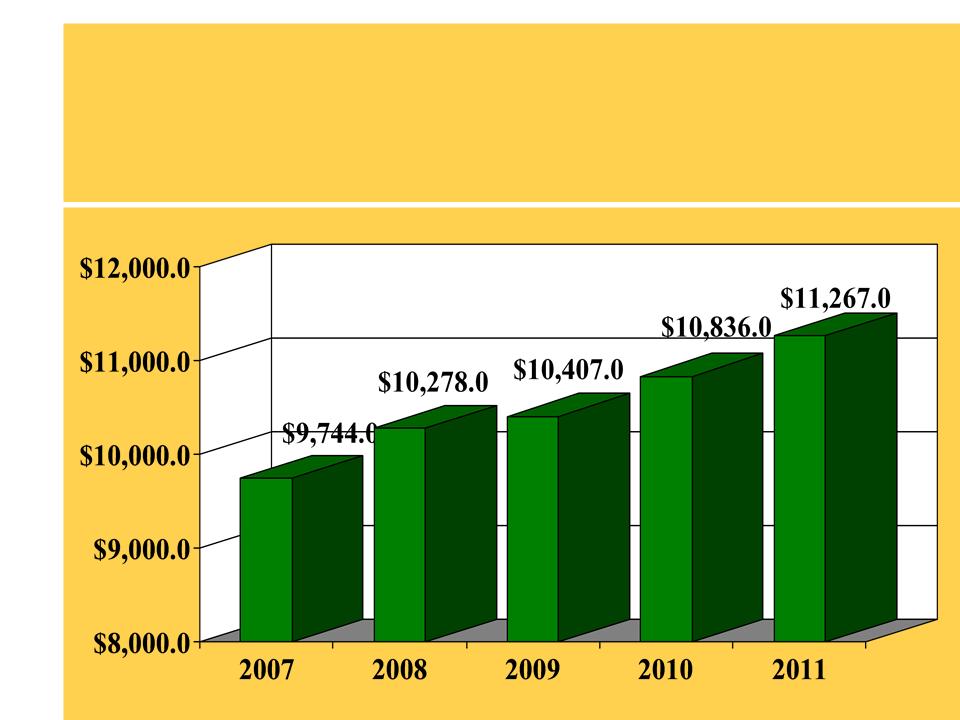

Wayne Savings Bancshares, Inc.

Total Assets

($ in millions)

Total Assets

($ in millions)

7

Wayne Savings Bancshares, Inc.

Total Deposits

($ in millions)

Total Deposits

($ in millions)

8

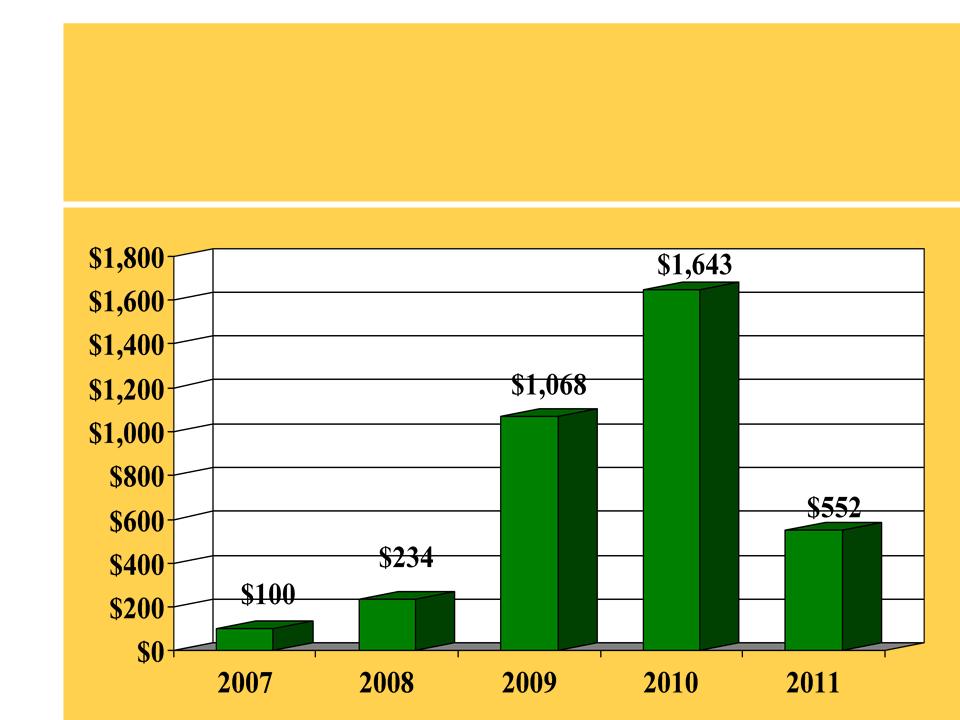

Provisions For Loan Losses

($ in thousands)

($ in thousands)

9

Non-Interest Income

($ in thousands)

($ in thousands)

10

Non-Interest Expense

($ in thousands)

($ in thousands)

11

RISK

MANAGEMENT

MANAGEMENT

12

H. Stewart Fitz Gibbon III,

EVP, COO, CRO

Risk Management

13

Major Strategic Initiative:

•development of an enterprise risk

management program

management program

Risk Management Framework

14

CAMELS:

C - Capital

A - Asset Quality

M - Management

E - Earnings

L - Liquidity

S - Sensitivity

(C) - Capital

15

• Increased by earnings

• Decreased by dividends and stock

buyback programs

buyback programs

• Decreased by losses

(A) - Asset Quality

• Delinquencies

• Non-performing

• Real estate owned

(M) - Management

17

• Everything not included in another category

• Compliance

• Community Reinvestment Act

• Trust

• Information Technology

• Legal

• Insurance

• Operations

• Accounting/Financial Reporting

• Reputation

18

(E) - Earnings

• Net Interest Margin

• Fee Income

• Non-interest Expense

(L) - Liquidity

19

ØOn balance sheet

• Securities

• Loans

• Cash

ØOff balance sheet

• Borrowing capacity

(S) - Sensitivity

20

• Interest Rate Risk

The company’s principal exposure

to market risk is through changes

in interest rates.

Enterprise Risk Management (ERM)

• www.sec.gov

• 8-K Filing

21

Change of Fiscal Year

• Currently March 31

• Will be December 31, starting at

the end of this year - 2011

the end of this year - 2011

• Annual meeting will be in April or

May instead of July

May instead of July

• Purpose is to provide better

comparisons with other institutions

and to facilitate call reporting.

comparisons with other institutions

and to facilitate call reporting.

22

QUESTIONS

23

Your investment and

continuing support are

greatly appreciated.

continuing support are

greatly appreciated.

THANK YOU

24