Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Delta Tucker Holdings, Inc. | d8k.htm |

Public Lender’s Presentation

August 1, 2011

For Public -

Side Dissemination

Exhibit 99.1 |

Safe

Harbor This presentation contains statements that may be considered forward

looking within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, such as estimates of

contract values, anticipated revenues from indefinite delivery, indefinite

quantity contracts; expected percentages of future revenues represented by

fixed-price contracts; and statements covering the Company’s

business strategy. These statements speak of DynCorp International’s

plans, goals, beliefs, or expectations, refer to estimates or use similar

terms. Actual results could differ materially, because the realization of

those results is subject to many uncertainties. All

forward

looking

statements

included

in

this

presentation

are

based

upon

information presently available. DynCorp International undertakes no obligation

to publicly update or revise any forward-looking statement. The risks and

uncertainties relating to the forward-looking statements in this

presentation include those described under the caption “Risk

Factors” and “Forward-Looking

Statements”

in Delta Tucker Holdings Inc., DynCorp International’s parent,

Registration Statement on form S-4 which was declared effective on June 21,

2011.

This presentation includes non-GAAP financial measures, including Adjusted

EBITDA,

that

are

different

from

financial

measures

calculated

in

accordance

with

GAAP and may be different from non-GAAP calculations made by other

companies. A quantitative reconciliation of non-GAAP information to the most

directly

comparable

GAAP

financial

measures

has

been

included

in

this

presentation. |

Page 3

August 1, 2011

Presenters

DynCorp International

Steve Gaffney, Chairman and CEO

Bill Kansky, Senior Vice President & CFO

Chris Porter, Vice President & Treasurer

Bank of America Merrill Lynch |

1.

Business Summary and Update

2.

Financial Review

3.

Amendment Review

4.

Questions & Answers

Agenda |

Page 5

August 1, 2011

Business Summary and Update |

Page 6

August 1, 2011

Business Strategies

Leverage LOGCAP IV to become the

leading defense contingency services

provider

Diversify portfolio into intelligence and

international capacity building

Leverage experience in Training and

Mentoring into other rule of

law/governance/mentoring customers

Business Strategies

Consolidate and expand leading position in

aviation maintenance

Leverage DoS Air Wing and APPS Aviation

Task Orders into new aviation services

customers

Become a leading defense land equipment

O&M provider

Business Strategies

Continue to support INSCOM translator

needs throughout he complete draw down of

troops in Iraq

Expand capabilities to focus on higher-

value intelligence and mentoring

requirements

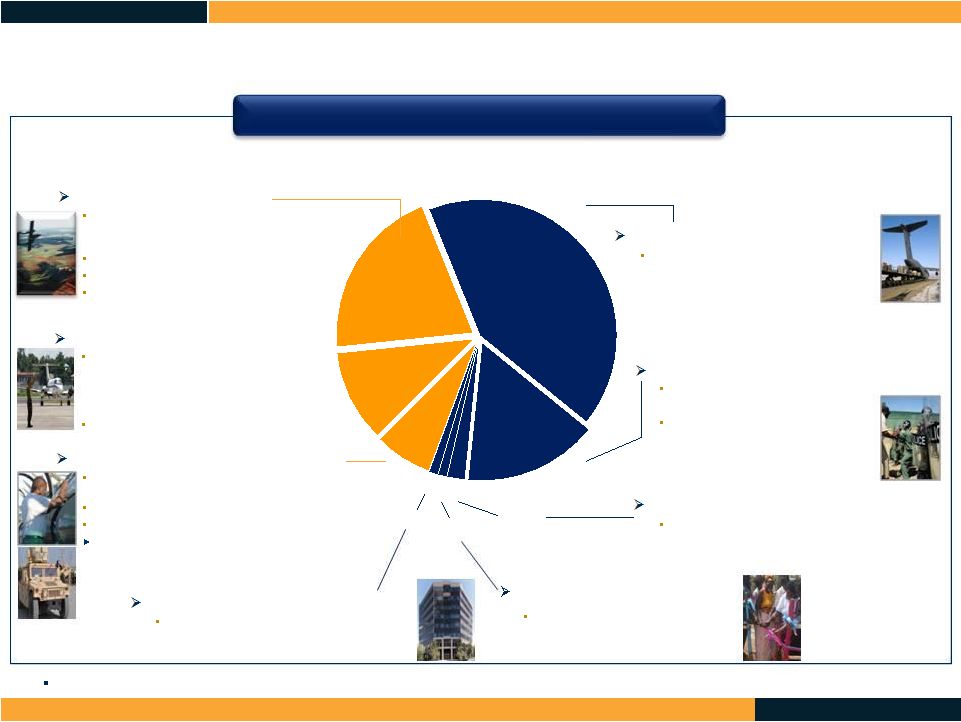

With a heritage extending from 1951, DI is a leading

provider of specialized, mission-critical outsourced

professional and technical support services

CY 2010 Revenue: $3.4B*

CY 2010 Adjusted EBITDA: $219.7M

Personnel: ~23,000 in 36 countries

*Excludes GLS Revenue

DI Facts:

97% of Revenue Generated as Prime Contractor

Contract Mix:

61% -

Cost Reimbursement

27% -

Fixed Price

12% -

Time & Material

98% of Revenue Generated from U.S. Government

$2.14B

$2.38B

$2.56B

$3.39B

FY08

FY09

CY09

CY10

Historical Revenue*

Global Platform Support Solutions

(GPSS)

Global Stabilization & Development

Solutions (GSDS)

Global Linguist Solutions

(GLS)

DynCorp International, Inc.

Delta Tucker Holdings, Inc

Other DoD

3%

Other

3%

Army

50%

Navy

7%

Air Force

8%

DOS

29%

Revenue By Customer (CY10) |

Page

7 August 1, 2011

DI Business Area Team Offering

Aviation: $695.1M

Aircraft maintenance and logistical support

services for 200 U.S. Army and Navy C-12/RC-

12/UC-35 reconnaissance aircraft

Life cycle support for USG VIP aircraft

Aerial firefighting in California

Various CONUS/OCONUS fleet support

programs

Air Operations: $372.2M

Aircraft maintenance and operations support

services to DoS including; support to drug

eradication missions in South America

through INL contract; Colombian National

Police ARAVI air service support

Secure Aviation Transport in Iraq &

Afghanistan

Operations and Maintenance: $230.5M

Maintenance of in-theater vehicles and support

equipment including NAVISTAR MRAPs

Maintenance support to UAE armed forces

Reset/Recap services through Army FIRST

Base operations support

Development: $32.5M

Intel Training & Solutions: $33.8M

Intelligence technical, analytical and HUMINT

training and operations services, enabled through

Phoenix Consulting acquisition in 2009

Total Revenue by Business Area Team CY 2010

Global

Linguist

Sol

Global Platform Support Solutions (GPSS)

$1.3B (38.3%)

Global Stabilization & Development Solutions (GSDS)

$2.1B (61.7%)

Rule of law, anti-corruption and post-

conflict resolution support through recent

purchase of Casals & Associates

41.9%

15.8%

6.8%

11.0%

20.5%

Contingency

Operations:

$1,423.5M

Provides in-theater logistical support to

government personnel through LOGCAP IV

and AFCAP

Training & Mentoring : $534.7M

Mentoring of local military, Intel, justice and

law enforcement personnel

Training of indigenous police forces

through CIVPOL

Security

Services:

$67.9M

Security services for DoS through WPPS

1.0%

1.0%

2.0%

Global

Linguist

Solutions

(GLS):

$594.9M

(Deconsolidated and not reported as part of DI revenues as of Q2 CY 10) |

Page 8

August 1, 2011

CEO View

Strong Leadership Team in Place

Operations aligned to meet the needs of the customer

Centers of Excellence drive efficiency and accountability

High Confidence in ability to achieve 2011 results

MRAP contracts will experience lower profit levels as program moves to sustainment

phase Expect lower margins as ACAS transitions to AMDP

T&M dominated contract migrates to cost responsive contract

Favorable to budget, award fee on LOGCAP significantly de-risks plan

De-leverage Plan Remains Focus

Debt reduction ahead of original plan

$50M term loan reduction achieved in March

$100+M term loan reduction anticipated in 2H 2011-primarily through working

capital improvements and earnings

Focus remains on freeing up working capital

Market Dynamics Evolving - Revenue Opportunities Identified |

Page 9

August 1, 2011

Market Environment

Business Area

Description

Key

Customers

Size &

Outlook

DI Differentiators

Contingency

Operations

•

Provide Responsive Support to Large

Numbers of Deployed Government

Personnel

~$8B

•

Long-term Position on LOGCAP (10 Year

Award)

•

Expanding Global Footprint

Training and

Mentoring

•

Law Enforcement and Security Capacity

Building

•

Mentor and Advise Foreign Ministries

~$8B

•

Largest Int’l Police Trainer

•

Mentoring in Support of U.S. Foreign

Policy

Aviation

•

Aircraft Upgrades and Maintenance

•

Depot and Ground Support

~$8B

•

Strong Legacy Position and Past

Performance

•

59 Years of Experience in CFT Program

Air Operations

•

Support Full Flight Operations

•

Counter Narcotics Air Support

•

Diplomatic Air Transport

~$2B

•

Good Contract Positions

•

Demonstrated Ability to Transfer

Knowledge

Operations and

Maintenance

•

Manage & Support Gov’t Facilities

•

Operations and Maintenance Support

for Ground Fleets

~$9B

•

Ability to Leverage Strong Legacy O&M

Capabilities

•

Best Value

to Gov’t

•

Broad OCONUS Operations Capabilities

Intelligence

Training

Solutions

•

Provide Sophisticated HUMINT Training

Services

and

Intelligence,

Technical

and

Analytical

Services

~$8B

•

Strong Customer Intimacy with IC

Agencies

•

Strong Contract Positions

Development

•

Provide Post-conflict Development

Expertise

•

Rule of Law and Nation Building

~$2B

•

Growing USAID Footprint

•

Full Global Reach

Security

Services

•

Provide Comprehensive Protective SS

to Support U.S. Department of State

Operations Around the World

~$0.5B

•

Strong Legacy Position

•

Global Footprint and Capabilities

UAE

Kuwait

UAE

SA |

Page 10

August 1, 2011

Big Drivers in US Defense and Foreign Policy

Afghanistan

“What we can do, and will do, is build

a partnership with the Afghan people

that endures—one that ensures that

we will be able to continue targeting

terrorists and supporting a sovereign

Obama, 6/22/11

•

President

Obama

provided

military

commanders maximum flexibility by

leaving the surge force in place through

the 2011 fighting season.

•10,000

end

of

2011.

Remaining

23,000

will

depart by summer of 2012, 70K forces

left in country.

•Increased Emphasis on building and

sustaining long-term Afghan National

Security Forces capabilities.

•

agreement is actively being

negotiated.

Will include the “non

permanent”

basing of 25,000 US troops

in Afghanistan at 3 major bases and

multiple FOBs.

•

USAID will consolidate

at 4 major

consulates and at the Embassy in Kabul.

•

throughout 2014; funding through

DoS likely to shrink.

The Admin has

lowered its FY12 request from $4.3B to

$3.2B.

Iraq

“Iraq is considering the possibility of

making a request for some kind of

presence to remain there. I have

every confidence a request…will be

forthcoming at some point.“-

Secretary of Defense designate Leon

Panetta

•

Political pressure to make agreement

on

permanent

troop

presence

–

but

Panetta upbeat in Senate Confirmation

hearing.

•The Administration request for State

Department funding in Iraq for Fiscal

Year 2012 is $6.2 Billion.

•

State presence will be driven by

Congressional budget.

•

Iraq sent a letter to Congress urging

full

funding:

John

Negroponte,

Zal

Khalilzad, Ryan Crocker and Chris Hill.

•

Embassy concerns focus on

Kurdish/Shia strains over oil, border,

and population. Bets are that conflict

won’t erupt; Kurds won’t risk current

semi-autonomous status.

DOD Budget

“I want to emphasize that while

America is at war and confronts a

range of future security threats, it is

important to not repeat the mistakes

of the past by making drastic and ill-

conceived cuts to the overall

defense budget.”

Secretary of

Defense Robert Gates

•

$670B

•Fully funds OCO

•O&M budget request is $204B

–

up $15B from FY08

•Procurement request $111B –

down $13B from FY08

equals reset and refurbishment of

existing

assets;

focus

on

maintaining

and upgrading existing platforms and

systems.

•

Latin America Drug War

More than 90 percent of the South

American cocaine that reaches the

United States funnels through

Guatemala and across Mexico’s

southern border, according to the

latest intelligence from the U.S. Drug

Enforcement Agency.

Year

2012

is

$335M.

Focus

is

capacity

building.

$20M

of

the

$1.6B

Merida

initiative

aid

package to Mexico has been assigned

to security for Mexico’s southern border

promised to spend $200M in FY12,

double FY11 spending,

to help Central

American countries fight the cartels and

regain control of lawless territories.

FY12;

up

from

$45M

in

FY11.

“A 2010 cable from US diplomats made

public by WikiLeaks reveals Guatemala

has only a single helicopter and five

pickup trucks to patrol its entire border

with Mexico.”

that only 125 Mexican immigration

officials monitor the country’s 540 mile

border with Guatemala.

surge

troops

will

be

withdrawn

Afghan

A long-term strategic framework

Civilian Advisors from DoS and

Civilian advisors will continue to grow

U.S. troops to stay after 2011?

Civilian footprint?

Four former US Ambassadors to

Short/Medium-term stability:

FY

11

DOD

Budget

(enacted

in

CR)

FY12 DOD Budget Request –

$671B

O& M up plus Procurement down

Continued DOD Growth Areas vs.

US Assistance to Mexico for Fiscal

US officials concede that only about

The Obama Administration has

In the Caribbean Basin, $75M in

According to the Washington Post:

The US Embassy in Mexico

states

government.”

-

President

OCO request –

$119B

New Efficiencies:

•

Continued growth of rotary-wing

systems—Army/Air Force

•Reduce non-combat headcount—

return to outsourcing?

•Divest assets—public/private

depot partnerships?

Permanent

and Expanded Authority for

Army Industrial Facilities to

Enter into Certain Cooperative

Arrangements with Non-Army

Entities

–

2012 HASC Bill |

Page 11

August 1, 2011

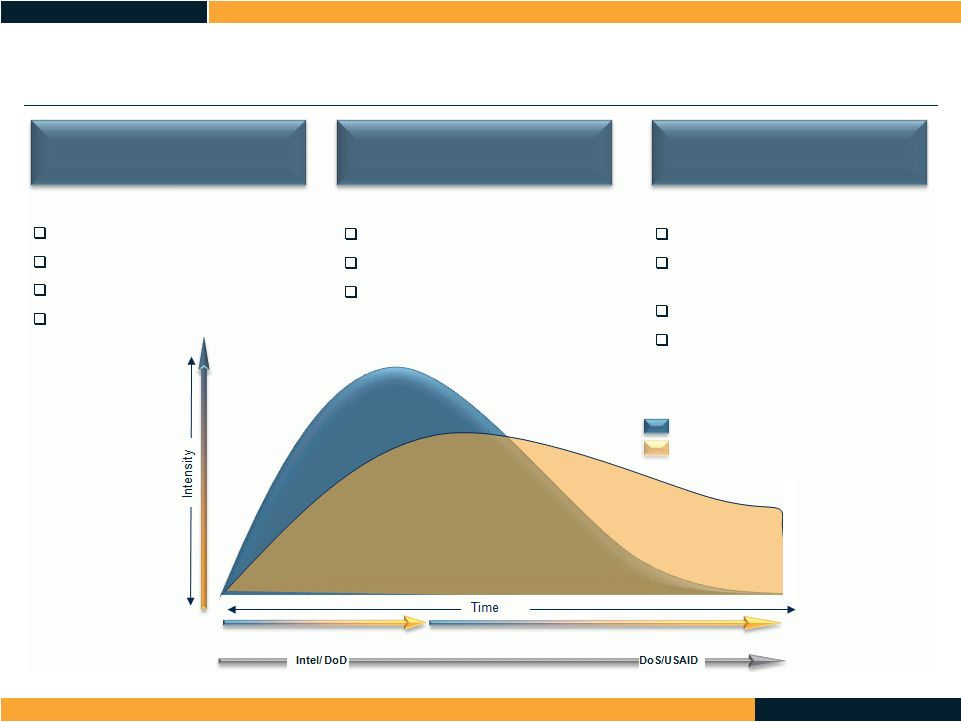

Integrated Life-Cycle of Services

Support Military Readiness

LOGCAP IV

Linguistics & Translation

Fleet Management

Aviation Services

Development

Defense

Diplomacy

Host Nation Capacity Building

Conflict Resolution

Peacekeeping Operations

Drill Wells to be used by Villages

Enabling the Rule Of Law

Civilian Police Training

Training & Mentoring at Foreign

Ministries

De-Mining

Drug Eradication

Stabilization, Security, Transition, and Reconstruction Operations (SSTR)

Major Combat Operations

Government Role

Contractor Role

Lead Agency |

Page 12

August 1, 2011

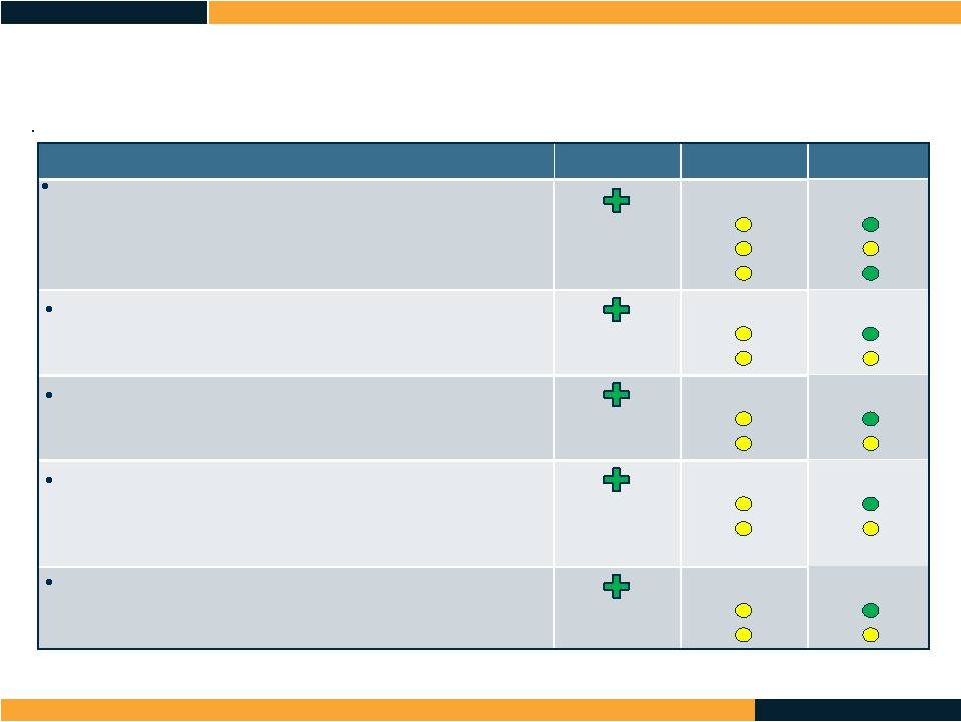

Improvement

Opportunities

(Critical

Action

Plan)

Reduce Indirect Cost Structure

–

Delayer and Develop Market Focus

–

Optimize Business Processes

Supply Chain Redesign

–

Identify the Right Leaders

–

Develop

Second

and

Third

Tier

Leaders

to

Support

Growth

Focus on Talent Development

–

Employee Assessments Complete –

All Level 1 & 2 Employees

–

Leadership

Training

and

Talent

Framework

Defined

–

Courses in

Development

Deleverage the Company

–

$50 million Debt Reduction in March 2011

–

$100+ million Additional Reduction Expected in 2H 2011

Initiative

Change

Mar ‘11

June ‘11

Business Development Redesign

–

Develop Marketing Department

–

Capture Process Enhancement

–

Pricing Function Aligned Within BD (Accountability and Impact)

|

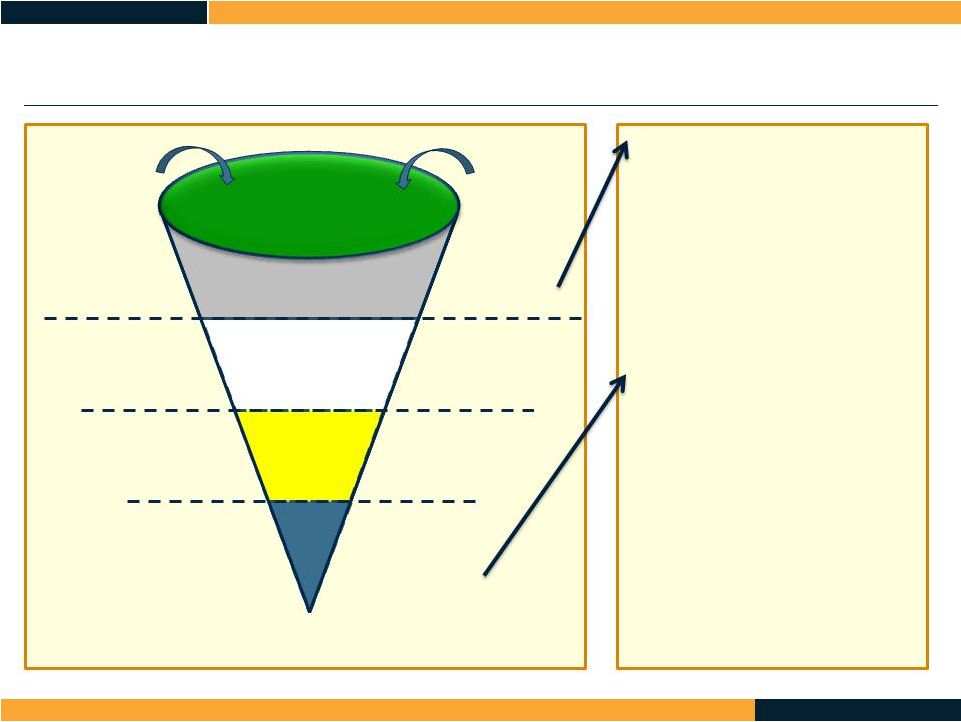

Jul

2010 Apr 2011

78 Interests

21 Pursuits

12 In Work

37 Submitted

83 Interests

19 Pursuits

18 In Work

39 Submitted

$8.0B

$4.2B

$2.1B

$1.8B

$13.5B

$4.5B

$1.2B

$4.3B

+ Redwood, Dlite

Total

$16.1B vs. $23.5B

New Business Opportunity Funnel

•

$5B Increase in Opportunities

Identified ($13.5B vs $8.0B)

–

Aviation -

$6.5B (AMCOM

Aviation

Field

Maint

-

$2B),

CNTPO

-

$1B,

USAF

C-20/37

CLS

-

$.8B)

–

Contingency Operations -

$4B

(UK Opportunities >$3B)

–

Training and Mentoring up $1.6B

(CJPS TO $1B, Law Enforcement

Professional Program -

$.5B)

•

$2.5B Increase in Submitted

Proposals

–

Security Services –

WPS Pursuit

-

$1.35B

–

Aviation -

$1.4B (VIPSAM -

$.4B,

NTW Pax -

$.5B, JPATS -

$.5B)

–

ITS –

Adventure -

$.2B

–

Contingency Operations -

$.8B

(LOGCAP BLS -

$.6B, UK

AFGHAN ISP -

$.2B)

–

Training and Mentoring -

$.5B

(Conventional Weapons

Destruction $.1B)

Page 13

August 1, 2011 |

Operational Highlights

LOGCAP IV Overall Performance is Very Good

Award Fee Score (improved) is in-line with original expectations

Submitted proposal for DoS Baghdad Life Support (BLS)

Afghan National Police (AMDP) Program is Transitioned

$1.25B/2.5yr DoD program awarded 30 Dec 2010

750 Mentors/Trainers and 3,400 support personnel

Principal Training program for the Afghan Security Force

Recent Win of the DoS Criminal Justice Police Services (CJPS) program

MRAP Up-Armor Installation Kit Win

In-theater upgrade of 10,000+ vehicles

Strengthens DI’s capabilities across the MRAP fleet

DoS Iraq Air Wing Expansion

Transfer of Authority from DoD to DoS by 31 Dec 2011

Build-out of 41 aircraft, infrastructure, and 800 personnel

Anticipated Afghanistan/MENA expansion

Page 14

August 1, 2011 |

Page 15

August 1, 2011

Operational Highlights -

Continued

Multiple Wins in Aviation

Regional Aviation Support Management –

West (RASM-W) $185M potential value

Fort Drum Directorate of Logistics (DOL) Aviation Logistics Management Division

(ALMD) -

$59.8M potential value

Four Recent

Task Order on Under the Air Force Contract Augmentation

Program (AFCAP)

$48M value

Includes Power production in Qatar and the Kyrgyz Republic, Vehicle Fleet

Management in Afghanistan and Engineering Services in the Kyrgyz

Republic

Worldwide Protective Services (WPS) Security Support in Irbil

$550M potential value

GLS Joint Venture

One of Six Providers selected to compete for Task Orders on Defense Language

Interpretation Translation Enterprise (DLITE) Contract

|

Page 16

August 1, 2011

Improvement Initiatives Already Yielding Results

Military, Diplomatic & Development Tools All Needed to Achieve Global

Stability Aligns with DI’s Integrated Life Cycle Offering

International Partners Will Need Our Support

Markets

are

Dynamic

–

O&M

Funding

is

Stable

2011 O&M Funding Greater than Procurement and RDT&E Combined

DoS Funding Up 33% Since 2008

Business Development pipeline up 46% since July 2010

Highly Confident in 2011 Targets and Strongly Committed to Longer-Term

De-Leveraging Plan Summary |

Page 17

August 1, 2011

Financial Review

Note: FY = LTM as of Friday closest to March 31

CY

=

LTM

as

of

Friday

closest

to

December

31

st

st |

Page 18

August 1, 2011

Highlights

Revenue

LOGCAP IV

Secure Air Transportation

Ft. Campbell 101st

CSTC-A, MNSTC-I, AMDP

CivPol Lower Content

MRAP Program to Sustainment

Program Losses-APK Somalia,

LCCS-Army, Qatar Guards

Adj.

EBITDA

LOGCAP IV Volume, Award Scores

New Contracts

Operational Efficiencies

CivPol Volume & Mix

MRAP Lower Profitability

Iraq Construction

GLS Lower Troop Levels in Iraq

Dollars in millions

* Adjusted for deconsolidation of GLS

Q1 2011

vs Q1 2010

Revenue*

$884.3

$894.0

(1.1%)

Adjusted EBITDA

$55.6

$55.6

–

Adjusted EBITDA Margin

6.3%

6.2%

10 bps

vs. Q4 2010

Total Backlog

$4,294.3

$4,782.2

(10.2%)

First Quarter 2011 Results |

Page 19

August 1, 2011

Q2

2011

Revenue

–

Range

$885M

to

$895M

Up 12% at Mid-Point from Q2 2010 (Excluding GLS Revenue)

Q2

2011

Adjusted

EBITDA

–

Range

$43M

to

$45M

Down $8.5M at Mid-Point from Q2 2010

6M

YTD

Revenue

–

Range

$1.77B

to

$1.78B

Up 5.1% at Mid-Point from 6M YTD 2010 (Excluding GLS Revenue)

6M

YTD

Adjusted

EBITDA

–

Range

$99M

to

$101M

Down $8.1M at Mid-Point from 6M YTD 2010

Resulting 2011 YTD Margins of 5.6%

2011 Guidance –

Second Quarter & YTD |

Page 20

August 1, 2011

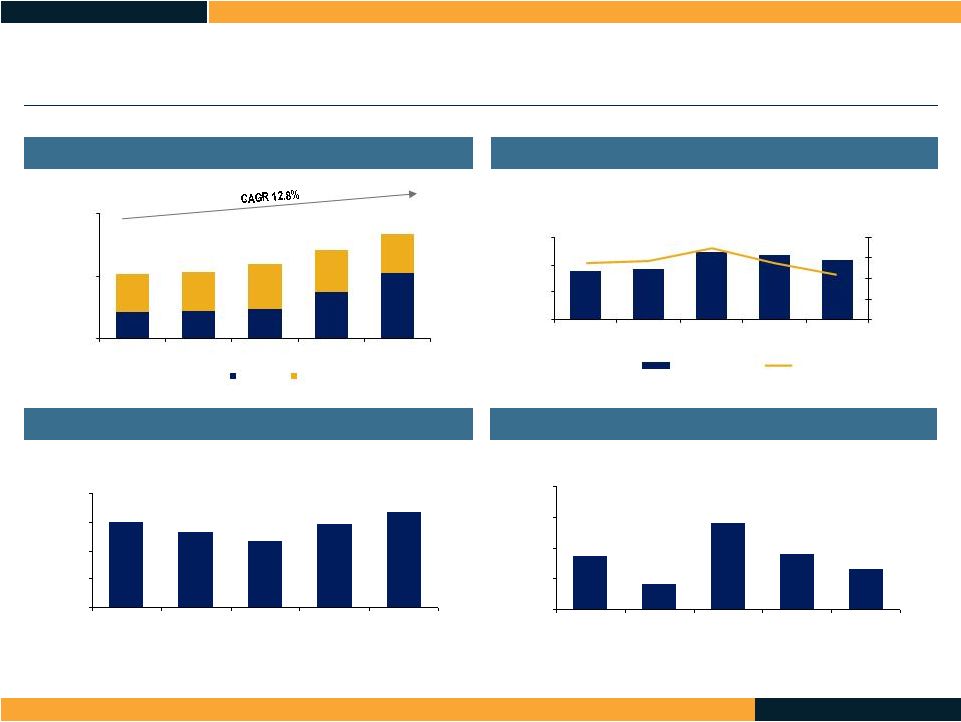

Summary Historical Financials

Capital Expenditures FY 2007-LTM 4/1/11

Adjusted EBITDA FY 2007-LTM 4/1/11

Segment Revenue FY 2007-LTM 4/1/11

(1)

Operating Cash Flow FY 2007-LTM 4/1/11

($ in Millions)

($ in Millions)

($ in Millions)

($ in Millions)

Note: FY = LTM as of Friday closest to March 31st.

(1) Excludes GLS and other corporate revenue

(2)

Capex

calculated

as

total

Capex

less

purchase

of

helicopter

assets.

(3) Excludes expenses related to merger.

(2)

(3)

$87

$42

$141

$90

$66

$0

$50

$100

$150

$200

2007

2008

2009

2010

LTM 4/1/11

$9

$8

$7

$9

$10

$0

$3

$6

$9

$12

2007

2008

2009

2010

LTM 4/1/11

$181

$183

$249

$236

$220

8.2%

8.6%

10.5%

8.3%

6.5%

$0

$100

$200

$300

2007

2008

2009

2010

LTM 4/1/11

0.0%

3.0%

6.0%

9.0%

12.0%

Adjusted EBITDA

Margin

862

884

969

1,512

2,108

1,224

1,253

1,421

1,325

1,263

$2,087

$2,136

$2,384

$2,838

$3,377

$0

$2,000

$4,000

2007

2008

2009

2010

LTM 4/1/11

GSDS

GPSS |

Page 21

August 1, 2011

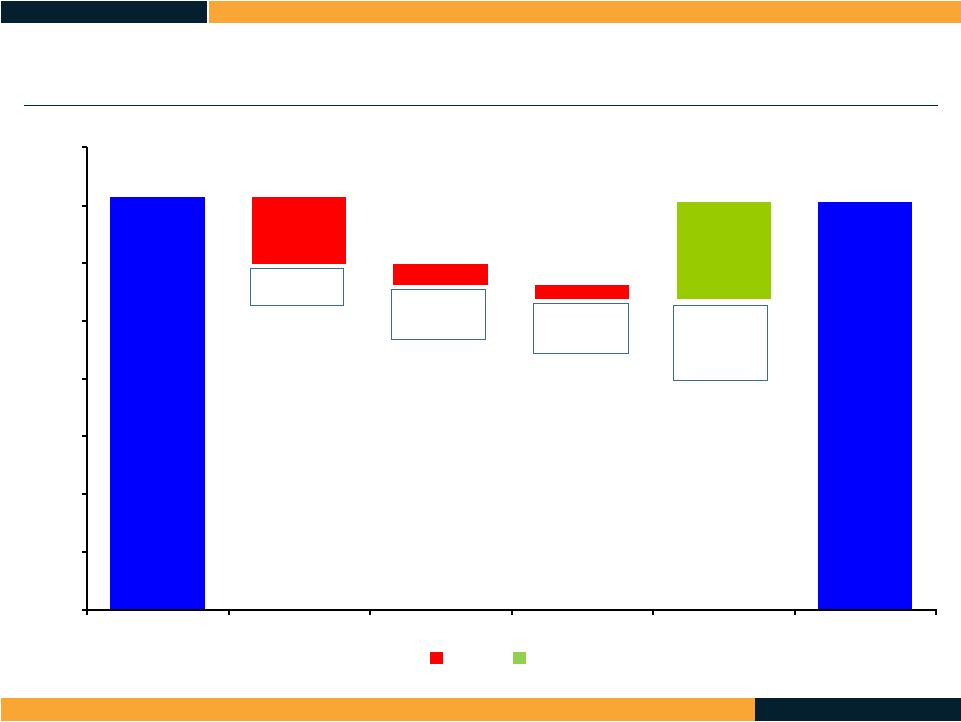

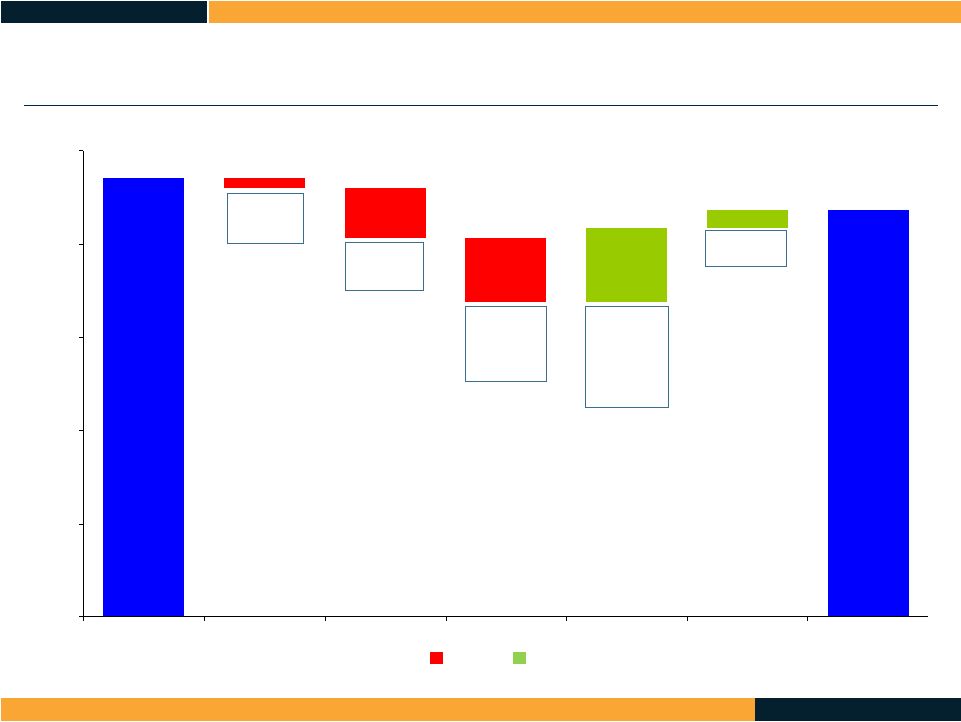

LTM 4/2/10 to LTM 4/1/11 Revenue

GLS

Deconsolidation

Lower CivPol

and MRAP

Volume

LCCS loss of

contract and

other items

LOGCAP IV, Air

Wing Volume

and new Training

and Mentoring

contracts

(Millions)

Losses

Additions

3,572

3,527

(585)

(176)

(123)

839

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2010

2011 |

Page 22

August 1, 2011

LTM 4/2/10 to LTM 4/1/11 Adjusted EBITDA

235.5

219.7

5.5

26.6

34.2

40.8

9.7

0

50

100

150

200

250

2010

2011

Higher Legal

Costs/

Settlements

GLS Volume

(Troop

Levels)

Lower Volume

and Mix on

CIVPOL,

MRAP, and

Air Wing

Higher

LOGCAP IV

and New

Training and

Mentoring

Contracts in

Afghanistan

LCCS

Settlement

(Millions)

Losses

Additions |

Page 23

August 1, 2011

Company on Plan Through June 2011

$1.775B of Revenue at Mid-Point

$100M of Adjusted EBITDA at Mid-Point

YTD Margins of 5.6% In-Line with Previous Guidance

Deleveraging Strategy On-Track

$50M Debt Pre-Payment in March 2011

Targeting $100M of Additional Pre-Payment in 2

nd

Half of 2011

Second LOGCAP Award Fee Score Higher

Score in the Very Good Category

De-Risks 2

nd

Half Plan

Requesting Credit Facility Amendment

Summary |

Page 24

August 1, 2011

Credit Facilities Amendment Request |

Page 25

August 1, 2011

Amendment Summary

s

Financial Covenants

Increase Total Leverage covenant to 5.5x over the next 4 quarters, stepping down to

3.25x over time Existing covenant steps down to 4.5x at year end

Improve interest coverage covenant so as not to be more restrictive than total

leverage Permit up to $50 million of unrestricted cash to be netted in testing

covenants (currently capped at $25 million) Amendment Rationale

Seeking modest flexibility on covenant levels

No other material changes to be made to the credit agreement

Offer to lenders will consist of:

A 50 bps Amendment Fee to consenting lenders

Extension of the 101 soft call provision for an additional 6 months

DynCorp is seeking an amendment to improve Leverage and

Interest Coverage cushions |

Page 26

August 1, 2011

Timeline

Date

Event

August 1

st

Lender’s Call & Post Revised Model and Amendment Doc

August 8

th

Consents Due by 5pm ET

August 10

th

Close Amendment

August 2011

Sun

Mon

Tue

Wed

Thu

Fri

Sat

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31 |

Page 27

August 1, 2011

Q&A |

Page 28

August 1, 2011

Adjusted EBITDA Reconciliation

2011

2011

2011

2010

2009

2008

2007

Three Months

Ended July 1, 2011

Six Months Ended

July 1, 2011

Twelve Months

Ended April 1,

2011

Fiscal Year Ended

April 2,

2010

Fiscal Year

Ended April 3,

2009

Fiscal Year

Ended March 28,

2008

Fiscal Year

Ended March 30,

2007

(Amounts in thousands)

Forecast -

Midpoint

Forecast -

Midpoint

Actual

Actual

Actual

Actual

Actual

RECONCILIATION OF NET INCOME/ (LOSS)

ATTRIBUTABLE TO DELTA TUCKER HOLDINGS, INC./PREDECESSOR

TO EBITDA AND ADJUSTED EBITDA:

Net (loss)/income attributable to Delta Tucker Holdings,

Inc./Predecessor 3,250

8,200

(19,947)

77,444

65,818

48,722

29,415

Income tax provision

2,450

6,000

4,973

47,035

39,756

28,434

21,904

Interest expense, net of interest income

23,250

46,750

82,390

55,108

56,587

51,832

68,898

Depreciation

and

amortization

( 1)

13,300

26,700

50,273

42,578

41,634

43,492

45,251

EBITDA

(2)

42,250

$

87,650

117,689

$

222,165

$

203,795

$

172,480

$

165,468

$

Equity-based compensation

-

-

3,518

2,863

1,883

4,599

2,400

Loss on early extinguishment of debt and swap ineffectiveness

1,850

5,000

3,062

648

5,376

-

9,201

Loss on Afghanistan contracts

-

250

1,974

16,501

40,511

(2,640)

-

(Gains)/Losses due to fluctuation in foreign exchange rates

150

200

(145)

(353)

(400)

-

-

Earnings

from

affiliates

not

received

in

cash

(3)

250

300

(618)

(1,863)

(2,413)

(2,072)

(1,191)

Retention bonuses, severance and acquisition earnouts

600

8,000

12,880

1,959

-

-

4,800

Management

fees

(4)

700

1,200

1,145

-

-

-

-

WWNS

-

-

-

(10,000)

-

10,967

-

(1,800)

(2,600)

73,950

3,622

-

-

-

-

-

6,271

-

-

-

-

Adjusted

EBITDA

(7)

44,000

$

100,000

$

219,726

$

235,542

$

248,752

$

183,334

$

180,678

$

(4) Amount presented relates to the Successor period management

fees, we excluded the Predecessor management fees from the EBITDA adjustments above.

(5) Amount includes acquisition accounting fair market value

adjustments, Merger-related and other acquisition expenses and changes in certain accruals and reserves required by GAAP.

(6) Per the terms of our Credit Agreement, the amount of cost savings,

operating expense reductions and synergies projected as a result

of specified actions taken or with respect to which substantial steps have been taken during the

period should be an adjustment to EBITDA to arrive at Adjusted

EBITDA. (7) We believe that Adjusted EBITDA is useful in assessing

our ability to generate cash to cover our debt obligations including interest and principal payments. As such, we add back certain non-cash items from operations and

certain other items as defined in our 10.375% Senior Unsecured Notes and

our Credit Facility. Non-GAAP financial measures are not intended to be a substitute for any GAAP financial measure and, as calculated, may not be

comparable to other similarly titled measures of the performance

of other companies.

(1) Amount includes certain depreciation and amortization amounts which

are classified as Cost of services on our Unaudited Condensed Consolidated Statements of Income.

(2) We define EBITDA as GAAP net income attributable to the Company.

adjusted for interest, taxes, depreciation and amortization. We believe these non-GAAP financial measures are useful in evaluating operating performance

and are regularly used by security analysts, institutional investors and

other interested parties in reviewing the Company. Non-GAAP financial measures are not intended to be a substitute for any GAAP financial measure and, as

calculated, may not be comparable to other similarly titled measures of

the performance of other companies. (3) Includes our

unconsolidated affiliates, except GLS.

$

$

$

$

$

$

$

$

Annualized operational

efficiencies Acquisition accounting and Merger-related items

(5)

(6) |