Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OUTERWALL INC | d8k.htm |

| EX-99.1 - EARNINGS RELEASE - OUTERWALL INC | dex991.htm |

Investor Update 2011 Q2

July 28, 2011

Exhibit 99.2 |

Safe

Harbor for Forward-Looking Statements ©

2011 Coinstar, Inc. All Rights Reserved. These materials may not be reproduced,

altered or distributed without the express written consent of Coinstar, Inc.

2

This presentation contains statements considered forward-looking for purposes

of the safe harbor provisions

under

the

Private

Securities

Litigation

Reform

Act

of

1995.

Actual

results

may

differ

materially from those indicated by these forward-looking statements as a result

of various factors, including those discussed in our most recent Annual

Report on Form 10-K and Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission. Coinstar, Inc. assumes no obligation and

does not intend to update these forward-looking statements. |

©

2011 Coinstar, Inc. All Rights Reserved. These materials may not be reproduced,

altered or distributed without the express written consent of Coinstar, Inc.

3

2011 Full Year and Q3 Guidance

2011 Full Year –

Revenue by Segment (in millions)

redbox

$1,480 –

$1,555

Coin

$280 –

$290

New Ventures

$0 –

$5

Total

$1,760 –

$1,850

2011 Full Year –

Other

Adjusted EBITDA from continuing

operations* (in millions)

$345 –

$360

EPS from continuing operations

$2.90 –

$3.15

Shares Outstanding (in millions)

32.0 –

32.1

Estimated Effective Tax Rate

39%

Free Cash Flow from continuing

operations** (in millions)

$115 –

$135

2011 Q3 Guidance

Revenue (in millions)

$450 –$470

Adjusted EBITDA from continuing

operations* (in millions)

$93 –

$100

EPS from continuing operations

$0.83 –

$0.93

2011 Full Year Capital Expenditures

from Continuing Operations (in millions)

redbox

$120 –

$125

Coin –

New

$16 –

$18

Coin –

Maintenance

$10 –

$12

Corporate/Other

$37 –

$45

Total

$183 –

$200

2011 Full Year –

Installations, net

redbox Kiosks

5,000 –

6,000

Coin Kiosks

1,400 –

1,500

As of July 28, 2011

* Adjusted EBITDA from continuing operations is defined

as earnings before net interest expense, income taxes,

depreciation, amortization and certain other non-cash charges including the

write-off from early retirement of debt, and share-based expenses from

continuing operations. ** Free cash flow from continuing operations is defined as net cash

provided by operating activities from continuing operations after cash

paid for capital expenditures from continuing operations.

|

©

2011 Coinstar, Inc. All Rights Reserved. These materials may not be reproduced,

altered or distributed without the express written consent of Coinstar, Inc.

4

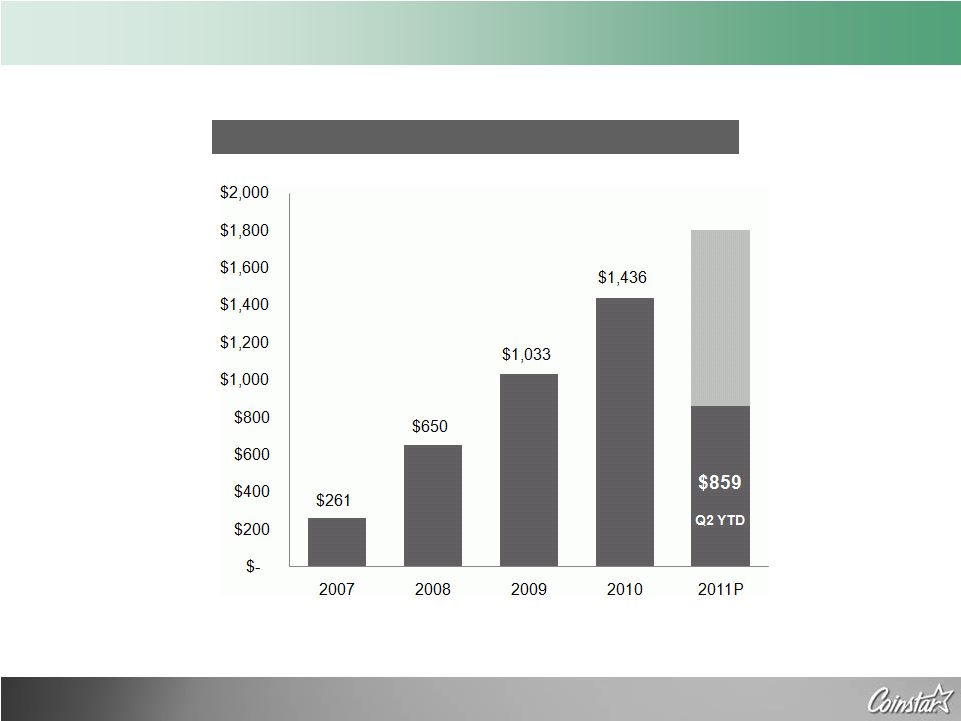

Consolidated Revenue

As of June 30, 2011

* Guidance as of July 28, 2011

$1,760 to $1,850*

Revenue

(in millions) |

©

2011 Coinstar, Inc. All Rights Reserved. These materials may not be reproduced,

altered or distributed without the express written consent of Coinstar, Inc.

5

Business Segment Information

As of June 30, 2011

* From acquisition date

redbox *

Q1

Q2

Q3

Q4

YTD

2011

362,344

$

363,862

$

---

---

726,206

$

2010

263,078

$

271,869

$

305,365

$

319,397

$

1,159,709

$

2009

154,697

$

188,909

$

198,064

$

231,760

$

773,430

$

2008

60,513

$

89,956

$

104,192

$

133,792

$

388,453

$

2007

2,602

$

3,063

$

1,649

$

2,218

$

9,532

$

Coin

Q1

Q2

Q3

Q4

YTD

2011

20,609

$

26,800

$

---

---

47,409

$

2010

15,020

$

28,043

$

27,872

$

25,380

$

96,315

$

2009

22,391

$

26,016

$

27,254

$

26,949

$

102,610

$

Coin

Q1

Q2

Q3

Q4

YTD

2011

61,363

$

71,065

$

---

---

132,428

$

2010

59,918

$

70,362

$

74,669

$

71,033

$

275,982

$

2009

57,876

$

64,741

$

69,501

$

66,398

$

258,516

$

2008

59,329

$

64,585

$

71,104

$

66,608

$

261,626

$

2007

54,915

$

62,523

$

67,513

$

66,363

$

251,314

$

New Ventures

Q1

Q2

Q3

Q4

YTD

2011

365

$

301

$

---

---

666

$

2010

126

$

125

$

153

$

326

$

730

$

2009

180

$

194

$

160

$

143

$

677

$

redbox *

Q1

Q2

Q3

Q4

YTD

2011

50,821

$

74,017

$

---

---

124,838

$

2010

46,301

$

37,167

$

53,648

$

53,736

$

190,852

$

2009

20,850

$

24,568

$

26,684

$

29,469

$

101,571

$

New Ventures

Q1

Q2

Q3

Q4

YTD

2011

(2,555)

$

(4,767)

$

---

---

(7,322)

$

2010

(1,488)

$

(1,927)

$

(2,248)

$

(2,560)

$

(8,223)

$

2009

(154)

$

(641)

$

(669)

$

(617)

$

(2,081)

$

Revenue

Operating Profit

(in thousands)

(in thousands) |

©

2011 Coinstar, Inc. All Rights Reserved. These materials may not be reproduced,

altered or distributed without the express written consent of Coinstar, Inc.

6

Business Segment Information

As of June 30, 2011

Coin

Q1

Q2

Q3

Q4

YTD

2011

7,371

$

7,451

$

---

---

14,822

$

2010

7,059

$

7,562

$

7,467

$

7,632

$

29,720

$

2009

6,741

$

7,177

$

7,081

$

7,008

$

28,007

$

redbox *

Q1

Q2

Q3

Q4

YTD

2011

27,098

$

27,360

$

---

---

54,458

$

2010

22,121

$

23,866

$

23,955

$

23,503

$

93,445

$

2009

13,169

$

14,725

$

15,527

$

17,267

$

60,688

$

New Ventures

Q1

Q2

Q3

Q4

YTD

2011

175

$

679

$

---

---

854

$

2010

3,500

$

184

$

(41)

$

183

$

3,826

$

2009

240

$

273

$

367

$

406

$

1,286

$

Depreciation, Amortization and Other

(in thousands)

* From acquisition date |

©

2011 Coinstar, Inc. All Rights Reserved. These materials may not be reproduced,

altered or distributed without the express written consent of Coinstar, Inc.

7

Installations and Same Store Sales

As of

June 30, 2011

redbox Kiosks (rounded)

Q1

Q2

Q3

Q4

2011

31,800

33,300

---

---

2010

24,800

26,900

28,500

30,200

2009

15,400

17,900

20,600

22,400

2008

7,900

9,600

11,800

13,700

2007

3,000

4,300

5,700

7,000

Coin Kiosk Same Store Sales

Q1

Q2

Q3

Q4

2011

5.3%

1.8%

---

---

2010

0.5%

7.9%

7.9%

10.0%

2009

-5.0%

-4.3%

-5.4%

-5.1%

Coin Kiosks (rounded)

Q1

Q2

Q3

Q4

2011

18,800

18,900

---

---

2010

19,100

19,000

18,900

18,900

2009

18,400

18,400

18,800

19,200

2008

15,500

16,500

17,500

18,400

2007

13,800

14,200

14,500

15,400

redbox Kiosk Same Store Sales

Q1

Q2

Q3

Q4

2011

15.3%

16.6%

---

---

2010

21.0%

3.5%

17.2%

12.5%

2009

35.0%

33.0%

26.3%

21.0%

redbox

Coin |

©

2011 Coinstar, Inc. All Rights Reserved. These materials may not be reproduced,

altered or distributed without the express written consent of Coinstar, Inc.

8

Other Information

As of June 30, 2011

redbox Gross Margin

Q1

Q2

Q3

Q4

YTD

2011

53.1%

58.4%

---

---

55.7%

2010

59.0%

56.4%

59.7%

54.4%

57.3%

2009

59.6%

57.4%

58.1%

54.0%

57.0%

2008

65.2%

63.0%

62.5%

62.2%

62.9%

Q1

Q2

Q3

Q4

YTD

2011

38,472

$

49,405

$

---

---

87,877

$

2010

31,517

$

52,822

$

48,135

$

38,373

$

170,847

$

2009

34,987

$

38,288

$

28,647

$

46,545

$

148,467

$

2008

28,182

$

34,653

$

47,692

$

33,525

$

144,052

$

2007

7,495

$

11,926

$

15,375

$

15,047

$

49,843

$

Consolidated Capital Expenditures* (in thousands)

* For continuing operations |

©

2011 Coinstar, Inc. All Rights Reserved. These materials may not be reproduced,

altered or distributed without the express written consent of Coinstar, Inc.

9

Top 5 Customers by Revenue

* All Walmart related companies, including Sam’s Club and ASDA

As of June 30, 2011

•

Walmart*

•

Walgreens

•

Kroger

•

7-

Eleven

•

McDonald’s

•

Walmart*

•

Kroger

•

Supervalu

•

Delhaize

•

Ahold

•

Walmart*

•

Walgreens

•

Kroger

•

7-Eleven

•

Supervalu

redbox

Coin

Consolidated |