Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Noranda Aluminum Holding CORP | d8k.htm |

| EX-99.1 - PRESS RELEASE - Noranda Aluminum Holding CORP | dex991.htm |

Noranda Aluminum

Holding Corp July 27, 2011

10:00 AM Eastern / 9:00 AM Central

Exhibit 99.2

SECOND QUARTER RESULTS CONFERENCE CALL |

The following

information contains, or may be deemed to contain, "forward-

looking statements" (as defined in the U.S. Private Securities Litigation Reform Act

of 1995). By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. The future results of Noranda may vary from

the results expressed in, or implied by, the following forward-looking statements,

possibly to a material degree. For a discussion of some of the important factors

that could cause Noranda’s results to differ from those expressed in, or implied by,

the following forward-looking statements, please refer to Noranda’s filings

with the SEC, including the Annual Report on Form 10-K.

Forward Looking Statements

2 |

Revenue (3

months ended) Segment Profit (3 months ended)

LTM Integrated Primary Aluminum Net Cash Cost

LTM Operating Cash Flow, excluding aluminum hedges

3

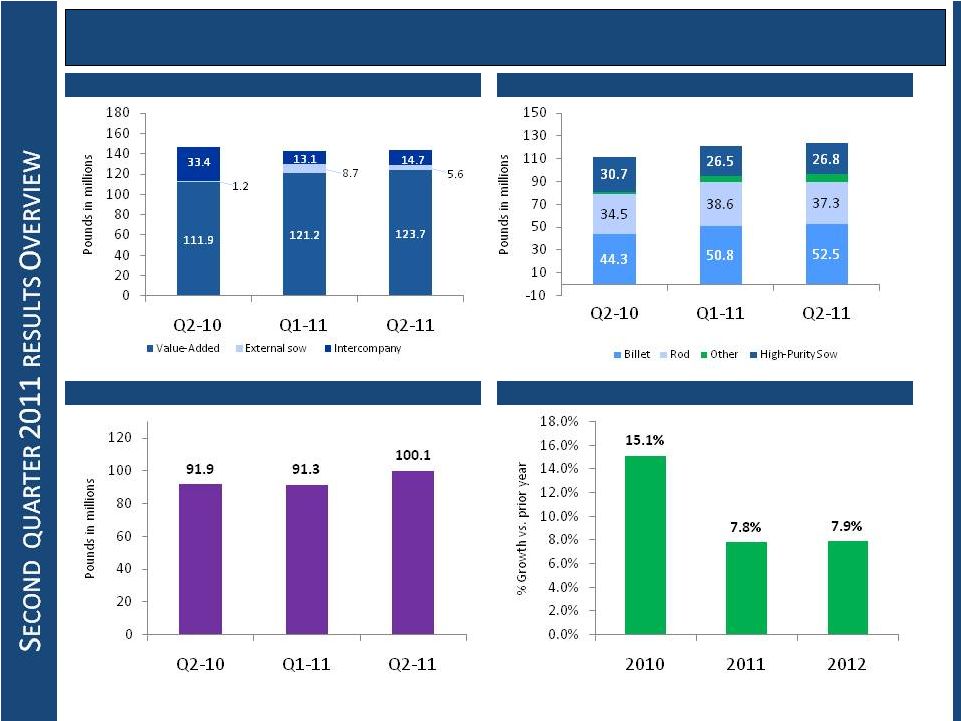

Sequential and Year-Over-Year Improvements in Revenues, Profitability and

Liquidity |

Primary Aluminum

Product Shipments (Total, 3 months ended) Primary Value-Added Volume by Category (3

months ended) U.S. Aluminum Consumption Growth Rates (CRU)

4

Continued Growth for Value-Added Products

Flat Rolled Product Shipments (3 months ended)

111.9

121.2

123.7

146.5

143.0

144.0 |

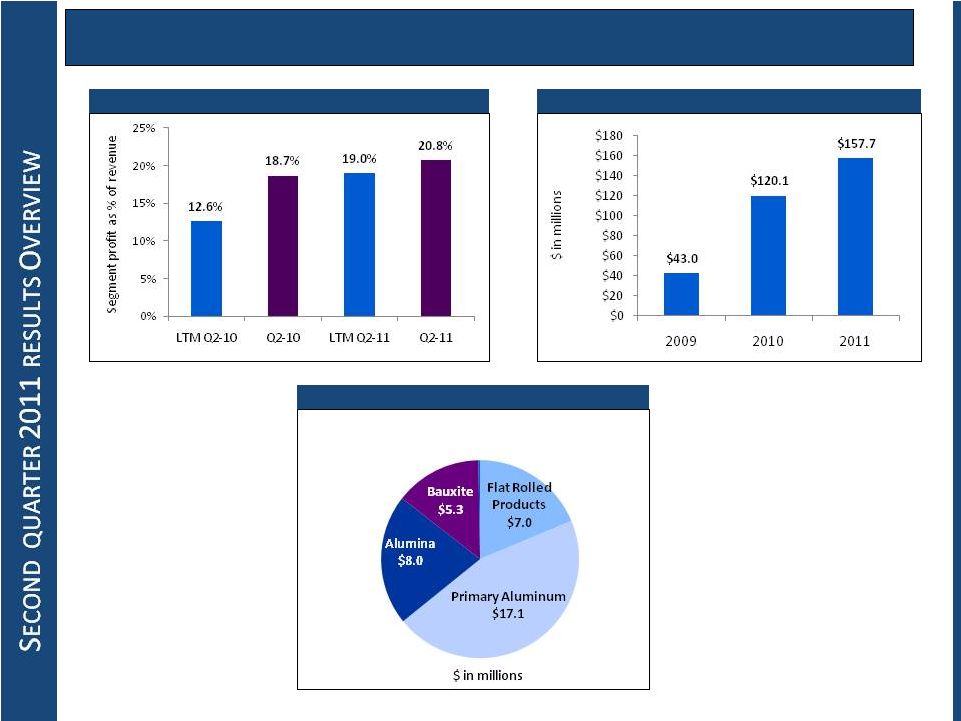

Cumulative CORE

Savings through Q2-11 Year to Date Q2-11 CORE Savings by Segment

5

Productivity Complements Growth in Creating Value

Segment Profit Margin |

6

Improved Segment Profit Performance

Q2-10

Q1-11

Q2-11

Integrated Upstream Segment Profit

$55.2

$75.2

$79.5

Flat Rolled Products Segment Profit

14.6

13.5

16.2

Corporate Costs

(7.3)

(6.6)

(7.2)

Total Segment Profit

$62.5

$82.1

$88.5 |

7

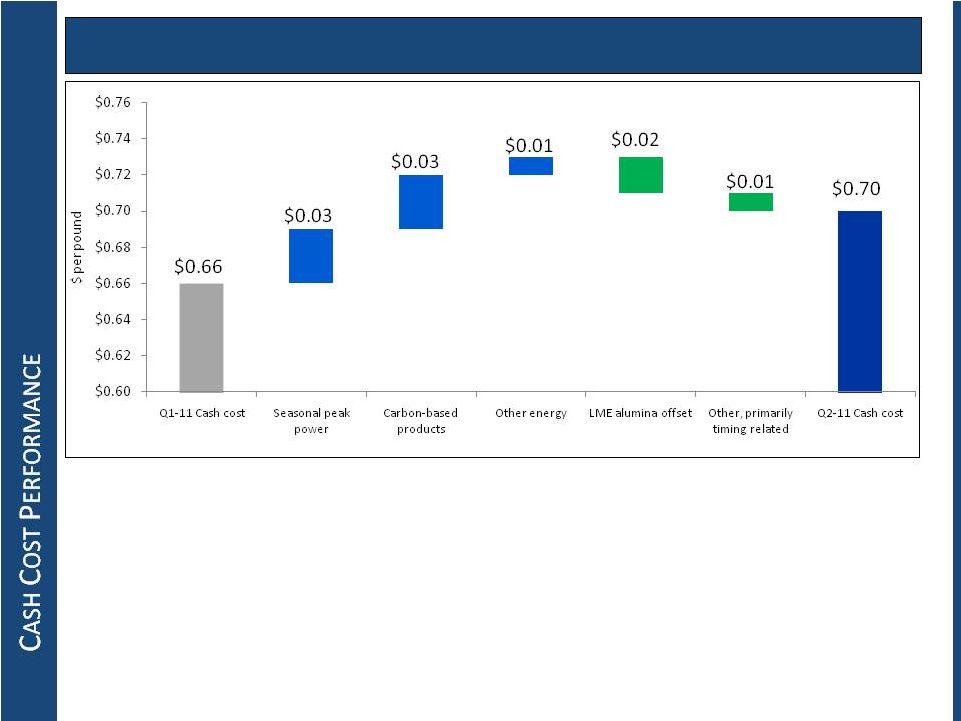

Continued Growth in Upstream Profitability

Q2-10

Q1-11

Q2-11

Realized Midwest Transaction Price

$

1.04

$

1.18

$ 1.26

Net integrated cash cost of primary aluminum

0.66

0.66

0.70

Integrated upstream margin per pound

$ 0.38

$

0.52

$ 0.56

Total primary aluminum shipments

146.5

143.0

144.0

Integrated upstream segment profit

$ 55.2

$

75.2

$ 79.5 |

8

Bridge of Segment Profit to Net Income, Excluding Special Items

Q2-10

Q2-11

Q2-11

Segment profit

$

62.5

$

82.1

$ 88.5

Depreciation and amortization

(25.1)

(23.6)

(24.5)

LIFO/LCM

(9.6)

(10.2)

(9.0)

Interest expense, net

(8.6)

(5.7)

(5.5)

Other recurring non-cash

(3.0)

(6.9)

(2.4)

Income tax impact of special items

(5.3)

(11.9)

(15.9)

Net income, excluding special items

$ 10.9

$

23.8

$ 31.2 |

9

Cash Costs Stable Despite Upward Pressures

•

Third Quarter Outlook Compared to Second Quarter

o

Chemical

costs

–

flat

to

1

cent

increase

o

Carbon-based

products

–

1

to

2

cent

increase

o

Recurring

impact

of

5.2%

increase

in

power

–

1

cent

increase

o

Peak

power

surcharge,

including

impact

of

5.2%

rate

increase

–

9

cent

increase

o

Turnaround

of

Q2

maintenance

timing

–

1

cent

increase |

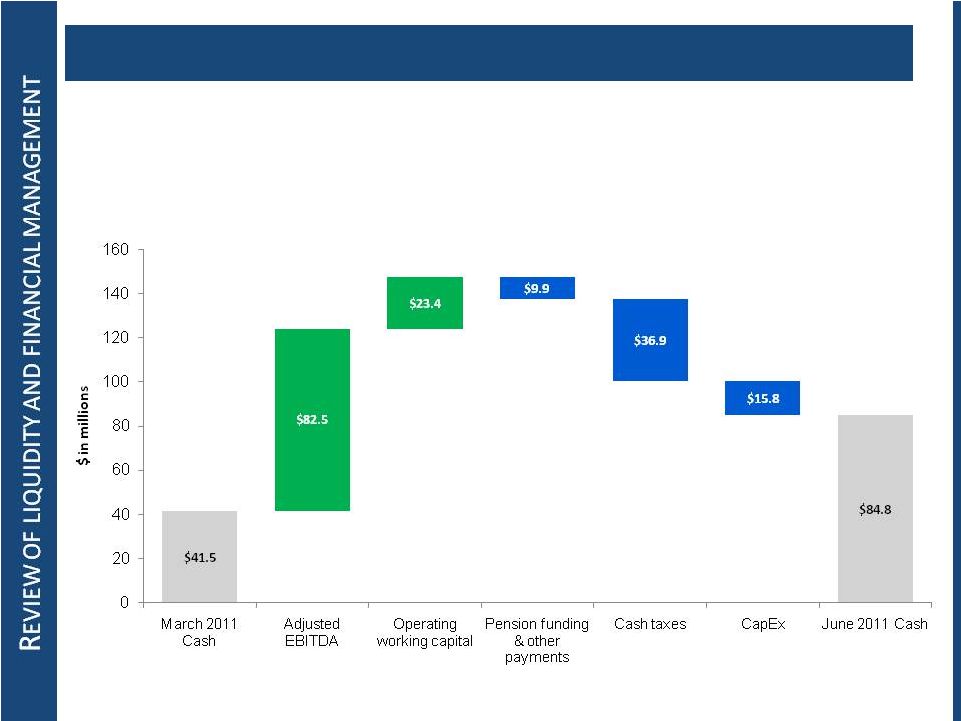

Q2-11

Liquidity and Capitalization Highlights •

$215.2

million of available borrowing

capacity under revolving credit facility

•

S&P upgraded debt ratings in Q2

•

Net debt (debt minus cash)—$343.7 million

•

Net debt to trailing twelve month Adjusted

EBITDA ratio—1.3

to

1

10 |

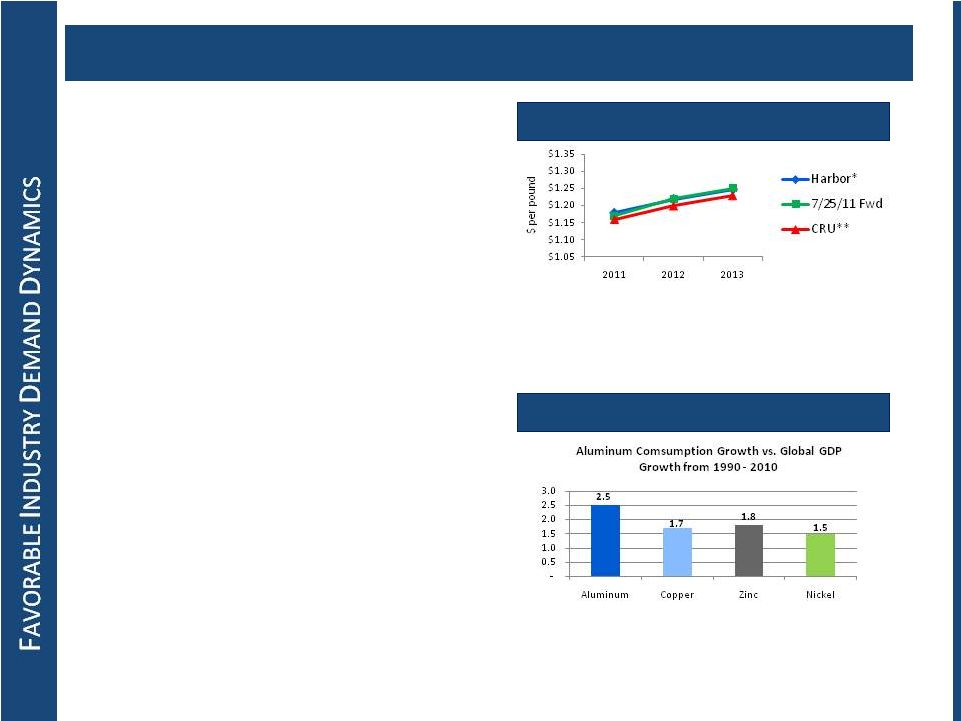

•

Global aluminum demand is expected to

continue to grow

o

Global economic growth

o

Higher standards of living and increased

demand from emerging markets

o

CRU: 2011 to see 8% growth in U.S.

primary aluminum consumption

•

Substitution from other metals such as

copper

o

Gains are occurring in wire and cable and

bus-bars, heat transfer applications,

commercial heat exchanger applications

•

Aluminum is highly correlated with

o

GDP growth

o

Rapid urbanization

o

Increasing environmental consciousness

11

We Hold a Positive Outlook For Aluminum

Beta to Global GDP

Source: CRU

* Source: Harbor Intelligence; 5 Al analysts most accurate from 2001 through 2010,

as of July 5, 2011.

** Source: CRU Aluminum Quarterly, as of July 26, 2011.

Forecasts of Average Annual LME |

•

Achieved sequential and year-over-year growth in:

o

Revenue

o

Profitability

o

Liquidity

•

Continued to validate our strategy and business model

o

Integration & cost discipline

o

Input cost independence from LME

o

Focus on productivity and growth

o

Continued process improvements

•

Announced new three year $140 million CORE savings target

•

Expanded financial flexibility to support prudent investments

Key Second Quarter Takeaways

12 |

Appendices |

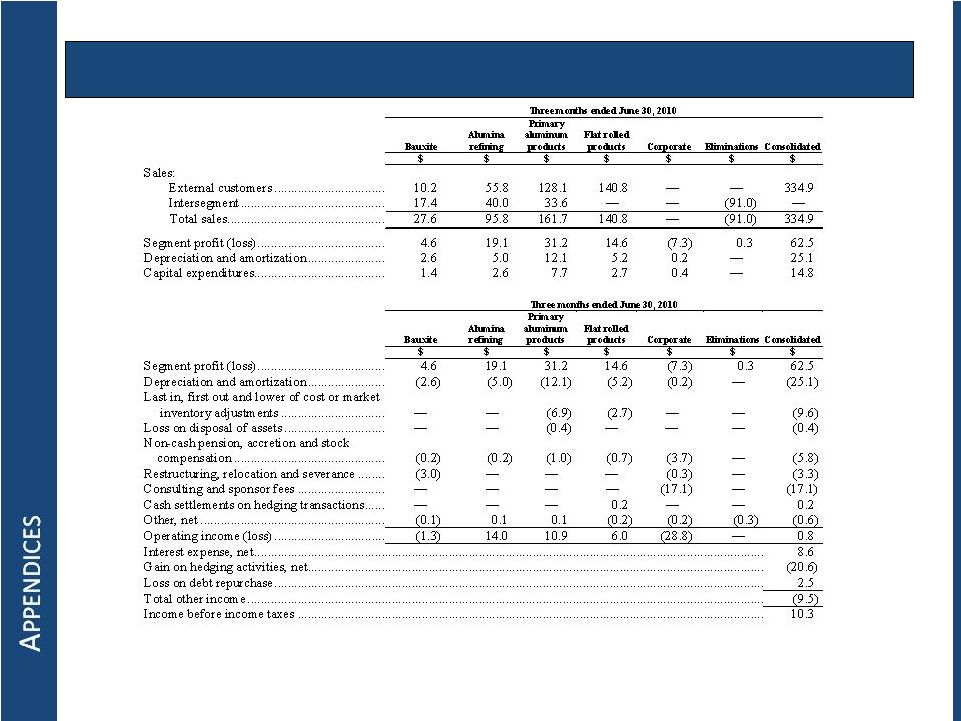

Second Quarter

2010 Segment Profit (Loss) 14 |

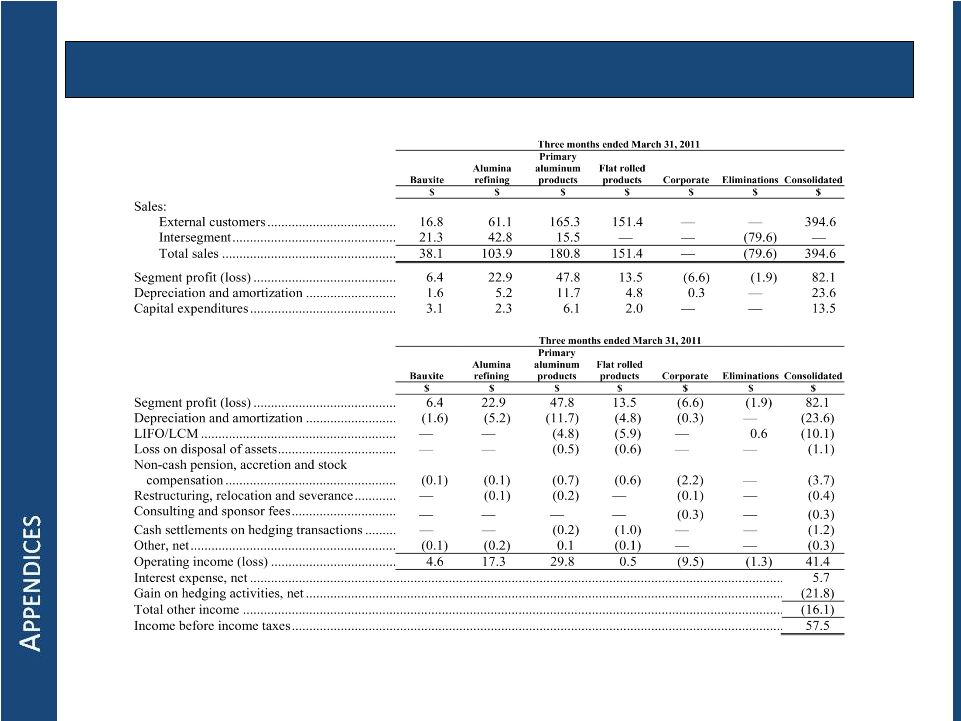

First Quarter

2011 Segment Profit (Loss) 15 |

Second Quarter

2011 Segment Profit (Loss) Three months ended June 30, 2011

Bauxite

Alumina

refining

Primary

aluminum

products

Flat rolled

products

Corporate

Eliminations

Consolidated

$

$

$

$

$

$

$

Sales:

External customers

................................

17.8

60.5

174.

3

173.7

—

—

426.3

Intersegment

...........................................

18.6

48.7

18.3

—

—

(85.6)

—

Total sales

...............................................

36.4

109.2

192.6

173.7

—

(85.6)

426.

3

Segment profit (loss)

.....................................

6.0

27.6

48.0

16.2

(7.2)

(2.1)

88.5

Depreciation and amortization

.....................

2.8

5.2

11.6

4.6

0.3

—

24.5

Capital expenditures

......................................

2.3

3.0

6.1

3.7

0.7

—

15.8

Three months ended June 30, 2011

Bauxite

Alumina

refining

Primary

aluminum

products

Flat rolled

products

Corporate

Eliminations

Consolidated

$

$

$

$

$

$

$

Segment profit (loss)

.......................................

6.0

27.6

48.0

16.2

(7.2)

(2.1)

88.5

Depreciation and amortization

.......................

(2.8)

(5.2)

(11.6)

(4.6)

(0.3)

—

(24.5)

Last in, first out and lower of

cost or market

inventory adjustments

................................

—

—

(3.6)

(2.4)

—

(3.0)

(9.0)

(Gain) loss on disposal of assets

....................

0.7

—

(0.7)

(0.4)

—

—

(0.4)

Non-cash pension, accretion and stock

compensation

..............................................

(0.2)

(0.2)

(0.7)

(0.6)

(1.

6)

—

(3.3)

Restructuring, relocation and severance

.......

—

(0.1)

—

(0.1)

—

—

(0.2)

Consulting and sponsor fees

.........................

—

—

—

—

(0.1)

—

(0.1)

Cash settlements on hedging transactions......

—

—

(0.2)

(1.4)

—

—

(1.6)

Other, net

........................................................

0.1

—

(0.

3)

0.1

(0.2)

3.5

3.2

Operating income (loss)

................................

3.8

22.1

30.9

6.8

(9.4)

(1.6)

52.6

Interest expense, net

..........................................................................................................................................................

5.5

Gain

on hedging activities, net

...........................................................................................................................................

(24.3)

Total other income

.............................................................................................................................................................

(18.8)

Income before income taxes

..............................................................................................................................................

71.4

16 |

Non-GAAP

Measure: Disclaimer This presentation contains non-GAAP financial measures as

defined by SEC rules. We think that these measures are helpful to investors in

measuring our financial performance and comparing our performance to our peers.

However, our non-GAAP financial measures may not be comparable to similarly titled

non-GAAP financial measures used by other companies. These non-GAAP financial

measures have limitations as an analytical tool and should not be considered in

isolation or as a substitute for U.S. GAAP financial measures. To the extent we

discuss any non-GAAP financial measures on the earnings call, a reconciliation of each

measure to the most directly comparable U.S. GAAP measure are available in the

appendices that

follow

and

are

filed

as

an

Exhibit

99

to

our

Current

Report

on

Form

8-K

furnished

to

the

SEC concurrent with the use of this presentation.

17 |

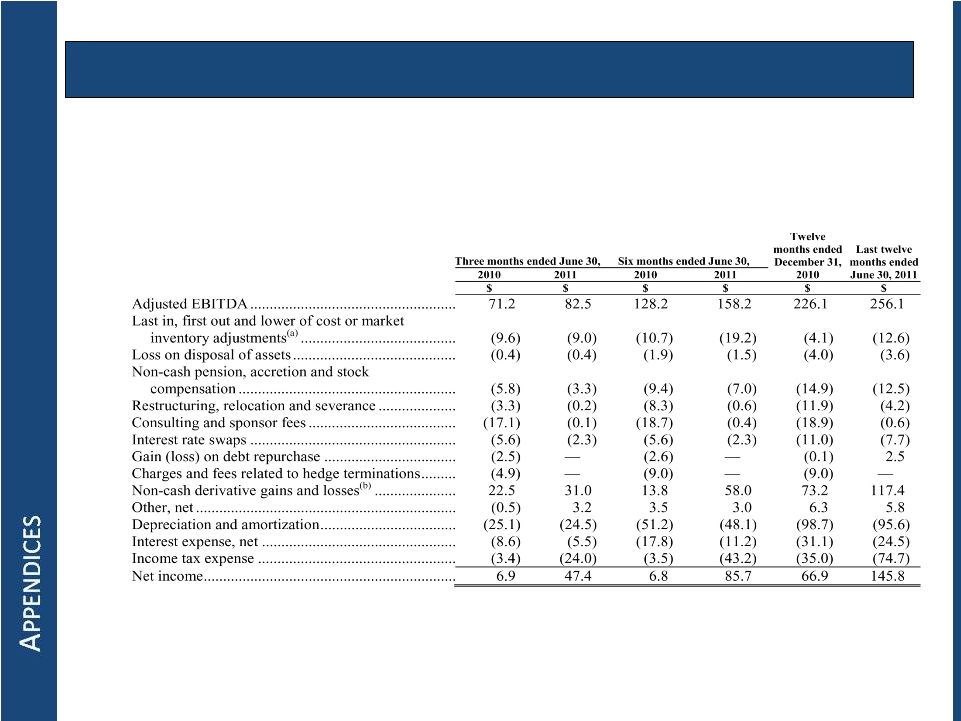

Non-GAAP

Measure: Adjusted EBITDA Management uses “Adjusted

EBITDA” as a liquidity measure in respect of the fixed-charge coverage ratio and the net senior

secured leverage ratio, as defined in our debt agreements. As used

herein, Adjusted EBITDA means net income before income taxes,

net interest expense and depreciation and amortization, adjusted to

eliminate certain non-cash expenses, restructuring charges, related

party management fees, charges resulting from purchase accounting and

other specified items of income or expense as outlined below (in

millions): 18 |

Non-GAAP

Measure: Adjusted EBITDA (Cont’d) Adjusted EBITDA is not a

measure of financial performance under U.S. GAAP, and may not be comparable to similarly titled

measures used by other companies in our industry. Adjusted EBITDA

should not be considered in isolation from or as an alternative to

net income, income from continuing operations, operating income or any

other performance measures derived in accordance with U.S. GAAP.

Adjusted EBITDA has limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis

of our results as reported under U.S. GAAP. For example, Adjusted

EBITDA excludes certain tax payments that may represent a

reduction in cash available to us; does not reflect any cash

requirements for the assets being depreciated and amortized that may have to

be replaced in the future; does not reflect capital cash expenditures,

future requirements for capital expenditures or contractual

commitments; does not reflect changes in, or cash requirements for, our

working capital needs; and does not reflect the interest expense,

or the cash requirements necessary to service interest or principal

payments, on our indebtedness. Adjusted EBITDA also includes

incremental stand-alone costs and adds back non-cash hedging

gains and losses, and certain other non-cash charges that are deducted in

calculating net income. However, these are expenses that may recur,

vary greatly and are difficult to predict. In addition, certain of

these expenses can represent the reduction of cash that could be used

for other corporate purposes. You should not consider our

Adjusted EBITDA as an alternative to operating income or net income,

determined in accordance with U.S. GAAP, as an indicator of our

operating performance, or as an alternative to cash flows from operating activities, determined in accordance with U.S. GAAP, as

an indicator of our cash flows or as a measure of liquidity.

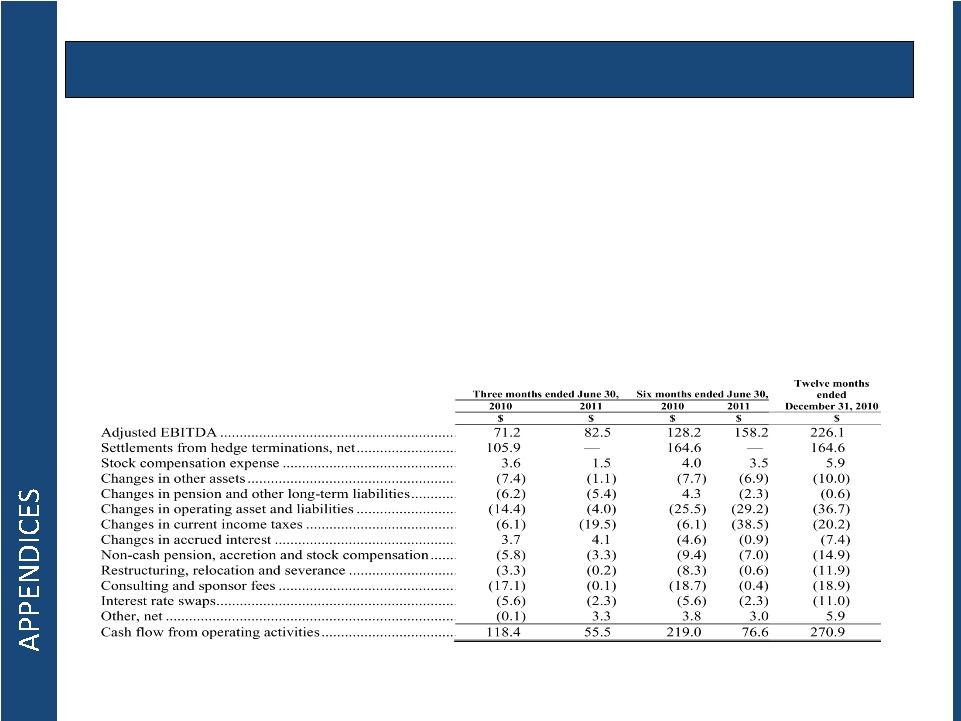

The following table reconciles Adjusted EBITDA to cash flow from

operating activities for the periods presented (in millions): 19

|

Our New Madrid smelter and our rolling mills use the LIFO method of

inventory accounting for financial reporting and tax purposes. This adjustment restates

net income to the FIFO method by eliminating LIFO expenses related to

inventories held at the New Madrid smelter and the rolling mills. Product

inventories at Gramercy and St. Ann and supplies inventories at New

Madrid are stated at lower of weighted-average cost or market, and are not subject to

the LIFO adjustment. We also reduce inventories to the lower of cost

(adjusted for purchase accounting) or market value. Non-GAAP Measure: Adjusted EBITDA

(Cont’d) (a)

(b)

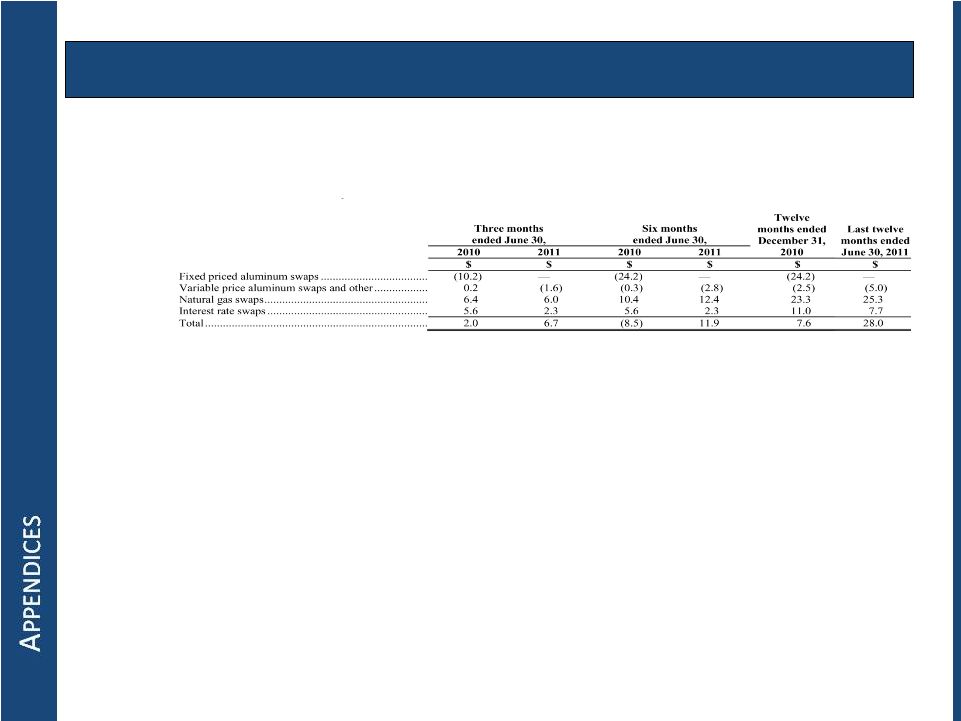

We use derivative financial instruments to mitigate effects of

fluctuations in aluminum and natural gas prices. This adjustment eliminates the non-cash gains

The previous table presents fixed price aluminum swap cash settlement

amounts net of early termination discounts totaling $4.9 million in the three months

ended

June

30,

2010, $9.0

million

in the six months ended June 30, 2010 and $9.0 million in the twelve

months ended December 31, 2010. We settled all and losses

resulting from fair market value changes of aluminum swaps. Cash settlements (received) or paid, except settlements on hedge terminations, related to our

derivatives

are

included

in

Adjusted

EBITDA

and

are

shown

in

the

table

below:

fixed price aluminum swaps in connection with our IPO.

20 |

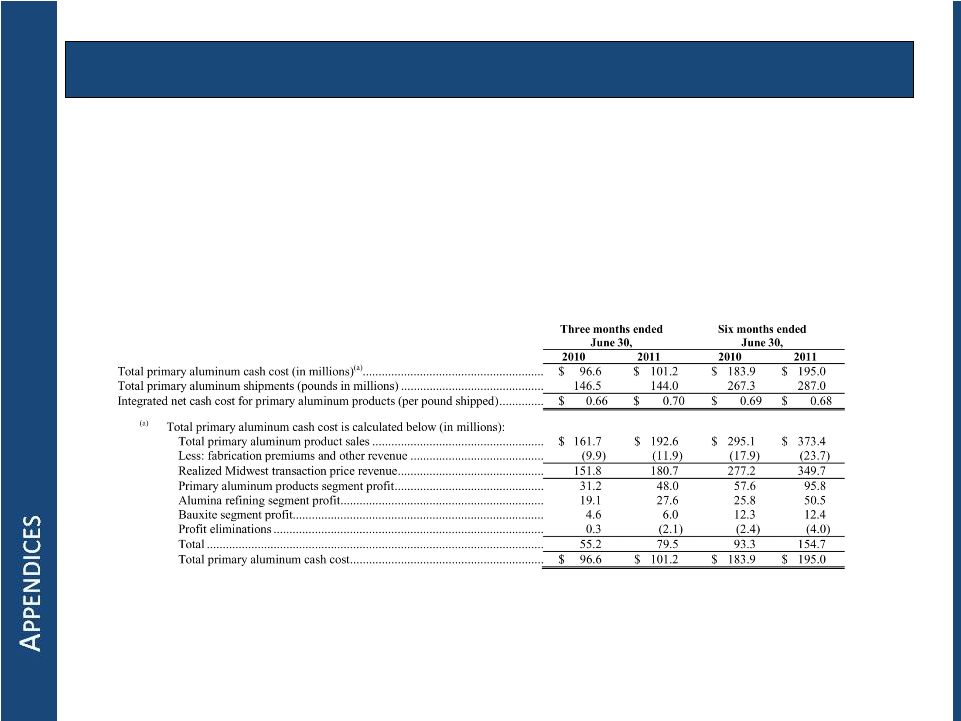

Non-GAAP

Measure: Net Cash Cost of Primary Aluminum

Unit net cash for primary aluminum per pound represents the costs of producing commodity grade aluminum net of

value-added premiums on primary aluminum sales. The Company has

provided unit net cash cost per pound of aluminum shipped

because it provides investors with additional information to measure

operating performance. Using this metric, investors are able to

assess the prevailing LME price plus Midwest premium per pound versus

unit net costs per pound shipped. Unit net cash cost per pound

is positively or negatively impacted by changes in primary aluminum, alumina and bauxite production and sales volumes,

natural gas and oil related costs, seasonality in electrical contract

rates, and increases or decrease in other production related costs.

Unit net cash costs is not a measure of financial performance under

U.S. GAAP and may not be comparable to similarly titled measures

used by other companies. Unit net cash costs per pound shipped should not be considered in isolation from or as an

alternative to any performance measures derived in accordance with U.S

GAAP. The following table shows the calculation of integrated

net cash cost of primary aluminum: 21 |

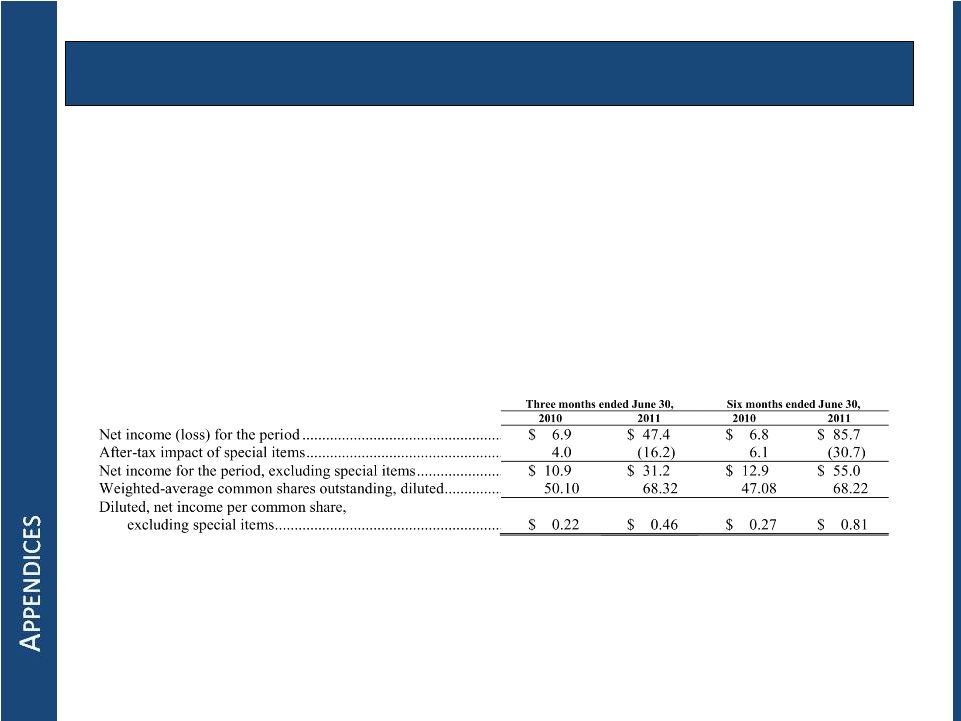

Non-GAAP

Measure: Diluted EPS, Excluding Special Items “Net income

(loss), excluding special items” means net income adjusted to eliminate the impact of certain transactions and

events referred to as “special items,” as listed herein.

“Diluted net income (loss) per share, excluding special items” refers to net

income (loss) excluding special items, divided by the number of diluted

weighted average shares outstanding. Management has provided net

income (loss), excluding special items and diluted net income (loss) per share, excluding special items because the

measure provides investors with additional information with which to

measure operating results. Using these metrics, investors are

able to assess the impact of certain transactions and events on

earnings and to compare net income (loss) from period to period with

the impact of those transactions and events removed from all periods.

Management believes this metric is a valuable tool in assisting

investors to compare financial results from period to period.

Net income (loss), excluding special items may not be comparable to

similarly titled measures used by other companies. Net income

(loss), excluding special items should not be considered in isolation

from or as an alternative to net income or any other performance

measures derived in accordance with U.S. GAAP. Net income (loss),

excluding special items has limitations as an analytical tool and

you should not consider it in isolation or as a substitute for analysis

of results as reported under U.S. GAAP.

22 |

|