Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMERICAN DENTAL PARTNERS INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - AMERICAN DENTAL PARTNERS INC | dex991.htm |

Second Quarter 2011

Earnings Conference Call

July 26, 2011

Exhibit 99.2 |

2

Introductory Comments

“Safe Harbor" Statement under the Private Securities Litigation Reform Act

of 1995: With the exception of the historical information contained in this

presentation, the matters described herein contain

"forward-looking" statements that involve risk and uncertainties

that may individually or collectively affect the matters herein described,

including but not limited to the Company's risks associated with overall or

regional economic conditions, dependence upon affiliated dental practices,

contracts the affiliated practices have with third-party

payors,

government

regulation

of

the

dental

industry,

impact

of

health

care

reform,

dependence

upon

service

agreements

and

the

impact

of

any

terminations

or

potential terminations of such contracts, business interruptions, the outcome of

pending litigation and the Company's acquisition and affiliation strategy,

which are detailed from time to time in the "Risk Factors" section

of the Company's filings with the Securities and Exchange Commission,

including its annual report on Form 10-K and quarterly reports on Form

10-Q. Certain financial measures that are not in accordance with

Generally Accepted Accounting Principles are included in these slides.

Please see our press release, which is available on our website, www.amdpi.com, for a presentation of the most comparable

GAAP measures and a reconciliation of these non-GAAP measures.

|

3

Highlights

•

Financial results for 2Q11 vs. 2Q10:

Net revenue +2%

Earnings from operations -25%

Net earnings -15%

•

Completed seven in-market acquisitions |

4

$116.0 million vs. $111.9 million +3.6%

•

+1.0% same market growth

•

+0.0% same market excluding

acquisitions growth

•

-0.7% same facility growth

Components of same market growth

•

+0.8% hours

•

+3.3% productivity per hour

•

-3.1% effectivity

(b)

Revenue mix

•

12% fee for service

•

78% PPO

•

5% managed care

•

5% Medicaid/CHIPS

Patient Revenue of Affiliated Practices (a)

Components of Same Market

-6%

-4%

-2%

0%

2%

4%

6%

2Q10

3Q10

4Q10

1Q11

2Q11

Hours

PPH

Effectivity

Same Market Growth

-4%

-2%

0%

2%

4%

2Q10

3Q10

4Q10

1Q11

2Q11

Same Facility

Development

Acquisitions

Revenue Mix

0%

25%

50%

75%

100%

2Q10

3Q10

4Q10

1Q11

2Q11

FFS

PPO

MC

Medicaid

(a)

See appendix for discussion of patient revenue of affiliated practices.

(b)

Effectivity

is the difference between full fee increases and the net fee increases actually

realized from patients and insurance companies.

|

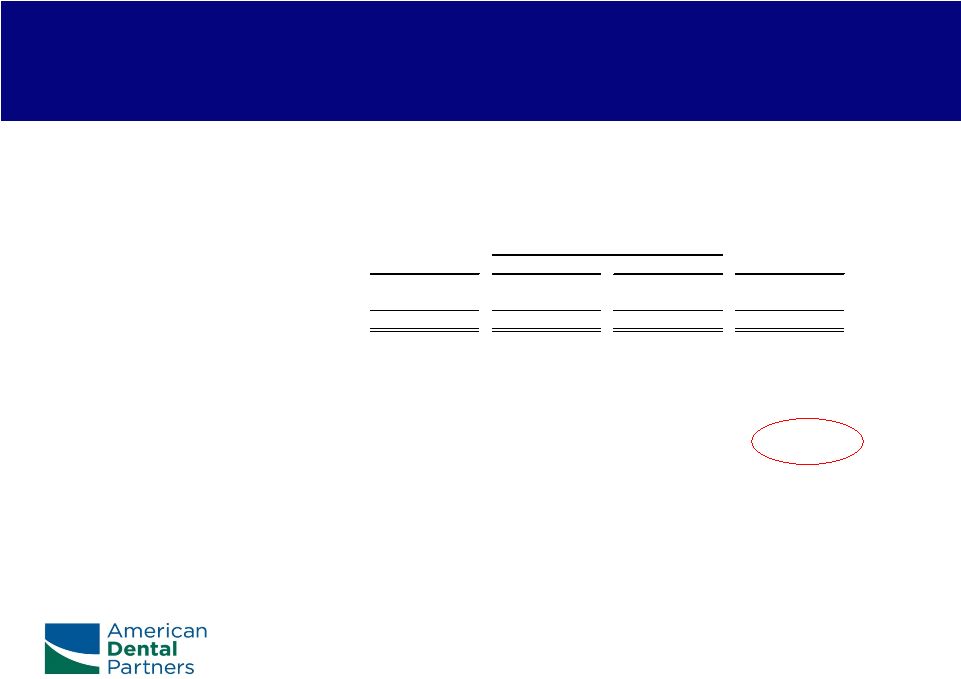

5

Income Statement

2011

2010

Change

Comments

Net revenue

73,953

$

72,366

$

2%

Cincinnati Dental (6/10) platform acquisition

Operating expenses:

Salaries and benefits

29,196

28,735

(23)

b.p.

Lab fees and dental supplies

11,790

10,668

120

b.p.

Lab fees 90 bp / dental supplies 30 bp

Office occupancy expenses

9,509

9,131

24

b.p.

Other operating expenses

7,682

6,878

88

b.p.

Cincinnati Dental 45 bp / professional fees 34 bp

General corporate expenses

4,160

3,669

56

b.p.

Legal fees 22 bp / stock option expense 14 bp

EBITDA

11,616

13,285

-13%

EBITDA margin

15.7%

18.4%

(265)

b.p.

Depreciation expense

3,070

2,862

20

b.p.

Amortization of intangible assets

2,559

2,464

6

b.p.

Earnings from operations

5,987

7,959

-25%

EFO margin

8.1%

11.0%

(290)

b.p.

Interest expense, net

1,525

2,726

Debt refinancing of $370K in 2011 and $615K in 2010

Earnings before income taxes

4,462

5,233

-15%

Income taxes

1,818

2,082

Effective tax rate

40.7%

39.8%

Consolidated net earnings

2,644

3,151

-16%

Noncontrolling interest

15

39

Net earnings

2,629

$

3,112

$

-16%

Diluted EPS

0.17

$

0.19

$

-14%

Diluted weighted shares outstanding

15,753

16,056

-2%

Q2

(thousands, except per share amts) |

6

Cash Flow

Operating activities

Favorable cash interest and cash

taxes. Patient receivable DSO @

6/30/11 of 25 vs

DSO @ 6/30/10 of 26

Maintenance capital expenditures

Includes 16 Improvis EDR

implementations

Acquisitions

Completed 7 in-market acquisitions

representing $3.3MM annualized

patient revenue

2Q11

2Q10

Cash flow from operating activities

Net income and non-cash items

11,107

$

10,038

$

Working capital items

797

(8)

Cash flow from operating activities

11,904

10,030

Maintenance capital expenditures

(3,450)

(801)

Free cash flow before growth investments

8,454

9,229

Growth capital expenditures

(1,019)

(1,307)

Acquisitions

(2,563)

(19,798)

Cash flow before financing activities

4,872

$

(11,876)

$

(thousands) |

7

Capitalization

Debt to Total Capitalization

35%

36%

34%

32%

Leverage

•

$87 million debt

•

1.8x debt/EBITDA (bank

compliance calculation)

•

$60 million available for borrowing

under credit facility (bank

compliance calculation)

Senior Indebtedness

•

Renegotiated May 2011

•

$180MM facility

•

May 2016 maturity

•

Reduced borrowing rates

•

Increased share repurchase

•

Participants

•

Bank of America

•

KeyBank

•

RBS Citizens

•

Wells Fargo

•

Toronto Dominion

•

Union Bank

30%

($ millions)

$0

$100

$200

$300

Jun '10

Sep '10

Dec '10

Mar '11

Jun '11

Equity

Debt |

8

(a) See Appendix for reconciliation of non-GAAP items.

(b) Calculated at $13.25 share price and trailing twelve months ended June 30, 2011

financial results. Diluted Earnings per Share

}+56%

}+42%

}+65%

(a)

TTM

PE(b)

Diluted Reported EPS

0.75

18x

Diluted non-GAAP EPS (a)

1.12

12x

+49%

-33% |

9

Return on Market Value

2010

Jun '10

Jun '11

TTM

Cash flow from operations

36.3

$

17.7

$

25.4

$

44.0

$

Maintenance capital expenditures

4.7

1.6

5.4

8.5

$

Free cash flow

31.6

$

16.1

$

20.0

$

35.5

$

Diluted shares outstanding

15.8

Share price

13.25

$

Market value of equity

209.4

$

Cash flow from operations/market value equity

21.0%

Free cash flow/market value equity

17.0%

6 Months

(millions, except per share amount) |

10

Operating Comments

•

Financial results negatively impacted by:

Economy (employment and retail spending both weak)

AHCCCS reimbursement decrease

Texas pediatric Medicaid performance:

9 facilities operational in 2Q11 as compared to 4 facilities in 2Q10

Facility EBITDA loss of $59,000 in 2Q11 as compared to loss of

$126,000 in 1Q11

Facilities operational in 2Q10 had EBITDA of $77,000 in 2Q11 as

compared to a loss of $212,000 in 2Q10

Anticipate 3 de novos

in 3Q11 and 5 de novos

in 4Q11 |

Operating Comments

•

Specialty care performance:

14% patient revenue growth

Continuing reinvesment in the business:

Technology initiatives –

42 EDR implementations the second half

of 2011 and 126 facilities utilizing EDR by the end of the year

De novos –

15 approved for construction and 9 currently being

evaluated

Acquisitions –

in-market pipeline robust |

12

Appendix |

13

Non-GAAP Financial Measures

•

•

Patient Revenue of the Affiliated Practices

•

Appendix

This presentation includes non-GAAP financial measures. In accordance with the requirements

of Regulation G of the Securities and Exchange Commission, please see the attached financial

tables for a presentation of the most comparable GAAP measures, the reconciliation to the

nearest GAAP measure and all additional reconciliations required by Regulation G.

The Company believes non-GAAP financial measures, such as adjusted net earnings and adjusted net

earnings excluding service agreement amortization, are important financial measures for

understanding its financial performance. The Company incurs significant amortization

expense related to its service agreements in contrast to many companies, in the same and other

industries, that do not amortize intangibles based on authoritative literature for goodwill and other intangible assets.

Expenses related to the Company’s debt refinancing and professional fees related to the

Company’s acquisitions have also been excluded from the Company’s non-GAAP

financial measures. The Company believes these items should be presented separately due

to their magnitude and non-recurring impact to the Company’s ongoing operations. The primary limitations

associated with the Company’s use of non-GAAP measures are that these measures may not be

directly comparable to the amounts reported by other companies. Management compensates

for these limitations by providing a detailed reconciliation of the non-GAAP financial

measures to the most directly comparable GAAP measures in this presentation.

The Company does not consolidate the financial statements of the practices affiliated with the

Company by means of service agreements with its financial statements. Patient revenue of

the affiliated practices is, however, a financial measure used by the Company’s

management to monitor operating performance and to help identify and analyze trends of the affiliated

practices that may affect the Company’s business. Most of the operating expenses incurred by the

Company, pursuant to the service agreements, are on behalf of the affiliated practices in the

operation of dental facilities. These expenses are significantly affected by the patient

revenue of the affiliated practices. |

14

Non-GAAP EPS Reconciliation

2010

2011

2010

Net earnings (as reported)

10,339

$

2,629

$

3,112

$

Add: Write-off of expenses associated with debt refinancing, net of tax (a)

370

219

370

Add: Expenses associated with Cincinnati Dental Services acquisition, net of tax (a)

203

-

123

Adjusted net earnings

10,912

2,848

3,605

Add: Amortization related to service agreements, net of tax (a)

5,960

1,506

1,475

Adjusted net earnings excluding service agreement amortization

16,872

$

4,354

$

5,080

$

Weighted average diluted shares outstanding

15,965

15,753

16,056

Diluted adjusted net earnings per share

0.68

$

0.18

$

0.22

$

Diluted adjusted net earnings excluding service agreement amortization per share

1.06

$

0.28

$

0.32

$

(a) Tax effected at effective tax rate in the period reported.

Q2

(thousands, except per share amt) |

15 |