Attached files

Convertible Debt Offering

Summary

Electronic Arts

July 20, 2011

Exhibit 99.2 |

Safe

Harbor Statement Please review our risk factors on Form 10-K filed with

the SEC. Some statements set forth in this presentation contain forward-looking statements

that are subject to change. These forward-looking statements are subject to risks and

uncertainties that could cause actual events or actual future results to differ materially from

the expectations set forth in the forward-looking statements. Some of the factors

which could cause results to differ materially from the expectations expressed in these

forward-looking statements include the following: sales of the Company’s titles; the

Company’s ability to manage expenses; the competition in the interactive entertainment

industry; the effectiveness of the Company’s sales and marketing programs; timely

development and release of Electronic Arts’ products; the Company’s ability to

realize the anticipated benefits of acquisitions, including the PopCap acquisition; the

consumer demand for, and the availability of an adequate supply of console hardware units; the

Company’s ability to predict consumer preferences among competing platforms; the

Company’s ability to service and support digital product offerings; general economic

conditions; and other factors described in EA’s SEC filings (including EA’s Annual

Report on Form 10-K for the year ended March 31, 2011). If any of these risks or

uncertainties materializes, actual results could differ materially from the expectations described in

these forward-looking statements. These

forward-looking statements speak only as of the date of this presentation. EA assumes no obligation to

update these forward-looking statements. |

3

Security

Convertible Senior Notes due 2016 (“The Notes”)

Total Size

$632.5MM (including fully exercised $82.5MM greenshoe)

Coupon

0.75%

Conversion Premium / Price

35.0% / $31.74

Underlying Shares

19.93MM

Call Spread

To raise the effective conversion premium and price to 75% and $41.14,

respectively Maturity

5 years

Call Protection

Non-call life

Puts

None

Financial Covenants

None

Settlement

Net share settlement

Ranking

Senior unsecured

Takeover Protection

Standard change of control provision with make-whole

Dividend Protection

Standard adjustment if EA initiates a dividend

Use of Proceeds

Fund

acquisition

of

PopCap,

pay

the

cost

of

the

convertible

note

hedge

transaction

and for general corporate

purposes

EA Announces Completion of

$632.5MM Convertible Notes Offering |

4

•

The Notes:

$632.5MM of 0.75% Convertible Senior Notes due 2016

•

Net cost of convertible note hedge transactions $42.3M or 6.7% of bond

issuance •

Significant high quality investor demand including existing shareholders of

EA •

Marketed

Efficiently:

One-day

marketed

transaction

enabled

EA

to

efficiently

reach

investors

while

minimizing market exposure and stock price impact

•

Settlement:

Net share settlement

•

Principal is paid with cash at maturity and only the amount above the upper strike

is settled in shares •

Minimal

Economic

Dilution:

Call

spread

overlay

increased

effective

conversion

premium

and

price

to

75% and $41.14, respectively

•

No ownership dilution to common stock holders below $41.14 per share

•

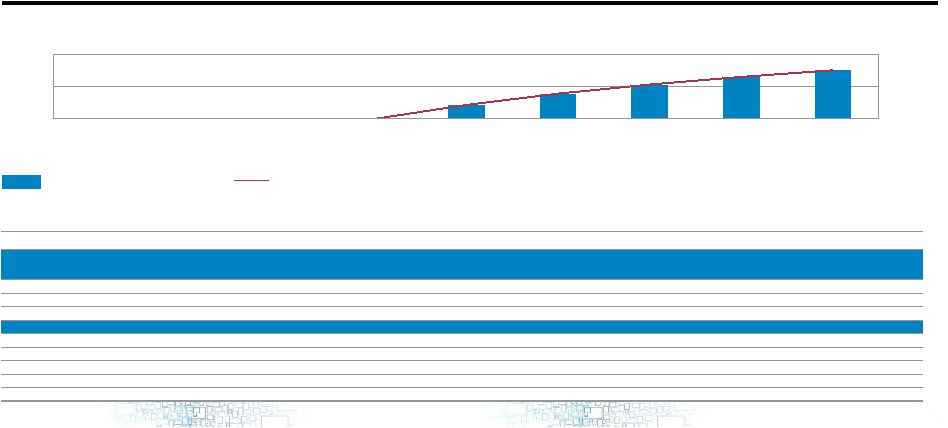

Allows for a 5-year ERTS CAGR of ~12% of stock price appreciation

Convertible Offering Highlights

A cost efficient form of financing; no shareholder dilution below $41.14/share

Note: Tax deductibility on issuance expected to be better than the stated cash coupon due to tax

integration of bond and hedge. The result is approximately $130 million of gross

implied deductible interest costs further lowering after-tax borrowing costs. Preliminary estimates as of July 20, 2011, subject to change.

|

0.0

5.0

10.0

$26.14

$31.14

$36.14

$41.14

$46.14

$51.14

$56.14

$61.14

$66.14

0.0%

1.5%

3.0%

Number of Shares

% of Total Shares Outstanding

Stock Price at Conversion

Shares Issued Upon Conversion

Minimal Economic Dilution

Shares Issued Upon Conversion

MM

% of TSO

0.75% up 35.0% for base convertible, $41.14 upper strike (75.0% effective premium)

A

B

C = Max(0, A-$41.14)

D = B*C

E = D/A

F

Stock Price At Conversion

Shares Underlying (MM)

In-the-Money Amount including

Call Spread

In-the-Money Amount ($MM)

including Call Spread

Number of Shares (MM)

% of Total Shares Outstanding

$26.14

19.9

$0.00

0.0

0.0

0.0%

$31.14

19.9

$0.00

0.0

0.0

0.0%

$36.14

19.9

$0.00

0.0

0.0

0.0%

$41.14

19.9

$0.00

0.0

0.0

0.0%

$46.14

19.9

$5.00

99.6

2.2

0.6%

$51.14

19.9

$10.00

199.2

3.9

1.2%

$56.14

19.9

$15.00

298.9

5.3

1.6%

$61.14

19.9

$20.00

398.5

6.5

2.0%

$66.14

19.9

$25.00

498.2

7.5

2.3%

5

Shares Issued Upon Conversion - Convertible with Call Spread Overlay |