Attached files

Global Hunter Securities

Conference

July 18-19, 2011

Exhibit 99.1 |

2

Forward-looking Statements

This

presentation

contains

various

forward-looking

statements

and

information

that

are

based

on

management’s

current

expectations

and

assumptions

about

future

events.

Forward-looking

statements

are

generally

accompanied

by

words

such

as

“estimate,”

“project,”

“predict,”

“expect,”

“anticipate,

” “plan,”

“intend,”

“seek,”

“will,”

“should,”

“goal”

and

other

words

that

convey

the

uncertainty

of

future

events

and

outcomes.

Forward-looking

information

includes,

among

other

matters,

statements

regarding

the

Company’s

anticipated

growth,

quality

of

assets,

rig

utilization

rate,

capital

spending

by

oil

and

gas

companies,

production

rates,

the

Company's

growth

strategy,

and

the

Company's

international

operations.

Although

the

Company

believes

that

the

expectations

and

assumptions

reflected

in

such

forward-looking

statements

are

reasonable,

it

can

give

no

assurance

that

such

expectations

and

assumptions

will

prove

to

have

been

correct.

Such

statements

are

subject

to

certain

risks,

uncertainties

and

assumptions,

including,

among

others:

general

and

regional

economic

conditions

and

industry

trends;

the

continued

strength

of

the

contract

land

drilling

industry

in

the

geographic

areas

where

the

Company

operates;

decisions

about

onshore

exploration

and

development

projects

to

be

made

by

oil

and

gas

companies;

the

highly

competitive

nature

of

the

contract

land

drilling

business;

the

Company’s

future

financial

performance,

including

availability,

terms

and

deployment

of

capital;

the

continued

availability

of

qualified

personnel;

changes

in

governmental

regulations,

including

those

relating

to

the

environment;

the

political,

economic

and

other

uncertainties

encountered

in

the

Company's

international

operations

and

other

risks,

contingencies

and

uncertainties,

most

of

which

are

difficult

to

predict

and

many

of

which

are

beyond

our

control.

Should

one

or

more

of

these

risks,

contingencies

or

uncertainties

materialize,

or

should

underlying

assumptions

prove

incorrect,

actual

results

may

vary

materially

from

those

expected.

Many

of

these

factors

have

been

discussed

in

more

detail

in

the

Company's

annual

report

on

Form

10-

K

for

the

fiscal

year

ended

December

31,

2010.

Unpredictable

or

unknown

factors

that

the

Company

has

not

discussed

in

this

presentation

or

in

its

filings

with

the

Securities

and

Exchange

Commission

could

also

have

material

adverse

effects

on

actual

results

of

matters

that

are

the

subject

of

the

forward-looking

statements.

All

forward-looking

statements

speak

only

as

the

date

on

which

they

are

made

and

the

Company

undertakes

no

duty

to

update

or

revise

any

forward-looking

statements.

We

advise

our

shareholders

to

use

caution

and

common

sense

when

considering

our

forward-looking

statements. |

Overview

Ticker Symbol:

PDC

Market Cap:

$788 million (July 14, 2011)

Stock price:

$14.61 (July 14, 2011)

Average 3-month daily

trading volume:

739,849 shares

Public float*:

Approximately 54 million shares

Employees:

2,692

Headquarters:

San Antonio, Texas

Website:

www.pioneerdrlg.com

3

*Does not include effect of 6,000,000 share offering priced on close of business July

14, 2011 |

4

Pioneer Drilling Overview |

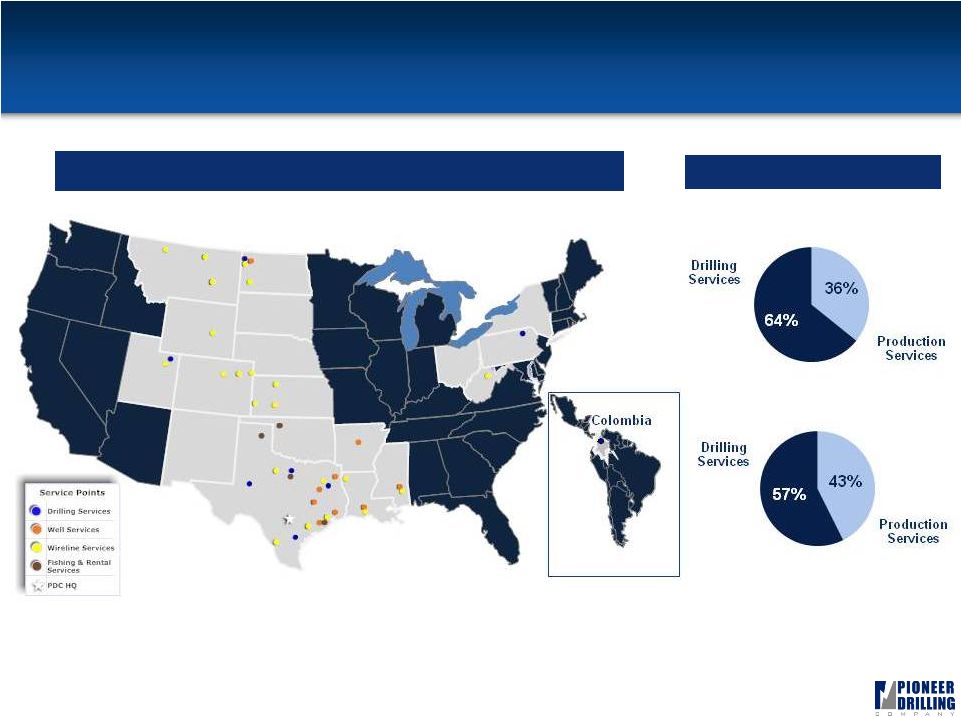

Pioneer Drilling Company

5

71 Drilling Rigs in 8 Locations

Approximately 9th largest contract driller

80 Well Service Rigs in 11 Locations

Approximately 7th largest well service

provider

99 Wireline Units in 21 Locations

81 cased hole

18 open hole |

6

Leading Service Provider Across Well Life Cycle

Diversified Business and Geography Mix

TTM March 31, 2011

Total Revenue: $555 million

Total Margin: $187 million |

Investment Considerations

Continued organic growth opportunities in core businesses: land drilling,

well services and wireline

Signed five new-build drilling term contracts for delivery in the first and

second quarters of 2012

Adding 12 well service rigs in 2011

Adding 17 wireline units in 2011

Recently opened West Texas drilling division with ten rigs drilling and four

additional rigs under contract to begin drilling late 2011

Strong contract backlog

37 rigs backed by term contracts (approximately 76% of working rigs)

Enhanced balance sheet flexibility

Equity offering of 6,000,000 shares priced on July 14, 2011, netting approximately

$82MM

Recently amended and restated credit agreement for $250mm, 5-yr, senior secured

credit facility maturing in 2016

Over 60% of Q1 revenue derived from oil/liquids-focused activity

7 |

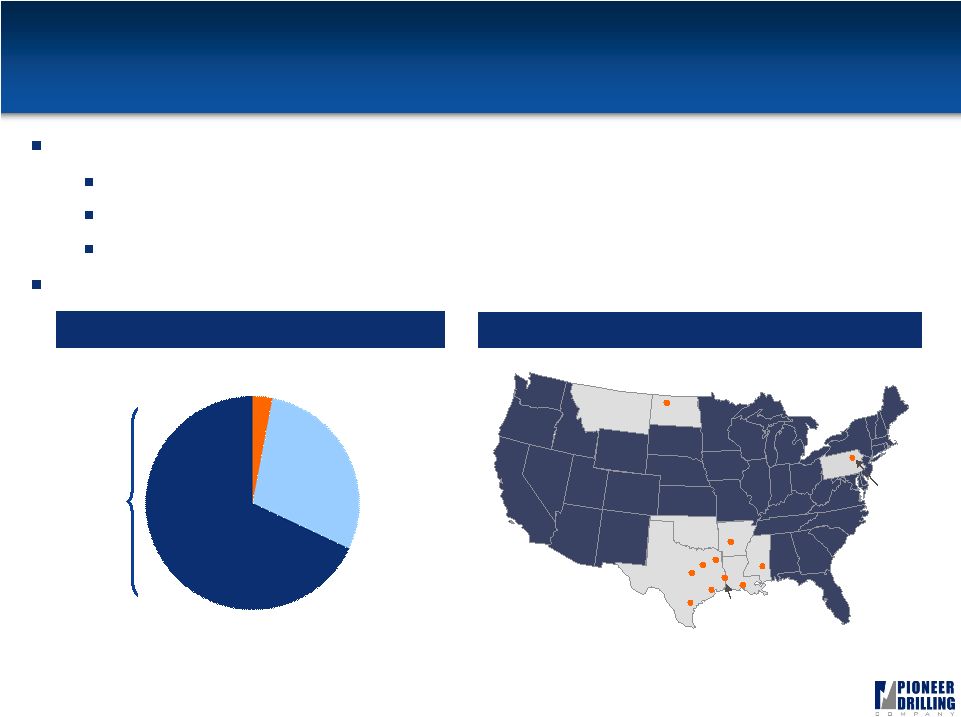

High Quality Drilling Fleet,

Focused on Unconventional Plays

8

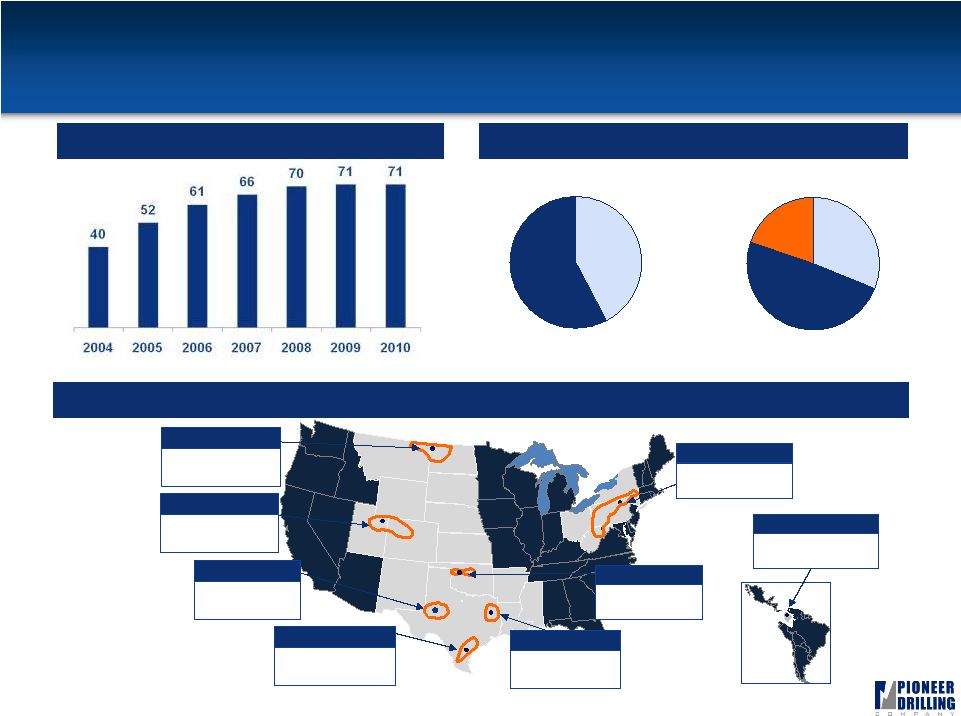

Historical Fleet Growth

Drilling Locations

Current Rig Fleet Mix

Note: Rig counts for 2004, 2005 and 2006 represent fiscal years ended March 31,

2004, 2005 and 2006 while 2007, 2008 and 2009 represent fiscal years ended

December 31, 2007, 2008 and 2009. *Cold-stacked

**10 rigs drilling, 4 under contract to begin drilling by the end of 2011

16 rigs

South Texas

9 rigs

East Texas

58%

42%

49%

31%

20%

Electric

Mechanical

550-999

HP

1,000-1,499

HP

1,500-2,000

HP

9 rigs

North Dakota

14 rigs

West Texas**

3 rigs

Utah

7 rigs

Appalachia

8 rigs

Colombia

5 rigs

Oklahoma* |

0%

20%

40%

60%

80%

100%

Pioneer

Helmerich & Payne

Patterson-UTI

Nabors

Precision (U.S.)

9

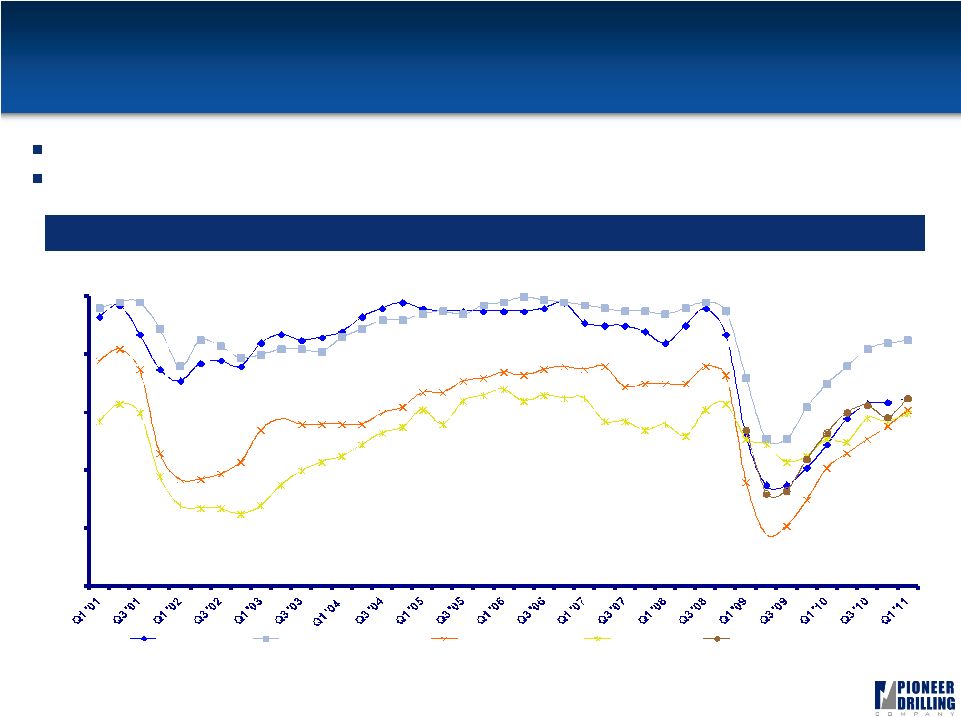

Strong Utilization Through the Cycles

Source: Helmerich & Payne, Patterson-UTI, & Precision Drilling

data consists of U.S. domestic utilization rates derived from Form 10-K, Form 10-Q reports, & press releases. Nabors utilization rates for worldwide land fleet obtained from

public documents and industry analysts. Helmerich & Payne Q3 2010 only

estimated based on analyst reports. Pioneer Drilling utilization rates include Colombian operations beginning Q3 2007.

(1) PDC utilization as of July 5, 2011.

Averaged 85% utilization through cycles since 2001, comparing favorably to

peers Utilization

has

rebounded

from

a

monthly

low

of

33%

in

June

2009

to

69%

currently

(1)

Comparable Utilization Rates

69% |

10

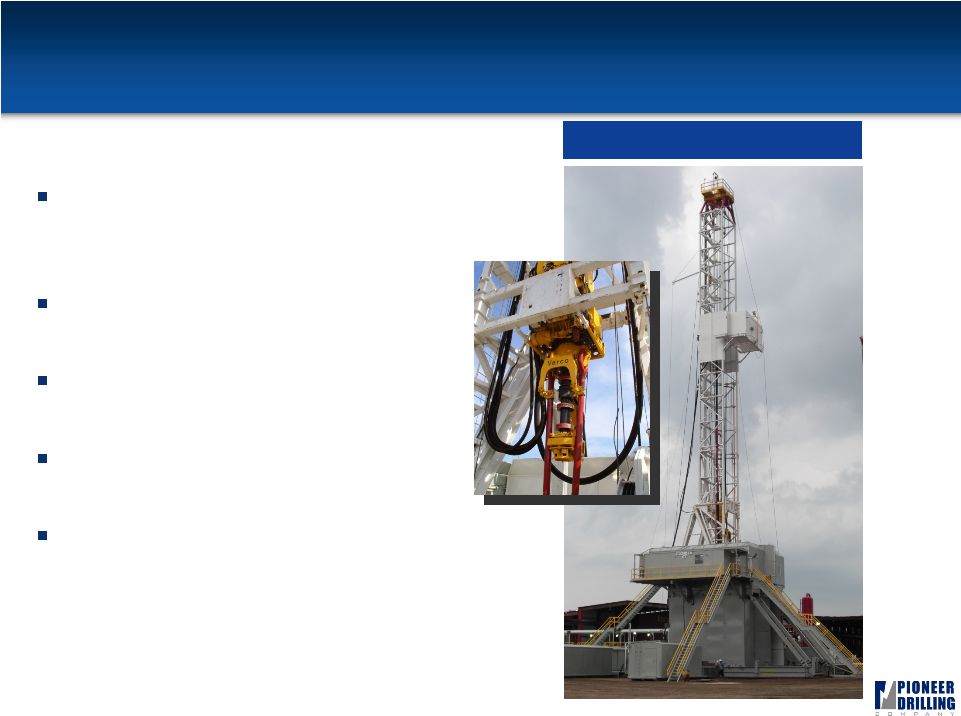

Modern, Efficient Drilling Fleet

35 rigs working with top drives (49%

of fleet)

16 walking/skidding systems on rigs

34 pairs of 1,300/1,600 HP mud pumps

62% of rigs have iron roughnecks

42% of rigs are electric

50 Series Rig |

New-Builds Driving Visible Organic Growth

11

Five state-of-the-art AC rigs under construction

Rigs secured with long term contracts up to four

years

Attractive rates of return (20%+ IRR)

Ideal for drilling complex shales such as Bakken,

Eagle Ford and Marcellus |

New-Build Features

12

State-of-the-art 550K and 750K sub & mast AC new-

builds

Integrated 500 ton top drives in mast section for

faster rig up and rig down

Crane free rig up / rig down design

30 loads on base rig for fast moves

BOP handling systems

Automatic catwalk

1,600 HP and 2,000 HP mud pumps

Latest features in rig control software

Ability to drill multi-well single-row pads and walk

easily between wells with above ground heads |

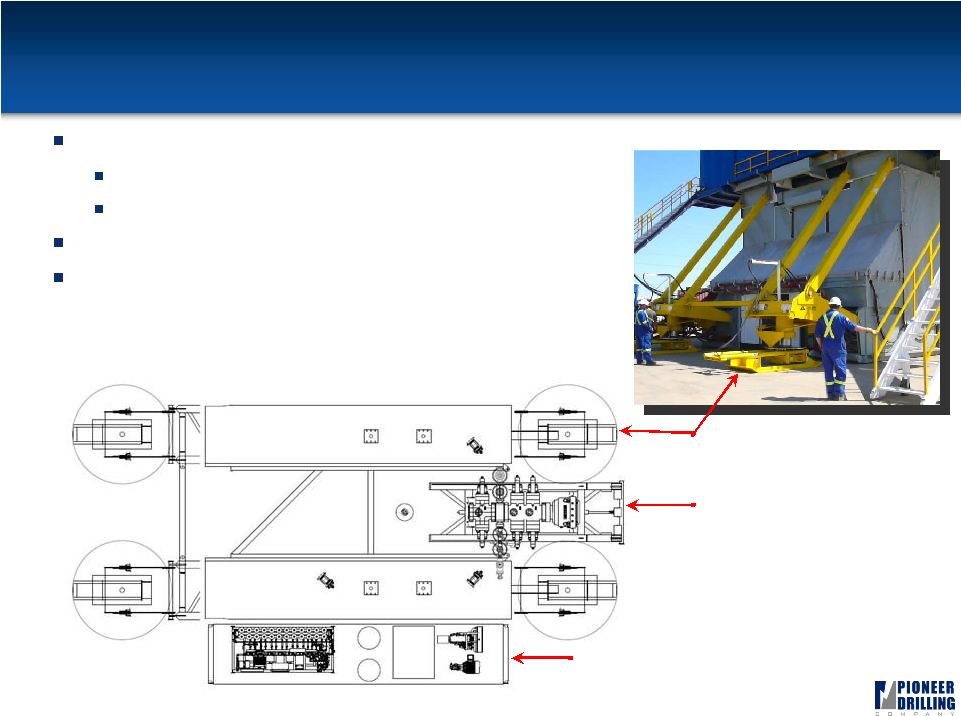

New-Build Pad Drilling Capability

13

BOP Wrangler

Pin On Walking System

One Walker Per Corner

Accumulator/HPU Skid

Pin On Walking System

Can walk in either direction or spin the rig

Can walk with full set back of drill pipes in mast

Accumulator & HPU walks with sub

BOP handling system walks with sub |

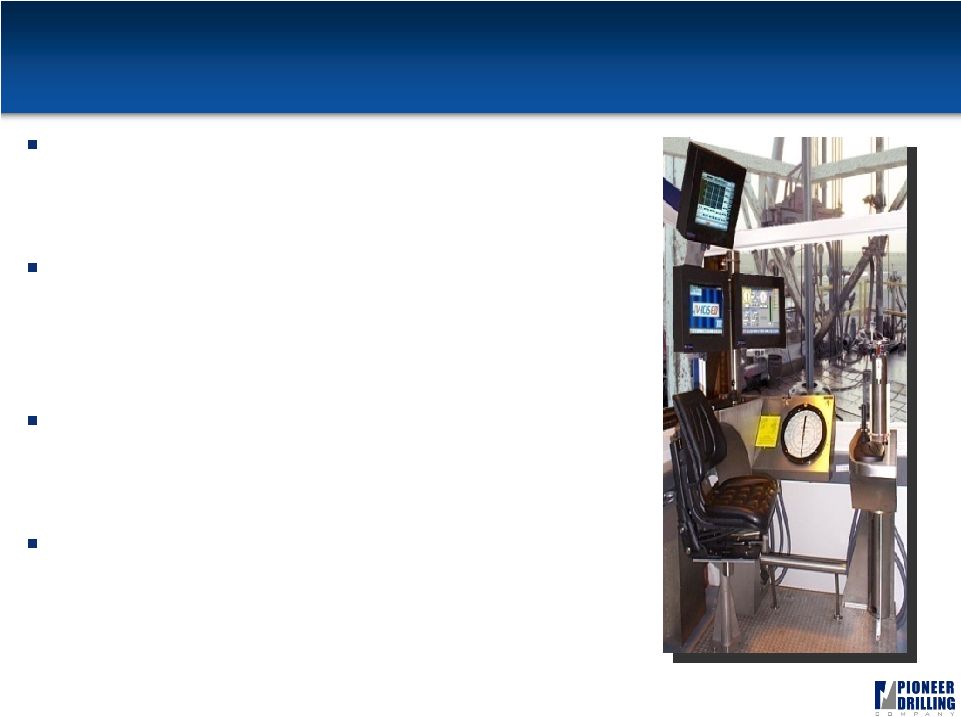

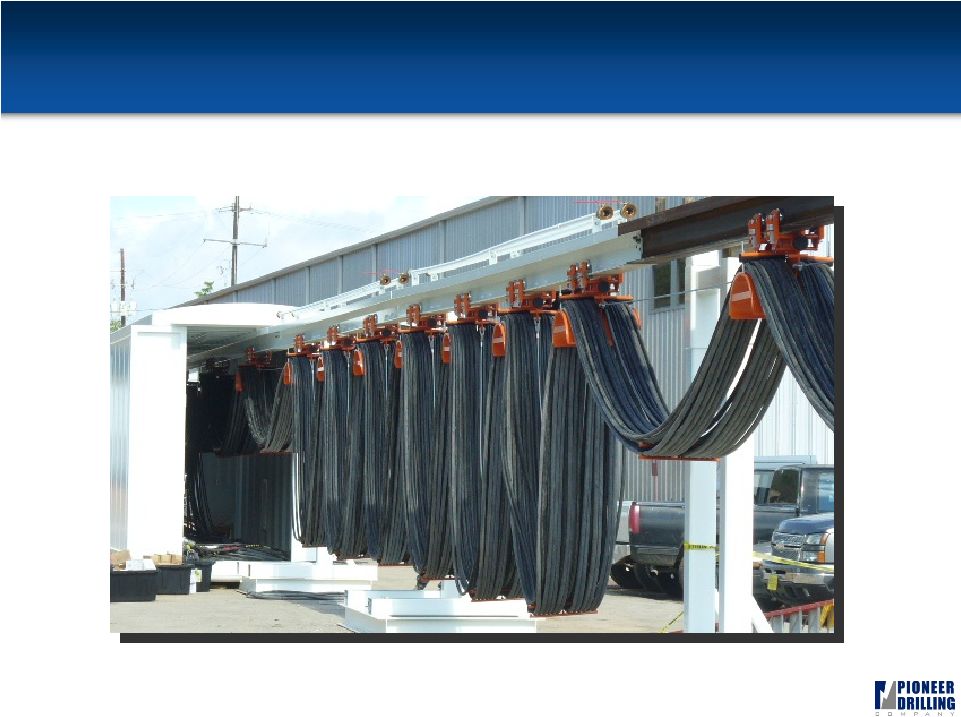

New-Build Advanced Electrical System

14

Festoon System to Manage Electrical Supply to Substructure

|

Premium Well Servicing Fleet,

Established Positions in Emerging Shale Plays

15

One

of

the

newest

and

most

highly

capable

well

service

fleets

in

the

industry

Seventy-three 550 HP rigs

Six 600 HP rigs

One 400 HP rig

Established in the Bakken, Fayetteville, Haynesville and Eagle Ford shales

Well Service Fleet Age

Well Service Locations

Average year in service: 2007

68%

2007 or

newer

29%

3%

Williston

Bryan

Palestine

Longview

New Iberia

El Campo

Liberty

Kenedy

Conway

Laurel

2005-2006

2002-2004

New

Milford |

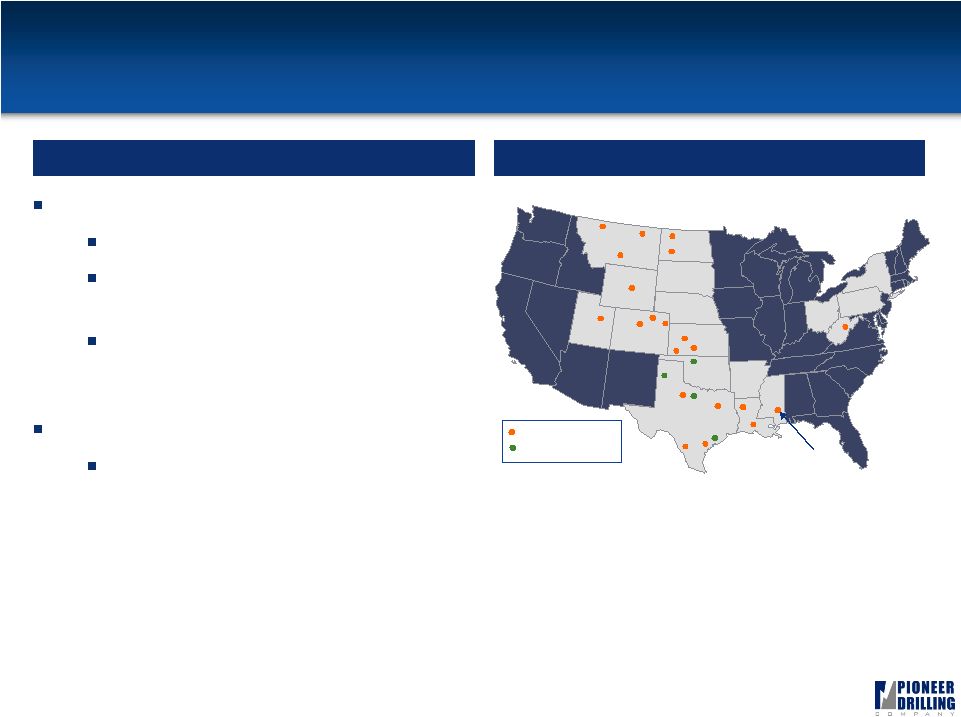

Wireline and Fishing & Rental Overview

16

Wireline Services

Open and cased-hole wireline services

Fleet of 99 wireline units has an

average age of less than 6 years

Established in the Bakken, Barnett,

Marcellus, Haynesville, Niobrara, and

Eagle Ford shales

Fishing & Rental Services

Range of specialized services and

equipment that are utilized on a non-

routine basis for both drilling and well

servicing operations

Overview

Wireline Locations

Williston

Dickinson

Cut Bank

Billings

Havre

Tyler

Bossier City

Broussard

Graham

Roosevelt

Pratt

Liberal

Hays

Casper

Buckhannon

Ft. Morgan

Brighton

Wray

Woodward

Pampa

Springtown

El Campo

Wireline

Fishing & Rental

Laredo

Laurel

Victoria |

17

Industry and Market Conditions |

Resurgence in U.S. Land Rig Count

1

18

Steady rig count improvement since the second half of 2009

Horizontal and oil rig counts have surpassed Fall 2008 peak levels

Land Rig Count

Horizontal & Oil Rig Count

Source: Baker Hughes

Source: Baker Hughes.

Oil

Fall ’08 Peak: 442

July 1, 2011: 1,006

Horizontal

Fall ’08 Peak: 650

July 1, 2011: 1,073 |

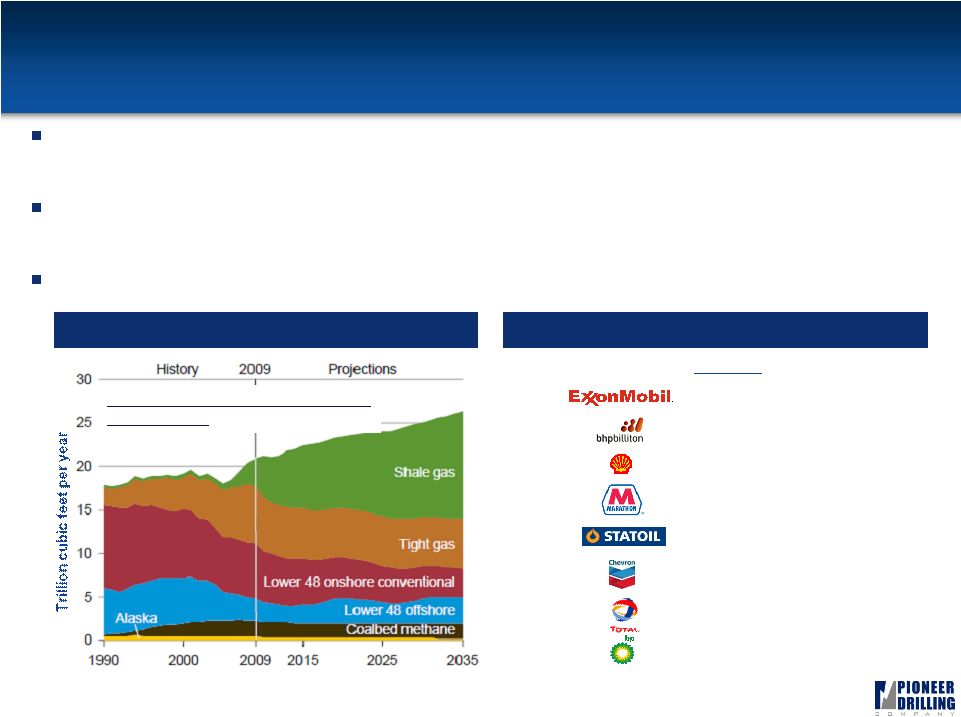

Benefits of Growing Shale Plays

1

19

Oilfield service companies stand to benefit from shale production due to its lower

risk

development

and

increased

service

intensity

(up

to

3

-

5x

conventional)

Shale

gas

is

expected

to

make

up

47%

of

total

U.S.

production

in

2035

vs.

its

16%

share in 2009

(1)

Reintroduction

of

the

Majors

in

the

U.S.

market

should

result

in

greater

activity

levels

Recent U.S. Shale Investments

Growing Importance of Shale

$Millions

$40,991

12/14/2009

$12,100

7/13/2011

$4,700

5/28/2010

$3,500

6/1/2011

$3,375

11/11/2008

$3,200

11/9/2010

$2,250

12/30/2009

$1,900

9/2/2008

(1)

SOURCE:

EIA

“ANNUAL

ENERGY

OUTLOOK

2011”

APRIL

2011

U.S. NATURAL GAS PRODUCTION

1990 –

2035

(1) |

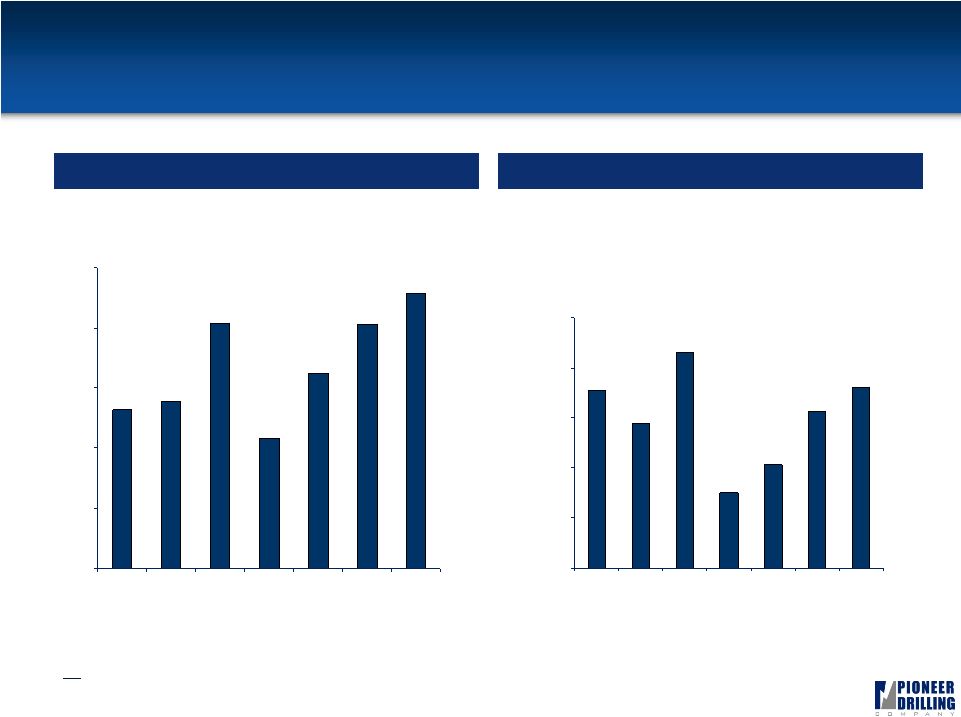

Conclusion: Improving Oil Service Outlook

1

20

North American capital spending and activity outlook is much

improved

Upstream Spending Outlook

Well Service / Workover Jobs Outlook

Source: Spears & Associates

Source: Spears & Associates. |

21

Financials |

22

$177

$145

$215

$75

$103

$154 -

$157

$174 -

$186

$0

$50

$100

$150

$200

$250

2006

2007

2008

2009

2010

2011E

Q2

TTM

2011E

Q2

Ann.

Strong Revenue and Adjusted EBITDA Growth

Revenue ($ millions)

Adjusted EBITDA ($ millions)

Note:

Fiscal year end was changed from March 31 to December 31 effective on December 31,

2007; all data points reflect calendar year and trailing twelve months information derived from 10K and 10Q filings.

(a) Please see our Form 8K dated July 12, 2011 for further information.

$396

$417

$610

$326

$487

$606 -

$611

$675 -

$695

$0

$150

$300

$450

$600

$750

2006

2007

2008

2009

2010

2011E

Q2

TTM

2011E

Q2

Ann.

(a)

(a)

(a)

(a) |

23

Recent Developments

New-Build Contracts

5 new-build AC drilling rigs with term contracts

Preliminary 2Q 2011 Operating Result Expectations

Drilling

rig

utilization

is

expected

to

be

between

approximately

68%

to

70%

Workover

rig

utilization

is

expected

to

be

between

approximately

89%

to

91%

Revenues are expected to be between approximately $168.8 and $173.8 million

Drilling Services is expected to be between approximately $105.0

and $108.0 million

Production Services is expected to be between approximately $63.8 and $65.8

million Net Income is expected to be between $2.6 and $4.6 million

EPS is expected to be between $0.05 and $0.08 per diluted share

Adjusted

EBITDA

is

expected

to

be

between

$43.6

million

to

$46.6

million

Capex is estimated to be between $200 and $220 million for full year 2011

Note: We have provided ranges for certain of our preliminary, estimated operating

results primarily because our quarter-end accounting close procedures for the three months ended June

30,

2011 are not

complete. As a result, there is a possibility that our final operating results

will vary materially from the preliminary estimates. Please see our Form 8K dated July 12, 2011 for further information. |

24

Recent Developments (cont.)

Priced equity offering of 6,000,000 shares on July 14, 2011

Estimated net proceeds of $82MM

Excludes exercise of over-allotment option of 15% (900,000 shares)

Amended and Restated Credit Agreement

Increases the aggregate amount of commitments from $225 million to $250

million Extends the maturity date from August 31, 2012 to June 30, 2016

Note: We have provided ranges for certain of our preliminary, estimated operating

results primarily because our quarter-end accounting close procedures for the three months ended June

30,

2011 are not complete. As a result,

there is a possibility that our final operating results will vary materially from

the preliminary estimates. Please see our Form 8K dated July 12, 2011 for

further information. |

Strong Liquidity and Capital Structure

25

Pro Forma Capitalization (As of March 31, 2011)

Pro Forma

$82MM Net Equity Offering

($ in millions)

March 31, 2011

Cash

$

15.3

$

55.2

Revolving

Credit

Facility

($250)

(1)

42.0

-

Sr. Unsecured Notes

240.3

240.3

Other

2.3

2.3

Total Debt

$

284.6

$

242.6

Stockholders' Equity

392.8

474.7

Total Capitalization

$

677.5

$

717.3

Liquidity

(2)

189.1

296.2

Debt

/

LTM

EBITDA

(3)

2.2x

1.9x

Debt / Total Book Capitalization

42.0%

33.8%

(1) Excludes $9.2 million of LCs outstanding. Pro-Forma for amended and

restated $250 mm credit facility. (2) Defined as remaining credit

facility capacity plus cash less LCs outstanding. (3) Total consolidated

leverage ratio as reported in form 10Q for 2011. |

26

Appendix |

27

Reconciliation of Adjusted EBITDA to Net Income

We define Adjusted EBITDA as earnings (loss) before interest income (expense),

taxes, depreciation, amortization, impairments, and the Colombian

Net

Equity

Tax.

Although

not

prescribed

under

GAAP,

we

believe

the

presentation

of

Adjusted

EBITDA

is

relevant

and

useful

because it helps our investors understand our operating performance and makes it

easier to compare our results with those of other companies that have

different financing, capital or tax structures. Adjusted EBITDA should not be considered in isolation from or as a

substitute for net earnings (loss) as an indication of operating

performance or cash flows from operating activities or as a measure of

liquidity. A reconciliation of net earnings (loss) to Adjusted EBITDA is included

in the table below. Adjusted EBITDA, as we calculate it, may not be

comparable to EBITDA measures reported by other companies. In addition, Adjusted EBITDA does not represent funds

available for discretionary use.

($ in millions)

Q3

2010

Q4

2010

Q1

2011

Q2

2011E

TTM

Adjusted EBITDA

34.2

37.7

38.9

43.6 - 46.6

154.4 - 157.4

Colombian Net Equity Tax

-

-

(7.3)

-

(7.3)

Depreciation & Amortization

(30.8)

(31.5)

(32.3)

(32.4)

(127.0)

Net Interest

(7.6)

(7.8)

(7.5)

(8.0)

(30.9)

Impairment Expense

-

(3.3)

-

-

(3.3)

Income Tax (Expense) Benefit

1.6

(1.0)

2.1

(0.6) - (1.6)

2.1 - 1.1

Net Income (Loss)

(2.6)

(6.0)

(6.0)

2.6 - 4.6

(12.0) - (10.0)

TTM

($ in millions)

2006

2007

2008

2009

2010

Adjusted EBITDA

176.6

144.5

214.8

74.9

103.2

Colombian Net Equity Tax

-

-

-

-

-

Depreciation & Amortization

(47.6)

(63.6)

(88.1)

(106.2)

(120.8)

Net Interest

3.6

3.3

(11.8)

(8.9)

(26.6)

Impairment Expense

-

-

(171.5)

-

(3.3)

Income Tax (Expense) Benefit

(47.7)

(27.3)

(6.1)

17.0

14.3

Net Income (Loss)

84.8

56.9

(62.7)

(23.2)

(33.3)

Fiscal Year

(a) Please see our Form 8K dated July 12, 2011 for further information.

(a)

(a) |

28 |