Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TPC Group Inc. | d8k.htm |

A

market leader in value-added products based on petrochemical raw

materials Annual Meeting of Shareholders

June 8, 2011

Exhibit 99.1 |

Forward-Looking Statements & Non-GAAP Financial Measures

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

securities

laws.

These

statements

include

assumptions,

expectations,

predictions,

intentions

or

beliefs

about

future

events,

particularly

statements

that

may

relate

to

future

operating

results,

existing

and

expected

competition,

market

factors

that

may

impact

financial

performance,

and

plans

related

to

strategic

alternatives

or

future

expansion

activities

and

capital

expenditures.

Although

TPC

Group

believes

that

such

statements

are

based

on

reasonable

assumptions,

no

assurance

can

be

given

that

such

statements

will

prove

to

have

been

correct.

A

number

of

factors

could

cause

actual

results

to

vary

materially

from

those

expressed

or

implied

in

any

forward-looking

statements,

including

risks

and

uncertainties

such

as

volatility

in

the

petrochemicals

industry,

limitations

on

the

Company’s

access

to

capital,

the

effects

of

competition,

leverage

and

debt

service,

general

economic

conditions,

litigation

and

governmental

investigations,

and

extensive

environmental,

health

and

safety

laws

and

regulations.

More

information

about

the

risks

and

uncertainties

relating

to

TPC

Group

and

the

forward-looking

statements

are

found

in

the

Company’s

SEC

filings,

including

the

Transition

Report

on

Form

10-K,

which

are

available

free

of

charge

on

the

SEC’s

website

at

http://www.sec.gov

.

TPC

Group

expressly

disclaims

any

obligation

to

update

any

forward-

looking

statements

contained

herein

to

reflect

events

or

circumstances

that

may

arise

after

the

date

of

this

presentation.

This

presentation

may

also

include

non-GAAP

financial

information.

A

reconciliation

of

non-GAAP

financial

measures

to

the

most

directly

comparable

GAAP

financial

measures,

as

well

as

additional

detail

regarding

the

utility

of

such

non-GAAP

financial

information,

is

included

in

the

Appendix.

2 |

TPC

Group overview 3

•

Market leader with products that are essential to our customers

•

Largest

independent

producer

of

butadiene;

35%

of

North

American

production

•

Attractive, growing markets driven by transportation trends and economic

growth •

Synthetic rubber, nylon, fuels, lubricants, plastics, surfactants

•

Unique, well-situated manufacturing assets and logistics network

•

In the Gulf Coast, along the industrial corridor

•

Stable, consistent cash flows

•

Substantial future growth opportunities

•

Capital and non-capital growth opportunities |

Fuel

& Lube Additives Gasoline & Blendstocks

Selected end product markets

4

Tires

Market Drivers:

Nylons

•

Increasing mobility trends

•

Improving tire

technologies

•

Engine life and

performance

•

Higher energy value in

fuels

•

Global growth of fuel

oxygenates

•

Attractive markets for

high performance nylons |

Executing well on a strong foundation

5 |

Business environment is favorable

6

•

Butadiene

markets

structurally

tight,

enabling

significant

price

increases

•

Global supply remains constrained as ethylene producers crack lighter feeds

•

Global demand rising on strength of economic recovery and Asia growth

•

Higher

gasoline

prices

have

benefited

margins.

Butene-1,

isobutylene

and

raffinates are priced relative to gasoline

•

Butene-1

market

strengthening

further

due

to

North

America

polyethylene

growth

•

Fuel and lube additives markets are growing globally, driven by desire for improved

engine life and performance

•

Strengthening global economies have improved the demand for propylene

derivatives used in a broad range of industrial and consumer products

|

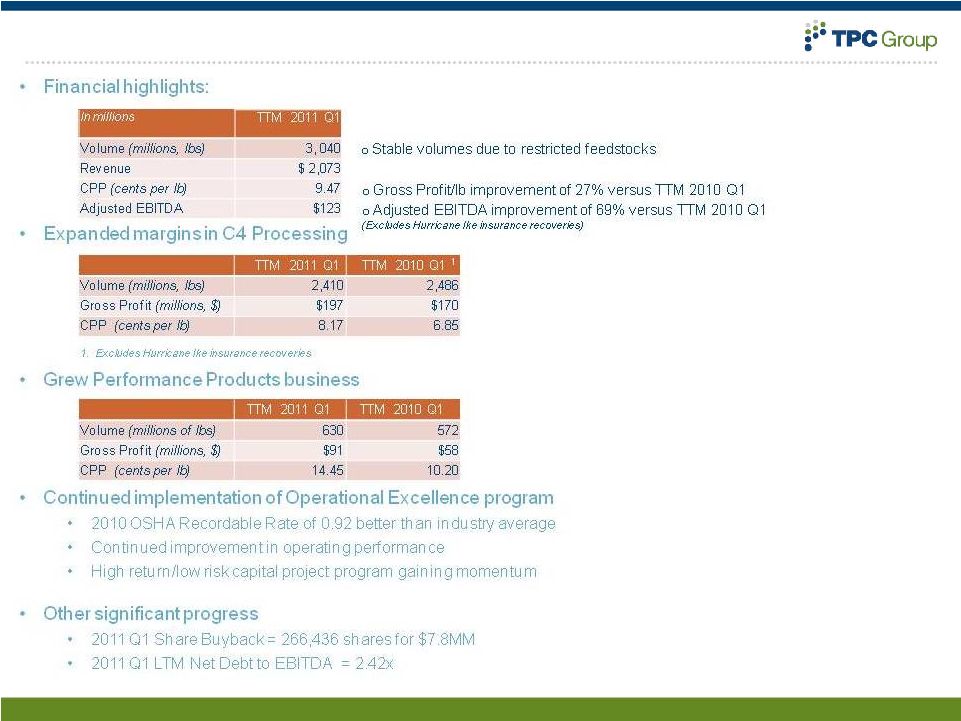

Driving sustained earnings growth

7

•

On track to achieve target of $150MM EBITDA by end of 2012

•

Margin expansion in C4 Processing segment

•

Growth in Performance Products segment

•

Implementation of high return/low risk capital projects

•

Expanding margins in C4 Processing segment through focus on profitability and

expansion of services model

•

Growing volumes in Performance Products, particularly polyisobutylene and

propylene derivative products

•

Accelerating High Return/Low Risk capital project program to drive productivity and

cost savings in manufacturing and supply chain

•

New Technical Center in Houston will enhance technology platforms

•

Operational Excellence initiatives continue to elevate our overall

performance |

Building-out our strategies for growth beyond 2013

8

•

Unprecedented, “game-changing”

opportunities for TPC Group

•

Attractive longer term fundamentals for our key products

•

Plentiful butane sourced from natural gas liquids

•

Idled assets capable of producing valuable C4 products from butane

•

Evaluating capital project to use idled Dehydrogenation Unit to produce isobutylene

from butane as a feedstock for our performance products and fuels businesses

by Q1 2014

•

Increasing availability of butane from natural gas liquids

•

Isobutylene

and

derivatives

pricing

associated

with

crude

oil

or

gasoline

price

levels

•

Engineering study in progress on one of two idled Dehydrogenation Units

•

Considering range of alternatives for second Dehydrogenation Unit, including

on- purpose production of butadiene from natural gas liquids

•

Our longstanding customers in North America are growing rapidly in Asia.

Potential opportunities for expansion of our business in the region

|

Adjusted EBITDA and Operating Cash Flow

9

* Excludes one time income tax refund of $40MM |

Key

Takeaways 10

1.

Focused growth in core markets

2.

Continued margin expansion through services model

3.

Operational Excellence initiatives generating substantial financial

value

4.

Margin model yields consistent cash flow

5.

“Game-changing”

growth opportunities for the future

Strong, sustainable earnings growth |

Appendix

11 |

Reconciliation of adjusted EBITDA to Net Income

12

TPC Group Inc

Annual Shareholder Meeting Presentation

Reconciliation of Adjusted Proforma EBITDA to Net Income (Loss) (in millions)

Calendar Year Ended December 31,

TTM March 31,

2008

2009

2010

2011

Adjusted Proforma EBITDA

$ 92

$ 60

$ 108

$ 123

Pro Forma Adjustments (1)

(45)

25

-

-

Adjusted EBITDA as Reported

47

86

108

123

Reconciliation to Net Income (Loss)

Income taxes

3

(8)

(16)

(19)

Interest expense, net

(17)

(15)

(22)

(27)

Depreciation and amortization

(40)

(41)

(39)

(40)

Asset impairment

-

(6)

-

-

Net income (loss)

$ (8)

$ 15

$ 31

$ 38

Net cash from operating activities

$ 28

$ 59

$ 105

$ 54

Income Tax Refund

$ (40)

$ 28

$ 59

$ 65

$ 54

(1) –

Adjusted for Hurricane Ike loss and subsequent recovery

|