Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WESTWOOD HOLDINGS GROUP INC | d8k.htm |

Westwood

Holdings Group, Inc. Investment Management & Specialty Finance Conference

June 7, 2011

Brian O. Casey

President &

Chief Executive Officer

Susan M. Byrne

Chairman &

Co-Chief Investment Officer

Exhibit 99.1 |

Forward

– Looking Statements

Statements in this presentation that are not purely historical facts, including statements

about our expected future financial position, preliminary estimates, results of

operations or cash flows, as well as other statements including words such as

“anticipate,” “believe,”

“plan,”

“estimate,”

“expect,”

“intend,”

“should,”

“could,”

“goal,”

“target,”

“designed,”

“on track,”

“comfortable with,”

“optimistic”

and other similar expressions, constitute forward-

looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Actual results and the timing of some events could differ materially from those projected in or contemplated by the forward-

looking statements due to a number of factors, including, without limitation, those set forth

below: •

our ability to identify and successfully market services that appeal to our customers;

•

the significant concentration of our revenues in four of our customers;

•

our relationships with investment consulting firms;

•

our relationships with current and potential customers;

•

our ability to retain qualified personnel;

•

our ability to successfully develop and market new asset classes;

•

our ability to maintain our fee structure in light of competitive fee pressures;

•

competition in the marketplace;

•

downturn in the financial markets;

•

the passage of legislation adversely affecting the financial services industries;

•

interest rates;

•

changes in our effective tax rate;

•

our ability to maintain an effective system of internal controls; and

•

the other risks detailed from time to time in our SEC reports.

Additional

factors

that

could

cause

our

actual

results

to

differ

materially

from

our

expectations

are

discussed

under

the

section

entitled

“Risk

Factors”

in our Form 10-K for the year ended December 31, 2010, which together with our other

filings can be viewed at www.sec.gov. You should not unduly rely on these

forward-looking statements. Except as required by law, we are not obligated to publicly release any revisions to these forward-looking

statements. |

Agenda

I.

Firm Overview

II.

Investment Process & Products

III.

Growth Opportunities

IV.

Financial Highlights

V.

Summary |

Firm

Overview |

Westwood

Overview •

Asset management firm focused on Value & Income investment strategies

•

Serving institutional, private client and mutual fund investors since 1983

•

Track record of providing strong long-term risk-adjusted returns

•

Client-centered culture; interests aligned with equity-based incentives

•

Publicly traded since 2002 (NYSE : WHG)

Page 1

1

as of May 31, 2011 |

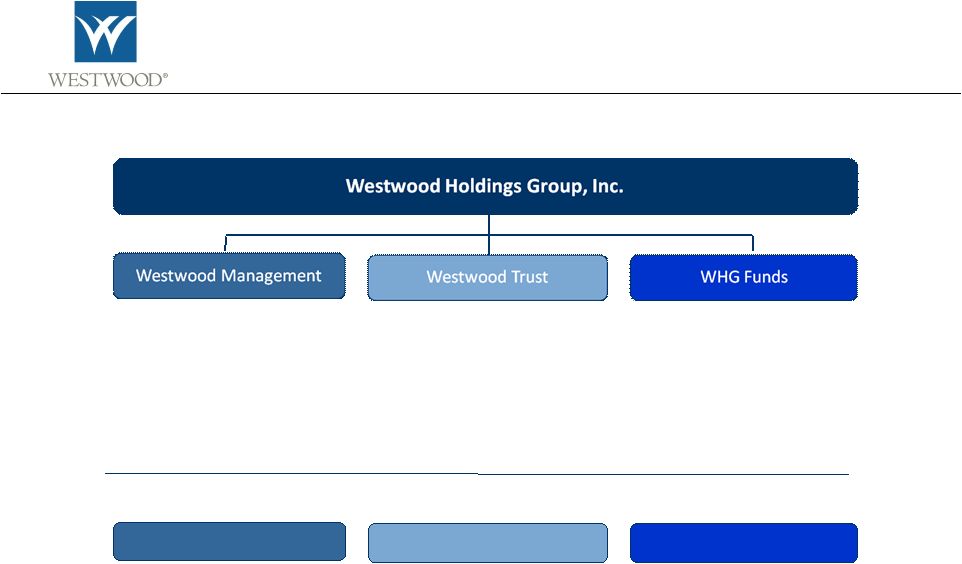

Product

Distribution •

Separately managed portfolios

•

Subadvisory

•

Collective funds

•

Targeted consultant

relationships

•

Subadvisory partners

•

Plan sponsor direct marketing

•

Enhanced

Balanced

TM

asset

allocation model

•

Commingled funds

•

Separately managed portfolios

•

Tax-managed accounts

•

Client referrals

•

Third party referral sources

•

Local community involvement

•

Capped expense ratios

•

Institutional share class

•

Defined contribution plans

•

Other institutions

•

A share class

•

Mutual fund supermarkets

•

DC consultants

•

Private Wealth Advisors

•

Media

Page 2

Distribution Channels

Institutional

Private Wealth

Mutual Funds |

Investment

Process & Products |

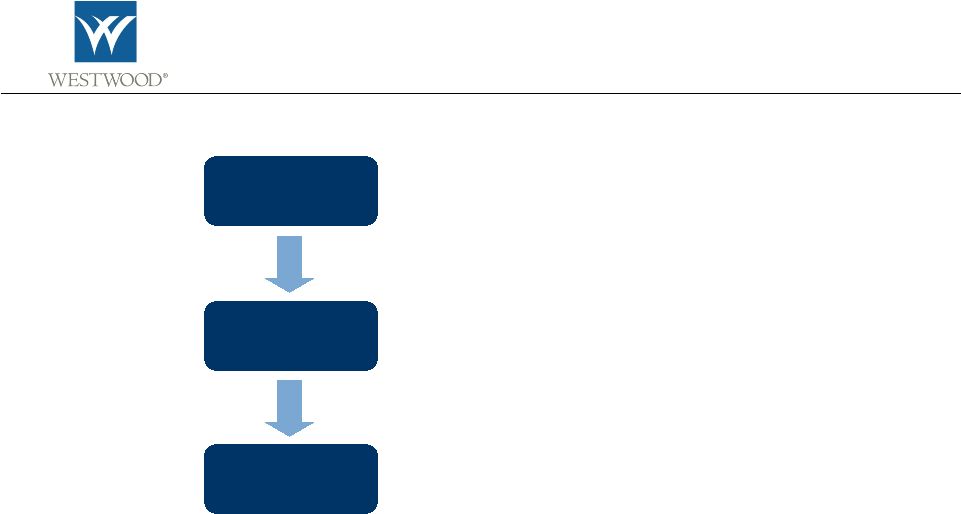

Overview of

Investment Process Qualities that Westwood analysts look for in securities:

•

Strong free cash flow characteristics

•

Stable to improving return on equity

•

Improving balance sheet

•

Upside earnings surprise without corresponding change in consensus estimates

Portfolio

Teams

Research

Analysts

•

Idea generation

•

Proprietary fundamental research

•

Make buy & sell recommendations

4 Research

Groups

•

Led by senior analysts

•

Weekly due diligence meetings to review analyst recommendations

•

Approved securities move to list of portfolio candidates

•

At least one member from each Research Group

•

Weekly meetings to review portfolio and new names

•

Makes buy and sell decisions and manages portfolio risk

Page 3

Team-based approach with risk analysis incorporated at every level

|

*Due

to

capacity

constraints,

this

product

closed

to

new

investors

effective

October

1,

2009.

Performance

provided

reflects

the

institutional

track

record

which

started

January

1,

2002.

In

2001,

Westwood

transitioned

a

midcap

core

equity

strategy

to

the

institutional

SMidCap

strategy.

The

midcap

core

portfolio

was

exclusively

offered

to

private

clients

of

Westwood's

Trust

Company.

This

change

occurred

as

a

result

of

the

increased

demand

we

observed

by

institutional

investors.

January

1,

2002reflects

the

inception

of

the

institutional

SMidCap

Equity

strategy.

The

true

inception

date

of

the

composite

is

7/1/97.

This

strategy

has

consistently

adhered

to

Westwood's

investment

process

and

philosophy.

Past

performance

is

not

a

guarantee

of

future

returns.

Returns

are

preliminary

and

are

subject

to

change.

Please

see

appendix

for

full

performance

disclosures

(http://westwoodgroup.com/disclaimers.pdf).

The

disclosures

provided

are

considered

an

integral

part

of

this

presentation.

Benchmark

DataSource:

©

2011

MellonAnalytical

Solutions,

LLC.

All

Rights

Reserved.

Investment Product Performance vs. Benchmark

Through March 31, 2011

Page 4

Our investment teams have delivered excess returns across Value & Income

products…

…with lower risk than their benchmarks |

Growth

Opportunities |

Growth

Opportunities •

Significant capacity remains in seasoned products

o

Opportunity for operating leverage is substantial

•

Subadvisory mandates

o

Access to broad distribution infrastructure & global markets

o

Support partner distribution network vs. building proprietary distribution network

•

WHG Funds

o

Seven mutual funds managed by Westwood Management

o

Strong organic growth; assets under management currently exceed $1.2 billion

o

WHG Dividend Growth Fund added via McCarthy acquisition

o

Asset acquisition opportunities

•

Private Wealth

o

Westwood Trust product development and asset gathering platform

o

Leverage referral sources

o

Expand

private

wealth

platform

in

new

markets

–

i.e.

McCarthy

Group

Advisors

(Omaha)

Page 5 |

Corporate

Development Opportunities We seek to augment organic growth by pursuing strategic

opportunities •

Mutual fund asset acquisition opportunities

o

Adds scale to WHG Funds

o

Incrementally profitable –

minimal ongoing costs

o

Benefits fund shareholders via expense ratio reduction opportunities

•

Private wealth

o

Expand private wealth platform in new markets

o

Acquire relationship managers and asset gatherers

•

Acquire additional products and research capabilities

o

International

o

Emerging Markets

o

Global

Page 6 |

Completed

Acquisitions Philadelphia

Fund

–

November

2009

o

$52 million AUM LargeCap Value fund (PHILX)

o

Merged into WHG LargeCap Value Fund (WHGLX)

o

Incremental scale and profitability for WHG Funds

o

Accretive purchase, low risk assets

McCarthy

Group

Advisors

–

November

2010

o

$1.1 billion AUM private wealth firm based in Omaha

o

Talented professionals with excellent reputation; loyal client base

o

Provides access to vibrant, underserved wealth market

o

Principals want to continue to grow the company

o

Addition to WHG Funds lineup –

WHG Dividend Growth Fund (WHGDX); $68 million as of 12/31/10

Page 7 |

International

Product Expansion We are exploring multiple opportunities to broaden our product lineup

to include international/emerging markets/global portfolio management.

o

Demand from institutional investors continues to be strong

o

Scarcity

of

quality

managers

with

available

capacity,

especially

in

emerging

markets

o

Considering buy / build / hire options

Page 8 |

Significant

Product Capacity Remains Page 9

Seasoned Products

(>3 year track record & >$100 Million in assets)

Assets Under

Management

As of 5/31/11

Estimated

Maximum

Capacity AUM

Asset Growth

Potential

Product

Inception

LargeCap Value

$6.3 billion

$25 billion

$18.7 billion

1987

SMidCap Value

$3.0+ billion

$3 billion

Closed

1997

SMidCap Plus+

$430 million

$8 billion

$7.6 billion

2010

SmallCap Value

$245 million

$1.5 billion

$1.3 billion

2004

AllCap Value

$210 million

$10 billion

$9.8 billion

2002

Dividend Growth

$150 million

$20 billion

$19.9 billion

2001

Income Opportunity

$690 million

$2 billion

$1.3 billion

2003

MLP

$170 million

$1.5 billion

$1.3 billion

2003

Total Seasoned

$11.6 billion

$71 billion

$59 billion

Unseasoned (R&D) & Legacy Products

Balanced / Fixed Income / REIT / MidCap / LargeCap Enhanced /

Global Strategic Diversification

$678 million

N/A

N/A

Various

Note:

Table reflects Westwood Management AUM as of 5/31/11 (including Westwood Trust commingled

funds); excludes approximately $860 million in Westwood Trust separately managed

accounts, agency assets and subadvised commingled funds and $830 million of additional assets managed by Omaha office

Opportunity for asset growth and operating leverage are substantial

|

Subadvisory

Page 10

Subadvisory opportunities –

attractive means for enhanced distribution of scalable products

•

Access to established distribution channels

•

Generally lower average fee, but high profitability due to low incremental costs

•

Current Westwood Subadvisory mandates |

Growth in

Subadvisory Assets Page 11

We have added 5 relationships and increased Subadvisory assets by $841 million since Q1

2008 |

Pictet &

Cie •

One of Europe’s oldest (founded in 1805) and largest ($418 B AUM) private banks

•

Selected Westwood to manage their first U.S. Value fund

•

Marketing tours to 15 European cities with Pictet since Spring 2010

Cities Visited:

Lugano, Milan, Paris, Zurich, Geneva, Lisbon, Madrid,

Luxembourg, Frankfurt, London, Helsinki, Stockholm, Amsterdam,

The

Hague & Vienna

•

Unique opportunity to introduce Westwood to significant new markets

•

Near-term

asset

expectations

are

modest

–

AUM

of

$216

million

at

5/31/11

•

Longer-term opportunity is substantial

Page 12 |

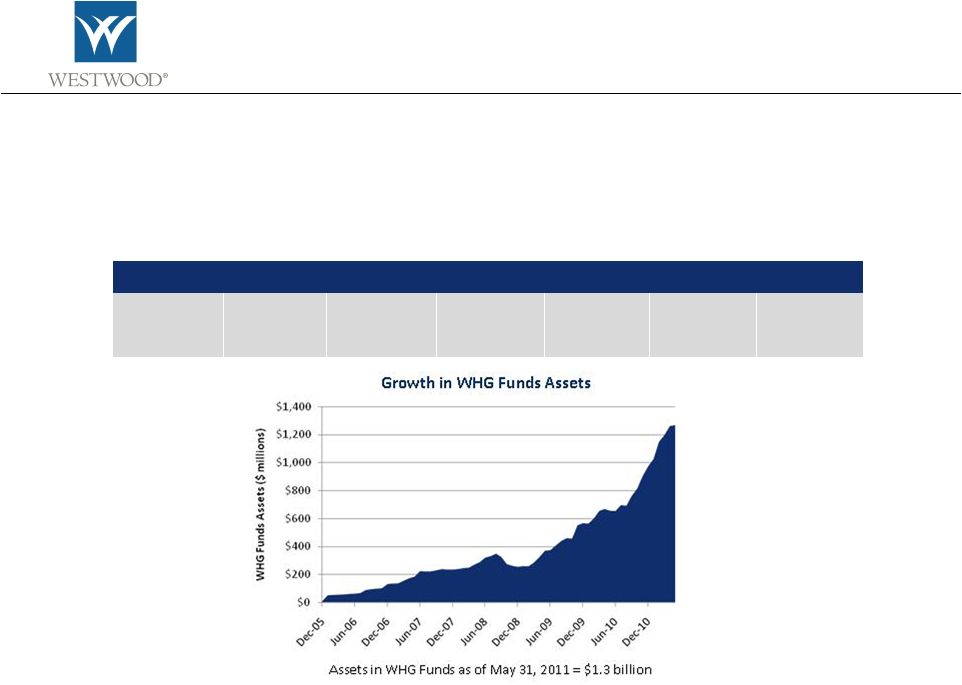

WHG

Funds Page 13

WHG Funds

•

Strong asset growth –

assets have grown to $1.3 billion from initial two fund launch in December 2005

•

Targeted primarily to institutional, defined contribution and RIA markets

Domestic Value & Income Strategies

LargeCap

Value

WHGLX

SMidCap

WHGMX

SMidCap

Plus+

WHGPX

SmallCap

Value

WHGSX

Dividend

Growth

WHGDX

Balanced

WHGBX

Income

Opportunity

WHGIX |

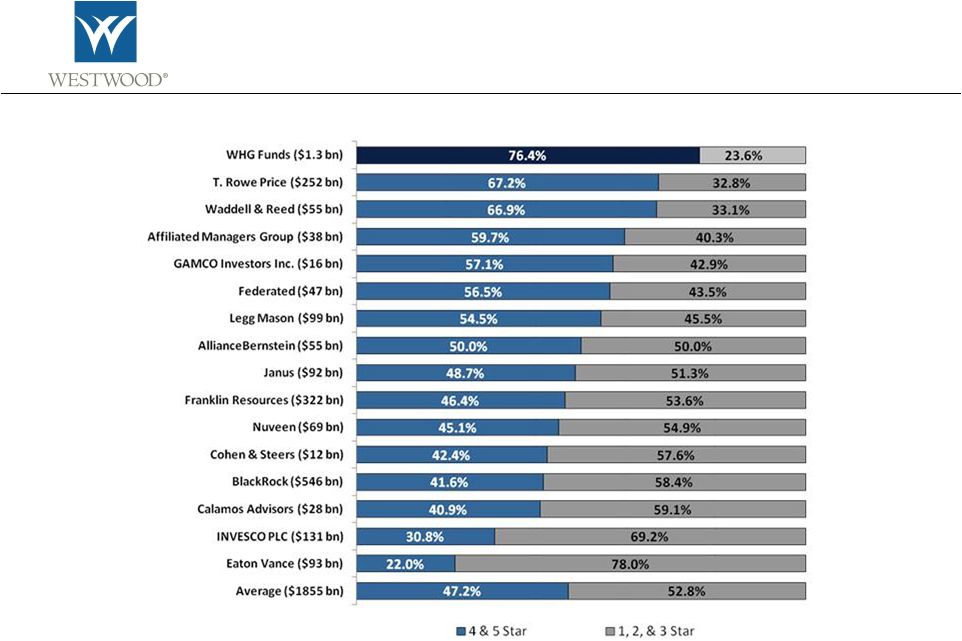

WHG Funds

– Morningstar Ratings

Proportion of Assets Rated Four or Five Star (Asset Weighted)

Page 14

Source: JPMorgan U.S. Asset Managers – North America Equity Research dated December

14, 2010; Strategic Insight.

WHG Funds

AUM as of 5/31/11 |

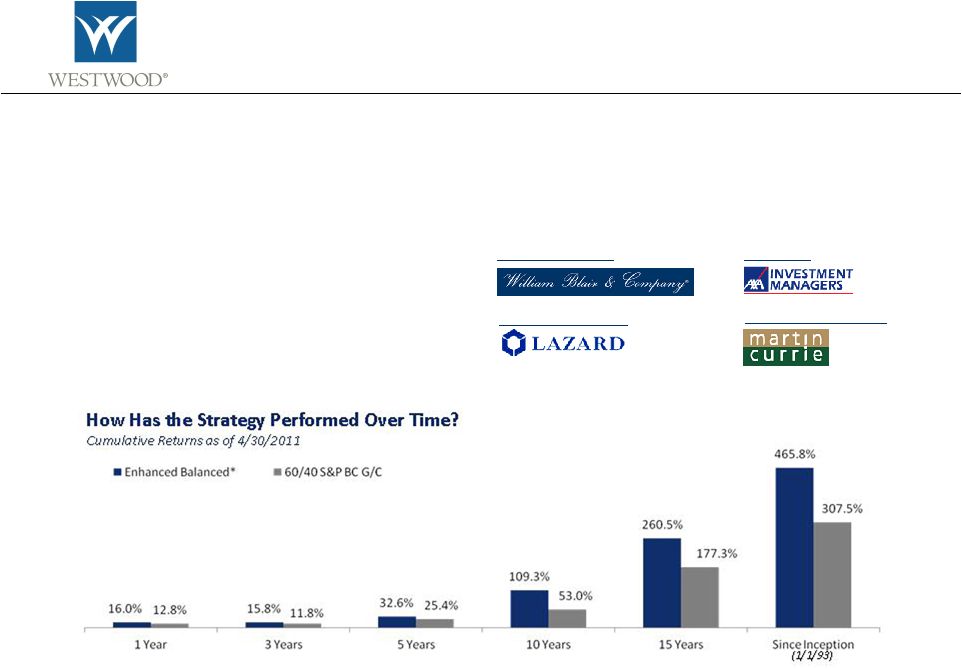

Westwood

Trust – Private Wealth

Solid performance and a high rate of client retention

A comprehensive allocation strategy

–

Consultative approach

–

Low cost, efficient solution

–

Asset gathering platform

–

“Best Ideas”

Trust services

–

Establishes long-term trust relationship

–

Capable of serving multiple generations

International Growth

High Yield

International Value

Domestic Growth

–

Enhanced Balanced™

asset allocation model consisting of

•

9 asset classes managed by Westwood Management

•

4 asset classes managed by subadvisors

*The Westwood Trust Representative Client is a representative account showing a client who has

been diversified among the available Westwood commingled funds throughout their term with Westwood. Past performance does not guarantee future results.

Stock

market conditions vary from year to year and can result in a decline in market value.

This information is provided for clients and prospective clients of Westwood Management Corp. and Westwood Trust only. This is not an offer or recommendation to buy or sell a

security or an economic sector.

Page 15 |

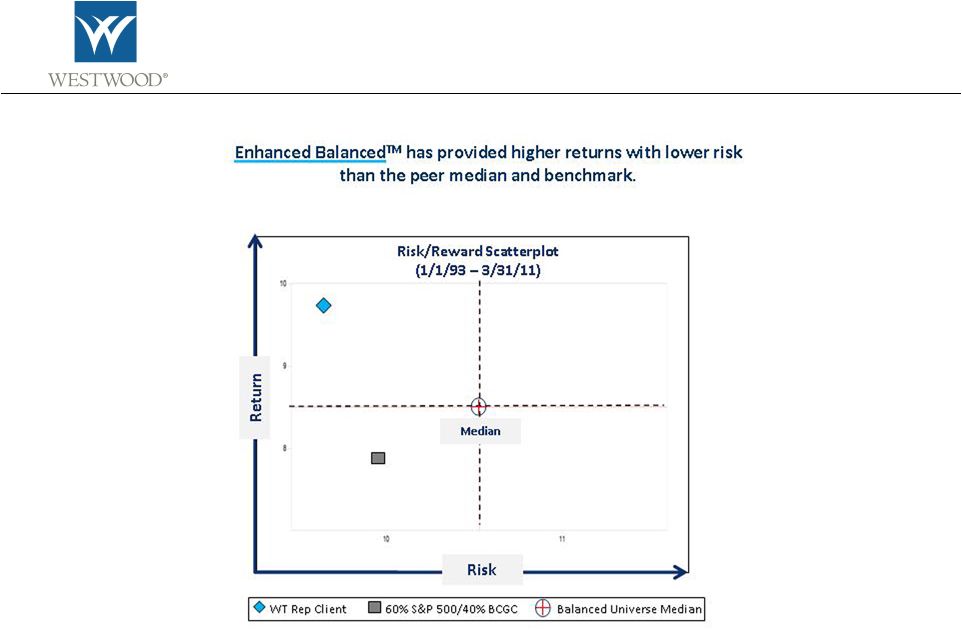

The eA US

Balanced/TAA Universe consists of 102 return sets. The Westwood Trust Representative Client is a representative account showing a client who has been diversified among the available

Westwood commingled funds throughout their term with Westwood.

Past performance does not guarantee future results.

Stock market conditions vary from year to year and can result in a decline in market

value. This information is provided for clients and prospective clients of Westwood Management Corp. and

Westwood Trust

only. This is not an offer or recommendation to buy or sell a security or an economic

sector. Westwood Trust –

Private Wealth

Enhanced Balanced™

Performance

Page 16 |

Financial

Highlights |

Growth in

Assets Under Management •

5-year compound annual growth rate in AUM of 20%

•

Over this same period, the level of the S&P 500 index

has risen by 4%

•

Trailing five years net inflows of $4.2 billion

AUM Growth in a Challenging Environment

Total AUM at 5/31/11 = $13.9 Billion

Page 17 |

Revenue

Growth (excluding performance-based fees)

Page 18

•

Consistent growth in asset-based fee revenue: 5-year CAGR of over 22%

•

The value of the S&P 500 index is essentially flat over this time period

|

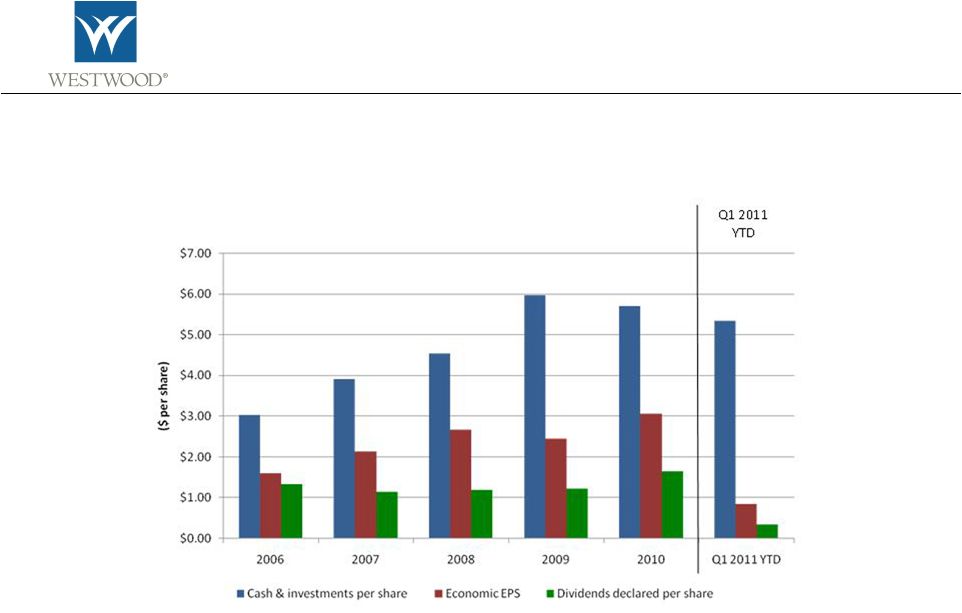

Economic EPS,

Dividends & Growing Cash Balances 2006 –

YTD Q1 2011

Cash & Liquid Investments as of March 31, 2011 were 107% higher than at year-end

2006 Note: 2007 and 2008 economic EPS include impact of performance fees of $3.0

million and $8.7 million, respectively; cash & investments excludes shares of

Teton Advisors, Inc. Page 19 |

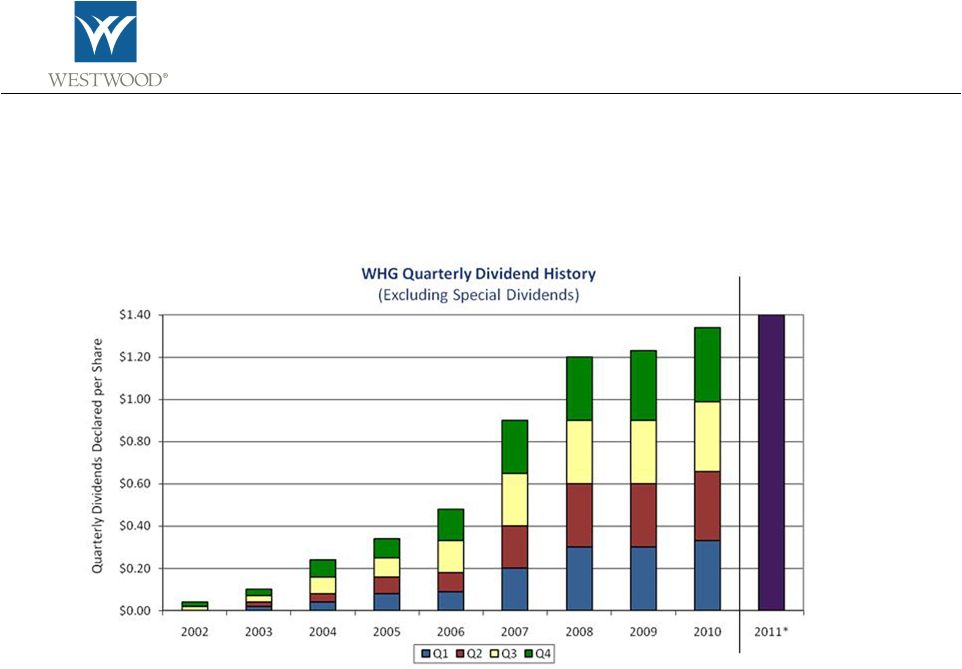

WHG Quarterly

Dividend History Page 20

•

We seek to share excess cash with shareholders

•

Dividends declared since 2002: $70 million ($10.56 per share)

•

3.9% yield as of May 31, 2011 close at $1.40 annualized dividend rate

*Annualized

based on

quarterly

dividend of

$0.35 per share |

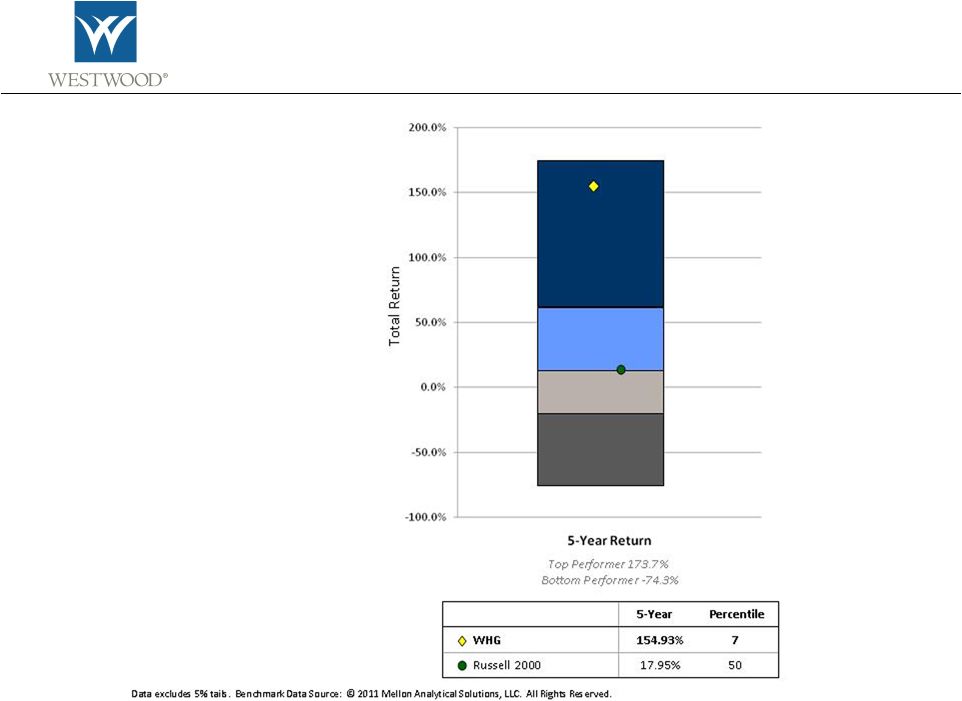

WHG Stock

Performance vs. NYSE Listed Companies as of 3/31/11

Page 21 |

Ownership

& Results Page 22

Equity-based compensation is a critical part of our compensation program

•

Aligns employees’

interests with clients and shareholders

•

Attracts and retains talented individuals and teams

•

Very high retention of key personnel

•

Transparency of public company structure allows broad dissemination of key financial metrics

to all employee shareholders

•

Restricted stock recipients have voting rights and receive dividends upon vesting

Results

•

Strong product performance.

Key products have outperformed respective benchmarks over

trailing 5-year period as of March 31, 2011.

•

Growth in assets under management.

AUM has increased by 200% from June 2002 spin-off to

May 31, 2011.

•

Increased shareholder value.

Market value has increased from $75 million at June 2002 to $313

million at March 31, 2011 –

a total return of 362% compared to 111% for the Russell 2000 index

over the same period.

•

Excess cash returned to shareholders through dividends.

We have declared $70 million in

dividends to shareholders since June 2002. |

Importance of

Alignment Page 23

•

We have long believed that our ownership model and employee compensation program

provide effective alignment of employees’

interests with clients and shareholders.

•

A recent study by Casey Quirk reveals evidence that employee ownership and low employee

turnover are positively correlated with better business performance.

•

Firms with low employee turnover produced 3-7% higher compounded revenue growth

over the 2003-2009 study period compared to firms with high employee turnover.

•

Firms with employee ownership produced 3.4% higher compounded revenue growth

over the study period compared to firms with no employee ownership.

•

The

Casey

Quirk/eVestment

Alliance

2010

Consultant

Survey

indicates

that

strong

alignment

has

become

a

critical

selection

criteria

for

gatekeepers.

•

92% of consultants surveyed responded that alignment issues are part of their manager

search criteria.

•

The two most important alignment issues for survey respondents were ownership

structure and long-term incentives. |

Summary

|

Summary of

Strategic Priorities Ongoing Priorities

•

Serve clients attentively

•

Generate competitive investment performance

•

Service consultant relationships

•

Leverage referral sources at Westwood Trust

•

WHG stock –

increase visibility; diversify/broaden ownership

Near Term Priorities

•

Leverage investment management expertise with distribution partners (Subadvisory)

•

Expand awareness of WHG Funds with Private Wealth Advisory firms

and Defined Contribution

Consultants

•

Invest in client reporting, branding, work environment and technology enhancements

•

Cultivate new “R&D”

products

•

Corporate development opportunities

•

Pursue International, Emerging Markets and Global investment management capabilities

Page 24 |

www.westwoodgroup.com

200

Crescent

Court

Suite

1200

Dallas,

Texas

75201

T. 214.756.6900

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

Disclosures |

Economic

Earnings Reconciliation Economic Earnings Reconciliation

($ thousands)

2006

2007

2008

2009

2010

Q1 2011

GAAP net income

4,508

$

7,944

$

10,543

$

7,895

$

11,280

$

3,549

$

Add: Restricted stock expense

4,500

5,316

6,735

7,666

9,269

2,383

Add: Stock option expense

126

-

-

-

-

-

Add: Intangible amortization

-

-

-

13

155

125

Add: Tax benefit from goodwill amortization

-

-

-

5

59

52

Less: Cumulative effect of change in accounting

principle

(39)

-

-

-

-

-

Non-GAAP economic earnings

9,095

$

13,260

$

17,278

$

15,579

$

20,763

$

6,109

$

Diluted shares

5,690,455

6,199,669

6,451,468

6,366,988

6,795,351

7,166,577

Economic EPS

1.60

$

2.14

$

2.68

$

2.45

$

3.06

$

0.85

$

|

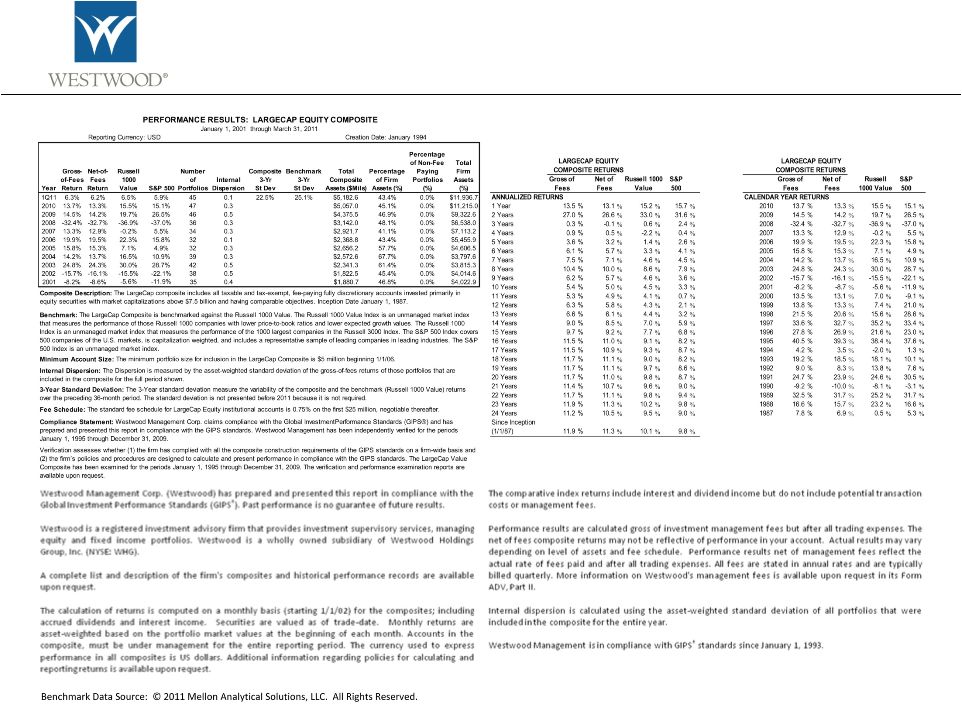

LargeCap

Value Disclosure Information |

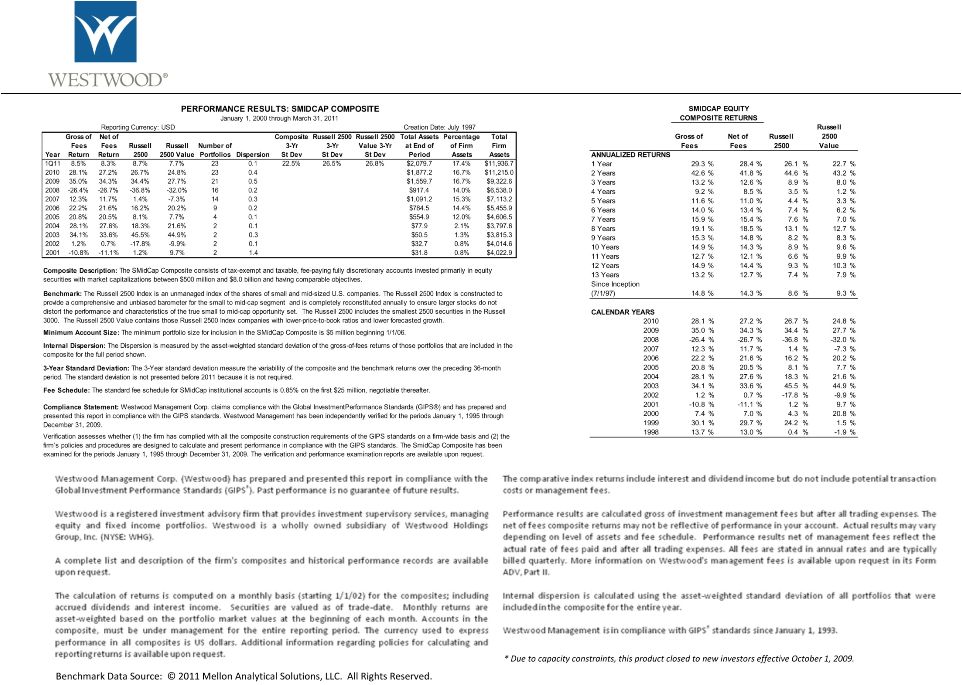

SMidCap Value

Disclosure Information* |

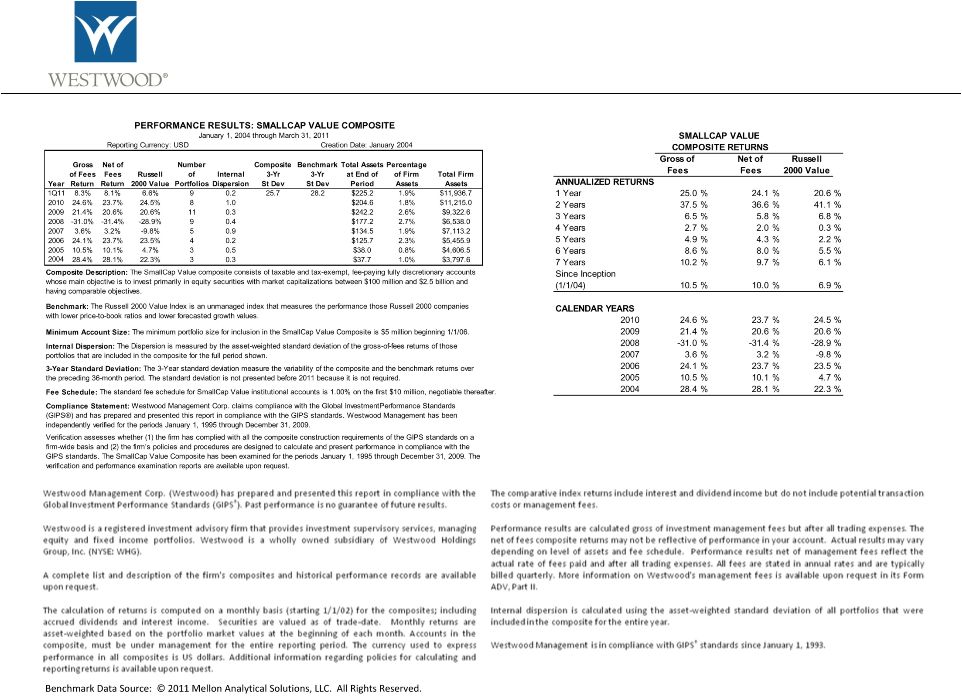

SmallCap

Value Disclosure Information |

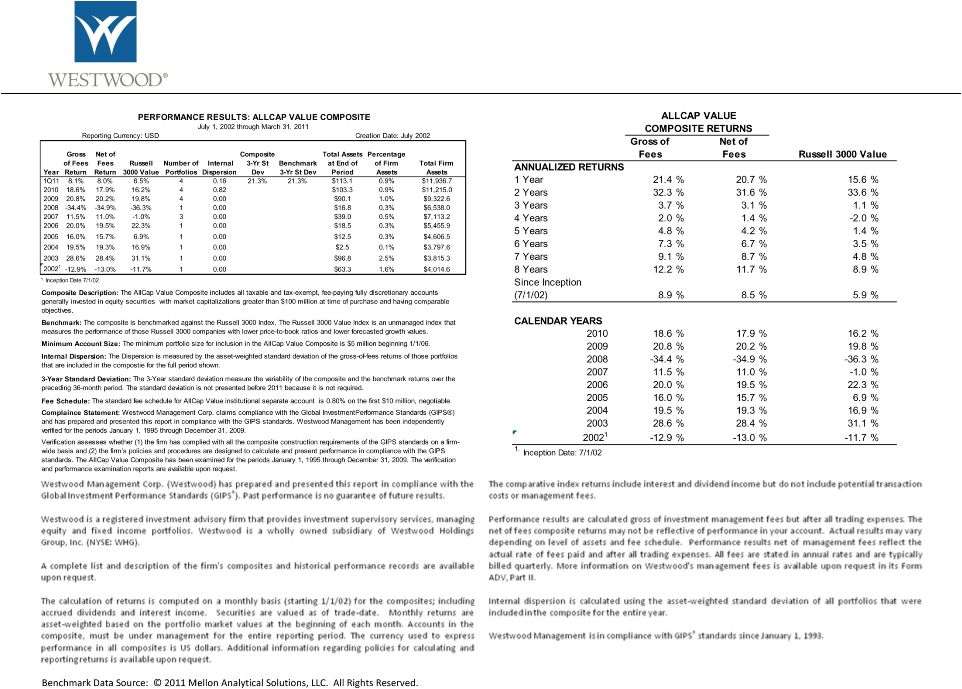

AllCap Value

Disclosure Information |

Income

Opportunity Disclosure Information |

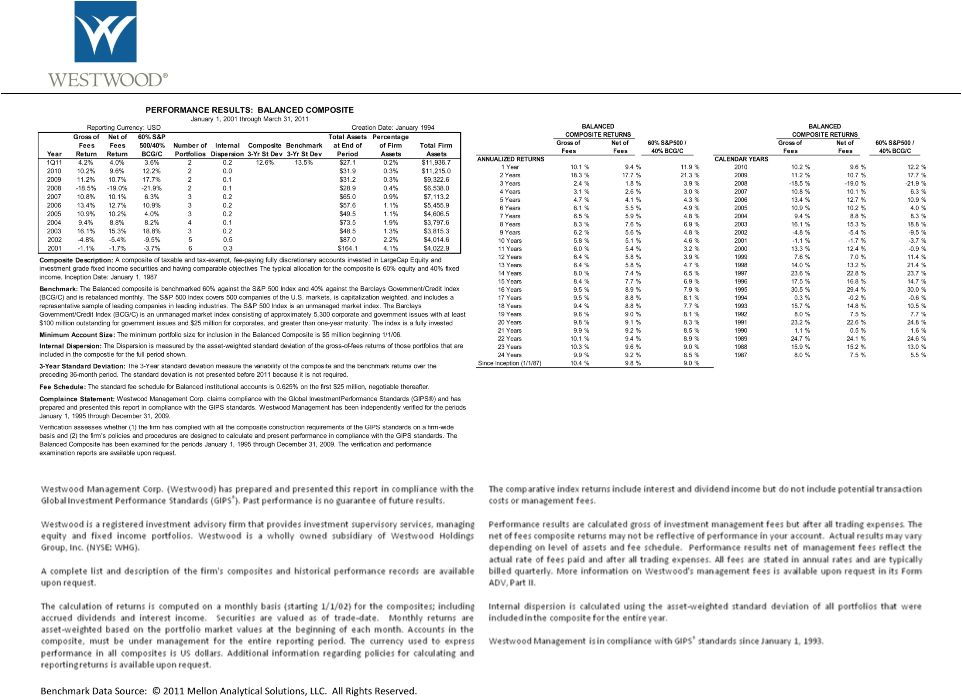

Balanced

Disclosure Information |

IMPORTANT

INFORMATION ABOUT YOUR PRIVACY |