Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sunstone Hotel Investors, Inc. | d8k.htm |

Company Presentation

June 2011

Exhibit 99.1 |

1

Forward-Looking Statements

This

presentation

contains

forward-looking

statements

that

have

been made pursuant to

the

provisions

of

the

Private

Securities

Litigation Reform

Act

of

1995.

These

statements

relate

to

future

events

or

our

future

financial

performance.

In

some

cases,

you

can

identify

forward-looking

statements

by

terminology

such

as

“anticipate,”

“believe,”

“continue,”

“could,”

“estimate,”

“expect,”

“intend,”

“may,”

“plan,”

“predict,”

“project,”

“should,”

“will”

or

the

negative

of

such

terms

and

other

comparable

terminology.

These

statements

are

only

predictions.

Actual

events

or

results

may

differ

materially

from

those

expressed

or

implied

by

these

forward-looking

statements.

In

evaluating

these

statements,

you

should

specifically

consider

the

risks

outlined

in

detail

under

the

heading

“Risk

Factors”

in

our

Annual

Report

on

Form

10-K,

filed

with

the

Securities

and

Exchange

Commission

(“SEC”)

on

February

23,

2010,

as

revised

by

the

filing

of

our

Current

Report

on

Form

8-K

on

January

14,

2011,

and

under

the

heading

“Risk

Factors”

on

page

2

of

our

Registration

Statement

on

Form

S-3,

filed

with

the

SEC

on

March

30,

2011,

including,

but

not

limited

to,

the

following

factors:

general

economic

and

business

conditions

affecting

the

lodging

and

travel

industry,

both

nationally

and

locally,

including

a

prolonged

U.S.

recession;

the

need

to

operate

as

a

REIT

and

comply

with

other

applicable

laws

and

regulations;

rising

operating

expenses;

relationships

with

and

requirements

of

franchisors

and

hotel

brands;

relationships

with

and

the

performance

of

the

managers

of

our

hotels;

the

ground

or

air

leases

for

7

of

the

33

hotels;

our

ability

to

complete

acquisitions

and

dispositions;

and

competition

for

the

acquisition

of

hotels.

These

factors

may

cause

our

actual

events

to

differ

materially

from

the

expectations

expressed

or

implied

by

any

forward-looking

statement.

We

do

not

undertake

to

update

any

forward-looking statement.

This

presentation

includes

non-GAAP

financial

information

that

the

issuer

considers

useful

to

investors

as

a

key

measure

of

operating

performance.

A

reconciliation

to

U.S.

GAAP

can

be

found

in

the

Investor

Relations

section

of

the

company’s

website

at

www.sunstonehotels.com. |

2

Sunstone Mission and Investment Strategy

Sunstone is focused on generating superior, risk-adjusted

shareholder returns through acquiring, asset managing and

capital recycling institutional-quality hotels.

Investment Highlights

High-quality portfolio

of institutional-quality, upper upscale hotels located in the top

U.S. lodging markets

Recently

redefined

management

team

comprised

of

industry

professionals

with

average industry tenure in excess of 20 years

Balanced

and

simple

strategy

focused

on

driving

long-term

shareholder

value

by:

Maximizing portfolio profitability through intensive asset management

Reducing risk through measured improvements in credit statistics

Enhancing portfolio quality through value-adding renovations

Improving portfolio quality, growth potential and scale through disciplined

acquisitions and select dispositions at attractive spreads to our WACC

|

3

Sunstone Portfolio –

We own…

460-room Hilton Times Square

807-room Renaissance Washington D.C.

494-room Renaissance Orlando

412-room Marriott Long Wharf Boston

460-room Doubletree Guest

Suites Times Square

…thirty-three institutional-quality, primarily upper-upscale

hotels. 1,190-room Hilton San Diego Bayfront

|

4

Sunstone Portfolio –

We own…

…a geographically diverse portfolio located primarily in coastal,

urban markets.

2010 Total Revenue by Region

(number of hotels in parentheses) |

5

Sunstone Portfolio –

We own…

Hotel

Rooms

Northeast Region

Marriott Boston Long Wharf

412

Marriott Boston Quincy

464

Doubletree Guest Suites Times Square (Hilton Suites)

(1)

460

Hilton Times Square

460

Renaissance Westchester

347

Marriott West Philadelphia

289

Renaissance Washington, D.C.

807

Marriott Tysons Corner

396

Renaissance Baltimore Harborplace

622

Northeast Total

4,257

Mid-West Region

Embassy Suites Chicago

367

Marriott Troy

350

Doubletree Guest Suites Minneapolis

229

Kahler Grand Rochester

668

Marriott Rochester

203

Kahler Inn & Suites

271

Residence Inn by Marriott Rochester

89

Mid-West Total

2,177

Hotel

Rooms

West Region

Renaissance Long Beach

374

Renaissance Los Angeles Airport

499

Courtyard by Marriott Los Angeles Airport

179

Sheraton Cerritos

203

Hyatt Regency Newport Beach

403

Fairmont Newport Beach

444

Hilton San Diego Bayfront

1,190

Embassy Suites La Jolla

340

Marriott Del Mar

284

Hilton Del Mar

257

Marriott Park City

199

Marriott Portland

249

Valley River Inn

257

West Total

4,878

South Region

Renaissance Orlando at SeaWorld®

781

JW Marriott New Orleans

494

Hilton Houston

480

Marriott Houston

390

South Total

2,145

Total

13,457

(1) Conversion to Hilton Suites is expected to be completed in 2012.

…a geographically diverse portfolio located primarily in coastal,

urban markets. |

6

Sunstone Portfolio –

We own…

(1) Pro forma Hotel EBITDA and pro forma metrics includes prior ownership of

acquired hotels and 100% ownership of the Hilton San Diego Bayfront.

…a geographically diverse portfolio located primarily in coastal,

urban markets.

Top-10 EBITDA Producing Hotels

(1)

Rooms

1

Hilton San Diego Bayfront

1,190

2

Doubletree Guest Suites Times Square

460

3

Renaissance Washington, D.C.

807

4

Marriott Boston Long Wharf

412

5

Renaissance Orlando

781

6

Hilton Times Square

460

7

Renaissance Baltimore

622

8

Embassy Suites Chicago

367

9

JW Marriott New Orleans

494

10

Embassy Suites La Jolla

340

% of pro forma 2010

(1)

Rooms

44%

Hotel revenue

58%

Hotel EBITDA

67% |

7

Sunstone Corporate Profile –

We are…

…a top quality lodging REIT with an enterprise value of over $3

billion.

Valuation Sensitivity

A change of:

Would result in a share

price change of:

$10,000 per key

$1.10

1.0x in EBITDA multiple

$1.75

25 bps in capitalization rate

$1.15

2010 Pro Forma & 2011 Guidance

(4)

2010 Pro Forma RevPAR

$114.39

2011 Pro Forma RevPAR Guidance (%)

6.0 -

8.0%

2011 Pro Forma RevPAR Guidance ($)

$121.25 -

$123.50

2010 Pro Forma Adjusted EBITDA

(4)

$203.4M

2011 Adjusted EBITDA Guidance

(4)

$204.0 -

$215.4M

2011 Pro Forma EBITDA Guidance

(5)

$211.1 -

$222.5M

Capital Structure / Valuation Metrics

Shares

117.2 M

Stock Price (June 2, 2011)

$9.81

Equity Market Cap

$1,150 M

Total Mortgage Debt

$1,632 M

Total Corporate Debt

$63 M

Total Preferreds

$391 M

Pro Forma Cash

(1)

($213 M)

TEV

$3,022.2 M

TEV/key

$230,000

2010 pro forma EBITDA Multiple

14.9x

Implied 2011 pro forma EBITDA Multiple

(2)

13.6x -

14.3x

2010 pro forma Cap Rate

(2) (3)

5.7%

Implied 2011 pro forma Cap Rate

(2) (3)

5.9% -

6.3% |

8

Sunstone Corporate Profile –

We are…

…

increasing our cash flow through disciplined internal and

external investments and proactive asset management.

Pro Forma Adjusted Corporate EBITDA Buildup |

9

Ken Cruse

President

(1)

Marc Hoffman

EVP & COO

Lindsay Monge

SVP –

Treasury &

Administration

Guy Lindsey

SVP –

Design &

Construction

Bryan Giglia

SVP –

Finance

John Arabia

EVP & CFO

Robert Springer

SVP –

Acquisitions

Experienced Management Team –

We are…

…a cohesive management team singularly focused on

driving shareholder value.

Hotel/Real Estate: 20 years

Hotel/Real Estate: 34 years

Hotel/Real Estate: 24 years

Hotel/Real Estate: 27 years

Hotel/Real Estate: 12 years

Hotel/Real Estate: 15 years

Hotel/Real Estate: 15 years

(1) Formal transition to CEO expected during 2011. |

10

Sunstone Corporate Profile –

We have…

…a significant opportunity to improve valuation by removing

overhang issues and unlocking our portfolio’s intrinsic value.

Management transition –

we will build investor confidence by completing

our leadership transition and consistently executing on our business plan

Improving operations –

we believe our recently completed or in-process

renovations combined with our redefined hotel operating models will produce

meaningful RevPAR index gains, margin expansion and cash flow growth

Credit enhancement –

by continuing to improve our credit statistics and

reducing our leverage, we will reduce corporate risk and provide

greater

flexibility

Dividend reintroduction –

improved cash flow from both internal and

external growth initiatives is likely to result in a reintroduction of our common

dividend beginning in 2011 |

11

Sunstone Portfolio –

We expect…

…our portfolio to generate significant internal growth over

the next several years, driven by:

Cyclical recovery –

we are in the early stages of what we believe will be a

strong and prolonged recovery. PKF expects a 6 -

7% RevPAR CAGR (2010

–

2015)

Renovations

–

we expect our recently completed and in-process

renovations will result in RevPAR index gains and meaningful cash flow

growth

Asset management –

our redefined hotel operating model drove significant

margin expansion as compared to prior trough. We expect margins to

continue to benefit from new efficiencies resulting in margin expansion over

prior peak |

12

Sunstone Portfolio –

We are…

Rebranding Doubletree Times Square to Hilton Suites Times Square

Capitalize on the strength of a higher-rated brand with international

draw Control of all Times Square Hilton branded product

Conversion expected following a renovation of the hotel (anticipated completion in

Q2 2012) Complexed Times Square Hotels under Highgate management

Maximize RevPAR and minimize overhead costs across our combined 920 rooms within

the Times Square sub-market

…enhancing the value of our portfolio. |

13

Sunstone Portfolio –

We have…

…completed, or are about to complete, significant renovations

throughout our portfolio.

In 2011, we expect to invest approximately $100 –

115 million

renovating and repositioning our portfolio.

1Q 2011 completed projects include:

Embassy Suites Chicago –

guestrooms/bathrooms

Marriott Boston Quincy –

guestrooms/bathrooms/lobby

Marriott Tysons Corner –

guestrooms/bathrooms/exterior

Sheraton Cerritos –

guestrooms

Marriott Rochester –

guestrooms/bathrooms/lobby

Marriott Houston –

guestrooms/bathrooms

Kahler Grand –

guestrooms/bathrooms/meeting space

Doubletree Minneapolis –

guestrooms/bathrooms/lobby |

14

Sunstone Portfolio –

Recent Renovations |

15

Proven Acquisitions Execution –

We have acquired…

…major urban hotels at attractive spreads to our

WACC, primarily sourced in off-market deals: |

16

460-key premier Times Square location

540 square foot standard rooms

Upscaling to Hilton Suites after renovation

Managed by Highgate Hotels

All-in acquisition cost of $286.0 million or

$622,000

per

key

(approximately

$500,000

per

key

net

of

signage

value)

Acquisition price effectively reduced by $27

million as a result of Sunstone’s acquisition of

mezzanine debt at a significant discount in 2010

14.7x multiple on 2010 EBITDA

Assumed $270.0 million, floating-rate non-

recourse senior mortgage at LIBOR + 115 bps

Strong market dynamics

Benefits from both business and leisure demand

generators resulting in high-90’s occupancy

Complexed with Sunstone’s Hilton Times Square

(both managed by Highgate)

Proven Acquisitions Execution –

We acquired…

…the Doubletree Guest Suites Times Square on January 14, 2011:

|

17

494-key luxury hotel centrally located in

downtown New Orleans

Managed by Marriott

All-in acquisition cost of $94.3 million or

$190,000 per key

12.8x multiple on 2010 EBITDA

Assumed $42.2 million, fixed 5.45% non-

recourse senior mortgage

Strong Market Dynamics

New Orleans ranked first out of the top-25 US

markets in terms of 2010 RevPAR growth

Growth trends expected to outperform through

2014

Off-market transaction sourced through

industry relationship

Proven Acquisitions Execution –

We acquired…

…the JW Marriott New Orleans on February 15, 2011: |

18

1,190-key upper-upscale hotel centrally

located in downtown San Diego

Top-quality convention property

Managed by Hilton

Acquisition value of $475.0 million (based

on 100%) or $399,000 per key

13.7x multiple on 2010 EBITDA

$240.0 million, non-recourse senior mortgage at

LIBOR + 325 bps

Strong Market Dynamics

San Diego ranks fourth out of 50 U.S. lodging

markets in terms of projected compounded

average

annual

RevPAR

growth

for

2010–2014

(1)

Provides balance to Sunstone’s large east

coast convention hotels

(1) Estimated at 8.4% according to PKF Hospitality Research.

Proven Acquisitions Execution –

We acquired…

…75% ownership of the Hilton San Diego Bayfront on April 15, 2011:

|

19

…maintaining our strong liquidity and access to capital,

increasing our financial flexibility and lowering our cost of

capital through a gradual and methodical reduction of our

leverage:

Balance Sheet Management –

We are focused on…

Highly equitized acquisitions that will enhance our growth profile

Debt reduction through capital recycling

Improving cash flow during the cyclical recovery

We will not issue equity at prices below our estimate of the

intrinsic value of our portfolio simply to achieve our balance

sheet objectives. |

20

Measured improvement of leverage profile

•

Cyclical cash flow growth

•

Transactions structured with higher equity content

Long-term focus: build strength, flexibility, and positioning over several

years •

18-month credit target: 1.65x Fixed Charge Coverage, 6.0x Debt to EBITDA

Position

Sunstone

to

capitalize

on

opportunities

during

the

next

cyclical

trough

Balance Sheet Management –

We are focused on…

…achieving our credit objectives: |

21

Balance Sheet Management –

We are focused on…

…maintaining a well staggered debt maturity schedule consisting of

low rated, primarily property-secured, non-recourse debt:

|

22

Sunstone Mission and Investment Strategy

Sunstone is focused on generating superior, risk-adjusted

shareholder returns through acquiring, asset managing and

capital recycling institutional-quality hotels.

Investment Highlights

High-quality portfolio

of institutional-quality, upper upscale hotels located in the top

U.S. lodging markets

Recently

redefined

management

team

comprised

of

industry

professionals

with

average industry tenure in excess of 20 years

Balanced

and

simple

strategy

focused

on

driving

long-term

shareholder

value

by:

Maximizing portfolio profitability through intensive asset management

Reducing risk through measured improvements in credit statistics

Enhancing portfolio quality through value-adding renovations

Improving portfolio quality, growth potential and scale through disciplined

acquisitions and select dispositions at attractive spreads to our WACC

|

Appendix |

24

…likely to reintroduce common dividends in 2011.

Sunstone Corporate Profile –

We are…

2011 Taxable Income Projection

2011 Guidance

(1)

Midpoint of 2011 Adjusted EBITDA Guidance

(1)

$209,700

Interest expense

78,500

Amortization of deferred financing

2,400

Tax depreciation

(2)

92,000

Preferred dividends

27,400

Estimated 2011 Taxable Income to Common Shareholders

(3)

$9,400 |

25

Sunstone 33-Hotel Portfolio

Hotel

State

Region

Chain

Scale

Service

Rooms

Manager

Segment

(1)

Category

West Region

Renaissance Long Beach

California

West

Upper Upscale

Full Service

374

Marriott

Renaissance Los Angeles Airport

California

West

Upper Upscale

Full Service

499

Marriott

Courtyard by Marriott Los Angeles Airport

California

West

Upscale

Select Service

179

Interstate SHP

Sheraton Cerritos

California

West

Upper Upscale

Full Service

203

Interstate SHP

Hyatt Regency Newport Beach

California

West

Upper Upscale

Full Service

403

Hyatt

Fairmont Newport Beach

California

West

Luxury

Full Service

444

Fairmont

Hilton San Diego Bayfront

California

West

Upper Upscale

Full Service

1,190

Hilton

Embassy Suites La Jolla

California

West

Upper Upscale

Extended Stay

340

Hilton

Marriott Del Mar

California

West

Upper

Upscale

Full

Service

284

Marriott

Hilton Del Mar

California

West

Upper Upscale

Full Service

257

Sage

Marriott Park City

Utah

West

Upper Upscale

Full Service

199

Interstate SHP

Marriott Portland

Oregon

West

Upper Upscale

Full Service

249

Interstate SHP

Valley River Inn

Oregon

West

Upscale

Full Service

257

Interstate SHP

West Total

West Total

4,878

Northeast Region

Marriott Boston Long Wharf

Massachusetts

Northeast

Upper Upscale

Full Service

412

Marriott

Marriott Boston Quincy

Massachusetts

Northeast

Upper Upscale

Full Service

464

Marriott

Doubletree Guest Suites Times Square (Hilton Suites)

(1)

New York

Northeast

Upscale

Full Service

460

Highgate

Hilton Times Square

New York

Northeast

Upper Upscale

Full Service

460

Highgate

Renaissance Westchester

New York

Northeast

Upper Upscale

Full Service

347

Marriott

Marriott West Philadelphia

Pennsylvania

Northeast

Upper Upscale

Full Service

289

Marriott

Renaissance Washington, D.C.

District of Columbia

Northeast

Upper Upscale

Full Service

807

Marriott

Marriott Tysons Corner

Virginia

Northeast

Upper Upscale

Full Service

396

Marriott

Renaissance Baltimore Harborplace

Maryland

Northeast

Upper Upscale

Full Service

622

Marriott

Northeast Total

Northeast Total

4,257

Mid-West Region

Embassy Suites Chicago

Illinois

Mid-West

Upper Upscale

Extended Stay

367

Davidson

Marriott Troy

Michigan

Mid-West

Upper Upscale

Full Service

350

Marriott

Doubletree Guest Suites Minneapolis

Minnesota

Mid-West

Upscale

Full Service

229

Interstate SHP

Kahler Grand Rochester

Minnesota

Mid-West

Upscale

Full Service

668

Interstate SHP

Marriott Rochester

Minnesota

Mid-West

Upper Upscale

Full Service

203

Interstate SHP

Kahler Inn & Suites

Minnesota

Mid-West

Midscale

with

F/B

Extended Stay

271

Interstate SHP

Residence Inn by Marriott Rochester

Minnesota

Mid-West

Upscale

Extended Stay

89

Interstate SHP

Mid-West Total

Mid-West Total

2,177

South Region

Renaissance Orlando at SeaWorld®

Florida

South

Upper Upscale

Full Service

781

Marriott

JW Marriott New Orleans

Louisiana

South

Luxury

Full Service

494

Marriott

Hilton Houston

Texas

South

Upper Upscale

Full Service

480

Interstate SHP

Marriott Houston

Texas

South

Upper

Upscale

Full

Service

390

Interstate SHP

South Total

South Total

2,145

Total

13,457

(1) Conversion to Hilton Suites is expected to be completed in 2012.

|

26

Sunstone Portfolio –

We have…

…completed, or are about to complete, significant renovations throughout our

portfolio. Marriott Boston Long Wharf lobby renderings:

|

27

Sunstone Portfolio –

We have…

…completed, or are about to complete, significant renovations throughout our

portfolio. Renaissance Long Beach completed lobby renovation:

|

28

Sunstone Portfolio –

We have…

…completed, or are about to complete, significant renovations throughout our

portfolio. Renaissance Washington D.C. completed lobby renovation:

|

29

Sunstone Portfolio –

We have…

…completed, or are about to complete, significant renovations throughout our

portfolio. Philadelphia Marriott completed lobby renovation:

|

30

Sunstone Portfolio –

We have…

…completed, or are about to complete, significant renovations throughout our

portfolio. Boston Marriott Quincy completed rooms and public space

renovation: |

31

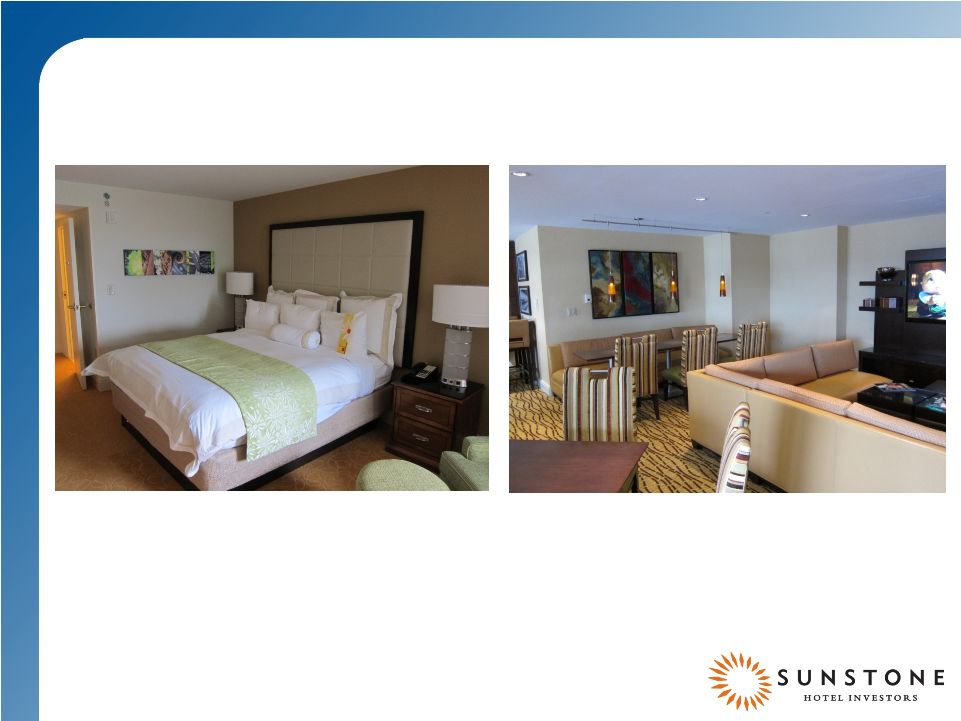

Sunstone Portfolio –

We have…

…completed, or are about to complete, significant renovations throughout our

portfolio. Embassy Suites Chicago completed rooms renovation:

|

32

Sunstone Portfolio –

We have…

…completed, or are about to complete, significant renovations throughout our

portfolio. Doubletree Minneapolis completed rooms and public space

renovation: |

33

Sunstone Portfolio –

We have…

…completed, or are about to complete, significant renovations throughout our

portfolio. Renaissance Orlando themed pool experience and 10,000

sq. ft. function

lawn -

2Q 2011 estimated completion date: |