Attached files

| file | filename |

|---|---|

| EX-31.1 - TRESORO MINING CORP. | ex31-1.htm |

| EX-32.1 - TRESORO MINING CORP. | ex32-1.htm |

| EX-14.1 - CODE OF CONDUCT - TRESORO MINING CORP. | ex14-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended February 28, 2011

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________.

Commission file number 000-52660

MERCER GOLD CORP.

(Exact name of registrant as specified in its charter)

|

Nevada |

20-1769847 |

880-666 Burrard Street, Vancouver, British Columbia V6C 2G3

(604) 681-3130

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.0001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. [ ] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ] |

Accelerated filer [ ] |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of the registrant's stock held by non-affiliates of the registrant as of

August 31, 2010, computed by reference to the price at which such stock was last sold on the OTC Bulletin Board ($0.40 per share) on that date, was approximately $25,255,000.The registrant had

17,459,369 shares of common stock outstanding as of May 31, 2011.__________

2

FORWARD LOOKING STATEMENTS

This annual report contains forward-looking statements that involve risks and uncertainties. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential" or "continue", the negative of such terms or other comparable terminology. In evaluating these statements, you should consider various factors, including the assumptions, risks and uncertainties outlined in this annual report under "Risk Factors". These factors or any of them may cause our actual results to differ materially from any forward-looking statement made in this annual report. Forward-looking statements in this annual report include, among others, statements regarding:

- our capital needs;

- business plans; and

- expectations.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding future events, our actual results will likely vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Some of the risks and assumptions include:

- our need for additional financing;

- our exploration activities may not result in commercially exploitable quantities of ore on our mineral properties;

- the risks inherent in the exploration for minerals such as geologic formation, weather, accidents, equipment failures and governmental restrictions;

- our limited operating history;

- our history of operating losses;

- the potential for environmental damage;

- our lack of insurance coverage;

- the competitive environment in which we operate;

- the level of government regulation, including environmental regulation;

- changes in governmental regulation and administrative practices;

- our dependence on key personnel;

- conflicts of interest of our directors and officers;

- our ability to fully implement our business plan;

- our ability to effectively manage our growth; and

- other regulatory, legislative and judicial developments.

We advise the reader that these cautionary remarks expressly qualify in their entirety all forward-looking statements attributable to us or persons acting on our behalf. Important factors that you should also consider, include, but are not limited to, the factors discussed under "Risk Factors" in this annual report.

The forward-looking statements in this annual report are made as of the date of this annual report and we do not intend or undertake to update any of the forward-looking statements to conform these statements to actual results, except as required by applicable law, including the securities laws of the United States.

3

AVAILABLE INFORMATION

Mercer Gold Corp. files annual, quarterly and current reports, proxy statements, and other information with the Securities and Exchange Commission (the "Commission" or "SEC"). You may read and copy documents referred to in this Annual Report on Form 10-K that have been filed with the Commission at the Commission's Public Reference Room, 450 Fifth Street, N.W., Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. You can also obtain copies of our Commission filings by going to the Commission's website at http://www.sec.gov.

As used in this annual report: (i) the terms "we", "us", "our", "Mercer" and the "Company" mean Mercer Gold Corp.; (ii) "SEC" refers to the Securities and Exchange Commission; (iii) "Securities Act" refers to the United States Securities Act of 1933, as amended; (iv) "Exchange Act" refers to the United States Securities Exchange Act of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

__________

4

TABLE OF CONTENTS

|

ITEM 1. |

BUSINESS |

6 |

|

ITEM 1A. |

RISK FACTORS |

20 |

|

ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

25 |

|

ITEM 2. |

PROPERTIES |

25 |

|

ITEM 3. |

LEGAL PROCEEDINGS |

25 |

|

ITEM 4. |

(REMOVED AND RESERVED) |

26 |

|

ITEM 5. |

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

26 |

|

ITEM 6. |

SELECTED FINANCIAL DATA |

28 |

|

ITEM 7. |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

28 |

|

ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

35 |

|

ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

36 |

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

64 |

|

ITEM 9A. |

CONTROLS AND PROCEDURES |

64 |

|

ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

64 |

|

ITEM 11. |

EXECUTIVE COMPENSATION |

67 |

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

70 |

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

71 |

|

ITEM 14. |

PRINCIPAL ACCOUNTING FEES AND SERVICES |

71 |

|

ITEM 15. |

EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

72 |

__________

5

PART I

Corporate Organization

Our company was incorporated under the laws of the State of Nevada on October 11, 2004 under the name "Ancor Resources Inc." On June 4, 2007, we completed a forward split of our shares of common stock on the basis of five new shares of common stock for each one share of common stock outstanding on that date and increased our authorized share capital from 75,000,000 shares of common stock to 375,000,000 shares of common stock. On the same date, we merged with our wholly-owned subsidiary, Nu-Mex Uranium Corp., to change our name to Nu-Mex Uranium Corp.

Effective February 26, 2008, we merged with our wholly-owned subsidiary, Uranium International Corp., to change our name to Uranium International Corp.

On March 11, 2008, we completed a forward split of our shares of common stock on the basis of one and one half new shares of common stock for each one share of common stock outstanding on that date. Due to an administrative oversight, we did not file a Certificate of Change with the Nevada Secretary of State to simultaneously increase our authorized share capital in the same ratio. On June 8, 2010, we rectified this oversight by filing a Certificate of Change with the Nevada Secretary of State, increasing our authorized share capital from 375,000,000 shares of common stock to 562,500,000 shares of common stock.

On May 17, 2010, we filed Articles of Merger with the Nevada Secretary of State in order to merge with our wholly-owned subsidiary, Mercer Gold Corporation, and to change our name to Mercer Gold Corporation. This name change was effected on the OTC Bulletin Board on June 9, 2010, and the name change became effective under Nevada corporate law on June 17, 2010. We changed our name to "Mercer Gold Corporation" in furtherance of our entry into an option agreement with Mercer Gold Corporation, a private company, pursuant to which we had the option to acquire an interest in certain gold prospect mineral property concession interests located in Colombia (known as the "Guayabales Property"), as described below.

On June 2, 2010, we caused two wholly-owned subsidiary companies to be incorporated under the laws of the Republic of Panama, namely, Mercer One Panama Corp. and Mercer Two Panama Corp. .

On April 14, 2011, we filed a Certificate of Change with the Nevada Secretary of State to give effect to a reverse split of our authorized and issued and outstanding shares of common stock on a three (3) old for one (1) new basis. Subsequently, the directors agreed it was in the best interest of the Company to amend the reverse split to a ratio of four (4) old for one (1) new such that the Company's authorized capital was decreased from 562,500,000 shares of common stock with a par value of $0.001 to 140,625,000 shares of common stock with a par value of $0.001. Accordingly, on April 28, 2011 the Company filed a Certificate of Correction with the Nevada Secretary of State to effect the four (4) old for one (1) new reverse split.

Our principal offices are located at 880-666 Burrard Street, Vancouver, British Columbia V6C 2G3, and our telephone number is (604) 681-3130.

General

At the present time, our primary property of interest is the Guayabales Property, Colombia as described below.

6

Mineral Properties - Guayabales Property, Colombia

Mineral Assets Option Agreement

On April 13, 2010, we entered into a definitive Mineral Assets Option Agreement (the "Definitive Option Agreement") with Mercer Gold Corporation, a private mining company ("MGC"), pursuant to which MGC formally granted to us an exclusive option (the "Option") to acquire all of MGC's current underlying option interests under a certain "Option Agreement", dated for reference March 4, 2010 (the "Underlying Option Agreement"), as entered into between MGC and Comunidad Minera Guayabales (the "Underlying Property Owner" or "CMG"), pursuant to which MGC acquired from the Underlying Property Owner an option (the "Underlying Option") to acquire a 100% legal, beneficial and registerable interest in and to certain mineral property concession interests which are held by way of license and which are located in the municipality of Marmato, Colombia, and which are better known and described as the "Guayabales" property (collectively, the "Guayabales Property"). The Definitive Option Agreement replaces an underlying letter of intent by and between and MGC and us, dated April 3, 2010.

The Definitive Option Agreement provides that, in order to exercise our Option, we are obligated to:

1. Pay to MGC $200,000 immediately upon the execution of the Definitive Option Agreement (the "Effective Date") (paid on April 14, 2010);

2. Issue to MGC, both prior to and after the due and complete exercise of the Option, an aggregate of up to 5,000,000 restricted shares of the Company's common stock, as follows:

- an initial issuance of 2,500,000 shares within two business days of the Effective Date (issued on April 15, 2010); and

- a final issuance of 2,500,000 shares within five business days of the Company's prior receipt of a "technical report" (as that term is defined in section 1.1 of National Instrument 43-101 of the Canadian Securities Administrators, Standards of Disclosure for Mineral Projects ("NI 43-101") meeting certain criteria);

3. Provide funding for or expend minimum cumulative "Expenditures" for "Exploration and Development" (as defined in the Definitive Option Agreement) work on or in connection with any of the mineral interests comprising the Property interests of not less than $11,500,000 in the following manner:

- no less than an initial $1,500,000 of the Expenditures shall be expended on the Property by December 31, 2010 ($1,000,000 incurred);

- no less than a further $5,000,000 of the Expenditures shall be expended on the Property by December 31, 2011($354,855 incurred); and

- no less than a final $5,000,000 of the Expenditures shall be expended on the Property by December 31, 2012; and

4. Pay on MGC's behalf all underlying option, regulatory and governmental payments and assessment work required to keep the Property in good standing during the Option period (being that period from the Effective Date to the closing date in respect of the due and complete exercise of the Option as described in the Definitive Option Agreement, which shall not be later than January 13, 2013), and including, without limitation, all remaining cash payments required to be made to the Underlying Property Owner under the Underlying Option Agreement. The Company must pay the Underlying Property Owner an aggregate of $4,000,000 in the instalments by the dates specified as follows:

- Pay $20,000 by October 14, 2009 (paid);

- Pay additional $40,000 on or by 90 days from October 14, 2009 (paid);

- Pay additional $40,000 on or by April 14, 2010 (paid);

- Pay additional $55,000 on or by July 14, 2010 (paid);

- Pay additional $55,000 on or by October 14, 2010 (paid);

- Pay additional $65,000 on or by January 14, 2011 (paid);

- Pay additional $75,000 on or by April 14, 201l (paid);

- Pay additional $75,000 on or by July 14, 201l;

- Pay additional $85,000 on or by October 14, 201l;

7

- Pay additional $85,000 on or by January 14, 2012;

- Pay additional $160,000 on or by July 14, 2012;

- Pay additional $160,000 on or by January 14, 2013;

- Pay additional $190,000 on or by July 14, 2013;

- Pay additional $190,000 on or by January 14, 2014;

- Pay additional $230,000 on or by July 14, 2014;

- Pay additional $230,000 on or by January 14, 2015; and

- Pay additional $2,245,000 on or by July 14, 2015.

On December 30, 2011, an amendment was agreed to whereby the funding for minimum cumulative "Expenditures" for "Exploration and Development" (as defined in the Definitive Option Agreement) work on or in connection with any of the mineral interests comprising the Property interests of not less than $11,500,000 was revised in the following manner:

- no less than an initial $750,000 of the Expenditures shall be expended on the Property by December 31, 2010 ($750,000 incurred);

- no less than a further $5,750,000 of the Expenditures shall be expended on the Property by December 31, 2011 ($604,855 incurred); and

- no less than a final $5,000,000 of the Expenditures shall be expended on the Property by December 31, 2012.

On March 22, 2011, a further amendment was agreed to whereby the funding for minimum cumulative "Expenditures" for "Exploration and Development" (as defined in the Mercer Option Agreement) work on or in connection with any of the mineral interests comprising the Property interests was reduced from $11,500,000 to $3,000,000 to be incurred in the following manner:

- no less than an initial $1,000,000 of the Expenditures shall be expended on the Property by December 31, 2011 ($1,000,000 incurred);

- no less than a further $1,000,000 of the Expenditures shall be expended on the Property by December 31, 2012 ($354,855 incurred); and

- no less than a final $1,000,000 of the Expenditures shall be expended on the Property by December 31, 2013.

Title to Property and Underlying Option Agreement

CMG, a Colombian legal entity, is the rightful owner of the concession contract #LH 0071-17, an exploitation license valid until March 28, 2032, that was registered on March 28, 2008 by INGEOMINAS in the Department of Caldas (registration #HHXB 01). As described above, MGC, a privately-held, Canadian entity registered in British Colombia, entered into an Option Agreement "Underlying Option Agreement" with CMG on March 4, 2010 to acquire a 100% interest in Guayabales. The Company entered into the Definitive Option Agreement with MGC as described above to acquire the 100% interest of Guayabales subject to the terms of the Underlying Option Agreement. No surface agreements are in place; however, CMG represents and warrants reasonable surface access to Guayabales in the Underlying Option Agreement and the Colombian Mining Code guarantees surface access.

In Colombia, all mineral rights are the property of the government of Colombia. Obtaining a mining right does not transfer ownership of the mineral estate, but creates a temporary right to explore and benefit from minerals in exchange for royalty payments so long as the mining title remains in good standing. Under Colombian mining law, foreign individuals and corporations have the same rights as Colombian individuals and corporations, and Colombian governmental regulatory bodies are specifically prohibited from requiring any additional or different requirements than would be required of a Colombian individual or corporation.

Subject to the Definitive Option Agreement as described above, the Company is responsible for all obligations established in the Underlying Option Agreement between MGC and CMG in order to complete the 100% acquisition of the Guayabales Property. These obligations include cash payments; provision for allowing continued Limited Mining Rights as described below; property maintenance; and quarterly reports. More specifically, these include:

8

1. Cash Payments: The Company is responsible to make cash payments to CMG as described above.

2. Limited Mining Rights: The Company provides CMG with Limited Mining Rights, allowing the cooperative group of miners belonging to the entity to continue mining operations on the property. Operations are not to exceed 80 metric tonnes per day, providing that the mining operations are restricted to geographic areas in which mining operations are currently being conducted. The Company has the right to terminate this right to mine, by either completing the cash payment schedule described above, or by making a one time cash payment of $600,000.

3. Property Maintenance: The Company is obligated to maintain the property in good standing, free and clear of all liens, charges and encumbrances.

4. Property Reports: The Company is obligated to provide CMG with summary operating reports on a 3 month/quarterly schedule.

Technical Report

We received a technical report in accordance with the provisions of National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101"), of the Canadian Securities Administrators for the Guayabales Property, which is located in the Department of Caldas, Colombia. The complete technical report, which was authored by Dean D. Turner, C.P.G., a qualified person as defined in NI 43-101, was filed under our Company's profile on the Canadian Securities Administrators public disclosure website, at www.sedar.com, on May 28, 2010. Mr. Turner prepared an update to this technical report, dated February 8, 2011. The technical report, as updated, is referred to herein as the "Technical Report."

As required by NI 43-101, the Technical Report contains certain disclosure relating to measured, indicated and inferred mineral resource estimates for the Guayabales Project. Such mineral resources have been estimated in accordance with the definition standards on mineral resources of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in NI 43-101. Measured mineral resources, indicated mineral resources and inferred mineral resources, while recognized and required by Canadian regulations, are not defined terms under the SEC's Industry Guide 7, and are normally not permitted to be used in reports and registration statements filed with the SEC. Accordingly, we have not reported them in this annual report or otherwise in the United States.

Investors are cautioned not to assume that any part or all of the mineral resources in these categories will ever be converted into mineral reserves. These terms have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. In particular, it should be noted that mineral resources which are not mineral reserves do not have demonstrated economic viability. It cannot be assumed that all or any part of measured mineral resources, indicated mineral resources or inferred mineral resources discussed in the Technical Report will ever be upgraded to a higher category. In accordance with Canadian rules, estimates of inferred mineral resources cannot form the basis of feasibility or other economic studies. Investors are cautioned not to assume that any part of the reported measured mineral resources, indicated mineral resources or inferred mineral resources referred to in the Technical Report are economically or legally mineable.

The following information regarding the Guayabales Property is derived largely from the Technical Report.

Location and Means of Access to Property

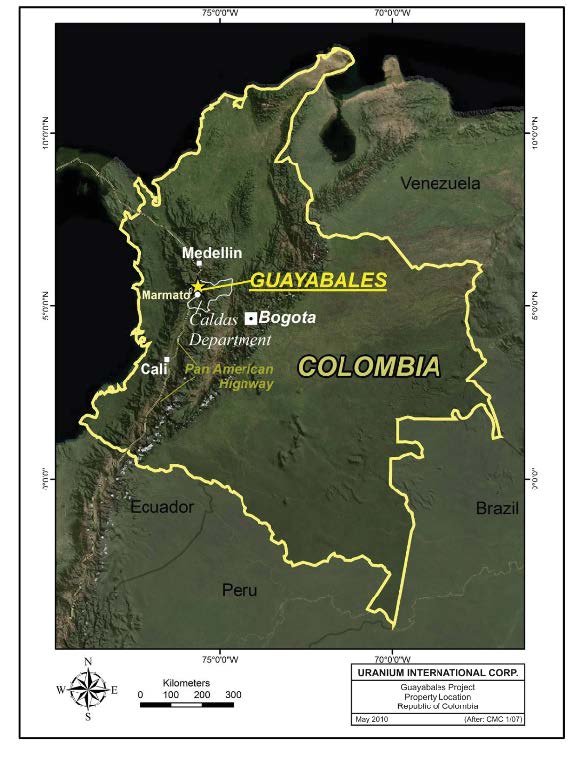

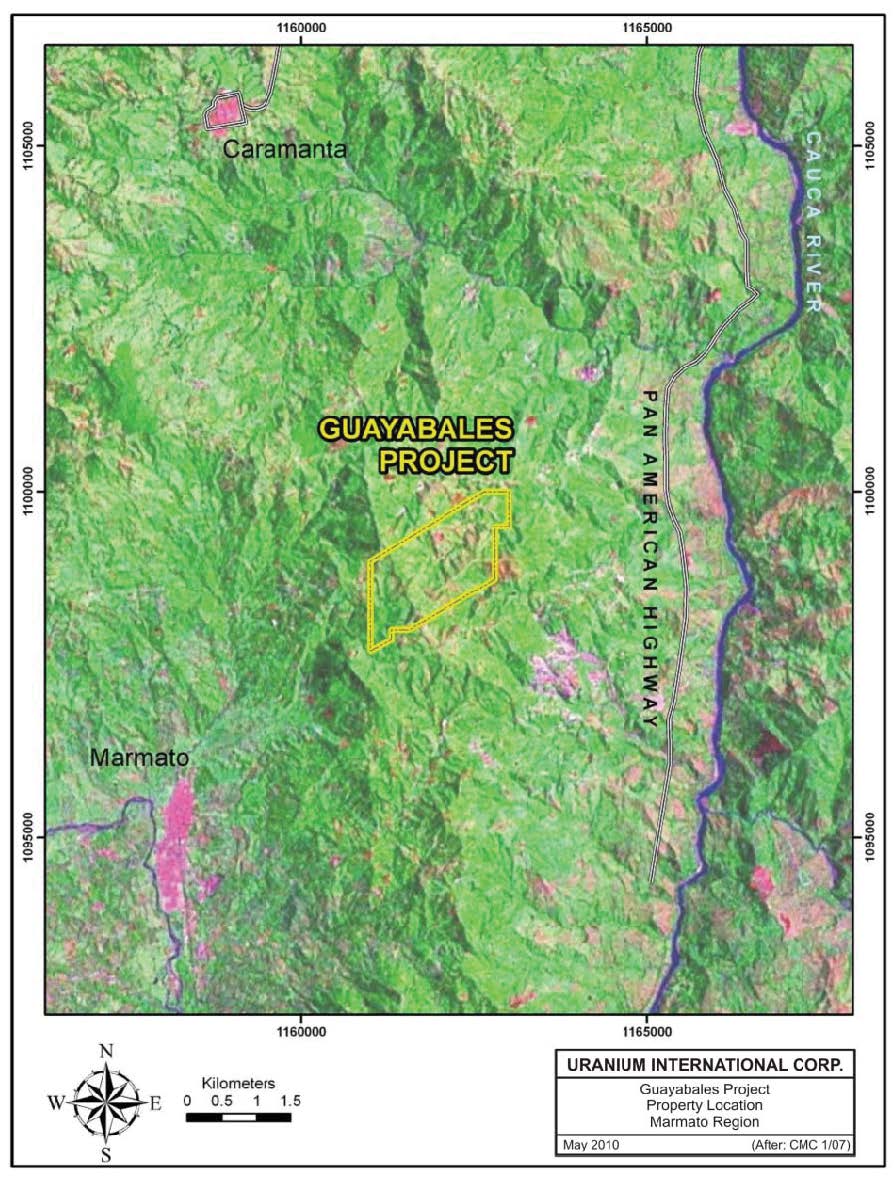

The Guayabales Property consists of 247.85 hectares in the Marmato Mining District of Caldas Department, Colombia. The property is located approximately 80 kilometers south of the city of Medellin (Figure 1), and is centered at approximately 1,162,000E, 1,099,000N, Colombian National Grid, Choco projection, or in geographic coordinates at latitude: 5.48oN and longitude: 75.61oW (Figure 2).

The Guayabales Property is accessible by a combination of paved and all weather gravel roads. From Medellin, Colombia, the property can be accessed by driving approximately 114 kilometers along the paved Pan American Highway, and then 25 kilometers through the mining town of Marmato to the Guayabales Property. The climatic conditions of the region support mining operations year-round.

9

10

Infrastructure

The Marmato region has an extensive mining history, and as such, provides a skilled work force from the surrounding communities for exploration and mining labor requirements. Water is abundant from either surface or underground sources. Three high tension power lines (230 kV each) belonging to the Colombian national power grid are located between Marmato and the Cauca River valley to the east. A 132 kV substation is located at Marmato, which supplies power to the community and surrounding area, including Guayabales.

11

Property Geology

A key aspect of the geology of Guayabales is the sheared and mineralized intrusive contact zone between the Tertiary age Marmato Stock and older Paleozoic age marine sediments present in the vicinity of property. The main shear, the Encanto Zone corridor, trends roughly N60oW, is sub-vertical to steeply southwest/northwest dipping, and has widths ranging from 20 to 40 meters. Existing mine workings demonstrate approximately 500 meters of strike, and geomorphic expressions indicate approximately 1.3 kilometers of cumulative strike extent. Lesser shears and other structures are evident throughout the property and range from N 60o W to east-west in strike with sub-vertical dips. A strong rectilinear drainage pattern is present on much of the property which suggests drainages are controlled by structures parallel to the Marmato and Echandia structural trends, offset by cross-cutting faults.

Mineralization

The mineralization at Guayabales is typical of an intermediate sulfidation type gold-silver metal deposit associated with a porphyry system. This type of mineralization is similar to that found at Marmato Mountain in La Zona Alta and La Zona Baja. The intermediate sulfidation-type epithermal mineralization is superimposed on, and paragenetically later than the porphyry-style. Targets related to the precursor porphyry-style mineralization may have the potential to develop significant gold-copper-molybdenum mineralization. These types of deposits often have high exploration potential for surface and underground resources amenable to bulk mining techniques. Most of the precious metal mineralization in the Marmato District is associated with base metal sulfides or native precious metal species. Oxide mineralization may occur in the weathering zone above the sulfides but is limited, as is generally typical in the development of supergene oxidation in the Western Cordillera of Colombia. The Company is primarily targeting the bulk tonnage potential of the Guayabales property. However existing underground development and resulting production at Guayabales demonstrates significant target potential for high grade mineralization amenable to selective mining techniques. Narrow, unoxidized, vein-type portions of the main Encanto Zone, as well as subparallel zones, are actively being mined by the CMG.

The Guayabales Property covers an extensive zone of mineralization and alteration at the projected northwest extension of the Marmato and Echandia structural trends. Guayabales hosts a gold-silver mineralized corridor of shearing and veining (Encanto Zone) and high-level intrusions associated with porphyry gold (copper) mineralization (La Portada and Mill Zones).

Multiple mineralized shears are exposed in the accessible mine workings and in road cuts on the Guayabales Property. The main prospective productive zone on the property, known as the Encanto Zone, is exposed and developed in the underground workings. The Encanto structural corridor ranges from 20 to 40 meters in width, strikes N50o to N60oW and has a sub-vertical dip. This mineralized zone is sympathetic to the major mineralized fault zones along strike to the southeast at Marmato and Echandia. Other mineralized structures and shears range from a few millimeters to several meters in width, are sub-vertical, and strike from east-west to N40oW.

The Encanto Zone consists of multi-phase quartz, clay-white mica, and sulfide-rich breccia. Gold and silver mineralization occurs in quartz and sulfides as native gold, auriferous pyrite, argentite, argentiferous galena, and electrum. At Marmato and Guayabales the precious metal-bearing minerals are controlled by late fractures that crosscut earlier pyrite, chalcopyrite and sphalerite veins. The paragenetic sequence indicates an early base-metal mesothermal assemblage formed at temperatures greater than 250 degrees centigrade, associated with quartz-sericite-pyrite alteration, crosscut by later, relatively high-temperature epithermal, precious-metal bearing assemblages associated with quartz-clay-white mica.

History of Previous Operations

CMG has conducted underground exploration and development activities since 1995. They have developed and prospected a total of sixteen underground workings, with low rates of production by artisanal miners.

12

Two foreign companies are known to have conducted exploration programs on the property: a) Colombia Gold ("CG") from 2005-2006, and b) Colombian Mines Corporation ("CMC") from 2006-2009. CG and CMC principally focused their geologic mapping and geochemical sampling programs on Encanto Zone mines and associated underground workings that are encompassed within a 500 meter by 500 meter area. Significant mineralization was also sampled in the underground workings of the Encanto Zone hanging and footwalls. Taken together, the CMC and CG mine area sampling delineated a west-northwest trending, gold-silver mineralized corridor centered along the Encanto Zone, with dimensions of 650 meters northwest-southeast by 350 meters northeast-southwest. Much of this mineralized corridor has not been explored.

CMC's Encanto Zone exploration work culminated in a 17 hole diamond drill program in 2008. The holes were located along 450 meters of projected Encanto Zone strike length, and had orientations that yielded approximate true thickness intercepts. The drill program yielded: a) five holes that successfully intersected the main Encanto Zone across its entire width, b) four holes that initiated penetration of the main zone, but were lost before completion, c) three holes that intersected anomalous gold-silver mineralization along trend to the northwest and southeast, and d) intercepts from a number of drill holes in the hanging and footwall of the gold zone. The CMC core drilling program successfully extended the Encanto Zone's strike length to 500 meters, and down dip extent to 200 meters. The zone remains open along strike and to depth, with additional exploration potential within in-parallel mineralized zones in the hanging and footwall rocks.

In addition to the Encanto Zone exploration, CMC also collected 163 chip channel samples along an access road leading to the underground mining area. The road generally trends perpendicular to the west-northwest structural trend projecting onto the Guayabales property from Marmato-Echandia. CMC's sampling discovered a broad, 600 meter wide zone of fracturing, quartz veining, anomalous copper-lead geochemistry, and gold mineralization. Taken together, CMC's underground and road cut sampling define a 1,100 meter wide corridor of significant to anomalous gold mineralization that is on trend with Marmato-Echandia, and has the potential to host a bulk tonnage, near surface, oxide gold resource.

Small scale production continues on the property by CMG. CMG is producing approximately 30 to 50 metric tonnes per week from multiple small adits. Ore is processed in up to 15 separate mills operating at from 1 to 14 metric tonnes per week. Of the ore processed on the property, gold-silver recovery is achieved by milling, gravity concentration and cyanidization. No mercury is used on the Guayabales Property. The late-stage fracture-controlled nature of the precious metals mineralization in the form of electrum and native gold may be a primary reason for the good recovery rates from unoxidized ores.

The Company's Exploration Activities

The Company commenced exploration activities in April-May 2010, with programs that consisted of: 1) property-wide 1:5000 scale geological mapping accompanied by reconnaissance level rock sampling, 2) a systematic property-wide soil sampling campaign, 3) detailed (1:200 scale) road cut geological mapping and chip channel sampling, and 4) a core drilling campaign in the Encanto mine area that is ongoing. The Company's work over a period of approximately nine months has established the first property-wide context for the well-known intermediate sulfidation gold-silver mineralization related to the Encanto Zone, as well as porphyry related mineralization suggested by CMC's earlier work.

The Company's direct project related work expenditures through 2010 were as follows:

13

|

Guayabales 2010 Exploration Expenditures |

||

|

Item |

Description |

Cost (US$) |

|

Geologic mapping etc. |

Professional technical staff |

$158,000.00 |

|

Consultants |

Geologic field investigations & reports |

$21,678.00 |

|

Drilling |

Ongoing DDH program |

$349,445.27 |

|

Drill Analysis |

DDH assays |

$9,647.60 |

|

Soils Geochem |

Property-wide survey |

$26,802.12 |

|

Rock Geochem |

Property-wide, road cut, etc. surveys |

$10,295.49 |

|

Geophysics |

Down payment for 2011 survey |

$7,000.00 |

|

Camp costs |

Project field living |

$12,768.72 |

|

Transport |

Field travel, assay shipments, etc. |

$15,793.61 |

|

Field labor |

Local labor for pad building, maintenance, etc. |

$49,014.09 |

|

Environmental |

Required reclamation etc. |

$17,800.00 |

|

Permitting |

Water use permit |

$1,000.00 |

|

CSR |

Community supplies, education, etc. |

$9,800.00 |

|

Total Approved Expenditures |

$689,044.90 |

|

Interpretations and Conclusions from Technical Report

The author of the Technical Report concluded that the mineralization at Guayabales, and the Marmato District in general, is related to the emplacement of porphyry stocks of late Miocene age. Structure is an important control on the mineralization, particularly along northwest trending shear zones. Guayabales hosts a porphyry gold (copper) system and related intermediate sulfidation gold-silver mineralization within a northwest trending structural corridor that projects across the property from the Marmato-Echandia mining complex to the southeast.

The Company's mapping of argillic-intermediate to argillic-potassic overprinted by +- phyllic alteration assemblages, coupled with a coincident suite of zoned geochemical anomalies, has established the 750 by 400 meter porphyry gold target. Road chip channel sampling across the gold-enriched porphyry has consistently yielded average grades in the range of 0.24 to 0.28 g/t gold.

The Encanto Zone gold-silver mineralization has long been established as a viable exploration target through the work of small scale miners, as well as substantial underground sampling programs (over 1000 meters of chip channeling) by previous operators Colombian Gold and Colombian Mines Corporation. Taken together, the CMC and CG mine area sampling delineated a west-northwest trending, gold-silver mineralized corridor centered along the Encanto Zone, with dimensions of 650 meters northwest-southeast by 350 meters northeast-southwest. The Encanto Zone proper ranges from 20 to 40 meters in width, strikes N50◦-60◦W, and has a sub-vertical dip. CMC's 17 hole diamond drill program increased the Encanto Zone's down dip extent to 200 meters, with intercepts such as 21.85 meters (9.18m est. true thickness), including 3.15 meters (1.32m est. true thickness). The Company's Encanto Zone drill program, has completed 1114.6 meters of drilling in four core holes. All four of the Company's holes intersected the Encanto Zone. From the CMC and the Company's drilling, the Encanto Zone remains open along strike and to depth, with additional exploration potential within in-parallel mineralized zones in the hanging and footwall rocks.

Taken together, the geologic mapping, property-wide geochemistry, drilling, and underground and road cut sampling define a 1,100 meter wide northwest trending corridor of porphyry gold (Portada and Mills Zones) and intermediate sulfidation gold-silver (Encanto Zone) mineralization. This northwest corridor is on trend with the Marmato mining complex to the southeast.

The Company's 2010 exploration program focused on three principal goals: a) perform a property-wide assessment based upon geological mapping and geochemical sampling in order to provide context for the intermediate sulfidation gold-silver and porphyry gold styles of mineralization, as well as to define new exploration targets, b) conduct detailed road cut geological mapping and sampling to further refine the porphyry alteration and geochemical models and their relationship to gold mineralization, and c) initiate a drill campaign in the Encanto Zone to confirm previous CMC results, as well as to test for extensions along strike and down dip. The Company's 2010 work achieved these primary objectives.

14

As a whole, the exploration database that has resulted from the Company's 2010 programs, and previous work spanning from 2005 (Colombia Gold) through 2009 (Colombian Mines Corporation) is extensive from the perspective of early-stage mineral property evaluation. These data are judged to be reliable, as three different companies, working independently, have generated similar results over time. The author's independent sampling and database checks, and review of the Company's and CMC's sample methods, preparation, analysis and chain of custody have further validated these results. In the case of Encanto Zone related exploration, the underground sampling has now been augmented by CMC's and the Company's initial drill testing. While this drilling has verified, from an exploration vantage, the continuity of Encanto gold-silver mineralization along strike and to depth, detailed geologic and grade modeling will require a tighter drill spacing (i.e., 25 m or less), careful surveying, and increasing recovery rates in the mineralized zones before a 43-101 compliant resource can be estimated. Further work on determining the structural controls and three dimensional geometries of the high grade zones should be a priority. The Encanto Zone remains open along strike and down dip, with additional, but lower priority targets occurring in the hanging and footwalls of the zone. Road cut mapping and sampling north of the underground mining area has delineated a broad zone of lower grade porphyry gold mineralization. The work to date has been conducted at a density, and is of a type to identify a viable porphyry exploration target. This is especially so considering the cover of soil and vegetation that conceals the mineralization over +95% of the property. However, additional work, including geophysics (IP, magnetics, VLF-R) and drill testing will be needed to delineate the porphyry gold zones and to further determine the distribution and grade of the mineralization.

The Company has identified a number of priority exploration targets at Guayabales. The exploration targets identified by the Company define Guayabales as a property of merit, and, in the author of the Technical Report's view, justify a significant follow-up work program as discussed below.

Recommendations and Plan of Operations

The geologic relationship of gold-silver intermediate sulfidation to porphyry gold mineralization provides metallogenic context for the exploration targets and 2011 program for the Guayabales project. The Company's principal exploration target is a bulk-tonnage, porphyry precious metals deposit that will be potentially amenable to open-pit mining. A second target type with upside exploration potential is the long recognized, higher-grade vein zones amenable to selective, underground mining exploitation. The potential for defining economic gold-silver mineralization of this style is clearly manifested by the presence of a number of small scale mining operations on the property.

General recommendations for the 12 month Guayabales work program are listed below:

1) A system of umpire lab check assays should be implemented to provide additional confidence in the Company drill sample results. This QA program should concentrate on samples from mineralized intervals, but random samples of non-mineralized material should be included.

2) A study to determine if there is a recovery versus grade sampling issue for Encanto mineralized intervals should be conducted. Efforts to improve recoveries at the rig should continue.

3) A study of whether a coarse gold component can be identified with screen fire assay analysis of coarse rejects from mineralized Encanto Zone intervals should be conducted.

4) Mineralized and altered zones from the CMC drilling should be re-logged and results confirmed by re-assaying the available coarse rejects.

5) A survey network on the property should be established as a base to accurately locate current and past drilling, all mine openings and other works related to ongoing mining, as well as to provide a reference for field mapping and setup a grid for geophysical surveying.

6) An updated, photogrammetrically accurate topographic base should be generated, most likely from satellite stereo imagery. The imagery must be tied to the local ground survey from 5) above.

7) A 10,000 line-meter IP program should be carried out on a priority basis over the porphyry target area. In conjunction with this survey, magnetics and VLF-R should be performed over the entire property.

8) The current drill program should be extended to a total of 7500 meters (approximately 1100m already drilled) in order to test priority targets.

9) A follow-up drill program of 12,000 meters to follow-up on the results of the drill program from 8) above.

10) Underground workings should be re-mapped and check sampled to confirm earlier results. Furthermore, additional underground channel sampling should be conducted for tunnels with limited CMC or CG data.

11) A metallurgical testing program should be carried out on fresh samples from recent drilling to characterize recoveries from gravity techniques, direct cyanidization, flotation with cyanidization, etc.

15

12) All exploration data should be compiled into an integrated 3-D model in order to review results to date, plan future work, and as an input to 13) below.

13) A resource estimate should be prepared for the Encanto mineralized corridor, as well as potential near-surface porphyry related mineralization.

14) Additional property should be acquired in areas bounding the identified target areas and obvious extensions of mineralized trends.

The one year Guayabales exploration program as outlined in the 43-101 is budgeted at US$5,831,635, including land payments until the end of 2011, as follows:

|

2011 Guayabales Program Budget |

||

|

Item |

Description |

Cost USD |

|

Access |

Road build/maintenance & drill pads, etc |

95,000 |

|

Drilling |

18500 meters of core drilling |

3,000,000 |

|

Geological consulting |

43-101 resource report |

100,000 |

|

Environmental |

On-going clean-up req.; water treat |

76,000 |

|

Equipment |

Field gear, generators, etc. |

60,000 |

|

Geochemistry |

Field survey costs |

90,000 |

|

Geophysics |

IP, VLF and magnetics surveys |

52,000 |

|

Assay Laboratory |

Drill & geochemical analyses |

665,000 |

|

Line cutting |

For geophysical surveys, etc. |

30,000 |

|

Mapping |

Surface and UG |

36,000 |

|

Metallurgy |

Contract services |

80,000 |

|

Other contracts |

Satellite imagery, photogrammetry, etc. |

25,000 |

|

Permitting |

Permits for roads, drilling, etc. |

18,000 |

|

Reclamation |

Required reclamation work, drill pads, etc. |

100,000 |

|

Field Supplies |

Sample bags, expendables, etc. |

60,000 |

|

Surveying |

Survey base network, DH locs, etc |

30,000 |

|

Camp costs |

Project housing, food, etc. |

93,000 |

|

Personnel/Labor costs |

Professional staff & local labor |

489,000 |

|

Technical Subtotal |

5,099,000 |

|

|

Community/Social Subtotal |

Health, community projects, education, etc. |

62,000 |

|

Communications |

Cell phones, etc. |

12,000 |

|

Legal |

Title opinion, etc. |

24,000 |

|

Licenses, etc. |

Government requirements |

12,000 |

|

Land Payments |

CMG 2011 payments |

300,000 |

|

Safety, health, training |

Company and government requirements |

36,000 |

|

Logistics, vehicles, etc. |

Travel and field expenses |

130,000 |

|

Personnel |

Professional staff |

14,000 |

|

Direct Project Administration Subtotal |

528,000 |

|

|

Total |

5,689,400 |

|

|

Contingency |

Estimated at 2.5% |

142,235 |

|

Grand Total |

5,831,635 |

|

The 2011 work program is initially focused on further drill testing of the Encanto related mineralization. Accurate surveying of drill hole and underground working locations in the Encanto mining area will allow a 3-D model of the gold-silver mineralization to be developed. Check assaying of CMC drill results, as well as underground confirmation sampling will provide additional confidence in using these data for the Encanto modeling exercise. Further, underground geologic mapping will very likely provide important new, and detailed information on the mineralizing controls of the system. Beyond the Encanto related mineralization, the geophysical surveys will provide important information on the porphyry gold system. Based upon these results, targets can be selected for drill follow-up.

16

The Company has subsequently decided to conduct the proposed work program over a longer period in order to adequately assess the results of work performed and to incorporate drilling results into the on-going work program. Accordingly, the revised 12 month work program is now budgeted at approximately $1,000,000.

Competition

We operate in a highly competitive industry, competing with other mining and exploration companies, and institutional and individual investors, which are actively seeking mineral exploration properties throughout the world together with the equipment, labour and materials required to exploit such properties. Many of our competitors have financial resources, staff and facilities substantially greater than ours. The principal area of competition is encountered in the financial ability to cost effectively acquire prime mineral exploration prospects and then exploit such prospects. Competition for the acquisition of mineral exploration properties is intense, with many properties available in a competitive bidding process in which we may lack technological information or expertise available to other bidders. Therefore, we may not be successful in acquiring and developing profitable properties in the face of this competition. No assurance can be given that a sufficient number of suitable exploration properties will be available for acquisition and development.

Applicable Laws and Regulations

Colombian Laws and Regulations

As indicated above, our primary property of interest is the Guayabales Property in Colombia. As such, we will be subject to applicable Colombian laws and regulations.

Colombian Mining Code-General Discussion

Mineral property rights are governed by the Colombian Mining Code, which has been subject to various changes and amendments. The oldest version applicable is Law 20 promulgated in 1969. Law 20 was superseded by decree 2655 in 1988 (the "1988 Decree"), which in turn was amended by Law 685 in 2001 (the "2001 Law"). A recent development is the amendment of the 2001 Law by Law 1382, enacted February 9, 2010. Under Colombian mining law, the holder of surface or subsurface minerals, whether operating on government or private property, is subject to the legal requirements established under the 1988 Decree, the 2001 Law, and the new (February 2010) Law 1382.

The following discussion of applicable Colombian mining laws is subject to any amendments thereto which may be effected based upon Law 1382. The Company has been advised that the new law excludes mining and exploration activity from the Pàramo ecosystem, which occurs above 3,200 meters elevation. The Guayabales Property occurs within an elevation range of 1620 to 2240 meters elevation.

The Company has reviewed the Law 1382 and has determined that there is no impact on the Guayabales Property or the Company's planned exploration program.Under the 2001 Law, there is a single type of mineral tenure, a Concession Contract covering exploration, construction and exploitation. The initial duration of a Concession Contract is 30 years, but may be extended for up to 30 additional years. A Concession Contract has three distinct phases: exploration, construction, and exploitation.

The exploration phase lasts for the first three years of the Concession Contract, but may be extended for a term of up to two years. During this phase, the holder has the right to carry out within the given area, the studies necessary to establish the existence of the minerals. These studies should include a determination of the existence, location, geometry, and economic viability of the mineral deposit. In order to proceed to the construction phase, 30 days prior to the completion of the exploration phase, the Concession Contract holder must submit a building and works plan - Plan de Trabajas y Obras (a "PTO") to the mining authority for approval and concurrently submit an environmental impact study - Estudio de Impacto Ambiental (an "EIA") to the environmental authority.

17

The EIA provides the technical support parameters to obtain an environmental license. Depending on the commodity being produced and the level of production, this study must be submitted to the Ministry of the Environment or to environmental authority of the jurisdiction in which the mining project is located (i.e. the Regional Autonomous Corporations). The environmental license grants the necessary environmental permits, including concessions and authorizations, to make use of and profit from renewable natural resources necessary to move the project forward including resources such as water and timber. The construction and exploitation stage cannot begin until the environmental license is obtained.

The construction phase lasts for three years, commencing on acceptance of the PTO, and may be extended for an additional year. During this phase, the holder has the right to prepare the mining area and install the services, equipment, and fixed machinery necessary to start and carry out the extraction, storage, transportation and beneficiation of the minerals.

During the exploitation phase, the holder has the right to carry out within the given area the exploitation of minerals according to the principles, rules and criteria of accepted geology and mining engineering. The Company is obligated to comply with all legal, technical, operative and environmental rules set forth in the mining code, with all buildings, facilities and mining assemblies designed and installed according to the approved PTO. The exploitation phase lasts for the remaining duration of the Concession Contract.

Exploration on a mineral tenure which exceeds prospecting, mapping and sampling, requires the submittal and approval of an Environmental Management Plan - Plan of Management Environmental ("PMA") which must include:

(a) the work to be done (i.e., the number of drill holes, location, direction, depth, etc);

(b) the proposed points of diversion for water so appropriate water permits can be issued;

(c) the location and number of settling ponds to prevent turbidity in the streams by drilling fluids; and

(d) the location of fuel and oil storage areas, away from streams and creeks.

The preparation and filing of the PMA is normally the responsibility of the drill contractor, and is typically approved in 15 to 30 days, up to a maximum of 90 days. There is no bond requirement for exploration PMA's, and no site reclamation is required. While PMA's do not require any authorization or environmental permits, any such work carried out in areas designated as natural reserves according to Article 34 of the Code are to be governed by those rules and restrictions.

As discussed above, an EIA must be submitted before an environmental license will be issued. The EIA has to demonstrate the PTO's environmental feasibility. Without approval of this study and the issuance of the corresponding Environmental License, mining and exploitation cannot commence.

Chapter 20 of the Mining Code under the 2001 Law deals with the issuance of the required environmental licenses for mining titles. Once an EIA has been submitted, the law provides that the issuance of the required environmental licenses can only be refused when:

(a) the EIA does not comply with the requirement in Article 204 of the Code and specifically those foreseen in the terms of reference and/or guides, established by the competent environmental authority;

(b) the EIA has errors or omissions that cannot be corrected by the applicant and that are required components of such study;

(c) the level of prevention, mitigation, correction, compensation and substitution for the negative impacts of the mining project prescribed in the EIA do not comply with the substantial elements established for such effects in the guidelines; or

(d) the omissions, errors or deficiencies of the EIA, and of the proposed measures referred to in the previous subsections, affect the total mining project.

18

The 2001 Law also requires a Concession Contract holder to obtain an Environmental Mining Insurance Policy. During the exploration stage, the insured value under the policy must be 5% of the value of the planned annual exploration expenditures and during the construction phase the insured value under the policy must be 5% of the planned investment for assembly and construction under the PTO. During the exploitation phase the insured value under the policy must be 10% of the product of the estimated annual production multiplied by the mine mouth price of the minerals being produced, as fixed annually by the Colombian government. For licenses or agreements to be maintained under decree 2655 (the 1988 Decree), the holder has to obtain an insurance policy and the insured value must be 10% of the estimated production for the first two years as established by the PTI. Further, the policy must be maintained during the entire term of the license or agreement.

Surface Rights And Surface Tenure

Colombian law specifically provides that the owner of a Concession Contract, exploration license or exploitation license is entitled to use so much of the surface as is necessary to carry out the activities under the given license or contract. Under normal conditions, this requires little more than speaking with the surface owner, obtaining permission and paying a reasonable fair market price for the area actually used. Colombian law grants exclusive temporary possession of mineral deposits and provides mandatory easements to ensure efficient exploration and exploitation of legal mining titles and further provides authority to impose appropriate easements as necessary both within and external to the limits of the mining title. The holder of a mining title must agree with the surface owner or other party against which such easement is enforceable, including other mining title holders, upon the time, and appropriate remuneration for the use and occupancy. Colombian law provides that the remuneration payable to the surface owner is to be based on the reasonable fair market value of the land and is not to include any value attributable to the development of the "mineral wealth", and that it should only be for so much of the surface as is actually affected, consumed or occupied by the exploration or mining activity. Should the use of the surface affect the value of areas not subject to the easement, this loss of value will also be taken into account when fixing the remuneration payable to the land owners.

Furthermore, since the mining industry is an activity of public interest, it is also possible for the concessionaire to request the competent mining authority for the expropriation of the lands necessary for mining activities. The acquisition of land through expropriation is also subject to prior indemnification to the owner(s).

Taxes And Royalty Obligations

In Colombia, production of gold and silver is subject to a royalty payable to the state equal to 4% of the gross value of the minerals calculated at the mine mouth for gold, subject to certain deductions and adjustments. CMG has represented and warranted in the Underlying Option Agreement on March 4, 2010 that they are obligated to pay all associated royalty payments related to their current exploitation. The Company is not liable for any of the royalty payments related to the current exploitation.

The value per gram of gold and silver at mine mouth for the estimation of royalties will be eighty per cent (80%) of the average international price for the previous month, as published in the London Metal Exchange.

Under the 2001 Law, Colombian staff of a mining company, as a whole, should receive not less than seventy percent (70%) of the total payroll of qualified or of skilled personnel in upper management or senior level staff, and no less than eighty percent (80%) of the value of total payroll of the subordinates. Upon prior authorization, relief may be granted by the Ministry of Labour for a specified time to allow specialized training for Colombian personnel.

Other Applicable Laws and Regulations

In addition to the Guayabales Property in Colombia, we have certain mineral property interest in Sweden as described above. If we determine to advance our interests on these properties, we will be subject to Swedish laws and regulations, and we will take such actions as necessary to ensure compliance therewith, including obtaining any necessary permits and complying with environmental and other applicable laws and regulations.

19

Research and Development Activities

No research and development expenditures have been incurred, either on our account or sponsored by customers, during the past three years.

We do not employ any persons on a full-time or on a part-time basis. William Thomas is our sole executive officer and is primarily responsible for all of our day-to-day operations. Other services are provided by outsourcing and consultant and special purpose contracts.

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this annual report in evaluating our company and its business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below may not be all of the risks facing our company. Additional risks not presently known to us or that we currently consider immaterial may also impair our business operations. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Business

We will require significant additional financing in order to continue our exploration activities and our assessment of the commercial viability of our mineral properties.

We will need to raise additional financing to complete further exploration of our mineral properties. Furthermore, if the costs of our planned exploration programs are greater than anticipated, we may have to seek additional funds through public or private share offerings or arrangements with corporate partners. There can be no assurance that we will be successful in our efforts to raise these require funds, or on terms satisfactory to us. The continued exploration of our mineral properties and the development of our business will depend upon our ability to establish the commercial viability of our mineral properties and to ultimately develop cash flow from operations and reach profitable operations. We currently are in the exploration stage and we have no revenue from operations and we are experiencing significant negative cash flow. Accordingly, the only other sources of funds presently available to us are through the sale of equity. We presently believe that debt financing will not be an alternative to us as all of our properties are in the exploration stage. Alternatively, we may finance our business by offering an interest in our mineral properties to be earned by another party or parties carrying out further exploration thereof or to obtain project or operating financing from financial institutions, neither of which is presently intended. If we are unable to obtain this additional financing, we will not be able to continue our exploration activities and our assessment of the commercial viability of our mineral properties.

As our mineral properties do not contain any reserves or any known body of economic mineralization, we may not discover commercially exploitable quantities of ore on our mineral properties that would enable us to enter into commercial production, achieve revenues and recover the money we spends on exploration.

Our properties do not contain reserves in accordance with the definitions adopted by the SEC and there is no assurance that any exploration programs that we carry out will establish reserves. All of our mineral properties are in the exploration stage as opposed to the development stage and have no known body of economic mineralization. The known mineralization at these projects has not yet been determined to be economic ore, and may never be determined to be economic. We plan to conduct further exploration activities on our mineral properties, which future exploration may include the completion of feasibility studies necessary to evaluate whether a commercial mineable orebody exists on any of our mineral properties. There is a substantial risk that these exploration activities will not result in discoveries of commercially recoverable quantities of ore. Any determination that our properties contain commercially recoverable quantities of ore may not be reached until such time that final comprehensive feasibility studies have been concluded that establish that a potential mine is likely to be economic. There is a substantial risk that any preliminary or final feasibility studies carried out by us will not result in a positive determination that our mineral properties can be commercially developed.

20

Our exploration activities on our mineral properties may not be successful, which could lead us to abandon our plans to develop such properties and our investments in exploration.

We are an exploration stage company and have not as yet established any reserves on our properties. Our long-term success depends on our ability to establish commercially recoverable quantities of ore on our mineral properties that can then be developed into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of mineral exploration is determined in part by the following factors:

- identification of potential mineral mineralization based on superficial analysis;

- availability of government-granted exploration permits;

- the quality of management and geological and technical expertise; and

- the capital available for exploration.

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be established or determined to be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may reduce the trading price of our common stock and impair our ability to raise future financing. We cannot provide any assurance to investors that we will discover any mineralized material in sufficient quantities on any of our properties to justify commercial operations. Further, we will not be able to recover the funds that we spend on exploration if we are not able to establish commercially recoverable quantities of ore on our mineral properties.

Our business is difficult to evaluate because we have a limited operating history.

In considering whether to invest in our common stock, you should consider that our inception was October 11, 2004 and, as a result, there is only limited historical financial and operating information available on which to base your evaluation of our performance.

We have a history of operating losses and there can be no assurances we will be profitable in the future.

We have a history of operating losses, expect to continue to incur losses, are considered to be in the exploration stage, and may never be profitable. Further, we have been dependent on sales of our equity securities and debt financing to meet our cash requirements. We have incurred net losses totaling $30,653,110 from October 11, 2004 (inception) to February 28, 2011. We incurred net losses totaling $5,547,005 in the year ended February 28, 2011 and $1,264,929 in the year ended February 28, 2010. Further, we do not expect positive cash flow from operations in the near term. There is no assurance that actual cash requirements will not exceed our estimates. In particular, additional capital may be required in the event that: (i) the costs to acquire additional mineral exploration claims are more than we currently anticipate; (ii) exploration costs for additional claims increase beyond our expectations; or (iii) we encounter greater costs associated with general and administrative expenses or offering costs.

Our participation in of mineral exploration prospects has required and will continue to require substantial capital expenditures. The uncertainty and factors described throughout this section may impede our ability to economically discover mineral prospects. As a result, we may not be able to achieve or sustain profitability or positive cash flows from operating activities in the future.

21

We will require additional funding in the future.

In addition to our current capital requirements, based upon our historical losses from operations, we will require additional funding in the future. If we cannot obtain capital through financings or otherwise, our ability to execute our exploration programs will be greatly limited. Our current plans require us to make capital expenditures for the exploration of our minerals exploration properties. Historically, we have funded our operations through the issuance of equity and short-term debt financing arrangements. We may not be able to obtain additional financing on favorable terms, if at all. Our future cash flows and the availability of financing will be subject to a number of variables, including the market prices of relevant minerals. Further, debt financing could lead to a diversion of cash flow to satisfy debt-servicing obligations and create restrictions on business operations. If we are unable to raise additional funds, it would have a material adverse effect upon our operations.

As part of our growth strategy, we may acquire additional mineral exploration properties.

Such acquisitions may pose substantial risks to our business, financial condition, and results of operations. In pursuing acquisitions, we will compete with other companies, many of which have greater financial and other resources to acquire attractive properties. Even if we are successful in acquiring additional properties, such properties may not produce positive results of exploration, or we may not complete exploration of such prospects within specified time periods, which may cause the forfeiture of the lease or other interest in that prospect. There can be no assurance that we will be able to successfully integrate acquired properties, which could result in substantial costs and delays or other operational, technical, or financial problems. Further, acquisitions could disrupt ongoing business operations. If any of these events occur, it would have a material adverse effect upon our operations and results from operations.

The mineral exploration industry is highly competitive and there is no assurance that we will be successful in acquiring any additional property interests which we may seek.

The mineral exploration industry is intensely competitive, and we compete with other companies that have greater resources. Many of these companies not only explore for and produce minerals, but also market various minerals and other products on a regional, national or worldwide basis. These companies may be able to pay more for productive mineral properties and exploratory prospects or define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, these companies may have a greater ability to continue exploration activities during periods of low mineral market prices. Our larger competitors may be able to absorb the burden of present and future federal, state, local and other laws and regulations more easily than we can, which would adversely affect our competitive position. Our ability to acquire additional properties and to explore them in the future will be dependent upon our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. In addition, because we have fewer financial and human resources than many companies in our industry, we may be at a disadvantage in bidding for exploratory prospects.

We are a new entrant into the mineral exploration industry without profitable operating history.

Since inception, our activities have been limited to organizational efforts, obtaining working capital and acquiring and exploring a very limited number of properties. As a result, there is limited information upon which to base our future success.

The business of minerals exploration is subject to many risks and uncertainties, including those described in this section, and if minerals found in economic quantities, the profitability of future mining ventures depends upon factors beyond our control. The profitability of mining mineral properties if economic quantities of minerals are found is dependent upon many factors and risks beyond our control, including, but not limited to: (i) unanticipated ground and water conditions and adverse claims to water rights; (ii) geological problems; (iii) metallurgical and other processing problems; (iv) the occurrence of unusual weather or operating conditions and other force majeure events; (v) lower than expected ore grades; (vi) accidents; (vii) delays in the receipt of or failure to receive necessary government permits; (viii) delays in transportation; (ix) labor disputes; (x) government permit restrictions and regulation restrictions; (xi) unavailability of materials and equipment; and (xii) the failure of equipment or processes to operate in accordance with specifications or expectations.

22

The risks associated with exploration and, if applicable, mining could cause personal injury or death, environmental damage, delays in mining, monetary losses and possible legal liability.

We are not currently engaged in mining operations because we are in the exploration phase and have not yet any proved mineral reserves. We are in the process of applying for property and liability insurance. Cost effective insurance contains exclusions and limitations on coverage and may be unavailable in some circumstances.

The marketability of natural resources will be affected by numerous factors beyond our control which may result in us not receiving an adequate return on invested capital to be profitable or viable.

The marketability of natural resources which may be acquired or discovered by us will be affected by numerous factors beyond our control. These factors include macroeconomic factors, market fluctuations in commodity pricing and demand, the proximity and capacity of natural resource markets and processing equipment, governmental regulations, land tenure, land use, regulation concerning the importing and exporting of minerals and environmental protection regulations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital to be profitable or viable.

Mining operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess of those anticipated, causing an adverse effect on our business operations.

If economic quantities of minerals are found on any of our mineral property interests by us in sufficient quantities to warrant mining operations, such mining operations are subject to federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Mining operations are also subject to federal, state, and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of mining methods and equipment. Various permits from government bodies are required for mining operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus resulting in an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may elect not to insure against due to prohibitive premium costs and other reasons. To date we have not been required to spend material amounts on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

Mineral exploration and development and mining activities are subject to certain environmental regulations, which may prevent or delay the commencement or continuance of our operations.

Mineral exploration and development and future potential mining operations are or will be subject to stringent federal, state, provincial, and local laws and regulations relating to improving or maintaining environmental quality. Environmental laws often require parties to pay for remedial action or to pay damages regardless of fault. Environmental laws also often impose liability with respect to divested or terminated operations, even if the operations were terminated or divested of many years ago.

Future potential mining operations and current exploration activities are or will be subject to extensive laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, protection and remediation of the environment, protection of endangered and protected species, mine safety, toxic substances and other matters. Mining is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production. Compliance with these laws and regulations will impose substantial costs on us and will subject us to significant potential liabilities.

Costs associated with environmental liabilities and compliance are expected to increase with the increasing scale and scope of operations and we expect these costs may increase in the future.

We believe that our operations comply, in all material respects, with all applicable environmental regulations. However, we are not fully insured at the current date against possible environmental risks.

23

Any change in government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.