Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Noranda Aluminum Holding CORP | d8k.htm |

Post Q1 2011

Investor Meetings |

The following

information contains, or may be deemed to contain, "forward-looking

statements" (as defined in the U.S. Private Securities Litigation Reform Act of

1995). By their nature, forward-looking statements involve risks and uncertainties

because they relate to events and depend on circumstances that may or may not occur in

the future. The future results of Noranda may vary from the results expressed in, or

implied by, the following forward looking statements, possibly to a material degree. For

a discussion of some of the important factors that could cause the Noranda results to

differ from those

expressed in, or implied by, the following forward-looking statements, please

refer to our filings with the SEC, including our annual report on Form 10-K.

Forward Looking Statements

2 |

Mr. Mahoney

was appointed Chief Financial Officer in May 2009 Mr. Mahoney has over 24 years of

cyclical industry experience in senior financial management positions for semiconductor

and electrical components companies including Hi-P International

Limited and Molex Inc.

Mr. Mahoney received a BA in Economics and History from the

University of Virginia and an MBA from the University of Michigan

President

and

Chief Executive

Officer

Robert B. Mahoney

Mr. Smith was appointed President, Chief Executive Officer and

Director in 2008

Mr. Smith has diverse leadership experience, including various

management assignments with The Dow Chemical Company and

positions as COO of Resolution Performance Products and CEO of

Covalence Specialty Materials

Mr. Smith holds a BA in Chemistry and an MBA from Harvard

University

Layle “Kip”

Smith

3

Management Attendees

Chief Financial

Officer |

•

Global economic growth drives positive aluminum fundamentals

•

Our operating model is leveraged to the aluminum prices

–

We are fully integrated, from bauxite to aluminum foil

–

We have cost effective, globally competitive assets

–

We choose to manage with a focus on productivity

–

We drive a value-added growth strategy

•

We have financial capacity and flexibility to support growth

–

We have a highly flexible capital structure with no near-term maturities, undrawn

revolver and no maintenance covenants

–

Our ratio of net debt to LTM adjusted EBITDA was 1.5x at Q1 2011

Key Investment Messages

4 |

5

Produced Financial Success in 2010, Continued in Q1 2011

LTM Net Income Excluding Special Items

LTM Operating Cash Flow, Excluding Aluminum Hedges

LTM Integrated Primary Aluminum Net Cash Cost

LTM Adjusted EBITDA |

Key Investment

Highlights We are well positioned to take advantage of favorable medium-

and long-term fundamentals

Integrated,

Cost Effective

Assets

Profitable Growth

& Productivity

Experienced

Management

Team

Favorable

Industry

Dynamics

Strong

Financial

Profile and

Performance |

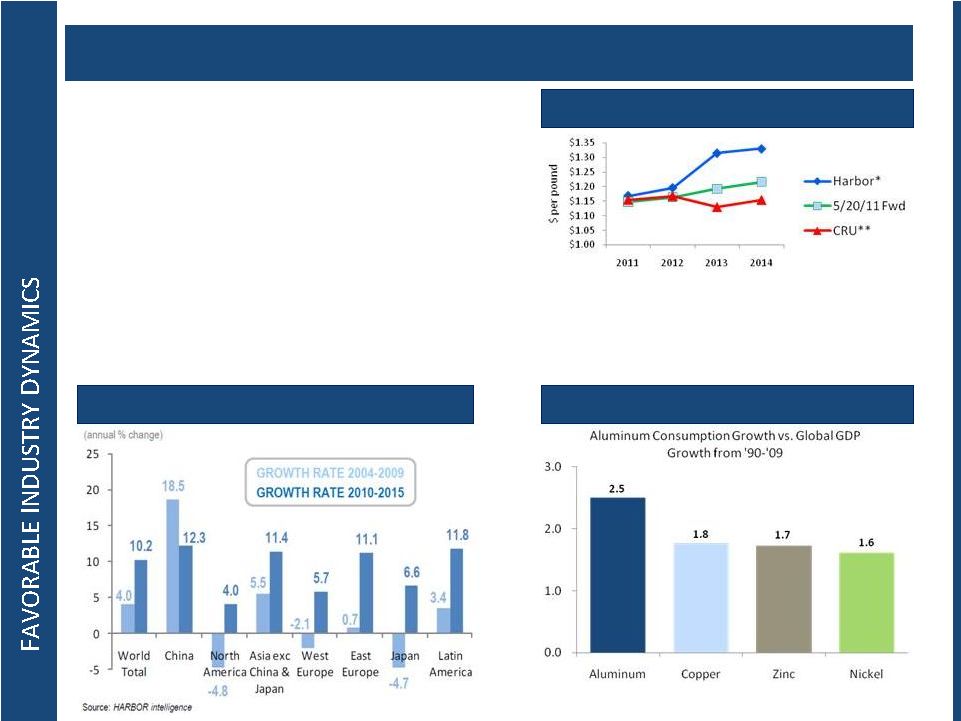

•

Global aluminum demand is expected to

continue to grow

–

Global economic growth

–

Higher standards of living and increased

demand from emerging markets

•

Aluminum is highly correlated with GDP

growth

–

Favorable substitution trends

–

Rapid urbanization

–

Environmental consciousness

*Source: Harbor Intelligence; 5 Al analysts most accurate from 2001

through 2010, as of May 19, 2011.

** Source: CRU Aluminum Quarterly, as of April 26, 2010.

Global economic growth drives positive aluminum fundamentals

Forecasts of Average Annual LME

Beta to Global GDP

7

Regional Global Aluminum Demand Forecast

Source: CRU |

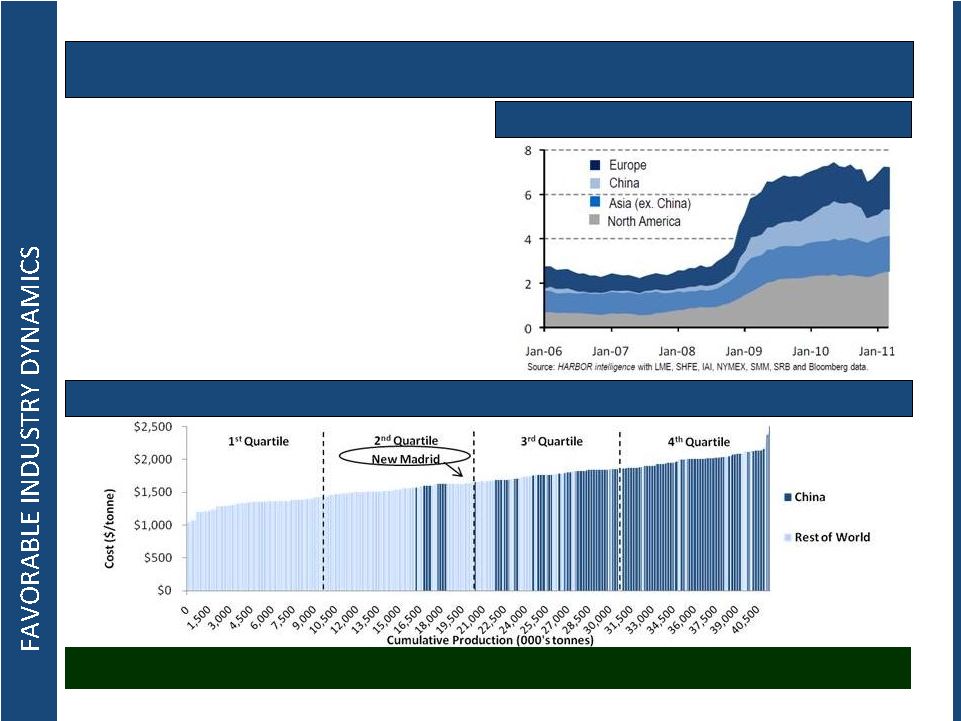

World

Aluminum

Smelter

Business

Costs

for

2010

(1)

8

•

Though aluminum inventory levels

remain elevated, physical availability is

tight, indicating inventories supported

by financing arrangements

•

Rising global smelter costs help to

place a natural

floor for the aluminum

metal price

New Madrid smelter is in 2

nd

quartile

“Cost push”

and supply constraints expected to support LME prices

(1)

CRU Data March 14, 2011.

Visible Aluminum Inventories by Region (mmt) |

Key Investment

Highlights Exhibited significant ability to create value across the cycle

9

Integrated,

Cost Effective

Assets

Profitable Growth

& Productivity

Experienced

Management

Team

Favorable

Industry

Dynamics

Strong

Financial

Profile and

Performance |

Downstream Business

Downstream Business

Annual Capacity: 495mm lbs

(2)

St. Ann

Bauxite Mine

New Madrid

Aluminum

Smelter

Newport

Rolling Mills

Salisbury

Rolling Mills

East

Mill

West

Mill

Huntingdon

Rolling Mills

Bauxite

Discovery Bay,

Jamaica

4.5mm Mt

Alumina

Gramercy, LA

1.2mm Mt

Aluminum

Primary Metal

New Madrid, MO

263k

Mt

(580mm

lbs)

(1)

Fin stock (HVAC) and Auto, Semi-Rigid Container Stock, Flexible Packaging,

Transformer Windings

Huntingdon, TN

Huntingdon

West

235mm

lbs

(2)

Huntingdon

East

130mm

lbs

(2)

Newport, AR

35mm

lbs

(2)

Salisbury, NC

95mm

lbs

(2)

Products:

Location:

Annual

Capacity:

Upstream Business

Upstream Business

Annual Capacity: 580mm lbs

LTM Q1 2011 Cash Cost was $0.68

Gramercy

Refinery

Revenue

Drivers:

Volume & LME

Residential construction / remodeling, packaging, U.S. consumer

(1)

According to CRU’s March 2011 production forecasts, at full capacity New Madrid

represents 15% of U.S. primary aluminum production. (2)

Maximum capacity, with actual capacity depending upon production mix.

Noranda’s Integrated Footprint

10 |

Vertically

Integrated Upstream Business Primary

Aluminum

Alumina

Noranda

Bauxite

Mine

Noranda

Alumina

Refinery

New Madrid

Primary Aluminum

Smelter

Bauxite

Integration drives leverage to LME, secure supply and expanded cost-cutting

opportunities •

The integration of our Upstream Business is the lynchpin to our

strategy and sustainability

•

Significant Operating Leverage to LME

–

Third party sales of excess raw materials (e.g., bauxite and

alumina) enhance our leverage to LME

•

Secure Supply

–

We have sufficient capacity to provide over 100% of our

internal alumina and bauxite requirements

•

Low Cost & Operating Flexibility

–

Competitive positions on global business costs curves:

Bauxite

–

second

quartile,

Alumina

–

third

quartile,

Primary

Aluminum

–

second

quartile

11 |

Noranda

chooses to manage costs without directly linking them to the LME

Operating Leverage Comparison

15%

New Madrid

(263k mt)

Not Indexed

to LME

Not Indexed

to LME

Pure

US$ Exposure

LTM Q1 2011 Business Summary

(1)

Represents LTM Q1 2011 actual.

(2)

Represents LTM Q1 2011 integrated upstream margin on cash cost per pound multiplied by

583 million pounds. LTM Primary aluminum shipments (mm lbs)

583

LTM average LME ($/lb)

$ 1.02

LTM MWTP ($/lb)

0.06

LTM average realized Midwest Transaction

Price ($/lb)

(1)

1.08

0.68

Integrated

upstream

margin

on

cash

cost

(1)

($/lb)

$ 0.39

Integrated upstream segment profit ($ mm)

(2)

$ 230

Rolled

products

segment

profit

(1)

($

mm)

52

Corporate

expenses

(1)

($

mm)

(27)

Total

segment

profit

(1)

($

mm)

$ 255

12

Net

integrated

cash

cost

of

primary

aluminum

($/lb)

(1) |

•

Foil products

•

Light gauge sheet

Rolling Mill Operations

Four Rolling Mills in Three States

Huntingdon, TN

2 plants, East and West

Started 1967 & 2000

Max. East capacity: 130mm lbs

(1)

Max. West capacity: 235mm lbs

(1)

Salisbury, NC

Started 1965

Max. Capacity: 95mm lbs

(1)

Newport, AR

Started 1951

Max. Capacity:

35mm lbs

(1)

Downstream segment completes integration and is a stable free cash flow generator

Low Cost, Leading Downstream Business

•

Low Cost Production

–

Huntingdon West is the lowest conversion

cost foil mill in North America according to

CRU

–

Q1 2011 LTM adjusted EBITDA of $245

million

–

Maintenance capital expenditures average

25% of adjusted EBITDA

•

Focused Growth

–

Gained demand share in 2009 and 2010

Products

_______________________

(1) Maximum capacity, with actual capacity depending upon

production mix. •

HVAC fin stock

•

Container

•

Transformer winding

13

•

Stable

source

of

free

cash

flow |

Key Investment

Highlights Disciplined cost-cutting & profitable growth drive our

sustainability 14

Integrated,

Cost Effective

Assets

Profitable Growth

& Productivity

Experienced

Management

Team

Favorable

Industry

Dynamics

Strong

Financial

Profile and

Performance |

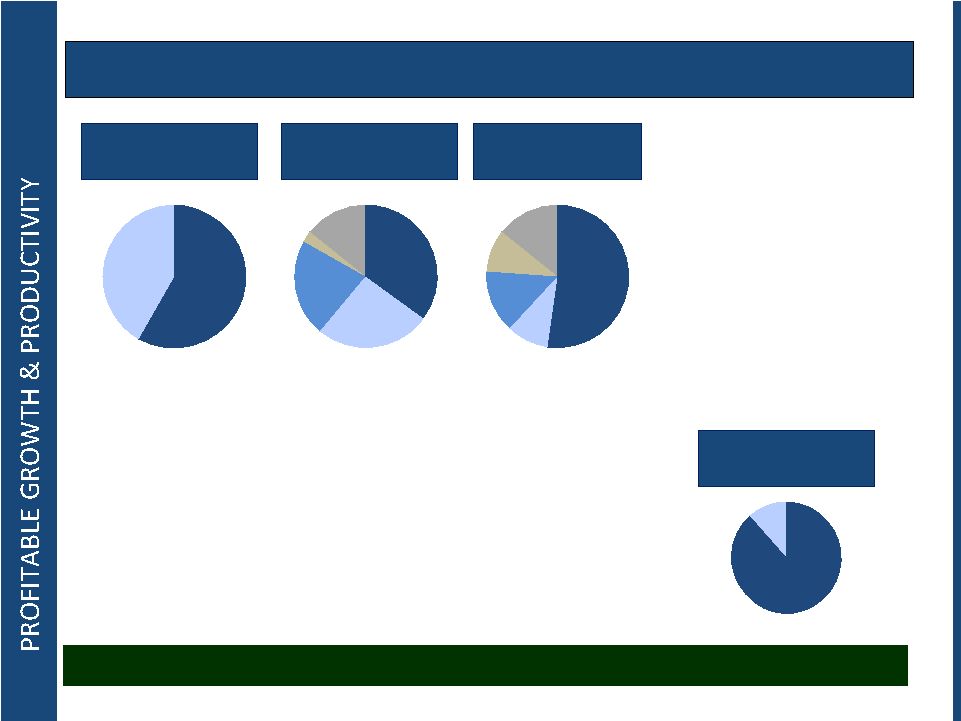

Multiple Levers

for Growth •

Noranda has several avenues through which to pursue growth

Growth offers new opportunities to drive cost savings and productivity

Prudent capital investment

Debottlenecking

Increase share of demand

Strategic acquisitions

15 |

Primary

$27

Bauxite

$20

Alumina

$17

Corporate

$2

Flat-Rolled

$11

Strong Focus on Productivity

2010 CORE savings

$77 million

CORE productivity program generating substantial recurring cost savings

16

Primary

$25

Flat-Rolled

$18

2009 CORE savings

$43 million

Primary

$11

Bauxite

$2

Alumina

$3

Corporate

$2

Flat-Rolled

$3

Q1 2011 CORE

savings $21 million

EBITDA

88%

CAPEX

12%

Average CORE

savings by type

•

CORE program generates:

–

EBITDA savings (cost

savings, cost avoidance

or cash generation)

–

Capital expenditure

savings or avoidance

•

CORE program is fundamental to our integrated strategy

•

$140 million CORE savings target during the period from 2009

through 2011

–

Exceeded our $140 million target during Q1 2011

–

New three year target to be announced in H2 2011 |

Less debt,

lower costs, more cash flow and strong liquidity Key Investment Highlights

17

Integrated,

Cost Effective

Assets

Profitable Growth

& Productivity

Experienced

Management

Team

Favorable

Industry

Dynamics

Strong

Financial

Profile and

Performance |

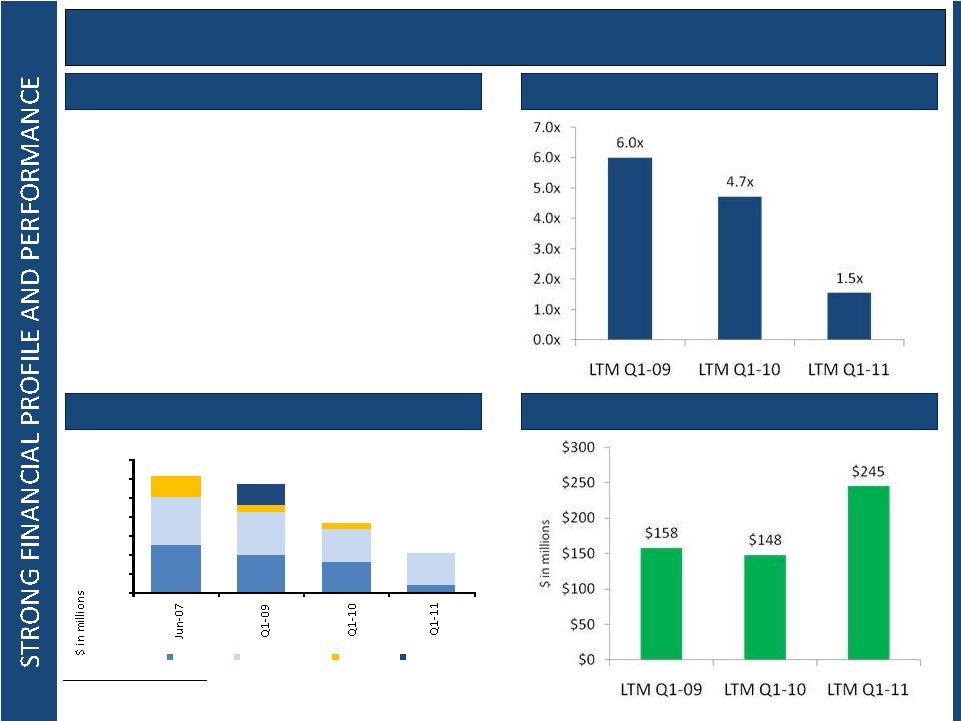

18

We Have Created the Financial Flexibility to Grow

Debt Balances (gross balances)

Net Debt

(3)

to LTM Adjusted EBITDA

LTM Adjusted EBITDA

Strong Balance Sheet

•

Highly flexible capital structure with no

near-term maturities, undrawn

revolver

(1)

, $257 million of liquidity

(2)

and no maintenance covenants

•

Repositioned during downturn by using

hedges to repurchase/repay debt

$420

$728

$1,142

$1,230

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

Term B

AcquisitionCo

HoldCo

Revolver

(1)

As of March 31,2011

(2)

$41.5 million of cash plus $215.2 million of available borrowing capacity under Revolver, as

of March 31, 2011

(3)

Net debt is calculated as debt less cash and cash equivalents |

Key Investment

Highlights Deep experience in cyclical and commodity businesses

19

Integrated,

Cost Effective

Assets

Profitable Growth

& Productivity

Experienced

Management

Team

Favorable

Industry

Dynamics

Strong

Financial

Profile and

Performance |

•

Management has created significant shareholder value at Noranda

•

Our executive team’s 14 members have an average of 24 years of experience in cyclical

and commodity industries

–

Layle “Kip”

Smith,

President

and

Chief

Executive

Officer,

has

over

26

years

of

leadership

experience,

including

in

various management positions with The Dow Chemical Company, as COO of Resolution Performance

Products and as CEO of Covalence Specialty Materials

–

Robert

B.

Mahoney,

Chief

Financial

Officer,

has

over

24

years

of

cyclical

industry

experience

in

senior

financial

management positions for semiconductor and electrical components

companies

–

Gail E. Lehman,

Vice

President

&

General

Counsel,

has

over

20

years

of

corporate

law

experience,

having

held

senior

roles at industrial companies Honeywell, Covalence Specialty Materials and Hawker

Beechcraft –

Peter

J.

Hartland,

President

of

the

Upstream

Business,

most

recently

served

as

President

of

the

Coatings

&

Inks

Division for Hexion Specialty Chemicals, Inc. Since 1982, Hartland has held several

operational management positions with Hexion and its predecessor, Borden

Chemical –

Scott

Croft,

President

of

Norandal

USA,

Inc,

has

25

years

of

experience

in

the

rolling

mill

business

–

Richard

Lapine,

Vice

President

of

Sales

&

Marketing,

has

35

years

of

experience

in

Chemicals,

Plastics

and

Automotive segments as a former executive at The Dow Chemical Company

–

Charles

Skoda,

Vice

President

of

Operations

Support,

has

10

years

of

experience

in

cyclical

industries,

including

as

an

executive at Capital One, following a decorated career as an aviator in the U.S. Navy

–

Remaining executive team members bring strong experience and are

experts in their functional areas

20

Experienced Management Team |

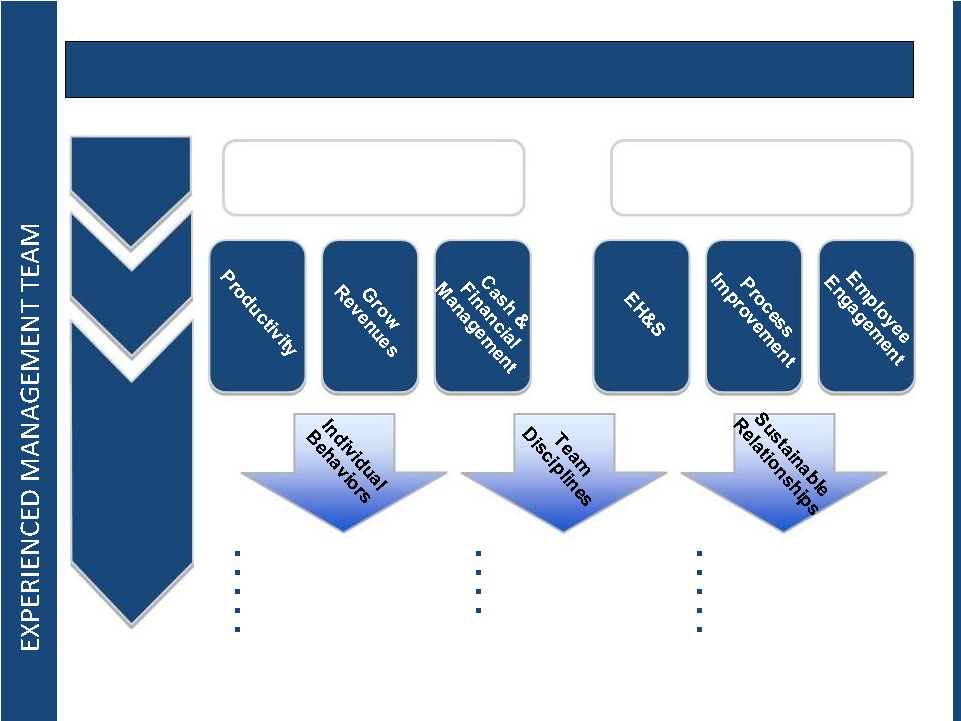

Noranda

Mission Action oriented

Ethics and Values

Drive for Results

Process Management

Safety Focus

Problem Solving

Peer Relationships

Priority Setting

Managing Through

Systems

Existing for Customers

Caring for Co-workers

Respecting Suppliers

Enriching Communities

Rewarding Investors

21

Two #1

Priorities

Sustainable

Goals

Core

Values

Get the Results

Get the Results

Do the Right Things

Do the Right Things

the Right Way

the Right Way |

Appendices |

Non-GAAP

Measure: Disclaimer This presentation contains non-GAAP financial measures as

defined by SEC rules. We think that these measures are helpful to investors in

measuring our financial performance and comparing our performance to our peers.

However, our non-GAAP financial measures may not be comparable to similarly titled

non-GAAP financial measures used by other companies. These non-GAAP financial

measures have limitations as an analytical tool and should not be considered in

isolation or as a substitute for GAAP financial measures. To the extent we discuss any

non-GAAP financial measures in the course of this presentation, a reconciliation

of

each

measure

to

the

most

directly

comparable

GAAP

measure

are

available

in

the

appendices that follow and are filed as an Exhibit 99 to our Current Report on Form 8-K

furnished to the SEC concurrent with the use of this presentation.

|

Non-GAAP

Measure: LTM Segment Profit (Loss) Management has provided last twelve months

(“LTM”) segment profit because it provides investors with additional

information to measure operating performance. Using this metric, investors

are

able

to

assess

our

segment

results

for

a

full

four

quarter

operating

cycle,

current

through

the

most

recently

completed

quarter.

LTM

segment

profit

(loss)

is

positively

or

negatively impacted by LME pricing and sales volumes, seasonality in electrical contract

rates, and increases or decreases in other production related costs.

LTM segment profit is not a measure of financial performance under U.S. GAAP and may not be

comparable to similarly titled measures used by other companies.

LTM segment profit per

pound shipped has limitations as an analytical tool and you should not consider it in

isolation or as a substitute for analysis of results under U.S. GAAP.

The following table reconciles LTM segment profit for the periods presented (in

millions): 31-Mar-11

$

Prior full year Segment Profit

216.1 Less: prior year Q1 Segment

Profit

(42.9) Plus: current year Q1

Segment Profit

82.1 LTM Segment

Profit

255.3 |

Non-GAAP

Measure: LTM Segment Profit (Loss) (Cont’d) The following tables summarize

operating results and assets of our reportable segments and a reconciliation of segment

profit (loss) to income before income taxes (in millions):

Sales:

External customers .....................................

54.9

222.8

495.9

521.3

—

—

1,294.9

Intersegment ...............................................

65.5

142.6

125.4

0.1

—

(333.6)

—

120.4

365.4

621.3

521.4

—

(333.6)

1,294.9

Segment profit (loss) .........................................

23.8

61.9

112.2

50.0

(26.9)

(4.9)

216.1

Depreciation and amortization ..........................

9.6

19.3

48.3

20.5

1.0

—

98.7

Capital expenditures ..........................................

7.7

11.1

26.4

14.3

1.8

—

61.3

Segment profit (loss) ........................................

23.8

61.9

112.2

50.0

(26.9)

(4.9)

216.1

Depreciation and amortization .........................

(9.6)

(19.3)

(48.3)

(20.5)

(1.0)

—

(98.7)

LIFO/LCM .......................................................

—

—

(6.1)

3.7

—

2.8

0.4

Loss on asset disposal.......................................

—

—

(3.3)

(0.6)

(0.1)

—

(4.0)

Non-cash pension, accretion and stock

compensation ............................................

(0.8)

(1.1)

(3.3)

(2.4)

(7.3)

—

(14.9)

Restructuring, relocation and severance ...........

(3.2)

(1.5)

(2.0)

(1.5)

(3.7)

—

(11.9)

Consulting and sponsor fees .............................

—

—

—

—

(18.9)

—

(18.9)

Cash settlements on hedging transactions ........

—

—

0.1

(2.5)

—

—

(2.4)

Other, net

.......................................................... 0.1

1.1

(0.1)

—

0.7

—

1.8

Operating income (loss) ...................................

10.3

41.1

49.2

26.2

(57.2)

(2.1)

67.5

Interest expense, net .........................................

31.1

Gain on hedging activities, net .........................

(65.6)

Loss on debt repurchase ...................................

0.1

Total other income ...........................................

34.4

Income before income taxes .............................

101.9

Year ended December 31, 2010

Bauxite

Alumina

refining

Primary

aluminum

products

Flat rolled

products

Corporate

Eliminations

Consolidated

$

$

$

$

$

$

$

Year ended December 31, 2010

Bauxite

Alumina

refining

Primary

aluminum

products

Flat rolled

products

Corporate

Eliminations

Consolidated

$

$

$

$

$

$

$ |

Non-GAAP

Measure: LTM Segment Profit (Loss) (Cont’d) The following tables summarize

operating results and assets of our reportable segments and a reconciliation of segment

profit (loss) to income before income taxes (in millions):

Sales:

External customers .................................

14.9

53.9

106.9

125.8

—

—

301.5

Intersegment ...........................................

12.7

37.8

26.5

—

—

(77.0)

—

Total sales ...............................................

27.6

91.7

133.4

125.8

—

(77.0)

301.5

Segment profit (loss) ......................................

7.7

6.7

26.4

11.2

(6.4)

(2.7)

42.9

Depreciation and amortization .......................

3.0

5.4

12.3

5.2

0.2

—

26.1

Capital expenditures.......................................

1.5

1.6

7.6

1.8

0.5

—

13.0

Segment profit (loss) ......................................

7.7

6.7

26.4

11.2

(6.4)

(2.7)

42.9

Depreciation and amortization .......................

(3.0)

(5.4)

(12.3)

(5.2)

(0.2)

—

(26.1)

Last in, first out and lower of cost or market

inventory adjustments ...............................

—

—

0.3

(1.3)

—

1.9

0.9

Loss on disposal of assets ..............................

—

—

(1.1)

(0.4)

—

—

(1.5)

Non-cash pension, accretion and stock

compensation .............................................

(0.2)

(0.6)

(0.8)

(0.5)

(1.5)

—

(3.6)

Restructuring, relocation and severance ........

(0.1)

(1.6)

(1.9)

(1.4)

—

—

(5.0)

Consulting and sponsor fees ..........................

—

—

—

—

(1.6)

—

(1.6)

Cash settlements on hedging transactions ......

—

—

0.1

(0.5)

—

—

(0.4)

Other, net

....................................................... 0.1

2.0

(0.1)

—

—

—

2.0

Operating income (loss) .................................

4.5

1.1

10.6

1.9

(9.7)

(0.8)

7.6

Three months ended March 31, 2010

Bauxite

Alumina

refining

Primary

aluminum

products

Flat rolled

products

Corporate

Eliminations

Consolidated

$

$

$

$

$

$

$

Three months ended March 31, 2010

Bauxite

Alumina

refining

Primary

aluminum

products

Flat rolled

products

Corporate

Eliminations

Consolidated

$

$

$

$

$

$

$

Interest expense,

net................................................................

................................

................................

9.2

Gain on hedging activities, net................................

................................................................

(1.7)

Loss

on debt repurchase................................

................................

................................

................................

0.1

Total other expense

................................

................................

................................

...............................................

7.6

Income before income taxes................................

................................

................................

..................................

—

.................

................................

........ |

Non-GAAP

Measure: LTM Segment Profit (Loss) (Cont’d) The following tables summarize

operating results and assets of our reportable segments and a reconciliation of segment

profit (loss) to income before income taxes (in millions):

Sales:

External customers ..................................

16.8

61.1

165.3

151.4

—

—

394.6

Intersegment ............................................

21.3

42.8

15.5

—

—

(79.6)

—

Total sales ...............................................

38.1

103.9

180.8

151.4

—

(79.6)

394.6

Segment profit (loss) ......................................

6.4

22.9

47.8

13.5

(6.6)

(1.9)

82.1

Depreciation and amortization .......................

1.6

5.2

11.7

4.8

0.3

—

23.6

Capital expenditures .......................................

3.1

2.3

6.1

2.0

—

—

13.5

Segment profit (loss) ......................................

6.4

22.9

47.8

13.5

(6.6)

(1.9)

82.1

Depreciation and amortization .......................

(1.6)

(5.2)

(11.7)

(4.8)

(0.3)

—

(23.6)

Last in, first out and lower of cost or market

inventory adjustments ................................

—

—

(4.8)

(5.9)

—

0.6

(10.1)

Loss on disposal of assets ...............................

—

—

(0.5)

(0.6)

—

—

(1.1)

Non-cash pension, accretion and stock

compensation ..............................................

(0.1)

(0.1)

(0.7)

(0.6)

(2.2)

—

(3.7)

Restructuring, relocation and severance .........

—

(0.1)

(0.2)

—

(0.1)

—

(0.4)

Consulting and sponsor fees ...........................

—

—

—

—

(0.3)

—

(0.3)

Cash settlements on hedging transactions ......

—

—

(0.2)

(1.0)

—

—

(1.2)

Other, net

........................................................ (0.1)

(0.2)

0.1

(0.1)

—

—

(0.3)

Operating income (loss) .................................

4.6

17.3

29.8

0.5

(9.5)

(1.3)

41.4

Three months ended March 31, 2011

Bauxite

Alumina

refining

Primary

aluminum

products

Flat rolled

products

Corporate

Eliminations

Consolidated

$

$

$

$

$

$

$

Three months ended March 31, 2011

Bauxite

Alumina

refining

Primary

aluminum

products

Flat rolled

products

Corporate

Eliminations

Consolidated

$

$

$

$

$

$

$

Interest expense, net

................................

................................

................................

................................

...............

5.7

Gain on hedging activities, net

................................

................................

................................

................................

(21.8)

Total other income................................

................................

................................

................................

.................

(16.1)

Income before income taxes

................................

................................

................................

...................................

57.5 |

Non-GAAP

Measure: Adjusted EBITDA 31-Mar-09

31-Mar-10

31-Mar-11

$

$

$

Prior full year Adjusted EBITDA

234.9

98.3

226.1

Less: prior year Q1 Adjusted EBITDA

(84.7)

(7.6)

(57.0)

Plus: current year Q1 Adjusted EBITDA

7.6

57.0

75.7

LTM Adjusted EBITDA

157.8

147.7

244.8

Last twelve months ended

Management uses “Adjusted EBITDA” as a liquidity measure in respect of the

fixed-charge coverage ratio and the net senior secured leverage ratio, as defined

in our debt agreements. As used herein, Adjusted EBITDA means net income before income

taxes, net interest expense and depreciation and amortization, adjusted to eliminate

certain non-cash expenses, restructuring

charges, related party management fees, certain charges resulting from the use of purchase

accounting and other specified items of income or expense.

The following table reconciles last twelve months (“LTM”) adjusted EBITDA for the

periods presented (in millions): |

Non-GAAP

Measure: Adjusted EBITDA (Cont’d) Adjusted EBITDA is not a measure of financial

performance under U.S. GAAP, and may not be comparable to similarly titled measures

used by other companies in our industry. Adjusted EBITDA has limitations as an

analytical tool and you should not consider it in isolation or as a substitute for

analysis of our results as reported under U.S. GAAP. For example, Adjusted EBITDA

excludes certain tax payments that may represent a reduction in cash available to us;

does not reflect any cash requirements for the assets being depreciated and amortized that

may have to be replaced in the future; does not reflect capital cash expenditures,

future requirements for capital expenditures or contractual commitments; does not

reflect changes in, or cash requirements for, our working capital needs; and does not

reflect the significant interest expense, or the cash requirements necessary to service

interest or principal payments, on our indebtedness. Adjusted EBITDA also includes

incremental stand-alone costs and adds back non-cash hedging gains and losses,

and certain other non-cash charges that are deducted in calculating net income.

However, these are expenses that may recur, vary greatly and are difficult

to

predict.

In

addition,

certain

of

these

expenses

can

represent

the

reduction

of

cash

that could be used for other corporate purposes.

You

should

not

consider

our

Adjusted

EBITDA

as

an

alternative

to

operating

or

net

income,

determined in accordance with U.S. GAAP, as an indicator of our operating performance, or as

an alternative to cash flows from operating activities, determined in accordance with

U.S. GAAP, as an indicator of our cash flows or as a measure of liquidity.

|

Non-GAAP

Measure: Adjusted EBITDA (Cont’d) The following table reconciles Adjusted EBITDA to

net income (loss) for the periods presented (in millions):

Twelve months ended December 31,

2008

2009

2010

$

$

$

Adjusted EBITDA

.......................................................................

234.9

98.3

226.1

LIFO/LCM

(a)

...............................................................................

(25.0)

17.4

0.4

Loss on disposal of assets

............................................................

(8.5)

(7.3)

(4.0)

Non-cash pension, accretion and stock compensation

................ (9.8)

(10.8)

(14.9)

Restructuring, relocation and severance

...................................... (8.3)

(2.8)

(11.9)

Consulting and sponsor fees

........................................................ (10.2)

(5.8)

(18.9)

Interest rate swaps

.......................................................................

(6.0)

(11.9)

(11.0)

Gain (loss) on debt repurchases

................................................... (1.2)

211.2

(0.1)

New Madrid power outage

(b)

.......................................................

—

30.6

—

Charges/fees related to early extinguishment of derivatives

....... —

(17.9)

(9.0)

Non-cash derivative gains and losses

(c)(d)

....................................

(47.0)

86.1

73.2

Goodwill and other intangible asset impairment

......................... (25.5)

(108.0)

—

Joint venture impairment

.............................................................

—

(80.3)

—

Gain on business combination

..................................................... —

120.3

—

Joint venture EBITDA

(e)

..............................................................

(13.2)

(8.0)

—

Purchase accounting and other

(f)

.................................................

(0.9)

(11.0)

1.8

Depreciation and amortization

.................................................... (98.3)

(86.6)

(98.7)

Interest expense, net

....................................................................

(88.0)

(53.5)

(31.1)

Income tax expense (benefit)

...................................................... 32.9

(58.6)

(35.0)

Net income (loss)

........................................................................

(74.1)

101.4

66.9

|

Non-GAAP

Measure: Adjusted EBITDA (Cont’d) The

following

table

reconciles

Adjusted

EBITDA

to

cash

flow

from

operating

activities

for

the

periods presented (in millions):

Twelve months ended December 31,

2008

2009

2010

$

$

$

Adjusted

EBITDA.........................................................................

234.9

98.3

226.1

Settlements from hedge terminations,

net..................................... —

120.8

164.6

Insurance proceeds applied to capital

expenditures....................... —

(11.5)

—

Equity in net income of investment in

affiliates............................ (7.7)

(0.7)

—

Stock Compensation

expense.........................................................

2.4

1.5

5.9

Changes in other

assets..................................................................

7.5

0.9

(10.0)

Changes in pension and other long-term

liabilities....................... 0.2

(2.9)

(0.6)

Changes in operating asset and

liabilities...................................... 28.3

21.2

(32.6)

Income

taxes..................................................................................

(40.5)

(0.9)

(20.2)

Interest expense,

net......................................................................

(82.9)

(12.1)

(7.4)

LIFO/LCM

(a)

.................................................................................

(25.0)

17.4

0.4

Non-cash pension,

accretion and stock compensation..................

(9.8)

(10.8)

(14.9)

Restructuring, relocation and

severance........................................ (8.3)

(2.8)

(11.9)

Consulting and sponsor

fees..........................................................

(10.2)

(5.8)

(18.9)

Interest rate

swaps.........................................................................

(6.0)

(11.9)

(11.0)

New

Madrid

power

outage

(b)

.........................................................

—

30.6

—

disposal of

assets....................................................................

—

8.8

—

................................................................

(13.2)

(8.0)

—

...................................................

(4.2)

(11.6)

1.4

Cash flow from operating

activities..............................................

65.5

220.5

270.9

Insurance proceeds applied to depreciation expense and loss on

Joint

venture

EBITDA

(e)

Purchase

accounting

and

other

(f) |

Non-GAAP

Measure: Adjusted EBITDA (Cont’d) Year ended December 31,

2008

2009

2010

$

$

$

Fixed priced aluminum swaps

......................................................... 5.3

(93.1)

(24.2)

Variable price aluminum swaps and other

....................................... 8.0

23.8

(2.5)

Natural gas swaps

............................................................................

3.7

31.8

23.3

Interest rate swaps

...........................................................................

6.0

11.9

11.0

Total

................................................................................................

23.0

(25.6)

7.6

(a)

Our New Madrid smelter and our rolling mills use the LIFO method of

inventory accounting for financial reporting and tax purposes. This adjustment restates net

income to the FIFO method by eliminating LIFO expenses related to

inventory held at the New Madrid smelter and the rolling mills. Inventories at Gramercy and

St. Ann are stated at lower of weighted-average cost or market,

and are not subject to the LIFO adjustment. We also reduce inventory to the lower of cost (adjusted

for purchase accounting) or market value.

(b)

Represents the portion of the insurance settlement used for

claim-related capital expenditures. (c)

We use derivative financial instruments to mitigate effects of

fluctuations in aluminum and natural gas prices. This adjustment eliminates the non-cash gains and

losses resulting from fair market value changes of aluminum swaps, but

does not affect the following cash settlements (received)/paid (in millions):

Year ended December 31,

2008

2009

$

$

Depreciation and amortization

......................................................................................................

16.0

8.7

Net tax expense

............................................................................................................................

(2.7)

(0.7)

Interest income

.............................................................................................................................

(0.1)

—

Total joint venture EBITDA adjustments

.....................................................................................

13.2

8.0

(f)

Represents impact from inventory step-up and other adjustments

arising from adjusting assets acquired and liabilities assumed in the Joint Venture Transaction to

their fair values as well as other immaterial non-recurring items The

previous table presents fixed price aluminum swap cash settlement amounts net of early termination discounts totaling $17.9 million in 2009 and $9.0 million in

2010.

(d)

During third quarter 2010, we concluded that certain non-cash

hedge gains should be excluded for purposes of calculating Adjusted EBITDA under the credit

agreement governing our senior secured credit facilities. As such, we

excluded from the calculation of Adjusted EBITDA hedge gains totaling $53.6 million for the

year ended December 31, 2010.

(e)

Prior to the consummation of the Joint Venture Transaction on August

31, 2009, our reported Adjusted EBITDA includes 50% of the net income of Gramercy and St.

Ann. To reflect the underlying economics of the vertically

integrated upstream business, this adjustment eliminates the following components of equity income to

reflect 50% of the EBITDA of the joint ventures for the following

periods (in millions): |

Non-GAAP

Measure: Adjusted EBITDA (Cont’d) The following table reconciles Adjusted EBITDA to

net income (loss) for the periods presented (in millions):

Three months ended

March 31, 2009

March

31, 2010

March 31, 2011

$

$

$

Adjusted EBITDA

.................................................

57.0

75.7

LIFO/LCM

(a)

........................................................

0.9

(10.1)

Loss

on disposal of assets

.....................................

(1.5)

(1.1)

Non-cash pension, accretion and stock

compensation

..................................................

(3.6)

(3.7)

Restructuring, relocation and severance

(5.0)

(0.4)

Consulting and sponsor fees

................................

(1.6)

(0.3)

Interest rate swaps

.............................................

—

—

Loss on debt repurchases

......................................

(0.1)

—

New Madrid power outage

—

—

Charges/fees related to early extinguishment

of

derivatives...................................................

(4.1)

—

Non-cash derivative gains

and

losses

(b)(c)

(8.7)

27.0

Goodwill and other intangible asset

impairment........................................................

—

—

Joint venture impairment

.....................................

—

—

Joint venture EBITDA.........................................

—

—

Other, net

(d)

...........................................................

2.0

(0.3)

Depreciation and amortization

..........................

(26.1)

(23.6)

Interest expense, net

..............................................

(9.2)

(5.7)

Income tax expense

..............................................

(0.1)

(19.2)

Net income (loss)

.................................................

(0.1)

38.3

............

7.6

4.4

(2.4)

(2.3)

(0.3)

(0.9)

—

152.2

0.8

(8.6)

36.9

(43.0)

(45.3)

(3.7)

(1.9)

(25.4)

(15.9)

(7.9)

44.3 |

Non-GAAP

Measure: Adjusted EBITDA (Cont’d) The

following

table

reconciles

Adjusted

EBITDA

to

cash

flow

from

operating

activities

for

the

periods presented (in millions):

Three

months ended

March 31,

2009

March 31,

2010

March 31,

2011

$

$

$

Adjusted EBITDA

......................................................

7.6

57.0

75.7

Settlements from hedge terminations, net

................

50.4

58.7

—

Equity in net income of affiliates

..............................

(1.3)

—

—

Stock compensation expense

.....................................

0.4

0.4

2.0

Changes in other assets

..............................................

6.0

(0.3)

(5.8)

Changes in pension and other long-term liabilities

9.7

10.5

3.1

Changes in operating asset and liabilities

..................

15.5

(9.1)

(25.1)

Income taxes

..............................................................

7.5

—

(19.0)

Interest expense, net

...................................................

(15.2)

(8.3)

(5.0)

Non-cash pension, accretion and stock compensation

(2.3)

(3.6)

(3.7)

Restructuring, relocation and severance

.....................

(0.3)

(5.0)

(0.4)

Consulting and sponsor fees

.......................................

(0.9)

(1.6)

(0.3)

Interest rate swaps

.......................................................

—

—

—

New Madrid power ou

tage

.........................................

0.8

—

—

Joint Venture EBITDA

.................................................

(3.7)

—

—

Purchase

accounting

and

other

(d)

...............................

1.0

1.9

(0.4)

Cash flow from operating activities

............................

75.2

100.6

21.1 |

Non-GAAP

Measure: Adjusted EBITDA (Cont’d) (a)

Our New

Madrid smelter and our rolling mills use the LIFO method of inventory

accounting for financial reporting and tax purposes. This adjustment restates net

income to the FIF

O method by eliminating LIFO expenses related to inventory held at the

NewMadrid smelter and the rolling mills. Inventories at Gramercy and

St.

Ann are stated at lower of weighted

-

average cost or market, and are not subject to the LIFO adjustment. We

also reduce inventory to the lower of cost

(adjusted for purchase accounting) or market value.

(b)

We use derivative financial instruments to mitigate effects of

fluctuations in aluminum and natural gas prices. This adjustment eliminates the non-cash

losses resulting from fair market value changes of aluminum swaps, but

does not affect the following cash settlements (received)/paid (in millions):

Three

months ended

March 31, 2009

March 31, 2010

March 31, 2011

$

$

$

Fixed priced aluminum

swaps

..................................

(26.2)

(14.0)

—

Variable price aluminum swaps and other...................

11.3

(0.5)

1.2

Natural gas swaps

......................................................

6.7

4.0

(6.4)

Interest rate swaps

................................

.....................

__

Total

................................

..........................................

(8.2)

(10.5)

(5.2)

The previous table presents fixed price aluminum swap cash settlement

amounts net of early termination discounts totaling $4. 1

million in the three months

__

__

ended March

31,

2010 and $9.0

million

in the twelve months ended December 31, 2010.

(c)

During third quarter 2010, we concluded that certain non-cash

hedge gains should be excluded for purposes of calculating Adjusted EBITDA under the credit

agreement governing our senior secured credit facilities. As such, we

excluded from the calculation of Adjusted EBITDA hedge gains totaling $53.6

the twelve months ended December

31,

2010.

(d)

Represents impact from inventory step-up and other adjustments

arising from adjusting assets acquired and liabilities assumed in the

Joint Venture Transaction to

their fair values as well as other immaterial non-recurring items.

As discussed in our 2010 Annual Report on Form 10-K, the Joint Venture Transaction closed on

August

31,

2009, whereby we became the sole owner of Gramercy and St.

Ann.

gains

and

million

for |

Non-GAAP

Measure: Net Cash Cost of Primary Aluminum Unit

net

cash

cost

for

primary

aluminum

per

pound

represents

the

costs

of

producing

commodity grade aluminum net of value-added and Midwest premiums on primary aluminum

sales, and alumina and bauxite sales to external customers. The Company has provided

unit net cash cost per pound of aluminum shipped because it provides investors with

additional information

to

measure

operating

performance.

Using

this

metric,

investors

are

able

to

assess

the prevailing LME price plus Midwest premium per pound versus unit net costs per pound

shipped. Unit net cash cost per pound is positively or negatively impacted by changes in

primary aluminum, alumina and bauxite production and sales volumes, natural gas and oil

related costs, seasonality in electrical contract rates, and increases or decreases in

other production related costs.

Unit net cash costs is not a measure of financial performance under U.S. GAAP and may not be

comparable to similarly titled measures used by other companies.

Unit net cash costs per

pound shipped has limitations as an analytical tool and you should not consider it in

isolation or as a substitute for analysis of results under U.S. GAAP.

|

Non-GAAP

Measure: Net Cash Cost of Primary Aluminum (Cont’d) The following table reconciles

last twelve months (“LTM”) net cash costs for the periods presented:

31-Mar-09

31-Mar-10

31-Mar-11

$

$

$

Cash Cost:

Prior full year cash costs (in millions)

$

482.5

$

271.6

$

391.2 Less: prior year Q1 cash costs

(100.6)

(75.3)

(87.3)

Plus: current year Q1 cash costs

75.3

87.3

93.8

LTM cash costs

$

457.2

$

283.6

$

397.7 Shipments:

Prior full year shipments (in millions)

589.9

351.6

560.5

Less: prior year Q1 shipments

(144.8)

(88.9)

(120.8)

Plus: current year Q1 shipments

88.9

120.8

143.0

LTM shipments

534.0

383.5

582.7

Net cash cost of primary aluminum ($/lb)

$

0.86

$

0.74

$

0.68 Last twelve

months ended |

Non-GAAP

Measure: Net Cash Cost of Primary Aluminum (Cont’d) The following table reconciles

net cash costs for the periods presented: Year ended December

31, 2008

2009

2010

Total

primary

aluminum

cash

cost

(in

millions)

(a)

........................................................

$

482.5

$

271.6

$

391.2

Total shipments (pounds in millions)

..............................................................................

589.9

351.6

560.5

Net

primary

aluminum

cash

cost

per

pound

of

primary

aluminum

...........................

$

0.82

$

0.77

$

0.70

(a)

Total primary aluminum cash cost is calculated below (in

millions): Total primary aluminum revenue

..................................................................

$

758.5

$

340.3

$

621.3

Less fabrication premiums and other revenue

.............................................

(45.9)

(55.8)

(37.1)

Realized Midwest transaction price revenue

...............................................

712.6

284.5

584.2

Primary aluminum products segment profit

...............................................

222.7

4.9

112.2

Alumina refining segment profit (loss)

........................................................

—

(2.3)

61.9

Bauxite segment profit

..................................................................................

—

12.3

23.8

Profit eliminations

........................................................................................

7.4

(2.0)

(4.9)

Total

...............................................................................................................

230.1

12.9

193.0

Total primary aluminum cash cost (in millions)

........................................

$

482.5

$

271.6

$391.2

(b)

During 2009, we refined our cash cost calculation methodologies to

reflect an adjusted EBITDA based calculation (see the “Covenant

Compliance”

section for a full description and reconciliation of adjusted

EBITDA). As a result, 2008 figures may not tie to cash costs as

presented in 2008 filings.

(b) |

Non-GAAP

Measure: Net Cash Cost of Primary Aluminum (Cont’d) The following table reconciles

net cash costs for the periods presented: Three months ended

March 31, 2009

March 31, 2010

March 31, 2011

Total primary aluminum cash cost (in millions)

(a)

............................

.

$

75.3

$

87.3

$

93.8

Total shipments (pounds in

millions)................................................

88.9

120.8

143.0

Net cash cost for

primary aluminum

products (per pound shipped)..

$

0.85

$

0.72

$

0.66

(a)

Total primary aluminum cash cost is calculated below (in

millions): Total primary aluminum

product sales

.............................................................

$

75.3

$

133.4

$

180.

8

Less fabrication premiums

and other revenue

................................................

(13.5

)

(8.0)

(11.8)

Realized Midwest transaction price revenue

..................................................

61.8

125.4

169.0

Primary aluminum products segment profit

....................................................

(13.5)

26.4

47.8

Alumina refining segment profit

........................................................................

-

6.7

22.9

Bauxite segment profit

........................................................................................

-

7.7

6.4

Profit

eliminations

................................................................................................

-

(2.7)

(1.9)

Total

.......................................................................................................................

(13.5)

38.1

75.2

Total primary aluminum cash cost

.....................................................................

$

75.3

$

87.3

$

93.8 |

Non-GAAP

Measure: Net Income (Loss), Excluding Special Items

31-Mar-09

31-Mar-10

31-Mar-11

$

$

$

Prior full year net income (loss)

(74.1)

101.4

66.9 Less: prior year

Q1 net income (loss)

(17.2)

(44.3)

0.1 Plus:

current year Q1 net income (loss)

44.3

(0.1)

38.3 LTM net income

(loss)

(47.0)

57.0

105.3 Less: impact of

special items

(24.7)

(140.2)

(38.3) LTM net income (loss)

excluding special items

(71.7)

(83.2)

67.0 Last

twelve months ended “Net income (loss), excluding special items” means

net income adjusted to eliminate the impact of certain transactions and events referred

to as “special items,” as listed herein. Management has provided net income

(loss), excluding special items because the measure provides investors with additional

information with which to measure operating results. Using these metrics, investors are

able to assess the impact of certain transactions and events on earnings and to compare

net income (loss) from period to period with the impact of those transactions and

events removed from all periods. Management believes this metric is a valuable tool in

assisting investors to compare financial results from period to period.

Net income (loss), excluding special items may not be comparable to similarly titled measures

used by other companies. Net income (loss), excluding special items should not be

considered in isolation from or as an alternative to net income or any other

performance measures derived in accordance with U.S. GAAP. Net income (loss), excluding

special items has limitations as an analytical tool and you should not consider it in

isolation or as a substitute for analysis of results as reported under U.S. GAAP.

The following table reconciles last twelve months (“LTM”) net income (loss),

excluding special items for the periods presented (in millions): |

Non-GAAP

Measure: Net Income (Loss), Excluding Special Items (Cont’d)

31-Mar-09

31-Mar-10

31-Mar-11

$

$

$

Prior full year special items

(68.3)

239.0

21.7 Less: prior year

Q1 special items

(3.7)

(96.7)

2.1 Plus:

current year Q1 special items

96.7

(2.1)

14.5 LTM special

items

24.7

140.2

38.3 Last

twelve months ended The

following

table

presents

the

impact

of

special

items

for

the

periods

presented

(in

millions):

2009

2010

2011

First

quarter

Second

quarter

Third

quarter

Fourth

quarter

First

quarter

Second

quarter

Third

quarter

Fourth

quarter

First

quarter

$

$

$

$

$

$

$

$

$

Pre

-

tax impact of specific transactions:

Insurance recoveries in excess of

losses

..............................................

—

29.2

14.3

—

—

—

—

—

—

Management agreement termination

.....

—

—

—

—

—

(12.5)

—

—

—

Modification of stock options

.................

—

—

—

—

—

(3.2)

—

—

—

Transaction related legal costs

................

—

—

—

—

(0.3)

(5.2)

—

—

—

Restructuring

...........................................

—

—

—

—

(4.4)

(3.2)

—

—

—

Executive separation agreement

.............

—

—

—

—

—

—

—

(3.3)

—

Goodwill and other intangible asset

impairment

....................................

(43.0)

—

—

(65.0)

—

—

—

—

—

Gain on hedging activities

.......................

45.1

53.2

5.9

7.6

1.7

20.6

21.

7

21.6

21.

8

Joint venture impairment

........................

(45.3)

(35.0)

—

—

—

—

—

—

—

Gain (loss) on debt repurchase

................

152.2

12.4

28.6

18.0

(0.1)

(2.5)

3.5

(1.0)

—

Gain

on business combination

...............

—

—

120.3

—

—

—

—

—

—

Income

tax impact of special items

......

(12.3

)

(19.8)

(41.7

)

14.3

1.0

2.0

(8.8)

(5.9)

(7.3)

Impact of special items on net income

(loss)...........................................................

96.7

40.0

127.4

(2

5.1

)

(2.1)

(4.0)

16

.4

11.

4

14.5 |

Non-GAAP

Measure: Operating Cash Flow, Excluding Aluminum Hedges

31-Mar-09

31-Mar-10

31-Mar-11

$

$

$

Prior full year operating cash flow

65.5

220.5

270.9

Less: prior year Q1 operating cash flow

(78.6)

(75.2)

(100.6)

Plus: current year Q1 operating cash flow

75.2

100.6

21.1

LTM operating cash flow

62.1

245.9

191.4

Less: Aluminum hedge settlements

(67.9)

(210.1)

(116.1)

LTM Operating cash flow, excluding aluminum hedges

(5.8)

35.8

75.3

Last twelve months ended

“Operating cash flow, excluding aluminum hedges” means operating cash flow adjusted

to eliminate the impact of cash settlements related to aluminum hedges. Management has

provided operating cash flow, excluding aluminum hedges because the measure provides

investors with additional information with which to measure our operating results.

Using these metrics, investors are able to assess our cash flows from operations from

period to period with the impact of aluminum hedge settlements removed from all periods.

Management believes this metric is a valuable tool in assisting investors to compare

financial results from period to period.

Operating cash flow, excluding aluminum hedges may not be comparable to similarly titled

measures used by other companies and should not be considered in isolation from or as

an alternative to cash flow from operating activities or any other performance measures

derived in accordance with U.S. GAAP. Operating cash flow, excluding aluminum hedges

has limitations as an analytical tool and you should not consider it in isolation or as

a substitute for analysis of results as reported under U.S. GAAP.

The following table reconciles last twelve months (“LTM”) operating cash flow,

excluding aluminum hedges for the periods presented (in millions): |

|