Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CenterState Bank Corp | d8k.htm |

| EX-99.1 - INVESTOR PRESENTATION, FIRST QUARTER 2011 - CenterState Bank Corp | dex991.htm |

Comments on

Federal Trust Corp.

Transaction |

This presentation contains forward-looking statements, as defined by Federal

Securities Laws, relating to present or future trends or factors affecting

the operations, markets and products

of

CenterState

Banks,

Inc.

(CSFL).

These

statements

are

provided

to

assist

in the

understanding of future financial performance. Any such statements are based on

current expectations and involve a number of risks and uncertainties. For a

discussion of factors that may cause such forward-looking statements to

differ materially from actual results, please refer to CSFL’s most

recent Form 10-Q and Form 10-K filed with the Securities Exchange

Commission. CSFL undertakes no obligation to release revisions to these

forward-looking statements or reflect events or circumstances after the

date of this presentation. Forward Looking Statement

2 |

Financial Highlights and Branch Network

3

Buyer (52 branches)

Target (11 branches)

Headquarters

Sanford, FL

Year Established

1988

Deposits (approximate)

$230,000

Loans (approximate)

$170,000

Self-capitalizing transaction

27% loan discount on selected performing

loans; 0% deposit premium

1 year put back on any past due or adversely

classified loan

Assumption of approximately $5 million of

TruPs at LIBOR + 2.95%

Target Branch network to be evaluated

1

Dollars in thousands

Financial Highlights¹

Selected Deal Terms |

4

Loans

Selected SF 1-4

Balances by Origination Year

(Percent of Outstandings, excluding HELOCs)

Selected Residential Loans by Florida County

Selected Loan Criteria:

Loan portfolio mix: 90% 1-4 Single Family; 6% HELOCs; 4%

Commercial No problem loans including no OREO, nonaccrual loans,

adversely classified for regulatory purposes, and Troubled Debt

Restructures No past due

loans

including

no

60

days

past

due

anytime

during

last

12

months

and

no

loans

past

due

more

than 2

times during last 12 months

Selected SF 1-4

Balances by Origination Year

(Percent of Outstandings, excluding HELOCs)

Selected Residential Loans by Florida County

|

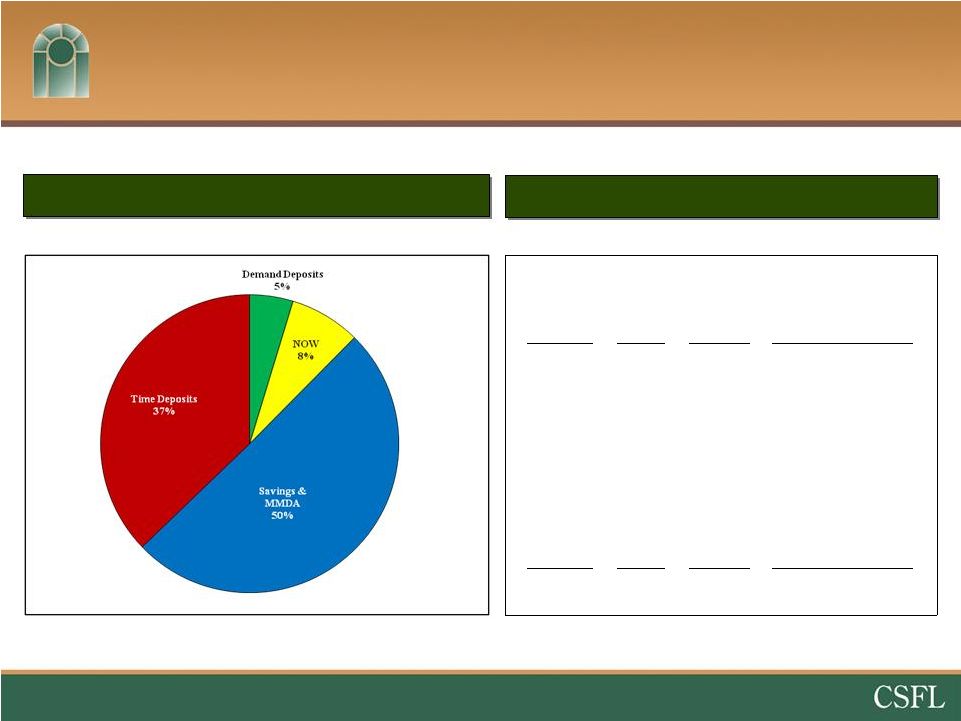

5

Deposits

Deposit

Type

No. of

Accts

12/31/10

Balance

Avg

Balance

WA

Rate

Demand

Deposits

3,289

$11MM

$3,300

0.00%

NOW

778

18MM

23,100

0.42%

Savings &

MMDA

2,307

118MM

51,100

0.98%

Time

Deposits

3,107

87MM

28,000

2.42%

Total

9,481

$234MM

$24,700

1.44%

Data as of 12/31/10

Total Deposits by Type (%)

Total Deposits Detail |