Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Enventis Corp | form8k.htm |

Exhibit 99.1

Annual Shareholder Meeting

May 17, 2011

May 17, 2011

Information set forth in this presentation contains financial estimates

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may effect

future results is contained in HickoryTech’s filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures will be

available in our presentation to be filed with the SEC.

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may effect

future results is contained in HickoryTech’s filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures will be

available in our presentation to be filed with the SEC.

Safe Harbor Statement

Dale Parker

Board Chairman

Welcome

Agenda

Board of Directors

Business Meeting

Proposals

• Ratification of Grant Thornton as the company’s

independent accounting firm and auditor for 2011

independent accounting firm and auditor for 2011

John Finke

President and CEO

Business Overview

Executive Team

Video

Building a Business & Broadband

Communications Company

Communications Company

Expanded fiber network includes

2,750 fiber route miles

2,750 fiber route miles

• Expanded route to Sioux Falls and Fargo

• Expanded network capacity in Des Moines

and backhaul to Minnesota

and backhaul to Minnesota

• Secured broadband stimulus grant

Project will add 400 route miles

Project will add 400 route miles

HickoryTech Fiber Network

Fiscal 2010 compared to fiscal 2009:

• Consolidated revenue +17%

o Business Sector revenue +34%

Fiber and Data revenue +43%

Equipment revenue +27%

o Telecom Sector revenue flat

Broadband revenue +11%

Surpassed 10,000 Digital TV subscribers

Surpassed 10,000 Digital TV subscribers

• Extended fiber network to the Dakotas,

built fiber network in Des Moines, upgraded backhaul to Minnesota

built fiber network in Des Moines, upgraded backhaul to Minnesota

• Secured Broadband Stimulus Grant of $16.8 M

2010 Highlights

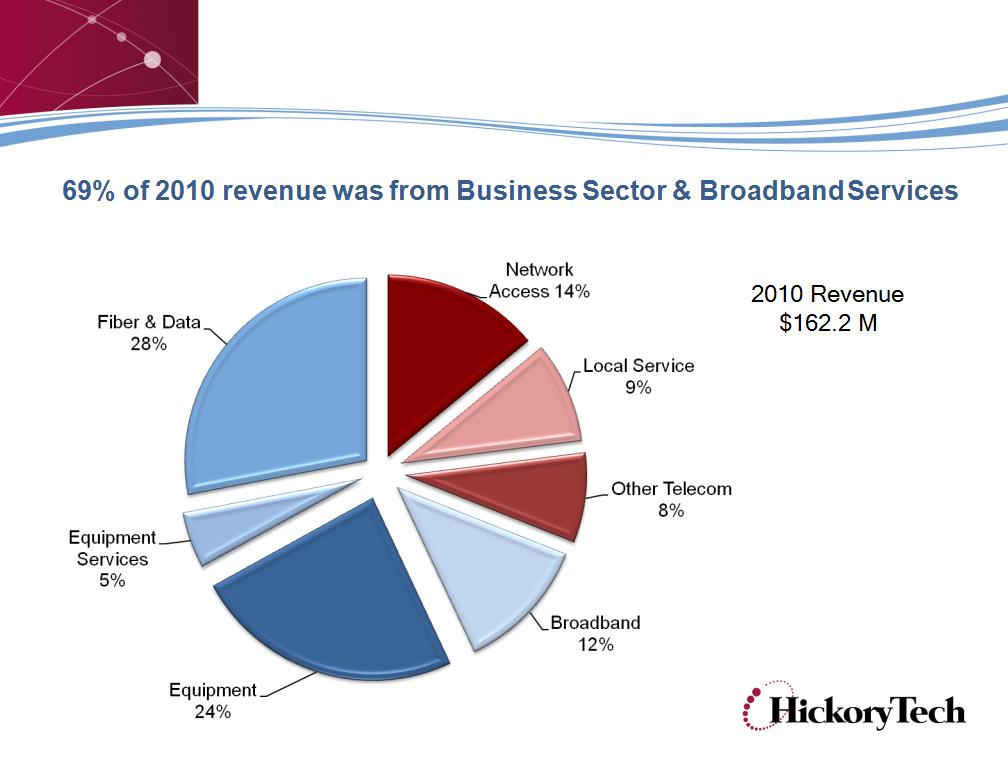

Revenue Diversification

Business & Broadband Growth

Business & Broadband Revenue

Fiber & Data Revenue Growth

Broadband Penetration of Access Lines

David Christensen,

Sr. Vice President and

Chief Financial Officer

Chief Financial Officer

Financial Overview

• 2009 net income included a

$4.4 M income tax reserve release

(non recurring)

$4.4 M income tax reserve release

(non recurring)

• 2010 net income included a

$2.7 M income tax reserve release

(non recurring)

$2.7 M income tax reserve release

(non recurring)

• Lower interest expense in 2010

• Strong wholesale transport sales,

equipment sales rebound, and a

unique fiber construction project

positively impacted income

equipment sales rebound, and a

unique fiber construction project

positively impacted income

2010 Financial Results

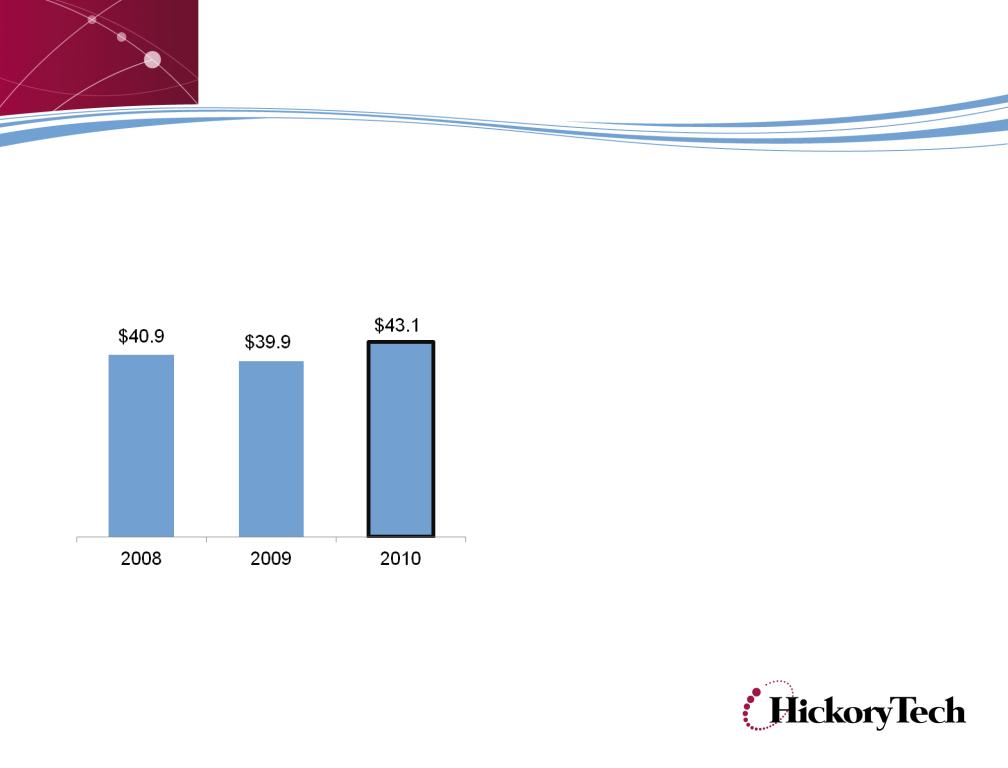

EBITDA

2010 compared to 2009

• Business Sector EBITDA

grew 46%

grew 46%

• Telecom Sector EBITDA

down 7%

down 7%

• Net overall EBITDA increase

($ in Millions)

2010 Financial Results

2010 Company Results

EBITDA

($ in Millions)

Revenue

EBITDA

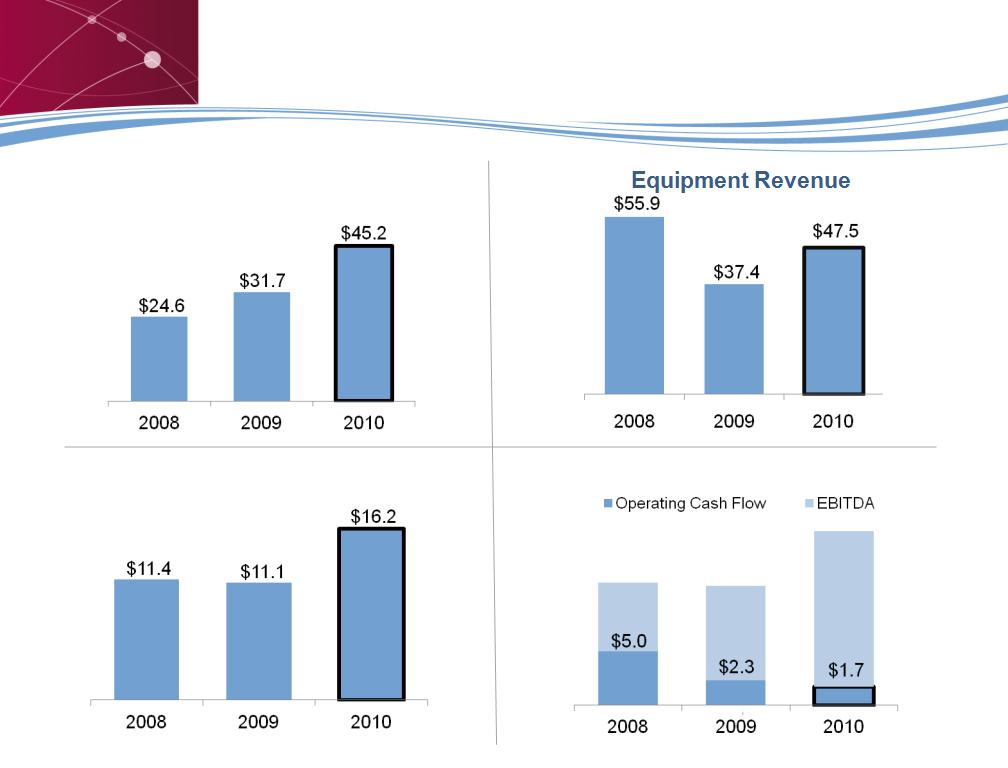

Fiber and Data Revenue

($ in Millions)

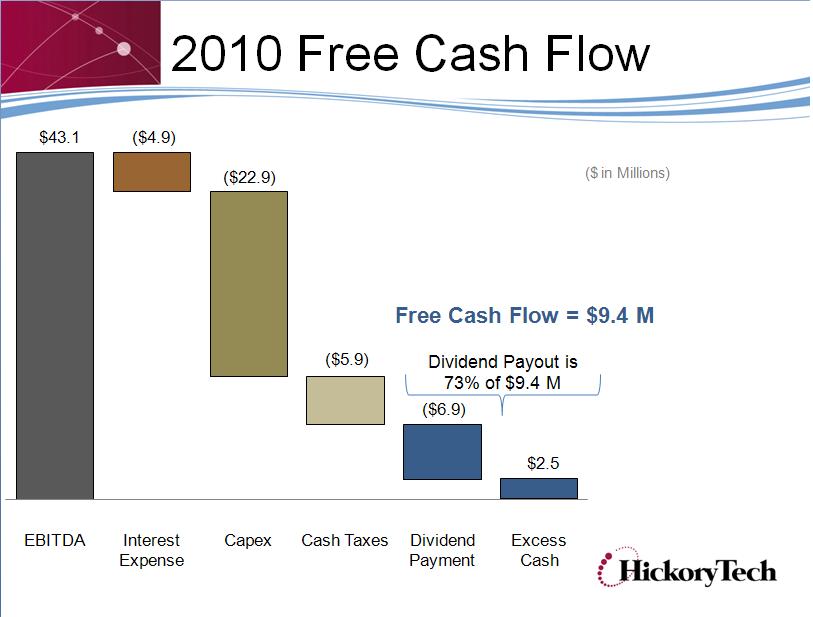

Operating Cash Flow (EBITDA minus Capex)

Business Sector Results

EBITDA

Operating Cash Flow

Telecom Sector Results

($ in Millions)

Telecom Operating Cash Flow Remains Strong

Telecom Sector Results

First Quarter 2011 Highlights

Q1-11 compared to Q1-10

• Consolidated revenue totaled $38.6 million

– Fiber and data revenue grew 13%

– Equipment support services revenue up 20%

– Broadband revenue grew 14%

– Surpassed 20,000 DSL subscribers

• Operating Income of $4.7 M, up 5%

• Pre-tax Income of $3.6 M, up 24%

• Net Income of $2.1 M, up 50%

• Net debt position improved $10 M

• Net debt was $108.9 M,

down $10 M from 12/31/10

down $10 M from 12/31/10

• Lower intra-quarter

borrowing and interest rates

in 2011, 33% reduction in

interest expense

borrowing and interest rates

in 2011, 33% reduction in

interest expense

• New senior debt agreement

expected by Q3-11

expected by Q3-11

Deleveraging the Balance Sheet

Maximum Debt/EBITDA ratio in debt covenant

• Reduced leverage by executing on growth plan and managing debt

• Achieved lower debt to EBITDA ratio reducing our interest rates

Debt/EBITDA ratio

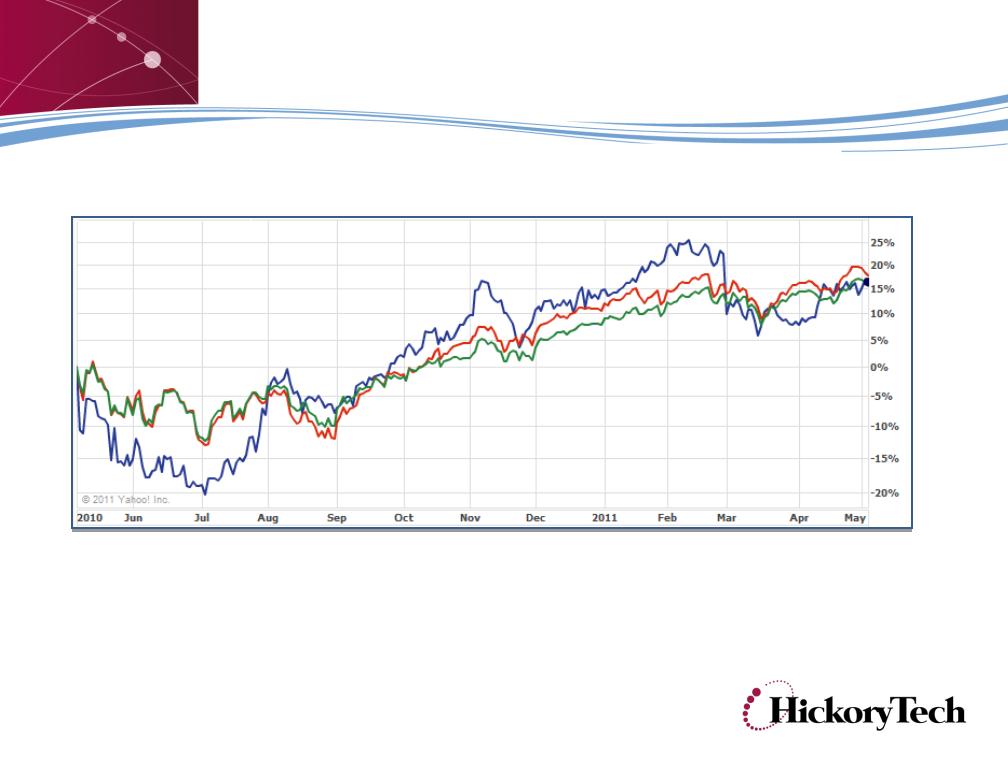

HTCO - Nasdaq - S&P 500 -

Daily performance May 2010 to May 2011

Relative Stock Performance

$0.525

$9.72*

=

5.4% Yield

*Yield based on HTCO Stock Price of $9.72 on 5/16/11

Dividend Return

• Q1-2011 dividend declared of $0.135 per share

Dividend increased in Q4-10 to $0.135, +3.9%

• 2010 annual dividends totaled $0.525 per share

• Dividend yield: 5-6%

• More than 60 years of dividend payments

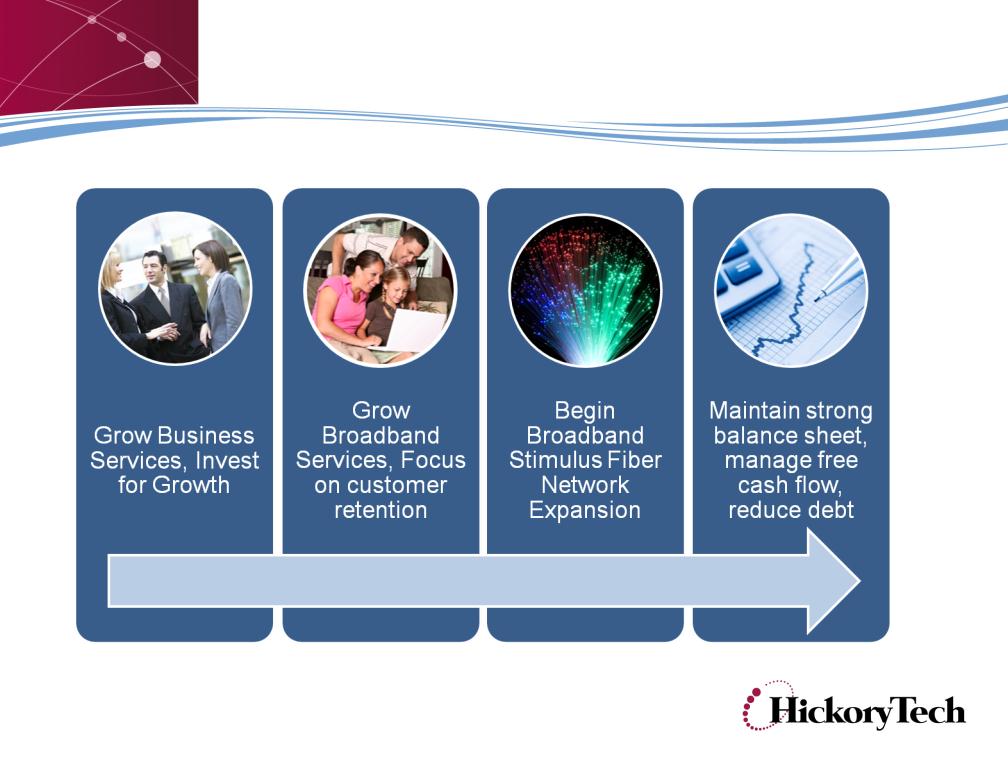

Business and Broadband Growth

Business Sector

• Focus on growth in fiber and data services

• Expand fiber network (broadband stimulus, last mile fiber builds)

• Focus on SMB, enterprise, & wholesale customer segments

• Grow monthly recurring revenue streams

Telecom Sector

• Grow broadband services, market bundle of services,

focus on customer retention

focus on customer retention

• Manage the network access decline

• Leverage local customer service and community presence

• Maintain strong free cash flow

Strategic Business Initiatives

Key Initiatives in 2011

Goal: to double the value of HickoryTech by 2014

Goal: to double shareholder value by the end of 2014 by growing EBITDA,

driving growth in lines of business with higher value and management of our debt level.

driving growth in lines of business with higher value and management of our debt level.

Five-Year Growth Goal

Why invest in HickoryTech?

Diverse revenue streams / markets, emerging

growth through business revenue stream and fiber

network expansion

growth through business revenue stream and fiber

network expansion

More than 60 years of dividend return, yield 5-6%

Experienced company with 113-year track record of

financial stability

financial stability

Strong cash flow, strong balance sheet, solid track

record, high level of recurring revenue

record, high level of recurring revenue

Focused on doubling the value of HickoryTech by

2014 by growing EBITDA, strategic services,

managing debt

2014 by growing EBITDA, strategic services,

managing debt

Questions

Focused on Business and

Broadband Growth

Broadband Growth

Reconciliation of Non-GAAP Measures

Reconciliation of Non-GAAP Measures

Reconciliation of Non-GAAP Measures