Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - DELTA AIR LINES, INC. | delta_8k-051911.htm |

Exhibit 99.1

Delta: Building a Better Airline

2011 Global Transportation Conference

May 19, 2011

1

1

Safe Harbor

This presentation contains various projections and other forward-looking statements which

represent Delta’s estimates or expectations regarding future events. All forward-looking

statements involve a number of assumptions, risks and uncertainties, many of which are

beyond Delta’s control, that could cause the actual results to differ materially from the

projected results. Factors which could cause such differences include, without limitation,

business, economic, competitive, industry, regulatory, market and financial uncertainties

and contingencies, as well as the “Risk Factors” discussed in Delta’s Form 10-K for the year

ended December 31, 2010. Caution should be taken not to place undue reliance on Delta’s

forward-looking statements, which represent Delta’s views only as of the date of this

presentation, and which Delta has no current intention to update.

represent Delta’s estimates or expectations regarding future events. All forward-looking

statements involve a number of assumptions, risks and uncertainties, many of which are

beyond Delta’s control, that could cause the actual results to differ materially from the

projected results. Factors which could cause such differences include, without limitation,

business, economic, competitive, industry, regulatory, market and financial uncertainties

and contingencies, as well as the “Risk Factors” discussed in Delta’s Form 10-K for the year

ended December 31, 2010. Caution should be taken not to place undue reliance on Delta’s

forward-looking statements, which represent Delta’s views only as of the date of this

presentation, and which Delta has no current intention to update.

In this presentation, we will discuss certain non-GAAP financial measures. You can find the

reconciliations of those measures to comparable GAAP measures on our website at

delta.com.

reconciliations of those measures to comparable GAAP measures on our website at

delta.com.

2

2

Delta: Building a Better Airline

Significant pressure on the business from rising

fuel prices, impact of events in Japan, and

Transatlantic weakness

fuel prices, impact of events in Japan, and

Transatlantic weakness

Adjusting to the New Fuel

Environment

Environment

Strong operating cash flows with limited capital

requirements allow for considerable free cash

flow generation and continued delevering of the

balance sheet

requirements allow for considerable free cash

flow generation and continued delevering of the

balance sheet

Aligning revenue, capacity and cost structure

to build a sustainable business model at $3+

per gallon jet fuel

to build a sustainable business model at $3+

per gallon jet fuel

Position Delta for long-term

success

success

Challenging March Quarter

3

Results Show Delta’s Solid Foundation

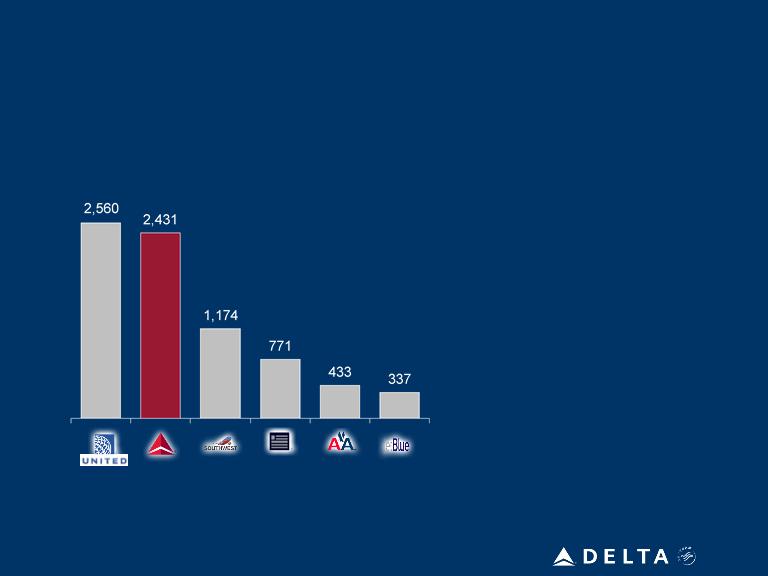

LTM March 2011 Operating Income ($M)

March Quarter Highlights:

• Increased revenues by 13%

• Generated $450 million in free

cash flow

cash flow

• Refinanced Delta’s exit facility

with a new $2.6 billion credit

facility in April

with a new $2.6 billion credit

facility in April

• Reduced adjusted net debt to

$14.5 billion

$14.5 billion

• Ended the quarter with $5.5

billion in unrestricted liquidity

billion in unrestricted liquidity

• Generated 9.5% return on

invested capital for prior 12

months

invested capital for prior 12

months

Operating

Margin

Margin

7.4%

8.6%

1.9%

6.3%

9.3%

7.4%

4

Current Trends Are Positive

• Strong yields drove April RASM up

7%, with May up 12%

7%, with May up 12%

• Corporate revenue up 25% in 2011,

from new accounts and increased

share

from new accounts and increased

share

• Domestic showing strong yields and

load factors

load factors

• Double digit yields for Latin,

Transatlantic and Pacific

Transatlantic and Pacific

• Japan continues to rebound

• June quarter all-in fuel price now

forecasted at $3.20

forecasted at $3.20

– Quarter only partially benefits due to

timing of fuel price decline

timing of fuel price decline

• September quarter reflects current

impact of price decline, which results in

an expected all-in price of $3.10

impact of price decline, which results in

an expected all-in price of $3.10

Continued revenue strength…

…and moderating fuel prices

5

High Fuel Prices are the Norm for the Industry

• 17 successful pricing actions in 2011, coupled with

international fuel surcharges, resulting in double

digit yield improvements across all entities

international fuel surcharges, resulting in double

digit yield improvements across all entities

Higher Revenues

Reduce Capacity

Flat Non-Fuel Cost

Fuel Management

• Resizing the airline to achieve flat ex-fuel unit costs

by the end of the year, including reduction of 140

aircraft over next 18 months

by the end of the year, including reduction of 140

aircraft over next 18 months

• Reducing post-Labor Day capacity 4%, with a focus

on markets where revenue has not kept pace with

higher fuel costs

on markets where revenue has not kept pace with

higher fuel costs

• Reshaping hedge portfolio into Brent and

heating oil cashless collars, while also retiring

least fuel-efficient aircraft

heating oil cashless collars, while also retiring

least fuel-efficient aircraft

Actively managing through revenue, capacity and cost adjustments

6

Need to Size Airline to Ensure It Can Cover Higher

Fuel Costs

Fuel Costs

Revenue increases must keep pace with rising cost of operating flights

March Quarter 2011 YOY Change

|

Entity

|

Unit Revenue

|

Unit Cost

|

|

Domestic

|

Up 9%

|

Up 12%

|

|

Latin

|

Up 16%

|

Up 11%

|

|

Pacific

|

Up 11%

|

Up 7%

|

|

Atlantic

|

Down 1%

|

Up 11%

|

|

System

|

Up 7%

|

Up 11%

|

7

Reducing Delta’s Post-Labor Day Capacity by 4%

Targeted reductions where revenue not keeping pace with costs

|

Domestic

|

(1-3%)

|

• Reducing Memphis hub departures

by 25% • Right-size domestic network for high

fuel environment, continued progress on 140 aircraft reduction |

|

|

Atlantic

|

(10-12%)

|

• Market cancellations and frequency

reductions, in conjunction with JV partners |

|

|

Latin

|

2-4%

|

• Thinning of Caribbean markets for off

-season, offset by build-up of Mexico and profitable deep South America flying |

|

|

Pacific

|

(1-3%)

|

• Frequency reductions and

downgauging of Haneda service |

|

|

System

|

(4%)

|

|

|

Region

YOY Capacity Change

Capacity Actions

8

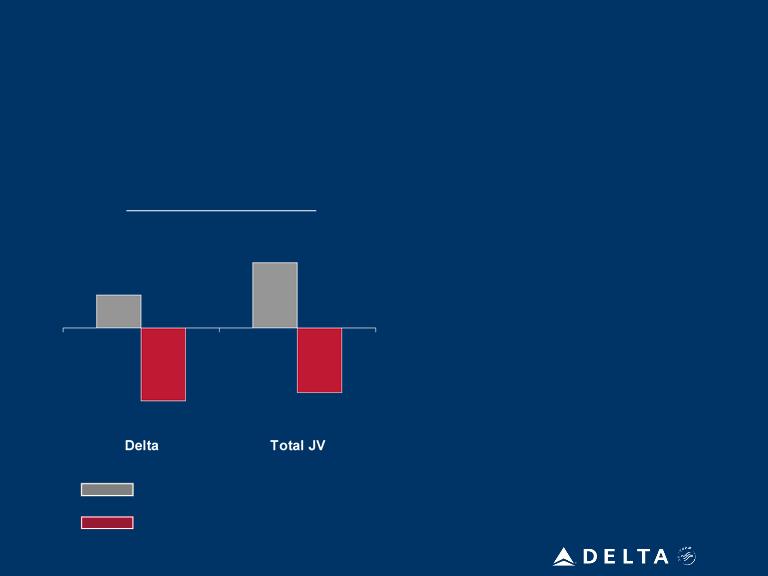

SkyTeam JV Partners Working Together to Address

Transatlantic Capacity

Transatlantic Capacity

Transatlantic Winter

YOY Capacity Change

YOY Capacity Change

(10-12%)

(7-9%)

3-4%

7-8%

Original Plan

Revised Plan

• All carriers are significantly

reducing post-Labor Day

capacity from prior plans

reducing post-Labor Day

capacity from prior plans

• Total JV capacity down ~15

points from plan

points from plan

• Capacity reductions

accomplished through:

accomplished through:

– Market cancellations

– Reduced frequencies

– Market downgauges

JV will reduce planned winter capacity by 15 points

Note: Transatlantic flying defined as US to Europe/Middle East/Africa and Amsterdam to India for Delta; and US and Canada to Europe for JV

9

9

Targeting Incremental Revenue of $1 Billion by 2013

New revenue streams expected to deliver $150-200 million this year

Deliver a Consistent, Quality Experience for Customers

• Improved seat experience with flat-beds, Economy

Comfort and more domestic first class seats

Comfort and more domestic first class seats

• State of the art facilities in JFK and Atlanta

Offer New Products and Services Customers Value

• Seat-related products (e.g. Economy Comfort)

• SkyPriority recognizes our highest-value customers

• Ancillary products to improve the travel experience (e.g.,

hotels, SkyClub passes, Wi-Fi)

hotels, SkyClub passes, Wi-Fi)

Invest in Technology To Sustain Innovation

• Revamped eCommerce platforms enable revenue

innovation

innovation

• Improved revenue management from stronger pricing

tools

tools

JFK Terminal 4

10

Selling and Other

Expenses

Expenses

Headcount

Reductions

Reductions

Maintenance

Savings

Savings

• Reduced distribution costs

• Technology-driven

productivity (i.e. kiosk

auction for voluntary

“bumping”)

productivity (i.e. kiosk

auction for voluntary

“bumping”)

• Full corporate review of

discretionary expenses

discretionary expenses

• Announced company-wide

voluntary exit program, with

55,000 employees eligible

voluntary exit program, with

55,000 employees eligible

• Flexible workforce provides

opportunities for improved

efficiency

opportunities for improved

efficiency

• Reducing aircraft count by

140 shells over next 18

months

140 shells over next 18

months

• Remove fleet-associated

costs (maintenance, parts

inventory, insurance)

costs (maintenance, parts

inventory, insurance)

• Maintenance savings from

reduced average age of

fleet

reduced average age of

fleet

• Forecast maintenance

costs for 2H11 are $250

million lower than 1H11

costs for 2H11 are $250

million lower than 1H11

Targeting Flat Ex-Fuel Unit Costs by End of Year

Actions underway to reduce cost base as airline is resized

11

11

Moderating Fuel Offsets Other Cost Pressures

|

|

|

June quarter 2011

|

|

|

|

Operating margin

|

7 - 9%

|

|

|

|

|

Fuel price

|

$3.20

|

|

|

|

|

Total unrestricted liquidity

|

$5.7 billion

|

|

|

|

|

|

|

|

|

|

|

|

|

June quarter 2011 vs.

June quarter 2010 |

|

|

|

Consolidated non-fuel

unit cost

|

Up 3 - 5%

|

|

|

|

|

|

|

|

|

|

|

System capacity

|

Up 1 - 3%

|

|

|

|

|

|

Domestic

|

Flat to down 2%

|

|

|

|

|

International

|

Up 6 - 8%

|

|

|

Note: Unit costs exclude profit sharing

12

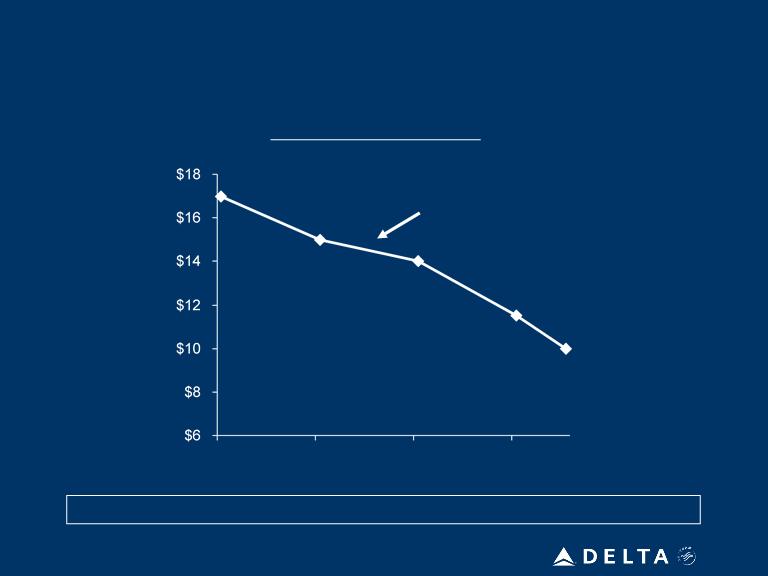

Commitment to Debt Reduction Remains Intact

Adjusted Net Debt

12/31/09

Mid-2013

6/30/11

$13.8 billion

$13.8 billion

$17 billion

$10 billion

Expect to generate $700 million in free cash flow in June quarter

13

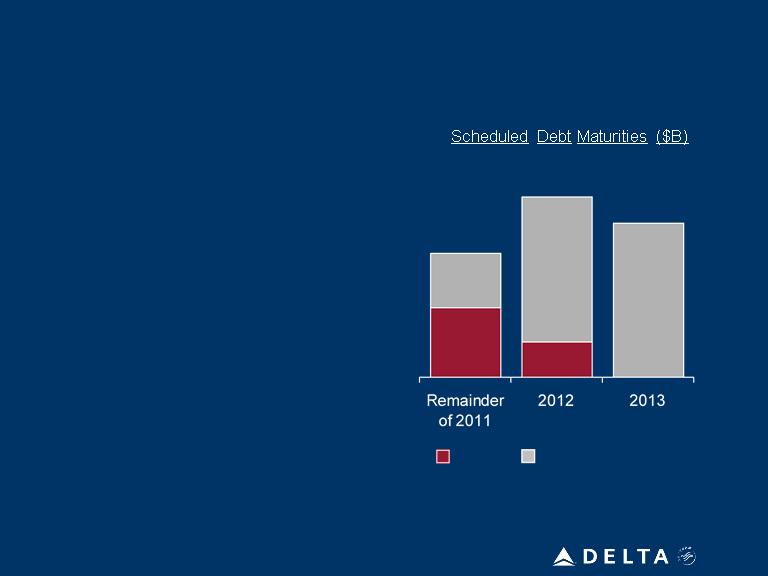

Near-Term Debt Maturities are Manageable

$1.6

$1.3

$1.9

EETC

Other debt / capital leases

• Maintaining solid liquidity position through

free cash flow generation and proactive

management of near-term debt maturities

free cash flow generation and proactive

management of near-term debt maturities

• Taking advantage of market opportunities

to proactively address future maturities

and reduce cost of debt

to proactively address future maturities

and reduce cost of debt

• Closed on a new $2.6 billion credit facility

to refinance Delta’s exit facility

to refinance Delta’s exit facility

– New $1.2 billion revolver brings

total undrawn credit lines to $1.8

billion

total undrawn credit lines to $1.8

billion

– Effective interest rate of 3.67% for

five years

five years

Plan in place to maintain minimum $5 billion in liquidity

14

Plan to Maintain Annual CapEx at $1.2 to $1.4 Billion

Annual Capital Spending Levels (billions)

Prudent capital management enables sustainable annual free cash flows

14

2008 2009 2010 2011 2012 2013 2014+

$2.2 $1.3 $1.3 $1.2 $1.2 $1.4 $1.3

Merger

Integration

International

Product &

Facilities

Product &

Facilities

Domestic

Narrowbody

Replacement

Narrowbody

Replacement

15

15

Path To Improving Shareholder Returns

10 - 12% operating margin

$5 billion EBITDAR

Minimize capital reinvestment

requirements

requirements

Use cash to delever the balance

sheet

sheet

Generate sustainable 10%+ return on invested capital

16

|

Non-GAAP Financial Measures

|

||||||||||

|

We sometimes use information that is derived from our Condensed Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Certain of this information is considered “non-GAAP financial measures” under the U.S. Securities and Exchange Commission rules. The non-GAAP financial measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results.

|

||||||||||

|

Delta is unable to reconcile certain forward-looking projections to GAAP, including projected consolidated unit cost, as the nature or amount of special items cannot be estimated at this time.

|

||||||||||

|

Delta excludes special items because management believes the exclusion of these items is helpful to investors to evaluate the company’s recurring operational performance.

|

||||||||||

|

Delta excludes non-cash mark-to-market (MTM) adjustments related to fuel hedges settling in future periods in order to evaluate the company’s financial results related to operations in the period shown.

|

||||||||||

|

Delta uses adjusted total debt, including aircraft rent, in addition to long-term adjusted debt and capital leases, to present estimated financial obligations. Delta reduces adjusted total debt by cash, cash equivalents and short-term investments, resulting in adjusted net debt, to present the amount of additional assets needed to satisfy the debt.

|

||||||||||

|

Delta presents free cash flow because management believes this metric is helpful to investors to evaluate the company’s ability to generate cash.

|

||||||||||

|

Delta presents consolidated unit cost excluding ancillary businesses not associated with the generation of a seat mile. These businesses include aircraft maintenance and staffing services Delta provides to third parties and Delta’s vacation wholesale operations.

|

||||||||||

|

Delta presents return on invested capital (ROIC) as management believes it is helpful to investors in assessing the company's ability to generate returns using its invested capital. ROIC represents operating income excluding special items divided by the sum of market value of equity and average adjusted net debt.

|

||||||||||

|

Operating Income

|

||||

|

(in millions)

|

Last Twelve Months Ended

March 31, 2011

|

|||

|

Operating income

|

$ | 2,057 | ||

|

Items excluded:

|

||||

|

MTM adjustments for fuel hedges settling in future periods

|

(29 | ) | ||

|

Restructuring and other items

|

403 | |||

|

Operating income excluding special items

|

$ | 2,431 | ||

|

Operating Margin

|

||||

|

Last Twelve Months Ended

March 31, 2011

|

||||

|

Operating margin

|

6.3 | % | ||

|

Items excluded:

|

||||

|

MTM adjustments for fuel hedges settling in future periods

|

-0.1 | % | ||

|

Restructuring and other items

|

1.2 | % | ||

|

Operating margin excluding special items

|

7.4 | % | ||

|

Adjusted Net Debt

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

(in billions)

|

March 31, 2011

|

December 31, 2010

|

September 30, 2010

|

June 30, 2010

|

March 31, 2010

|

December 31, 2009

|

||||||||||||||||||||||||||||||||||||||||||

|

Debt and capital lease obligations

|

$ | 15.2 | $ | 15.3 | $ | 15.4 | $ | 15.8 | $ | 16.9 | $ | 17.2 | ||||||||||||||||||||||||||||||||||||

|

Plus: unamortized discount, net from purchase accounting and fresh start reporting

|

0.6 | 0.6 | 0.7 | 1.0 | 1.1 | 1.1 | ||||||||||||||||||||||||||||||||||||||||||

|

Adjusted debt and capital lease obligations

|

$ | 15.8 | $ | 15.9 | $ | 16.1 | $ | 16.8 | $ | 18.0 | $ | 18.3 | ||||||||||||||||||||||||||||||||||||

|

Plus: 7x last twelve months' aircraft rent

|

2.5 | 2.7 | 3.0 | 3.2 | 3.3 | 3.4 | ||||||||||||||||||||||||||||||||||||||||||

|

Adjusted total debt

|

18.3 | 18.6 | 19.1 | 20.0 | 21.3 | 21.7 | ||||||||||||||||||||||||||||||||||||||||||

|

Less: cash, cash equivalents and short-term investments

|

(3.8 | ) | (3.6 | ) | (3.9 | ) | (4.4 | ) | (4.9 | ) | (4.7 | ) | ||||||||||||||||||||||||||||||||||||

|

Adjusted net debt

|

$ | 14.5 | $ | 15.0 | $ | 15.2 | $ | 15.6 | $ | 16.4 | $ | 17.0 | ||||||||||||||||||||||||||||||||||||

|

Free Cash Flow

|

||||||||

|

(in millions)

|

Three Months Ended March 31, 2011

|

|||||||

|

Net cash provided by operating activities (GAAP)

|

$ | 788 | ||||||

|

Net cash used in investing activities (GAAP)

|

$ | (576 | ) | |||||

|

Adjustment:

|

||||||||

|

Purchase of short-term investments

|

240 | |||||||

|

Cash used in investing

|

(336 | ) | ||||||

|

Total free cash flow

|

$ | 452 | ||||||

|

Unit Cost

|

||||||||

|

Three Months Ended March 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

Unit cost

|

13.94 | ¢ | 12.72 | ¢ | ||||

|

Items excluded:

|

||||||||

|

Ancillary businesses

|

(0.30 | ) | (0.26 | ) | ||||

|

Restructuring and other items

|

(0.01 | ) | (0.10 | ) | ||||

|

MTM adjustments for fuel hedges settling in future periods

|

0.05 | - | ||||||

|

Unit cost excluding special items

|

13.68 | ¢ | 12.36 | ¢ | ||||

|

March quarter 2011 YOY change

|

11% | |||||||

|

Capital Expenditures

|

||||||||

|

(in billions)

|

2009

|

2008

|

||||||

|

Delta property and equipment additions (GAAP)

|

$ | 1.2 | $ | 1.5 | ||||

|

Northwest property and equipment additions (GAAP) for the period from January 1 to October 29, 2008

|

- | 1.1 | ||||||

|

Other

|

0.1 | (0.4 | ) | |||||

|

Total capital expenditures

|

$ | 1.3 | $ | 2.2 | ||||

|

ROIC

|

||||

|

(in billions, except % return)

|

Last Twelve Months Ended March 31, 2011

|

|||

|

Operating income excluding special items

|

$ | 2.4 | ||

|

Market value of equity (assuming $12.60/ share)

|

$ | 10.7 | ||

|

Average adjusted net debt

|

$ | 15.0 | ||

|

Total invested capital

|

$ | 25.7 | ||

|

Return on invested capital

|

9.5% | |||