Attached files

Exhibit 10.45

LEASE AGREEMENT

BETWEEN

JEFFROAD GREEN, LLC,

A Delaware Limited Liability Company,

LANDLORD,

-AND-

PINNACLE FOODS GROUP LLC,

a Delaware Limited Liability Company,

TENANT

DATED: December 14, 2010

Prepared by:

Robert A. Klausner, Esq.

Day Pitney LLP

One Jefferson Road

Parsippany, New Jersey 07054-2891

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE 1 | DEFINITIONS | 3 | ||||

| ARTICLE 2 | DEMISE, TERM | 3 | ||||

| ARTICLE 3 | BASIC RENT; ADDITIONAL RENT | 5 | ||||

| ARTICLE 4 | REAL ESTATE TAXES | 6 | ||||

| ARTICLE 5 | OPERATING EXPENSES | 8 | ||||

| ARTICLE 6 | ELECTRICITY | 11 | ||||

| ARTICLE 7 | MAINTENANCE; ALTERATIONS; REMOVAL OF TRADE FIXTURES | 13 | ||||

| ARTICLE 8 | USE OF PREMISES | 15 | ||||

| ARTICLE 9 | LANDLORD’S SERVICES | 16 | ||||

| ARTICLE 10 | COMPLIANCE WITH REQUIREMENTS | 18 | ||||

| ARTICLE 11 | COMPLIANCE WITH ENVIRONMENTAL LAWS | 19 | ||||

| ARTICLE 12 | DISCHARGE OF LIENS | 21 | ||||

| ARTICLE 13 | PERMITTED CONTESTS | 21 | ||||

| ARTICLE 14 | INSURANCE; INDEMNIFICATION | 22 | ||||

| ARTICLE 15 | ESTOPPEL CERTIFICATES | 25 | ||||

| ARTICLE 16 | ASSIGNMENT AND SUBLETTING | 26 | ||||

| ARTICLE 17 | CASUALTY | 31 | ||||

| ARTICLE 18 | CONDEMNATION | 32 | ||||

| ARTICLE 19 | EVENTS OF DEFAULT | 32 | ||||

| ARTICLE 20 | CONDITIONAL LIMITATIONS, REMEDIES | 34 | ||||

| ARTICLE 21 | ACCESS; RESERVATION OF EASEMENTS | 36 | ||||

| ARTICLE 22 | ACCORD AND SATISFACTION | 37 | ||||

| ARTICLE 23 | SUBORDINATION | 37 | ||||

| ARTICLE 24 | TENANT’S REMOVAL | 39 | ||||

-i-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| ARTICLE 25 | BROKERS | 40 | ||||

| ARTICLE 26 | NOTICES | 40 | ||||

| ARTICLE 27 | NONRECOURSE | 40 | ||||

| ARTICLE 28 | INTENTIONALLY OMITTED | 40 | ||||

| ARTICLE 29 | MISCELLANEOUS | 40 | ||||

| ARTICLE 30 | USA PATRIOT ACT | 43 | ||||

| ARTICLE 31 | EXTENSION OPTION | 44 | ||||

| ARTICLE 32 | SIGNAGE | 45 | ||||

| ARTICLE 33 | ROOF RIGHTS | 46 | ||||

| ARTICLE 34 | RIGHT OF FIRST REFUSAL | 47 | ||||

| ARTICLE 35 | ART WORK | 48 | ||||

-ii-

LEASE AGREEMENT

This LEASE AGREEMENT (this “Lease”) is dated December 14, 2010 and is between JEFFROAD GREEN, LLC, a Delaware limited liability company (“Landlord”), and PINNACLE FOODS GROUP LLC, a Delaware limited liability company (“Tenant”).

BASIC LEASE PROVISIONS

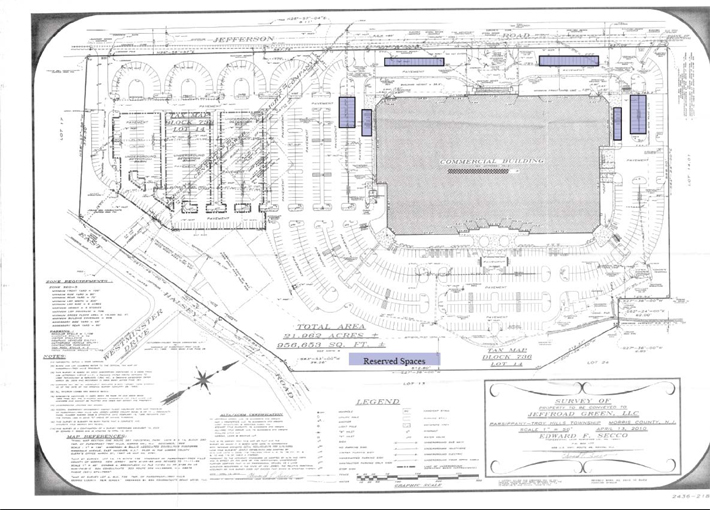

| (1) Land: |

Block 736, Lot 14 on the official tax map of the Township of Parsippany-Troy Hills, New Jersey, as more particularly described on Schedule A attached hereto. | |

| (2) Building: |

399 Jefferson Road, Parsippany, New Jersey 07054. | |

| (3) Premises: |

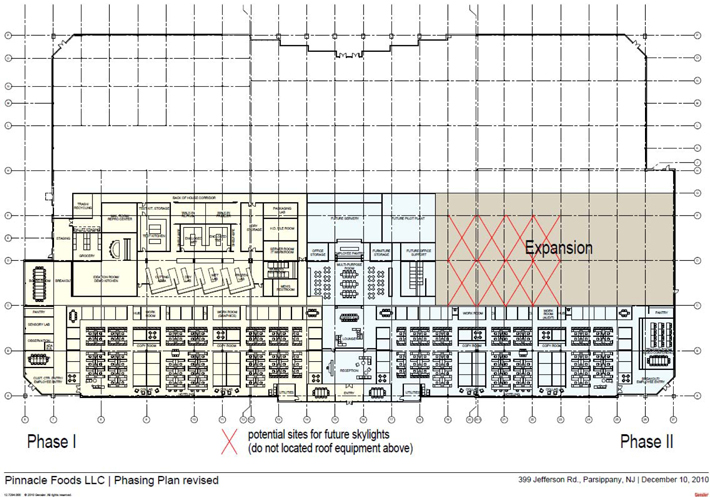

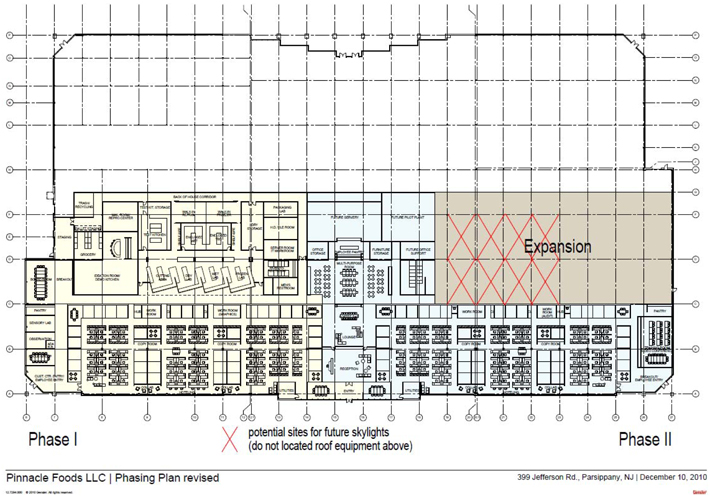

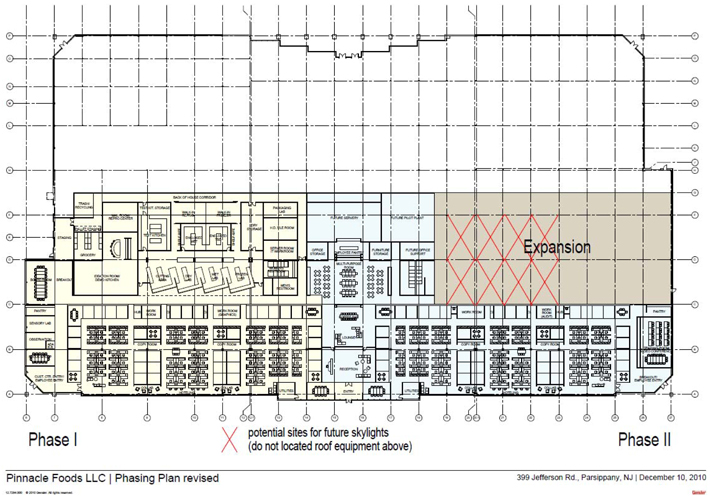

82,552 rentable square feet in the Building, comprised of 45,865 rentable square feet designated at Suite 100 (the “Phase 1 Premises”) and 36,686 rentable square feet designated at Suite 110 (the “Phase 2 Premises”), as shown on Schedule B attached hereto. | |

| (4) Commencement Date: |

January 1, 2011. | |

| (5) Termination Date: |

April 15, 2023, or such earlier date upon which the Term may expire or be terminated. | |

| (6) Basic Rent: |

From the Commencement Date until November 30, 2011, Tenant shall not be obligated to pay any Basic Rent. From December 1, 2011 (the “Phase 1 Premises Rent Commencement Date”) until March 31, 2012, Basic Rent hereunder shall be $1,009,030.00 per annum ($22.00 per rentable square foot for the Phase 1 Premises) due and payable, in advance, on the first day of each month in equal monthly installments of $84,085.83 per month. From April 1, 2012 (the “Phase 2 Premises Rent Commencement Date”) through March 31, 2016, Basic Rent hereunder shall be $1,816,144.00 per annum ($22.00 per rentable square foot for the entire Premises) due and payable, in advance, on the first day of each month in equal monthly installments of $151,345.33 per month. Notwithstanding the foregoing, if Tenant commences its business operations in the Phase 2 Premises prior to January 1, 2012 (the “Phase 2 Accelerated Use Date”), then from and after the Phase 2 Accelerated Use Date until March 31, 2012, in addition to any Basic Rent payable for the Phase 1 Premises as | |

| provided above, Tenant shall pay Landlord Basic Rent for such period an amount equal to $23,845.90 per month ($0.65 per rentable square foot for the Phase 2 Premises) due and payable, in advance, on the first day of each month with the Basic Rent payable above for the Phase 1 Premises. | ||

| From April 1, 2016 through March 31, 2021, Basic Rent hereunder shall be $1,939,972.00 per annum ($23.50 per rentable square foot) due and payable, in advance, on the first day of each month in equal monthly installments of $161,664.33 per month. | ||

| From April 1, 2021 through the Termination Date, Basic Rent hereunder shall be $2,063,800.00 per annum ($25.00 per rentable square foot) due and payable, in advance, on the first day of each month in equal monthly installments of $171,983.33 per month. | ||

| (7) Rentable Size of Building: |

178,347 square feet. | |

| (8) Rentable Size of Premises: |

82,552 square feet. | |

| (9) Tenant’s Proportionate Share: |

46.29% | |

| (10) Base Period: |

Twelve (12) month period beginning on November 16, 2011. | |

| (11) Parking Spaces: |

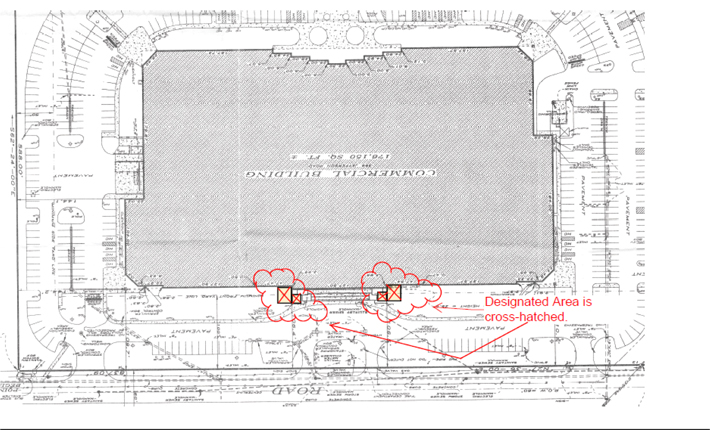

330 parking spaces, of which 83 shall be marked for the exclusive use of Tenant as near to Tenant’s main entrance to the Premises as possible and as shown on Schedule B-1. | |

| (12) Security: |

N/A | |

| (13) Permitted Use: |

Executive and administrative offices, together with a test kitchen for the cooking of food and manufacture of food products, research activities, and any lawfully permitted ancillary use. Notwithstanding anything herein to the contrary, Tenant shall not permit more than thirty-five percent (35%) of the rentable square feet of the Premises, in the aggregate, to be used for the cooking, preparation and storage of food and other manufacturing activities. | |

| (14) Brokers: |

Jones Lang LaSalle Brokerage, Inc. | |

2

| (15) Enumeration of Schedules / Appendix: |

Schedules A, B, C, D, E, F and G and Appendix I attached hereto are incorporated into this Lease. | |

| (16) Governing Law: |

This Lease is governed by the laws of the State of New Jersey. | |

| (17) Landlord’s Notice Address: |

Jeffroad Green, LLC 50 Grand Avenue Englewood, New Jersey 07631-3506 Attn: Eugene Diaz

and

Greenfield Partner LLC 50 North Water Street South Norwalk, Connecticut 06854 Attn: Barry Marcus | |

| (18) Tenant’s Notice Address: |

Prior to the Commencement Date:

One Bloomfield Avenue Mountain Lakes, New Jersey Attn: General Counsel

From and after the Commencement Date:

At the Premises Attn: General Counsel | |

ARTICLE 1

DEFINITIONS

Capitalized terms used in this Lease but not otherwise defined have the meanings set forth in Appendix I.

ARTICLE 2

DEMISE, TERM

2.1 Demise of Premises. Landlord hereby leases and demises to Tenant, and Tenant hereby hires and takes from Landlord, upon the terms and conditions set forth herein, the Premises for the Term. Landlord and Tenant hereby agree that for all purposes of this Lease, the size of the Premises shall be as set forth in clauses (3) and (10) of the Basic Lease Provisions.

3

2.2 Term.

(a) Term: The Term of this Lease will commence on the Commencement Date and end on the Termination Date.

(b) Commencement Date. The “Commencement Date” will be as set forth in the Basic Lease Provisions, notwithstanding the date Tenant actually completes the Finish Work in accordance with Schedule D attached hereto; provided however, if (i) there is a delay in the substantial completion of the Finish Work that is solely caused by the Base Building Work (other than any mechanical work which is part of the Base Building Work) not being completed by March 15, 2011 and the Base Building Work pertaining to any mechanical work not being completed by May 1, 2011, and (ii) such delay in the Substantial Completion of the Base Building Work is not caused by a Tenant Delay or Excusable Delay, then the Commencement Date shall be delayed one day for each day that the Base Building Work is not Substantially Completed in accordance with the schedule set forth in Schedule D. From and after the date hereof, Tenant will have the right to enter upon the Premises for the purposes of constructing the Finish Work. Such occupancy by Tenant is expressly subject to all of the terms and conditions of this Lease, except Tenant’s obligation to pay Basic Rent. For purposes hereof, the term “Substantially Completed” or “Substantial Completion” means that (i) Landlord has completed the Base Building Work, except for (x) minor details of construction that will not unreasonably interfere with Tenant’s use of the Premises (collectively, “Punch List Items”), and (y) any part of the Base Building Work that is not completed due to any act or omission of Tenant or Tenant’s Visitors. The failure of Tenant to complete the Phase I Working Plans and the Phase 2 Working Plans by the dates set forth in Schedule D shall be deemed to be a Tenant Delay, which will excuse Landlord’s failure to timely complete the Base Building Work for the duration of the Tenant Delay.

(c) AS IS. Tenant acknowledges that neither Landlord nor any employee, agent or representative of Landlord has made any express or implied representations or warranties with respect to the physical condition of the Building or the Premises, the fitness or quality thereof or any other matter or thing whatsoever with respect to the Building or the Premises or any portion thereof, and that Tenant is not relying upon any such representation or warranty in entering into this Lease. Tenant has inspected the Building and the Premises and is thoroughly acquainted with their respective condition and agrees to take the same “AS IS”. Landlord is not aware of any material condition at the Premises or the Building that would have an adverse impact on Tenant’s ability to occupy and use the Premises for the Permitted Use.

2.3 Finish Work. Landlord shall have no obligation to perform the Finish Work, provided, that Landlord shall give Tenant the Allowance pursuant to Schedule D.

2.4 Base Building Work. Landlord shall perform the work (the “Base Building Work”) set forth on Schedule D-2.

4

ARTICLE 3

BASIC RENT; ADDITIONAL RENT

3.1 Basic Rent. Tenant shall pay the Basic Rent to Landlord in lawful money of the United States of America in equal monthly installments, in advance, on the Basic Rent Payment Dates, commencing on the Phase 1 Rent Commencement Date. If the Commencement Date is not a Basic Rent Payment Date, the Basic Rent for the month in which the Commencement Date occurs will be prorated and Tenant shall pay such prorated amount to Landlord on the Commencement Date.

3.2 Additional Rent. In addition to the Basic Rent, Tenant shall pay and discharge when due, as additional rent (“Additional Rent”), all other amounts, liabilities and obligations which Tenant herein agrees to pay to Landlord, together with all interest, penalties and costs which may be added thereto pursuant to the terms of this Lease.

3.3 Late Charge. If any installment of Basic Rent or Additional Rent is not paid when due, Tenant shall pay to Landlord, on demand, a late charge equal to three percent (3%) of the amount unpaid. Notwithstanding the foregoing, Tenant shall not be required to pay the foregoing late charge amount the first time Tenant is late during each twelve (12) month period in the Term, unless Tenant has been given five (5) business days’ notice and an opportunity to cure said nonpayment during said five (5) business day period and has still failed to cure the same. The late charge is not intended as a penalty but is intended to compensate Landlord for the extra expense Landlord will incur to send out late notices and handle other matters resulting from the late payment. In addition, any installment or installments of Basic Rent or Additional Rent that are not paid within ten (10) days after the date when due, will bear interest at the lesser of: (i) five percent (5%) over the Prime Rate, or (ii) the highest legal rate permitted by law. Any interest due as set forth in the preceding sentence shall be calculated from the due date of the delinquent payment until the date of payment, which interest will be deemed Additional Rent and shall be payable by Tenant upon demand by Landlord.

3.4 Prorating Rent. If any Lease Year consists of a period of less than twelve (12) full calendar months, payments of Basic Rent and Additional Rent, will be prorated on the basis of a thirty (30) day month or 360-day year, unless otherwise provided.

3.5 No Abatement or Set-off. Except as herein provided, Tenant shall pay to Landlord, at Landlord’s first address for notices hereunder, or such other place as Landlord may from time to time designate, without any offset, set-off, counterclaim, deduction, defense, abatement, suspension, deferment or diminution of any kind (i) the Basic Rent, without notice or demand, (ii) Additional Rent, and (iii) all other sums payable by Tenant hereunder. Except as otherwise expressly provided herein, this Lease will not terminate, nor will Tenant have any right to terminate or avoid this Lease or be entitled to the abatement of any Basic Rent, Additional Rent or other sums payable hereunder or any reduction thereof, nor will the obligations and liabilities of Tenant hereunder be in any way affected for any reason. The obligations of Tenant hereunder are separate and independent covenants and agreements.

3.6 Invoices. If Landlord issues monthly or other periodic rent billing statements to Tenant, the issuance or non-issuance of such statements will not affect Tenant’s obligation to pay Basic Rent and the Additional Rent set forth in Sections 4.3 and 5.3, all of which are due and payable on the Basic Rent Payment Dates.

5

ARTICLE 4

REAL ESTATE TAXES

4.1 Taxes. Tenant shall pay to Landlord Tenant’s Proportionate Share of the amount by which the Taxes for any Lease Year during the Term exceed the Base Taxes; provided, however, that if any special assessments may be paid in installments, Landlord may elect to pay same over the longest period allowed by law. Tenant’s Proportionate Share of the Taxes for less than a full Lease Year will be prorated.

4.2 Landlord’s Tax Statement. As soon as reasonably possible after the first day of the Lease Year following the Lease Year in which Base Period occurs and thereafter as soon as reasonably practical after the end of each succeeding Lease Year, Landlord shall determine or estimate the amount by which the Taxes for the Lease Year in question will exceed the Base Taxes (the “Projected Taxes”) and shall submit such information to Tenant in a written statement (“Landlord’s Tax Statement”). Landlord shall use reasonable efforts to issue Landlord’s Tax Statement within one hundred twenty (120) days following the end of each Lease Year. Landlord’s failure to render Landlord’s Tax Statement for any Lease Year will not prejudice Landlord’s right to thereafter render Landlord’s Tax Statement with respect to such Lease Year or with respect to any other Lease Year, nor will the rendering of any Landlord’s Tax Statement prejudice Landlord’s right to thereafter render a revised Landlord’s Tax Statement for the applicable Lease Year.

4.3 Monthly Tax Payment. Commencing on the first Basic Rent Payment Date following the submission of Landlord’s Tax Statement and continuing thereafter on each successive Basic Rent Payment Date until Landlord renders the next Landlord’s Tax Statement, Tenant shall pay to Landlord on account of its obligation under Section 4.1, a sum (the “Monthly Tax Payment”) equal to one-twelfth (1/12) of Tenant’s Proportionate Share of the Projected Taxes for such Lease Year. Tenant’s first Monthly Tax Payment after receipt of Landlord’s Tax Statement shall be accompanied by the payment of an amount equal to the product of the number of full months, if any, within the Lease Year which have elapsed prior to such first Monthly Tax Payment, times the Monthly Tax Payment; minus any Additional Rent already paid by Tenant on account of its obligation under Section 4.1 for such Lease Year. From time to time during, but only once in any Lease Year, Landlord may revise the Landlord’s Tax Statement and adjust Tenant’s Monthly Tax Payment to reflect Landlord’s revised estimate, in which event Tenant shall pay, along with the next monthly payment due, the difference (if any) between the aggregate amount of Tenant’s Monthly Tax Payments theretofore made on account of its obligation under Section 4.1 for such Lease Year, and the amount which would have been payable by Tenant during such Lease Year had Landlord billed Tenant for the revised Monthly Tax Payment for such prior elapsed months during such Lease Year. Thereafter, Tenant shall pay the revised monthly estimate in accordance with the provisions of this Section 4.3.

4.4 Reconciliation. Landlord shall use reasonable efforts to deliver to Tenant, as soon as reasonably possible, after the end of the Base Period, Landlord’s final determination of the Base Taxes. Landlord shall also use reasonable efforts to deliver to Tenant within one hundred

6

twenty (120) days after the end of each Lease Year, Landlord’s final determination of the amount by which the Taxes for the Lease Year in question exceed the Base Taxes and shall submit such information to Tenant in a written statement (“Landlord’s Final Tax Statement”). Each Landlord’s Final Tax Statement must reconcile the payments made by Tenant in the Lease Year in question with Tenant’s Proportionate Share of the amount by which actual Taxes imposed for the period covered thereby exceed Base Taxes. Any balance due to Landlord shall be paid by Tenant within twenty (20) days after Tenant’s receipt of Landlord’s Final Tax Statement; any surplus due to Tenant shall be applied by Landlord against the next accruing monthly installment(s) of Additional Rent due under this Article 4. If the Term has expired or has been terminated, Tenant shall pay the balance due to Landlord or, alternatively, Landlord shall refund the surplus to Tenant, whichever the case may be, within twenty (20) days after Tenant’s receipt of Landlord’s Final Tax Statement; provided, however, that, if the Term terminated as a result of a default by Tenant, then Landlord will have the right to retain such surplus to the extent Tenant owes Landlord any Basic Rent or Additional Rent.

4.5 Refund of Taxes. Landlord will have the right, but not the obligation, to seek to obtain a lowering of the assessed valuation of the Property. Landlord will be reasonable in determining whether or not to contest or approve the Taxes. Landlord may employ whatever individuals and firms Landlord, in its sole judgment, deems necessary to undertake such endeavor. Tenant shall cooperate with Landlord and its representatives in all such endeavors. If Landlord receives a refund of Taxes in respect of a Lease Year and if Tenant paid Additional Rent based on the Taxes paid prior to the refund, Landlord shall first deduct from such tax refund any expenses, including, but not limited to, attorneys fees and appraisal fees, incurred in obtaining such tax refund, and out of the remaining balance of such tax refund, Landlord shall credit Tenant’s Proportionate Share of such refund against the next accruing monthly installment(s) of Additional Rent, or if the Term has expired, Landlord shall pay to Tenant Tenant’s Proportionate Share of such refund within thirty (30) days after receipt thereof by Landlord; provided, however, that (i) if the Term terminated as a result of a default by Tenant, Landlord will have the right to retain Tenant’s Proportionate Share of the refund to the extent Tenant owes Landlord any Basic Rent or Additional Rent, and (ii) Tenant’s Proportionate Share of such refund will in no event exceed the amount of Additional Rent actually paid by Tenant on account of the Taxes for the Lease Year in question. Any expenses incurred by Landlord in contesting the validity or the amount of the assessed valuation of the Property or any Taxes, to the extent not offset by a tax refund, will, for the purpose of computing the Additional Rent due Landlord or any credit due to Tenant hereunder, be included as an item of Taxes for the tax year in which such contest is finally determined. Notwithstanding anything to the contrary contained in this Lease, Tenant will have no right to contest or appeal the validity of any Taxes or the assessed valuation of the Property, provided that Landlord agrees to reasonably consider Tenant’s request to contest or appeal the Taxes.

4.6 Payment Pending Appeal. While proceedings for the reduction in assessed valuation for any year are pending, the computation and payment of Tenant’s Proportionate Share of Taxes will be based upon the original assessments for such year.

4.7 Taxes on Tenant’s Improvements. Tenant shall also pay to Landlord, upon demand, the amount of all increases in Taxes and/or all assessments or impositions made, levied or assessed against or imposed upon the Property or any part thereof which are (i) solely

7

attributable to above-standard additions or improvements in, on or about the Premises made by or on behalf of Tenant or which in whole or in part belong to Tenant, and (ii) not based on the “income approach” to valuation by the applicable taxing authority. Landlord agrees that if the applicable taxing authority increases Taxes bases solely on above-standard improvements of other tenants in the Building, and such taxing authority does not use the “income approach” to valuation, then Tenant shall not be responsible for such increased Taxes.

4.8 Survival. In no event will any adjustment in Tenant’s obligation to pay Additional Rent under this Article 4 result in a decrease in the Basic Rent. Tenant’s obligation to pay Additional Rent, and Landlord’s obligation to credit and/or refund to Tenant any amount, pursuant to the provisions of this Article 4, will survive the Termination Date.

4.9 Bills and Statements. The provisions of Section 29.3 apply to Landlord’s Tax Statement.

4.10 Rent Tax: If an excise, transaction, sales, or privilege tax or other tax or imposition (other than Federal, state or local income or estate taxes) is levied or assessed against Landlord or the Property on account of or measured by, in whole or in part, the Basic Rent and/or Additional Rent expressly reserved hereunder as a substitute for or in addition to, in whole or in part, Taxes or if any assessments and/or taxes are levied or assessed against Landlord or the Property on account of or as a result of the operation and/or existence of Tenant’s business, then Tenant shall pay to Landlord upon demand: (i) the amount of such excise, transaction, sales or privilege tax or other tax or imposition lawfully assessed or imposed as a result of Landlord’s interests in this Lease or of the Basic Rent and/or Additional Rent accruing under this Lease; and (ii) the amount of any assessments and/or taxes levied or assessed against Landlord or the Property on account of or as a result of the operation and/or existence of Tenant’s business in the Property.

ARTICLE 5

OPERATING EXPENSES

5.1 Operating Expenses.

(a) The Landlord’s CAM Expenses, the Utility Expenses and the Insurance Expenses are collectively referred to as “Landlord’s Operating Expenses” and shall be determined and paid in accordance with the provisions of this Article 5.

(b) Tenant shall pay to Landlord, Tenant’s Proportionate Share of the amount by which Landlord’s CAM Expenses for any Lease Year during the Term exceeds the Base CAM Expenses. Tenant’s Proportionate Share of Landlord’s CAM Expenses for less than a full Lease Year will be prorated.

(c) Tenant shall pay to Landlord, Tenant’s Proportionate Share of the amount by which the Utility Expenses for any Lease Year during the Term exceeds the Base Utility Expenses. Tenant’s Proportionate Share of the Utility Expenses for less than a full Lease Year will be prorated.

8

(d) Tenant shall pay to Landlord, Tenant’s Proportionate Share of the amount by which the Insurance Expenses for any Lease Year during the Term exceeds the Base Insurance Expenses. Tenant’s Proportionate Share of the Insurance Expenses for less than a full Lease Year will be prorated.

5.2 Landlord’s Estimated Expense Statement. On or before November 1 of each Lease Year following the Lease Year in which Base Period occurs, Landlord shall determine or estimate the amount by which Landlord’s Operating Expenses for the Lease Year in question will exceed the Base Operating Expenses (“Landlord’s Estimated Operating Expenses”) and shall submit such information to Tenant in a written statement (“Landlord’s Estimated Expense Statement”). Landlord’s failure to render Landlord’s Estimated Expense Statement for any Lease Year will not prejudice Landlord’s right to thereafter render Landlord’s Estimated Expense Statement with respect to such Lease Year or with respect to any other Lease Year, nor will the rendering of any Landlord’s Estimated Expense Statement prejudice Landlord’s right to thereafter render a revised Landlord’s Estimated Expense Statement for the applicable Lease Year.

5.3 Monthly Expense Payment. Commencing on the first Basic Rent Payment Date of the new Lease Year following the submission of Landlord’s Estimated Expense Statement and continuing thereafter on each successive Basic Rent Payment Date until Landlord renders the next Landlord’s Estimated Expense Statement, Tenant shall pay to Landlord on account of its obligation under Section 5.1, a sum (the “Monthly Expense Payment”) equal to one-twelfth (1/12) of Tenant’s Proportionate Share of Landlord’s Estimated Operating Expenses for such Lease Year. Tenant’s first Monthly Expense Payment after receipt of Landlord’s Estimated Expense Statement shall be accompanied by the payment of an amount equal to the product of the number of full months, if any, within the Lease Year which have elapsed prior to such first Monthly Expense Payment, times the Monthly Expense Payment; minus any Additional Rent already paid by Tenant on account of its obligation under Section 5.1 for such Lease Year. From time to time, but only once in any during any Lease Year, Landlord may revise the Landlord’s Estimated Expense Statement and adjust Tenant’s Monthly Expense Payment to reflect Landlord’s revised good faith estimate, in which event Tenant shall pay, along with the next monthly payment due, the difference (if any) between the aggregate amount of Tenant’s Monthly Expense Payments theretofore made on account of its obligation under Section 5.1 for such Lease Year, and the amount which would have been payable by Tenant during such Lease Year had Landlord billed Tenant for the revised Monthly Expense Payment for such prior elapsed months during such Lease Year. If any such revised good faith estimate results in a material change in the monthly amount payable by Tenant, then Landlord shall provide Tenant appropriate documentation evidencing the need for such revision. Thereafter, Tenant shall pay the revised monthly estimate in accordance with the provisions of this Section 5.3.

5.4 Reconciliation. Landlord shall use reasonable efforts to deliver to Tenant, within one hundred twenty (120) days after the end of each Lease Year, Landlord’s final determination of the amount by which the Landlord’s Operating Expenses for the Lease Year in question exceed the Base Operating Expenses and shall submit such information to Tenant in a written statement (the “Annual Expense Reconciliation”). Each Annual Expense Reconciliation must reconcile the aggregate of all Monthly Expense Payments made by Tenant in the Lease Year in question with Tenant’s Proportionate Share of the amount by which actual Landlord’s Operating Expenses for the period covered thereby exceed Base Operating Expenses. Tenant shall pay any balance

9

due to Landlord within twenty (20) days after Tenant’s receipt of the Annual Expense Reconciliation, provided however, if Tenant, in good faith, disputes the inclusion of any specific item of Landlord’s Operating Expenses (as opposed to disputing the billed amount) (a “Disputed Item”), Tenant may withhold from such payment the amount applicable to such Disputed Item until such dispute is resolved either (i) through a good faith discussion between the parties to take place -within thirty (30) days following the date Landlord receives Tenant’s notice of such dispute or (ii) pursuant to the arbitration process described in Section 29.12 below. Any surplus due to Tenant shall be applied by Landlord against the next accruing monthly installment(s) of Additional Rent due under this Article 5. If the Term has expired or has been terminated, Tenant shall pay the balance due to Landlord or, alternatively, Landlord shall refund the surplus to Tenant, whichever the case may be, within twenty (20) days after Tenant’s receipt of the Annual Expense Reconciliation; provided, however, that if the Term terminated as a result of a default by Tenant, then Landlord will have the right to retain such surplus to the extent Tenant owes Landlord any Basic Rent or Additional Rent.

5.5 Audit. For one hundred eighty day (180) days following Landlord’s delivery to Tenant of the Annual Expense Reconciliation, Tenant will have the right, during normal business hours and upon no less than five (5) days prior written notice to Landlord, to examine Landlord’s books and records either directly or through a third party (subject to the last sentence of this Section 5.5) for the purpose of confirming the Annual Expense Reconciliation. Tenant will be deemed to have accepted the Annual Expense Reconciliation (and any unresolved Disputed Item shall be determined in Landlord’s favor) unless, within forty five (45) days after Tenant’s examination of Landlord’s books and records, Tenant delivers an objection notice to Landlord specifying in detail why Tenant believes such Annual Expense Reconciliation is incorrect. Notwithstanding anything to the contrary contained in this Section 5.5, Tenant will not be permitted to examine Landlord’s books and records or to dispute any Annual Expense Reconciliation unless (i) Tenant has paid to Landlord all amounts due as shown on such Annual Expense Reconciliation (other than any Disputed Items), and (ii) Tenant has signed a confidentiality agreement acceptable to Landlord. Tenant shall not engage the services of any legal counsel or other professional consultant who charges for its services on a so-called contingency fee basis for the purpose of reviewing Landlord’s books and records, unless, prior to each such engagement, Tenant pays Landlord $2,500. If the result of Tenant’s audit reveal that Landlord’s CAM Expenses were overstated by seven percent (7%) or more, then Landlord shall either (1) repay such $2,500 payment to Tenant if Tenant engages an auditor on a contingency fee basis or (2) reimburse Tenant for its reasonable, out-of-pocket costs (not to exceed $10,000) for an auditor not paid on a contingency fee basis, provided Tenant gives Landlord a reasonably detailed invoice showing such costs. If (A) Tenant’s audit discloses any overcharge to Tenant, (B) Landlord disputes such findings, and (C) any such dispute is not settled by Landlord and Tenant within thirty (30) days after the dispute arises, or such longer period to which they may mutually agree, then such dispute may, at the option of either party, be submitted to arbitration in accordance with Section 29.12 of this Lease. If Tenant’s audit discloses any overcharge to Tenant and Landlord agrees with such findings, or, in the event of a dispute, the arbitrator rules in favor of Tenant, then the amount overcharged to Tenant shall be applied against the next accruing monthly installment(s) of Additional Rent due under this Article 5. If the Term has expired or has been terminated, Landlord shall refund the surplus to Tenant within thirty (30) days after receipt of Tenant’s audit results.

10

5.6 Survival. In no event will any adjustment in Tenant’s obligation to pay Additional Rent under this Article 5 result in a decrease in Basic Rent. Tenant’s obligation to pay Additional Rent, and Landlord’s obligation to credit and/or refund to Tenant any amount, pursuant to this Article 5 will survive the Termination Date.

5.7 Operating Expenses With Respect to Tenant. Tenant shall also pay to Landlord, upon demand, the amount of any increase in Landlord’s Operating Expenses which is directly and solely attributable to Tenant’s use or manner of use of the Premises, to activities conducted on or about the Premises by Tenant or on behalf of Tenant or to any additions, improvements or alterations to the Premises made by or on behalf of Tenant.

5.8 Bills and Statements. The provisions of Section 29.3 apply to Landlord’s Estimated Expense Statement.

ARTICLE 6

ELECTRICITY

6.1 Cost of Electricity. The electricity (including the electricity serving the HVAC system exclusively serving the Premises) and natural gas consumed in the Premises will be measured by submeters, check meters or other measuring devices. From and after the Commencement Date, Tenant shall pay Landlord, within ten (10) business days after delivery of a bill therefor, all charges, including, without limitation, usage charges, demand factors, all other charges calculated at the rate structure then existing of the utility company supplying electrical energy to the Building for Tenant’s consumption as determined by such meter and Landlord’s actual costs of reading such meters. If the electricity or natural gas consumed in the Premises is measured by direct meter, Tenant shall contract with, and pay directly to, the applicable service provider for such service.

6.2 Tenant Not To Exceed Capacity. Tenant’s use of electric energy in the Premises shall not at any time exceed the capacity of any of the electrical conductors and equipment in or otherwise serving the Premises. In order to insure that such capacity is not exceeded and to avert possible adverse effect upon the Building electric service, Tenant shall not, without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed, connect any fixtures, appliances or equipment to the Building electric distribution system which require electricity greater than that of equipment used by an office user of typical office space in northern New Jersey or make any alteration or addition to the electric system of the Premises. Any changes requested by Tenant must be sent in writing to Landlord, and if, in the sole judgment of Landlord, such changes will not cause or create a dangerous or hazardous condition or damage or injury to the Building, or entail excessive or unreasonable alterations or repairs, or interfere with or disturb other tenants or occupants and/or the service then or thereafter to be supplied to tenants or occupants, Landlord will, at the sole cost and expense of Tenant, make such changes. Tenant shall pay Landlord for such reasonable costs and expenses within twenty (20) days of Tenant’s receipt of an invoice therefor.

6.3 Utility Deregulation. If permitted by law, Landlord will have the right to choose the service providers that deliver electricity to the Premises. Tenant shall cooperate with Landlord and such service providers, including granting reasonable access to the electric lines,

11

feeders, risers, wiring, and any other machinery within the Premises. If the law prohibits Landlord from choosing the service providers that deliver electricity to the Premises, then Tenant’s choice of such service providers is subject to Landlord’s prior written consent, which consent will not be unreasonably withheld or delayed, and no such service provider will be permitted to deliver service to or otherwise affect the Building’s electric system without such consent.

6.4 Landlord Not Liable. Landlord will not be responsible for any loss, damage or expenses, and Tenant will not be entitled to any rent abatement, diminution, setoff, or any other relief from its obligations hereunder, on account of any change in the quantity or character of the electric service or any cessation or interruption of the supply of electricity to the Premises.

6.5 Generator Rights. (a) Subject to compliance with Legal Requirements, Tenant shall have the right to install a back-up generator for the exclusive use of Tenant (“Tenant’s Generator”) on the Property in such location as may be approved by Landlord in its sole and absolute discretion, in accordance with the provisions of this Section 6.5. Tenant shall furnish to Landlord detailed plans and specifications for Tenant’s Generator, the associated fuel tank (which shall be located above-ground) or other fuel supply source required for the operation of Tenant’s Generator and all wires, lines, pipes, conduits and other apparatus in connection with Tenant’s Generator (collectively “Tenant’s Generator Equipment”) for Landlord’s prior approval, which approval shall not be unreasonably withheld, conditioned, or delayed. Upon approval of such plans and specifications for Tenant’s Generator Equipment, Tenant shall have the right to install Tenant’s Generator Equipment, at Tenant’s expense subject to Landlord’s reasonable supervision. Tenant shall comply with all Legal Requirements in connection with the installation, use, maintenance, and removal of Tenant’s Generator Equipment and Tenant shall keep the Premises, Building and Land free and clear from liens arising from or related to the installation, use, maintenance and repair thereof. Tenant shall be responsible for procuring whatever approvals, licenses or permits may be required for the installation, use and maintenance of Tenant’s Generator Equipment and the related support systems required for the installation and use of Tenant’s Generator Equipment. Landlord agrees that, at no cost to Landlord, it shall cooperate with Tenant in Tenant’s pursuit of any such approvals, licenses, or permits, which cooperation shall include executing any necessary owner’s consent forms. Upon termination or expiration of this Lease, Tenant may, at Tenant’s sole option, remove Tenant’s Generator Equipment, in which event Tenant shall repair and restore the Property and Building to the condition that existing prior to such installation, reasonable wear and tear and events of casualty and condemnation excepted. Landlord and Tenant shall cooperate reasonably in the design and location of routing for Tenant’s Generator(s). Tenant’s Generator(s) must at all times be independent of the Building’s electrical distribution system. Tenant shall supply its own emergency transfer switches in connecting Tenant’s Generator to its electrical system and shall not use the emergency switches existing in the Building.

(b) Tenant shall be responsible for all costs and expenses in connection with the use, operation and repair of Tenant’s Generator, including, without limitation, the cost of fuel necessary to operate Tenant’s Generator and all other utility costs in connection therewith. Tenant shall maintain and repair Tenant’s Generator in a commercially reasonable manner consistent with generators used in other buildings similar to the Building in the State of New Jersey.

12

ARTICLE 7

MAINTENANCE; ALTERATIONS; REMOVAL OF TRADE FIXTURES

7.1 Tenant’s Maintenance. Tenant shall, at its sole cost and expense, keep the Premises in good order and condition (except for ordinary wear and tear) and, except as provided in Section 7.2, shall make all non-structural repairs, alterations, renewals and replacements and shall take such other action as may be necessary or appropriate to keep and maintain the Premises in good order and condition. Except as expressly provided in this Lease, Landlord will not be obligated to maintain, alter or repair the Premises. All repairs made by Tenant must be at least equal in quality to the original work.

7.2 Landlord’s Repairs. Landlord, at its sole cost (but subject to inclusion in Landlord’s Operating Expenses as provided herein) shall make all repairs and replacements to the foundation, the bearing walls, the structural columns and beams, the exterior walls, the exterior windows and the roof of the Building, all mechanical, electrical, plumbing, HVAC systems within the Building (including, but not limited to the HVAC system serving the Premises and the duct distribution systems within the Premises) and Common Areas. Notwithstanding the foregoing, Tenant shall reimburse Landlord for the actual reasonable costs incurred by Landlord in repairing, maintaining and replacing the distribution systems and VAV boxes within the Premises (not on the roof) within thirty (30) days after Landlord has delivered to Tenant a written invoice for such costs, provided that no such payments shall be due to Landlord with respect to any claim covered by warranty. With respect to all other repairs and replacements which are Landlord’s responsibilities pursuant to this Section 7.2, the costs and expenses incurred by Landlord in connection with such repairs and replacements will be included in Landlord’s Operating Expenses to the extent permitted by the terms of this Lease; provided, that if such repairs and replacements (including repairs and replacements with respect to the Property) are necessitated by the intentional acts or negligence of Tenant or Tenant’s Visitors, then Tenant shall reimburse Landlord, upon demand, for the reasonable cost thereof and provided further that no such cost shall be charged to Tenant to the extent caused by the gross negligence or intentional misconduct of the Landlord or Landlord’s agents.

7.3 Requirements for Tenant’s Maintenance. All maintenance and repair, and each addition, improvement or alteration, performed by on behalf of Tenant must be (a) completed expeditiously in a good and workmanlike manner, and in compliance with all applicable Legal Requirements and Insurance Requirements, (b) completed free and clear of all Liens, and (c) performed in a manner and by contractors approved by Landlord to the extent such work involves any work to any electrical, mechanical, plumbing or other system of the Building, any work to the outside of the Building, any work to the roof of the Building or any work to any structural element of the Building.

7.4 (a) Permitted Alterations. Provided Tenant is not in default of any its obligations under this Lease, Tenant may, upon prior written notice to Landlord and submission to Landlord of plans and specifications therefor, make interior, non-structural additions, improvements or alterations to the Premises having an aggregate cost not to exceed $100,000.00 in any twelve (12) month period, so long as the same do not (i) require a building permit, (ii) affect, alter, interfere with or disrupt any of the electrical, mechanical, plumbing or other system of the Building, (iii) affect the outside appearance of the Building, (iv) affect the roof of the Building, or (v) affect any structural element of the Building.

13

(b) Landlord’s Consent to Alterations. Except as set forth in Section 7.4(a), Tenant shall not make any addition, improvement or alteration to the Land or Building. In addition, Tenant shall not make any addition, improvement or alteration of the Premises having an aggregate cost in excess of $100,000.00 or (i) requiring a building permit, (ii) affecting, altering, interfering with or disrupting any electrical, mechanical, plumbing or other system of the Building, or (iii) affecting the outside appearance of the Building, the roof of the Building, the ingress to or the egress from the Premises and/or any structural element of the Building (such work, “Major Work”), unless Tenant submits to Landlord detailed plans and specifications therefor and Landlord approves such plans and specifications in writing (which approval shall not be unreasonably withheld, conditioned or delayed). Tenant shall reimburse Landlord, upon demand, for its actual reasonable third party costs for reviewing any plans submitted by Tenant for any Major Work.

(c) Contractors. Notwithstanding anything contained in the Lease to the contrary, Landlord reserves the right to require Tenant to use Landlord’s designated engineers and contractors in connection with any Major Work affecting the outside appearance of the Building, the roof of the Building, the ingress to or the egress from the Premises and/or any structural element of the Building. With respect to any Major Work involving the electrical, mechanical, plumbing or other system of the Building, Tenant may use Tenant’s designated contractors subject to Landlord’s approval, which approval shall not be unreasonably withheld, conditioned or delayed.

7.5 (a) Surrender of Alterations. Each addition, improvement and alteration to the Premises (each a “Tenant Improvement”) will, upon installation, become the property of Landlord and be deemed to be a part of the Premises. Notwithstanding anything to the contrary contained in this Section 7.5, prior to the Termination Date, Tenant shall remove all Tenant Improvements that are specialty improvements or above standard improvements (i.e., raised flooring, built-in bookcases, wall coverings, kitchen equipment, supplemental mechanical or electrical equipment, all roof mounted or ground mounted telecommunications equipment, vaults, any other piece of heavy equipment, vertical penetrations created by Tenant, or any item of work performed by Tenant which is specific to the particular use of the Premises by Tenant, etc.) and all wires installed by Tenant for standard voice and telecommunication data equipment. Prior to the Termination Date, Tenant shall repair any damage to the Premises caused by such removal and shall restore the Premises to the condition existing prior to the installation of such Tenant Improvement.

(b) Removal of Improvements. Tenant may install in, and remove from, the Premises any trade equipment, machinery and personal property belonging to Tenant (such trade equipment, machinery and personal property will not become the property of Landlord), provided that (i) Tenant shall repair all damage caused by such installation or removal; (ii) Tenant shall not install any equipment, machinery or other items on the roof of the Building or make any openings in the roof except for approved Finish Work including the compressors for the refrigeration and freezer units located in the Premises; and (iii) Tenant shall not install any equipment, machinery or other items on the floor, walls or ceiling of the Premises that exceed the load bearing capacity or compromise the structural integrity of the floor, walls or ceiling of the Premises.

14

7.6 Utility Rooms. Tenant acknowledges and that (i) a portion of the Premises contains two utility rooms (the “Utility Rooms”) located on the westerly side of the Premises shown on Schedule B attached hereto, (ii) the Utility Rooms contains utility lines, risers, meters and panels which are used for the entire Building, in addition to the Premises, (iii) Tenant shall not perform any work or make any modifications to the Utility Rooms without Landlord consent, which may be withheld by Landlord in its reasonable, and (iv) in no event shall Tenant store any materials in the Utility Rooms or make or install any equipment which inhibit or obstruct Landlord ability to utilize the Building equipment described above

ARTICLE 8

USE OF PREMISES

8.1 Permitted Use. Tenant shall not use or permit the use of the Premises for any purpose other than the Permitted Use specified in the Basic Lease Provisions.

8.2 Prohibited Uses. Tenant shall not use or permit the use of the Premises in any manner or for any purpose or do, bring or keep anything, or permit anything to be done, brought or kept in the Premises that (a) violates any Legal Requirement or Insurance Requirement, (b) could overload the electrical or mechanical systems of the Building or exceed the design criteria, the structural integrity, character, appearance or fair market value of the Building, (c) in the reasonable judgment of Landlord, may impair or interfere with the proper and economic heating or air conditioning of the Building; or (d) in the reasonable judgment of Landlord, may interfere with the use or occupancy of any portion of the Building outside of the Premises by Landlord or any other tenant or occupant of the Building.

8.3 Dispensing Food. Landlord acknowledges that Tenant will be using a portion of the Premises as a “Test Kitchen” and therefore, Tenant shall be permitted to prepare and dispense food and beverages only in such area of the Premises. Tenant shall install, maintain and operate a venting system to ensure that no odors from its production of food and/or from the test kitchen area emanate outside of the Premises. In addition, Tenant shall maintain an extermination contract using a contractor approved by Landlord (which approval shall not be unreasonably withheld, conditioned, or delayed), and said contract shall provide routine preventative measures against potential vermin.

8.4 Parking. (a) Tenant will have the right during the term of this Lease to park up to the number of cars indicated in the Basic Lease Provisions in the parking area of the Property. Any of the following actions by Tenant and/or Tenant’s Visitors will be deemed a material default under this Lease: (i) the use of more parking spaces than the number indicated in the Basic Lease Provisions; (ii) parking in spaces designated for the exclusive use of other parties, (iii) parking outside of marked parking spaces, (iv) the maintenance, repair or cleaning of any vehicle in the parking area, and (v) the violation of any other parking rules and regulations promulgated by Landlord.

15

(b) Landlord will have no liability for any damage to vehicles on the Property or for any loss of property from within such vehicles, or for any injury suffered by Tenant’s employees or Tenant’s Visitors, except to the extent such loss, damage or injury is caused solely by Landlord’s negligence or willful misconduct. Tenant shall advise its employees, Tenant’s Visitors, and any subtenant’s employees of the requirements of this Section 8.4 and Tenant shall be responsible for compliance by such parties with such requirements. If Tenant or Tenant’s Visitors park illegally or in areas designated for use by others, or in driveways, fire lanes or areas not striped for general parking or otherwise violate any parking rules and regulations promulgated by Landlord, then Landlord may, at Tenant’s sole cost and expense, tow such vehicles away from the Property and/or attach violation notices to such vehicles. Any amount due from Tenant pursuant to this Article will be deemed Additional Rent and Tenant shall pay such amounts to Landlord upon demand. Landlord reserves the right, from time to time, to assign other Building tenants reserved parking spaces, and Tenant agrees to be bound thereby; however, Landlord agrees that it will not grant other Building tenants a proportionately more favorable ratio of reserved parking spaces than it has granted to Tenant.

8.5 Permits, Licenses and Authorizations. Tenant shall obtain and maintain in full force and effect, at its sole cost and expense, all permits, licenses or authorizations of any nature required in connection with the operation of Tenant’s business at the Premises.

ARTICLE 9

LANDLORD’S SERVICES

9.1 Landlord’s Services. Provided Tenant is not in default under any of the provisions of this Lease beyond applicable grace periods provided herein, Landlord shall furnish to Tenant the services set forth in this Article 9 (collectively “Building Services”) during Building Hours.

9.2 Heating and Air Cooling. Landlord shall install an HVAC system (in accordance with the specification set forth on Schedule D-2) to exclusively serve the Premises, which system shall be in the exclusive control of Tenant. Tenant shall operate such HVAC system in an appropriate manner in accordance with such system’s design specifications.

9.3 Water. Landlord shall furnish adequate hot and cold water at standard Building temperatures to the Building for drinking, lavatory, cooking and cleaning purposes (including for Tenant’s “Test Kitchen” located in the Premises), the cost of which shall be separately metered and charged to the Tenant. Tenant will pay the costs of such water use to Landlord within ten (10) days after the delivery of an invoice therefore.

9.4 Common Area Maintenance. Landlord shall furnish electrical lighting, cleaning, and maintenance, repair and replacements of the Common Areas of the Building and the Property.

9.5 Building Directory. At Tenant’s request, Landlord shall include Tenant’s name in the main Building directory. Tenant shall promptly reimburse Landlord for the cost of any changes made to such listing at Tenant’s request.

16

9.6 (a) Premises Cleaning. Landlord shall provide the janitorial services described on Schedule C attached hereto (“Janitorial Services”) five (5) days a week, provided the Premises are kept in reasonable order by Tenant. Janitorial Services will not be provided on Saturdays, Sundays or Building Holidays. Notwithstanding the foregoing, Landlord shall not, as part of its normal Janitorial Services, clean the “Test Kitchen” area of the Premises. Tenant shall contract directly with Landlord’s Janitorial Services contractor for the cleaning of the “Test Kitchen” area of the Premises and pay a separate charge for such cleaning directly to the Janitorial Services contractor.

(b) Special Cleaning Services. If Tenant requests special or more frequent cleaning and janitorial services (“Special Cleaning Services”), Landlord may, upon reasonable advance notice by Tenant, elect to furnish such Special Cleaning Services and Tenant shall pay to Landlord, within ten (10) days of being billed therefor, Landlord’s charge for providing such Special Cleaning Services. Special Cleaning Services include, but are not limited to the following: (i) cleaning of permitted eating facilities (if any), including the removal of garbage therefrom, (ii) cleaning of computer centers, including peripheral areas, and the removal of waste paper therefrom, (iii) cleaning of special equipment areas, kitchen areas, private toilets and locker rooms, medical centers and large scale duplicating rooms (if any), (iv) cleaning of areas of special security, such as storage units, (v) consumable supplies for private toilet rooms, (vi) cleaning of light fixtures, (viii) cleaning or shampooing of carpeting and the cleaning, waxing, refinishing and buffing of non-carpeted areas, (viii) stain removal, (ix) painting, (x) removal of any refuse in excess of the amount ordinarily accumulated in routine office occupancy, as determined by Landlord.

(c) Performance of Janitorial Services. Tenant shall grant Landlord’s cleaning personnel and contractors access to the Premises from and after 6:00 PM on weekdays and at any time on Saturdays, Sundays and Building Holidays for the purpose of performing the Janitorial Services. Tenant shall not hinder the performance of the Janitorial Services and, if Tenant does hinder the performance of the Janitorial Services, Landlord will have no liability to Tenant on account thereof. Tenant shall supply adequate waste receptacles, cabinets and bookcases to prevent unreasonable hardship to Landlord in discharging its obligations regarding Janitorial Services. If any Legal Requirement requires trash to be separated into different components before carting (e.g., office paper, computer paper, newspaper, cans and bottles), Tenant shall comply with such requirements and shall supply adequate receptacles for each such component at Tenant’s sole expense.

(d) Day Porter. Landlord shall provide a day porter to provide day-to-day maintenance for the Building.

9.7 Telecommunications. Subject to the Rules and Regulations of Landlord and any applicable telecommunications provider, Tenant will have access to the existing telecommunications system in the Building, if any. Tenant hereby acknowledges that the telecommunications system has been installed and is operated by a third-party provider, not Landlord. Landlord makes no representations or warranties with respect to the telecommunications system. Tenant acknowledges that telecommunications service may be suspended or reduced by reason of repairs, alterations, improvements, accidents, or other causes beyond the reasonable control of Landlord. Any such interruption or suspension of services will

17

not be deemed an eviction or disturbance of Tenant’s use and possession of the Premises, nor render Landlord liable to Tenant for damages by abatement of rent or otherwise, nor relieve Tenant of any of its obligations under this Lease. Tenant shall contract directly with the company providing telecommunications services to the Premises. Tenant shall pay all charges for telecommunications services before any interest or penalties are added thereto and shall furnish to Landlord, upon request, satisfactory proof of payment.

9.8 Interruption of Services. Landlord reserves the right to suspend the Building Services on account of fire, storm, explosion, strike, lockout, labor dispute, casualty or accident, acts of God, riot, war, terrorism, interference by civil or military authorities, or any other cause beyond Landlord’s control or for emergency, inspection, cleaning, repairs, replacement, alterations or improvements that Landlord reasonably deems desirable or necessary. Landlord shall use reasonable efforts to restore any Building Services suspended pursuant to this Section 9.9. Landlord will not be liable to Tenant for any costs, expenses or damages incurred by Tenant as a result of any failure to furnish any Building Services and such failure will not (i) be construed as a constructive eviction or eviction of Tenant, (ii) excuse Tenant from the performance of any of its obligations hereunder, or (iii) entitle Tenant to any abatement or offset against Basic Rent or Additional Rent. In addition, no deduction from Basic Rent or Additional Rent will be permitted on account of any Building Services used by Tenant.

9.9 Energy Conservation. Landlord and Tenant shall comply with all mandatory energy conservation controls and requirements imposed or instituted by the federal, state or local governments and applicable to office buildings, or as may be required to operate the Building as an office building comparable to equivalent facilities in the county in which the Property is located. These controls and requirements may include, without being limited to, controls on the permitted range of temperature settings in office buildings and curtailment of the volume of energy consumed or the hours of operation of the Building. Any terms or conditions of this Lease that conflict with such controls and requirements will be suspended for the duration of such controls and requirements. Compliance with such controls and requirements will not be considered an eviction, actual or constructive, of Tenant from the Premises and will not entitle Tenant to terminate this Lease or to an abatement of any Basic Rent or Additional Rent.

ARTICLE 10

COMPLIANCE WITH REQUIREMENTS

10.1 Compliance. Tenant shall (i) comply with all Legal Requirements and Insurance Requirements applicable to the Premises and Tenant’s use thereof, and (ii) maintain and comply with all permits, licenses and other authorizations required by any governmental authority for Tenant’s use of the Premises and for the proper operation, maintenance and repair of the Premises. Landlord shall, at no cost to Landlord, join in any application for any permit or authorization with respect to Legal Requirements if such joinder is necessary. If any structural repairs or replacements are required in order for Tenant to comply with its obligations under this Section 10.1, Landlord shall perform such repairs or replacements and Tenant shall, upon demand, reimburse Landlord for the costs and expenses incurred by Landlord in connection with such repairs or replacements.

18

10.2 Increases in Insurance Premiums. Tenant shall not do, or permit to be done, anything in or to the Premises, or keep anything in the Premises that increases the cost of any insurance maintained by Landlord. Tenant shall, upon demand, pay to Landlord any such increase in insurance premiums and any other costs incurred by Landlord as result of the negligence, carelessness or willful action of Tenant or Tenant’s Visitors.

10.3 Compliance with Legal Requirements. As of the date hereof, to Landlord’s knowledge, the Building is in compliance with all applicable Legal Requirements.

ARTICLE 11

COMPLIANCE WITH ENVIRONMENTAL LAWS

11.1 Environmental Laws. Tenant shall comply, at its sole cost and expense, with all Environmental Laws in connection with Tenant’s use and occupancy of the Premises; provided, however, that the provisions of this Article 11 will not obligate Tenant to comply with the Environmental Laws if such compliance is required solely as a result of the occurrence of a spill, discharge or other event before the Commencement Date, or if such spill, discharge or other event was not caused by the act, negligence or omission of Tenant or Tenant’s Visitors.

11.2 Copies of Environmental Documents. Tenant shall deliver promptly to Landlord a true and complete copy of any correspondence, notice, report, sampling, test, finding, declaration, submission, order, complaint, citation or any other instrument, document, agreement and/or information submitted to, or received from, any governmental entity, department or agency in connection with any Environmental Law relating to or affecting the Premises.

11.3 Hazardous Substances and Hazardous Wastes. Tenant shall not cause or permit any “hazardous substance” or “hazardous waste” (as such terms are defined in the ISRA) to be kept in the Premises, except for de minimus quantities of cleaning supplies, medicines and other materials used by Tenant in the ordinary course of its business and in accordance with all Legal Requirements. Tenant shall not engage in, or permit any other person or entity to engage in, any activity, operation or business in the Premises that involves the generation, manufacture, refining, transportation, treatment, storage, handling or disposal of hazardous substances or hazardous wastes.

11.4 (a) Discharge. If a spill or discharge of a hazardous substance or a hazardous waste occurs on or from the Premises, Tenant shall give Landlord immediate oral and written notice of such spill and/or discharge, setting forth in reasonable detail all relevant facts, including, without limitation, a copy of (i) any notice of a violation, or a potential or alleged violation, of any Environmental Law received by Tenant or any subtenant or other occupant of the Premises; (ii) any inquiry, investigation, enforcement, cleanup, removal, or other action instituted or threatened against Tenant or any subtenant or other occupant of the Premises; (iii) any claim instituted or threatened against Tenant or any subtenant or other occupant of the Premises; and (iv) any notice of the restriction, suspension, or loss of any environmental operating permit by Tenant or any subtenant or other occupant of the Premises. If a spill or discharge arises out of or relates to Tenant’s use and occupancy of the Premises, or if a spill or discharge is caused by the act, negligence or omission of Tenant or Tenant’s Visitors, then Tenant shall pay all costs and expenses relating to compliance with applicable Environmental Laws (including, without limitation, the costs and expenses of site investigations and the removal and remediation of such hazardous substance or hazardous waste).

19

(b) Landlord’s Cleanup Rights. Without relieving Tenant of its obligations under this Lease and without waiving any default by Tenant under this Lease, Landlord will have the right, but not the obligation, to take such action as Landlord deems necessary or advisable to cleanup, remove, resolve or minimize the impact of or otherwise deal with any spill or discharge of any hazardous substance or hazardous waste on or from the Premises. If a spill or discharge arises out of or relates to Tenant’s use and occupancy of the Premises, or if a spill or discharge is caused by the act, negligence or omission of Tenant or Tenant’s Visitors, then Tenant shall, on demand, pay to Landlord all costs and expenses incurred by Landlord in connection with any action taken in connection therewith by Landlord.

11.5 (a) ISRA. If Tenant’s operations at the Premises now or hereafter constitute an “Industrial Establishment” (as defined under ISRA) or are subject to the provisions of any other Environmental Law, then Tenant agrees to comply, at its sole cost and expense, with all requirements of ISRA and any other applicable Environmental Law to the satisfaction of Landlord and the governmental entity, department or agency having jurisdiction over such matters (including, but not limited to, performing site investigations and performing any removal and remediation required in connection therewith) in connection with (i) the occurrence of the Termination Date, (ii) any termination of this Lease prior to the Termination Date, (iii) any closure, transfer or consolidation of Tenant’s operations at the Premises, (iv) any change in the ownership or control of Tenant, (iv) any permitted assignment of this Lease or permitted sublease of all or part of the Premises or (v) any other action by Tenant which triggers ISRA or any other Environmental Law.

(b) Compliance with ISRA. Tenant further agrees to implement and execute all of the provisions of this section in a timely manner so as to coincide with the termination of this Lease or to coincide with the vacating of the Premises by Tenant at any time during the term of this Lease. In connection with subsection (a) above, if, with respect to ISRA, Tenant fails to obtain a no further action and covenant not to sue letter from the New Jersey Department of Environmental Protection or to otherwise comply with the provisions of ISRA prior to the Termination Date, or if, with respect to any other Environmental Law, Tenant fails to fully comply with the applicable provisions of such other Environmental Law prior to the Termination Date, Tenant will be deemed to be a holdover tenant and shall pay rent at the rate set forth in Section 24.3 and shall continue to diligently pursue compliance with ISRA and/or such other Environmental Law. Upon Tenant’s full compliance with the provisions of ISRA or of such other Environmental Law, Tenant shall deliver possession of the Premises to Landlord in accordance with the provisions of this Lease and such holdover rent shall be adjusted as of said date.

11.6 (a) Landlord’s ISRA Compliance. In connection with (i) any sale or other disposition of all or part of Landlord’s interest in the Premises, (ii) any change in the ownership or control of Landlord, (iii) any condemnation, (iv) any foreclosure or (v) any other action by Landlord which triggers ISRA or any other Environmental Law, Landlord shall comply, at its sole cost and expense, with all requirements of ISRA and such other applicable Environmental Law; provided, however, that if any site investigation is required as a result of Tenant’s use and

20

occupancy of the Premises or a spill or discharge of a hazardous substance or hazardous waste caused by the act, negligence or omission of Tenant or Tenant’s Visitors, then Tenant shall pay all costs associated with such site investigation and, if any removal and remediation is required as a result of a spill or discharge of a hazardous substance or hazardous waste caused by the act, negligence or omission of Tenant or Tenant’s Visitors, then Tenant shall, upon demand by Landlord, pay all costs associated with such removal and remediation.

(b) Tenant’s Cooperation. If, in order to comply with any Environmental Law, Landlord requires any affidavits, certifications or other information from Tenant, Tenant shall, at no charge to Landlord, deliver the same to Landlord within five (5) business days of Landlord’s request therefor.

11.7 Notices. If Landlord has given to Tenant the name and address of any holder of an Underlying Encumbrance, Tenant agrees to send to said holder a photocopy of those items given to Landlord pursuant to the provisions of Section 11.2.

11.8 Survival. Tenant’s obligations under this Article 11 shall survive the expiration or earlier termination of this Lease.

11.9 North American Industry Classification System. Tenant hereby represents and warrants to Landlord that Tenant’s operations at the Premises will at all times have the following North American Industry Classification System (“NAICS”) code: 311911.

11.10 Landlord’s Representations and Indemnification. Landlord represents that, to its knowledge, the Property is in compliance with all applicable Environmental Laws. Landlord shall indemnify, defend, and hold harmless Tenant from and against any and all liabilities, damages, claims, losses, judgments, causes of action, and reasonable costs and expenses (including the reasonable fees and expenses of counsel) that may be incurred by Tenant or threatened against Tenant, relating to or arising out of, hazardous substances or hazardous wastes that were located on the Property as of the Commencement Date, or were introduced onto the Property after the Commencement Date by the acts of Landlord or its agents.

11.11 Recycling Requirements. Landlord shall comply with all Legal Requirements regarding recycling and shall supply the necessary services to the Building for such compliance.

ARTICLE 12

DISCHARGE OF LIENS

Within twenty (20) days after receipt of notice thereof, Tenant shall discharge or bond over any Lien on the Premises, the Basic Rent, Additional Rent or any other sums payable under this Lease caused by or arising out of Tenant’s acts or Tenant’s failure to perform any obligation under this Lease.

ARTICLE 13

PERMITTED CONTESTS

Tenant may, by appropriate proceedings, contest the amount, validity or application of any Legal Requirement which Tenant is obligated to comply with or any Lien which Tenant is

21

obligated to discharge, provided that (a) such proceedings suspend the collection thereof, (b) no part of the Premises, Basic Rent or Additional Rent or any other sum payable hereunder is subject to loss, sale or forfeiture during such proceedings, (c) Landlord is not subject to any civil or criminal liability for failure to pay or perform, as the case may be, (d) Tenant furnishes such security as may be required in the proceedings or reasonably requested by Landlord, (e) such proceedings do not affect the payment of Basic Rent, Additional Rent or any other sum payable to Landlord hereunder or prevent Tenant from using the Premises for its intended purposes, and (f) Tenant notifies Landlord of such proceedings not less than ten (10) days prior to the commencement thereof and describes such proceedings in reasonable detail. Tenant shall conduct all such contests in good faith and with due diligence and shall, promptly after the determination of such contest, pay all amounts required to be paid by Tenant.

ARTICLE 14

INSURANCE; INDEMNIFICATION

14.1 (a) Tenant’s Insurance. Tenant shall obtain, and shall keep in full force and effect, the following insurance, with insurers that are authorized to do business in the State of New Jersey and are rated at least A (Class X) in Best’s Key Rating Guide:

(i) Commercial general liability insurance (including, during any period when Tenant is making alterations or improvements to the Premises, coverage for any construction on or about the Premises), against claims for bodily injury, personal injury, death or property damage occurring on, in or about the Premises in an amount per occurrence of not less than $5,000,000.00 combined single limit. If the policy covers other locations owned or leased by Tenant, then such policy must include an aggregate limit per location endorsement.

(ii) Special form (all risk) personal property insurance insuring all equipment, trade fixtures, inventory, fixtures and personal property located on or in the Premises with an agreed endorsement in an amount equal to the full replacement cost of such property.

(iii) Workers’ compensation insurance coverage for the full statutory liability of Tenant and employers’ liability insurance with a limit of not less than (x) $500,000 per accident for bodily injury by accident, (y) $500,000 policy limit by disease, and (z) $500,000 per employee for bodily injury by disease.

(iv) Business interruption insurance in such amounts as will reimburse Tenant for direct and indirect loss of earnings attributable to those events commonly insured against by reasonably prudent tenants and/or attributable to Tenant’s inability to access or occupy (all or part of) the Premises.

(v) Such other insurance as Landlord deems necessary and prudent or as may be required by any Lender or Master Landlord.

(b) Policy Requirements. The policies of insurance required to be maintained by Tenant pursuant to Section 14.1 must be reasonably satisfactory to Landlord and must be written as primary policy coverage and not contributing with, or in excess of, any coverage carried by Landlord. All policies must name as additional insureds (except for workers’ compensation insurance and business interruption insurance) Landlord, Lender, any parties

22

named by Landlord as having an interest in the Premises, and Tenant, as their respective interests may appear. All such policies (except for worker’s compensation insurance) must (i) provide that thirty (30) days’ prior written notice of suspension, cancellation, termination, modification, non-renewal or lapse or material change of coverage will be given to Landlord and that such insurance will not be invalidated by (x) any act or neglect of Landlord or Tenant or any owner of the Property, (y) any change in the title or ownership of the Property, or (z) occupation of the Premises for purposes more hazardous than are permitted by such policy, and (ii) not contain a provision relieving the insurer thereunder of liability for any loss by reason of the existence of other policies of insurance covering the Premises against the peril involved, whether collectible or not. All policies must include a contractual liability endorsement evidencing coverage of Tenant’s obligation to indemnify Landlord pursuant to Section 14.3. Tenant shall not self-insure for any insurance coverage required to be carried by Tenant under this Lease. The deductible for any insurance policy required hereunder must not exceed $500,000, so long as the Tenant named herein maintains EBITDA (as reported in its publically available financial statements) in excess of $100,000,000. If Tenant’s EBITDA does not exceed $100,000,000, then no deductible for any insurance policy required hereunder shall exceed $50,000. Tenant will have the right to provide the insurance coverage required under this Lease through a blanket policy, provided such blanket policy expressly affords coverage to the Premises and to Landlord as required by this Lease.

(c) Certificates of Insurance. Prior to the Commencement Date, Tenant shall deliver to Landlord original or duplicate policies or certificates evidencing all insurance Tenant is obligated to carry under this Lease. Within ten (10) days prior to the expiration of any such insurance, Tenant shall deliver to Landlord original or duplicate policies or certificates evidencing the renewal of such insurance. Tenant’s certificates of insurance must be on: (i) ACORD Form 27 with respect to property insurance, and (ii) ACORD Form 25-S with respect to liability insurance or, in each case, on successor forms approved by Landlord.

(d) No Separate Insurance. Tenant shall not obtain or carry separate insurance concurrent in form or contributing in the event of loss with that required by Section 14.1 unless Landlord and Tenant are named as insureds therein.

(e) Tenant’s Failure to Maintain Insurance. If Tenant fails to maintain the insurance required by this Lease, Landlord may, but will not be obligated to, obtain, and pay the premiums for, such insurance. Upon demand, Tenant shall pay to Landlord all amounts paid by Landlord pursuant to this Section 14.1(e).

14.2 Waivers. (a) Landlord hereby waives and releases Tenant, and Tenant hereby waives and releases Landlord, from any and all liabilities, claims and losses for which the released party is or may be held liable to the extent of any insurance proceeds received by the injured party.

(b) Each party hereto agrees to have included in its property insurance policies a waiver of the insurer’s right of subrogation against the other party. If such a waiver is not enforceable or is unattainable, then such insurance policy must contain either (i) an express agreement that such policy will not be invalidated if Landlord or Tenant, as the case may be, waives its right of recovery against the other party, or (ii) any other form for the release of

23

Landlord or Tenant, as the case may be. If such waiver, agreement or release is not obtainable from a party’s insurance company, then such party shall notify the other party of such fact and shall use its best efforts to obtain such waiver, agreement or release from another insurance company satisfying the requirements of this Lease.