UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

May 11, 2011

(Date of earliest event reported)

LABORATORY CORPORATION OF

AMERICA HOLDINGS

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

1-11353

|

13-3757370

|

||

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

358 South Main Street,

|

||||

|

Burlington, North Carolina

|

27215

|

336-229-1127

|

||

|

(Address of principal executive offices)

|

(Zip Code)

|

(Registrant’s telephone number including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ]

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 7.01

|

Regulation FD Disclosure

|

Summary information of the Company in connection with its Annual Meeting of Stockholders in Burlington, NC on May 11, 2011.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

LABORATORY CORPORATION OF AMERICA HOLDINGS

Registrant

|

By:

|

/s/ F. SAMUEL EBERTS III

|

|

|

F. Samuel Eberts III

|

||

|

Chief Legal Officer and Secretary

|

May 11, 2011

May 11, 2011

2011

Annual Meeting

of Stockholders

2

This slide presentation contains forward-looking

statements which are subject to change based on

various important factors, including without limitation,

competitive actions in the marketplace and adverse

actions of governmental and other third-party payors.

statements which are subject to change based on

various important factors, including without limitation,

competitive actions in the marketplace and adverse

actions of governmental and other third-party payors.

Actual results could differ materially from those

suggested by these forward-looking statements.

Further information on potential factors that could

affect the Company’s financial results is included in

the Company’s Form 10-K for the year ended

December 31, 2010, and subsequent SEC filings.

suggested by these forward-looking statements.

Further information on potential factors that could

affect the Company’s financial results is included in

the Company’s Form 10-K for the year ended

December 31, 2010, and subsequent SEC filings.

Forward Looking Statement

Introduction

3

Leading National Lab Provider

• Fastest growing national lab

• $55 Billion market

• Clinical, Anatomic and Genomic Testing

• Serving clients in all 50 states and Canada

• Leading clinical trials testing business

Mission Statement

4

We Will Offer The Highest Quality

Laboratory Testing and Most

Compelling Value to Our

Customers

Laboratory Testing and Most

Compelling Value to Our

Customers

We Will Execute This Mission

Through Our Five Pillar Strategy

Through Our Five Pillar Strategy

Five Pillar Strategy

Pillar One

5

Deploy Cash to Enhance

Footprint and Test Menu

and to Buy Shares

Footprint and Test Menu

and to Buy Shares

Five Pillar Strategy—Pillar One

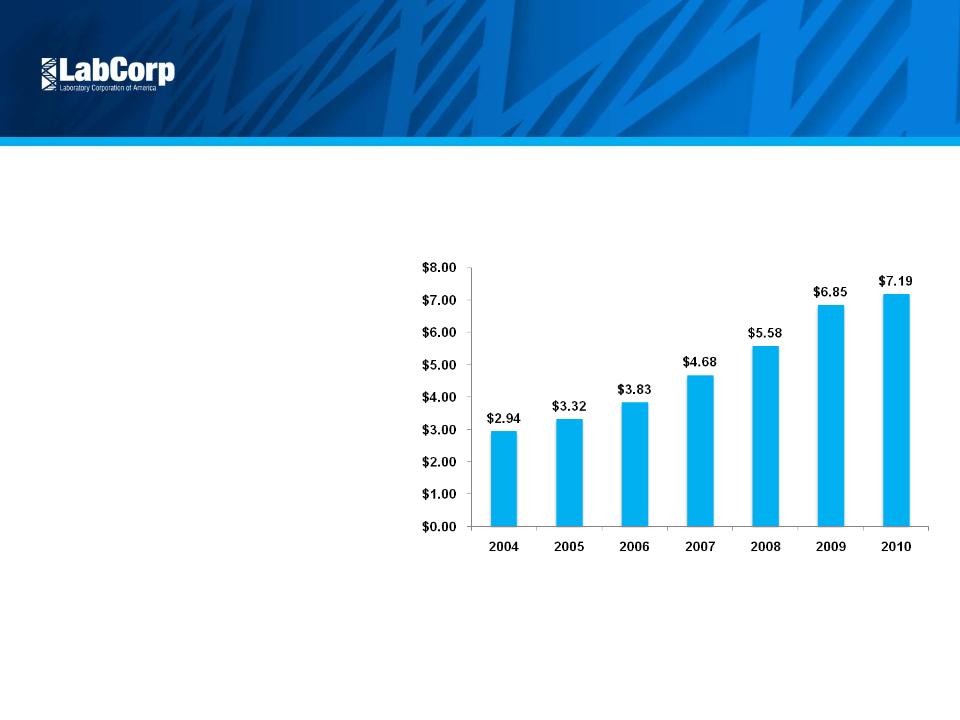

Impressive FCF Trend

Free Cash Flow Per Share

• 6-year FCF Per Share CAGR of 16.1%

• FCF Yield ranged from approximately

8% to 10% in 2010

Note: Free Cash Flow Per Share and Free Cash Flow Yield are non-GAAP metrics

FCF Yield range noted above was calculated using trailing twelve month Free Cash Flow, weighted average diluted share

counts and closing stock prices during 2010

counts and closing stock prices during 2010

6

Five Pillar Strategy—Pillar One

Key Uses of Cash

7

Key Uses of Cash

• Acquisitions

• Genzyme GeneticsSM*

• Westcliff (LabWest, Inc)

• DCL

• Share Repurchase

• $337.4 million in 2010

• $265.0 million in Q1 of 2011

*GENZYME GENETICSSM and its logo are trademarks of Genzyme

Corporation and used by Esoterix Genetic Laboratories, LLC, a wholly

-owned subsidiary of LabCorp, under license. Esoterix Genetic

Laboratories and LabCorp are operated independently from Genzyme

Corporation.

Corporation and used by Esoterix Genetic Laboratories, LLC, a wholly

-owned subsidiary of LabCorp, under license. Esoterix Genetic

Laboratories and LabCorp are operated independently from Genzyme

Corporation.

Five Pillar Strategy—Pillar One

Genzyme Genetics Aquisition

8

Acquisition Rationale

• Creates the premier genetics and

oncology business in the industry

• Builds on our strategy of leadership in

personalized medicine

• Generates revenue opportunities

• Selling LabCorp’s test menu to

Genzyme Genetics accounts

• Selling Genzyme Genetics’ test menu to

LabCorp accounts

• Genzyme Genetics customer access to

LabCorp’s convenient PSC network

• Expanded use of genetic counselors

• Creates cost synergies

• Logistics

• Specimen collection

• G&A

• Facility overlap

9

Five Pillar Strategy

Pillar Two

Enhance IT Capabilities

To Improve Physician

and Patient Experience

To Improve Physician

and Patient Experience

10

Five Pillar Strategy

Pillar Three

Continue to Improve

Efficiency to Offer the

Most Compelling Value

in Laboratory Services

Efficiency to Offer the

Most Compelling Value

in Laboratory Services

11

Five Pillar Strategy

Pillar Four

Scientific Innovation At

Appropriate Pricing

Appropriate Pricing

12

Five Pillar Strategy

Pillar Five

Alternative Delivery

Models

Models

Note: During both the first quarter of 2010 , inclement weather reduced Adjusted EPS by approximately eight cents.

13

Fourth Quarter and Full Year 2010 Results

|

|

Three Months Ended Dec 31,

|

|

|

|

|

|

Twelve Months Ended Dec 31,

|

|

|

|

|

||||

|

|

2010

|

|

2009

|

|

+/(-)

|

|

|

|

2010

|

|

2009

|

|

+/(-)

|

|

|

|

Revenue

|

$1,295.40

|

|

$1,165.10

|

|

11.2%

|

|

|

|

$5,003.90

|

|

$4,694.70

|

|

6.6%

|

|

|

|

Adjusted Operating Income (1)

|

$252.40

|

|

$221.90

|

|

13.7%

|

|

|

|

$1,016.50

|

|

$954.90

|

|

6.5%

|

|

|

|

Adjusted Operating Income Margin (1)

|

19.5%

|

|

19.0%

|

|

50

|

bp

|

|

20.3%

|

|

20.3%

|

|

-

|

bp

|

||

|

Adjusted EPS (1)

|

$1.34

|

|

$1.16

|

|

15.5%

|

|

|

|

$5.55

|

|

$4.89

|

|

13.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Cash Flow

|

$259.20

|

|

$224.70

|

|

15.4%

|

|

|

|

$883.60

|

|

$862.40

|

|

2.5%

|

|

|

|

Less: Capital Expenditures

|

($32.80)

|

|

($37.60)

|

|

-12.8%

|

|

|

|

($126.10)

|

|

($114.70)

|

|

9.9%

|

|

|

|

Free Cash Flow

|

$226.40

|

|

$187.10

|

|

21.0%

|

|

|

|

$757.50

|

|

$747.70

|

|

1.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and…

4th Quarter 2010 Customer Satisfaction levels were the highest in LabCorp history.

(1) Non-GAAP measure

Note: During both the first quarter of 2010 and the first quarter of 2011, inclement weather reduced Adjusted EPS Excluding Amortization

by approximately eight cents.

14

First Quarter 2011 Results

|

|

Three Months Ended Mar 31,

|

|

|

|

||

|

|

2011

|

|

2010

|

|

+/(-)

|

|

|

Revenue

|

$ 1,368.4

|

|

$ 1,193.6

|

|

14.6%

|

|

|

Adjusted Operating Income1

|

$ 263.7

|

|

$ 243.5

|

|

8.3%

|

|

|

Adjusted Operating Income Margin1

|

19.3%

|

|

20.4%

|

|

-110

|

bp

|

|

Adjusted EPS Excluding Amortization1

|

$ 1.52

|

|

$ 1.40

|

|

8.6%

|

|

|

|

|

|

|

|

|

|

|

Operating Cash Flow

|

$ 215.3

|

|

$ 232.0

|

|

-7.2%

|

|

|

Less: Capital Expenditures

|

$ (29.4)

|

|

$ (24.5)

|

|

20.0%

|

|

|

Free Cash Flow

|

$ 185.9

|

|

$ 207.5

|

|

-10.4%

|

|

|

|

|

|

|

|

|

|

|

(1) Non-GAAP measure

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15

Supplemental Financial Information

|

Laboratory Corporation of America

|

||||||||||||||||||

|

Other Financial Information

|

||||||||||||||||||

|

FY 2009, FY 2010 and Q1 2011

|

||||||||||||||||||

|

($ in millions)

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 09

|

|

Q2 09

|

|

Q3 09

|

|

Q4 09

|

|

Q1 10

|

|

Q2 10

|

|

Q3 10

|

|

Q4 10

|

|

Q1 11

|

|

Bad debt as a percentage of sales

|

|

5.3%

|

|

5.3%

|

|

5.3%

|

|

5.3%

|

|

5.0%

|

|

4.8%

|

|

4.8%

|

|

4.7%

|

|

4.7%

|

|

Days sales outstanding1

|

|

52

|

|

50

|

|

48

|

|

44

|

|

46

|

|

45

|

|

44

|

|

46

|

|

47

|

|

A/R coverage (Allow. for Doubtful Accts. / A/R)2

|

|

19.5%

|

|

20.6%

|

|

21.9%

|

|

23.2%

|

|

21.7%

|

|

20.7%

|

|

20.4%

|

|

18.5%

|

|

19.4%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Excluding the impact from Genzyme Genetics, DSO was 43 days in Q4 of 2010 and 45 days in Q1 of 2011

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(2) Excluding the impact from Genzyme Genetics, A/R Coverage was 19.9% in Q4 of 2010 and 20.4% in Q1 of 2011

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

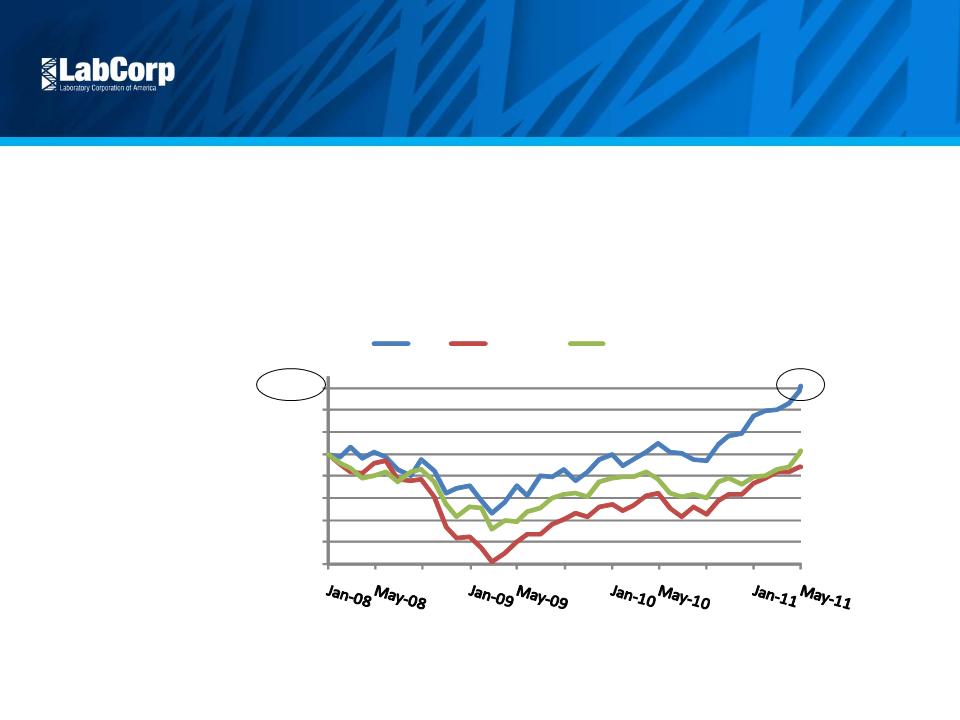

Stock Performance

16

Note: Period measured is from January 2008 2nd - May 2nd, 2011

Source: First Call

Superior Three-Year Return

• LabCorp shares up 31.0%

• S&P Healthcare Index up 1.4%

• S&P 500 Index down 5.9%

-

50.0%

-

40.0%

-

30.0%

-

20.0%

-

10.0%

0.0%

10.0%

20.0%

30.0%

Stock Performance: January 2008

-

Present

LH

S&P 500

S&P 500 Healthcare

Key Points

• Critical position in health care delivery

system

system

• Attractive market

• Consistent strategy

• Excellent cash flow deployed to enhance

strong competitive position

strong competitive position

• IT innovation to improve physician and

patient experience

patient experience

• Most efficient provider delivering greatest

value

value

• Scientific leadership

• Alternative delivery models

• Track record of execution and success

Conclusion

17

©2010 LabCorp. All rights reserved. 6967-0409