Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Encore Bancshares Inc | d8k.htm |

Gulf

South Bank Conference May 10, 2011 |

2

Forward-Looking Statements

This

presentation

may

include

forward-looking

statements.

These

forward-looking

statements

include

comments

with

respect

to

assumptions

relating

to

projected

growth,

earnings,

earnings

per

share,

capital

levels

and

ratios

and

other

financial

performance

measures,

as

well

as

management’s

short-term

and

long-term

performance,

trends,

anticipated

effects

on

results

of

operations

or

financial

condition

from

recent

and

expected

developments

or

events

relating

to

business

and

growth

strategies

and

any

other

statements,

projections

or

assumptions

that

are

not

historical

facts.

These

statements

are

based

upon

Encore

Bancshares,

Inc.’s

current

expectations

and

beliefs.

However,

these

forward-looking

statements

are

based

on

assumptions

and

are

subject

to

known

and

unknown

risks,

and

uncertainties.

Factors

that

could

cause

actual

results,

performance

or

achievements,

to

differ

materially

from

anticipated

or

projected

results,

performance

or

achievements

expressed

or

implied

by

these

forward-looking

statements

are

described

under

“Risk

Factors”

in

the

Company’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2010

and

other

reports

and

documents

filed

by

the

Company

from

time

to

time

with

the

SEC.

You

should

not

place

undue

reliance

on

any

forward-looking

statements.

These

statements

speak

only

as

of

the

date

the

statement

is

made.

The

Company

undertakes

no

obligation

to

publicly

update

or

revise

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events,

changed

circumstances

or

any

other

reason

after

the

date

the

statement

is

made. |

3

Encore Profile

Businesses:

Community Bank,

Wealth Management and Insurance

Headquarters:

Houston, Texas

Total Assets:

$1.5 billion

Total Loans:

$0.9 billion

Total Deposits:

$1.0 billion

Assets Under Management:

$2.9 billion

Total Equity:

$168 million

Tier 1 Risk-Based Capital:

13.05%

Private Client Offices:

11*

* Additional private client office expected to be opened Q3 2011.

|

4

Current Position

•

Emerging profitability

•

Improving net interest margin

•

Improving asset quality

•

Building Houston franchise

•

Growing fee-based businesses

•

Solid capital |

5

Quarterly Income Statement

Three Months Ended

Mar 31,

2011

2010

Net interest income

11,095

$

11,490

$

Provision for loan losses

2,170

4,960

Noninterest income

7,066

6,909

Noninterest expense

14,355

18,264

Net earnings (loss) before taxes

1,636

(4,825)

Income taxes

484

(2,574)

Net earnings (loss)

1,152

$

(2,251)

$

Earnings (loss) available to common

594

$

(2,807)

$

Diluted earnings (loss) per share

0.05

$

(0.27)

$

$ in thousands, except diluted earnings per share |

6

Total Revenue

$ in millions

*

Revenue excludes gain on sale of branches.

$6.9

$6.8

$7.0

$7.3

$7.1

$11.5

$10.9

$11.0

$11.1

$11.1

$0

$5

$10

$15

$20

1Q10

2Q10 *

3Q10

4Q10 *

1Q11

Net Interest Income

Noninterest Income

$18.4

$17.7

$18.0

$18.4

$18.2 |

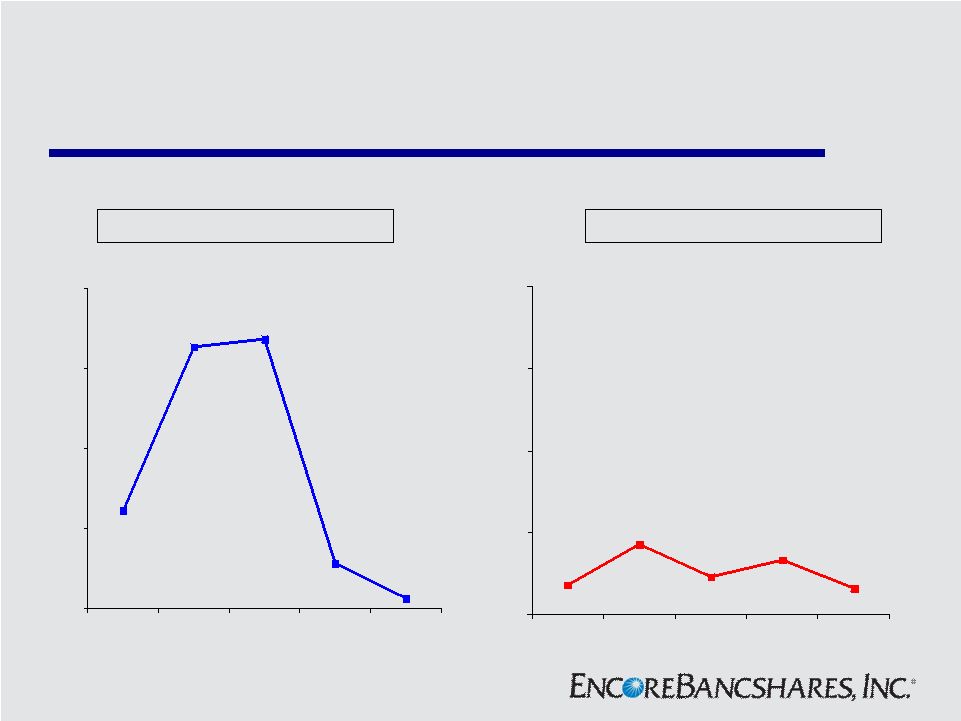

7

Net Interest Income *

$11.2

$11.2

$11.1

$11.1

$11.6

3.37%

2.89%

2.83%

2.92%

3.11%

$0

$6

$12

$18

$24

1Q10

2Q10

3Q10

4Q10

1Q11

0.0%

0.9%

1.8%

2.7%

3.6%

Net Interest Income

Net Interest Margin

$ in millions

*

On

taxable

–

equivalent

basis. |

8

Noninterest Expense

$8.7

$8.5

$8.5

$8.6

$8.6

$5.7

$11.7

$12.2

$10.8

$9.7

$0

$6

$12

$18

$24

1Q10

2Q10

3Q10

4Q10

1Q11

Personnel expense

Non-personnel expense

$ in millions

$18.3

$19.4

$20.7

$20.2

$14.4 |

9

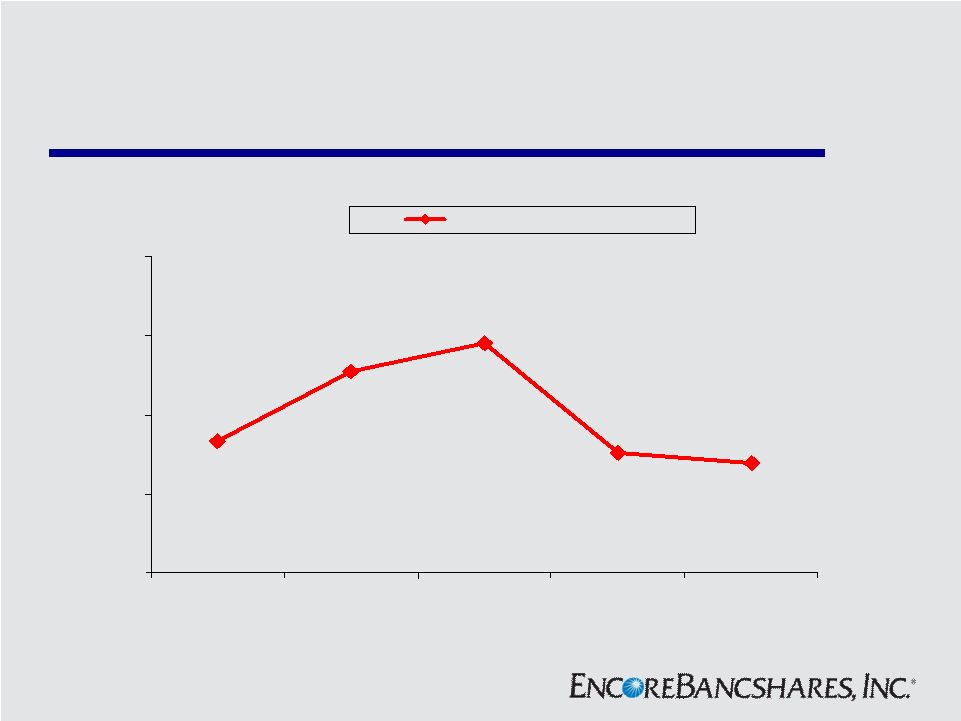

Delinquent Loans *

$33.5

$51.0

$58.0

$27.8

$30.5

$0

$20

$40

$60

$80

1Q10

2Q10

3Q10

4Q10

1Q11

Total delinquent loans

$ in millions

* Represents the legal loan balance of loans 30 days or more past due.

|

10

Non-Performing Assets

$ in millions

$11.1

$13.6

$10.8

$9.3

$7.3

$27.7

$26.5

$51.7

$64.2

$40.7

$0

$20

$40

$60

$80

1Q10

2Q10

3Q10

4Q10

1Q11

Nonaccrual loans

Investment in real estate

$51.8

$77.8

$62.5

$35.8

$35.0 |

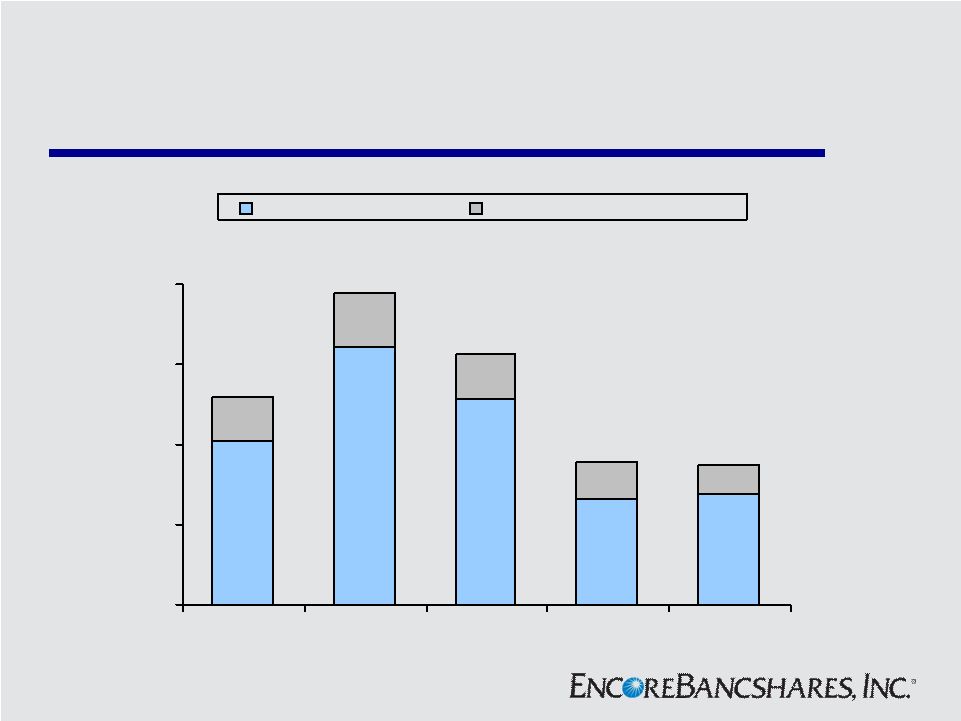

11

Net Charge-offs

$4.9

$13.5

$0.5

$2.3

$13.1

$0

$4

$8

$12

$16

1Q10

2Q10

3Q10

4Q10

1Q11

$ in millions

Commercial Net Charge-offs

$1.5

$3.4

$1.8

$2.7

$1.3

$0

$4

$8

$12

$16

1Q10

2Q10

3Q10

4Q10

1Q11

Consumer Net Charge-offs |

12

Building Houston Franchise

•

Take advantage of market disruptions

•

Utilize strong team of experienced commercial and

private bankers

•

Leverage local decision making and local contacts

•

Continue to grow DDA deposits and commercial loan

portfolio |

13

Houston Market

•

4

th

largest city; 6

th

largest MSA

•

Unemployment rate of 8.3% vs. 9.2% for U.S.*

•

Population growth ranked 2

nd

in the nation between

2000 and 2009

•

Second largest U.S. port based on tonnage

•

Texas entered recession a year later; exiting at the

same time

*

Not seasonally adjusted.

Source: Greater Houston Partnership; U.S. Dept. of Labor

|

14

Houston Deposit Market Share

# of Branches

$ in Millions

Market Share %

1

JP Morgan Chase (NY)

216

41,181

$

30.01%

2

Wells Fargo (CA)

237

14,798

10.78%

3

Bank of America (NC)

119

9,755

7.11%

4

Zions (Amegy) (UT)

83

8,577

6.25%

5

BBVA (Spain)

79

7,831

5.71%

6

Comerica *

67

4,658

3.39%

7

Prosperity

56

3,039

2.21%

8

Capital One (VA)

51

2,365

1.72%

9

Woodforest

106

2,351

1.71%

10

Frost

28

2,304

1.68%

11

Regions (AL)

27

1,519

1.11%

12

Bank of Texas (OK)

15

1,379

1.00%

13

Encore

11

1,033

0.75%

June 30, 2010

* Combined with Sterling Bank.

Source: FDIC Bank Data & Statistics |

15

Houston Market

Includes additional private client office expected to be opened Q3 2011.

|

16

Texas Loans

$ in millions

$345

$367

$335

$320

$308

$537

$524

$557

$566

$560

$0

$300

$600

$900

$1,200

1Q10

2Q10

3Q10

4Q10

1Q11

Commercial loans

Consumer loans

$868

$886

$892

$882

$891 |

17

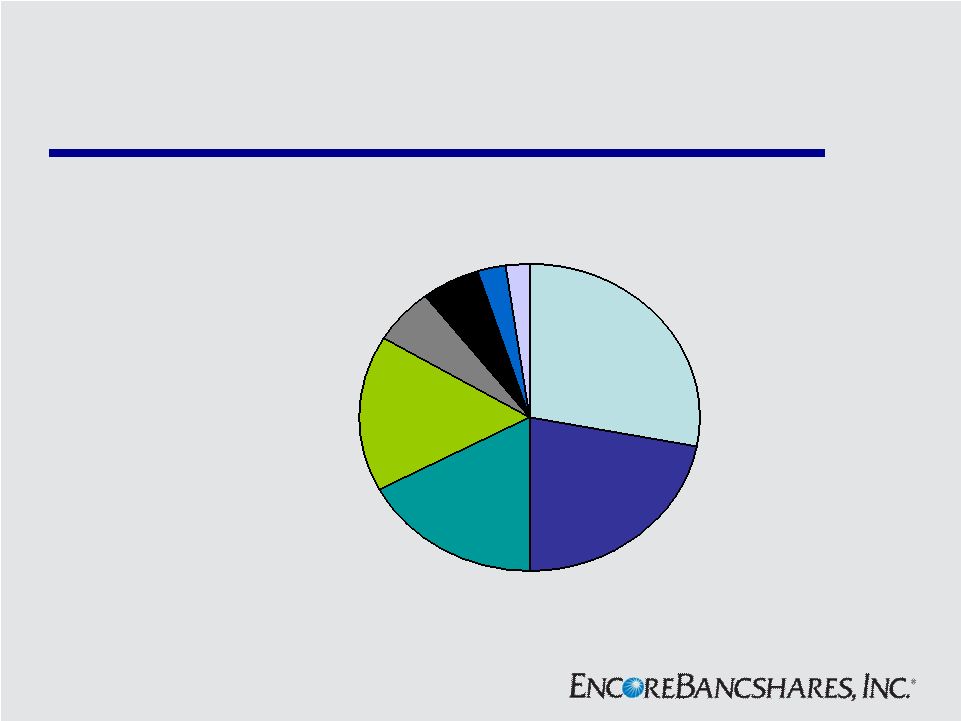

Loan Portfolio

Residential 2nd

lien

28.0%

Home equity

lines

5.9%

Consumer

2.4%

Construction

5.4%

Commercial

17.3%

Residential

1st lien

21.9%

FL Retained

2.7%

Commercial

real estate

16.4%

Excludes held-for-sale of $2.9 million.

|

18

Residential Loan Portfolio

$0

$100

$200

$300

$400

1Q10

2Q10

3Q10

4Q10

1Q11

1st SBO

1st Mortgage

PMT

HELOC/Others

$211

$358

$216

$357

$207

$344

$205

$323

$ in millions

$330

$206 |

19

Residential Loan Delinquency |

20

Texas Deposits

$ in millions

$803

$833

$838

$830

$821

$156

$183

$206

$220

$220

$0

$300

$600

$900

$1,200

1Q10

2Q10

3Q10

4Q10

1Q11

Interest-bearing deposits

Noninterest-bearing deposits

$959

$1,016

$1,044

$1,050

$1,041 |

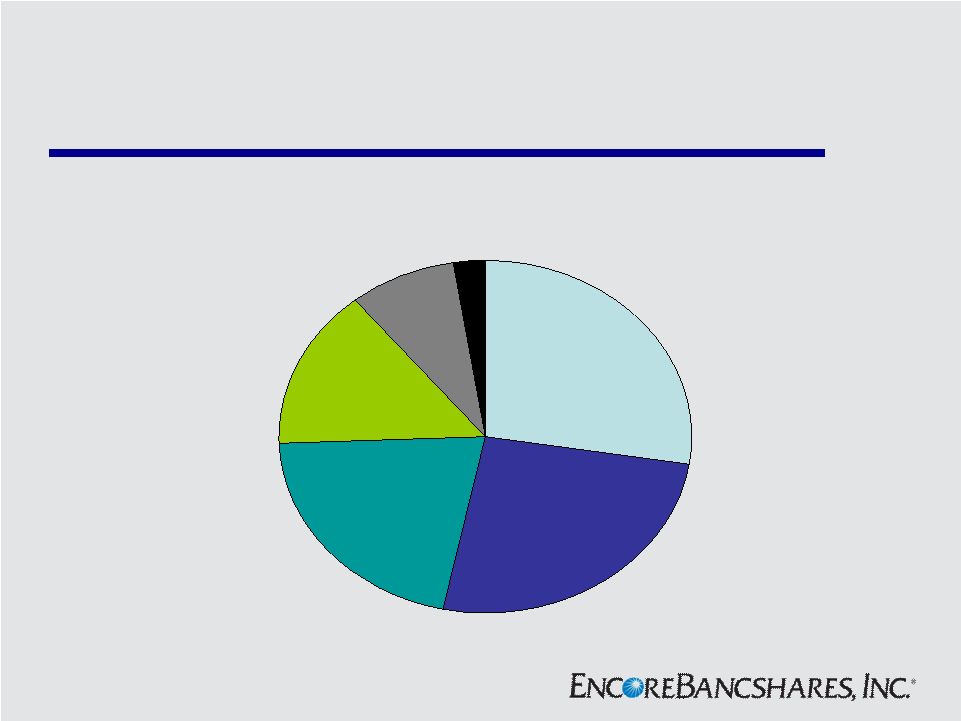

21

Deposit Mix

Money market

and savings

27.4%

Noninterest-

bearing deposits

21.1%

Interest checking

14.9%

CDs under

$250,000

25.8%

CDs over

$250,000

8.3%

Brokered

deposits

2.5% |

22

Wealth Management

$2.8

$2.7

$2.9

$2.9

$2.6

$0

$1

$2

$3

$4

1Q10

2Q10

3Q10

4Q10

1Q11

Assets Under Management

$ in Billions |

23

Wealth Management

$4.7

$4.7

$5.2

$5.1

$4.6

$0

$2

$4

$6

$8

1Q10

2Q10

3Q10

4Q10

1Q11

Revenues

$ in Millions |

24

Insurance Commissions

$1.6

$1.5

$1.1

$1.4

$1.5

$0

$1

$2

$3

$4

1Q10

2Q10

3Q10

4Q10

1Q11

Commissions

$ in Millions |

25

Solid Capital

3/31/2011

TCE/ Tangible Assets

6.91%

Leverage Ratio

9.29%

Tier 1 RBC

13.05%

Tier 1 Common RBC

8.08%

Allowance for Loan Losses/ Total Loans *

2.03%

* Excludes loans held-for-sale of $2.9 million.

|

26

Investment Considerations

•

Solid capital position

•

Improving asset quality

•

Capacity for loan growth

•

Attractive market valuation relative to peers

•

High margin fee-based businesses

•

Desirable Houston franchise |

27

Non-GAAP Financial Measures

March 31, 2011

Shareholders' equity (GAAP)

167,914

$

Less: Preferred stock

29,633

Goodwill and other intangible assets, net

40,374

Tangible common equity (1)

97,907

$

Total assets (GAAP)

1,458,181

$

Less: Goodwill and other intangible assets, net

40,374

Tangible assets

1,417,807

$

(1)

Tangible

common

equity,

a

non-GAAP

financial

measure,

includes

total

equity,

less

preferred

equity,

goodwill

and

other

intangible

assets.

Management

reviews

tangible

common

equity

along

with

other

measures

of

capital

as

part

of

its

financial

analyses

and

has

included

this

information

because

of

current

interest

on

the

part

of

market

participants

in

tangible

common

equity

as

a

measure

of

capital.

The

methodology

of

determining

tangible

common

equity

may

differ

among

companies.

$ in Thousands |