Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CenterState Bank Corp | d8k.htm |

Investor Presentation

First Quarter 2011

Exhibit 99.1 |

This presentation contains forward-looking statements, as defined by Federal

Securities Laws, relating to present or future trends or factors affecting

the operations, markets and products

of

CenterState

Banks,

Inc.

(CSFL).

These

statements

are

provided

to

assist

in

the

understanding of future financial performance. Any such statements are based on

current expectations and involve a number of risks and uncertainties. For a

discussion of factors that may cause such forward-looking statements to

differ materially from actual results, please refer to CSFL’s most

recent Form 10-Q and Form 10-K filed with the Securities Exchange

Commission. CSFL undertakes no obligation to release revisions to these

forward-looking statements or reflect events or circumstances after the

date of this presentation. Forward Looking Statement

2 |

Corporate Overview

Headquartered in Davenport, FL

$2.2 billion in assets

$1.2 billion in loans

$1.9 billion in deposits

Company formed: June 2000

2 Subsidiary Banks; 59 locations

3

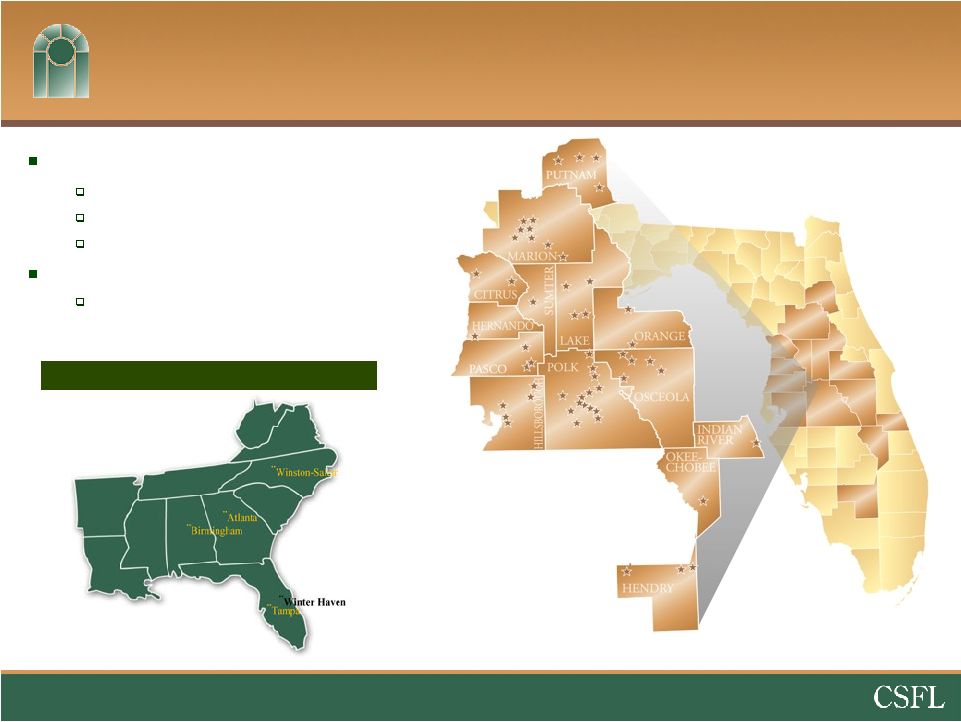

Correspondent Banking market |

4

2010 Initiatives

Vero Beach Office

Opened May 2010

$40 million in deposits

$13 million in loans

1,280 new accounts

Okeechobee Office

Opened June 2010

$26 million in deposits

1,531 new accounts

Wealth Management

Joe Keating and team on board May of 2010

$109 million of new assets under management

3 FDIC Acquisitions

Total assets acquired –

$371MM

Stable core deposits

Performing to model

Delayed systems conversion |

5

2011 Initiatives

TD Transaction

Acquired 4 branches in Putnam County, FL –

January 20, 2011

Acquired $121 million in loans and $115 million in deposits

$11 million bargain purchase gain

Credit Protection –

2 year “Put Back”

agreement with TD Bank

Core Processing System Conversions

All 4 Legacy Bank conversions completed

3 FDIC Banks slated for Third Quarter 2011

Evaluating Acquisition Opportunities

FDIC

Branch P&A –

TD acquisition

Whole banks |

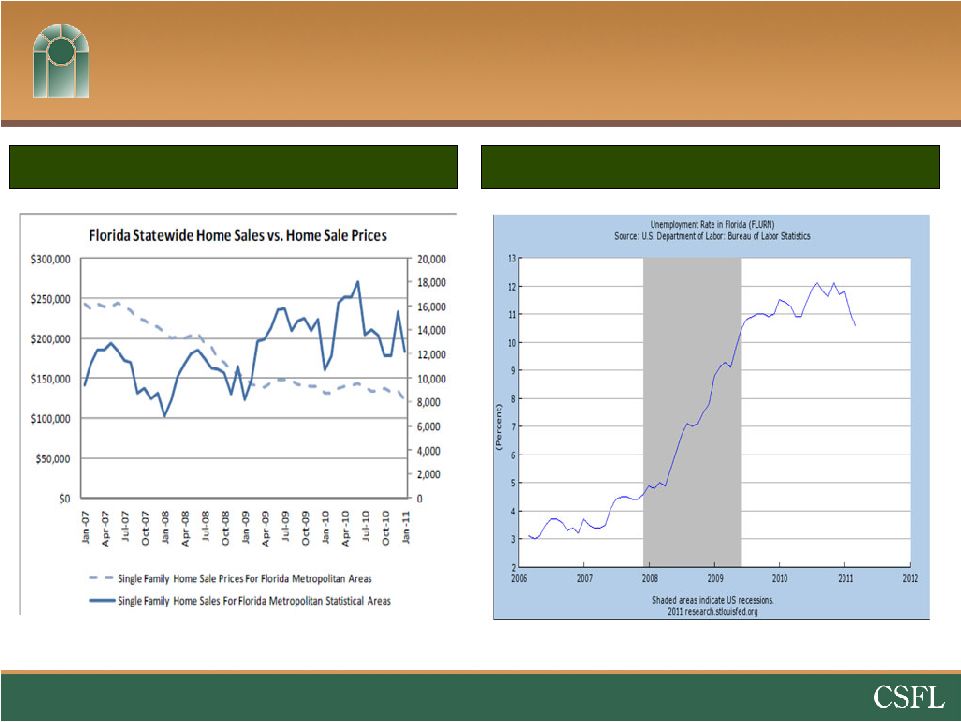

Florida Economy Slowly Recovering

6

Source:

Sterne,

Agee

and

Leach,

Inc.

and

the

US

Department

of

Labor

Home Prices Flat

Unemployment Down in 1Q |

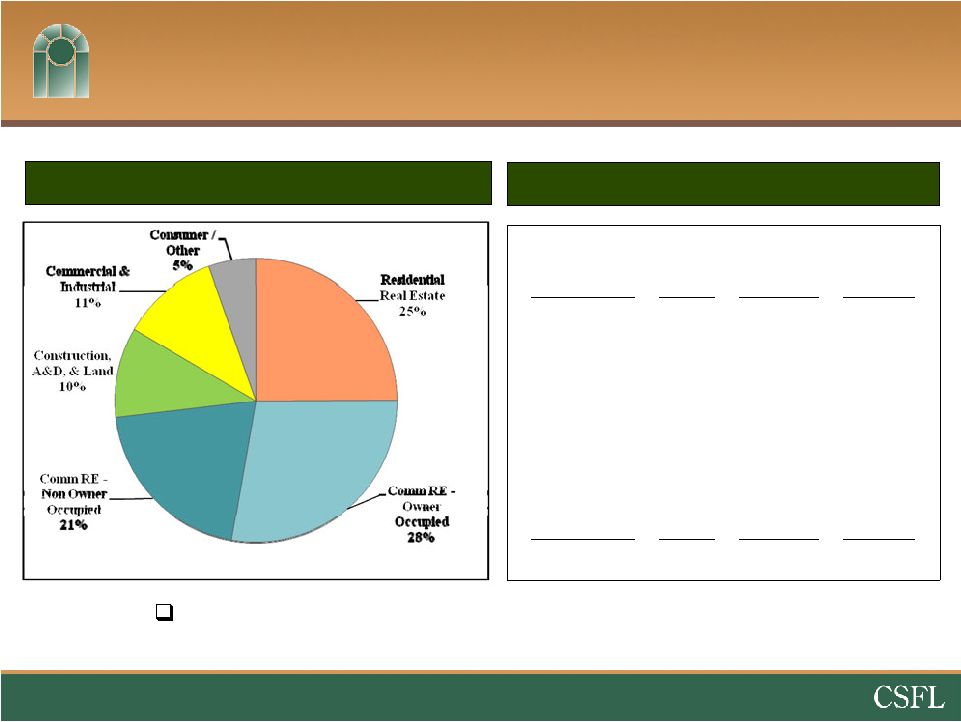

Loan Portfolio

(excluding FDIC Covered Loans)

Total Loans by Type (%)

Total Loans Detail

7

Loan Type

No. of

Loans

03/31/11

Balance

Avg Loan

Balance

Residential Real

Estate

3,006

$259MM

$86,000

Commercial

Real Estate

1,431

501MM

350,000

Construction,

A&D, & Land

590

107MM

181,000

Commercial &

Industrial

1,045

116MM

111,000

Consumer

/Other

3,399

56MM

16,000

Total

9,471

$1,039MM

$110,000

Includes $115MM of loans purchased from TD Bank which are

subject to a 2 year “Put Back”

option . |

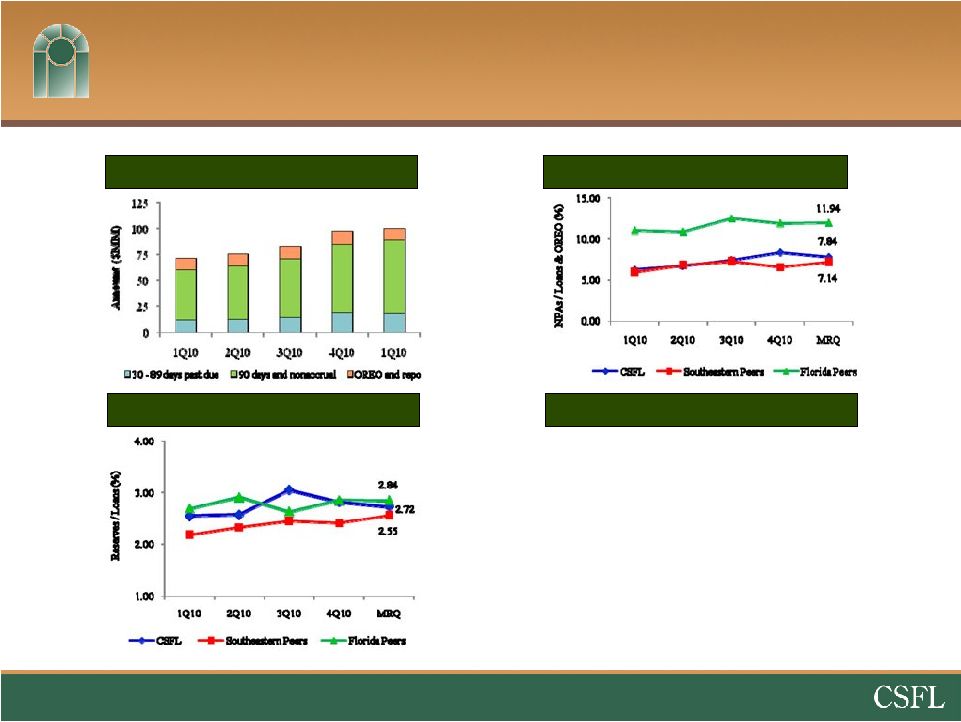

Credit Quality Trends

NPAs / Loans & OREO (%)

Credit Cycle Burn Down

Problem Loan Trends ($MM)

Reserves / Loans (%)

8

Source: SNL Financial

Nonperforming assets include 90 days or more past due.

Florida peers include publicly traded banks and thrifts headquartered in

Florida. Southeastern peers include publicly traded financial

institutions located in AL, AR, FL, GA, MS, NC, SC, TN VA, and WV with total assets between $2 and $5 billion.

Since 12-31-07, 8.1% of the

loan portfolio balance has

been expensed as a write

down or elevated reserves. |

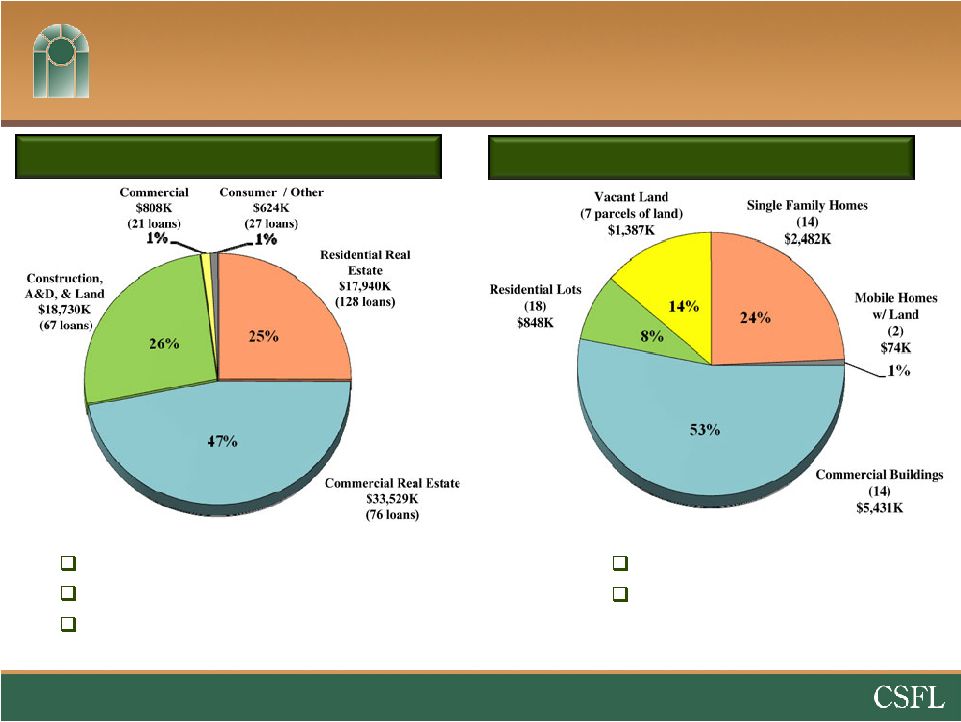

Non-Performing Loans

Other Real Estate Owned

$71,631,000 (6.89% of Gross Loans,)

29% of NPLs are current

75% of legal unpaid loan balance

(net of specific reserves and partial charge-offs)

$10,222,000

60% of legal unpaid loan

balance at repossession date

9

Data as of 3/31/11

NonPerforming Assets

(excluding FDIC Covered Assets) |

Conservative Balance Sheet

Total Risk-Based Capital Ratio –

18.0% at 3/31/11

Loans

/

Assets

of

55%

at

3/31/11

Approximately 24% of loans have credit protection

15%

of loans are covered by loss sharing agreements with the FDIC

9%

are subject to a 2 year “Put Back”

agreement with TD Bank

41% of assets backed by the US Government

Low Concentration Levels

CRE

at

139%

of

capital

vs.

300%

guidance

CD&L

at

34%

of

capital

vs.

100%

guidance

Operating leverage yet untapped

10 |

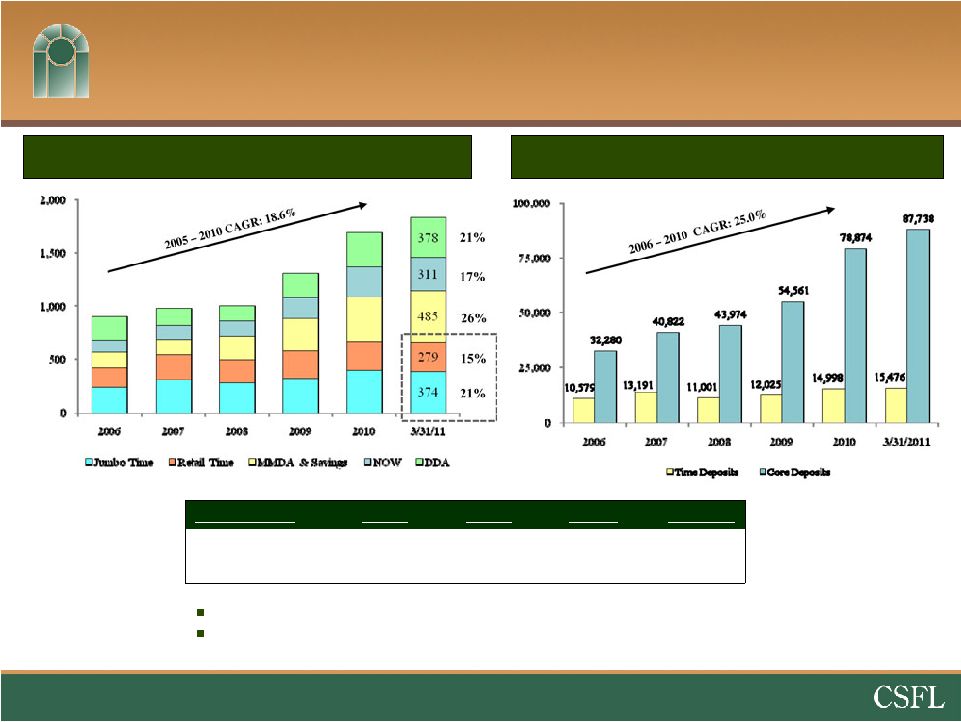

Core Deposit Focus

Value of core deposits not fully realized in this low rate

environment. Approximately

103,214

total

accounts

-

$17,710

average

balance

per

account

Core deposits defined as non-time deposits.

Total Deposits ($MM)

Number of Deposit Accounts

11

DDA and NOW

3/31/10

3/31/11

Change

% Change

Balance

$418MM

$689MM

$271MM

65%

No. of Accounts

40,753

67,859

27,106

67% |

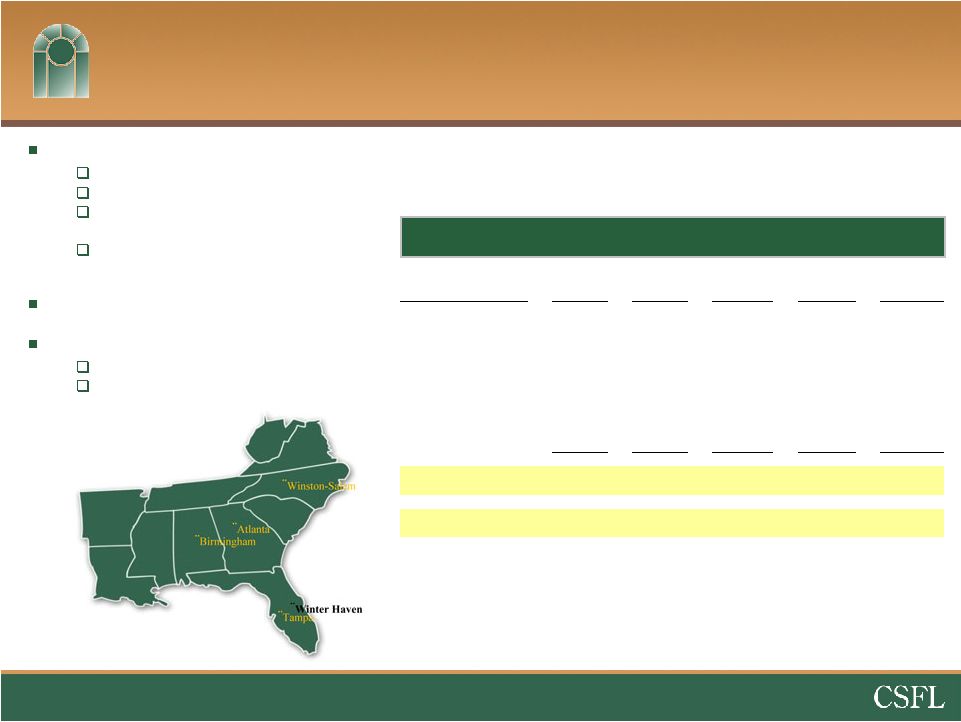

Correspondent Banking Division

Primary business lines

Bond Sales

Fed funds

Safekeeping, bond accounting, and

asset/liability consulting services

No loan participations / holding company

loan product

Customer base –

520 community banks

Opportunity

Bank Clearing & Cash Management

Talent Recruiting / M&A

Division Contribution

12

($000s, except per share)

1Q10

2Q10

3Q10

4Q10

1Q11

Net Interest Income

$1,526

$1,319

$1,148

$974

$662

Non-Interest Income

6,622

7,758

12,358

7,576

4,984

Non-Interest Expense

(6,164)

(6,740)

(9,249)

(6,689)

(4,978)

Income Tax Expense

(764)

(900)

(1,564)

(700)

(251)

Net Income Impact

$1,220

$1,437

$2,693

$1,161

$417

EPS Impact

$0.05

$0.05

$0.09

$0.04

$0.01 |

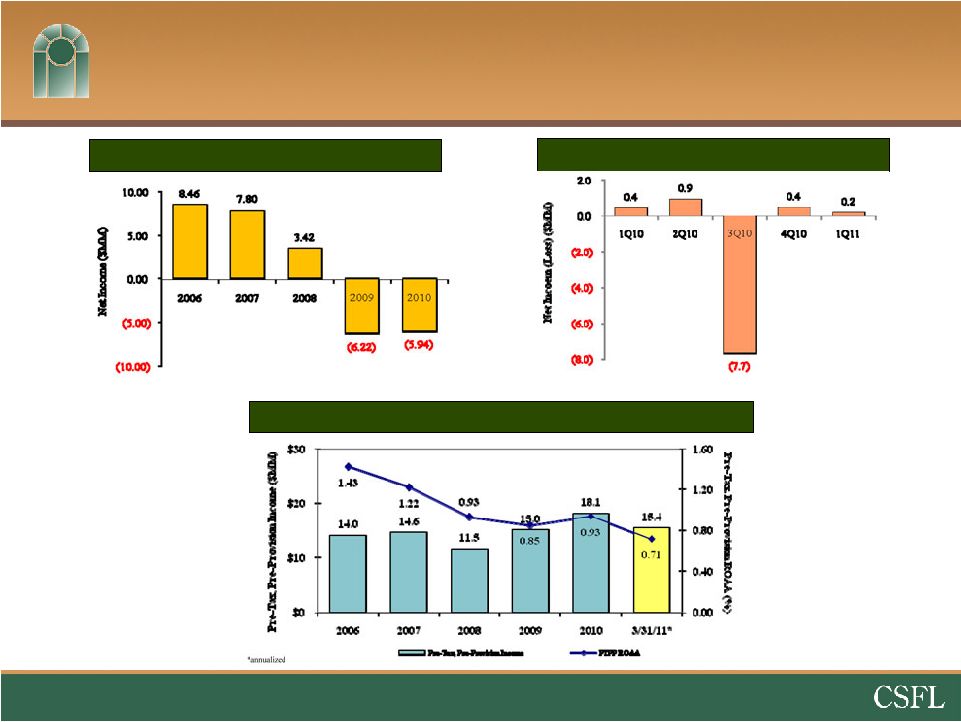

Profitability

Net

Income

($MM)

–

5

yr

history

Pre-Tax Pre Provision Income & ROAA(%)

13

Net

Income

($MM)

–

5

quarter

history |

Summary

Energetic & experienced local management team taking

advantage of opportunities

Turmoil offers significant organic growth opportunities

Regulator support for continued growth strategy

Increased FDIC-assisted deals coming to our market in the

next 6 –

9 months

Elevated temporary operating expenses due to acquisitions

and conversions

Unprecedented opportunities to add shareholder value

14 |