Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - RPT Realty | a6707915ex99-1.htm |

| EX-10.2 - EXHIBIT 10.2 - RPT Realty | a6707915ex10-2.htm |

| 8-K - RAMCO-GERSHENSON PROPERTIES TRUST 8-K - RPT Realty | a6707915.htm |

Exhibit 10.1

SECOND AMENDED AND RESTATED

UNSECURED MASTER LOAN AGREEMENT

DATED AS OF APRIL 29, 2011

among

RAMCO-GERSHENSON PROPERTIES, L.P.,

as Borrower,

RAMCO-GERSHENSON PROPERTIES TRUST,

as a Guarantor,

KEYBANK NATIONAL ASSOCIATION,

as a Bank,

THE OTHER BANKS WHICH ARE A PARTY TO THIS AGREEMENT,

THE OTHER BANKS WHICH MAY BECOME PARTIES TO THIS AGREEMENT,

KEYBANK NATIONAL ASSOCIATION,

as Agent,

KEYBANC CAPITAL MARKETS,

as Sole Lead Manager and Arranger,

JPMORGAN CHASE BANK, N.A.

and

BANK OF AMERICA, N.A.

as Co-Syndication Agents,

and

DEUTSCHE BANK SECURITIES INC.,

as Documentation Agent

TABLE OF CONTENTS

Page

|

DEFINITIONS AND RULES OF INTERPRETATION

|

1 | |||||

|

§1.1.

|

Definitions

|

1 | ||||

|

§1.2.

|

Rules of Interpretation

|

22 | ||||

|

§2.

|

THE CREDIT FACILITY

|

23 | ||||

|

§2.1.

|

Commitment to Lend Revolving Credit Loans

|

23 | ||||

|

§2.2.

|

Commitment to Lend Term Loan

|

23 | ||||

|

§2.3.

|

Unused Facility Fee

|

23 | ||||

|

§2.4.

|

Interest on Loans

|

24 | ||||

|

§2.5.

|

Requests for Revolving Credit Loans

|

24 | ||||

|

§2.6.

|

Funds for Loans

|

25 | ||||

|

§2.7.

|

Optional Reduction of Revolving Credit Commitments

|

26 | ||||

|

§2.8.

|

Increase of Revolving Credit Commitment and Term Loan Commitment

|

27 | ||||

|

§2.9.

|

Letters of Credit

|

28 | ||||

|

§2.10.

|

Swing Line Loans

|

33 | ||||

|

§2.11.

|

Evidence of Debt

|

37 | ||||

|

§3.

|

REPAYMENT OF THE LOANS

|

38 | ||||

|

§3.1.

|

Stated Maturity

|

38 | ||||

|

§3.2.

|

Mandatory Prepayments

|

38 | ||||

|

§3.3.

|

Optional Prepayments

|

38 | ||||

|

§3.4.

|

Partial Prepayments

|

39 | ||||

|

§3.5.

|

Effect of Prepayments

|

39 | ||||

|

§4.

|

CERTAIN GENERAL PROVISIONS

|

39 | ||||

|

§4.1.

|

Conversion Options

|

39 | ||||

|

§4.2.

|

Commitment and Syndication Fee

|

40 | ||||

|

§4.3.

|

Agent’s Fee

|

40 | ||||

|

§4.4.

|

Funds for Payments

|

40 | ||||

|

§4.5.

|

Computations

|

41 | ||||

|

§4.6.

|

Suspension of LIBOR Rate Loans

|

41 | ||||

|

§4.7.

|

Illegality

|

41 | ||||

|

§4.8.

|

Additional Interest

|

42 | ||||

|

§4.9.

|

Additional Costs, Etc

|

42 | ||||

-i-

TABLE OF CONTENTS

(continued)

Page

|

§4.10.

|

Capital Adequacy

|

43 | ||||

|

§4.11.

|

Indemnity of Borrower

|

44 | ||||

|

§4.12.

|

Interest on Overdue Amounts; Late Charge

|

44 | ||||

|

§4.13.

|

Certificate

|

44 | ||||

|

§4.14.

|

Limitation on Interest

|

44 | ||||

|

§4.15.

|

Extension of Revolving Credit Maturity Date and Term Loan Maturity Date

|

45 | ||||

|

§4.16.

|

Cash Collateral

|

47 | ||||

|

§5.

|

UNSECURED OBLIGATIONS; GUARANTY

|

47 | ||||

|

§5.1.

|

Unsecured Obligations

|

47 | ||||

|

§5.2.

|

New Guarantors

|

47 | ||||

|

§6.

|

REPRESENTATIONS AND WARRANTIES OF THE TRUST AND THE BORROWER

|

48 | ||||

|

§6.1.

|

Corporate Authority, Etc

|

48 | ||||

|

§6.2.

|

Governmental Approvals

|

49 | ||||

|

§6.3.

|

Title to Properties; Lease

|

49 | ||||

|

§6.4.

|

Financial Statements

|

49 | ||||

|

§6.5.

|

No Material Changes

|

50 | ||||

|

§6.6.

|

Franchises, Patents, Copyrights, Etc

|

50 | ||||

|

§6.7.

|

Litigation

|

50 | ||||

|

§6.8.

|

No Materially Adverse Contracts, Etc

|

50 | ||||

|

§6.9.

|

Compliance with Other Instruments, Laws, Etc

|

51 | ||||

|

§6.10.

|

Tax Status

|

51 | ||||

|

§6.11.

|

No Event of Default

|

51 | ||||

|

§6.12.

|

Investment Company Acts

|

51 | ||||

|

§6.13.

|

Absence of UCC Financing Statements, Etc

|

51 | ||||

|

§6.14.

|

[Intentionally Omitted.]

|

51 | ||||

|

§6.15.

|

Certain Transactions

|

51 | ||||

|

§6.16.

|

Employee Benefit Plans

|

52 | ||||

|

§6.17.

|

Regulations T, U and X

|

52 | ||||

|

§6.18.

|

Environmental Compliance

|

52 | ||||

|

§6.19.

|

Subsidiaries and Unconsolidated Affiliates

|

54 | ||||

-ii-

TABLE OF CONTENTS

(continued)

Page

|

§6.20.

|

Loan Documents

|

54 | ||||

|

§6.21.

|

Property

|

54 | ||||

|

§6.22.

|

Brokers

|

54 | ||||

|

§6.23.

|

Other Debt

|

54 | ||||

|

§6.24.

|

Solvency

|

55 | ||||

|

§6.25.

|

Contribution Agreement

|

55 | ||||

|

§6.26.

|

No Fraudulent Intent

|

55 | ||||

|

§6.27.

|

Transaction in Best Interests of Borrower; Consideration

|

55 | ||||

|

§6.28.

|

Partners and the Trust

|

55 | ||||

|

§6.29.

|

Tax Indemnity Agreement

|

56 | ||||

|

§6.30.

|

Embargoed Persons

|

56 | ||||

|

§6.31.

|

Unencumbered Borrowing Base Properties

|

56 | ||||

|

§7.

|

AFFIRMATIVE COVENANTS OF THE TRUST AND THE BORROWER

|

56 | ||||

|

§7.1.

|

Punctual Payment

|

56 | ||||

|

§7.2.

|

Maintenance of Office

|

56 | ||||

|

§7.3.

|

Records and Accounts

|

56 | ||||

|

§7.4.

|

Financial Statements, Certificates and Information

|

57 | ||||

|

§7.5.

|

Notices

|

59 | ||||

|

§7.6.

|

Existence; Maintenance of Properties

|

60 | ||||

|

§7.7.

|

Insurance

|

61 | ||||

|

§7.8.

|

Taxes

|

61 | ||||

|

§7.9.

|

Inspection of Properties and Books

|

61 | ||||

|

§7.10.

|

Compliance with Laws, Contracts, Licenses, and Permits

|

62 | ||||

|

§7.11.

|

Use of Proceeds

|

62 | ||||

|

§7.12.

|

Further Assurances

|

62 | ||||

|

§7.13.

|

Compliance

|

62 | ||||

|

§7.14.

|

Limiting Agreements

|

62 | ||||

|

§7.15.

|

Ownership of Real Estate

|

63 | ||||

|

§7.16.

|

More Restrictive Agreements

|

63 | ||||

|

§7.17.

|

Trust Restrictions

|

63 | ||||

|

§7.18.

|

Interest Rate Contract(s)

|

64 | ||||

-iii-

TABLE OF CONTENTS

(continued)

Page

|

§7.19.

|

Unencumbered Borrowing Base Properties

|

64 | ||||

|

§8.

|

CERTAIN NEGATIVE COVENANTS OF THE TRUST AND THE BORROWER

|

68 | ||||

|

§8.1.

|

Restrictions on Indebtedness

|

68 | ||||

|

§8.2.

|

Restrictions on Liens Etc

|

69 | ||||

|

§8.3.

|

Restrictions on Investments

|

70 | ||||

|

§8.4.

|

Merger, Consolidation

|

72 | ||||

|

§8.5.

|

Conduct of Business

|

72 | ||||

|

§8.6.

|

Compliance with Environmental Laws

|

73 | ||||

|

§8.7.

|

Distributions

|

74 | ||||

|

§8.8.

|

Asset Sales

|

75 | ||||

|

§8.9.

|

Development Activity

|

75 | ||||

|

§8.10.

|

[Intentionally Omitted.]

|

76 | ||||

|

§8.11.

|

Trust Preferred Equity and Subordinated Debt

|

76 | ||||

|

§9.

|

FINANCIAL COVENANTS OF THE TRUST AND THE BORROWER

|

76 | ||||

|

§9.1.

|

Liabilities to Assets Ratio

|

76 | ||||

|

§9.2.

|

Fixed Charges Coverage

|

76 | ||||

|

§9.3.

|

Consolidated Tangible Net Worth

|

77 | ||||

|

§9.4.

|

Secured Indebtedness

|

77 | ||||

|

§9.5.

|

Borrowing Base Test

|

77 | ||||

|

§10.

|

CLOSING CONDITIONS

|

77 | ||||

|

§10.1.

|

Loan Documents

|

77 | ||||

|

§10.2.

|

Certified Copies of Organizational Documents

|

77 | ||||

|

§10.3.

|

Resolutions

|

77 | ||||

|

§10.4.

|

Incumbency Certificate; Authorized Signers

|

78 | ||||

|

§10.5.

|

Opinion of Counsel

|

78 | ||||

|

§10.6.

|

Payment of Fees

|

78 | ||||

|

§10.7.

|

Performance; No Default

|

78 | ||||

|

§10.8.

|

Representations and Warranties

|

78 | ||||

|

§10.9.

|

Proceedings and Documents

|

78 | ||||

|

§10.10.

|

Stockholder and Partner Consents

|

78 | ||||

-iv-

TABLE OF CONTENTS

(continued)

Page

|

§10.11.

|

Compliance Certificate

|

79 | ||||

|

§10.12.

|

Contribution Agreement

|

79 | ||||

|

§10.13.

|

No Legal Impediment

|

79 | ||||

|

§10.14.

|

Governmental Regulation

|

79 | ||||

|

§10.15.

|

Release Documents

|

79 | ||||

|

§10.16.

|

Other

|

79 | ||||

|

§11.

|

CONDITIONS TO ALL BORROWINGS

|

79 | ||||

|

§11.1.

|

Prior Conditions Satisfied

|

79 | ||||

|

§11.2.

|

Representations True; No Default

|

79 | ||||

|

§11.3.

|

Borrowing Documents

|

80 | ||||

|

§12.

|

EVENTS OF DEFAULT; ACCELERATION; ETC

|

80 | ||||

|

§12.1.

|

Events of Default and Acceleration

|

80 | ||||

|

§12.2.

|

Limitation of Cure Periods

|

84 | ||||

|

§12.3.

|

Termination of Commitments

|

84 | ||||

|

§12.4.

|

Remedies

|

84 | ||||

|

§12.5.

|

Distribution of Proceeds

|

84 | ||||

|

§13.

|

SETOFF

|

85 | ||||

|

§14.

|

THE AGENT

|

86 | ||||

|

§14.1.

|

Authorization

|

86 | ||||

|

§14.2.

|

Employees and Agents

|

86 | ||||

|

§14.3.

|

No Liability

|

86 | ||||

|

§14.4.

|

No Representations

|

86 | ||||

|

§14.5.

|

Payments

|

87 | ||||

|

§14.6.

|

Holders of Notes

|

88 | ||||

|

§14.7.

|

Indemnity

|

89 | ||||

|

§14.8.

|

Agent as Bank

|

89 | ||||

|

§14.9.

|

Resignation

|

89 | ||||

|

§14.10.

|

Duties in the Case of Enforcement

|

90 | ||||

|

§14.11.

|

Bankruptcy

|

90 | ||||

|

§14.12.

|

Approvals

|

90 | ||||

|

§14.13.

|

Borrower not Beneficiary

|

90 | ||||

-v-

TABLE OF CONTENTS

(continued)

Page

|

§15.

|

EXPENSES

|

91 | ||||

|

§16.

|

INDEMNIFICATION

|

91 | ||||

|

§17.

|

SURVIVAL OF COVENANTS, ETC

|

92 | ||||

|

§18.

|

ASSIGNMENT AND PARTICIPATION

|

93 | ||||

|

§18.1.

|

Conditions to Assignment by Banks

|

93 | ||||

|

§18.2.

|

Register

|

94 | ||||

|

§18.3.

|

New Notes

|

94 | ||||

|

§18.4.

|

Participations

|

94 | ||||

|

§18.5.

|

Pledge by Bank

|

94 | ||||

|

§18.6.

|

No Assignment by Borrower or the Trust

|

95 | ||||

|

§18.7.

|

Disclosure

|

95 | ||||

|

§18.8.

|

Amendments to Loan Documents

|

95 | ||||

|

§18.9.

|

Mandatory Assignment

|

95 | ||||

|

§18.10.

|

Titled Agents

|

96 | ||||

|

§19.

|

NOTICES

|

96 | ||||

|

§20.

|

RELATIONSHIP

|

97 | ||||

|

§21.

|

GOVERNING LAW: CONSENT TO JURISDICTION AND SERVICE

|

97 | ||||

|

§22.

|

HEADINGS

|

98 | ||||

|

§23.

|

COUNTERPARTS

|

98 | ||||

|

§24.

|

ENTIRE AGREEMENT, ETC

|

98 | ||||

|

§25.

|

WAIVER OF JURY TRIAL AND CERTAIN DAMAGE CLAIMS

|

98 | ||||

|

§26.

|

DEALINGS WITH THE BORROWER OR THE GUARANTORS

|

99 | ||||

|

§27.

|

CONSENTS, AMENDMENTS, WAIVERS, ETC

|

99 | ||||

|

§28.

|

SEVERABILITY

|

100 | ||||

|

§29.

|

TIME OF THE ESSENCE

|

100 | ||||

|

§30.

|

NO UNWRITTEN AGREEMENTS

|

100 | ||||

|

§31.

|

REPLACEMENT OF NOTES

|

100 | ||||

|

§32.

|

TRUST EXCULPATION

|

100 | ||||

|

§33.

|

PATRIOT ACT

|

101 | ||||

-vi-

EXHIBITS AND SCHEDULES

|

EXHIBIT A

|

FORM OF REVOLVING CREDIT NOTE

|

|

EXHIBIT B

|

FORM OF TERM LOAN NOTE

|

|

EXHIBIT C

|

FORM OF SWING LINE NOTE

|

|

EXHIBIT D

|

FORM OF JOINDER AGREEMENT

|

|

EXHIBIT E

|

FORM OF LOAN REQUEST

|

|

EXHIBIT F

|

FORM OF SWING LINE LOAN NOTICE

|

|

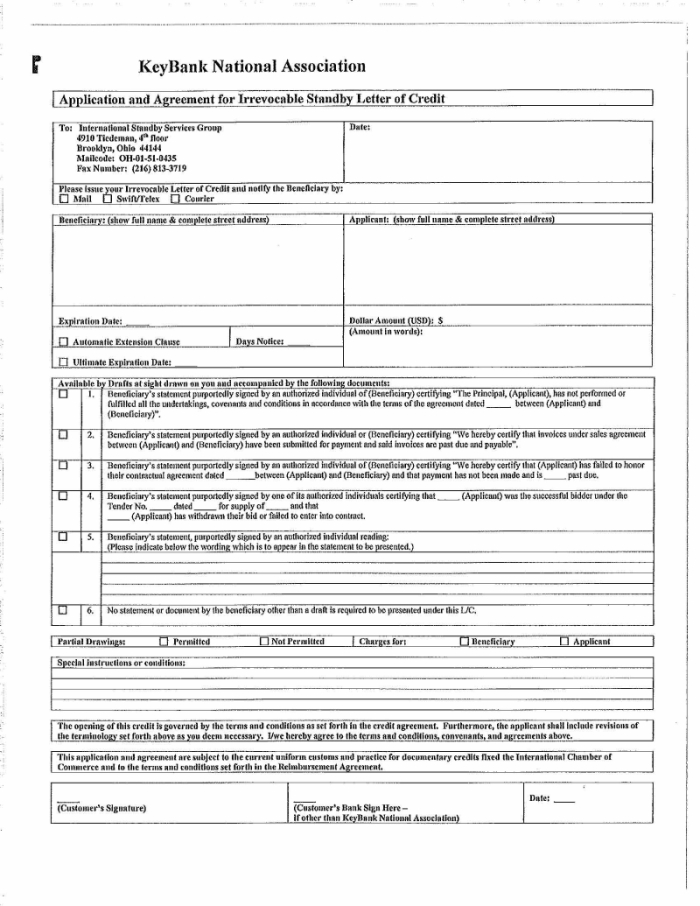

EXHIBIT G

|

LETTER OF CREDIT APPLICATION

|

|

EXHIBIT H

|

FORM OF REQUEST FOR EXTENSION OF LOANS

|

|

EXHIBIT I

|

FORM OF COMPLIANCE CERTIFICATE

|

|

EXHIBIT J

|

FORM OF ASSIGNMENT AND ACCEPTANCE AGREEMENT

|

|

SCHEDULE 1.1

|

BANKS AND COMMITMENTS

|

|

SCHEDULE 2.9

|

EXISTING LETTERS OF CREDIT

|

|

SCHEDULE 6.5

|

MARKETED PROPERTIES

|

|

SCHEDULE 6.6

|

TRADEMARKS; TRADENAMES

|

|

SCHEDULE 6.7

|

LITIGATION

|

|

SCHEDULE 6.15

|

AFFILIATE TRANSACTIONS

|

|

SCHEDULE 6.18

|

ENVIRONMENTAL MATTERS

|

|

SCHEDULE 6.19

|

SUBSIDIARIES OF THE BORROWER AND GUARANTOR

|

|

SCHEDULE 6.21

|

MANAGEMENT AGREEMENTS; OPTIONS

|

|

SCHEDULE 6.23

|

EXISTING DEFAULTS

|

|

SCHEDULE 6.29

|

PROPERTY OF GUARANTOR

|

|

SCHEDULE 6.31

|

INITIAL UNENCUMBERED BORROWING BASE PROPERTIES

|

|

SCHEDULE 8.9

|

EXISTING UNDEVELOPED LAND PROJECTS

|

-vii-

SECOND AMENDED AND RESTATED

UNSECURED MASTER LOAN AGREEMENT

This SECOND AMENDED AND RESTATED UNSECURED MASTER LOAN AGREEMENT is made as of the 29th day of April, 2011 by and among RAMCO-GERSHENSON PROPERTIES, L.P. (the “Borrower”), a Delaware limited partnership, RAMCO-GERSHENSON PROPERTIES TRUST (the “Trust”), a Maryland real estate investment trust, KEYBANK NATIONAL ASSOCIATION, a national banking association (“KeyBank”), and the other lending institutions that are a party hereto, and the other lending institutions which may become parties hereto pursuant to §18 (the “Banks”), and KEYBANK NATIONAL ASSOCIATION, a national banking association, as Administrative Agent for the Banks (the “Agent”).

RECITALS

WHEREAS, the Borrower, the Trust, Agent and the Banks are parties to that certain Amended and Restated Secured Master Credit Agreement dated as of December 11, 2009, as amended by a First Amendment to Amended and Restated Secured Master Credit Agreement dated as of October 26, 2010 (the “Prior Credit Agreement”); and

WHEREAS, the Borrower has requested that the Banks extend the maturity date under the Prior Credit Agreement and make certain other modifications; and

WHEREAS, the Borrower, the Guarantor, the Agent and the Banks desire to amend and restate the Prior Credit Agreement in its entirety;

NOW, THEREFORE, in consideration of the terms and conditions herein, and of any loans, advances, or extensions of credit heretofore, now or hereafter made to or for the benefit of the Borrower by the Banks, the parties hereto amend and restate the Prior Credit Agreement in its entirety and covenant and agree as follows:

|

§1.

|

DEFINITIONS AND RULES OF INTERPRETATION.

|

§1.1. Definitions. The following terms shall have the meanings set forth in this §1 or elsewhere in the provisions of this Agreement referred to below:

Affiliate. An Affiliate, as applied to any Person, shall mean any other Person directly or indirectly controlling, controlled by, or under common control with, that Person. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlling”, “controlled by” and “under common control with”), as applied to any Person, means (a) the possession, directly or indirectly, of the power to vote ten percent (10%) or more of the stock, shares, voting trust certificates, beneficial interest, partnership interests, member interests or other interests having voting power for the election of directors of such Person or otherwise to direct or cause the direction of the management and policies of that Person, whether through the ownership of voting securities or by contract or otherwise, or (b) the ownership of (i) a general partnership interest, (ii) a managing member’s interest in a limited liability company or (iii) a limited partnership interest or preferred stock (or other ownership interest) representing ten percent (10%) or more of the outstanding limited partnership interests, preferred stock or other ownership interests of such Person.

1

Agent. KeyBank National Association, acting as Administrative Agent for the Banks, its successors and assigns.

Agent’s Head Office. The Agent’s head office located at 127 Public Square, Cleveland, Ohio 44114-1306, or at such other location as the Agent may designate from time to time by notice to the Borrower and the Banks.

Agent’s Special Counsel. McKenna Long & Aldridge LLP or such other counsel as may be approved by the Agent.

Agreement. This Second Amended and Restated Unsecured Master Loan Agreement, including the Schedules and Exhibits hereto.

Applicable Margin. On any date, the applicable margin set forth below based on the ratio of the Consolidated Total Liabilities of the Borrower to the Consolidated Total Adjusted Asset Value of the Borrower (expressed as a percentage):

|

Revolving Credit Loans

|

Term Loans

|

||||

|

Ratio

|

Base Rate Loans

|

LIBOR Rate Loans

|

Base Rate Loans

|

LIBOR Rate Loans

|

|

|

Pricing Level 1

|

Less than 40%

|

1.00%

|

2.00%

|

1.00%

|

2.00%

|

|

Pricing Level 2

|

Equal to or greater than 40%, but less than 45%

|

1.25%

|

2.25%

|

1.25%

|

2.25%

|

|

Pricing Level 3

|

Equal to or greater than 45%, but less than 50%

|

1.375%

|

2.375%

|

1.375%

|

2.375%

|

|

Pricing Level 4

|

Equal to or greater than 50% but less than 55%

|

1.50%

|

2.50%

|

1.50%

|

2.50%

|

|

Pricing Level 5

|

Equal to or greater than 55%

|

1.75%

|

2.75%

|

1.75%

|

2.75%

|

The initial Applicable Margin shall be at Pricing Level 2. The Applicable Margin shall be adjusted based upon such ratio, if at all, on the first day of the first month following the delivery by the Borrower to the Agent of the Compliance Certificate at the end of each fiscal quarter. In the event that Borrower shall fail to deliver to the Agent a quarterly Compliance Certificate on or before the date required by §7.4(e), then without limiting any other rights of the Agent and the Banks under this Agreement, the Applicable Margin shall be at Pricing Level 5 until such failure is cured within any applicable cure period.

Arranger. KeyBanc Capital Markets.

2

Assignment and Acceptance Agreement. See §18.1.

Balance Sheet Date. December 31, 2010.

Banks. KeyBank, the other Banks a party hereto, and any other Person who becomes an assignee of any rights of a Bank pursuant to §18; and collectively, the Revolving Credit Banks, the Term Loan Banks and the Swing Line Lender. The Issuing Bank shall be a Bank, as applicable.

Base Rate. The greater of (a) the variable annual rate of interest announced from time to time by Agent at Agent’s Head Office as its “prime rate”, (b) one-half of one percent (0.5%) above the Federal Funds Effective Rate, or (c) the LIBOR Rate determined as of any date of determination for an Interest Period of one month plus one percent (1%) (rounded upwards, if necessary, to the next one-eighth of one percent). The Base Rate is a reference rate and does not necessarily represent the lowest or best rate being charged to any customer. Any change in the rate of interest payable hereunder resulting from a change in the Base Rate shall become effective as of the opening of business on the day on which such change in the Base Rate becomes effective, without notice or demand of any kind.

Base Rate Loans. Collectively, the Revolving Credit Base Rate Loans and the Term Base Rate Loans.

Board. See the definition of Change of Control.

Borrower. As defined in the preamble hereto.

Borrowing Base Availability. At any date of determination, the Borrowing Base Availability for Eligible Real Estate owned by the Borrower or any Subsidiary Guarantor included in the Unencumbered Borrowing Base Property shall be the amount which is the lesser of (a) sixty percent (60%) of the Unencumbered Pool Value; and (b) the Debt Service Coverage Amount for the Unencumbered Borrowing Base Properties.

Borrowing Base Property Certificate. See §7.4(e).

Building. With respect to each parcel of Real Estate, all of the buildings, structures and improvements now or hereafter located thereon.

Business Day. Any day on which banking institutions located in the same city and state as the Agent’s Head Office and in New York are open for the transaction of banking business and, in the case of LIBOR Rate Loans, which also is a LIBOR Business Day.

Capital Expenditure Reserve Amount. With respect to any Person or property, a reserve for replacements and capital expenditures equal to $.10 per square foot of building space located on all Real Estate owned by such Person, other than Real Estate subject to leases which provide that the tenant is responsible for all building maintenance.

Capital Improvement Project. With respect to any Real Estate now or hereafter owned by the Borrower or any of its Subsidiaries which is utilized principally for shopping centers, capital improvements consisting of rehabilitation, refurbishment, replacement, expansions and improvements (including related amenities) to the existing Buildings on such Real Estate and capital additions, repairs, resurfacing and replacements in the common areas of such Real Estate all of which may be properly capitalized under GAAP.

3

Capitalization Rate. Eight percent (8%).

Capitalized Lease. A lease under which a Person is the lessee or obligor, the discounted future rental payment obligations under which are required to be capitalized on the balance sheet of the lessee or obligor in accordance with GAAP.

Cash Equivalents. As of any date, (i) securities issued or directly and fully guaranteed or insured by the United States government or any agency or instrumentality thereof having maturities of not more than one year from such date, (ii) time deposits and certificates of deposits having maturities of not more than one year from such date and issued by any domestic commercial bank having, (A) senior long term unsecured debt rated at least A or the equivalent thereof by S&P or A2 or the equivalent thereof by Moody’s and (B) capital and surplus in excess of $100,000,000.00; (iii) commercial paper rated at least A-1 or the equivalent thereof by S&P or P-1 or the equivalent thereof by Moody’s and in either case maturing within one hundred twenty (120) days from such date, and (iv) shares of any money market mutual fund rated at least AAA or the equivalent thereof by S&P or at least Aaa or the equivalent thereof by Moody’s.

CERCLA. See §6.18.

Change of Control. The occurrence of any one of the following events:

(a) during any twelve month period on or after the date of this Agreement, individuals who at the beginning of such period constituted the Board of Directors or Trustees of the Trust (the “Board”) (together with any new directors whose election by the Board or whose nomination for election by the shareholders of the Trust was approved by a vote of at least a majority of the members of the Board then in office who either were members of the Board at the beginning of such period or whose election or nomination for election was previously so approved) cease for any reason to constitute a majority of the members of the Board then in office;

(b) any Person or group (as that term is understood under Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and regulations thereunder) shall have acquired beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) of a percentage (based on voting power, in the event different classes of stock shall have different voting powers) of the voting stock of the Trust equal to at least thirty percent (30%);

(c) the Borrower or Trust consolidates with, is acquired by, or merges into or with any Person (other than a merger permitted by Section 8.4); or

(d) the Borrower fails to own, free of any lien, encumbrance or other adverse claim, at least one hundred percent (100%) of the economic interest in the Voting Interest of each Subsidiary Guarantor.

4

Closing Date. The first date on which all of the conditions set forth in §10 and §11 have been satisfied.

Code. The Internal Revenue Code of 1986, as amended, and all regulations and formal guidance issued thereunder.

Commitment. With respect to each Bank, the aggregate of (a) the Revolving Credit Commitment of such Bank and (b) the Term Loan Commitment of such Bank.

Commitment Percentage. With respect to each Bank, the percentage set forth on Schedule 1.1 hereto as such Bank’s percentage of the aggregate Commitments of all of the Banks, as the same may be changed from time to time in accordance with the terms of this Agreement.

Compliance Certificate. See §7.4(e).

Consolidated or combined. With reference to any term defined herein, that term as applied to the accounts of a Person and its Subsidiaries, consolidated or combined in accordance with GAAP.

Consolidated Operating Cash Flow. With respect to any period of a Person, an amount equal to the Operating Cash Flow of such Person and its Subsidiaries for such period consolidated in accordance with GAAP.

Consolidated Tangible Net Worth. The amount by which Consolidated Total Adjusted Asset Value exceeds Consolidated Total Liabilities, and less the sum of:

(a) the total book value of all assets of a Person and its Subsidiaries properly classified as intangible assets under GAAP, including such items as good will, the purchase price of acquired assets in excess of the fair market value thereof, trademarks, trade names, service marks, brand names, copyrights, patents and licenses, and rights with respect to the foregoing; and

(b) all amounts representing any write-up in the book value of any assets of such Person or its Subsidiaries resulting from a revaluation thereof subsequent to the Balance Sheet Date; and

(c) all amounts representing minority interests as of such date which are applicable to third parties in Investments of the Borrower.

5

Consolidated Total Adjusted Asset Value. With respect to any Person, the sum of all assets of such Person and its Subsidiaries determined on a Consolidated basis in accordance with GAAP, provided that all Real Estate that is improved and not Under Development shall be valued at an amount equal to (A) the Operating Cash Flow of such Person and its Subsidiaries and Unconsolidated Affiliates described in §8.3(i) from such Real Estate for the period covered by the four previous consecutive fiscal quarters (treated as a single accounting period) divided by (B) the Capitalization Rate, provided that (i) prior to such time as the Borrower or any of its Subsidiaries or such Unconsolidated Affiliates has owned and operated any parcel of Real Estate for four full fiscal quarters, such Real Estate shall be valued at acquisition cost determined in accordance with GAAP, and provided further that (ii)(A) with respect to any Redevelopment Property that has been valued at cost as permitted below and has recommenced operations for less than four full fiscal quarters, the Operating Cash Flow for such Redevelopment Property for the number of full fiscal quarters which the Borrower or its Subsidiary or such Unconsolidated Affiliate has recommenced operations as annualized shall be utilized, and (B) the Operating Cash Flow for any Redevelopment Property that has recommenced operations without a full quarter of performance shall be annualized in such manner as the Agent shall approve, such approval not to be unreasonably withheld, and (iii) to the extent that the capitalized Operating Cash Flow with respect to any parcel of Real Estate owned by an Unconsolidated Affiliate of such Person is included in the calculation of Consolidated Total Adjusted Asset Value for such Person, such Person’s interest in the Unconsolidated Affiliate shall not be included in the calculation of Consolidated Total Adjusted Asset Value for such Person. Real Estate that is Under Development and undeveloped Land shall be valued at its capitalized cost in accordance with GAAP. Notwithstanding the foregoing, Borrower may elect to value a Redevelopment Property at cost as determined in accordance with GAAP, as set forth in the first sentence of this definition, for a period of up to twenty-four (24) months which twenty-four (24) month period shall commence upon the date which Agent receives written notice from Borrower of such election (including any notice provided under the Prior Credit Agreement). The assets of the Borrower and its Subsidiaries on the consolidated financial statements of the Borrower and its Subsidiaries shall be adjusted to reflect the Borrower’s allocable share of such asset (including Borrower’s interest in any Unconsolidated Affiliate whose asset value is determined by application of the capitalization rate above), for the relevant period or as of the date of determination, taking into account (a) the relative proportion of each such item derived from assets directly owned by the Borrower and from assets owned by its respective Subsidiaries and Unconsolidated Affiliates, and (b) the Borrower’s respective ownership interest in its Subsidiaries and Unconsolidated Affiliates.

Consolidated Total Liabilities. All liabilities of a Person and its Subsidiaries determined on a Consolidated basis in accordance with GAAP and all Indebtedness of such Person and its Subsidiaries, whether or not so classified, including any liabilities arising in connection with sale and leaseback transactions, and shall include such Person’s pro rata share of the foregoing items of its Unconsolidated Affiliates. Consolidated Total Liabilities shall not include Trust Preferred Equity or Subordinated Debt. Amounts undrawn under this Agreement shall not be included in Indebtedness for purposes of this definition. Notwithstanding anything to the contrary contained herein, (a) Indebtedness (i) of Borrower and its Subsidiaries consisting of environmental indemnities and guarantees with respect to customary exceptions to exculpatory language with respect to Non-recourse Indebtedness and (ii) of Borrower with respect to the TIF Guaranty shall not be included in the calculation of Consolidated Total Liabilities of Borrower and its Subsidiaries unless a claim shall have been made against Borrower or a Subsidiary of Borrower on account of any such guaranty or indemnity, and (b) Indebtedness of Borrower, the Trust and their Subsidiaries under completion guarantees shall equal the remaining costs to complete the applicable construction project in excess of construction loan or mezzanine loan proceeds available therefor and any equity deposited or invested for the payment of such costs.

Contribution Agreement. That certain Contribution Agreement dated of even date herewith among the Borrower, the Trust and the Subsidiary Guarantors.

6

Conversion Request. A notice given by the Borrower to the Agent of its election to convert or continue a Loan in accordance with §4.1.

Co-Syndication Agents. JPMorgan Chase Bank, N.A. and Bank of America, N.A.

Debt Offering. The issuance and sale by the Borrower or any Guarantor of any debt securities of the Borrower or such Guarantor.

Debt Service. For any period, the sum of all interest, including capitalized interest not paid in cash, bond related expenses, and mandatory principal/sinking fund payments due and payable during such period excluding any balloon payments due upon maturity of any Indebtedness. Any of the foregoing payable with respect to Subordinated Debt shall be included in the calculation of Debt Service.

Debt Service Coverage Amount. At any time determined by the Agent, an amount equal to the maximum principal amount of all Unsecured Indebtedness of the Trust, the Borrower and their Subsidiaries (including, without limitation, the Outstanding Revolving Credit Loans, Outstanding Swing Loans, Outstanding Term Loans and Letter of Credit Liabilities) which, when bearing interest at a rate per annum equal to the greater of (a) the then-current annual yield on seven (7) year obligations issued by the United States Treasury most recently prior to the date of determination plus 2.50% payable based on a 25 year mortgage style amortization schedule (expressed as a mortgage constant percentage) and (b) 7.5%, would be payable by the monthly principal and interest payment amount resulting from dividing (a) the Operating Cash Flow from the Unencumbered Borrowing Base Properties for the preceding four fiscal quarters divided by 1.5 by (b) 12. With respect to any Unencumbered Borrowing Base Property which has not been owned by Borrower or a Subsidiary thereof for four (4) full fiscal quarters, then for the purposes of determining the Debt Service Coverage Amount, the historic Operating Cash Flow from such Unencumbered Borrowing Base Property shall be used, or if such information is not available, then the Operating Cash Flow shall be the Borrower’s pro forma underwritten Operating Cash Flow for such Unencumbered Borrowing Base Property for the next succeeding four (4) fiscal quarters as reasonably approved by Agent (provided, that the pro forma underwritten Operating Cash Flow for each of such four (4) fiscal quarters shall be replaced by the actual Operating Cash Flow for each fiscal quarter thereafter until such time as there are four (4) full fiscal quarters of operating results for the Borrower, and the pro forma underwritten Operating Cash Flow approved by Agent shall continue to be used for the fiscal quarters not yet occurred). The determination of the Debt Service Coverage Amount and the components thereof by the Agent shall, so long as the same shall be determined in good faith, be conclusive and binding absent manifest error.

Default. See §12.1.

Defaulting Bank. See §14.5(c).

Derivatives Contract. Any and all rate swap transactions, basis swaps, credit derivative transactions, forward rate transactions, commodity swaps, commodity options, forward commodity contracts, equity or equity index swaps or options, bond or bond price or bond index swaps or options or forward bond or forward bond price or forward bond index transactions, interest rate options, forward foreign exchange transactions, cap transactions, floor transactions, collar transactions, currency swap transactions, cross-currency rate swap transactions, currency options, spot contracts, or any other similar transactions or any combination of any of the foregoing (including any options to enter into any of the foregoing), whether or not any such transaction is governed by or subject to any master agreement. Not in limitation of the foregoing, the term “Derivatives Contract” includes any and all transactions of any kind, and the related confirmations, which are subject to the terms and conditions of, or governed by, any form of master agreement published by the International Swaps and Derivatives Association, Inc., any International Foreign Exchange Master Agreement, or any other master agreement of similar type, including any such obligations or liabilities under any such master agreement.

7

Directions. See §14.12.

Distribution. With respect to any Person, the declaration or payment of any cash, cash flow, dividend or distribution on or in respect of any shares of any class of capital stock, partnership interest, membership interest or other beneficial interest of such Person other than that portion of any dividends or distributions payable in equity securities of such Person; the purchase, redemption, exchange or other retirement of any shares of any class of capital stock, partnership interest, membership interest or other beneficial interest of such Person, directly or indirectly through a Subsidiary of such Person or otherwise; the return of capital by such Person to its shareholders, partners, members or other owners as such; or any other distribution on or in respect of any shares of any class of capital stock or other beneficial interest of such Person.

Documentation Agent. Deutsche Bank Securities Inc.

Dollars or $. Dollars in lawful currency of the United States of America.

Domestic Lending Office. Initially, the office of each Bank designated as such in Schedule 1.1 hereto; thereafter, such other office of such Bank, if any, located within the United States that will be making or maintaining Base Rate Loans.

Drawdown Date. The date on which any Loan is made or is to be made, and the date on which any Loan which is made prior to the Revolving Credit Maturity Date or Term Loan Maturity Date, as applicable, is converted or combined in accordance with §4.1.

Eligible Real Estate. Real Estate which meets the conditions set forth in § 7.19(a).

Employee Benefit Plan. Any employee benefit plan within the meaning of §3(3) of ERISA maintained or contributed to by the Borrower, a Guarantor or any ERISA Affiliate, other than a Multiemployer Plan.

Environmental Laws. See §6.18(a).

Equity Offering. The issuance and sale by the Borrower or any Guarantor of any equity securities of the Borrower or such Guarantor.

ERISA. The Employee Retirement Income Security Act of 1974, as amended and in effect from time to time, and all regulations and formal guidance issued thereunder.

8

ERISA Affiliate. Any Person which is treated as a single employer with the Borrower or any Guarantor under §414 of the Code or §4001 of ERISA, or any predecessor entities of any of them.

ERISA Reportable Event. A reportable event with respect to a Guaranteed Pension Plan within the meaning of §4043 of ERISA as to which the requirement of notice has not been waived or any other event with respect to which Borrower or an ERISA Affiliate could have liability under ERISA §§4062(e) or 4063.

Event of Default. See §12.1.

Existing Letters of Credit. The Letters of Credit issued by Issuing Bank and described on Schedule 2.9 hereto.

Federal Funds Effective Rate. For any day, the rate per annum (rounded to the nearest one hundredth of one percent (1/100 of 1%)) announced by the Federal Reserve Bank of Cleveland on such day as being the weighted average of the rates on overnight federal funds transactions arranged by federal funds brokers on the previous trading day, as computed and announced by such Federal Reserve Bank in substantially the same manner as such Federal Reserve Bank computes and announces the weighted average it refers to as the “Federal Funds Effective Rate”, or, if such rate is not so published for any day that is a Business Day, the average of the quotations for such day on such transactions received by the Agent from three (3) Federal funds brokers of recognized standing selected by the Agent.

Fixed Charges. With respect to the Trust and its Subsidiaries for any fiscal period, an amount equal to the sum of (a) the Debt Service of the Trust and its Subsidiaries, plus (b) the Preferred Distributions of the Trust and its Subsidiaries, all determined on a consolidated basis in accordance with GAAP.

Funds from Operations. With respect to any Person for any fiscal period, the Net Income (or Deficit) of such Person computed in accordance with GAAP, excluding losses from sales of property and impairment charges, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect funds from operations on the same basis.

GAAP. Principles that are (a) consistent with the principles promulgated or adopted by the Financial Accounting Standards Board and its predecessors, as in effect from time to time and (b) consistently applied with past financial statements of the Person adopting the same principles; provided that a certified public accountant would, insofar as the use of such accounting principles is pertinent, be in a position to deliver an unqualified opinion (other than a qualification regarding changes in GAAP) as to financial statements in which such principles have been properly applied. Notwithstanding the foregoing, for the purposes of the financial calculations hereunder, any amount otherwise included therein from a mark-up or mark-down of a derivative product of a Person shall be excluded.

Government Acts. See §2.9(j).

9

Ground Lease. A ground lease which is not subordinate to any mortgage, deed of trust or security deed as to which no default or event of default has occurred and containing the following terms and conditions: (a) a remaining term (exclusive of any unexercised extension options) of forty (40) years or more from the Closing Date; (b) the right of the lessee to mortgage and encumber its interest in the leased property without the consent of the lessor; (c) the obligation of the lessor to give the holder of any mortgage lien on such leased property written notice of any defaults on the part of the lessee and agreement of such lessor that such lease will not be terminated until such holder has had a reasonable opportunity to cure or complete foreclosure, and fails to do so; (d) reasonable transferability of the lessee’s interest under such lease, including the ability to sublease; and (e) such other rights customarily required by mortgagees making a loan secured by the interest of the holder of the leasehold estate demised pursuant to a ground lease.

Guaranteed Pension Plan. Any employee pension benefit plan within the meaning of §3(2) of ERISA maintained or contributed to by the Borrower, any Guarantor or any ERISA Affiliate the benefits of which are guaranteed on termination in full or in part by the PBGC pursuant to Title IV of ERISA, other than a Multiemployer Plan.

Guarantors. Collectively, the Trust and each Subsidiary Guarantor, and individually, any one such Guarantor.

Guaranty. The Second Amended and Restated Unconditional Guaranty of Payment and Performance dated of even date herewith made by the Guarantors in favor of the Agent and the Banks, as the same may be modified or amended, such Guaranty to be in form and substance satisfactory to the Agent.

Hazardous Substances. See §6.18(b).

Indebtedness. All obligations, contingent and otherwise, that in accordance with GAAP should be classified upon the obligor’s balance sheet as liabilities, or to which reference should be made by footnotes thereto, but without any double counting, including in any event and whether or not so classified: (a) all debt and similar monetary obligations, whether direct or indirect (including, without limitation, any obligations evidenced by bonds, debentures, notes or similar debt instruments); (b) all liabilities secured by any mortgage, pledge, security interest, lien, charge or other encumbrance existing on property owned or acquired subject thereto, whether or not the liability secured thereby shall have been assumed; (c) all guarantees, endorsements and other contingent obligations whether direct or indirect in respect of indebtedness of others, including any obligation to supply funds to or in any manner to invest directly or indirectly in a Person, to purchase indebtedness, or to assure the owner of indebtedness against loss through an agreement to purchase goods, supplies or services for the purpose of enabling the debtor to make payment of the indebtedness held by such owner or otherwise; (d) any obligation as a lessee or obligor under a Capitalized Lease; (e) all subordinated debt, including, without limitation, Subordinated Debt (but excluding Trust Preferred Equity); (f) all obligations to purchase under agreements to acquire (but excluding agreements which provide that the seller’s remedies thereunder are limited to market liquidated damages in the event the purchaser defaults thereunder), or otherwise to contribute money with respect to, properties under “development” within the meaning of §8.9; and (g) all obligations, contingent or deferred or otherwise, of any Person, including, without limitation, any such obligations as an account party under acceptance, letter of credit or similar facilities including, without limitation, obligations to reimburse the issuer in respect of a letter of credit except for contingent obligations (but excluding any guarantees or similar obligations) that are not material and are incurred in the ordinary course of business in connection with the acquisition or obtaining commitments for financing of Real Estate.

10

Interest Payment Date. As to each Base Rate Loan, the first day of each calendar month during the term of such Base Rate Loan and as to each LIBOR Rate Loan, the first day of each calendar month during the term of such LIBOR Rate Loan and the last day of the Interest Period relating thereto.

Interest Period. With respect to each LIBOR Rate Loan (a) initially, the period commencing on the Drawdown Date of such Loan and ending one, two, three or six months (or, with the consent of the Banks, a period of less than one (1) month) thereafter and (b) thereafter, each period commencing on the day following the last day of the next preceding Interest Period applicable to such Loan and ending on the last day of one of the periods set forth above, as selected by the Borrower in a Conversion Request; provided that all of the foregoing provisions relating to Interest Periods are subject to the following:

(i) if any Interest Period with respect to a LIBOR Rate Loan would otherwise end on a day that is not a LIBOR Business Day, that Interest Period shall end and the next Interest Period shall commence on the next preceding or succeeding LIBOR Business Day as determined conclusively by the Agent in accordance with the then current bank practice in the London Interbank Market;

(ii) if the Borrower shall fail to give notice as provided in §4.1, the Borrower shall be deemed to have requested a conversion of the affected LIBOR Rate Loan to a Base Rate Loan on the last day of the then current Interest Period with respect thereto; and

(iii) no Interest Period relating to any LIBOR Rate Loan shall extend beyond the Revolving Credit Maturity Date or Term Loan Maturity Date, as applicable.

Interest Rate Contracts. Interest rate swap, collar, cap or similar agreements providing interest rate protection.

Investments. With respect to any Person, all shares of capital stock, evidences of Indebtedness and other securities issued by any other Person, all loans, advances, or extensions of credit to, or contributions to the capital of, any other Person, all purchases of the securities or business or integral part of the business of any other Person and commitments and options to make such purchases, all interests in real property, and all other investments; provided, however, that the term “Investment” shall not include (i) equipment, inventory and other tangible personal property acquired in the ordinary course of business, or (ii) current trade and customer accounts receivable for services rendered in the ordinary course of business and payable in accordance with customary trade terms. In determining the aggregate amount of Investments outstanding at any particular time: (a) the amount of any Investment represented as a guaranty shall be taken at not less than the principal amount of the obligations guaranteed and still outstanding; (b) there shall be included as an Investment all interest accrued with respect to Indebtedness constituting an Investment unless and until such interest is paid; (c) there shall be deducted in respect of each such Investment any amount received as a return of capital (but only by repurchase, redemption, retirement, repayment, liquidating dividend or liquidating distribution); (d) there shall not be deducted in respect of any Investment any amounts received as earnings on such Investment, whether as dividends, interest or otherwise, except that accrued interest included as provided in the foregoing clause (b) may be deducted when paid; and (e) there shall not be deducted from the aggregate amount of Investments any decrease in the value thereof.

11

Issuing Bank. KeyBank in its capacity as the Bank issuing Letters of Credit, or any successor issuing bank hereunder.

Joinder Agreement. The joinder agreement with respect to the Guaranty and the Contribution Agreement to be executed and delivered pursuant to §5.5 by any additional Guarantor, substantially in the form of Exhibit D hereto.

KeyBank. As defined in the preamble hereto.

Leases. Leases, licenses and agreements whether written or oral, relating to the use or occupation of space in or on any Building or on any Real Estate by persons other than the Borrower.

Letter of Credit. Any standby letter of credit issued at the request of the Borrower and for the account of the Borrower in accordance with §2.9.

Letter of Credit Application. See §2.9(b).

Letter of Credit Liabilities. At any time and in respect of any Letter of Credit, the sum of (a) the maximum undrawn face amount of such Letter of Credit plus (b) the aggregate unpaid principal amount of all drawings made under such Letter of Credit which have not been repaid (including repayment by a Revolving Credit Loan). For purposes of this Agreement, a Revolving Credit Bank (other than the Bank acting as the Issuing Bank) shall be deemed to hold a Letter of Credit Liability in an amount equal to its participation interest in the related Letter of Credit under §2.9, and the Bank acting as the Issuing Bank shall be deemed to hold a Letter of Credit Liability in an amount equal to its retained interest in the related Letter of Credit after giving effect to the acquisition by the Revolving Credit Banks other than the Bank acting as the Issuing Bank of their participation interests under such Section.

Letter of Credit Sublimit. An amount equal to $25,000,000.00, as such amount may increase as provided in §2.9 or may reduce as provided in §2.7.

LIBOR Business Day. Any day on which commercial banks are open for international business (including dealings in Dollar deposits) in London.

LIBOR Lending Office. Initially, the office of each Bank designated as such in Schedule 1.1 hereto; thereafter, such other office of such Bank, if any, that shall be making or maintaining LIBOR Rate Loans.

12

LIBOR Rate. For any LIBOR Rate Loan for any Interest Period, the average rate (rounded to the nearest 1/100th) as shown in Reuters Screen LIBOR 01 Page at which deposits in U.S. dollars are offered by first class banks in the London Interbank Market at approximately 11:00 a.m. (London time) on the day that is two (2) LIBOR Business Days prior to the first day of such Interest Period with a maturity approximately equal to such Interest Period and in an amount approximately equal to the amount to which such Interest Period relates, adjusted for reserves and taxes if required by future regulations. If such service no longer reports such rate or Agent determines in good faith that the rate so reported no longer accurately reflects the rate available to Agent in the London Interbank Market, Agent may select a replacement index. For any period during which a Reserve Percentage shall apply, the LIBOR Rate with respect to LIBOR Rate Loans shall be equal to the amount determined above divided by an amount equal to 1 minus the Reserve Percentage.

LIBOR Rate Loans. Collectively, the Revolving Credit LIBOR Rate Loans and the Term LIBOR Rate Loans.

Lien. See §8.2.

Loan Documents. This Agreement, the Notes (if any), the Letters of Credit, the Letter of Credit Applications, the Guaranty and all other documents, instruments or agreements now or hereafter executed or delivered by or on behalf of the Borrower or the Guarantors in connection with the Loans.

Loan Request. See §2.5.

Loans. The Revolving Credit Loans and the Term Loans. Swing Line Loans shall constitute “Revolving Credit Loans” for all purposes under this Agreement (provided that only the Swing Line Lender shall be obligated to make a Swing Line Loan), but shall not be considered the utilization of a Revolving Credit Bank’s Revolving Credit Commitment (except to the extent of such Revolving Credit Bank’s participation in Swing Line Loans).

Majority Banks. As of any date, any Bank or collection of Banks whose aggregate Commitment Percentage is more than fifty percent (50%); provided, that, in determining said percentage at any given time, all then existing Defaulting Banks will be disregarded and excluded and the Commitment Percentages of the Banks shall be redetermined for voting purposes only, to exclude the Commitment Percentages of such Defaulting Banks.

Majority Revolving Credit Banks. As of any date, any Revolving Credit Bank or collection of Revolving Credit Banks whose aggregate Revolving Credit Commitment Percentage is greater than fifty percent (50%); provided that in determining said percentage at any given time, all the existing Revolving Credit Banks that are Defaulting Banks will be disregarded and excluded and the Revolving Credit Commitment Percentages of the Revolving Credit Banks shall be redetermined for voting purposes only to exclude the Revolving Credit Commitment Percentages of such Defaulting Banks.

Majority Term Loan Banks. As of any date, any Term Loan Bank or collection of Term Loan Banks whose aggregate Term Loan Commitment Percentage is greater than fifty percent (50%); provided that in determining said percentage at any given time, all the existing Term Loan Banks that are Defaulting Banks will be disregarded and excluded and the Term Loan Commitment Percentages of the Term Loan Banks shall be redetermined for voting purposes only to exclude the Term Loan Commitment Percentages of such Defaulting Banks.

13

Multiemployer Plan. Any multiemployer plan within the meaning of §3(37) or 4001(a)(3) of ERISA or §414(f) of the Code maintained or contributed to by the Borrower, a Guarantor or any ERISA Affiliate.

Net Income (or Deficit). With respect to any Person (or any asset of any Person) for any fiscal period, the net income (or deficit) of such Person (or attributable to such asset), after deduction of all expenses, taxes and other proper charges, determined in accordance with GAAP.

Net Offering Proceeds. The gross cash proceeds received by the Borrower or any Guarantor as a result of a Debt Offering or an Equity Offering less the customary and reasonable costs, fees, expenses, underwriting commissions and discounts incurred by the Borrower or such Guarantor in connection therewith.

Net Rentable Area. With respect to any Real Estate, the floor area of any buildings, structures or improvements available (or to be available upon completion) for leasing to tenants determined in accordance with the Rent Roll for such Real Estate, the manner of such determination to be consistent for all Real Estate unless otherwise approved by the Agent.

Non-recourse Indebtedness. Indebtedness of a Person which is secured solely by one or more parcels of Real Estate and related personal property and is not a general obligation of such Person, the holder of such Indebtedness having recourse solely to the parcels of Real Estate securing such Indebtedness, the Building and any leases thereon and the rents and profits thereof.

Non-Consenting Bank. See §18.9.

Notes. Collectively, the Revolving Credit Notes, Term Loan Notes, and the Swing Line Note, if any.

Notice. See §19.

Obligations. All indebtedness, obligations and liabilities of the Borrower and the Guarantors to any of the Banks and the Agent, individually or collectively, under this Agreement or any of the other Loan Documents or in respect of any of the Loans, the Letters of Credit or the Notes, or other instruments at any time evidencing any of the foregoing, whether existing on the date of this Agreement or arising or incurred hereafter, direct or indirect, joint or several, absolute or contingent, matured or unmatured, liquidated or unliquidated, secured or unsecured, arising by contract, operation of law or otherwise.

OFAC. Office of Foreign Asset Control of the Department of the Treasury of the United States of America.

Operating Cash Flow. With respect to any Person (or any asset of any Person) for any period, for the four (4) most recently completed consecutive fiscal quarters of such Person an amount equal to the sum of (a) the Net Income of such Person (or attributable to such asset) for such period (excluding from Net Income any base rents from tenants leasing 10,000 square feet or more (1) that are subject to any bankruptcy proceeding and that have not affirmed or assumed their respective lease or other occupancy agreement or (2) as to which a payment default has occurred under the applicable Lease for sixty (60) days or more beyond any applicable grace and cure period) plus (b) depreciation and amortization, interest expense, and any extraordinary or nonrecurring losses deducted in calculating such Net Income, minus (c) any extraordinary or nonrecurring gains included in calculating such Net Income, minus (d) the Capital Expenditure Reserve Amount, minus (e) to the extent not already deducted in calculating Net Income, a management fee of 3% of minimum rents attributable to any Real Estate of such Person, all as determined in accordance with GAAP, minus (f) any lease termination payments not received in the ordinary course of business. Payments from Borrower or its Affiliates under leases shall be excluded from Operating Cash Flow.

14

Outstanding. With respect to the Loans, the aggregate unpaid principal thereof as of any date of determination. With respect to Letters of Credit, the aggregate undrawn face amount of issued Letters of Credit

Patriot Act. The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, as the same may be amended from time to time, and corresponding provisions of future laws.

PBGC. The Pension Benefit Guaranty Corporation created by §4002 of ERISA and any successor entity or entities having similar responsibilities.

Permitted Liens. Liens, security interests and other encumbrances permitted by §8.2.

Person. Any individual, corporation, partnership, limited liability company, trust, unincorporated association, business, or other legal entity, and any government or any governmental agency or political subdivision thereof.

Potential Defaulting Bank. As reasonably determined by the Agent or the Issuing Bank, as applicable, any Bank which (or whose parent holding company) is subject to (a) any bankruptcy, insolvency, reorganization, liquidation or similar proceeding, (b) any “cease and desist” or “consent” order from, receivership of, or other operational control of any applicable state or federal regulatory authority, provided that a Bank shall not be a Potential Defaulting Bank solely by virtue of the ownership or acquisition of any equity interest in that Bank or any direct or indirect parent company thereof by a Governmental Authority so long as such ownership interest does not result in or provide such Bank with immunity from the jurisdiction of courts within the United States or from the enforcement or judgments or writs of attachment on its assets for permit such Bank (or such Governmental Authority or instrumentality) to reject, repudiate, disavow or disaffirm any contracts or agreements made with such Bank, or (c) has failed to comply with, or has made a public statement to the effect that it does not intend to comply with, its funding obligations under one or more syndicated credit facilities or other agreements in which it commits or is obligated to extend credit unless such failure to comply is the result of, or such public statement states that such position is based on, such Bank’s determination that a condition precedent to funding (which condition precedent, together with the applicable default, if any, shall be specifically identified) cannot be satisfied.

15

Preferred Distributions. For any period, the amount of any and all Distributions (but excluding any repurchase of Preferred Equity) paid, declared but not yet paid or otherwise due and payable to the holders of Preferred Equity.

Preferred Equity. Any form of preferred stock or partnership interest (whether perpetual, convertible or otherwise) or other ownership or beneficial interest in the Trust or any Subsidiary of the Trust (including any Trust Preferred Equity) that entitles the holders thereof to preferential payment or distribution priority with respect to dividends, distributions, assets or other payments over the holders of any other stock, partnership interest or other ownership or beneficial interest in such Person.

Prior Credit Agreement. As defined in the recitals.

Real Estate. All real property at any time owned or leased (as lessee or sublessee) by the Borrower or any of its Subsidiaries.

Record. The grid attached to any Note, or the continuation of such grid, or any other similar record, including computer records, maintained by Agent with respect to any Loan referred to in such Note.

Recourse Indebtedness. Any Indebtedness (whether secured or unsecured) that is recourse to the Borrower or the Trust. Guaranties with respect to customary exceptions to Non-recourse Indebtedness of Borrower’s Subsidiaries or Unconsolidated Affiliates shall not be deemed to be Recourse Indebtedness; provided that if a claim is made against Borrower or the Trust with respect thereto, the amount so claimed shall be considered Recourse Indebtedness.

Redevelopment Property. Any Real Estate which is not Under Development and (1) is undergoing a significant Capital Improvement Project and (2) is designated as a Redevelopment Property by Borrower and approved by Agent, such approval not to be unreasonably withheld.

Register. See §18.2.

REIT Status. With respect to the Trust, its status as a real estate investment trust as defined in §856(a) of the Code.

Related Fund. With respect to any Bank which is a fund that invests in loans, any Affiliate of such Bank or any other fund that invests in loans that is managed by the same investment advisor as such Bank or by an Affiliate of such Bank or such investment advisor.

Release. See §6.18(c)(iii).

Required Banks. As of any date, any Bank or collection of Banks whose aggregate Commitment Percentage is equal to or greater than sixty-six and two-thirds percent (66.66%); provided that in determining said percentage at any given time, all then existing Defaulting Banks will be disregarded and excluded and the Commitment Percentages of the Banks shall be redetermined for voting purposes only to exclude the Commitment Percentages of such Defaulting Banks.

16

Reserve Percentage. For any day with respect to a LIBOR Rate Loan, the maximum rate (expressed as a decimal) at which any lender subject thereto would be required to maintain reserves (including, without limitation, all base, supplemental, marginal and other reserves) under Regulation D of the Board of Governors of the Federal Reserve System (or any successor or similar regulations relating to such reserve requirements) against “Eurocurrency Liabilities” (as that term is used in Regulation D or any successor or similar regulation), if such liabilities were outstanding. The Reserve Percentage shall be adjusted automatically on and as of the effective date of any change in the Reserve Percentage.

Revolving Credit Banks. Collectively, the Banks which have a Revolving Credit Commitment, the initial Revolving Credit Banks being identified on Schedule 1.1 hereto.

Revolving Credit Base Rate Loans. The Revolving Credit Loans bearing interest by reference to the Base Rate.

Revolving Credit Commitment. With respect to each Revolving Credit Bank, the amount set forth on Schedule 1.1 hereto as the amount of such Revolving Credit Bank’s Revolving Credit Commitment to make or maintain Revolving Credit Loans to Borrower or to participate in Swing Line Loans and Letters of Credit, as the same may be changed from time to time in accordance with the terms of this Agreement.

Revolving Credit Commitment Percentage. With respect to each Revolving Credit Bank, the percentage set forth on Schedule 1.1 hereto as such Revolving Credit Bank’s percentage of the aggregate Revolving Credit Commitments of all of the Revolving Credit Banks, as the same may be changed from time to time in accordance with the terms of this Agreement; provided that if the Revolving Credit Commitments of the Revolving Credit Banks have been terminated as provided in this Agreement, then the Revolving Credit Commitment Percentage of each Revolving Credit Bank shall be determined based on the Revolving Credit Commitment Percentage of such Revolving Credit Bank immediately prior to such termination and after giving effect to any subsequent assignments made pursuant to the terms thereof.

Revolving Credit Extension Request. See §4.15(a)(i).

Revolving Credit Loan or Loans. An individual Revolving Credit Loan or the aggregate Revolving Credit Loans, as the case may be, made by the Revolving Credit Banks hereunder to Borrower, as more particularly described in §2.1.

Revolving Credit Note. A promissory note made by the Borrower in favor of a Revolving Credit Bank in the principal face amount equal to such Revolving Credit Bank’s Revolving Credit Commitment, or if less, the outstanding amount of all Revolving Credit Loans made by such Revolving Credit Bank, in substantially the form of Exhibit A hereto.

Revolving Credit LIBOR Rate Loans. Revolving Credit Loans bearing interest calculated by reference to the LIBOR Rate.

Revolving Credit Maturity Date. April 29, 2014, as such date may be extended as provided in §4.15, or such earlier date on which the Loans shall become due and payable pursuant to the terms hereof.

17

SEC. The federal Securities and Exchange Commission.

Secured Indebtedness. Indebtedness of a Person that is pursuant to a Capitalized Lease or is directly or indirectly secured by a Lien.

Secured Recourse Indebtedness. Secured Indebtedness of a Person that is also Recourse Indebtedness.

Short-term Investments. Investments described in subsections (a) through (g), inclusive, of §8.3.

State. A state of the United States of America.

Subordinated Debt. Any subordinated debt which is not Trust Preferred Equity issued by the Trust or the Borrower (or a subsidiary trust created to issue such subordinated debt) (a) which has a minimum remaining term of not less than five (5) years, (b) which is unsecured and which is not guaranteed by any other Person, (c) which imposes no financial tests or covenants or negative covenants of the type set forth in §8 or §9 of this Agreement or the Guaranty or §12.1(p) or (q) of this Agreement (or other covenants, representations or defaults which have the same practical effect thereof) on the Trust, the Borrower or their respective Subsidiaries other than those approved by Agent, (d) pursuant to which all claims and liabilities of the Trust, Borrower and their respective Subsidiaries with respect to the principal and any premium and interest thereon are subordinate to the payment of the principal, letter of credit reimbursement obligations and any premium and interest thereon of the Borrower, the Trust and their respective Subsidiaries under this Agreement and other Indebtedness which by its terms is not subordinate to or pari passu with such Subordinated Debt on terms acceptable to the Agent, and as to which subordination provisions the Agent and the Banks shall be third party beneficiaries, and (e) which does not violate the terms of §8.11.

Subsidiary. Any corporation, association, partnership, trust, or other business entity of which the designated parent shall at any time own directly or indirectly through a Subsidiary or Subsidiaries at least a majority (by number of votes or controlling interests) of the outstanding Voting Interests, and shall include all Persons the accounts of which are consolidated with those of such Person in accordance with GAAP.

Subsidiary Guarantor. Collectively, Ramco Fox River LLC and Ramco Liberty Square LLC, and each Subsidiary of Borrower or the Trust which becomes a Guarantor pursuant to §5.5.

Swing Line. The revolving credit facility made available by the Swing Line Lender pursuant to §2.10.

Swing Line Borrowing. A borrowing of a Swing Line Loan pursuant to §2.10.

Swing Line Lender. KeyBank, in its capacity as provider of Swing Line Loans, or any successor swing line lender hereunder.

Swing Line Loan. See §2.10(a).

18

Swing Line Loan Notice. A notice of a Swing Line Borrowing pursuant to §2.10(b), which, if in writing, shall be substantially in the form of Exhibit F attached hereto.

Swing Line Note. See §2.10(g).

Swing Line Sublimit. An amount equal to $17,500,000.00, as such amount may increase as provided in §2.10 or may reduce as provided in §2.7. The Swing Line Sublimit is part of, and not in addition to, the Total Revolving Credit Commitments.

Tax Indemnity Agreement. That certain Tax Agreement dated as of May 10, 1996 between Atlantic Realty Trust and RPS Realty Trust (now known as the Trust).

Term Base Rate Loans. The Term Loans bearing interest by reference to the Base Rate.

Term LIBOR Rate Loans. The Term Loans bearing interest by reference to the LIBOR Rate.

Term Loan or Term Loans. An individual term loan or the aggregate term loans, as the case may be, in the maximum principal amount of $75,000,000.00 made by the Term Loan Banks hereunder pursuant to §2.2, as the same may be increased as provided in this Agreement.

Term Loan Banks. Collectively, the Banks which have a Term Loan Commitment, the initial Term Loan Banks being identified on Schedule 1.1 hereto.

Term Loan Commitment. As to each Term Loan Bank, the amount equal to such Term Loan Bank’s Term Loan Commitment Percentage of the aggregate principal amount of the Term Loans from time to time outstanding to Borrower.

Term Loan Commitment Percentage. With respect to each Term Loan Bank, the percentage set forth on Schedule 1.1 hereto as such Term Loan Bank’s percentage of the aggregate Term Loans to Borrower, as the same may be changed from time to time in accordance with the terms of this Agreement.

Term Loan Extension Request. See §4.15(b)(i).

Term Loan Maturity Date. April 29, 2015, as such date may be extended as provided in §4.15, or such earlier date on which the Loans shall become due and payable pursuant to the terms hereof.

Term Loan Note. A promissory note made by the Borrower in favor of a Term Loan Bank in the principal face amount equal to such Term Loan Bank’s Term Loan Commitment, in substantially the form of Exhibit B hereto.

TIF Guaranty. That certain Guaranty dated as of March 11, 2005 made by Borrower and the Trust in favor of the City of Jacksonville relating to the development by Ramco Jacksonville LLC.

Titled Agents. The Arranger, the Co-Syndication Agents and the Documentation Agent.

19

Total Commitment. The sum of the Commitments of the Banks, as in effect from time to time. As of the date of this Agreement, the Total Commitment is Two Hundred Fifty Million and No/100 Dollars ($250,000,000.00). The Total Commitment may increase in accordance with §2.8.

Total Leverage Ratio. The ratio as of any determination date of Consolidated Total Liabilities to Consolidated Total Adjusted Asset Value.

Total Revolving Credit Commitment. The sum of the Revolving Credit Commitments of the Revolving Credit Banks, as in effect from time to time. As of the date of this Agreement, the Total Revolving Credit Commitment is One Hundred Seventy-Five Million and No/100 Dollars ($175,000,00.00). The Total Revolving Credit Commitment may increase in accordance with §2.8.

Total Term Loan Commitment. The sum of the Term Loan Commitments of the Term Loan Banks, as in effect from time to time. As of the date of this Agreement the Total Term Loan Commitment is Seventy-Five Million and No/100 Dollars. The Total Term Loan Commitment may increase in accordance with §2.8.

Trust. Ramco-Gershenson Properties Trust, a Maryland real estate investment trust.