Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - NORTHWEST NATURAL GAS CO | Financial_Report.xls |

| 10-Q - FORM 10-Q - NORTHWEST NATURAL GAS CO | form10q.htm |

| EX-32.1 - CEO ANF CFO CERTIFICATION - NORTHWEST NATURAL GAS CO | ex32.htm |

| EX-12 - EXHIBIT 12 - FIXED CHARGES - NORTHWEST NATURAL GAS CO | ex12.htm |

| EX-31.1 - CEO CERTIFICATION - NORTHWEST NATURAL GAS CO | ex31-1.htm |

| EX-31.2 - CFO CERTIFICATION - NORTHWEST NATURAL GAS CO | ex31-2.htm |

March 22, 2011

Mr. James Zadvorny

Encana Oil & Gas (USA) Inc.

370 Seventeenth Street, Suite 1700

Denver, Colorado 80202

Re: First Amendment to C&E Agreement

Dear Jim:

Northwest Natural Gas Company (“NWN”) and Encana Oil & Gas (USA) Inc. (“Encana”) have entered into that certain Carry and Earning Agreement dated and effective as of May 1, 2011 (“C&E Agreement”). NWN and Encana anticipated executing Letters of Attornment relating to the Gathering Agreement and the Processing Agreement, as defined in the C&E Agreement. In consideration of the execution of the Letters of Attornment, NWN and Encana have agreed to certain additional matters set forth in this Letter Agreement. The terms of this Letter Agreement shall amend and be incorporated into the C&E Agreement. All capitalized terms not defined in this Letter Agreement shall have the meanings set forth in the C&E Agreement and the Letters of Attornment, as applicable.

1. New Connections. [***], Encana agrees that for so long as the C&E Agreement is in effect, all New Connections affecting Carry Wells shall be constructed at Encana’s sole cost and expense, as provided in Section 5.1 of the C&E Agreement.

2. Successor Shipper MDQ. The written notice required by [***] of the [***] shall set Successor Shipper’s MDQ in the Successor Shipper Gas Gathering Agreement at 33,000 Mcf per Day unless NWN and Encana agree otherwise prior to executing the notice.

3. Successor Shipper Plant Capacity. The written notice required by [***] of the [***] shall set Successor Shipper Plant Capacity in the Successor Shipper Gas Processing Agreement at 33,000 Mcf per Gas Day unless NWN and Encana agree otherwise prior to executing the notice.

4. [***]

5. [***]

6. Section 10.5 of the C&E Agreement. Section 10.5 of the C&E Agreement shall be replaced in its entirety with the following:

10.5 Amendment of Gathering and Processing Agreement. Prior to any election under Article VI.G. of the Operating Agreement by NWN to take its gas in kind, Encana may amend the

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

Gathering Agreement or Processing Agreement subject to the following:

(i) Encana may enter into any such amendment without the consent of NWN so long as such amendment does not affect NWN’s rights, costs or fees under the Gathering Agreement, Processing Agreement, or NWN’s rights, costs or fees under a future Successor Shipper Gas Gathering Agreement or Successor Shipper Gas Processing Agreement;

(ii) If Encana desires that NWN’s rights be subject to the amendment, Encana shall provide thirty (30) days advance written notice to NWN in order to provide NWN an opportunity to discuss with Encana the amendments in advance of and during negotiations. The Parties acknowledge that [***], and because Encana has interests in multiple producing properties other than the Leases, amendments to the Gathering Agreement and Processing Agreement that may be of benefit to Encana will not provide equivalent benefit to NWN. If the Parties agree on amendments to this Agreement that will place NWN in an equivalent economic position under this Agreement as before such amendment or amendments to the Gathering Agreement and Processing Agreement, then NWN shall agree to be bound by the proposed amendment to the Gathering Agreement or Processing Agreement.

Sincerely,

/s/

Barbara Cronise

Accepted and Agreed:

Encana Oil & Gas (USA) Inc. Northwest Natural Gas Company

By: /s/ By: /s/

*John Schopp Gregg S. Kantor

|

Vice President

|

Chief Executive Officer

|

|

|

North Rockies Business Unit

|

|

|

*By Kurt S. Froistad

|

|

|

Attorney in Fact

|

|

|

Delegate

|

|

|

Carry and Earning Agreement

by and between

Encana Oil & Gas (USA) Inc.

a Delaware corporation

and

Northwest Natural Gas Company

an Oregon corporation

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

TABLE OF CONTENTS

SECTION 12. TERM 27

SECTION 15. TAXES 29

Carry and Earning Agreement

Carry and Earning Agreement

CARRY AND EARNING AGREEMENT

THIS CARRY AND EARNING AGREEMENT (this “Agreement”) dated and effective as of May 1, 2011 (the “Effective Date”) is by and between ENCANA OIL & GAS (USA) INC., a Delaware corporation (“Encana”) with an address of 370 17th Street, Suite 1700, Denver, Colorado 80202, and NORTHWEST NATURAL GAS COMPANY, an Oregon corporation (“NWN”) with an address of 220 NW Second Avenue, Portland, Oregon 97209-3991. Encana and NWN shall be referred to in this Agreement, individually, as a “Party” and, collectively, as the “Parties.”

RECITALS

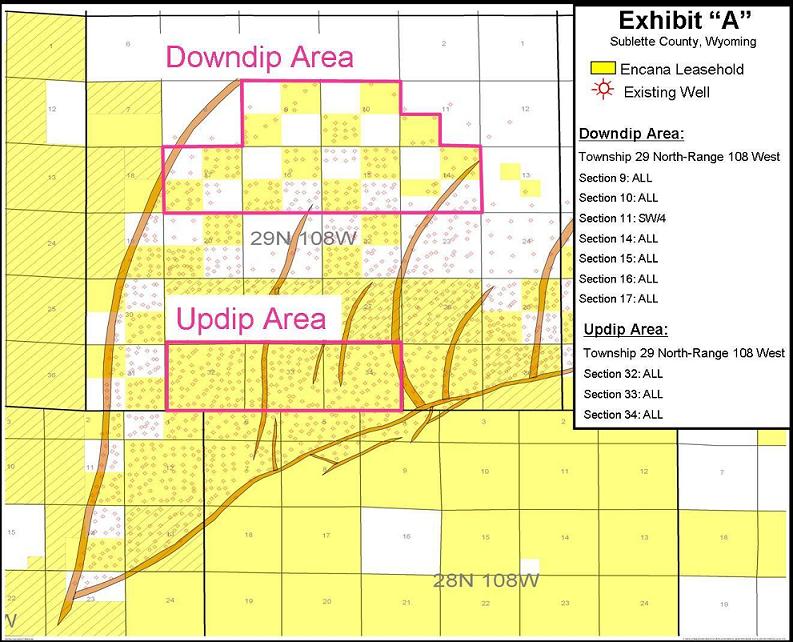

A. Encana owns oil and gas Leasehold Interests in the “Updip Area” and the “Downdip Area,” as both are fully described in Exhibit A of this Agreement (collectively, the “Property”), within the Jonah Field in Sublette County, Wyoming, pursuant to the Leases identified in Exhibit A-1 of this Agreement. The Property shall include any additional oil and gas Leasehold Interests which Encana acquires in the Downdip Area after the Effective Date, and Exhibit A-1 is subject to amendment in the event of any such acquisition.

B. NWN desires to participate in the further development of the oil and gas Leasehold Interests in the Property by paying a portion of the costs incurred by Encana associated with the drilling of [***] Net Carry Wells on the Property in exchange for certain portions of Encana’s right, title and interest in the Leases, Carry Wells, and Existing Wells in the Updip Area, as well as in and to the wellbores of Carry Wells and the production from such wellbores in the Downdip Area.

C. The Parties desire to enter into this Agreement to govern their rights and obligations with respect to exploration and development of the Property.

AGREEMENT

IN CONSIDERATION OF ONE HUNDRED DOLLARS ($100) and other good and valuable consideration, the receipt and sufficiency of which are acknowledged, the Parties agree as follows:

Section 1. Exhibits

The following Exhibits are attached to this Agreement and shall be considered part of this Agreement:

(i) Exhibit A – Property (with the Updip Area and Downdip Area described and also depicted on a map)

(ii) Exhibit A-1 – Lease Schedule

Page 1 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

(iii) Exhibit B-1 – Form of Wellbore Assignment

(iv) Exhibit B-2 – Form of Assignment and Stipulation of Interest

(v) Exhibit C – Form of Operating Agreement

(vi) Exhibit D – Disclosure Statement

(vii) Exhibit E – Wire Transfer Instructions for NWN Share

(viii) Exhibit F – Letters of Attornment

(ix) Exhibit G – Composite Producer Price Index Table

(x) Exhibit H – Drilling Schedule

Section 2. Definitions

The following terms shall have the following meanings:

2.1 “Acquisition” is defined in Section 3.10 below.

2.2 “AFE” shall mean an authorization for expenditure.

2.3 “Affiliates” shall mean, with respect to any Person, any other Person that either directly or indirectly controls or manages, is controlled or managed by or is under common control or management with such first Person. For purposes of the definition of “Affiliates,” “control” means the right or power to direct the policies of another through management authority, equity ownership, delegated authority, voting rights or otherwise.

2.4 “Agreement” has the meaning set forth in the first paragraph of this Agreement.

2.5 “Arbitrators” is defined in Section 24 below.

2.6 “Assets” means (i) all of Encana’s right, title, and interest in and to the Leasehold Interests; (ii) all of Encana’s immovable personal property located on the Leasehold Interests used in connection with or attributable in any manner to the exploration or development of the Leasehold Interests for Gas or the operation of the Leasehold Interests or the treating, storing or transporting of Gas produced from the Leasehold Interests, excluding gathering lines; (iii) all of Encana’s rights with respect to any and all contracts, agreements, instruments, governmental orders and contractual rights insofar as they cover the Leasehold Interests; and (iv) all of Encana’s rights with respect to any and all easements, rights-of-way, rights, permits, licenses and servitudes insofar as they are used or held in connection with the exploration, development or operation of the Leasehold Interests or the transportation of Gas produced therefrom. The term “Assets” shall not include any ownership interest in (a) gathering, dehydration, compression or treatment facilities beyond the wellhead installations; (b) any existing or future water disposal

Page 2 of 35

wells or water management facility(ies) located on the Property; or (c) Encana’s title to the severed surface lands in the S/2 and S/2N/2 of Section 32 except as may arise from a Lease, but shall include the right to use such facilities and lands described in (b), (c) and (d) insofar as they are necessary for the production, gathering and processing of Gas produced from the Leasehold Interests.

2.7 “Assigned Section” is defined in Section 3.5 below.

2.8 “Assignment and Stipulation of Interest” shall mean the Assignment and Stipulation of Interest attached to this Agreement as Exhibit B-2.

2.9 “Basic Contracts” shall mean those agreements that are contractually binding arrangements to which the Assets are or may be subject and which will be binding on the Assets or NWN after the Effective Date (including, without limitation, farmout and farmin agreements, option agreements, forced pooling orders, assignments of production payments, unit agreements, joint operating agreements, gas balancing agreements, pooling agreements, communitization agreements, surface use agreements, letter agreements, indenture, bank loans, and credit agreements) and which may result in a potential positive or negative economic impact upon NWN in excess of $25,000 in any calendar year. Pursuant and subject to Section 6.2(viii), Basic Contracts are listed in Section 6.2(viii) of the Disclosure Statement.

2.10 “BLM” shall mean the Bureau of Land Management of the United States Department of the Interior.

2.11 “Boundary Well” is defined in Section 3.11 below.

2.12 INTENTIONALLY OMITTED

2.13 “Carry Well” shall mean a well drilled pursuant to Section 3 of this Agreement and “Carry Wells” shall mean all wells drilled pursuant to Section 3 of this Agreement. The term “Carry Well” and “Carry Wells” shall include, but not be limited to, any Post-Carry Well drilled pursuant to Section 3 of this Agreement.

2.14 “Casualty Defect” means, with respect to all or any material portion of the Assets taken as a whole, any destruction by fire, blowout, leak, explosion or other casualty (above or below ground), or any taking, or pending or threatened taking, in condemnation or under the right of eminent domain, of all or any material portion of the Assets taken as a whole.

2.15 “CDP” shall mean a central delivery point, referring to the facilities owned by Encana which will receive and dehydrate Gas from the Carry Wells and Existing Wells, remove Condensate, and deliver such Gas to the custody transfer meters owned by [***].

2.16 “Composite PPI” shall mean the weighted average of the Producer Price Indices shown on Exhibit G attached to this Agreement, weighted in the proportions shown on Exhibit G attached to this Agreement.

Page 3 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

2.17 “Condensate” shall mean those liquid hydrocarbons that are separated from the Gas at a CDP.

2.18 “Costs of Completing” shall mean all costs of completing a well, including but not limited to, the costs of fracture stimulation and the drilling out of frac plugs with respect to such well.

2.19 “Costs of Drilling” shall mean the following costs related to a well: costs of constructing and upgrading access roads, obtaining and preparing the location, obtaining permits and title opinions, obtaining drilling contractor services and consultants necessary for the drilling of such well, obtaining mud chemicals, pipe and supplies and all other costs and expenses associated with or incurred in moving in, rigging up, drilling, logging and testing so that a decision can be made to either attempt to set pipe and complete such well or to plug and abandon it as a dry hole.

2.20 “Costs of Equipping” shall mean the costs of the acquisition and installation of the initial equipment for a well and the costs to tie the well into a CDP, which may include but is not limited to the wellhead and wellsite equipment (including but not limited to, flow lines, wellsite or CDP separation facilities, wellsite or CDP tanks and storage facilities, measurement equipment, meter connection facilities, power lines and electrical facilities, and expansions and improvements of such equipment) other than equipment required for gathering, regardless of when such cost is incurred and which costs are capitalized for federal income tax purposes.

2.21 “Disclosure Statement” shall mean Exhibit D attached to this Agreement.

2.22 “Downdip Area” has the meaning set forth in the first Recital above.

2.23 “Downdip Carry Well” shall mean a Carry Well drilled within the Downdip Area.

2.24 “Drilling Schedule” shall mean the drilling schedule set forth in Exhibit H to this Agreement. All wells shown on the Drilling Schedule are intended to designate Net Carry Wells.

2.25 “Effective Date” has the meaning set forth in the first paragraph of this Agreement.

2.26 “Election Well” has the meaning set forth in Section 3.10 of this Agreement.

2.27 “Encana” has the meaning set forth in the first paragraph of this Agreement.

2.28 “Environmental Laws” shall mean all federal, state, county, or local laws, rules, regulations, ordinances and common law torts relating to (i) protection of the environment from pollution, (ii) the release, emission or control of any pollutant, (iii) solid, gaseous or liquid waste generation, handling, treatment, storage, disposal or transportation, (iv) exposure to hazardous, toxic, dangerous or other substances alleged to be harmful, (v) protection of wildlife, including threatened and endangered species, and (vi) protection and preservation of historic sites and

Page 4 of 35

objects. The term “Environmental Laws” shall include, but not be limited to, the following statutes and the regulations promulgated thereunder: the Clean Air Act, 42 U.S.C. § 7401, et seq., the Clean Water Act, 33 U.S.C. § 1251, et seq., the Resource Conservation and Recovery Act, 42 U.S.C. § 6901, et seq., the Superfund Amendments and Reauthorization Act, 42 U.S.C. § 11011, et seq., the Toxic Substances Control Act, 15 U.S.C. § 2601, et seq., the Water Pollution Control Act, 33 U.S.C. § 1251, et seq., the Safe Drinking Water Act, 42 U.S.C. § 300f, et seq., the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended, 42 U.S.C. § 9601, et seq., the Oil Pollution Act of 1990, 33 U.S.C. § 2701, et seq., the Emergency Planning and Community Right-To-Know Act, 42 U.S.C. § 11001, et seq., the Endangered Species Act of 1973, 16 U.S.C. § 1531, et seq., the Migratory Bird Treaty Act, 16 U.S.C. § 703, et seq., and any other federal, state, county, or local laws, rules, regulations, ordinances, licenses, permits, judgments, writs, decrees, injunctions or orders relating to the protection of human health or the environment.

2.29 “Existing Wells” shall mean those oil and gas wells which have been drilled, completed and placed on production in the Updip Area prior to the Effective Date, and all production, operating rights, personal property, and leasehold equipment, including but not limited to casing, wellhead equipment, fixtures and pipelines owned by Encana and associated with such wells.

2.30 “Force Majeure Event” shall mean an act of God, act of terrorism, strike, lockout, or other industrial disturbance, act of the public enemy, war, blockade, public riot, lightning, fire, storm, flood, explosion, governmental action, restraint or inaction, the interruption or suspension of the receipt or delivery of natural gas due to the inability or failure of any party not a party to this Agreement to receive or deliver such gas, unavailability of equipment, or inability to gain access, ingress or egress to conduct operations (including without limitation delays in or inability to obtain permits, approvals or clearances (including without limitation permits or approvals related to the use of any specific fracture stimulation technology or methodology) from any Governmental Authority).

2.31 “Gas” shall mean any mixture of gaseous hydrocarbons or of hydrocarbons and other gasses, in a gaseous state, consisting primarily of methane.

2.32 “Gathering Agreement” shall mean that [***].

2.33 “Governmental Authority” and “Governmental Authorities” shall mean the United States and the state, county, city and political subdivisions in which the Property is located and which exercise jurisdiction over the Property, and any agency, department, board or instrumentality thereof which exercises jurisdiction over the Property.

2.34 “Hazardous Substances” shall mean any hazardous, toxic, or radioactive pollutant, material or waste defined in or listed under any Environmental Laws, including, without limitation, those elements or compounds which are contained in the list of hazardous substances adopted by the United States Environmental Protection Agency and the list of toxic pollutants

Page 5 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

designated by the United States Congress or said agency and petroleum products, including without limitation, gasoline, fuel oil, diesel, heating oil, motor oil and waste oil.

2.35 [***].

2.36 “Lance Pool” shall mean the interval correlative to that shown on the Schlumberger Phasor Induction-SFL with Linear Correlation Log run on December 4, 1994 in the Stud Horse Butte No. 13-27 well located in the southwest quarter of the southwest quarter (SW1/4SW1/4) of Section 27, Township 29 North, Range 108 West, 6th P.M. which is from a depth of 7,975 feet (equivalent to a subsea -695 feet) to a bottom depth of 12,400 feet (-5,120 feet, subsea), as defined by the Wyoming Oil & Gas Conservation Commission in Cause No. 1, Order No. 1, Docket No. 84-2003 dated April 25, 2003.

2.37 “Leases” and/or “Leasehold Interest” shall mean, collectively, any oil and gas lease interest and/or other mineral interest (including fee interests), surface drillsite tract or contractual right to earn such an interest within, upon or under those lands described on Exhibit A-1, including without limitation the leases described on Exhibit A-1 and all amendments, renewals, extensions, ratifications or replacements thereof, which is obtained or is earned by purchase, assignment, leasehold seismic option, extension, renewal, farmin, acreage contribution or by any other means by either Party to this Agreement, including without limitation all agreements granting, reserving or otherwise conferring rights to explore for, drill for, produce, take, use, market, share in the production of or the proceeds from the sale of oil and/or gas; and rights to acquire any of the foregoing rights.

2.38 “Letters of Attornment” shall mean those letters in Exhibit F attached to this Agreement to be executed on or before the Effective Date by Encana, NWN and [***] and acknowledging Encana’s assignment of a portion of its Leasehold Interest to NWN.

2.39 “Marketable Title” shall mean, as to each Leasehold Interest, such right, title and interest that (i) is deducible of record from the official records of Sublette County, Wyoming, and the official records of the BLM or the Wyoming Office of Lands and Investments, and is free from reasonable doubt to the end that a prudent person engaged in the business of the ownership, development, and operation of producing oil and gas properties with knowledge of all of the facts and their legal bearing would be willing to accept the same, (ii) entitles Encana to receive not less than the interest set forth in Exhibit A-1 as “Encana’s Net Revenue Interest” with respect to all of the oil, gas, and hydrocarbon minerals produced, saved, and marketed from the formations located on the Property for the productive life of the Property, (iii) obligates Encana to pay operating costs and expenses in an amount not greater than “Encana’s Working Interest” set forth in Exhibit A-1 with respect to such Leasehold Interest, and (iv) except for Permitted Encumbrances, is free and clear of all liens and encumbrances.

Page 6 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

2.40 “Marketing Agreement” shall mean that Marketing Agreement attached to the Operating Agreement as Exhibit H.

2.41 “Material Adverse Effect” shall mean (i) any material diminution in the value of the Leasehold Interests, (ii) any material and adverse effect on the use or operation of the Property, or (iii) any material and adverse effect on the ability of Encana to perform its obligations under this Agreement, the Wellbore Assignments, the Assignments and Stipulations of Interest, and the Operating Agreement.

2.42 “Material Change in Financial Condition” shall mean that a Party’s credit rating becomes downgraded to a rating of Ba1 or lower as defined by Moody’s Investors Service, and/or a rating of BB+ or lower as defined by Standard & Poor’s Financial Services.

2.43 “Net Carry Well” shall mean (i) for a Carry Well drilled in which Encana and NWN collectively own One Hundred Percent (100%) of the working interest, one (1) Net Carry Well, (ii) for a Carry Well drilled in which Encana and NWN collectively own less than One Hundred Percent (100%) of the working interest, the fraction of one (1) Net Carry Well derived from the formulae set forth in Section 3.4 or 3.5, as applicable. For purposes of the term “Net Carry Well” only, the term “Carry Well” shall not include Post-Carry Wells.

2.44 “Net Revenue Interest” shall mean a percentage share of the Gas produced and saved from or attributable to a particular Lease or well, after deducting all royalties, overriding royalties, non-participating royalties, net profits interests, production payments, and other burdens on or payments out of production.

2.45 “NGLs” shall mean those liquid hydrocarbons obtained by processing Gas after Gas leaves a CDP.

2.46 “NWN” has the meaning set forth in the first paragraph of this Agreement.

2.47 “NWN Gas” shall mean all Gas produced from or attributable to NWN’s interest in the Downdip Carry Wells and in the Assigned Sections, but excluding Condensate.

2.48 “NWN Share” is [***].

2.49 “Operating Agreement” shall mean the operating agreement attached to this Agreement as Exhibit C, executed as of the Effective Date of this Agreement.

2.50 “OPUC” shall mean the Oregon Public Utilities Commission.

2.51 “Party” and “Parties” have the meanings set forth in the first paragraph of this Agreement.

Page 7 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

2.52 “Permitted Encumbrances” shall mean:

(i) lessors’ royalties, overriding royalties, reversionary interests and similar burdens that (a) are of record on the Effective Date, (b) do not at any time reduce Encana’s Net Revenue Interest in any Lease (or wells located on any Lease) below the percentage identified in Exhibit A-1 as “Encana’s Net Revenue Interest” for that Lease (or wells located on that Lease), (c) do not at any time increase Encana’s Working Interest in any Lease (or wells located on any Lease) without a corresponding increase in Encana’s Net Revenue Interest for that Lease (or wells located on that Lease), and (d) do not cumulatively operate to materially reduce Encana’s Net Revenue Interest with respect to Gas produced from any Lease (or wells located on any lease) below the percentage identified in Exhibit A-1 as “Encana’s Net Revenue Interest” for that Lease (or wells located on that Lease);

(ii) liens, charges, encumbrances, contracts, agreements, instruments, obligations, and other matters that (a) are specifically described in Section 2.52(ii) of the Disclosure Statement as Basic Contracts, (b) do not at any time reduce Encana’s Net Revenue Interest in any Lease (or wells located on any Lease) below the percentage identified in Exhibit A-1 as “Encana’s Net Revenue Interest” for that Lease (or wells located on that Lease), (c) do not at any time increase Encana’s Working Interest in any Lease (or wells located on any Lease) without a corresponding increase in Encana’s Net Revenue Interest for that Lease (or wells loEcated on that Lease), and (d) do not cumulatively operate to materially reduce Encana’s Net Revenue Interest with respect to Gas produced from any Lease (or wells located on any lease) below the percentage identified in Exhibit A-1 as “Encana’s Net Revenue Interest” for that Lease (or wells located on that Lease);

(iii) liens for Taxes or governmental assessments that are not yet delinquent or are being contested in good faith by appropriate proceedings which effectively delay any enforcement thereof;

(iv) materialman’s, mechanic’s, repairman’s, employee’s, contractor’s, operator’s, Tax, and other similar liens or charges arising by law or contract in the ordinary course of business securing current accounts payable (owing with respect to goods or services provided with respect to the Leasehold Interests) that are not more than sixty (60) days past the invoice or due date, whichever is earlier, unless being contested in good faith by appropriate proceedings which effectively delay any enforcement thereof;

(v) easements, rights-of-way, servitudes, permits, surface leases and other rights in respect of surface operations that do not interfere materially with the operation, value or use of such Leasehold Interest; and

(vi) all rights reserved to or vested in any governmental, statutory or public authority to control or regulate any of the Leasehold Interests in any manner, and all applicable laws, rules and orders of Governmental Authority.

Page 8 of 35

For purposes of clauses (i) and (ii) above, a reduction in the interest of Encana with respect to Gas produced from a Lease listed in Exhibit A-1, or an increase in the portion of the costs and expenses relating to any such Lease that Encana is obligated to pay, shall not be material if the reduction or increase is 0.1% or less (by way of example, and without limiting the generality of the foregoing, if “Encana’s Net Revenue Interest” percentage shown in Exhibit A-1 for a unit or well is 88.0%, a reduction in the interest of Encana will not be material if Encana is entitled to receive not less than 87.9% of all Gas produced from such unit or well).

2.53 “Person” shall mean an individual, corporation, partnership, limited liability company, association, joint stock company, pension fund, trust or trustee thereof, estate or executor thereof, unincorporated organization or joint venture, court or governmental unit or any agency or subdivision thereof, or any other legally recognizable entity.

2.54 “Post-Carry Well” shall mean one or more additional wells which may or may not be drilled pursuant to Section 3.6 following the drilling and completion of [***] Net Carry Wells.

2.55 “Processing Agreement” shall mean that First Amended and Restated Gas Processing Agreement between Enterprise Gas Processing, LLC, a Delaware limited liability company, and Encana dated March 21, 2007 but effective as of February 1, 2006.

2.56 “Property” has the meaning set forth in the first Recital above.

2.57 “Property Tax” has the meaning set forth in Section 15.1 below.

2.58 “Quarterly Statement” has the meaning set forth in Section 3.6 below.

2.59 “Redelivery Points” shall mean (i) [***], as defined in the [***], and (ii) as to NWN’s share of Residue Gas, as defined in the [***], the [***].

2.60 “Reserve Report” shall mean the Year End 2010 Reserve Report prepared for Encana by Netherland, Sewell & Associates, Inc. The term “Reserve Report” shall not include nor refer to any prior or subsequent reserve reports prepared for Encana by any other Person.

2.61 “Rig Release Date” shall mean the date Encana releases the drilling rig from the wellbore of a Carry Well.

2.62 [***]

2.63 [***]

2.64 [***]

Page 9 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

2.65 “Services” is defined in Section 10.1 below.

2.66 “Tax” or “Taxes” means any and all federal, state, local, foreign or other ad valorem, real or personal property, gathering, transportation, pipeline regulating, gross receipts, severance, production, excise, heating content, carbon, environmental, occupation, sales, use, value added, fuel, franchise, employment, premium, windfall profits, excess profits, customs duties, capital stock, profits, withholding, social security (or similar), unemployment, disability, transfer, registration, estimated, alternative or add-on minimum, or other tax, government charge or assessment of any kind whatsoever imposed on or with respect to all or any part of the Leasehold Interests, the Gas produced from Leasehold Interests or the proceeds thereof, or activities in connection with the Leasehold Interests, regardless of the point at which or the manner in which or the Person against whom such taxes, charges or assessments are charged, collected, levied or otherwise imposed, and including any interest, penalties and additions thereto and any obligations to indemnify or otherwise assume or succeed to the liability of any other Person; provided, however, that Taxes shall not include federal and state net income taxes and any penalty or interest surcharges thereon.

2.67 “Term” is defined in Section 12 below.

2.68 “Third Party Failure” is defined in Section 5.3 below.

2.69 “Total NWN Share” is Two Hundred Fifty Million Nine Hundred Twenty Thousand Dollars ($250,920,000).

2.70 “Unspent NWN Share” shall mean the amount by which the NWN Share for a Carry Well exceeds the actual expended Costs of Drilling and Costs of Completing the Carry Well.

2.71 “Updip Area” has the meaning set forth in the first Recital above.

2.72 “Updip Carry Well” shall mean a Carry Well drilled in the Updip Area.

2.73 “Wellbore Assignment” shall mean the wellbore assignment attached to this Agreement as Exhibit B-1.

Section 3. Carry Wells

3.1 Drilling of Carry Wells. During the Term of this Agreement, Encana shall designate and drill [***] Net Carry Wells in which NWN shall participate pursuant to the terms of this Agreement. The location of each Carry Well shall be determined by Encana in its sole discretion, provided that (i) all Carry Wells shall be drilled within either the Updip Area or the Downdip Area on the Leases insofar as they are described in Exhibit A-1, unless NWN elects, under Section 3.10, to allow well(s) planned to be drilled within Acquisition lands to be designated as Carry Wells; (ii) Carry Wells shall be drilled within all areas of proved undeveloped reserves in the Updip Area, as designated in the Reserve Report, that have not been drilled on the Effective Date (i.e., [***] wells); (iii) Encana shall endeavor to drill [***] additional Carry Wells within areas of proved undeveloped reserves in the Updip Area that may

Page 10 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

be identified in subsequent reserve reports; and (iv) each Carry Well in the Downdip Area shall be drilled within an area of proved undeveloped reserves, as designated in the Reserve Report.

Encana shall drill all [***] Net Carry Wells prior to the fifth (5th) anniversary of the Effective Date, as such period may be extended by Force Majeure Events. Encana shall drill no fewer than [***] Net Carry Wells in total during each of the first three (3) twelve- (12-) month periods following the Effective Date, and no fewer than [***] Net Carry Wells in total during each of the last two (2) twelve- (12-) month periods following the Effective Date. If the number of Net Carry Wells actually drilled in any calendar quarter is less than the number shown on the Drilling Schedule, then Encana shall make commercially reasonable efforts to drill makeup Net Carry Wells in the next calendar quarter, in addition to the Net Carry Wells scheduled for that quarter on the Drilling Schedule. If Encana drills more Net Carry Wells than shown on the Drilling Schedule in any calendar quarter, the excess Net Carry Well(s) can be credited to any other calendar quarter in which Encana drills fewer Net Carry Wells than scheduled on the Drilling Schedule. Encana shall drill and complete, equip, tie in and produce, or plug and abandon the Carry Wells, with due diligence and reasonable dispatch in accordance with applicable laws and the Operating Agreement and in a good and workmanlike manner, in accordance with good oil field practice. Encana shall act as a reasonable and prudent operator to complete each Carry Well within a reasonable and customary period of time without consideration of market prices for production.

Notwithstanding anything to the contrary in this Agreement, Encana shall not be required to drill Carry Wells and NWN shall not be required to pay the NWN Share, if Encana is unable to secure necessary permits for Carry Wells from any Governmental Authority.

3.2 Costs of Carry Wells. NWN agrees to pay Encana the NWN Share for each Carry Well drilled pursuant to this Agreement, chargeable in accordance with the Operating Agreement for the Costs of Drilling and Costs of Completing each Carry Well. After [***] Net Carry Wells have been drilled, to the extent that NWN has not contributed the Total NWN Share, then Encana shall issue an AFE to NWN for the amount of such deficiency, to be applied to the Costs of Drilling and Costs of Completing one or more Post-Carry Wells. [***]. Encana shall provide NWN with an AFE for Costs of Equipping each Carry Well, which shall be solely for information purposes, and NWN shall have no obligation to make any payment towards any such informational AFE.

Unless the obligation to fund and drill Carry Wells is terminated early pursuant to Section 14.1 or Section 14.3, NWN’s obligation to fund Carry Wells shall terminate when NWN has paid the Total NWN Share to Encana.

3.3 Payment of NWN Share. At least fifteen (15) days but no more than thirty (30) days prior to the anticipated spud date for each Carry Well, Encana shall issue to NWN an AFE that (i) identifies the well as a Carry Well, (ii) specifies the anticipated spud date, and (iii) provides a specific description of the location and the survey plat and wellbore diagram for the

Page 11 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

well. In connection with any AFE, Encana agrees promptly to provide any additional information regarding the Carry Well that is reasonably requested by NWN. NWN shall pay Encana the NWN Share (less any credit for an Unspent NWN Share as described in the following paragraph) for each Carry Well within fifteen (15) days after receipt of notice from Encana that such Carry Well has been spudded. Payment shall be pursuant to the wiring instructions attached to this Agreement as Exhibit E.

As each Carry Well is drilled and completed, Encana shall apply the NWN Share to [***] of the amount invoiced by third parties [***]. After Encana closes its accounting for a Carry Well’s AFE, the Unspent NWN Share, if any, shall be shown as a credit towards the NWN Share on the AFE issued to NWN for the next Carry Well and shall reduce the amount NWN must pay on that AFE.

In the event NWN fails to timely pay all or a portion of the NWN Share (taking into account any credit for Unspent NWN Share from a prior Carry Well) for one or more Carry Wells, Encana shall give NWN written notice of such failure, and NWN shall have thirty (30) days thereafter to remedy the default. If NWN fails to timely remedy the default, Encana may, at its sole discretion and upon notice to NWN, elect to terminate the obligation to fund and drill any future Carry Wells under this Agreement, and

(i) if the Marketing Agreement is then in effect, Encana may withhold delivery of a sufficient amount of NWN’s share of production proceeds from the Updip Area and Downdip Area and apply such proceeds to offset the cumulative total delinquent amount due on the AFE(s) until such time as the delinquent amounts have been recouped, at which time Encana shall assign to NWN the interests provided by this Section 3 for the affected Carry Well(s), if Encana has not done so already; or

(ii) whether or not the Marketing Agreement is in effect, Encana may elect to either

(1) demand that NWN pay the cumulative total delinquent amount due on the AFE(s), and upon receipt of such amount Encana shall assign to NWN the interests provided by this Section 3 for the affected Carry Well(s), if Encana has not done so already; or

(2) not demand that NWN pay the cumulative total delinquent amount due on the AFE(s), in which case Encana shall have no obligation to assign to NWN the interests provided by this Section 3 for the affected Carry Well(s) and may keep the Net Revenue Interest share of Gas that would have been assigned to NWN pursuant to this Section 3 for the affected Carry Well(s).

Any termination pursuant to this Section 3.3 shall not affect NWN’s rights and Encana’s obligations in relation to Carry Wells for which (a) the full NWN Share has been paid (taking into account any credit for Unspent NWN Share from a prior Carry Well) prior to the date of termination and (b) pursuant to the preceding paragraph, Encana recoups delinquent amounts out of production proceeds or receives payment of the total deliquent amount due on the AFE(s).

Page 12 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

The Leasehold Interests that NWN has earned under this Agreement shall continue to be governed by this Agreement and the Operating Agreement. If Encana elects to terminate the obligation to fund and drill Carry Wells pursuant to the preceding paragraph, NWN shall pay [***] to Encana within thirty (30) days of receipt of written notice of termination from Encana under this Section 3.3, and such payment shall be the exclusive remedy for early termination of the obligation to drill Carry Wells under this Agreement due to NWN’s failure to timely pay the NWN Share. The Parties agree that actual damages for early termination of the obligation to drill Carry Wells under this Agreement cannot be ascertained with certainty and intend for the payments to Encana under the preceding sentence to serve as liquidated damages for such default.

3.4 NWN’s Earned Interest in Carry Wells and Leases in the Downdip Area. In consideration of NWN’s timely payment of the NWN Share for each Carry Well drilled in the Downdip Area, Encana shall promptly execute, acknowledge and deliver a Wellbore Assignment, effective as of the first day of the month following the Rig Release Date for each such Downdip Carry Well, assigning to NWN (i) Five Percent (5%) of eight-eighths (8/8ths) of the Leasehold Interest in the wellbore of such Downdip Carry Well together with Five Percent (5%) of “Encana’s Net Revenue Interest,” as set forth for the applicable Lease in Exhibit A-1, in the wellbore of such Downdip Carry Well, limited in depth to the interval correlative to the stratigraphic equivalent of the Lance Pool as encountered in each such Carry Well and excluding any right, title or interest in and to Condensate produced from such Carry Well, and (ii) the right to use the Assets insofar as they are necessary for the production, gathering and processing of Gas produced from such Carry Well, all subject to the terms and conditions of this Agreement and the Permitted Encumbrances in existence on the Effective Date including without reservation Basic Contracts that satisfy Section 2.52(ii). Such percentages shall be proportionately reduced if any Carry Well is a Boundary Well or Election Well in which one or more third parties own a working interest by multiplying such percentages by a decimal fraction equal to (a) the cumulative working interest percentage of production in that Carry Well allocated to NWN and Encana, divided by (b) the total production from such Carry Well. For a Boundary Well or Election Well drilled in the Downdip Area, the decimal fraction so calculated shall be the fraction of a Net Carry Well represented by such well for the purpose of determining when [***] Net Carry Wells have been drilled. With respect only to a Post-Carry Well, in the event the Post-Carry Well is drilled in the Downdip Area, then the Five Percent (5%) interests to be assigned to NWN in the Wellbore Assignment pursuant to this Section 3.4 for the Post-Carry Well shall be multiplied by a decimal fraction equal to (1) the amount of the cumulative Unspent NWN Share paid for that well [***].

Encana shall execute, acknowledge and deliver Wellbore Assignment(s) pursuant to this Section 3.4 once each calendar quarter for interests earned in the preceding calendar quarter. Promptly thereafter, Encana shall cause the Wellbore Assignment(s) to be placed of record in the official records of the County Clerk and Recorder in Sublette County, Wyoming to effect the

Page 13 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

assignment and shall then promptly provide a copy of the recorded Wellbore Assignment(s) to NWN. Additionally, Encana shall promptly prepare the federal/state assignment forms to transfer the applicable operating rights to NWN and file such documents in the appropriate BLM or Wyoming Office of State Lands and Investments office on behalf of NWN. NWN shall reimburse Encana promptly for any fees incurred in connection with the recording or filing of assignments on behalf of NWN.

3.5 NWN’s Earned Interest in Updip Carry Wells and Leases. In consideration of NWN’s timely payment of the NWN Share for each Carry Well drilled in either the Updip Area or the Downdip Area, and without regard to the actual location of any Carry Well, Encana shall execute, acknowledge and deliver an Assignment and Stipulation of Interest effective as of the first day of the month following the Rig Release Date for such Carry Well, assigning to NWN (i) One and Two-Tenths Percent (1.2%) of eight-eighths (8/8ths) of the Leasehold Interest in the appropriate Assigned Section (as defined below in this Section 3.5) together with One and Two-Tenths Percent (1.2%) of “Encana’s Net Revenue Interest,” as set forth in Exhibit A-1, in such Assigned Section, limited in depth to the interval correlative to the stratigraphic equivalent of the Lance Pool and excluding any right, title or interest in and to Condensate produced from the Assigned Section, and (ii) the right to use the Assets insofar as they are necessary for the production, gathering and processing of Gas produced from the Assigned Section, all subject to the terms and conditions of this Agreement and the Permitted Encumbrances in existence on the Effective Date, including without reservation Basic Contracts that satisfy Section 2.52(ii). Such percentages shall be proportionately reduced if any Carry Well is a Boundary Well or Election Well in which one or more third parties owns a working interest by multiplying such percentages by a decimal fraction equal to (a) the cumulative working interest percentage of production in that Carry Well allocated to NWN and Encana, divided by (b) the total production from such Carry Well. For a Boundary Well drilled in the Updip Area, the decimal fraction so calculated shall be the fraction of a Net Carry Well represented by such well for the purpose of determining when [***] Net Carry Wells have been drilled. With respect only to a Post-Carry Well, in the event the Post-Carry Well is drilled in the Updip or Downdip Area, then the One and Two-Tenths Percent (1.2%) interests to be assigned to NWN in the Assignment and Stipulation of Interest pursuant to this Section 3.5 for the Post-Carry Well shall be multiplied by a decimal fraction equal to (1) the amount of the cumulative Unspent NWN Share paid for that well [***].

The Assignment and Stipulation of Interest shall cover the Leasehold Interest in Existing Wells in the Assigned Section (and, in the case of a Carry Well drilled in the Updip Area that triggers this Section 3.5, specifically including that Carry Well).

The “Assigned Section” shall initially be Section 32 until such time as the cumulative Leasehold Interest assigned to NWN by Encana in Section 32 reaches Forty-Five Percent (45%) of eight-eighths (8/8ths) of the Leasehold Interest in Section 32, after which the Assigned Section shall be Section 33, until such time as the cumulative Leasehold Interest assigned to NWN in Section 33 reaches Forty-Five Percent (45%) of eight-eighths (8/8ths) of the Leasehold Interest in Section 32, after which the Assigned Section shall be Section 34. Any fraction of a Leasehold Interest percentage that NWN earns that would cause NWN’s cumulative Leasehold Interest to exceed Forty-Five Percent (45%) of eight-eighths (8/8ths) of the Leasehold Interest in Section 32 or 33 shall be assigned to Section 33 or 34, respectively.

Page 14 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

Encana shall execute, acknowledge and deliver Assignment(s) and Stipulation(s) of Interest pursuant to this Section 3.5 once each calendar quarter for interest earned in the preceding calendar quarter. Promptly thereafter, Encana shall cause the Assignment(s) and Stipulation(s) of Interest to be placed of record in the official records of the County Clerk and Recorder in Sublette County, Wyoming to effect the assignment and shall promptly provide a copy of the recorded Assignment(s) and Stipulation(s) of Interest to NWN. Additionally, Encana shall promptly prepare the federal assignment forms to transfer the applicable operating rights to NWN and file such documents in the appropriate BLM office on behalf of NWN. NWN shall reimburse Encana promptly for any fees incurred in connection with the recording of any assignment on behalf of NWN.

3.6 Post-Carry Wells. After [***] Net Carry Wells have been drilled, the cumulative Unspent NWN Share, if any, shall be used to drill one or more Post-Carry Wells. Encana shall issue one or more AFEs to NWN for the cumulative Unspent NWN Share, provided that Encana shall not issue an AFE for a Post-Carry Well for more than the NWN Share. Except as provided in this Section 3.6, the Parties’ rights and obligations vis-à-vis a Post-Carry Well shall be the same as for a Carry Well. If a Post-Carry Well is drilled in the Downdip Area, the interest assigned to NWN in the Wellbore Assignment for that Post-Carry Well shall be calculated as provided in Section 3.4. If a Post-Carry Well is drilled in the Updip Area or the Downdip Area, the interest assigned to NWN in the Assignment and Stipulation of Interest for that Post-Carry Well shall be calculated as provided in Section 3.5.

3.7 Quarterly Statements. Within twenty (20) days of the first day of each calendar quarter following the Effective Date, Encana shall prepare and submit to NWN a statement (the “Quarterly Statement”) showing the drilling activity and earned interest on a quarterly and cumulative basis. The Quarterly Statement shall identify (i) the number and legal location of all Carry Wells drilled in the prior three-month period, (ii) the status of each Carry Well, (iii) the amount NWN paid for each Carry Well, (iv) the Unspent NWN Share, if any, for each Carry Well, (v) the amount and location of Leasehold Interest and Net Revenue Interest earned pursuant to Sections 3.4 and 3.5 above, and (vi) the cumulative totals since the Effective Date for each of the foregoing.

(i) By way of illustration only, the following example shows the interests NWN would earn pursuant to Sections 3.4 and 3.5 during two hypothetical calendar quarters.

Assume that the first day of the month following the Rig Release Date for the following [***] Carry Wells falls in the first hypothetical calendar quarter:

● [***]

● [***]

● [***]

Page 15 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

During that first quarter, NWN would have earned an assignment of (i) pursuant to Section 3.4, a 5% Leasehold Interest and corresponding Net Revenue Interest in the wellbores of the [***] Downdip Carry Wells, and (ii) pursuant to Section 3.5, a 6.0% Leasehold Interest (i.e., 1.2% multiplied by the five Carry Wells) and the corresponding Net Revenue Interest in all Carry Wells, all Existing Wells, and in Encana’s Leasehold Interest in Section 32, each assignment being effective on the first day of the month following the Rig Release Date of the respective Carry Well.

Assume that the first day of the month following the Rig Release Date for the following [***] Carry Wells falls in the second hypothetical calendar quarter:

● [***]

● [***]

● [***]

● [***]

During that second quarter, NWN would have earned an assignment of (i) pursuant to Section 3.4, a 5% Leasehold Interest and the corresponding Net Revenue Interest in the wellbores of the two Downdip Carry Wells, and (ii) pursuant to Section 3.5, a 7.2% Leasehold Interest (i.e., 1.2% multiplied by the six Carry Wells) and the corresponding Net Revenue Interest in all Carry Wells, all Existing Wells, and Encana’s Leasehold Interest in Section 32, each assignment being effective on the first day of the month following the Rig Release Date of the respective Carry Well.

(ii) By way of illustration only, the following example shows the interests NWN would earn pursuant to Section 3.6 in a hypothetical situation:

Assume that after [***] Net Carry Wells have been drilled, the cumulative Unspent NWN Share equals $[***] and Encana drills [***] Post-Carry Well in the Downdip Area. NWN would have earned an assignment of (i) pursuant to Sections 3.6 and 3.4, a 2.5% Leasehold Interest (i.e., [***] cumulative Unspent NWN Share divided by $2.46 million) and the corresponding Net Revenue Interest in the wellbore of the Post-Carry Well, and (ii) pursuant to Sections 3.6 and 3.5, a [***] Leasehold Interest (i.e., [***] cumulative Unspent NWN Share divided by $[***] in all Carry Wells, all Existing Wells, and Encana’s Leasehold Interest in Section 34, each assignment being effective on the first day of the month following the Rig Release Date of the Post-Carry Well.

3.9 Tax Partnership. On the date of execution of this Agreement, the Parties shall enter into a tax partnership agreement in the form set forth in Exhibit G to the Operating Agreement.

Page 16 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

3.10 Subsequent Acquisitions in Downdip Area. In the event Encana acquires an oil and gas Leasehold Interest or an option to acquire any oil and gas Leasehold Interest in the Downdip Area (“Acquisition”) prior to drilling [***] Net Carry Wells, Encana shall provide written notice of the terms, conditions, burdens, obligations and commitments associated with the Acquisition to NWN within thirty (30) days of the closing of the Acquisition. If an Acquisition includes lands located within the Downdip Area and lands located outside the boundaries of the Downdip Area, the Acquisition shall be deemed to include only those lands located inside the Downdip Area for purposes of this Section 3.10, unless the Parties agree otherwise. NWN shall have thirty (30) days after receipt of the notice to notify Encana whether NWN elects to participate in well(s) that Encana may elect to drill on the Acquisition lands (“Election Wells”). Failure to provide such election notice within the thirty- (30-) day period will be deemed an election not to participate in any Election Well, and the interests acquired in the Acquisition will not be subject to this Agreement or the Operating Agreement. If NWN elects to participate, the Election Well(s) will be considered to be drilled on the Leases as described in the first Recital above and will be deemed Carry Wells subject to the terms of the Agreement, provided that (i) an election by NWN to participate will be deemed consent and agreement by NWN to be bound by the terms, conditions, burdens, obligations and commitments of the Acquisition, (ii) Encana shall have no obligation to extend any warranty, representation or indemnification under this Agreement to NWN with respect to any Election Well, and (iii) NWN’s election to participate in any Election Well will be at its sole cost, risk, expense and liability. If an Election Well is drilled and completed in a location in which Encana and NWN collectively own or acquire less than One Hundred Percent (100%) of the working interest, the NWN Share payable for such Carry Well, and the interests assigned to NWN for such Carry Well pursuant to Section 3.4 and 3.5 shall each be proportionately reduced according to the formulae provided in those Sections, and such decimal fraction so calculated shall be the fraction of a Net Carry Well represented by such Election Well for the purpose of determining when [***] Net Carry Wells have been drilled.

3.11 Boundary Line Wells. In the event that a Carry Well is drilled and completed such that the bottomhole location is not in conformance with applicable setback requirements of the Wyoming Oil & Gas Conservation Commission, or if the well is in an approved spacing unit in which Encana and NWN collectively own less than One Hundred Percent (100%) of the working interest (“Boundary Well”), the NWN Share payable for such Carry Well, and the interests assigned to NWN for such Boundary Well pursuant to Section 3.4 or 3.5, as applicable, shall each be proportionately reduced according to the formulae in such Sections, and such fraction of a Net Carry Well shall be counted in determining when [***] Net Carry Wells have been drilled.

Section 4. Title and Other Information

4.1 Title Information. NWN shall have the right, but not the obligation, to review title documentation in Encana’s file relating to any Carry Well at any time. Any title information provided to NWN by Encana is without warranty as to accuracy of title information. Except as required by the Operating Agreement, Encana shall have no obligation to purchase new or supplemental abstracts of title. Encana will undertake curative work in connection with title to

Page 17 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

the Carry Wells which is required by the Operating Agreement or any other operating agreement applicable to such Carry Well and which a reasonably prudent operator would undertake in a similar situation. Encana shall use reasonable commercial efforts to ensure that no liens or encumbrances, other than Permitted Encumbrances, attach to the Updip Area or the Downdip Area prior to the time that all Carry Wells under this Agreement have been drilled and the respective assignments have been delivered, and to cause any such liens or encumbrances to be released reasonably promptly upon receipt of notice thereof.

4.2 Assumption of Certain Obligations. Subject to the other provisions of this Agreement, NWN shall not assume and shall not take title to any interest in the Property from Encana subject to any obligation not listed on the Disclosure Statement. To the extent such obligations are found to exist, Encana and NWN shall take such actions as are necessary to provide NWN with the full benefit of the transactions contemplated by this Agreement as if such obligation did not exist.

Section 5. Operations

5.1 Operating Agreement. Concurrent with the execution of this Agreement, Encana and NWN shall enter into the Operating Agreement that, subject to the terms of this Agreement, shall govern all operations for the Carry Wells and all Existing Wells in which NWN earns an interest pursuant to this Agreement. Encana shall be designated as Operator under the Operating Agreement. The Parties may record or file all documents reasonably required to perfect the Operator’s lien and NWN’s lien, including but not limited to (i) a detailed memorandum in the form attached to the Operating Agreement as Exhibit I that Encana shall promptly record in the official records of Sublette County, Wyoming, upon satisfaction of the condition subsequent identified in Section 7, and (ii) a financing statement in the form attached to the Operating Agreement as Exhibit J that shall be filed with the Delaware Secretary of State upon satisfaction of the condition subsequent identified in Section 7, both of which shall secure Encana’s obligations under the Operating Agreement.

As each Carry Well is drilled, completed and equipped as provided in Section 3.1, Encana and NWN shall each bear and pay its share of the costs and expenses of such Carry Well in accordance with this Agreement and the Operating Agreement, provided that, as between Encana and NWN, Encana shall bear One Hundred Percent (100%) of all capital costs for:

(i) equipment or improvements in the [***] beyond the wellhead of any well governed by the Operating Agreement (including without limitation the cost of connecting the wells to the [***]),

(ii) equipment and improvements at the CDPs, and

(iii) improvements to the [***].

Page 18 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

In addition, Encana shall bear [***] of all costs for fines and/or penalties arising out of alleged violations of [***], without regard to whether such violation arose or was discovered prior to or during the Term of this Agreement. Encana shall also bear [***] of costs for remediation or remedial action which exceed Twenty Thousand Dollars ($20,000) as lease operating expense incurred per incident.

Encana shall also bear and pay One Hundred Percent (100%) of the costs to [***] pursuant to this Agreement and [***] and to perform [***] in accordance with applicable laws, including but not limited to [***].

Provided NWN has timely paid the NWN Share for any specific Carry Well, NWN shall be entitled to, and Encana shall credit to the account of NWN, and unless Encana markets NWN Gas, deliver to NWN at the Redelivery Points its Net Revenue Interest share of Gas produced from each Carry Well drilled in the Downdip Area, and NWN’s cumulative Net Revenue Interest share of Gas produced from each Assigned Section from the effective date of the respective Wellbore Assignments and Assignments and Stipulations of Interest.

5.2 Conflicts. If there is any conflict between this Agreement and the Operating Agreement, this Agreement shall control.

5.3 Sharing of Recoveries. If Encana declares a Force Majeure Event pursuant to Section 9 as a result of the interruption or suspension of the receipt or delivery of Gas (or any of its constituents) due to the inability or failure of any party not a party to this Agreement to receive or deliver such Gas (a “Third Party Failure”), then in the event of the recovery by Encana of any damage amount or other compensation for a Third Party Failure, NWN shall be entitled to a share of such damage amount or compensation calculated based on NWN’s proportionate share of the volume of Gas from the Property affected as a percentage of the total volume of Gas affected.

Section 6. Representations, Warranties and Agreements

6.1 Representations and Warranties. Each Party, with respect to itself only, represents and warrants to the other Party the following:

(i) Existence. Each Party is duly organized, validly existing and in good standing under the applicable laws of the State of its incorporation or formation, and is qualified to do business and is in good standing in the State of Wyoming and in every other jurisdiction where the failure to so qualify would have a Material Adverse Effect on its ability to execute, deliver and perform this Agreement and the other agreements contemplated in this Agreement.

(ii) Power. Except for the required approval described in Section 7, each Party has all requisite power and authority to (a) own, lease or operate its assets and properties and to carry on the business as now conducted, and (b) enter into and perform its obligations under this Agreement and to carry out the transactions contemplated by this Agreement.

Page 19 of 35

[***] This confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

(iii) Authority. Each Party has taken (or caused to be taken) all acts and other proceedings required to be taken by such Party to authorize the execution, delivery and performance by such Party of this Agreement and the other agreements contemplated in this Agreement. This Agreement has been duly executed and delivered by each Party and constitutes the valid and binding obligation of each Party, enforceable against such Party in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, moratorium, reorganization or similar laws affecting the rights of creditors generally and by principles of equity, whether considered in a proceeding at law or in equity. The execution, delivery and performance of this Agreement by each Party does not and will not (a) conflict with, or result in any violation of or constitute a breach or default (with notice or lapse of time, or both) under (1) any provision of the organizational documents of such Party, or (2) any applicable statute, law, rule, regulation, order, writ, judgment, decree, agreement, instrument or license applicable to such Party, except as would not have a Material Adverse Effect, or (b) require the submission of any notice, report, consent or other filing with or from any Governmental Authority or third persons, other than such consents as are customarily obtained after assignment of an interest similar to the Wellbore Assignment and Assignment and Stipulation of Interest.

(iv) Pending Matters. Except as set forth in Section 6.1(iv) of the Disclosure Statement, there are no actions, suits or proceedings by a third party or a Governmental Authority pending or, to such Party’s knowledge, threatened against a Party which if decided unfavorably to such Party could have a Material Adverse Effect on the ability of such Party to execute, deliver or perform this Agreement or could materially affect its title to, or ownership or operation of the Property.

(v) Broker Fee. No Party has incurred any obligation or liability, contingent or otherwise, (or taken any action) for any fee payable to a broker or finder with respect to the matters provided for in this Agreement or the other agreements contemplated in this Agreement which could be attributable to or charged to the other Party. Each Party shall indemnify, defend and hold harmless the other Party from any claims, damages, liabilities, costs and expenses, including reasonable attorneys’ fees in the event the prior sentence should be or become untrue as to such Party.

(vi) Enforceability. This Agreement has been duly executed and delivered by each Party. This Agreement and the Operating Agreement constitute, and each Wellbore Assignment and Assignment and Stipulation of Interest will constitute, on the date of their respective executions, the legal, valid and binding acts and obligations of each Party, enforceable against each Party in accordance with its terms, subject, however, to bankruptcy, insolvency, reorganization, moratorium and other laws affecting creditors’ rights generally and to general principles of equity.

(vii) No Conflicts. Encana’s execution, delivery and performance of this Agreement and the Operating Agreement, and each Wellbore Assignment and Assignment and Stipulation of Interest, and NWN’s execution, delivery and performance of this Agreement and the Operating Agreement will not (a) result in a breach of or constitute a default under any Lease or any agreement binding or affecting the Leasehold Interests, any indenture, bank loan, credit agreement or farmout agreement, program agreement or operating agreement, or any other material agreement or instrument to which either Encana or NWN is a party or by either Party or

Page 20 of 35

its respective properties may be currently bound or affected, (b) cause either Party to become obligated to, or to offer to, prepay, redeem or purchase any indebtedness, or (c) except as set forth in Section 6.2(vii) of the Disclosure Statement, result in or require the creation or imposition of any mortgage, lien, pledge, security interest, charge or other encumbrance upon or of any of the properties or assets of either Party (including the Leasehold Interests). Neither Party is in default under any order, writ, judgment, decree, determination, indenture, agreement or instrument in any manner that now or in the future could reasonably be expected to have a Material Adverse Effect.

(viii) Governmental Approvals. Except for approvals by Governmental Authorities that are customarily obtained after execution of the respective document and listed in Section 6.1(viii) of the Disclosure Statement, no authorization, consent, approval, license or exemption of, and no filing or registration with, any court or governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign, is necessary for the valid execution and delivery by either Party of, or the performance by either Party of its respective obligations under this Agreement or the Operating Agreement that has not been obtained or performed or the period for objection thereto expired.

6.2 Representations and Warranties of Encana. Encana represents and warrants to NWN, and to any mortgagee or beneficiary under a deed of trust given by NWN, as of the Effective Date and on each date Encana executes, acknowledges, and delivers an assignment pursuant to Sections 3.4 and 3.5, the following:

(i) Disclosure. Taken as a whole, and to the best of Encana’s knowledge based upon commercially reasonable inquiry, none of the information, memoranda, exhibits, reports, financial statements, and other data furnished by or on behalf of Encana to NWN in connection with the transactions described in this Agreement, including without limitation the Reserve Report, contains an untrue statement of a material fact or omits to state any material fact. To the best of Encana’s knowledge based upon commercially reasonable inquiry, there is no material fact that has not been disclosed to NWN that might reasonably be expected to have a Material Adverse Effect. The Leasehold Interests constitute all of the properties and interests of Encana within the Updip Area and the Downdip Area that are the subject of the Reserve Report, and, except for (a) production from the Property in the ordinary course of business, (b) matters listed in Section 6.2(i) of the Disclosure Statement, and (c) changes in the general market prices of oil and natural gas, no material adverse change in the condition of or remaining recoverable reserves attributable to the Property has occurred since the date of the Reserve Report. Except for matters listed in Section 6.2(i) of the Disclosure Statement, no material adverse change in the financial condition, or results of operations or cash flows, of Encana has occurred since the date of the most recent audited financial statements delivered to NWN, if any. The actions of Encana in furnishing information to NWN in connection with the transactions described in this Agreement do not and will not violate any duty owed by Encana to any Person to which such information relates or any obligation of Encana under any existing agreement, document, or instrument.

Page 21 of 35

(ii) Lessee Qualification. Encana is qualified pursuant to federal and state law, as applicable, to own and operate federal and state oil and gas leases in the State of Wyoming, and is in good standing with, authorized by, and qualified with all Governmental Authorities with jurisdiction over operations on such oil and gas leases, to the extent Encana is required by such Governmental Authorities to so qualify and maintain good standing.

(iii) Status of Leases. The Leases are in full force and effect, are valid and subsisting and cover the entire estate which they purport to cover. Encana is not aware of any material alleged or actual default under any contract or agreement pertaining to the Property, including without limitation the Basic Contracts. No party to any Lease has given to Encana or threatened to give notice of any action to terminate, cancel, rescind or procure judicial reformation of any Lease or of any provision thereof.

(iv) Marketable Title. Encana represents and warrants that it holds Marketable Title to the Leasehold Interests as shown on Exhibit A-1 sufficient to convey to NWN the percentages of the working interest and Net Revenue Interest in the Leasehold Interests provided in Section 3 of this Agreement, provided that this warranty is personal to NWN and may not be conveyed by NWN. Encana owns good title to the Assets, free and clear of any encumbrances, liens or security interests other than Permitted Encumbrances.

(v) Consents, Preferential Rights and Required Notices. Except as disclosed in Section 6.2(v) of the Disclosure Statement, all consents and approvals necessary to permit the valid conveyance by Encana of the Leasehold Interests and execution and delivery of this Agreement and the Operating Agreement, and each Wellbore Assignment and Assignment and Stipulation of Interest, have been obtained (or deemed obtained, due to the time for exercising such preferential rights having expired). Waivers of all preferential purchase rights affecting Encana’s right, title and interest in the Leasehold Interests have been obtained. All advance notifications required to be given to third parties of the transactions contemplated in this Agreement and the Operating Agreement, and each Wellbore Assignment and Assignment and Stipulation of Interest, necessary to permit the valid conveyance to NWN of the Leasehold Interests and execution and delivery of this Agreement and the Operating Agreement, and each Wellbore Assignment and Assignment and Stipulation of Interest, have been timely and properly given.

(vi) Operations. Neither the Existing Wells nor the Carry Wells that will be drilled pursuant to this Agreement are subject to any third-party operating agreements.

(a) no third party has any right to purchase from Encana any natural gas from the Property (including any call, right of first refusal or preferential right to purchase) that does not terminate within one month or is not terminable by Encana without penalty on notice of one month or less;

Page 22 of 35

(b) neither the Leasehold Interests nor the Gas attributable to the Leasehold Interests are subject, committed, or dedicated to any joint operating, unitization, pooling, communitization or area of mutual interest agreement; and

(c) neither the Leasehold Interests nor the Gas attributable to the Leasehold Interests are subject, committed, or dedicated to any contract that will or could reasonably be expected to prevent or interfere with the ownership, exploration, development, operation, maintenance or use of any of the Leasehold Interests in accordance with prudent industry practices or in accordance with the manner in which such Leasehold Interest is currently being owned, explored, developed, operated, maintained or used.

(viii) Documents. To the best of Encana’s knowledge upon commercially reasonable inquiry, (a) all Basic Contracts are listed on Section 6.2(viii) of the Disclosure Statement; (b) Encana has furnished or made available to NWN accurate and complete copies of all Basic Contracts; (c) all Basic Contracts are in full force and effect and are the valid and legally binding obligations of the parties to the Basic Contracts and are enforceable in accordance with their respective terms; (d) no default, event of default, or other similar condition or event (however described) exists or, with the lapse of time or the giving of notice, or both, would exist for any Basic Contracts; and (e) the execution and delivery of this Agreement and the consummation of the transactions contemplated by this Agreement will not result in a breach of, constitute a default under, or result in a violation of the provisions of any Basic Contract to which Encana is a party or any overriding royalty agreement applicable to those lands subject to the Leases.

(ix) Compliance with Laws. Except as disclosed in Section 6.2(ix) of the Disclosure Statement, and to the best of Encana’s knowledge based upon commercially reasonable inquiry, (a) the Leasehold Interests have been and are being owned and operated, in all material respects, in accordance with all applicable laws, rules and regulations (including Environmental Laws) of all Governmental Authorities having or asserting jurisdiction relating to the Leasehold Interests or to the ownership and operation of the Leasehold Interests, and (b) Encana has obtained and is and has been in compliance in all material respects with all licenses, approvals and permits required under any such laws, and all licenses, approvals and permits are in full force and effect (including those relating to past or present treatment, storage, disposal or release of a Hazardous Substance into the environment).

(x) No Casualties. During the last twelve (12) months, no Casualty Defect adversely affecting (a) the operation of the Leasehold Interests or (b) the ability of Encana to perform Encana’s obligations under this Agreement, the Wellbore Assignments, the Assignments of Leasehold and Wellbore Interests, and the Operating Agreement, has occurred.

(xi) ORRI Amendments. The overriding royalty agreements affecting the Leases that were subject to that certain Amendment of Assignments of Overriding Royalty Interests dated June 1, 2000 have been made subject to an amendment in the identical form to that certain Second Amendment of Assignments of Overriding Royalty Interest between Encana and Joseph J. Scott Trust dated December 27, 2010.

Page 23 of 35

The representations and warranties provided in this Section 6.2 shall in no event be deemed waived or made ineffective by reason of NWN’s opportunity for or results from conducting due diligence prior to the execution of this Agreement.

Section 7. Condition Subsequent: OPUC Approval

This Agreement shall have no force and effect unless and until the OPUC approves this Agreement in full and without modification in an order satisfactory to NWN.

Section 8. Additional Covenants

8.1 Encana shall keep the representation and warranty in Section 6.2(iii) true until the obligations under Section 3 have been completed.

8.2 Encana shall use commercially reasonable efforts to maintain the Leases in effect without liens or encumbrances arising after the Effective Date until all Carry Wells have been drilled and all assignments required by Sections 3.4 and 3.5 have been recorded.

8.3 Encana shall not, during the Term, create or suffer any calls on production or contracts for sale of production encumbering NWN’s interest in all Existing Wells, Carry Wells, and any future wells drilled in the Updip Area which provide for the delivery of Gas at a price below the prevailing market price.

8.4 Prior to drilling a Carry Well, Encana shall have obtained all consents, approvals, certificates, licenses, permits, and other authorizations of the necessary Governmental Authorities required for Encana to own, develop, operate, and maintain the Property insofar as it pertains to such Carry Well.

8.5 Each Party shall take its pro-rata share of all Gas produced from the Property so as to not go out of balance.

8.6 In all material respects, Encana shall use commercially reasonable efforts to ensure that Encana’s operations on the Property comply with all applicable laws, rules and regulations (including Environmental Laws) of all Governmental Authorities having or asserting jurisdiction relating to the Property.