Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - NORTHWEST NATURAL GAS CO | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 CFO CERTIFICATION - NORTHWEST NATURAL GAS CO | nwn-2014x930x10qxexhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 CEO CERTIFICATION - NORTHWEST NATURAL GAS CO | nwn-2014x930x10qxexhibit311.htm |

| EX-32.1 - EXHIBIT 32.1 CEO AND CFO CERTIFICATION - NORTHWEST NATURAL GAS CO | nwn-2014x930x10qxexhibit321.htm |

| EX-12 - EXHIBIT 12 FIXED CHARGES - NORTHWEST NATURAL GAS CO | nwn-2014x930x10qxexhibit12.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to____________

Commission file number 1-15973

NORTHWEST NATURAL GAS COMPANY

(Exact name of registrant as specified in its charter)

Oregon | 93-0256722 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

220 N.W. Second Avenue, Portland, Oregon 97209

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (503) 226-4211

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ X ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer [ X ] Accelerated Filer [ ]

Non-accelerated Filer [ ] Smaller Reporting Company [ ]

(Do not check if a Smaller Reporting Company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [ X ]

At October 24, 2014, 27,206,484 shares of the registrant’s Common Stock (the only class of Common Stock) were outstanding.

NORTHWEST NATURAL GAS COMPANY

For the Quarterly Period Ended September 30, 2014

TABLE OF CONTENTS

Page | ||

PART 1. | FINANCIAL INFORMATION | |

Unaudited Consolidated Financial Statements: | ||

PART II. | OTHER INFORMATION | |

FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements regarding the following:

• | plans; |

• | objectives; |

• | goals; |

• | strategies; |

• | assumptions and estimates; |

• | future events or performance; |

• | trends; |

• | timing and cyclicality; |

• | earnings and dividends; |

• | growth; |

• | customer rates; |

• | commodity costs; |

• | gas reserves; |

• | operational performance and costs; |

• | projections and efficacy of derivatives and hedges; |

• | liquidity and financial positions; |

• | project development and expansion; |

• | competition; |

• | procurement and development of gas supplies; |

• | estimated expenditures; |

• | costs of compliance; |

• | credit exposures; |

• | potential efficiencies; |

• | rate recovery and refunds; |

• | impacts of laws, rules, and regulations; |

• | tax liabilities or refunds; |

• | levels and pricing of gas storage contracts and gas storage market trends; |

• | efficacy of system enhancements; |

• | outcomes and effects of potential claims, litigation, regulatory actions, and other administrative matters; |

• | projected obligations under retirement plans; |

• | availability, adequacy, and shift in mix of gas supplies; |

• | approval and adequacy of regulatory deferrals; |

• | effects of regulatory mechanisms; |

• | environmental, regulatory, litigation and insurance costs and recoveries; and |

• | effects of the new labor contract. |

Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We therefore caution you against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements are discussed in our 2013 Annual Report on Form 10-K, Part I, Item 1A “Risk Factors” and Part II, Item 7 and Item 7A, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Quantitative and Qualitative Disclosures about Market Risk,” and in Part I, Items 2 and 3, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Quantitative and Qualitative Disclosures About Market Risk,” and Part II, Item 1A, “Risk Factors,” herein.

Any forward-looking statement made by us in this report speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as may be required by law.

1

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS

NORTHWEST NATURAL GAS COMPANY CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED) | ||||||||||||||||

Three Months Ended | Nine Months Ended | |||||||||||||||

September 30, | September 30, | |||||||||||||||

In thousands, except per share data | 2014 | 2013 | 2014 | 2013 | ||||||||||||

Operating revenues | $ | 87,199 | $ | 88,195 | $ | 513,754 | $ | 497,770 | ||||||||

Operating expenses: | ||||||||||||||||

Cost of gas | 32,227 | 33,655 | 245,708 | 235,156 | ||||||||||||

Operations and maintenance | 32,968 | 32,636 | 103,085 | 99,610 | ||||||||||||

General taxes | 7,143 | 6,954 | 22,508 | 23,028 | ||||||||||||

Depreciation and amortization | 19,938 | 18,737 | 59,236 | 56,474 | ||||||||||||

Total operating expenses | 92,276 | 91,982 | 430,537 | 414,268 | ||||||||||||

Income (loss) from operations | (5,077 | ) | (3,787 | ) | 83,217 | 83,502 | ||||||||||

Other income and expense, net | 407 | 1,300 | 2,052 | 3,270 | ||||||||||||

Interest expense, net | 10,805 | 11,347 | 34,024 | 33,543 | ||||||||||||

Income (loss) before income taxes | (15,475 | ) | (13,834 | ) | 51,245 | 53,229 | ||||||||||

Income tax expense (benefit) | (6,742 | ) | (5,601 | ) | 21,023 | 21,697 | ||||||||||

Net income (loss) | (8,733 | ) | (8,233 | ) | 30,222 | 31,532 | ||||||||||

Other comprehensive income: | ||||||||||||||||

Amortization of non-qualified employee benefit plan liability, net of taxes of $108 and $152 for the three months and $324 and $454 for the nine months ended September 30, 2014 and 2013, respectively | 166 | 232 | 497 | 697 | ||||||||||||

Comprehensive income (loss) | $ | (8,567 | ) | $ | (8,001 | ) | $ | 30,719 | $ | 32,229 | ||||||

Average common shares outstanding: | ||||||||||||||||

Basic | 27,189 | 26,987 | 27,145 | 26,962 | ||||||||||||

Diluted | 27,189 | 26,987 | 27,195 | 27,013 | ||||||||||||

Earnings (loss) per share of common stock: | ||||||||||||||||

Basic | $ | (0.32 | ) | $ | (0.31 | ) | $ | 1.11 | $ | 1.17 | ||||||

Diluted | (0.32 | ) | (0.31 | ) | 1.11 | 1.17 | ||||||||||

Dividends declared per share of common stock | 0.460 | 0.455 | 1.380 | 1.365 | ||||||||||||

See Notes to Unaudited Consolidated Financial Statements.

2

NORTHWEST NATURAL GAS COMPANY CONSOLIDATED BALANCE SHEETS (UNAUDITED) | ||||||||||||

In thousands | September 30, 2014 | September 30, 2013 | December 31, 2013 | |||||||||

Assets: | ||||||||||||

Current assets: | ||||||||||||

Cash and cash equivalents | $ | 8,275 | $ | 16,105 | $ | 9,471 | ||||||

Accounts receivable | 30,468 | 29,821 | 81,889 | |||||||||

Accrued unbilled revenue | 12,442 | 16,493 | 61,527 | |||||||||

Allowance for uncollectible accounts | (840 | ) | (802 | ) | (1,656 | ) | ||||||

Regulatory assets | 52,250 | 26,293 | 22,635 | |||||||||

Derivative instruments | 5,587 | 1,452 | 5,311 | |||||||||

Inventories | 86,600 | 75,419 | 60,669 | |||||||||

Gas reserves | 21,455 | 18,083 | 20,646 | |||||||||

Income taxes receivable | 7,639 | 909 | 3,534 | |||||||||

Deferred tax assets | 5,100 | — | 45,241 | |||||||||

Other current assets | 19,158 | 11,936 | 21,181 | |||||||||

Total current assets | 248,134 | 195,709 | 330,448 | |||||||||

Non-current assets: | ||||||||||||

Property, plant, and equipment | 2,990,662 | 2,865,860 | 2,918,739 | |||||||||

Less: Accumulated depreciation | 883,568 | 846,346 | 855,865 | |||||||||

Total property, plant, and equipment, net | 2,107,094 | 2,019,514 | 2,062,874 | |||||||||

Gas reserves | 131,745 | 115,218 | 121,998 | |||||||||

Regulatory assets | 263,321 | 387,676 | 369,603 | |||||||||

Derivative instruments | 602 | 1,682 | 1,880 | |||||||||

Other investments | 67,980 | 67,548 | 67,851 | |||||||||

Restricted cash | 3,000 | 4,000 | 4,000 | |||||||||

Other non-current assets | 11,648 | 14,566 | 12,257 | |||||||||

Total non-current assets | 2,585,390 | 2,610,204 | 2,640,463 | |||||||||

Total assets | $ | 2,833,524 | $ | 2,805,913 | $ | 2,970,911 | ||||||

See Notes to Unaudited Consolidated Financial Statements.

3

NORTHWEST NATURAL GAS COMPANY CONSOLIDATED BALANCE SHEETS (UNAUDITED) | ||||||||||||

In thousands | September 30, 2014 | September 30, 2013 | December 31, 2013 | |||||||||

Liabilities and equity: | ||||||||||||

Current liabilities: | ||||||||||||

Short-term debt | $ | 190,000 | $ | 141,300 | $ | 188,200 | ||||||

Current maturities of long-term debt | 40,000 | 60,000 | 60,000 | |||||||||

Accounts payable | 71,018 | 67,652 | 96,126 | |||||||||

Taxes accrued | 11,876 | 11,302 | 10,856 | |||||||||

Interest accrued | 10,427 | 11,143 | 7,103 | |||||||||

Regulatory liabilities | 23,352 | 16,506 | 28,335 | |||||||||

Derivative instruments | 5,520 | 8,275 | 1,891 | |||||||||

Other current liabilities | 33,481 | 26,289 | 40,280 | |||||||||

Total current liabilities | 385,674 | 342,467 | 432,791 | |||||||||

Long-term debt | 621,700 | 681,700 | 681,700 | |||||||||

Deferred credits and other non-current liabilities: | ||||||||||||

Deferred tax liabilities | 499,809 | 463,566 | 532,036 | |||||||||

Regulatory liabilities | 312,500 | 298,220 | 303,485 | |||||||||

Pension and other postretirement benefit liabilities | 142,502 | 210,943 | 149,354 | |||||||||

Derivative instruments | 551 | 1,404 | 615 | |||||||||

Other non-current liabilities | 118,531 | 77,322 | 119,058 | |||||||||

Total deferred credits and other non-current liabilities | 1,073,893 | 1,051,455 | 1,104,548 | |||||||||

Commitments and contingencies (see Note 13) | — | — | — | |||||||||

Equity: | ||||||||||||

Common stock - no par value; authorized 100,000 shares; issued and outstanding 27,203, 27,001, and 27,075 at September 30, 2014 and 2013 and December 31, 2013, respectively | 371,657 | 361,789 | 364,549 | |||||||||

Retained earnings | 386,461 | 377,096 | 393,681 | |||||||||

Accumulated other comprehensive loss | (5,861 | ) | (8,594 | ) | (6,358 | ) | ||||||

Total equity | 752,257 | 730,291 | 751,872 | |||||||||

Total liabilities and equity | $ | 2,833,524 | $ | 2,805,913 | $ | 2,970,911 | ||||||

See Notes to Unaudited Consolidated Financial Statements.

4

NORTHWEST NATURAL GAS COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) | ||||||||

Nine Months Ended | ||||||||

September 30, | ||||||||

In thousands | 2014 | 2013 | ||||||

Operating activities: | ||||||||

Net income | $ | 30,222 | $ | 31,532 | ||||

Adjustments to reconcile net income to cash provided by operations: | ||||||||

Depreciation and amortization | 59,236 | 56,474 | ||||||

Regulatory amortization of gas reserves | 13,795 | 8,132 | ||||||

Deferred tax liabilities, net | 10,721 | 22,003 | ||||||

Non-cash expenses related to qualified defined benefit pension plans | 3,795 | 4,256 | ||||||

Contributions to qualified defined benefit pension plans | (10,500 | ) | (8,900 | ) | ||||

Deferred environmental recoveries, net of (expenditures) | 89,537 | (10,805 | ) | |||||

Other | (1,692 | ) | (2,116 | ) | ||||

Changes in assets and liabilities: | ||||||||

Receivables | 100,931 | 70,154 | ||||||

Inventories | (25,931 | ) | (7,817 | ) | ||||

Taxes accrued | (3,085 | ) | 3,357 | |||||

Accounts payable | (28,762 | ) | (19,860 | ) | ||||

Interest accrued | 3,324 | 5,190 | ||||||

Deferred gas costs | (22,173 | ) | (4,159 | ) | ||||

Other, net | (4,554 | ) | 9,961 | |||||

Cash provided by operating activities | 214,864 | 157,402 | ||||||

Investing activities: | ||||||||

Capital expenditures | (86,552 | ) | (86,287 | ) | ||||

Utility gas reserves | (21,734 | ) | (41,777 | ) | ||||

Proceeds from sale of assets | — | 6,580 | ||||||

Restricted cash | 1,000 | — | ||||||

Other | 82 | 2,116 | ||||||

Cash used in investing activities | (107,204 | ) | (119,368 | ) | ||||

Financing activities: | ||||||||

Common stock issued, net | 5,460 | 3,754 | ||||||

Long-term debt issued | — | 50,000 | ||||||

Long-term debt retired | (80,000 | ) | — | |||||

Change in short-term debt | 1,800 | (48,950 | ) | |||||

Cash dividend payments on common stock | (37,442 | ) | (36,783 | ) | ||||

Other | 1,326 | 1,127 | ||||||

Cash used in financing activities | (108,856 | ) | (30,852 | ) | ||||

Increase (decrease) in cash and cash equivalents | (1,196 | ) | 7,182 | |||||

Cash and cash equivalents, beginning of period | 9,471 | 8,923 | ||||||

Cash and cash equivalents, end of period | $ | 8,275 | $ | 16,105 | ||||

Supplemental disclosure of cash flow information: | ||||||||

Interest paid | $ | 30,701 | $ | 28,353 | ||||

Income taxes paid | 14,945 | 570 | ||||||

5

NORTHWEST NATURAL GAS COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1. ORGANIZATION AND PRINCIPLES OF CONSOLIDATION

The accompanying consolidated financial statements represent the consolidation of Northwest Natural Gas Company (NW Natural or the Company) and all companies that we directly or indirectly control, either through majority ownership or otherwise. We have two core businesses: our regulated local gas distribution business, referred to as the utility segment, which serves residential, commercial, and industrial customers in Oregon and southwest Washington; and our gas storage businesses, referred to as the gas storage segment, which provides storage services for utilities, gas marketers, electric generators, and large industrial users from facilities located in Oregon and California. In addition, we have investments and other non-utility activities that we aggregate and report as other.

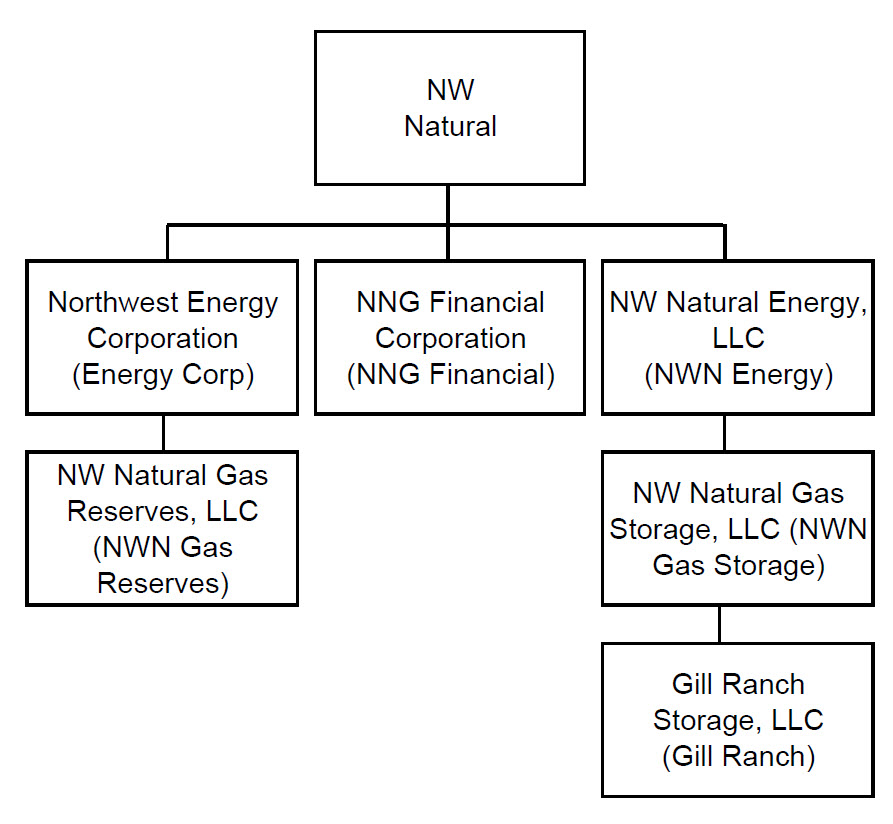

Our core utility business assets and operating activities are largely included in the parent company, NW Natural. Our direct and indirect wholly-owned subsidiaries include NW Natural Energy, LLC (NWN Energy), NW Natural Gas Storage, LLC (NWN Gas Storage), Gill Ranch Storage, LLC (Gill Ranch), NNG Financial Corporation (NNG Financial), Northwest Energy Corporation (Energy Corp), and NW Natural Gas Reserves, LLC (NWN Gas Reserves). Investments in corporate joint ventures and partnerships that we do not directly or indirectly control, and for which we are not the primary beneficiary, are accounted for under the equity method, which includes NWN Energy’s investment in Palomar Gas Holdings, LLC (PGH) and NNG Financial's investment in Kelso-Beaver (KB) Pipeline. NW Natural and its affiliated companies are collectively referred to herein as NW Natural. The consolidated unaudited financial statements are presented after elimination of all significant intercompany balances and transactions, except for amounts required to be included under regulatory accounting standards to reflect the effect of such regulation. In this report, the term “utility” is used to describe our regulated gas distribution business, and the term “non-utility” is used to describe our gas storage businesses and other non-utility investments and business activities.

Certain prior year balances in our unaudited consolidated financial statements and notes have been reclassified to conform with the current presentation. These reclassifications had no impact on our prior year’s consolidated results of operations, financial condition, or cash flows.

Information presented in these interim consolidated financial statements is unaudited, but includes all material adjustments that management considers necessary for fair presentation of the results for each period reported including normal recurring accruals. These consolidated financial statements should be read in conjunction with the audited consolidated financial statements and related notes included in our 2013 Annual Report on Form 10-K (2013 Form 10-K). A significant part of our business is of a seasonal nature; therefore, results of operations for interim periods are not necessarily indicative of full year results.

2. SIGNIFICANT ACCOUNTING POLICIES

Our significant accounting policies are described in Note 2 of the 2013 Form 10-K. There were no material changes to those accounting policies during the nine months ended September 30, 2014. The following are current updates to certain critical accounting policy estimates and new accounting standards in general.

6

Regulatory Accounting

In applying regulatory accounting in accordance with generally accepted accounting principles in the United States of America (GAAP), we capitalize or defer certain costs and revenues as regulatory assets and liabilities. These deferrals were as follows:

Regulatory Assets | ||||||||||||

September 30, | December 31, | |||||||||||

In thousands | 2014 | 2013 | 2013 | |||||||||

Current: | ||||||||||||

Unrealized loss on derivatives(1) | $ | 5,520 | $ | 8,275 | $ | 1,891 | ||||||

Gas costs | 23,795 | — | 4,286 | |||||||||

Other(2) | 22,935 | 18,018 | 16,458 | |||||||||

Total current | $ | 52,250 | $ | 26,293 | $ | 22,635 | ||||||

Non-current: | ||||||||||||

Unrealized loss on derivatives(1) | $ | 551 | $ | 1,404 | $ | 615 | ||||||

Pension balancing(3) | 30,682 | 22,976 | 25,713 | |||||||||

Deferred income taxes | 49,007 | 53,065 | 51,814 | |||||||||

Pension and other postretirement benefit liabilities(3) | 118,485 | 187,000 | 125,855 | |||||||||

Environmental costs(4) | 51,861 | 118,029 | 148,389 | |||||||||

Gas costs | 1,936 | — | 1,840 | |||||||||

Other(2) | 10,799 | 5,202 | 15,377 | |||||||||

Total non-current | $ | 263,321 | $ | 387,676 | $ | 369,603 | ||||||

Regulatory Liabilities | ||||||||||||

September 30, | December 31, | |||||||||||

In thousands | 2014 | 2013 | 2013 | |||||||||

Current: | ||||||||||||

Gas costs | $ | 6,704 | $ | 3,096 | $ | 7,510 | ||||||

Unrealized gain on derivatives(1) | 5,320 | 1,386 | 5,290 | |||||||||

Other(2) | 11,328 | 12,024 | 15,535 | |||||||||

Total current | $ | 23,352 | $ | 16,506 | $ | 28,335 | ||||||

Non-current: | ||||||||||||

Gas costs | $ | 410 | $ | 11 | $ | 2,172 | ||||||

Unrealized gain on derivatives(1) | 602 | 1,682 | 1,880 | |||||||||

Accrued asset removal costs | 307,815 | 293,005 | 296,294 | |||||||||

Other(2) | 3,673 | 3,522 | 3,139 | |||||||||

Total non-current | $ | 312,500 | $ | 298,220 | $ | 303,485 | ||||||

(1) | Unrealized gains or losses on derivatives are non-cash items and, therefore, do not earn a rate of return or a carrying charge. These amounts are recoverable through utility rates as part of the annual Purchased Gas Adjustment (PGA) mechanism when realized at settlement. |

(2) | These balances primarily consist of deferrals and amortizations under approved regulatory mechanisms. The accounts being amortized typically earn a rate of return or carrying charge. |

(3) | Certain utility pension costs are approved for regulatory deferral, including amounts recorded to the pension balancing account, to mitigate the effects of higher and lower pension expenses. Pension costs that are deferred include an interest component when recognized in net periodic benefit costs; see Note 7 for further information. |

(4) | Environmental costs relate to specific sites approved for regulatory deferral by the Public Utility Commission of Oregon (OPUC) and Washington Utilities and Transportation Commission (WUTC). In Oregon, we earn a carrying charge on cash amounts paid, whereas amounts accrued but not yet paid do not earn a carrying charge until expended. In Washington, a carrying charge related to deferred amounts will be determined in a future proceeding. For further information on environmental matters, see Note 13. |

7

New Accounting Standards

Recent Accounting Pronouncements

REVENUE RECOGNITION. On May 28, 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2014-09 Revenue From Contracts with Customers. The underlying principle of the guidance requires entities to recognize revenue depicting the transfer of goods or services to customers at amounts expected to be entitled to in exchange for those goods or services. The model provides a five-step approach to revenue recognition: (1) identify the contract(s) with the customer; (2) identify the separate performance obligations in the contract(s); (3) determine the transaction price; (4) allocate the transaction price to separate performance obligations; and (5) recognize revenue when, or as, each performance obligation is satisfied. The new requirements are effective beginning January 1, 2017, and an entity may elect either a full retrospective or simplified transition adoption method. Early adoption is not permitted. NW Natural is currently assessing the impact of this standard on its financial statements and disclosures.

3. EARNINGS PER SHARE

Basic earnings per share are computed using net income and the weighted-average number of common shares outstanding for each period presented. The diluted earnings per share calculation also includes the effects of the assumed exercise of stock options and the payment of estimated stock awards from other stock-based compensation plans that are outstanding at the end of each period presented. Diluted earnings per share are calculated as follows:

Three Months Ended | Nine Months Ended | |||||||||||||||

September 30, | September 30, | |||||||||||||||

In thousands, except per share data | 2014 | 2013 | 2014 | 2013 | ||||||||||||

Net income (loss) | $ | (8,733 | ) | $ | (8,233 | ) | $ | 30,222 | $ | 31,532 | ||||||

Average common shares outstanding - basic | 27,189 | 26,987 | 27,145 | 26,962 | ||||||||||||

Additional shares for stock-based compensation plans outstanding | — | — | 50 | 51 | ||||||||||||

Average common shares outstanding - diluted | 27,189 | 26,987 | 27,195 | 27,013 | ||||||||||||

Earnings (loss) per share of common stock - basic | $ | (0.32 | ) | $ | (0.31 | ) | $ | 1.11 | $ | 1.17 | ||||||

Earnings (loss) per share of common stock - diluted | $ | (0.32 | ) | $ | (0.31 | ) | $ | 1.11 | $ | 1.17 | ||||||

Additional information: | ||||||||||||||||

Antidilutive shares excluded from net income per diluted common share calculation | 80 | 80 | 24 | 26 | ||||||||||||

4. SEGMENT INFORMATION

We primarily operate in two reportable business segments: local gas distribution and gas storage. We also have other investments and business activities not specifically related to one of these two reporting segments, which we aggregate and report as other. We refer to our local gas distribution business as the utility, and our gas storage segment and other as non-utility. Our utility segment also includes the utility portion of our Mist underground storage facility in Oregon (Mist) and NWN Gas Reserves, which is a wholly-owned subsidiary of Energy Corp. Our gas storage segment includes NWN Gas Storage, which is a wholly-owned subsidiary of NWN Energy, Gill Ranch, which is a wholly-owned subsidiary of NWN Gas Storage, the non-utility portion of Mist, and all third-party asset management services. Other includes NNG Financial and NWN Energy's equity investment in PGH, which is pursuing development of a cross-Cascades transmission pipeline project. See Note 4 in our 2013 Form 10-K for further discussion of our segments.

8

The following table presents summary financial information concerning the reportable segments; inter-segment transactions are insignificant for the periods presented:

Three Months Ended September 30, | ||||||||||||||||

In thousands | Utility | Gas Storage | Other | Total | ||||||||||||

2014 | ||||||||||||||||

Operating revenues | $ | 82,361 | $ | 4,782 | $ | 56 | $ | 87,199 | ||||||||

Depreciation and amortization | 18,279 | 1,659 | — | 19,938 | ||||||||||||

Income (loss) from operations | (6,221 | ) | 926 | 218 | (5,077 | ) | ||||||||||

Net income (loss) | (8,808 | ) | 2 | 73 | (8,733 | ) | ||||||||||

Capital expenditures | 33,717 | 346 | — | 34,063 | ||||||||||||

2013 | ||||||||||||||||

Operating revenues | $ | 80,705 | $ | 7,434 | $ | 56 | $ | 88,195 | ||||||||

Depreciation and amortization | 17,118 | 1,619 | — | 18,737 | ||||||||||||

Income (loss) from operations | (7,293 | ) | 3,556 | (50 | ) | (3,787 | ) | |||||||||

Net income (loss) | (9,605 | ) | 1,407 | (35 | ) | (8,233 | ) | |||||||||

Capital expenditures | 30,805 | 427 | — | 31,232 | ||||||||||||

Nine Months Ended September 30, | ||||||||||||||||

In thousands | Utility | Gas Storage | Other | Total | ||||||||||||

2014 | ||||||||||||||||

Operating revenues | $ | 495,931 | $ | 17,655 | $ | 168 | $ | 513,754 | ||||||||

Depreciation and amortization | 54,333 | 4,903 | — | 59,236 | ||||||||||||

Income from operations | 78,971 | 3,994 | 252 | 83,217 | ||||||||||||

Net income | 29,416 | 472 | 334 | 30,222 | ||||||||||||

Capital expenditures | 85,793 | 759 | — | 86,552 | ||||||||||||

Total assets at September 30, 2014 | 2,539,834 | 277,689 | 16,001 | 2,833,524 | ||||||||||||

2013 | ||||||||||||||||

Operating revenues | $ | 474,307 | $ | 23,295 | $ | 168 | $ | 497,770 | ||||||||

Depreciation and amortization | 51,617 | 4,857 | — | 56,474 | ||||||||||||

Income (loss) from operations | 72,372 | 11,138 | (8 | ) | 83,502 | |||||||||||

Net income (loss) | 27,083 | 4,495 | (46 | ) | 31,532 | |||||||||||

Capital expenditures | 85,327 | 960 | — | 86,287 | ||||||||||||

Total assets at September 30, 2013 | 2,502,688 | 287,317 | 15,908 | 2,805,913 | ||||||||||||

Total assets at December 31, 2013 | 2,644,367 | 310,097 | 16,447 | 2,970,911 | ||||||||||||

9

Utility Margin

Utility margin is a financial measure consisting of utility operating revenues, which are reduced by revenue taxes and the associated cost of gas. The cost of gas purchased for utility customers is generally a pass-through cost in the amount of revenues billed to regulated utility customers. By subtracting costs of gas from utility operating revenues, utility margin provides a key metric used by our chief operating decision maker in assessing the performance of the utility segment. The following table presents additional segment information concerning utility margin. The gas storage and other segments emphasize growth in operating revenues and net income as opposed to margin because these segments do not incur a product cost (i.e. cost of gas sold) like the utility and, therefore, use operating revenues and net income to assess performance.

The following table presents margin information for our utility segment:

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

In thousands | 2014 | 2013 | 2014 | 2013 | ||||||||||||

Utility margin calculation: | ||||||||||||||||

Utility operating revenues | $ | 82,361 | $ | 80,705 | $ | 495,931 | $ | 474,307 | ||||||||

Less: Utility cost of gas | 32,227 | 33,655 | 245,708 | 235,156 | ||||||||||||

Utility margin | $ | 50,134 | $ | 47,050 | $ | 250,223 | $ | 239,151 | ||||||||

5. STOCK-BASED COMPENSATION

Our stock-based compensation plans include a Long-Term Incentive Plan (LTIP) under which various types of equity awards may be granted, an Employee Stock Purchase Plan, and a Restated Stock Option Plan (Restated SOP). The Restated SOP was terminated with respect to new grants in 2012; however, options that had been granted before the Restated SOP was terminated will remain outstanding until the earlier of their expiration, forfeiture, or exercise. Any new grants of stock options would be made under the LTIP. No stock options were granted under the LTIP during the nine months ended September 30, 2014. These plans are designed to promote stock ownership in NW Natural by employees and officers. For additional information on our stock-based compensation plans, see Note 6 in the 2013 Form 10-K and the updates provided below.

Long-Term Incentive Plan

Performance-Based Stock Awards

LTIP performance shares incorporate a combination of market, performance, and service-based factors. During the first quarter of 2014, 43,625 performance-based shares were granted under the LTIP based on target-level awards with a weighted-average grant date fair value of $42.43 per share. Fair value for the market based portion of the LTIP was estimated as of the date of grant using a Monte-Carlo option pricing model based on the following assumptions:

Stock price on valuation date | $ | 41.78 | |

Performance term (in years) | 3.0 | ||

Quarterly dividends paid per share | $ | 0.460 | |

Expected dividend yield | 4.3 | % | |

Dividend discount factor | 0.8845 | ||

Performance-Based Restricted Stock Units (RSUs)

During the nine months ended September 30, 2014, 38,765 RSUs were granted under the LTIP with a weighted-average grant date fair value of $42.19 per share. The fair value of a RSU is equal to the closing market price of the Company's common stock on the grant date. As of September 30, 2014, there was $2.4 million of unrecognized compensation cost from grants of RSUs, which is expected to be recognized over a period extending through 2019. Generally, the RSUs awarded include a performance-based threshold and a vesting period of four years from the grant date. An RSU obligates the Company upon vesting to issue the RSU holder one share of common stock plus a cash payment equal to the total amount of dividends paid per share between the grant date and vesting date of that portion of the RSU.

10

6. DEBT

Short-Term Debt

At September 30, 2014, our short-term debt consisted of commercial paper notes payable with a maximum maturity of 209 days, an average maturity of 96 days, and an outstanding balance of $190 million. The carrying cost of our commercial paper approximates fair value using Level 2 inputs due to the short-term nature of the notes. See Note 2 in our 2013 Form 10-K for a description of the fair value hierarchy.

Current Maturities of Long-Term Debt

The utility has long-term debt due within the next 12 months consisting of $40 million of first mortgage bonds (FMBs) with a coupon rate of 4.70% and maturity in June 2015.

Long-Term Debt

Our utility segment has long-term debt, including current maturities referred to above, of $641.7 million. Utility long-term debt consists of FMBs with maturity dates ranging from 2015 through 2042, interest rates ranging from 3.176% to 9.05%, and a weighted-average coupon rate of 5.64%.

At September 30, 2014, our gas storage segment’s long-term debt consisted of $20 million of fixed-rate senior secured debt with a maturity date of November 30, 2016 and an interest rate of 7.75%. This debt is secured by all of the membership interests in Gill Ranch and is nonrecourse to NW Natural. Under the amended loan agreement, $20 million of variable-rate debt was retired in June 2014. As part of the amended agreement, the earnings before interest, tax, depreciation, and amortization (EBITDA) covenant requirement was suspended through March 31, 2015 and the EBITDA hurdles thereafter were lowered. The debt service reserve requirement was fixed at $3 million.

Retirements of Long-Term Debt

The utility redeemed $50 million of FMBs with a coupon rate of 3.95% in July 2014 and $10 million in September 2014 with a coupon rate of 8.26%. As noted above, in June 2014 Gill Ranch retired $20 million of variable interest rate debt with a coupon rate of 7.00%.

Fair Value of Long-Term Debt

Our outstanding debt does not trade in active markets. We estimate the fair value of our debt using utility companies with similar credit ratings, terms, and remaining maturities to our debt that actively trade in public markets. These valuations are based on Level 2 inputs as defined in the fair value hierarchy. See Note 2 in our 2013 Form 10-K.

The following table provides an estimate of the fair value of our long-term debt, including current maturities of long-term debt, using market prices in effect on the valuation date:

September 30, | December 31, | |||||||||||

In thousands | 2014 | 2013 | 2013 | |||||||||

Carrying amount | $ | 661,700 | $ | 741,700 | $ | 741,700 | ||||||

Estimated fair value | 748,902 | 828,360 | 806,359 | |||||||||

See Note 7 in our 2013 Form 10-K for more detail on our long-term debt.

11

7. PENSION AND OTHER POSTRETIREMENT BENEFIT COSTS

The following table provides the components of net periodic benefit cost for the Company's pension and other postretirement benefit plans:

The following table provides the components of net periodic benefit cost for the Company's pension and other postretirement benefit plans:

Three Months Ended September 30, | ||||||||||||||||

Other Postretirement | ||||||||||||||||

Pension Benefits | Benefits | |||||||||||||||

In thousands | 2014 | 2013 | 2014 | 2013 | ||||||||||||

Service cost | $ | 1,919 | $ | 2,341 | $ | 136 | $ | 178 | ||||||||

Interest cost | 4,511 | 4,103 | 309 | 286 | ||||||||||||

Expected return on plan assets | (4,887 | ) | (4,678 | ) | — | — | ||||||||||

Amortization of net actuarial loss | 2,579 | 4,421 | 46 | 169 | ||||||||||||

Amortization of prior service costs | 56 | 56 | 50 | 50 | ||||||||||||

Net periodic benefit cost | 4,178 | 6,243 | 541 | 683 | ||||||||||||

Amount allocated to construction | (1,242 | ) | (1,910 | ) | (177 | ) | (226 | ) | ||||||||

Amount deferred to regulatory balancing account(1) | (1,107 | ) | (2,230 | ) | — | — | ||||||||||

Net amount charged to expense | $ | 1,829 | $ | 2,103 | $ | 364 | $ | 457 | ||||||||

Nine Months Ended September 30, | ||||||||||||||||

Other Postretirement | ||||||||||||||||

Pension Benefits | Benefits | |||||||||||||||

In thousands | 2014 | 2013 | 2014 | 2013 | ||||||||||||

Service cost | $ | 5,755 | $ | 7,023 | $ | 407 | $ | 536 | ||||||||

Interest cost | 13,535 | 12,310 | 928 | 858 | ||||||||||||

Expected return on plan assets | (14,659 | ) | (14,034 | ) | — | — | ||||||||||

Amortization of net actuarial loss | 7,739 | 13,263 | 138 | 507 | ||||||||||||

Amortization of prior service costs | 168 | 167 | 148 | 148 | ||||||||||||

Net periodic benefit cost | 12,538 | 18,729 | 1,621 | 2,049 | ||||||||||||

Amount allocated to construction | (3,644 | ) | (5,566 | ) | (518 | ) | (656 | ) | ||||||||

Amount deferred to regulatory balancing account(1) | (3,331 | ) | (6,850 | ) | — | — | ||||||||||

Net amount charged to expense | $ | 5,563 | $ | 6,313 | $ | 1,103 | $ | 1,393 | ||||||||

(1) | The deferral of certain pension expenses above or below the amount set in rates was approved by the OPUC, with recovery of these deferred amounts through the implementation of a balancing account, which includes the expectation of lower net periodic benefit costs in future years. Deferred pension expense balances include accrued interest at the utility’s actual cost of long-term debt, with deferred revenue in the utility's allocated share of equity to be recognized in a future accounting period when deferred pension expense is collected. |

The following table presents amounts recognized in accumulated other comprehensive loss (AOCL) and the changes in AOCL related to our non-qualified employee benefit plans:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||

In thousands | 2014 | 2013 | 2014 | 2013 | |||||||||

Beginning balance | $ | (6,027 | ) | $ | (8,826 | ) | $ | (6,358 | ) | $ | (9,291 | ) | |

Amounts reclassified from AOCL: | |||||||||||||

Amortization of prior service costs | (1 | ) | (1 | ) | (5 | ) | (5 | ) | |||||

Amortization of actuarial losses | 275 | 385 | 826 | 1,156 | |||||||||

Total reclassifications before tax | 274 | 384 | 821 | 1,151 | |||||||||

Tax expense | (108 | ) | (152 | ) | (324 | ) | (454 | ) | |||||

Total reclassifications for the period | 166 | 232 | 497 | 697 | |||||||||

Ending balance | $ | (5,861 | ) | $ | (8,594 | ) | $ | (5,861 | ) | $ | (8,594 | ) | |

12

Employer Contributions to Company-Sponsored Defined Benefit Pension Plan

For the nine months ended September 30, 2014, we made cash contributions totaling $10.5 million to our qualified defined benefit pension plan. In 2012, Congress passed the "Moving Ahead for Progress in the 21st Century Act" (MAP-21), which, among other things, includes provisions that reduce the level of minimum required contributions in the near-term but generally increase contributions in the long-run as well as increase the operational costs of running a pension plan. In August 2014, the Highway and Transportation Funding Act of 2014 (HATFA) was signed and extends certain aspects of MAP-21 as well as modifies the phase-out periods for the limitations. Due to the effects of HATFA, we do not currently expect further pension plan contributions during the remainder of 2014 and anticipate a reduction in contributions of over $55 million in the next ten years.

Multiemployer Pension Plan

Prior to December 2013, the Company also participated in a multiemployer pension plan for its utility’s union employees. The Company withdrew from this plan in December 2013 and recorded a withdrawal liability of $8.3 million, which requires NW Natural to pay $0.6 million to the plan each year for the next 20 years. The cost of the withdrawal liability was deferred to a regulatory account on the balance sheet, and as of September 30, 2014 the liability balance was $8.1 million.

Defined Contribution Plan

The Retirement K Savings Plan provided to our employees is a qualified defined contribution plan under Internal Revenue Code Section 401(k). Company contributions to this plan totaled $2.8 million and $2.3 million for the nine months ended September 30, 2014 and 2013, respectively.

See Note 8 in the 2013 Form 10-K for more information concerning these retirement and other postretirement benefit plans.

8. INCOME TAX

An estimate of annual income tax expense is made each interim period using estimates for annual pre-tax income, regulatory flow-through adjustments, tax credits, and other items. The estimated annual effective tax rate is applied to year-to-date, pre-tax income to determine income tax expense for the interim period consistent with the annual estimate.

The effective income tax rate varied from the combined federal and state statutory tax rates due to the following:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

Dollars in thousands | 2014 | 2013 | 2014 | 2013 | |||||||||||

Income tax at statutory rates (federal and state) | $ | (6,161 | ) | $ | (5,489 | ) | $ | 20,288 | $ | 21,080 | |||||

Increase (decrease): | |||||||||||||||

Differences required to be flowed-through by regulatory commissions | (310 | ) | (393 | ) | 1,184 | 1,171 | |||||||||

Other, net | (271 | ) | 281 | (449 | ) | (554 | ) | ||||||||

Income tax expense (benefit) | $ | (6,742 | ) | $ | (5,601 | ) | $ | 21,023 | $ | 21,697 | |||||

Effective income tax rate | 43.6 | % | 40.5 | % | 41.0 | % | 40.8 | % | |||||||

The increase in the income tax benefit amount and the effective income tax rate for the three months ended September 30, 2014 compared to the same period in 2013 was primarily due to a higher pre-tax loss and the result of estimating a lower annual effective tax rate. The decrease for the nine months ended September 30, 2014 compared to the same periods in 2013 was primarily due to lower pre-tax income and a lower estimated annual effective tax rate. Partially offsetting this was a $0.6 million income tax charge related to a higher effective tax rate in Oregon, which required the revaluation of deferred tax balances in the first quarter of 2014. See Note 9 in the 2013 Form 10-K for more detail on income taxes and effective tax rates.

The Company’s examination by the Internal Revenue Service (IRS) for tax years 2009 through 2011 was completed during the first quarter of 2014. The examination did not result in a material change to the returns as originally filed or previously adjusted for net operating loss carrybacks. The 2012 and 2013 tax year are open and subject to examination, while the 2014 tax year is subject to review under the IRS Compliance Assurance Process.

13

9. PROPERTY, PLANT, AND EQUIPMENT

The following table sets forth the major classifications of our property, plant, and equipment and related accumulated depreciation:

September 30, | December 31, | |||||||||||

In thousands | 2014 | 2013 | 2013 | |||||||||

Utility plant in service | $ | 2,655,136 | $ | 2,482,034 | $ | 2,585,901 | ||||||

Utility construction work in progress | 31,778 | 80,325 | 28,855 | |||||||||

Less: Accumulated depreciation | 850,590 | 818,644 | 827,380 | |||||||||

Utility plant, net | 1,836,324 | 1,743,715 | 1,787,376 | |||||||||

Non-utility plant in service | 297,199 | 296,022 | 297,330 | |||||||||

Non-utility construction work in progress | 6,549 | 7,479 | 6,653 | |||||||||

Less: Accumulated depreciation | 32,978 | 27,702 | 28,485 | |||||||||

Non-utility plant, net | 270,770 | 275,799 | 275,498 | |||||||||

Total property, plant, and equipment | $ | 2,107,094 | $ | 2,019,514 | $ | 2,062,874 | ||||||

Capital expenditures in accrued liabilities | $ | 11,834 | $ | 9,265 | $ | 10,691 | ||||||

10. GAS RESERVES

We entered into our original agreements with Encana Oil & Gas (USA) Inc. (Encana) in 2011 to develop and produce physical gas reserves and provide long-term gas price protection for utility customers. Encana began drilling in 2011 under these agreements. Gas produced from working interests in these gas fields is sold at prevailing market prices, with revenues from such sales, less associated production costs, credited to the utility's cost of gas. The cost of gas, including a carrying cost for the rate base investment, is part of NW Natural's annual Oregon PGA filing, which allows us to recover our costs through customer rates. Our net investment under the original agreement earns a rate of return and provides long-term price protection for our utility customers.

On March 28, 2014, we amended the original gas reserve agreement in order to facilitate Encana's proposed sale of its interest in the Jonah field to Jonah Energy LLC. Under the amendment, we ended the drilling program with Encana, but increased our assigned ownership interests in certain sections of the Jonah field and retained the right to invest in additional wells with the new owner.

Since the amendment, we have been notified by Jonah Energy LLC of investment opportunities in the sections of the Jonah field where we have ownership interests. The amended agreement allows us to invest in additional wells on a well-by-well basis with drilling costs and resulting gas volumes shared at our proportionate ownership interest for each well in which we invest. We elected to participate in some of the additional wells drilled in 2014, and we may have the opportunity to participate in more wells in the future. We filed an application requesting regulatory deferral in Oregon for these additional investments. We intend to file seeking cost recovery for the additional wells drilled in 2014. We have also signed a memorandum of understanding with all parties agreeing that individual wells drilled in any year will be reviewed for prudence annually going forward. A decision on the prudence of the wells drilled in 2014 will occur when the parties and Commission review our filing seeking cost recovery and is expected in 2015. Our cumulative investment of approximately $8 million in these additional wells has been accounted for as a utility investment. If regulatory approval is not received, our investment in these additional wells would follow oil and gas accounting.

14

Gas reserves acted to hedge the cost of gas for approximately 10% and 6% of our utility's gas supplies for the nine months ended September 30, 2014 and 2013, respectively. Our utility gas reserves are stated at cost, net of regulatory amortization, with the associated deferred tax benefits recorded as liabilities on the balance sheet. The following table outlines our net investment in gas reserves:

September 30, | December 31, | |||||||||||

In thousands | 2014 | 2013 | 2013 | |||||||||

Gas reserves, current | $ | 21,455 | $ | 18,083 | $ | 20,646 | ||||||

Gas reserves, non-current | 164,115 | 130,836 | 140,573 | |||||||||

Less: Accumulated amortization | 32,370 | 15,618 | 18,575 | |||||||||

Total gas reserves(1) | 153,200 | 133,301 | 142,644 | |||||||||

Less: Deferred tax liabilities on gas reserves | 33,037 | 40,553 | 42,117 | |||||||||

Net investment in gas reserves(1) | $ | 120,163 | $ | 92,748 | $ | 100,527 | ||||||

(1) | Total gas reserves includes our investment in additional wells, subject to regulatory deferral approvals, with total gas reserves of $7.8 million and net investment of $6.5 million at September 30, 2014 and no net investment or total gas reserves from additional wells in 2013. |

11. INVESTMENTS

Equity Method Investments

Palomar Gas Transmission, LLC (Palomar), a wholly-owned subsidiary of PGH, is pursuing the development of a new gas transmission pipeline that would provide an interconnection with our utility distribution system. NWN Energy, a wholly-owned subsidiary of NW Natural owns 50% of PGH, and 50% is owned by TransCanada American Investments Ltd., an indirect wholly-owned subsidiary of TransCanada Corporation. PGH is a development stage Variable Interest Entity, with our investment in Palomar reported under equity method accounting. We have determined that we are not the primary beneficiary of PGH’s activities, in accordance with the authoritative guidance related to consolidations, as we only have a 50% share of the entity and there are no stipulations that allow us a disproportionate influence over it. Our investment in PGH and Palomar are included in other investments on our balance sheet. Should this investment not be developed, then our maximum loss exposure related to PGH is limited to our equity investment balance, less our share of any cash or other assets available to us as a 50% owner. Our investment balance in PGH was $13.4 million at September 30, 2014 and 2013 and December 31, 2013. See Note 12 in our 2013 Form 10-K.

Other Investments

Other investments include financial investments in life insurance policies, which are accounted for at cash surrender value, net of policy loans. See Note 12 in the 2013 Form 10-K.

12. DERIVATIVE INSTRUMENTS

We enter into financial derivative contracts to hedge a portion of our utility’s natural gas sales requirements. These contracts include swaps, options, and combinations of option contracts. We primarily use these derivative financial instruments to manage commodity price variability. A small portion of our derivative hedging strategy involves foreign currency exchange contracts. The financial derivatives used in order to meet our utility's natural gas requirements qualify for regulatory deferral accounting.

We enter into these financial derivatives, up to prescribed limits, primarily to hedge price variability related to our physical gas supply contracts as well as to hedge spot purchases of natural gas. The foreign currency forward contracts are used to hedge the fluctuation in foreign currency exchange rates for pipeline demand charges paid in Canadian dollars.

15

In the normal course of business, we also enter into indexed-price physical forward natural gas commodity purchase contracts and options to meet the requirements of utility customers. These contracts qualify for regulatory deferral accounting treatment. We also enter into exchange contracts related to the third-party asset management of our gas portfolio, some of which are derivatives that do not qualify for hedge accounting or regulatory deferral, but are subject to our regulatory sharing agreement.

Notional Amounts

The following table presents the absolute notional amounts related to open positions on our derivative instruments:

September 30, | December 31, | |||||||||||

In thousands | 2014 | 2013 | 2013 | |||||||||

Natural gas (in therms): | ||||||||||||

Financial | 368,425 | 527,700 | 389,225 | |||||||||

Physical | 620,550 | 572,675 | 552,500 | |||||||||

Foreign exchange | $ | 10,296 | $ | 13,862 | $ | 15,002 | ||||||

Purchased Gas Adjustment

Derivatives entered into by the utility for the procurement or hedging of natural gas for future gas years generally receive regulatory deferral accounting treatment. Derivative contracts entered into after the start of the PGA period are subject to our PGA incentive sharing mechanism in Oregon, which provides for either an 80% or 90% deferral of any gains and losses as regulatory assets or liabilities, with the remaining 10% or 20% recognized in current income. For both the 2013-14 and 2014-15 gas years, we selected the 90% deferral option. In general, our commodity hedging for the current gas year is completed prior to the start of the upcoming gas year, and hedge prices are reflected in the Company's weighted-average cost of gas in the PGA filing. As of November 1, 2013, we reached our target hedge percentage of approximately 75% for the 2013-14 gas year. These hedge prices were included in the PGA filings and qualified for regulatory deferral.

Unrealized and Realized Gain/Loss

The following table reflects the income statement presentation for the unrealized gains and losses from our derivative instruments. Outstanding derivative instruments related to regulated utility operations are deferred in accordance with regulatory accounting standards.

Three Months Ended September 30, | ||||||||||||||||

2014 | 2013 | |||||||||||||||

In thousands | Natural gas commodity | Foreign currency | Natural gas commodity | Foreign currency | ||||||||||||

Benefit (expense) to cost of gas | $ | (10,173 | ) | $ | (421 | ) | $ | 2,422 | $ | 502 | ||||||

Less: | ||||||||||||||||

Amounts deferred to regulatory accounts on the balance sheet | 10,559 | 421 | (2,433 | ) | (502 | ) | ||||||||||

Total gain (loss) in pre-tax earnings | $ | 386 | $ | — | $ | (11 | ) | $ | — | |||||||

Nine Months Ended September 30, | ||||||||||||||||

2014 | 2013 | |||||||||||||||

In thousands | Natural gas commodity | Foreign currency | Natural gas commodity | Foreign currency | ||||||||||||

Benefit (expense) to cost of gas | $ | 360 | $ | (242 | ) | $ | (6,534 | ) | $ | (11 | ) | |||||

Less: | ||||||||||||||||

Amounts deferred to regulatory accounts on the balance sheet | (93 | ) | 242 | 6,599 | 11 | |||||||||||

Total gain in pre-tax earnings | $ | 267 | $ | — | $ | 65 | $ | — | ||||||||

The cost of foreign currency forward contracts and natural gas derivative contracts are recognized immediately in the cost of gas; however, costs above or below the amount embedded in the current year PGA are subject to a regulatory deferral tariff and therefore, are recorded as a regulatory asset or liability.

16

We realized a net gain of $0.5 million and $13.3 million for the three and nine months ended September 30, 2014, respectively, compared to a net loss of $2.3 million and $6.3 million for the three and nine months ended September 30, 2013, respectively, from the settlement of natural gas financial derivative contracts. Realized gains are recorded as a reduction to the cost of gas, while realized losses were recorded as increases to the cost of gas.

Credit Risk Management of Financial Derivatives Instruments

No collateral was posted with, or by, our counterparties as of September 30, 2014 or 2013. We attempt to minimize the potential exposure to collateral calls by counterparties to manage our liquidity risk. Counterparties generally allow a certain credit limit threshold before requiring us to post collateral against loss positions. Given our counterparty credit limits and portfolio diversification, we have not been subject to collateral calls in 2013 or 2014. Our collateral call exposure is set forth under credit support agreements, which generally contain credit limits. We could also be subject to collateral call exposure where we have agreed to provide adequate assurance, which is not specific as to the amount of credit limit allowed, but could potentially require additional collateral in the event of a material adverse change. Based on current financial derivative contracts outstanding, which reflect net unrealized gains of $1.7 million at September 30, 2014, we currently do not have any collateral demand exposure.

Our financial derivative instruments are subject to master netting arrangements; however, they are presented on a gross basis in our statement of financial position. The Company and its counterparties have the ability to set-off their obligations to each other under specified circumstances. Such circumstances may include: when there is a defaulting party, or in the event of a credit change due to a merger that affects either party, or any other termination event. If netted by counterparty, our derivative position would result in an asset of $4.0 million and a liability of $3.9 million as of September 30, 2014. As of September 30, 2013, our derivative position would have resulted in an asset of $0.2 million and a liability of $6.7 million, and as of December 31, 2013, our position would have resulted in an asset of $7.2 million and a liability of $2.5 million.

We are exposed to derivative credit and liquidity risk primarily through securing fixed price natural gas commodity swaps to hedge the risk of price increases for our natural gas purchases made on behalf of customers. See Note 13 in our 2013 Form 10-K for additional information.

Fair Value

In accordance with fair value accounting, we include nonperformance risk in calculating fair value adjustments. This includes a credit risk adjustment based on the credit spreads of our counterparties when we are in an unrealized gain position, or on our own credit spread when we are in an unrealized loss position. The inputs in our valuation models include natural gas futures, volatility, credit default swap spreads, and interest rates. Additionally, our assessment of non-performance risk is generally derived from the credit default swap market and from bond market credit spreads. The impact of the credit risk adjustments for all outstanding derivatives was immaterial to the fair value calculation at September 30, 2014. As of September 30, 2014 and 2013 and December 31, 2013, the net fair value was an asset of $0.1 million, a liability of $6.5 million, and an asset of $4.7 million, respectively, using significant other observable, or Level 2, inputs. We have used no Level 3 inputs in our derivative valuations. We did not have any transfers between Level 1 or Level 2 during the nine months ended September 30, 2014 and 2013.

13. ENVIRONMENTAL MATTERS

We own, or previously owned, properties that may require environmental remediation or action. We estimate the range of loss for environmental liabilities based on current remediation technology, enacted laws and regulations, industry experience gained at similar sites and an assessment of the probable level of involvement and financial condition of other potentially responsible parties. Due to the numerous uncertainties surrounding the course of environmental remediation and the preliminary nature of several site investigations, in some cases, we may not be able to reasonably estimate the high end of the range of possible loss. In those cases, we have disclosed the nature of the possible loss and the fact that the high end of the range cannot be reasonably estimated. Unless there is an estimate within a range of possible losses that is more likely than other cost estimates within that range, we record the liability at the low end of this range. It is likely that changes in these estimates and ranges will occur throughout the remediation process for each of these sites due to our continued evaluation and clarification concerning our responsibility, the complexity of environmental laws and regulations, and the determination by regulators of remediation alternatives.

17

In the 2012 Oregon general rate case, the Site Remediation Recovery Mechanism (SRRM) was approved to recover the Company's deferred environmental costs. The Commission ordered a separate docket to determine the prudence of deferred costs, the allocation of insurance proceeds, and an earnings test that would be applied to past and future deferred costs. We are currently awaiting the Commission's decision regarding this matter.

In Washington, cost recovery and carrying charges on amounts deferred for costs associated with services provided to Washington customers will be determined in a future proceeding. We annually review all regulatory assets for recoverability and more often if circumstances warrant. If we should determine that all or a portion of these regulatory assets no longer meet the criteria for continued application of regulatory accounting, then we would be required to write off the net unrecoverable balances against earnings in the period such a determination is made.

In December 2010, NW Natural commenced litigation against certain of its historical liability insurers in Multnomah County Circuit Court, State of Oregon (see Part I, Item 3. Legal Proceedings in our 2013 Form 10-K). In the complaint, NW Natural sought damages in excess of the $50 million in losses it had incurred through the date of the complaint, as well as declaratory relief for additional losses it expected to incur in the future. Prior to 2014, we had settled with several defendant insurance companies for payments aggregating approximately $48 million. In February 2014, we settled with all remaining defendant insurance companies in this litigation with the Company to receive additional payments aggregating to approximately $102 million for a total of approximately $150 million. We received these payments, and the Court dismissed the case on July 29, 2014. The settlements are recognized in regulatory accounts with the treatment to be determined in the ongoing docket related to the SRRM.

Environmental Sites

The following table summarizes information regarding liabilities related to environmental sites, which are recorded in other current liabilities and other non-current liabilities on the balance sheet:

Current Liabilities | Non-Current Liabilities | |||||||||||||||||||||||

September 30, | December 31, | September 30, | December 31, | |||||||||||||||||||||

In thousands | 2014 | 2013 | 2013 | 2014 | 2013 | 2013 | ||||||||||||||||||

Portland Harbor site: | ||||||||||||||||||||||||

Gasco/Siltronic Sediments | $ | 686 | $ | 512 | $ | 1,278 | $ | 38,593 | $ | 38,034 | $ | 37,954 | ||||||||||||

Other Portland Harbor | 1,060 | 1,812 | 1,766 | 3,198 | 2,315 | 3,478 | ||||||||||||||||||

Gasco Uplands site | 7,399 | 2,094 | 11,010 | 37,748 | 7,126 | 39,508 | ||||||||||||||||||

Siltronic Uplands site | 634 | 405 | 763 | 577 | 434 | 406 | ||||||||||||||||||

Central Service Center site | 70 | 150 | 85 | 173 | 271 | 248 | ||||||||||||||||||

Front Street site | 804 | 411 | 1,274 | 99 | 158 | 122 | ||||||||||||||||||

Oregon Steel Mills | — | — | — | 179 | 179 | 179 | ||||||||||||||||||

Total | $ | 10,653 | $ | 5,384 | $ | 16,176 | $ | 80,567 | $ | 48,517 | $ | 81,895 | ||||||||||||

The following table presents information regarding the total amount of cash paid for environmental sites and the total regulatory asset deferred:

September 30, | December 31, | |||||||||||

In thousands | 2014 | 2013 | 2013 | |||||||||

Cumulative cash paid(1) | $ | 111,367 | $ | 93,264 | $ | 98,817 | ||||||

Total regulatory asset deferral(2) | $ | 51,861 | 118,029 | 148,389 | ||||||||

(1) | Includes $20.4 million reclassified to utility plant on November 1, 2013 associated with the water treatment station of which a portion was paid during 2012 through 2014. |

(2) | Includes cash paid, remaining liability, and interest, net of insurance reimbursement and amounts reclassified to utility plant for the water treatment station. |

PORTLAND HARBOR SITE. The Portland Harbor is an Environmental Protection Agency (EPA) listed Superfund site that is approximately 11 miles long on the Willamette River and is adjacent to NW Natural's Gasco uplands and

18

Siltronic uplands sites. We have been notified that we are a potentially responsible party to the Superfund site and we have joined with some of the other potentially responsible parties (the Lower Willamette Group or LWG) to develop a Portland Harbor Remedial Investigation/Feasibility Study (RI/FS). The LWG submitted a draft Feasibility Study (FS) to the EPA in March 2012 that provides a range of remedial costs for the entire Portland Harbor Superfund Site, which includes the Gasco/Siltronic Sediment site, discussed below. The range of costs estimated for various remedial alternatives for the entire Portland Harbor, as provided in the draft FS, is $169 million to $1.8 billion. NW Natural's potential liability is a portion of the costs of the remedy the EPA will select for the entire Portland Harbor Superfund site. The cost of that remedy is expected to be allocated among more than 100 potentially responsible parties. NW Natural is participating in a non-binding allocation process in an effort to settle this potential liability. We manage our liability related to the Superfund site as two distinct remediation projects, the Gasco/Siltronic Sediments and Other Portland Harbor projects.

GASCO/SILTRONIC SEDIMENTS. In 2009, NW Natural and Siltronic Corporation entered into a separate Administrative Order on Consent with the EPA to evaluate and design specific remedies for sediments adjacent to the Gasco uplands and Siltronic uplands sites. NW Natural submitted a draft Engineering Evaluation/Cost Analysis (EE/CA) to the EPA in May 2012 to provide the estimated cost of potential remedial alternatives for this site. At this time, the estimated costs for the various sediment remedy alternatives in the draft EE/CA as well as costs for the additional studies and design work needed before the clean-up can occur, and for regulatory oversight throughout the clean-up range from $39.3 million to $350 million. We have recorded a liability of $39.3 million for the sediment clean-up, which reflects the low end of the range. At this time, we believe sediments at this site represent the largest portion of our liability related to the Portland Harbor site, discussed above.

OTHER PORTLAND HARBOR. NW Natural incurs costs related to its membership in the LWG, which is performing the RI/FS for the EPA. NW Natural also incurs costs related to natural resource damages from these sites. The Company and other parties have signed a cooperative agreement with the Portland Harbor Natural Resource Trustee council to participate in a phased natural resource damage assessment to estimate liabilities to support an early restoration-based settlement of natural resource damage claims. Natural resource damage claims may arise only after a remedy for clean-up has been settled. We have accrued a liability for these claims which is at the low end of the range of the potential liability; the high end of the range cannot be reasonably estimated at this time. This liability is not included in the range of costs provided in the draft FS for the Portland Harbor and noted above.

GASCO UPLANDS SITE. NW Natural owns a former gas manufacturing plant that was closed in 1958 (Gasco site) and is adjacent to the Portland Harbor site described above. The Gasco site has been under investigation by us for environmental contamination under the Oregon Department of Environmental Quality (ODEQ) Voluntary Clean-Up Program. It is not included in the range of remedial costs for the Portland Harbor site noted above. We manage the Gasco site in two parts, the uplands portion and the groundwater source control action.

In May 2007, we completed a revised Remedial Investigation Report for the uplands portion and submitted it to ODEQ for review. We have recognized a liability for the remediation of the uplands portion of the site which is at the low end of the range of potential liability; the high end of the range cannot be reasonably estimated at this time.

In September 2013, we completed construction of a groundwater source control system, including a water treatment station, at the Gasco site. We are working with ODEQ on monitoring the effectiveness of the system and at this time it is unclear what, if any, additional actions ODEQ may require subsequent to the initial testing of the system or as part of the final remedy for the uplands portion of the Gasco site. We have estimated the cost associated with the ongoing operation of the system and have recognized a liability which is at the low end of the range of potential cost. We cannot estimate the high end of the range at this time due to the uncertainty associated with the duration of running the water treatment station, which will be highly dependent upon the remedy determined for both the upland portion as well as the final remedy for our Gasco sediment exposure.

Beginning November 1, 2013, capital asset costs of $19 million for the Gasco water treatment station were placed into rates with OPUC approval. During the first quarter of 2014, the OPUC deemed these costs prudent and approved the application of $2.5 million from insurance proceeds plus interest to reduce the total amount of Gasco capital costs to be recovered through rate base beginning November 1, 2014.

OTHER SITES. In addition to those sites above, we have environmental exposures at four other sites: Siltronic, Central Service Center, Front Street, and Oregon Steel Mills. Due to the uncertainty of the design of remediation,

19

regulation, timing of the liabilities, and in the case of the Oregon Steel Mills site, pending litigation, liabilities for each of these sites have been recognized at their respective low end of the range of potential liability; the high end of the range could not be reasonably estimated as of September 30, 2014.

Siltronic Upland site. Siltronic is the location of a manufactured gas plant formerly owned by NW Natural. We are currently conducting an investigation of manufactured gas plant wastes on the uplands at this site for the ODEQ.

Central Service Center site. We are currently performing an environmental investigation of the property under the ODEQ's Independent Cleanup Pathway. This site is on ODEQ's list of sites with confirmed releases of hazardous substances, and cleanup is necessary.

Front Street site. The Front Street site was the former location of a gas manufacturing plant we operated. Studies for source control investigation have been presented to ODEQ and a final sampling plan required by ODEQ is currently being developed.

Oregon Steel Mills site. See “Legal Proceedings,” below.

Legal Proceedings

NW Natural is subject to claims and litigation arising in the ordinary course of business. Although the final outcome of any of these legal proceedings cannot be predicted with certainty, including the matter described below, NW Natural does not expect the ultimate disposition of any of these matters will have a material effect on our financial condition, results of operations or cash flows. See also Part II, Item 1, “Legal Proceedings.”

OREGON STEEL MILLS SITE. In 2004, NW Natural was served with a third-party complaint by the Port of Portland (the Port) in a Multnomah County Circuit Court case, Oregon Steel Mills, Inc. v. The Port of Portland. The Port alleges that in the 1940s and 1950s petroleum wastes generated by our predecessor, Portland Gas & Coke Company, and 10 other third-party defendants, were disposed of in a waste oil disposal facility operated by the United States or Shaver Transportation Company on property then owned by the Port and now owned by Oregon Steel Mills. The complaint seeks contribution for unspecified past remedial action costs incurred by the Port regarding the former waste oil disposal facility as well as a declaratory judgment allocating liability for future remedial action costs. No date has been set for trial. Although the final outcome of this proceeding cannot be predicted with certainty, we do not expect that the ultimate disposition of this matter will have a material effect on our financial condition, results of operations or cash flows.

For additional information regarding other commitment and contingencies, see Note 14 in our 2013 Form 10-K.

20

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following is management’s assessment of Northwest Natural Gas Company’s (NW Natural or the Company) financial condition, including the principal factors that affect results of operations. The disclosures contained in this report refer to our consolidated activities for the three and nine months ended September 30, 2014 and 2013. References to “Notes” are to the Notes to Unaudited Consolidated Financial Statements in this report. A significant portion of our business results are seasonal in nature, and, as such, the results of operations for the three and nine month periods are not necessarily indicative of expected fiscal year results. Therefore, this discussion should be read in conjunction with our 2013 Annual Report on Form 10-K (2013 Form 10-K).

The consolidated financial statements include NW Natural, the parent company, and its direct and indirect wholly-owned subsidiaries. Selected subsidiaries are depicted and organized as follows:

We operate in two primary reportable business segments: local gas distribution and gas storage. We also have other investments and business activities not specifically related to one of these two reporting segments, which we aggregate and report as other. We refer to our local gas distribution business as the utility, and our gas storage segment and other as non-utility. Our utility segment includes our NW Natural local gas distribution business, NWN Gas Reserves, which is a wholly-owned subsidiary of Energy Corp, and the utility portion of our Mist underground storage facility in Oregon (Mist). Our gas storage segment includes NWN Gas Storage, which is a wholly-owned subsidiary of NWN Energy, Gill Ranch, which is a wholly-owned subsidiary of NWN Gas Storage, the non-utility portion of Mist, and asset management services. Other includes NWN Energy's equity investment in Palomar Gas Holdings, LLC (PGH), which is pursuing the development of a proposed natural gas pipeline through its wholly-owned subsidiary, Palomar Gas Transmission, LLC (Palomar), and NNG Financial's equity investment in Kelso-Beaver Pipeline (KB Pipeline). PGH and our equity investments, Palomar and KB Pipeline, are not depicted in the chart above. For a further discussion of our business segments and other, see Note 4.

In addition to presenting the results of operations and earnings amounts in total, certain financial measures are expressed in cents per share, which are non-GAAP financial measures. These amounts reflect factors that directly impact earnings. In calculating these financial disclosures, we allocate income tax expense based on the effective tax rate, where applicable. All references in this section to earnings per share (EPS) are on the basis of diluted shares (see Note 3 in our 2013 Form 10-K). We use such non-GAAP measures in analyzing our financial performance because we believe they provide useful information to our investors and creditors in evaluating our financial condition and results of operations.

21

EXECUTIVE SUMMARY

Key financial highlights include:

Key financial highlights include:

Three Months Ended September 30, | ||||||||||

In thousands, except per share data | 2014 | 2013 | Change | |||||||

Consolidated net loss | $ | (8,733 | ) | $ | (8,233 | ) | $ | (500 | ) | |

Consolidated loss per share | (0.32 | ) | (0.31 | ) | (0.01 | ) | ||||

Utility margin | $ | 50,134 | $ | 47,050 | $ | 3,084 | ||||

Utility net loss | (8,808 | ) | (9,605 | ) | 797 | |||||

Gas storage operating revenues | 4,782 | 7,434 | (2,652 | ) | ||||||

Gas storage net income | 2 | 1,407 | (1,405 | ) | ||||||

Consolidated other income and expense, net | 407 | 1,300 | (893 | ) | ||||||

THREE MONTHS ENDED SEPTEMBER 30, 2014 COMPARED TO SEPTEMBER 30, 2013. The primary factors contributing to the $0.5 million increase in consolidated net loss for the quarter were as follows:

• | an increase in utility margin of $3.1 million due to customer growth and rate-base returns on gas reserve and other investments; more than offset by the following variances: |

• | a decrease in gas storage operating revenues of $2.7 million due to re-contracting certain expiring capacity at lower prices for the 2014-15 gas storage year; and |

• | a decrease in other income and expense, net of $0.9 million due to lower interest income on reduced net deferred regulatory balances. |

From a longer-term operational perspective, we continue to make progress on several key strategic initiatives, as evidenced by the following items:

• | increased customer growth rate in the core utility from 1.1% a year ago to 1.3% at September 30, 2014; |

• | placed first in residential customer satisfaction among large gas utilities in the West in the 2014 J.D. Power and Associates Study, making 2014 the 13th consecutive year of top three rankings; |

• | launched a new online tool for customers and trade allies that enables online ordering services, tracking progress of orders, and managing multiple projects; |

• | announced a dividend increase in the fourth quarter, which reflects the 59th consecutive year of increases; and |

• | received approval from the OPUC for two rate schedules designed to provide no-notice gas storage and transportation services. If the potential expansion of our Mist gas storage facility proceeds, we believe Portland General Electric (PGE) will take service under one of these schedules. |

ISSUES AND CHALLENGES

ECONOMY. The local, national, and global economies continue to show signs of improvement. Our utility’s customer growth rate, on a trailing 12-month basis, increased from 1.1% at September 30, 2013 to 1.3% at September 30, 2014 as NW Natural neared the 700,000 total customer mark. On a consecutive quarter basis, the growth rate decreased slightly from the 1.4% rate at June 30, 2014 as warmer weather this fall slowed natural gas conversions and delayed customer re-connections to gas service. Additionally, the unemployment rate in the Portland metropolitan region decreased to under 6% during the third quarter of 2014, a decline of less than 1% from the same period in 2013. We believe our utility is well positioned to add customers and to serve increasing industrial demand as the economy improves, regional business projects move forward, and proposed legislation favoring lower carbon emissions continues to develop.