Attached files

| file | filename |

|---|---|

| EX-99.1 - EARNINGS PRESS RELEASE 4.27.11 - NORTHWESTERN CORP | ex991_pressrelease.htm |

| 8-K - EARNING RELEASE AND ANNUAL MEETING PRESENTATION - NORTHWESTERN CORP | ek042711-press_annualmtg.htm |

Grand Island, NE

April 27, 2011

Annual Shareholder

Meeting

Meeting

2

forward-looking statement…

During the course of this presentation, there will be forward-looking

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

The information in this presentation is based upon our current

expectations as of the date hereof unless otherwise noted. Our actual

future business and financial performance may differ materially and

adversely from our expectations expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update our

forward-looking statements or this presentation for any reason. Although

our expectations and beliefs are based on reasonable assumptions, actual

results may differ materially. The factors that may affect our results are

listed in certain of our press releases and disclosed in the Company’s

public filings with the SEC.

expectations as of the date hereof unless otherwise noted. Our actual

future business and financial performance may differ materially and

adversely from our expectations expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update our

forward-looking statements or this presentation for any reason. Although

our expectations and beliefs are based on reasonable assumptions, actual

results may differ materially. The factors that may affect our results are

listed in certain of our press releases and disclosed in the Company’s

public filings with the SEC.

3

who we are…

Above data as of 12/31/10

(1) Book capitalization calculated as total debt, excluding capital leases, plus shareholders’ equity.

¾ 665,000 customers

» 399,000 electric

» 266,000 natural gas

¾ Approximately 123,000 square

miles of service territory in

Montana, South Dakota, and Nebraska

miles of service territory in

Montana, South Dakota, and Nebraska

» 27,500 miles of electric T&D lines

» 9,200 miles of natural gas T&D pipelines

» 20 Bcf natural gas storage

» 8.4 Bcf natural gas proven reserves

¾ Total owned generation

» MT - 372 MW - regulated

» SD - 312 MW - regulated

¾ Total Assets: $3,038 MM

¾ Total Capitalization: $1,889 MM(1)

¾ Total Rate Base: $1,750 MM (est.)

¾ Total Employees: 1,363

• Located in states with relatively stable economies with

opportunity for system investment and grid expansion.

opportunity for system investment and grid expansion.

• Footprint of service territory covers some of the best

wind regimes in the United States

wind regimes in the United States

•Unique opportunity to provide transmission services in

to two different power markets (West and Midwest)

to two different power markets (West and Midwest)

4

NorthWestern’s attributes…

¾ Solid operations

» Cost competitive

» Above-average reliability

» Award-winning customer service

¾ Single A secured credit ratings with a strong balance sheet and liquidity

» January 21, 2011 Moody’s upgraded secured and unsecured ratings to A2 and Baa1, respectively

» April 15, 2010 Fitch upgraded secured and unsecured ratings to A- and BBB+ respectively

¾ Positive earnings and ROE trend

» Delivery services rate increase for Montana electric

» Mill Creek Generation Station achieved commercial operation on January 1, 2011

¾ Strong cash flows

» NOLs and repair tax deduction provide an effective tax shield likely beyond 2015

» 89% pension funded status at end of 2010

¾ Competitive shareholder return with a dividend that has increased every year since ‘05

» Added to S&P 600 SmallCap Index on April 9, 2010

¾ Constructive regulatory environment

¾ Forbes.com listed as one of “100 Most Trustworthy Companies”

¾ Realistic investment opportunities

strong credit ratings…

5

A security rating is not a recommendation to buy, sell or hold securities. Such rating may be subject to revision or withdrawal at

any time by the credit rating agency and each rating should be evaluated independently of any other rating.

any time by the credit rating agency and each rating should be evaluated independently of any other rating.

6

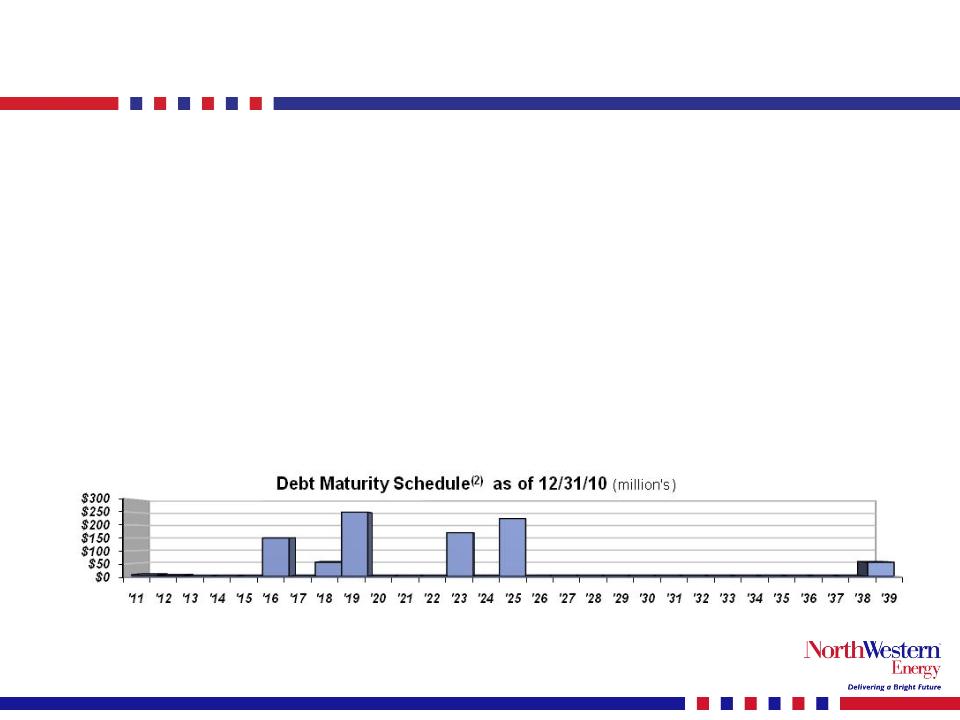

strong balance sheet and liquidity…

¾ Total liquidity of approximately $165 million as of February 2011

¾ Total Debt / Total capitalization of 56.6%(1)

¾ In past two years refinanced nearly all outstanding debt

» In May 2010 we refinanced existing $225 million, 5.875% Senior Secured Notes due

2014 with 5.01% First Mortgage Bonds due 2025.

2014 with 5.01% First Mortgage Bonds due 2025.

» Reduced long term debt cost from 6.8% to 5.6%

» Increased average debt maturity from 8.8 years to 11.5 years

¾ No significant debt maturities until after 2015

(1) Total capitalization as of 12/31/10

(2) Excludes outstanding 12/31/10 revolving credit facility balance of $153 million maturing in 2012.

7

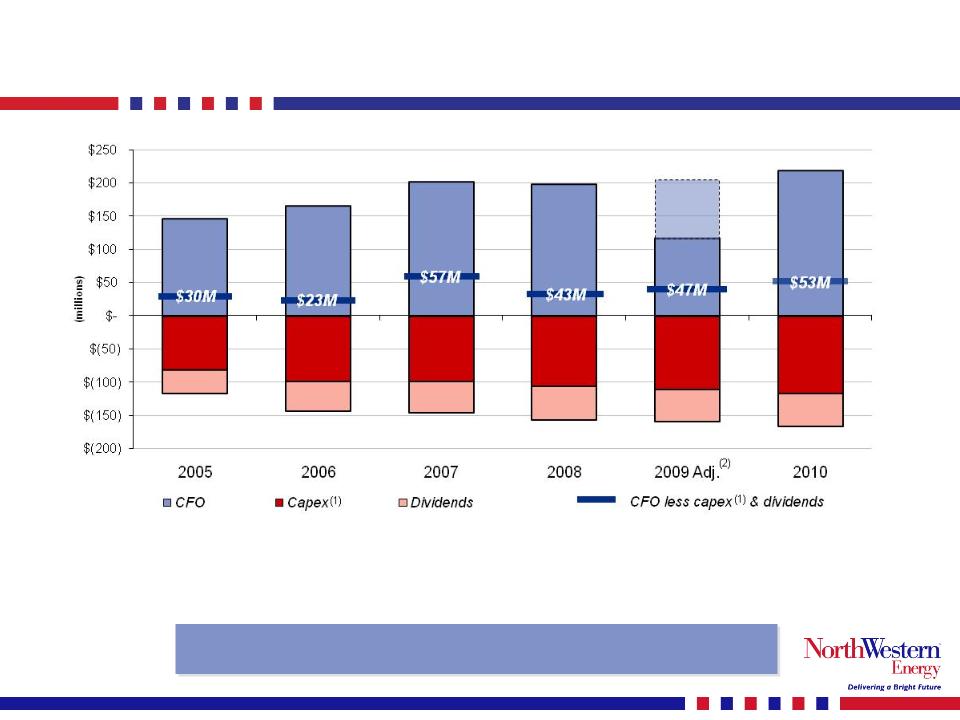

strong cash flows…

Earnings trend and NOLs provide strong cash flows to

fund future investment.

fund future investment.

(1) Utility maintenance capex only, excludes investment growth projects.

(2) 2009 Cash Flow from Operations adjusted to add back pension funding in excess of expense and Ammondson settlement paid..

solid pension funding position…

8

Data source: SNL Financial

As a result of significant contributions to our pension

plan over the past several years and solid market returns in 2009 and

2010, we are better positioned than our peers at December 31, 2010.

plan over the past several years and solid market returns in 2009 and

2010, we are better positioned than our peers at December 31, 2010.

9

and sustainable dividend…

Goal for dividend payout ratio of 60% - 70%.

Current dividend yield about 5% with year-over-year dividend growth.

Current dividend yield about 5% with year-over-year dividend growth.

(1) 2011 estimated payout range assumes midpoint of guidance range $2.25 - $2.40

10

reaffirming 2011 EPS guidance…

11

constructive regulatory environment…

¾ Montana

» Electric and natural gas general rate case

♦ September 2010: Joint stipulation with Montana Consumer Counsel (MCC) filed with MPSC

resulting in a net $6.7 million increase to revenue predicated upon a 10.25% ROE and 5.76%

cost of debt (7.92% ROR)

resulting in a net $6.7 million increase to revenue predicated upon a 10.25% ROE and 5.76%

cost of debt (7.92% ROR)

♦ December 2010: Final order issued approving stipulation with additional MPSC requirement

to implement a modified lost revenue adjustment mechanism (LRAM) and an inclining block

rate structure for electric energy supply customers. Additional requirement also reduced

stipulated 10.25% ROE by 25 bps. This ROE adjustment is estimated to potentially reduce

revenue increase by $1.3 million annually.

to implement a modified lost revenue adjustment mechanism (LRAM) and an inclining block

rate structure for electric energy supply customers. Additional requirement also reduced

stipulated 10.25% ROE by 25 bps. This ROE adjustment is estimated to potentially reduce

revenue increase by $1.3 million annually.

● The Company appealed the modified LRAM and inclining block rate structure

♦ April 2011: MPSC and Company settled the appeal and reinstated the joint stipulation:

● Removes the LRAM concept

● Removes inclining block rates

● Reinstates the Electric ROE to 10.25%

● NorthWestern agrees to reduced electric rates from the original stipulation by $650,000

annually in lieu of continuing the court appeal

annually in lieu of continuing the court appeal

» Dave Gates Generation Station at Mill Creek filed

♦ Interim rates approved by the MPSC and included in our monthly electric supply rates

beginning January 1, 2011

beginning January 1, 2011

♦ Compliance filing reflecting final construction costs has been filed

» Distribution System Infrastructure Plan

♦ Received an accounting order from the MPSC in March 2011 to defer and amortize related

O&M expense for 2011 and 2012 over a 5 year period beginning 2013.

O&M expense for 2011 and 2012 over a 5 year period beginning 2013.

12

regulatory environment con’t…

¾ Montana continued:

» Wind project for 40 MW’s in rate base

♦ Executed an asset purchase agreement in April 2011

♦ Agreement is contingent on receiving approval from MPSC to rate base

♦ Filing to occur before May 31, 2011

¾ South Dakota

» Expect to file natural gas rate cases during 2011 pending 2010 results

» Expect to file an environmental rider on the Big Stone & Neal plant for emissions

compliance projects

compliance projects

¾ Nebraska

» Don’t plan to file natural gas rate case during 2011 based on 2010 results

¾ FERC

» Docket filed for Mill Creek on April 10, 2010 to establish rates as of January 1, 2011

♦ October 15, 2010, Order issued authorizing us to put our filed tariffs in place effective

January 1, 2011, subject to refund.

January 1, 2011, subject to refund.

13

regulatory milestones in 2011…

|

Montana

|

|

|

Distribution Infrastructure

|

|

|

PDecision in favor of accounting order (MPSC)

|

Q1

|

|

Prudency Review for Mill Creek

|

|

|

PInterim rate filing (MPSC) 2010

|

Q4

|

|

¾Compliance filing (MPSC)

|

Q1

|

|

¾FERC tariff filing (FERC)

|

Q2

|

|

|

|

|

Approval for Montana Wind Projects

|

|

|

¾Pre - approval filing (MPSC)

|

Q2

|

|

|

|

|

Natural Gas - Rate Base Battle Creek

|

|

|

¾Filing to include in general rate base (MPSC)

|

Q2/

Q3 |

|

|

|

|

South Dakota

|

|

|

Natural Gas Rate Case

|

|

|

¾File rate case pending 2010 results (SDPUC)

|

Q2

|

|

Environmental Riders for Big Stone & Neal

|

|

|

¾Environmental rider filing (SDPUC)

|

Q4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

longer term investment opportunities…

¾ Distribution system enhancements

» Incremental rate based investment to enhance safety, reliability and

capacity, improve rural service, and prepare the system for

adaptation of new technologies.

capacity, improve rural service, and prepare the system for

adaptation of new technologies.

¾ Energy supply

» Big Stone and Neal plants’ pollution control equipment

» South Dakota peaking generation

» Wind projects and other renewable projects

» Natural gas reserves

¾ Transmission projects

» Network upgrades

» Colstrip 500 kV upgrade

» 230 kV Renewable Collector System

» Mountain States Transmission Intertie (MSTI)

» South Dakota transmission opportunities

14

15

potential project summary…

Opportunity to increase and diversify earnings as compared with our

existing $1.8 billion rate base (including Mill Creek).

existing $1.8 billion rate base (including Mill Creek).

Note: Color / label indicate NorthWestern Energy's current probability of execution and timing of expenditures.

in summary…

¾ Solid operations

¾ Single A secured credit ratings with a strong

balance sheet and liquidity

balance sheet and liquidity

¾ Positive earnings and ROE trend

¾ Strong cash flows

¾ Competitive total shareholder return with a dividend

that has increased every year since 2005

that has increased every year since 2005

¾ Constructive regulatory environment

¾ Forbes.com “100 Most Trustworthy Companies”

¾ Realistic investment opportunities

16