Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CFS BANCORP INC | f8k_042511.htm |

EXHIBIT 99.1

Welcome to the

CFS Bancorp, Inc.

2011 Annual Meeting

CFS Bancorp, Inc.

2011 Annual Meeting

Thomas F. Prisby

Chairman & CEO

Chairman & CEO

This presentation contains certain forward-looking statements and information

relating to the Company that is based on the beliefs of management as well as

assumptions made by and information currently available to management. These

forward-looking statements include but are not limited to statements regarding

successful execution of the Company’s strategy and its Strategic Growth and

Diversification Plan, current regulatory capital and equity ratios, diversification of

the loan portfolio, deepening client relationships, levels of core deposits, non-

performing asset levels, credit-related costs, revenue growth and levels of earning

assets, general economic and competitive conditions nationally and within its core

market area, cost savings initiatives, levels of provision for the allowance for loan

losses and charge-offs, loan and deposit growth, interest on loans, asset yields

and cost of funds, net interest income, net interest margin, non-interest income,

non-interest expense, interest rate environment, and other risk factors identified

in the Company’s Annual Report on Form 10-K for the fiscal year ended December

31, 2010, and other filings with the Securities and Exchange Commission. In

addition, the words “anticipate,” “believe,” “estimate,” “expect,” “indicate,”

“intend,” “should,” and similar expressions, or the negative thereof, as well as

statements that include future events, tense, or dates, or are not historical or

current facts, as they relate to the Company or the Company’s management, are

intended to identify forward-looking statements. Such statements reflect the

current views of the Company with respect to future events and are subject to

certain risks, uncertainties, assumptions, and changes in circumstances. Forward-

looking statements are not guarantees of future performance or outcomes, and

actual results or events may differ materially from those included in these

statements. The Company does not intend to update these forward-looking

statements unless required to under the federal securities laws.

relating to the Company that is based on the beliefs of management as well as

assumptions made by and information currently available to management. These

forward-looking statements include but are not limited to statements regarding

successful execution of the Company’s strategy and its Strategic Growth and

Diversification Plan, current regulatory capital and equity ratios, diversification of

the loan portfolio, deepening client relationships, levels of core deposits, non-

performing asset levels, credit-related costs, revenue growth and levels of earning

assets, general economic and competitive conditions nationally and within its core

market area, cost savings initiatives, levels of provision for the allowance for loan

losses and charge-offs, loan and deposit growth, interest on loans, asset yields

and cost of funds, net interest income, net interest margin, non-interest income,

non-interest expense, interest rate environment, and other risk factors identified

in the Company’s Annual Report on Form 10-K for the fiscal year ended December

31, 2010, and other filings with the Securities and Exchange Commission. In

addition, the words “anticipate,” “believe,” “estimate,” “expect,” “indicate,”

“intend,” “should,” and similar expressions, or the negative thereof, as well as

statements that include future events, tense, or dates, or are not historical or

current facts, as they relate to the Company or the Company’s management, are

intended to identify forward-looking statements. Such statements reflect the

current views of the Company with respect to future events and are subject to

certain risks, uncertainties, assumptions, and changes in circumstances. Forward-

looking statements are not guarantees of future performance or outcomes, and

actual results or events may differ materially from those included in these

statements. The Company does not intend to update these forward-looking

statements unless required to under the federal securities laws.

Economic Environment

Weak housing markets

Large inventory of unsold properties

High local unemployment

Rising energy costs

Constrained small business growth

Weak government policy

State taxation and budget issues

Banking industry consolidation through

closures and mergers

closures and mergers

Dodd-Frank Act

Signed into law July 21, 2010

800+ page document

Will result in an estimated 5,000 pages of new

legislation

legislation

Regulatory Environment

Office of Thrift Supervision to be consolidated

into the Office of the Comptroller of the

Currency on July 21, 2011

into the Office of the Comptroller of the

Currency on July 21, 2011

Examination costs and deposit insurance

premiums have increased from $400,000 in

2008 to $2.5 million in 2010

premiums have increased from $400,000 in

2008 to $2.5 million in 2010

Right People in the Right Place

Leadership

Organization

Technology Tools

Sales Management

Performance Training

Strategic Growth & Diversification

Four Key Long-Term Objectives

Reduce non-performing assets

Align costs with anticipated future asset base

Grow while diversifying by targeting small

and mid-sized business owners for

relationship banking opportunities

and mid-sized business owners for

relationship banking opportunities

Expand and deepen relationships with clients

Stock Performance

Sources: SNL, Bloomberg

4/21/2011

4/21/2011

Stock Performance

Sources: SNL, Bloomberg

4/21/2011

4/21/2011

Stock Performance

Sources: SNL, Bloomberg

4/21/2011

4/21/2011

Value Perspective

Business transformation well underway

Experienced management team in place

Executing on Strategic Growth & Diversification Plan

Significant insider ownership aligned with shareholders

NEOs & Directors: 16.4%

401(k) Plan: 8.8%

Valuation Opportunity

Substantial discount to tangible book value per

share

share

2011 Best Place to Work

Daryl D. Pomranke

President & COO

President & COO

Strategic Growth & Diversification

Four Key Long-Term Objectives

Reduce non-performing assets

Align costs with anticipated future asset base

Grow while diversifying by targeting small and

mid-sized business owners for relationship banking

opportunities

opportunities

Expand and deepen the Company’s relationships

with its clients by meeting a higher percentage of

the client’s financial needs

with its clients by meeting a higher percentage of

the client’s financial needs

Execution Status of the Strategic

Growth & Diversification

Growth & Diversification

Continue to execute the plan

Major investments in people and

infrastructure complete

infrastructure complete

Performance management system fully

implemented in the sales business units

implemented in the sales business units

Investor presentations conducted with large

current shareholders, prospective

shareholders, and all employees

current shareholders, prospective

shareholders, and all employees

Reduce Non-Performing Assets

Syndications & Purchased Loans

Retail & Commercial direct originations have held up well

Never originated Subprime, Alt-A, or Option ARMs

Non-Performing Assets

Non-Performing Loans vs. OREO

Ongoing NPA Remediation

Proactive Problem Asset Management

Weekly review of delinquencies by Asset

Management Committee

Management Committee

Action plan review for all loans graded watch or worse

Impairment analysis prepared quarterly on all NPLs

greater than $750,000

greater than $750,000

Loan grade validation for all loans 30-days past due

All performing past due loans reviewed

Monthly management reports prepared for Board of

Directors

Directors

Improved Credit/Underwriting Process

Hired new SVP Senior Credit Officer in

December 2007

December 2007

Hired new VP Credit Manager in July 2008

4 new Credit Analysts added since December

2007

2007

New Credit Policy implemented in early 2008

Developed new loan grading matrix utilizing

objective attribute analysis in mid-2009

objective attribute analysis in mid-2009

# of

NPAs -91

NPAs -91

128

138

124

6

8

3

Align Cost Structure

Improve Efficiency Ratio

Overall FTE headcount reduced from 360 in 2006 to 322 currently

Cost reduction initiatives targeting $1.2 million of core expenses

Operating contract negotiations

Salary freeze 2010

Paper to electronic statement conversion

Operations Center relocation/consolidation

Remote Deposit Capture

Construction of three new branches postponed

Review opportunities for additional ancillary fee income sources

(e.g. mortgage banking, wealth management)

(e.g. mortgage banking, wealth management)

Grow While Diversifying

Growth Results in Targeted Segments

62% increase in targeted growth segments since Q1 2007

C&I increased 134%

Multifamily increased 72%

Owner Occupied CRE increased 28%

Strategic Shift in Portfolio

31% reduction in targeted shrinkage segments since Q1 2007

Commercial participation loans reduced 72%

Commercial construction & development loans reduced 64%

Results of Commercial Loan Portfolio

Diversification Plan

Diversification Plan

Targeted Growth segments are up from 30%

to 51% of the portfolio

to 51% of the portfolio

Targeted Shrinkage categories are down from

70% to 49% of the portfolio

70% to 49% of the portfolio

Expand and Deepen Relationships

Focus on Business Relationships

Business Banking Group reorganized to drive

growth

growth

New EVP Sales Management hired in 2008

14 new Relationship Managers hired

Average tenure of 20+ years

Expertise in C&I and Multifamily lending

Regional partnerships formed between Retail

and Business Banking teams with shared goals

and incentives

and Business Banking teams with shared goals

and incentives

Performance Management Program

Power of Personal Performance (PoPP)

Primary focus on sales activities and behaviors

Utilization of balance scorecards to track

activities

activities

Coaching sessions, check-ins, skill builders,

and skip coaching

and skip coaching

Improved outcomes and employee

satisfaction

satisfaction

Focus on Business Relationships

Focus on small-sized and medium-sized

businesses

businesses

Significantly grow C&I relationships

Increase Multifamily and Owner-Occupied CRE as

a share of Commercial Loans

a share of Commercial Loans

Increase business deposits to generate

relationships and fund growth

relationships and fund growth

IT platform provides competitive advantage in

Cash Management opportunities

Cash Management opportunities

Focus on Business Relationships

Proactive prospecting

Feet on the street - experienced teams now

in their markets

in their markets

Trusted Advisor approach vs. transactional

lending

lending

Incentives more heavily weighted for

deposit gathering vs. loan production

deposit gathering vs. loan production

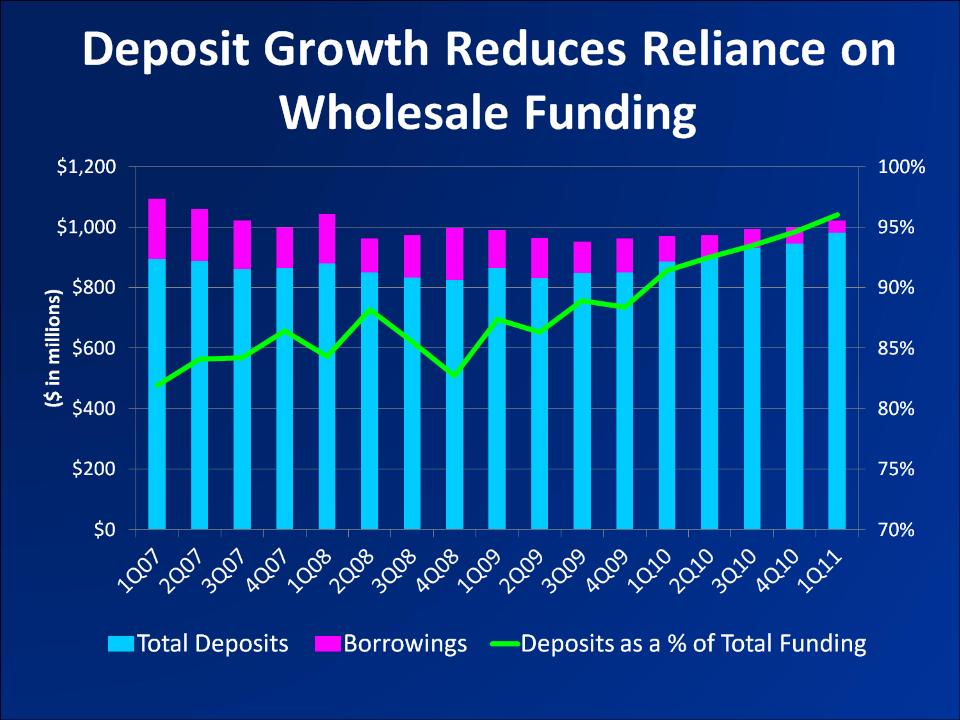

Non-Municipal Business Deposits

Total Deposits

Total Borrowed Funds

Impact of Core Deposits

Path Forward

Continue execution of Strategic Growth &

Diversification Plan

Diversification Plan

Focus on Northwest Indiana and South

Suburban Chicago markets

Suburban Chicago markets

Experienced senior management, sales, and

credit teams in place

credit teams in place

Improving reputation in our markets as business

bankers

bankers

Ongoing bank consolidation provides growth

opportunities

opportunities

Thomas F. Prisby

Chairman & CEO

Chairman & CEO