Attached files

| file | filename |

|---|---|

| EX-32.2 - Casablanca Mining Ltd. | ex32_2.htm |

| EX-32.1 - Casablanca Mining Ltd. | ex32_1.htm |

| EX-31.1 - Casablanca Mining Ltd. | ex31_1.htm |

| EX-31.2 - Casablanca Mining Ltd. | ex31_2.htm |

| EX-21.1 - Casablanca Mining Ltd. | ex21_1.htm |

| EX-99.1 - REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Casablanca Mining Ltd. | ex_99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

or

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ______________ to ________________.

Commission File Number: 000-53558

CASABLANCA MINING LTD.

(Exact name of Registrant as Specified in its Charter)

|

Nevada

|

80-0214005

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

9880 North Magnolia, Suite 176,

Santee, CA 92071

|

|

|

(Address of principal Executive Offices, including ZIP code)

|

|

|

619-717-8047

Registrant’s telephone number, including area code

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class

|

Name of each exchange on which registered

|

|

None

|

None

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

Common stock, $0.001 par value

|

|

Indicate by check mark if the registrant is a well known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer¨

|

Accelerated Filer ¨

|

|

|

Non-accelerated Filer ¨

(Do not check if a smaller reporting company)

|

Smaller reporting company ý

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes ý No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fiscal quarter. $10,221,510

On April 13, 2011, the Registrant had 52,053,878 outstanding shares of Common Stock, $.001 par value.

TABLE OF CONTENTS

|

Item 1

|

BUSINESS

|

4

|

||

|

Item 1A.

|

RISK FACTORS

|

8

|

||

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS | 8 | ||

|

Item 2

|

PROPERTIES

|

9

|

||

|

Item 3

|

LEGAL PROCEEDINGS

|

14

|

||

|

Item 4

|

(Removed and Reserved)

|

15

|

||

|

Item 5

|

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

15

|

||

|

Item 6

|

SELECTED FINANCIAL DATA

|

16

|

||

|

Item 7

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

16

|

||

|

Item 7A

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

28

|

||

|

Item 8

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

28

|

||

|

Item 9

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

29

|

||

|

Item 9A

|

CONTROLS AND PROCEDURES

|

29

|

||

|

Item 9B

|

OTHER INFORMATION

|

30

|

||

|

Item 10

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

30

|

||

|

Item 11

|

EXECUTIVE COMPENSATION

|

32

|

||

|

Item 12

|

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

32

|

||

|

Item 13

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

33

|

||

|

Item 14

|

PRINCIPAL ACCOUNTING FEES AND SERVICES

|

34

|

||

|

Item 15

|

EXHIBITS, FINANCIAL STATEMENTS SCHEDULES

|

35

|

2

Introductory Comment

Throughout this Annual Report on Form 10-K, the terms “we,” “us,” “our” and the “Company” refer to Casablanca Mining Ltd., a Nevada corporation, formerly known as USD Energy Corp., and, unless the context indicates otherwise, also include our subsidiary, Santa Teresa Minerals, S.A., a limited liability company organized under the laws of Chile (“Santa Teresa Minerals”).

“Safe Harbor” Statement

From time to time, we make oral and written statements that may constitute “forward-looking statements” (rather than historical facts) as defined by the Securities and Exchange Commission (the “SEC”) in its rules, regulations and releases, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

All statements in this Annual Report, including under the captions “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” other than statements of historical fact, are forward-looking statements for purposes of these provisions, including statements of our current views with respect to our business strategy, business plan and research and development activities, our future financial results, and other future events. These statements include forward-looking statements both with respect to us, specifically, and the mining industry, in general. In some cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,” “expects,” “plans,” “anticipates,” “estimates,” “potential” or “could” or the negative thereof or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements contained herein are reasonable, there can be no assurance that such expectations or any of the forward-looking statements will prove to be correct, and actual results could differ materially from those projected or assumed in the forward-looking statements.

All forward-looking statements involve inherent risks and uncertainties, and there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. Such risk factors include, among others: whether the Company can successfully execute its operating plan, including mining and exploration projects; results of exploration, project development and capital costs of mineral properties; volatility of market prices for gold, copper and copper sulfate; the Company’s ability to integrate acquired companies and technology; the Company’s ability to retain key employees; general market conditions; and other factors discussed under the captions “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” all of which you should review carefully. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we anticipate. Please consider our forward-looking statements in light of those risks as you read this Annual Report. Furthermore, any estimates of mineralized material are based upon estimates made by us and our consultants. Until mineralized material is actually mined and processed, it must be considered an estimate only. Actual results may differ materially from those contained in the forward-looking statements in this press release. The Company does not undertake any obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

3

|

Item 1

|

BUSINESS

|

History

The Company was incorporated in Nevada on June 27, 2008 as “USD Energy Corp.” Our historical plan of operations was to engage in the business of natural gas and oil production, with an emphasis on providing enhanced methods for redeveloping low risk developmental oil and gas wells. Until December 31, 2010, we had nominal cash and other assets and nominal operations, which made us a “shell” corporation as defined under the Securities Exchange Act of 1934, as amended.

On December 31, 2010, USD Energy Corp. acquired Santa Teresa Minerals pursuant to that certain Exchange Agreement (the “Exchange Agreement”), dated December 7, 2010, among the Company, Santa Teresa Minerals, and the stockholders of Santa Teresa Minerals (collectively, the “Santa Teresa Stockholders”). Santa Teresa Minerals was formed on July 27, 2008 as a limited liability company organized under the laws of Chile. Under the Exchange Agreement, we acquired all of the outstanding securities of Santa Teresa Minerals in exchange for 25,500,000 shares of our common stock and a convertible promissory note in the principal amount of $1,087,000. We accounted for this acquisition as a purchase. As a result of this acquisition (the “Santa Teresa Acquisition”), we ceased to be a “shell” corporation and modified our plan of operations to engage in the current business of Santa Teresa Minerals. On February 4, 2011, we amended our Articles of Incorporation to change our name from “USD Energy Corp.” to “Casablanca Mining Ltd.”

Mining Operations

Historical Development. We engage, through our wholly owned subsidiary, Santa Teresa Minerals, in the acquisition, exploration, development and operation of precious metal properties in Chile, South America.

Santa Teresa Minerals directly owns several mining properties in the “Casuto Project,” a gold exploration project, and also operates through a number of subsidiaries with gold, copper and copper sulfate properties in various stages of development. These subsidiaries include entities with other mining claims in the Casuto Project (Cia Contractual Casuto, Sociedad Legal Minera 5, Sociedad Legal Minera 6, and Sociedad Contractual Minera Los Azules), a producing gold mine (Sociedad Contractual Free Gold), and a copper sulfate production project (Sulfatos Chile, S.A.). These gold and copper mining operations are based in Quilpue, Illapel and Los Vilos, Chile. In addition, Santa Teresa Minerals owns 60% of a company with the rights to a proprietary and patent-pending electrolysis mining technology.

In November 2008, Santa Teresa Minerals and Mario Oscar Comas San Martin, Alfredo Rovaldo Manfredi Aguirre and Carlos Manuel Ugarte Lamarid formed the mining legal society, “Compania Minera Casuto,” (also known as “Cia Contractual Casuto”) to which they contributed the mining properties, Tauro Uno 1-20, Tauro Dos 1-20, Tauro Tres, 1-20 and Tauro Quatro, 1-20 of the “Casuto Project,” a gold exploration project. Santa Teresa Minerals owned 55.125% of the equity interests of Cia Contractual Casuto at December 31, 2010.

In August 2009, Santa Teresa Minerals formed the mining society, “Legal Minera Tauro Cinco” (also known as “Sociedad Legal Minera 5”) to which was contributed the gold exploration properties, Tauro Cinco 1-20 of the Casuto Project. Santa Teresa Minerals owned a 70% equity share in Sociedad Legal Minera 5 at December 31, 2010.

In August 2009, Santa Teresa Minerals formed the mining society, “Legal Minera Tauro Seis” (also known as “Sociedad Legal Minera 6”) to which was contributed the gold exploration properties, Tauro Seis 1-20 of the Casuto Project. Santa Teresa Minerals owned a 70% equity share in Sociedad Legal Minera 6 at December 31, 2010. In August 2009, Santa Teresa Minerals formed the mining legal society, “Compania Minera Los Azules,” (also known as “Sociedad Contractual Minera Los Azules”) to which was contributed the mining properties, “Los Azules Uno 1-20”, “Los Azules Dos 1-20” and “Los Azules Tres 1-20” of the Casuto Project. Santa Teresa Minerals owned a 55.125% equity share in Sociedad Contractual Minera Los Azules at December 31, 2010. In March 2010, Santa Teresa Minerals established mining exploration claims Chipi 1-16 of the Casuto Project by successfully completing mining exploration petitions in the Los Vilos, Chile Discovery of Mine Registry. Santa Teresa Minerals owns 100% of these claims.

4

In August 2010, the “Contract Mining Company - Free Gold” (also known as “Sociedad Contractual Free Gold”) was formed as a joint venture between Santa Teresa Minerals and Mario Oscar Comas San Martin. Santa Teresa Minerals contributed cash and mining properties owned by Santa Teresa Minerals identified in the Mine Registry of Quilpue, Chile as “Los Esteros 1-1-20,” “Los Esteros Dos-1-20,” “Los Esteros 2-1-20,” “Los Esteros 4-1-20,” “Los Esteros 5-1-20,” and Mario Oscar Comas San Martin contributed cash and mining properties identified in the Mining Registry of Quilpue, Chile as “Tauro 1-1-20,” “Tauro 2-1-13,” and Tauro 3-1-20.” Santa Teresa Minerals owned a 60% equity interest in Free Gold at December 31, 2010.

On September 15, 2010, Santa Teresa Minerals and Minera Anica Ltda. formed the Chilean corporation, “Sulfatos Chile, S.A.” Minera Anica contributed the Anico Copper Mine and intellectual property for the production of copper sulfate and its derivatives. Santa Teresa Minerals contributed cash and intends to provide the further financing necessary to put a copper sulfate production facility into production. Santa Teresa Minerals owned a 60% equity interest in Sulfatos Chile at December 31, 2010.

On October 21, 2010, Santa Teresa Minerals and LAC Ingeneria y Construcciones, Ltda. formed the Chilean corporation, “Fast Cooper, S.A.” Santa Teresa Minerals contributed cash and agreed to provide an undetermined amount of financing for Fast Cooper, and LAC Ingeneria y Construcciones, Ltda. contributed the intellectual property for its proprietary electro-mining process. Santa Teresa Minerals owned a 60% equity interest in Fast Cooper at December 31, 2010.

On February 2, 2011, Santa Teresa Minerals, signed a Business Purchase Agreement with Mario Oscar Comas San Martin (the “Business Purchase Agreement”) to increase its equity ownership in five of its Chilean gold mining subsidiaries. The increased ownership stakes have been recorded with the local Chiliean mining authorities. The transactions contemplated by the Business Purchase Agreement were completed upon recording of this agreement by the Chilean mining authorities. The increased stakes are being paid for in a combination of 20,000 shares of our common stock and $200,000 cash paid in five equal monthly installments of $40,000 each, starting February 4, 2011. Santa Teresa has made three payments under this agreement totaling $120,000 and two payments totaling $80,000 remain to be paid.

Pursuant to the Business Purchase Agreement, our equity ownership increased as follows:

|

●

|

Our equity interest in Cia Contractual Casuto, which is the owner of Tauro 1-4 mining properties of the Casuto Project, increased from 55.125% to 65.125%.

|

|

●

|

Our equity interest in Sociedad Contractual Free Gold, which is the owner of the Free Gold Project, increased from 50% to 99%.

|

|

●

|

Our equity interest in Sociedad Contractual Minera Los Azules, which is the owner of Los Azules 1-3 mining properties of the Casuto Project, increased from 55.125% to 65.125%.

|

|

●

|

Our equity interest in Sociedad Legal Minera Tauro 5, which is the owner of Tauro 5 mining property of the Casuto Project, increased from 70% to 85.215%.

|

|

●

|

Our equity interest in Sociedad Legal Minera Tauro 6, which is the owner of Tauro 6 mining property of the Casuto Project, increased from 70% to 85.215%.

|

|

Claims/Mining Properties

|

Location

|

Entity

|

Ownership Interest

|

|

Chipi 1 through 16

|

Casuto Project, Los Vilos

|

Santa Teresa Minerals (Directly)

|

100.00%

|

|

Tauro Uno (1), Tauro Dos (2), Tauro Tres (3), Tauro Cuatro (4)

|

Casuto Project, Los Vilos

|

Santa Teresa Minerals (Directly)

|

5.13%

|

|

Cia Contractual Casuto

|

65.125%

|

||

|

Total Tauro Uno through Tauro Cuatro

|

70.25%

|

||

|

Tauro Cinco (5)

|

Casuto Project, Los Vilos

|

Sociedad Legal Minera Tauro 5

|

85.215%

|

|

Tauro Seis (6)

|

Casuto Project, Los Vilos

|

Sociedad Legal Minera Tauro 6

|

85.215%

|

|

Los Azules 1, Los Azules 2, Los Azules 3

|

Casuto Project, Los Vilos

|

Sociedad Contractual Minera Los Azules

|

65.125%

|

|

Los Esteros 1, Los Esteros 2, Los Esteros 3, Los Esteros 4, Los Esteros 5

|

Free Gold Project, Marga Marga, Quilpue

|

Sociedad Contractual Free Gold

|

99.00%

|

|

Anica Copper Mines

|

Anico Project, Illapel

|

Sociedad Sulfatos Chile, S.A.

|

60.00%

|

5

Plan of Operations. Our current plan of operations is to perform further exploration, drilling and mapping on our various properties, as follows:

With respect to the Sociedad Contractual Free Gold, the Company plans to expand the alluvial gold operations at an estimated cost of $1.97 million within the next eight months, by increasing the existing equipment inventory and expanding the company’s alluvial processing plant.

With respect to our properties in the Casuto Project, we intend to conduct further geological assessment studies of the area in order to identify the old river channels and then to plan a campaign of boring and sampling in areas of greater interest. We estimate that we will spend approximately $1.0 million on this activity in 2011.

With respect to Sulfatos Chile, we intend to construct a copper sulfate production facility that extracts copper sulfate from raw material extracted from the Anica Copper Mine or purchased in bulk at an estimated cost of $6.2 million. The planning and permits for the facility were commenced on December 15, 2010 and we began construction on March 15, 2011.

On March 15, 2011, Santa Teresa Minerals V signed an Engineering and Construction of an SX-CR Plant Agreement with Francisco Morales Rivera – Ingefibras E.I.R.L. and Nunez, Ojeda Y da Silva Limitada – RCG Ingenieria (together the “Contractor”) for Contractor to design and build a Solvent Extraction and Crystallization Plant in the Sulfatos Chile S.A. Anico Project. We will pay for this project in installments after the completion and verification of multiple scheduled milestones through the expected completion date of October 24, 2011. The total project cost per the agreement is estimated to be $1,150,000 plus taxes.

This Engineering and Construction Agreement requires the Contractor’s professionals and employees to carry out all aspects of the project in order to design, engineer, build and deliver a “turnkey”, fully operational, solvent extraction (SX) and Crystallization (CR) plant to produce a minimum of 341 tons of feed-grade quality pentahydrated copper sulfate. In the event that a Feed-Grade quality is not obtained, the Contractor has agreed to introduce any modification necessary to the original design at its own expense. We anticipate that the operations will commence when construction is completed on approximately October 24, 2011, and we expect that when fully operational, operations will process up to 5,000 metric tons of raw material processing per month.

We contemplate undertaking additional research and development to build an electro-mining facility, as well as additional exploration and development costs on our properties. We expect to use a readily available outside labor force to explore and develop our properties.

During the next twelve months, the Company plans to satisfy its cash requirements through revenues from operations, existing cash and financing commitments and additional equity financings.

6

Distribution

Our subsidiary, Sociedad Contractual Free Gold is warehousing the gold it produces at the present time, due to the current trend of increasing gold price. The gold will be sold at a future time, and from time to time, as determined by management.

Employees

We currently have two management level employees who work for the Company on a part-time basis who are not compensated, not including persons employed through Santa Teresa Minerals.

Santa Teresa Minerals employs 24 full time employees.

The Company may require additional employees in the future as it expands its operations. There is intense competition for capable, experienced personnel and there is no assurance the Company will be able to obtain new qualified employees when required.

Patents

Santa Teresa Minerals owns a 60% equity interest in Fast Cooper, S.A. which holds the rights to mining technology that extracts gold, silver and copper from raw mining materials using a proprietary and patented electrolysis method of electromining. Patents are either issued or pending in the following countries: Chile, USA, China, South Africa, Canada, Australia, Brazil, and Peru. The Company owns no other patents or trademarks.

Competition

The exploration for, and the acquisition of gold and other precious metal properties, are subject to intense competition. We compete with major mining companies and other natural mineral resource companies in the acquisition, exploration, financing and development of new prospects. Factors that allow producers to remain competitive in the market over the long term include the quality and size of their ore bodies, costs of operation, and the acquisition and retention of qualified employees. Many of the companies we compete with are larger and better capitalized than we are. There is significant competition for the limited number of gold and precious metal acquisition and exploration opportunities. Due to our limited capital and personnel, we are at a competitive disadvantage compared to many other companies with regard to exploration and, if warranted, development of mining properties. Our present limited funding means that our ability to compete for properties to be explored and developed is limited. Furthermore, the availability of funds for exploration is sometimes limited, and we may find it difficult to compete with larger and more well-known companies for capital. Our inability to develop our mining properties due to lack of funding, even if warranted, could have a material adverse effect on our operation and financial position. We also compete with other mining companies for skilled mining engineers, mine and processing plant operators and mechanics, geologists, geophysicists and other technical personnel. This could result in higher turnover and greater labor costs. We believe that competition for acquiring mineral prospects will continue to be intense in the future.

Government Regulations and Permits

Our mineral exploration activities are subject to extensive foreign laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, protection and remediation of the environment, protection of endangered and protected species, mine safety, toxic substances and other matters. Mineral exploration is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production. Compliance with these laws and regulations may impose substantial costs on us and will subject us to significant potential liabilities. Changes in these regulations could require us to expend significant resources to comply with new laws or regulations or changes to current requirements and could have a material adverse effect on our business operations.

7

Various permits from government bodies are required for mining operations to be conducted; no assurance can be given that such permits will be received. Permits for exploration and development are administered by the Chilean National Geological and Mining Service (SERNAGEOMIN). Environmental compliance is assured via the offices of the National Environmental Committee (CONAMA). Claim titles are recorded at the local Mining Conservator in Copiapo (Conservador de Minas).

We have obtained or have pending applications for those licenses, permits or other authorizations currently required in conducting our exploration and other programs. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed there under. There are no current orders or directions relating to us with respect to the foregoing laws and regulations. For a more detailed discussion of the various government laws and regulations applicable to our operations and potential negative effects of these laws and regulations please see Item 7 --“Management’s Discussion and Analysis of Financial Condition and Results of Operations – Factors that May Affect Future Operating Results.”

Environmental Regulation

In connection with mining, production and exploration activities, we are subject to extensive federal, state and local laws and regulations governing the protection of the environment, including laws and regulations relating to protection of air and water quality, hazardous waste management and mine reclamation as well as the protection of endangered or threatened species. Potential areas of environmental consideration for mining companies, including ours include, but are not limited to, acid rock drainage, cyanide containment and handling, contamination of water courses, dust and noise. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuance of a given operation. Specifically, we may be subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. These laws are continually changing and, in general, are becoming more restrictive. Additionally, we may be subject to liability for pollution or other environmental damages that we may elect not to insure against due to prohibitive premium costs and other reasons.

Chile’s environmental law (Law No 19.300), which regulates all environmental activities in the country, was first published in March 1994. An exploration project or field activity cannot be initiated until its potential impact to the environment is carefully evaluated. This is documented in Article 8 of the environmental law and is referred to as the Sistema de Evaluación de Impacto Ambiental (SEIA).

The SEIA is administered and coordinated on both regional and national levels by the Comisión Regional del Medio Ambiente (COREMA) and the Comisión Nacional del Medio Ambiente (CONAMA), respectively. The initial application is generally made to COREMA, in the corresponding region where the property is located, however in cases where the property might affect various regions the application is made directly to the CONAMA. Various other Chilean government organizations are also involved with the review process, however most documentation is ultimately forwarded to CONAMA, which is the final authority on the environment and is the organization that issues the final environmental permits.

Our policy is to conduct business in a way that safeguards public health and the environment. We believe that our operations are conducted in material compliance with applicable laws and regulations.

|

Item

|

1A. RISK FACTORS

|

Not applicable.

|

Item

|

1B. UNRESOLVED STAFF COMMENTS

|

Not applicable.

8

|

Item 2

|

PROPERTIES

|

We have an administrative office in San Diego, California, which Director and Chief Financial Officer Trisha Malone provides to us without charge. Santa Teresa Minerals has offices in Santiago, Chile that are leased by our Chief Executive Officer Juan Carlos Camus Villegas and provided to us without charge.

We own, through Santa Teresa Minerals or through subsidiaries of Santa Teresa Minerals, various mining properties described below.

Operating Mine Property

Free Gold Company

Santa Teresa Mineral’s majority- owned subsidiary, Sociedad Contractual Free Gold, operates a producing alluvial gold mine in the Marga –Marga wash area of Quilpue, Chile. Alluvial mining refers to mining precious metal deposits found in alluvial deposits, or deposits of sand and gravel in modern or ancient stream beds.

History

The Marga-Marga wash has a history of artisanal alluvial mining since 1542. The area’s historical gold production was the subject of Benjamin Vicuña Mackenna’s book The Golden Age of Chile, that discusses the Marga-Marga area in the second chapter “The Gold in Chile at the Time of Don Pedro de Valdivia” and highlights the discovery of gold mines in Marga-Marga and its “prodigious wealth.” The wash is also mentioned in the fifth Chilean Geological Congress in Santiago, 8-12 August 1988, led by the Department of Geology and Geophysics, University of Chile (Volume 1, pgs. 489-502) which in summary translation states:

“Gold-bearing placers of the Marga-Marga stream in the Valparaíso region have always developed in a stretch of water 8 to 10 km upstream from the aforementioned stream (measured from the merging of the Quilpué stream to the East, and the Viña stream to the West). Practically uninterrupted exploitation of the wash has occurred from the time of the Spaniards in 1542, or around 450 years. The news of the remains of a fossil flora gold producing treasure-trove found in the area of Quilpué, motivated the authors to obtain geological information in relation as to the origin of gold present in the stream.”

Since January 2011 the project has operated at an average of 2,500 cubic meters of material per month. Since mid January 2011, this type of materials has generated anywhere from 0.6g to 1.0g of gold per cubic meter. At $1,400 per ounce, this equates to $39.20 of gold per cubic meter. This gold is being warehoused for sale at a future date. The Company’s historical average cost for operations of this project over the last six months is $19,910. We intend to increase production to 5,000 metric tons of material per month by July 2011 by finalizing water and use permits and increasing daily mining operations with existing equipment. Additional increases in production costs are expected in the coming months to support the increase in production.

9

Map of Marga-Marga Wash, Quilpue, Chile

The mine is open-pit and consists of 765 hectares on eight claims owned by Sociedad Contractual Free Gold, designated Los Esteros 1 through 5 and Tauro 1-3 in Region V, Quilpue, Chile. Quilpue is serviced by two ports in Valparaiso, a distance of approximately 53 kilometers away via established highways and roads. The property is accessible by access roads from Quilpue to the Marga-Marga creek. We have three trucks, an alluvial plant, a bulldozer and an excavator on site. Well water and electric power are available and in place.

Exploration Properties

Casuto Wash Location

Santa Teresa Minerals directly and indirectly through several majority owned subsidiaries has several mining claims in the Casuto Project, a gold exploration project. The Casuto project is comprised of 6,200 hectares, located 20 kilometers to the north of the city of Los Vilos, IV Region, Province of Choapa, Chile, and its central coordinates are N 6.483.000 and E 268.000 at an average height of 50 meters above sea level.

Access to the project is via access roads off the Pan American highway (Route 5 North) which passes 15 kilometers west of the Casuto Wash area. Well water resources are available on the property and power can be brought from existing power lines about four kilometers away. The area is serviced by two ports; the privately owned Port of Punta Chungo, in the City of Los Vilos, which is the closest, and the privately owned Port of Coquimbo, located about 200 kilometers away in Coquimbo. The area is served by La Florida Airport in Coquimbo. Communication with the area is by cellular telephone only.

10

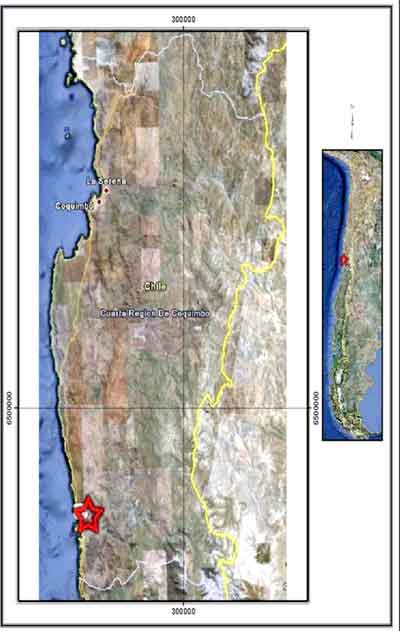

Map showing location of Casuto Wash Project

History

The history of the gold deposit dates back to the 1880s, when it was exploited by artisanal miners utilizing shafts, test pits and underground labor, built specifically to recognize the circa, where the most alluvial gold is concentrated. Numerous historical studies have been conducted over the past two centuries, indicating that the site may have significant resources of alluvial material.

Current Study

Santa Teresa Minerals commissioned a geological study by an independent geological consultant, Consultores Geologicos Asociados, on the property in February 2010. The study report, completed in May 2010, concluded that a further geological assessment study was warranted. Specifically, the study recommended a paleo geographic study of the area in order to identify the old river channels and then to plan a campaign of boring and sampling in areas of greater interest. The study was designed to define the form, occurrence and spatial distribution of gold mineralization on the properties, in order to determine the potential utility of economic resources and to propose evaluation studies and detail studies in areas of interest.

11

The study was developed in three phases: 1) background information and work planning, geological field studies; geological mapping and sampling of the alluvial terraces and locations in old extraction shafts; 2) district geological mapping at a scale of 1:10,000, based on a geo-referenced satellite generated image with spectral analysis for the determination of alteration, lithology and structures; and 3) processing and interpretation of all geological information.

In preparing the study, due diligence samples were collected in February 2010 and by guidelines, to ensure chain the custody, the samples were in his possession at all times.

The study concluded that there were several old gold bearing washes in the area, the latter of which were mainly associated with vein structures. The mineralization of alluvial gold was deposited in glacial river terraces, through several erosive events and near old river channels, with the highest concentration of gold found on the circa, the area of contact with the bedrock, and possibly caused by erosion of gold structures and zones of stockwork type mineralization, located on the intrusive underlying bedrock.

The study found that mineralization recognized on samplings corresponds mainly to thick gold with particle sizes over 150 mesh. “Mesh” is a unit of measurement equal to approximately .24 microns. Historical information indicates that some sectors may contain larger particles and gold bearing nuggets. A sampling of bedrock yielded values of 5 grams per metric ton of gold, indicating significant gold resources in the opinion of the author of the report.

Samples were collected at five points in the area of the wash where significant historical exploitation took place. The samples were collected and washed, each representing 1 cubic meter of material. Results indicate gold content between 0.5 and 0.6 grams per cubic meter. The samples were sent to an independent laboratory, La Serene CIMM Laboratories, and analyzed as gold concentrate, or raw gold before it is refined.

When the location of a potential sample was reached, the following protocol was followed:

|

1. Plastic sample bags were labeled with indelible ink.

|

|

2. A field sample tag with the same number as written on the outside of the bag put into the plastic sample bag with the sample.

|

|

3. The sample collected and the sample bag closed and sealed with a single use cable tie.

|

|

4. The author carried the sample to camp and remained in the author’s possession until submitted to La Serene CIMM Laboratories.

|

All QA/QC protocols are defined by the Canadian Instrument 43-101, which the Company has adopted and adheres to regarding its sample acquisition procedures.

The property is without known reserves and the proposed program is exploratory in nature. Current costs to December 31, 2010 are recorded at $5,298. On our Casuto Wash project properties, we intend to conduct further geological assessment studies of the area in order to identify the old river channels and then to plan a campaign of boring and sampling in areas of greater interest, at a cost of approximately $1.0 million within the next 12 months.

Sulfatos Chile

12

On September 15, 2010, Santa Teresa Minerals and Minera Anica Ltda. formed the Chilean corporation, “Sulfatos Chile, S.A.” Santa Teresa Minerals owns 60% of Sulfatos Chile S.A., which owns the Anico Copper Mine, and mining claims to Anico 1/5, and plans to extract copper sulfate and to construct and operate a copper sulfate production facility at the Anico Copper Mine. Copper sulfate is a byproduct of copper mining that is used in industrial processes, livestock feed and aerospace industries. Since 2010, copper sulfate has sold anywhere from $3/kg to $40/kg depending on the quality and intended use of the mineral. The Company’s historical cost to produce copper sulfate is estimated to be approximately $1.09/kg.

Map Showing Location of Anico Copper Mine

The Anico Copper Mine is located in the la Cuarta region, 22 kilometers northeast of the community of Illapel in the fourth region of the Choapa Province. Illapel is located on a plain along the side of the Illapel River, 37.2 miles northeast from Los Vilos and 158.4 miles south from Ovalle. The Anico Copper Mine is located at latitude North 31 degrees, 25 minutes, 6953 seconds, longitude East, 71 degrees, 10 minutes, 588 seconds, with UTM coordinates of 6.521.208 meters North, 293.319 meters east. The Anico Copper Mine is approximately 22 km by conventional roadways, from Illapel, on the road leading to Combarbalá, past the Auco sector, following the road that leads to Cocou, then to Culen Creek, where Anico Copper Mine is located.

History

Registered in 1999 as Anico 1/5, the property consists of 25 hectares, which was contributed to Sulfatos Chile S.A. by Minera Anica Ltda. The property has been exploited since 2008, extracting approximately 400 tons of raw material per month with an average copper grade of approximately 3% per cubic ton. Prior to Sulfatos Chile’ acquisition of the property in September of 2010, sales of the raw material had been made to refineries of the Empresa Nacional de Mineria (ENAMI), Chile’s state owned minerals company, approximately 20 kilometers away.

Current Study

The last geological study on the mine was made in April 2008. During the study, mineral samples were extracted using the random stratified sampling method from existing extraction piles, using material extracted from two vein trenches. Two samplings of 12 kilograms each were analyzed by and independent laboratory, Nueva Pudahel Chemical Laboratory, and results of 1.26% and 1.27% copper, respectively, were recorded. During the study, when the location of a potential sample was reached, the following protocol was followed:

13

|

1. Plastic sample bags were labeled with indelible ink.

|

|

2. A field sample tag with the same number as written on the outside of the bag put into the plastic sample bag with the sample.

|

|

3. The sample collected and the sample bag closed and sealed with a single use cable tie.

|

|

4. The author carried the sample to camp and it remained in the author’s possession until submitted to Nueva Pudahel Chemical Laboratory.

|

All QA/QC protocols are defined by the Canadian Instrument 43-101 which the Company has adopted and adheres to regarding its sample acquisition procedures.

The property is without known reserves and the proposed program is exploratory in nature. Current costs to December 31, 2010 are recorded at $122,488.

With Sulfatos Chile, we intend to construct a copper sulfate production facility that would extract copper sulfate from raw material extracted from the Anico Copper Mine or purchased in bulk. The permits for this facility have been received and we anticipate that the construction began on March 15, 2011. We estimate the cost of this facility to be approximately $6.2 million.

On February 21, 2011, a lease offer with purchase option agreement was formalized between Sulfatos Chile and the property owners of the plant site. The lease with option to purchase has a term of 10 years and includes the water rights of 2 liters per second. This agreement has been superseded by a purchase agreement executed on March 31, 2011. The total purchase price for 835 hectares in Fundo Puerto Oscuro, Comuna de Canela, Province of Choapa, Los Vilos, Chile is 280 million Chilean Pesos (currently $595,000 US) payable over 2 years. 100 million Chilean Pesos ($212,765 US) was paid upon signing and 90 million Chilean Pesos ($191,489 US) is due one year after signing and 90 million Chilean Pesos ($191,489 US) is due two years after signing.

On March 15, 2011, Santa Teresa Minerals signed an Engineering and Construction of an SX-CR Plant Agreement with Francisco Morales Rivera – Ingefibras E.I.R.L. and Nunez, Ojeda Y da Silva Limitada – RCG Ingenieria (together the “Contractor”) for Contractor to design and build a Solvent Extraction and Crystallization Plant in the Sulfatos Chile S.A. Anico Project. The project shall be paid for in installments after the completion and verification of multiple scheduled milestones through the expected completion date of October 24, 2011.

This Engineering and Construction Agreement requires the Contractor’s professionals and employees to carry out all aspects of the project in order to design, engineer, build and deliver a “turnkey”, fully operational, solvent extraction (SX) and Crystallization (CR) plant to produce a minimum of 341 tons of feed-grade quality pentahydrated copper sulfate. In the event that a Feed-Grade quality is not obtained, the Contractor commits itself to introduce any modification necessary to the original design at its own expense. The total project cost per the agreement is $1,150,000 plus taxes. We anticipate that the operations will commence immediately following completion on October 24, 2011 and we expect that when running at full capacity, operations will process up to 5,000 metric tons of raw material processing per month.

We also plan to install a copper refining operation using our proprietary electro-mining process, at an estimated cost of approximately $2 million by June 30, 2011. We anticipate the project will begin with 5,000 metric tons of raw material processing per month and will not require an environmental impact study. This plant is currently being designed, but has not yet been contracted to be built.

|

Item 3

|

LEGAL PROCEEDINGS

|

Nothing to report.

14

|

Item 4

|

(REMOVED AND RESERVED)

|

|

Item 5

|

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Our common stock has traded on the Over the Counter Bulletin Board under the symbol “UEGY” since May 3, 2010 and under the symbol “CUAU” since February 17, 2011. The market represented by the Over the Counter Bulletin Board is limited and the price for our common stock quoted on the Over the Counter Bulletin Board is not necessarily a reliable indication of the value of our common stock. The following table sets forth the high and low bid prices for shares of our common stock for the periods noted, as reported on the Over the Counter Bulletin Board since our common stock began trading. Quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. As of April 13, 2011, the closing-sale price on the most recent day our common stock traded was $10.00 per share.

|

Common Stock

|

||||||||

|

High

|

Low

|

|||||||

|

2010:

|

||||||||

|

Fourth Quarter

|

$ | 11.00 | $ | 2.00 | ||||

|

Third Quarter

|

$ | 3.25 | $ | 0.30 | ||||

|

Second Quarter (May 3 –June 30)

|

$ | 1.05 | $ | 0.15 | ||||

Holders

As of April 13, 2011, there were 51,508,878 shares of common stock outstanding held by approximately 38 holders of record.

Dividends

Our Board of Directors has not declared a dividend on our Common Stock since inception and we do not anticipate the payments of dividends in the near future as we intend to reinvest our profits to grow our business.

Unregistered Sales of Securities

On January 17, 2011, Suprafin, Ltd. (“Suprafin”) converted the outstanding balance of principal and accrued interest pursuant to that certain Convertible Promissory Note, dated February 7, 2009, issued by the Company in favor of Suprafin, as amended on February 5, 2010 (the “Suprafin Note”), into 641,111 shares of common stock. The amount of principal and accrued interest at the time of conversion was approximately $14,425, and the conversion price pursuant to the Suprafin Note was $.0225.

On January 19, 2011, the Company entered into a Stock Purchase Agreement with WealthMakers, Ltd. (“WealthMakers”) whereby WealthMakers purchased 800,000 shares of common stock of the Company for a purchase price of $800,000.

On March 10, 2011, the Company entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Angelique de Maison whereby Ms. de Maison agreed to purchase up to 1,000,000 shares of common stock of the Company for a purchase price of $1.00 per share, in one or more installments as requested by the Company. The purchase of 315,000 shares of common stock was completed concurrently with the execution of the Stock Purchase Agreement and the purchase of 230,000 shares of common stock was completed on March 16, 2011. Either party may terminate the Stock Purchase Agreement with respect to any shares of common stock not purchased on or before June 30, 2011.

Unless otherwise noted, all of the foregoing securities were issued in reliance on the exemption from registration contained in Section 4(2) of the Securities Act of 1933, as amended, and/or Regulation D there under. No general solicitation or advertising was used in connection with the sale of the shares, and the Company has imposed appropriate limitations on resales. There was no underwriter involved.

15

|

Item 6

|

SELECTED FINANCIAL DATA

|

Not Applicable.

|

Item 7

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes appearing elsewhere in this Report. This discussion and analysis may contain forward-looking statements based on assumptions about our future business. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including, but not limited to, those set forth under “Factors that May Affect Future Operating Results” below.

For a discussion of our financial statements prior to the Santa Teresa Acquisition, see our financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Annual Report on Form 10-K for the year ended December 31, 2009 and our Annual Report on Form 10-K for the year ended December 31, 2010. Prior to the Santa Teresa Acquisition, we conducted only nominal business operations. The transaction was accounted for as business combination or a purchase, and the operating statements of the Company prior to December 31, 2010 reflect the historical operations of Casablanca Mining Ltd. only.

Revenues

There have been no revenues generated to date.

We expect Santa Teresa Minerals will begin to generate revenues in the third quarter of 2011.

Operating Expenses

For the year ended December 31, 2010 operating expenses were $23,850, compared to $47,240 for the year ended December 31, 2009. Operating expenses were primarily associated with legal and accounting expenses required by a public company in addition to costs incurred in connection with the Santa Teresa acquisition.

Santa Teresa Minerals has incurred significant expenses since inception, mostly as the result of capital expenditures for equipment and infrastructure, exploration costs, development of technology, salaries for mining personnel, legal, accounting and office expenses. Going forward, Santa Teresa Minerals expects to incur average monthly expenses of approximately $600,000 as it builds out the copper sulfate production facility associated with Sulfatos Chile, S.A., and increases production at Sociedad Contractual Free Gold. Santa Teresa Minerals also expects to incur further exploration costs and costs to develop technology as set forth in its plan of operations.

Net Income (Loss)

For the year ended December 31, 2010, net loss was $26,051 compared to a net loss of $48,880 the year ended December 31, 2009. Net losses were due to the operating expenses discussed above.

Financial Condition, Liquidity and Capital Resources

At December 31, 2010, our principal sources of liquidity included cash of $9,390 compared to $0 at December 31, 2009. In addition, per the Stock Purchase Agreement dated December 7, 2010, in anticipation of the Santa Teresa Acquisition, the Company sold 21,500,000 shares of stock at a purchase price of $.05 per share. The majority of these funds have been used to provide working capital to Santa Teresa Minerals.

16

On our existing property in production, the Company plans to expand the alluvial gold operations at an estimated cost of $1.97 million within the next eight months, by increasing the existing equipment inventory and expanding the company’s alluvial processing plant.

On our Casuto Wash Project properties, we intend to conduct further geological assessment studies of the area in order to identify the old river channels and then to plan a campaign of boring and sampling in areas of greater interest, at a cost of approximately $1.0 million within the next 12 months.

With Sulfatos Chile, we intend to construct a copper sulfate production facility, at an estimated cost of $6.2 million, that extracts copper sulfate from raw material extracted from the Anico Copper Mine or purchased in bulk. Production began on this facility on March 15, 2011.

We also plan to install a copper refining operation using our proprietary electro-mining process, at a cost of approximately $2 million, by June 30, 2011. We anticipate the project will begin with 5,000 metric tons of raw material processing per month and will not require an environmental impact study.

During the next twelve months, the Company plans to satisfy its cash requirements by additional equity financing and contributions from its current principal shareholders. In December 2010, certain of the Company principal shareholders purchased 21,500,000 shares of the Company’s Common Stock $1.1 million, $1 million of which has been used to expand our current mining operations and extraction technologies. In January 2011, we raised $800,000 from the sale of 800,000 shares of common stock to an affiliate of Angelique de Maison. In February 2011, Ms. de Maison individually agreed to purchase from us up to an additional 1,000,000 shares of common stock at a purchase price of $1.00 per share. As of April 13, 2011, we had sold 545,000 shares to Ms. de Maison pursuant to this agreement. The Company intends to undertake private placements of its Common Stock in order to raise future development and operating capital. The Company depends upon capital to be derived from contributions from its principal shareholders and future financing activities such as subsequent offerings of its stock. There can be no assurance that the Company will be successful in raising the capital it requires through the sale of its Common Stock.

Off-Balance Sheet Arrangements

We have no off balance sheet arrangements.

Critical Accounting Estimates and Policies

The discussion and analysis of our financial condition and plan of operations is based upon our financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates including, among others, those affecting revenue, the allowance for doubtful accounts, the salability of inventory and the useful lives of tangible and intangible assets. The discussion below is intended as a brief discussion of some of the judgments and uncertainties that can impact the application of these policies and the specific dollar amounts reported on our financial statements. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form our basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions, or if management made different judgments or utilized different estimates. Many of our estimates or judgments are based on anticipated future events or performance, and as such are forward-looking in nature, and are subject to many risks and uncertainties, including those discussed elsewhere in this Annual Report on Form 10-K. We do not undertake any obligation to update or revise this discussion to reflect any future events or circumstances.

We have identified below some of our accounting policies that we consider critical to our business operations and the understanding of our results of operations. This is not a complete list of all of our accounting policies, and there may be other accounting policies that are significant to us. For a detailed discussion on the application of these and our other accounting policies, see Note 1 to the financial statements, included in this Annual Report on Form 10-K.

17

Proven and Probable Reserves

The definition of proven and probable reserves is set forth in SEC Industry Guide 7. Proven reserves are reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. Probable reserves are reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. In addition, reserves cannot be considered proven and probable until they are supported by a feasibility study, indicating that the reserves have had the requisite geologic, technical and economic work performed and are economically and legally extractable at the time of the reserve determination.

Mineral Acquisition Costs

The costs of acquiring land and mineral rights are considered tangible assets. Significant acquisition payments are capitalized. General, administrative and holding costs to maintain an exploration property are expensed as incurred. If a mineable ore body is discovered, such costs are amortized when production begins using the units-of-production method. If no mineable ore body is discovered or such rights are otherwise determined to have diminished value, such costs are expensed in the period in which the determination is made.

Exploration Costs

Exploration costs are charged to expense as incurred. Costs to identify new mineral resources, to evaluate potential resources, and to convert mineral resources into proven and probable reserves are considered exploration costs.

Design, Construction, and Development Costs

Certain costs to design and construct mine and processing facilities may be incurred prior to establishing proven and probable reserves. Under these circumstances, we classify the project as an exploration stage project and expense substantially all costs, including design, engineering, construction, and installation of equipment. Certain types of equipment, which have alternative uses or significant salvage value, may be capitalized. If a project is determined to contain proven and probable reserves, costs incurred in anticipation of production can be capitalized. Such costs include development drilling to further delineate the ore body, removing overburden during the pre-production phase, building access ways, constructing facilities, and installing equipment. Interest costs, if any, incurred during the development phase, would be capitalized until the assets are ready for their intended use. The cost of start-up activities and on-going costs to maintain production are expensed as incurred. Costs of abandoned projects are charged to operations upon abandonment.

If a project commences commercial production, amortization and depletion of capitalized costs is computed on a unit-of–production basis over the expected reserves of the project based on estimated recoverable gold equivalent ounces.

Income Taxes

Accounting Standards Codification Topic No. 740 “Income Taxes” (ASC 740) requires the asset and liability method of accounting be used for income taxes. Under the asset and liability method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

18

Factors that May Affect Future Operating Results

We are subject to various risks that may materially harm our business, financial condition and results of operations. You should carefully consider the risks and uncertainties described below and the other information in this filing before deciding to purchase our Common Stock. If any of these risks or uncertainties actually occurs, our business, financial condition or operating results could be materially harmed. In that case, the trading price of our Common Stock could decline and you could lose all or part of your investment.

Risks Related to Our Business

We are a young company with no operating history, which makes it difficult to evaluate an investment in our Company.

Until we completed the transaction with Santa Teresa Minerals, we had no operations. The future of our Company currently is dependent upon our ability to successfully develop our properties, the productivity of such properties, and our ability to otherwise implement our business plan for developing the Santa Teresa Minerals business. While we believe that our business plan, if implemented as conceived, will make us successful in the long term, we have limited operating history against which we can test our plans and assumptions, and therefore cannot evaluate the likelihood of success. At this stage of our business operations, even with our good faith efforts, potential investors have a high probability of losing their investment. Our future operating results will depend on many factors, including the ability to develop our properties, the productivity of such properties, the level of our competition, and our ability to attract and maintain key management and employees. While management believes their estimates of projected occurrences and events are within the timetable of their business plan, there can be no guarantees or assurances that the results anticipated will occur.

We expect to incur net losses in future quarters and we cannot assure you that we will ever achieve profitability.

We have operated at a loss since our inception. If we do not achieve profitability, our business may not grow or we may not be able to continue to operate. We are likely to continue to incur losses unless and until we are able to generate significantly more revenues from Santa Teresa Minerals. We will need to generate revenues from the production from our property interests and maintain profitability. We may not achieve sufficient revenues or profitability in any future period. If we do achieve profitability, we cannot be certain that we can sustain or increase profitability on a quarterly or annual basis. If we do not become profitable or are unable to maintain future profitability, the market value of our Common Stock may be adversely affected.

We require additional funds to operate in accordance with our business plan, which we may not be able to obtain on terms acceptable to us, if at all. If we cannot obtain additional funds, our ability to operate may be adversely affected.

We may not be able to obtain additional funds that we require. As discussed in greater detail under the Management’s Discussion and Analysis section below, we do not presently have adequate cash from operations or financing activities to meet our current plan of operations. Many of our plans have estimated costs far in excess of our current resources. Furthermore, if unanticipated expenses, problems, and unforeseen business difficulties occur, which result in material delays, we will not be able to operate within our budget. If we do not operate within our budget, we will require additional funds to continue our business. If we are unsuccessful in obtaining those funds, we cannot assure you of our ability to generate positive returns. Further, we may not be able to obtain the additional funds that we require on terms acceptable to us, if at all. We do not currently have any established third-party bank credit arrangements. If the additional funds that we may require are not available to us, we may be required to curtail significantly or to eliminate some or all of our exploration and development programs.

If we need additional funds, we may seek to obtain them primarily through equity or debt financings. Such additional financing, if available on terms and schedules acceptable to us, if available at all, could result in dilution to our shareholders. We may also attempt to obtain funds through arrangement with corporate partners or others. Those types of arrangements may require us to relinquish certain rights to our assets.

19

There is substantial doubt about our ability to continue as a going concern, which means that we may not be able to continue operations unless we obtain additional funding.

The report of our independent accountants on our December 31, 2010 financial statements includes an explanatory paragraph indicating that there is substantial doubt about our ability to continue as a going concern due to recurring losses and working capital shortages. Our ability to continue as a going concern will be determined by our ability to obtain additional funding. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We are highly dependent on Juan Carlos Camus Villegas, our Chief Executive Officer (“CEO”). The loss of Mr. Camus could negatively impact our business and the value of our Common Stock.

For the continued operation of the Santa Teresa Minerals business, we are largely dependent on Mr. Camus for his familiarity with the acquisition, exploration, development, and operation of mining properties in Chile. Our ability to successfully develop and operate our mining properties may be at risk from an unanticipated accident, injury, illness, incapacitation, or death of Mr. Camus. Upon such occurrence, unforeseen expenses, delays, losses and/or difficulties may be encountered. We have not purchased key man insurance on any of our officers, which insurance would provide us with insurance proceeds in the event of their death. Without key man insurance, we may not have the financial resources to develop or maintain our business until we could replace such individuals or to replace any business lost by the death of such individuals.

Our success may also depend on our ability to attract and retain other qualified management and mining personnel. We compete for such persons with other companies and other organizations, some of which have substantially greater capital resources than we do. We cannot give any assurance that we will be successful in recruiting or retaining personnel of the requisite caliber or in adequate numbers to enable us to conduct our business.

Precious metal exploration and production involves a high degree of risk, and as a result, we may never become commercially viable.

The exploration and production of precious metals involves a high degree of risk. Many exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Few properties that are explored are ultimately advanced to production. The projects of Santa Teresa Minerals may not contain commercial quantities of precious metals. Furthermore, some of the projects have not yet been established as proved or probable mineral reserves as defined by the SEC. The SEC has defined a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. In order to demonstrate the existence of proven or probable reserves with respect to these properties, it would be necessary for us to perform additional exploration to demonstrate the existence of sufficient mineralized material with satisfactory continuity and then obtain a positive feasibility study. Establishing reserves also requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically and legally extracted and produced. We have not completed a feasibility study with regard to all or a portion of any of our properties to date. The absence of proven or probable reserves makes it more likely that our properties may never be profitable and that the money we have spent on exploration and development may never be recovered.

Our current exploration efforts are, and any future development or mining operations we may elect to conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as, but not limited to:

|

●

|

economically insufficient mineralized material;

|

|

●

|

fluctuations in production costs that may make mining uneconomical;

|

20

|

●

|

labor disputes;

|

|

●

|

unanticipated variations in grade and other geologic problems;

|

|

●

|

environmental hazards;

|

|

●

|

water conditions;

|

|

●

|

difficult surface or underground conditions;

|

|

●

|

industrial accidents;

|

|

●

|

metallurgical and other processing problems;

|

|

●

|

mechanical and equipment performance problems;

|

|

●

|

failure of pit walls or dams;

|

|

●

|

unusual or unexpected rock formations;

|

|

●

|

personal injury, fire, flooding, cave-ins and landslides; and

|

|

●

|

decrease in reserves due to a lower prices for the precious metals being mined.

|

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, potential revenues and production dates. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable.

Estimates of mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated, which may have an adverse effect on our ability to achieve profitability.

Unless otherwise indicated, estimates of mineralized material presented in our press releases and regulatory filings are based upon estimates made by us and our consultants. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material on our properties. Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that:

|

●

|

these estimates will be accurate;

|

|

●

|

resource or other mineralization estimates will be accurate; or

|

|

●

|

this mineralization can be mined or processed profitably.

|

Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property’s return on capital. There can be no assurance that minerals recovered in small scale metallurgical tests will be recovered at production scale. These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable.

21

The mineralized material estimates have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove inaccurate. Extended declines in market prices for gold and other precious metals may render portions of our mineralized material uneconomic and adversely affect the commercial viability of one or more of our properties and could have a material adverse effect on our results of operations or financial condition.

Our existing production is limited and our ability to become and remain profitable over the long term will depend on our ability to identify, explore and develop additional properties, which we may not be able to do.

Precious metal mines properties are wasting assets. They eventually become depleted or uneconomical to continue mining. Accordingly, our ability to become and remain profitable over the long term depends on our ability to finalize exploration and development of the properties of Santa Teresa Minerals and produce mineralization from such projects and/or identify and successfully develop one or more additional properties. The acquisition of mining properties and their exploration and development are subject to intense competition. Companies with greater financial resources, larger staff, more experience and more equipment for exploration and development may be in a better position than us to compete for such mineral properties. If we are unable to find, develop, and economically mine our existing or new properties, we most likely will not be profitable on a long term basis and the price of our Common Stock may suffer.

The volatility of the price of precious metals could adversely affect our future operations and, if warranted, our ability to develop our properties.

The potential for profitability of our operations, the value of our properties and our ability to raise funding to conduct continued exploration and development, if warranted, are directly related to the market price of gold, copper and copper sulfate. The price of gold, copper and copper sulfate found on our properties may also have a significant influence on the market price of our Common Stock and the value of our properties. Our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before the first revenue from production would be received. A decrease in the price of gold or any other precious metal we estimate to find in a mine may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower prices.

The price of gold, copper and copper sulfate is affected by numerous factors beyond our control, including inflation, fluctuation of the United States dollar and foreign currencies, global and regional demand, the sale of gold by central banks, and the political and economic conditions of major producing countries throughout the world. For example, according to the World Gold Council (http://www.gold.org/investments/statistics/prices/), the average annual market price of gold since 2005 has fluctuated between approximately $400 per ounce and $1,400 per ounce, based on the daily London P.M. fix. As of January 4, 2011, the price of gold had risen to $1,405.50 per ounce, based on the daily London PM fix (http://66.38.218.33/gold.londonfix.html). The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. In the event prices for gold, copper or copper sulfate decline or remain low for prolonged periods of time, we might be unable to develop our properties, which may adversely affect our results of operations, financial performance and cash flows.

We currently do not enter into forward sales, commodity, derivatives or hedging arrangements and as a result we are exposed to the impact of any significant decrease in prices which could have a material adverse effect on our ability to generate revenue.

We will sell the gold and other precious metals we are producing at the prevailing market price. Currently, we do not enter into forward sales, commodity, derivative or hedging arrangements to establish a price in advance for the sale of future gold production, although we may do so in the future. As a result, we may realize the benefit of any short-term increase in the price, but we are not protected against decreases in the price, and if the price decreases significantly, our revenues may be materially adversely affected.

22

Our operations are subject to permitting requirements which could require us to delay, suspend or terminate our operations.