Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Cybergy Holdings, Inc. | exhibit32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Cybergy Holdings, Inc. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Mark One)

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________

Commission file number ______________

MOUNT KNOWLEDGE

HOLDINGS, INC.

(formerly Auror Capital Corp.)

(Exact name of registrant as specified in its charter)

| Nevada | 98-0371433 |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) | |

| 39555 Orchard Hill Place, Suite 600 PMB 6096 | |

| Novi, Michigan, USA | 48375 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code

248.893.4538

Securities registered under Section 12(b) of

the Act:

| None | N/A |

| Title of each class | Name of each exchange on which registered |

Securities registered under Section 12(g) of the Act:

Common Stock, $0.0001 par value

(Title of

class)

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes [

] No [X]

Indicate by checkmark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | (Do not check if a smaller | Accelerated filer [ ] |

| Non-accelerated filer [ ] | reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [

] No [ X

]

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 97,800,226 shares of common stock as of February 11, 2011.

Revenues for year ended December 31, 2010: $ 0

Aggregate market value of the voting common stock held by non-affiliates of the registrant as of April 14, 2011, was: $8,757,648

Documents Incorporated by Reference: None.

EXPLANATORY NOTE

This Form 10-K/A (“Amendment”) amends the Registrant’s Annual Report on Form 10-K for the year ended October 31, 2010, filed with the Securities and Exchange Commission on February 14, 2011 (“Annual Report”). The purpose of this Amendment is to amend the following items in the Annual Report:

| (i) | to reflect the change in our fiscal year end from October 31 to December 31, as previously announced in our Current Report on Form 8-K filed with the Commission on January 7, 2011; |

| (ii) | to give effect to our acquisition on December 31, 2010 of Language Key Asia Limited previously announced in our Current Report on Form 8-K filed with the Commission on January 6, 2011 and Mount Knowledge USA, Inc. as previously announced in our Current Report on Form 8-K filed with the Commission on January 7, 2011, respectively, whereby we succeeded to substantially all of the business operations of both Language Key Asia Limited and Mount Knowledge USA, Inc. |

As reported in this Amendment, the Company disclosures and related financial information for our new fiscal year ended December 31, 2010, include the business operations of Language Key Asia Limited, as predecessor, as audited for the period from January 1, 2009 to December 30, 2010, in the case of the combined successor entity.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the certifications required pursuant to the rules promulgated under the Exchange Act, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, which were included as exhibits to the Original Report, have been amended, restated and re-executed as of the date of this Amendment No. 1 and are included as Exhibits 31.1, 31.2, 32.1 and 32.2 hereto.

MOUNT KNOWLEDGE HOLDINGS, INC.

FORM 10-K

For the Year Ended December 31, 2010

TABLE OF CONTENTS

| PART I | PAGE NO. | |

| ITEM 1. | DESCRIPTION OF BUSINESS. | 2 |

| ITEM 1A. | RISK FACTORS. | 11 |

| ITEM 2. | PROPERTIES. | 12 |

| ITEM 3. | LEGAL PROCEEDINGS. | 12 |

| ITEM 4. | RESERVED. | 12 |

| PART II | ||

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. | 13 |

| ITEM 6. | SELECTED FINANCIAL DATA. | 14 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. | 14 |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. | F-1 |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. | 23 |

| ITEM 9A. | CONTROLS AND PROCEDURES. | 23 |

| ITEM 9B. | OTHER INFORMATION. | 24 |

| PART III | ||

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. | 24 |

| ITEM 11. | EXECUTIVE COMPENSATION. | 27 |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. | 29 |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. | 31 |

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. | 36 |

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES. | 37 |

| SIGNATURES | 39 |

Forward-Looking Statements

This Annual Report on Form 10-K may contain statements which constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Generally, words such as “may,” “will,” “should,” “could,” “would,” “anticipate,” “expect,” “anticipate,” “believe,” “goal,” “plan,” “intend,” “estimate” “continue” or the negative of or other variation on these and similar other expressions and variations thereof, if used, are intended to specifically identify forward-looking statements. Those statements appear in a number of places in this Form 10-K and in other places, and include statements regarding the intent, belief or current expectations of the Company, its directors or its officers with respect to, among other things, our future performance and operating results, our future operating plans, our liquidity and capital resources and our legal proceedings. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking statements are based on current expectations and involve risks and uncertainties and our future results could differ significantly from those expressed or implied by our forward-looking statements. Many factors could cause our actual consolidated results to differ materially from those expressed in any of our forward-looking statements.

1

PART I

ITEM 1. BUSINESS

Organizational History

Mount Knowledge Holdings, Inc. (“we,” “us,” “our” or the “Company”) was incorporated as Auror Capital Corp. under the laws of the State of Nevada on March 16, 2006. We are a global provider of learning products and training solutions with a focus on corporate training, language learning and technology development. We have offices in 7 major cities in the United States, Canada, Hong Kong and Mainland China.

We began our operations as an exploration stage company engaged in the acquisition and exploration of mineral properties. On January 23, 2009, our former management decided to abandon the Company’s Katrina mineral claim due to unsuccessful explorations to date and inability to attract investment capital to proceed with further exploration on the claim. We then began seeking other opportunities with established entities for the merger or other combination of a target business with the Company.

On July 27, 2009, we changed our business purpose to focus on becoming an educational software development and sales company. In furtherance of our new approach, we entered into an exclusive License Agreement with Mount Knowledge, Inc. (“MtK”), a corporation formed by the Chairman of our Board of Directors, Erwin Sniedzins, pursuant to which we obtained the exclusive worldwide licensing rights to promote, market and sell MtK’s products. At that time, MtK’s products included the “Syntality Knowledge Generator” and “Complete English Real Time Intelligent Self Learning Systems.” This License Agreement was subsequently superseded by an exclusive Master Software License Agreement dated January 21, 2010 (the “Master Software License Agreement”). The Master Software License was subsequently cancelled on December 27, 2010. See the discussion below under “Arrangements with UCandu Learning Centres Inc. – Purchase of Intellectual Property.”

Recent Developments

Arrangements with UCandu Learning Centres Inc.

On December 28, 2010, the Company entered into an Intellectual Property Purchase Agreement (the “IP Purchase Agreement”) with Erwin Sniedzins, the Chairman of the Company’s Board of Directors, and Ucandu Learning Centres Inc., an Ontario corporation founded and controlled by Mr. Sniedzins (“Ucandu” and, together with Mr. Sniedzins, the “Ucandu Sellers”), pursuant to which the Ucandu Sellers sold that certain software commonly referred to between the parties as the “Real-Time Self Learning Systems” (the “Software”), including all copyrights, patents, trademarks, service marks and trade secrets therein (collectively, with the Software, the “Intellectual Property”) to the Company. The Company previously licensed the Intellectual Property from MtK pursuant to the Master Software License Agreement. Pursuant to the IP Purchase Agreement, the Company acquired the Intellectual Property and as a result, the Master Software License Agreement was no longer needed.

On December 28, 2010, the Company entered into an Independent Contractor Agreement (the “Independent Contractor Agreement”) with Ucandu pursuant to which the Company engaged Ucandu to provide sales and marketing and technology services to the Company. As compensation for such services, the Company shall pay Ucandu an aggregate of $432,000 in equal monthly payments of $12,000 per month on the first business day of each month, which such payments commenced on January 3, 2011. The term of the Independent Contractor Agreement commenced upon execution of the agreement and shall continue in full force and effect through December 31, 2013. The agreement may only be extended thereafter by mutual agreement of the parties. The Company may terminate the agreement at any time upon 30 days written notice. The Company may terminate the agreement, effective immediately; with “Cause” as such term is defined in the agreement. If the Company terminates the agreement without cause on or before December 31, 2011, Ucandu will continue to receive monthly payments of $12,000 for the period of time between the date on which the agreement was terminated and December 31, 2011 and for the eight months thereafter.

2

If the Company terminates the agreement without cause after December 31, 2011, Ucandu will continue to receive monthly payments of $12,000 for the period of time that is the lesser of (i) eight (8) months after the termination date or (ii) the period of time between the termination date and the end of the term of the agreement.

On December 28, 2010, the Company entered into an Option Agreement (the “Option Agreement”) with Ucandu pursuant to which Ucandu granted to the Company an option (the “Option”) to purchase 510,000 shares of common stock of Mount Knowledge Technologies, Inc., an Ontario corporation (f/k/a 1827281 Ontario Inc.) (“MTK Tech”), from Ucandu. MTK Tech was formed on June 18, 2010 and is jointly owned by Ucandu, which currently holds 51% of MTK Tech’s common stock, and the Company, which currently holds the remaining 49% of the MTK Tech common stock. The shares of MTK Tech’s common stock underlying the Option represent all of the shares of MTK Tech’s common stock held by Ucandu as of December 28, 2010.

Acquisition of Language Key Asia, Ltd.

On December 31, 2010, the Company, through our wholly-owned subsidiary, Mount Knowledge Asia, Ltd. (“MTK Asia”) completed the acquisition of 100% of the ordinary shares of Language Key Asia, Ltd. (“LK Asia”) in exchange for an aggregate of 1,800,000 shares of the Company's common stock. As a group, LK Asia and its subsidiaries are engaged in the business of providing English and communication skills training consultancy with offices in Hong Kong, Shanghai, Beijing, Guangzhou and Shenzhen.

Also, in connection with the closing of the Acquisition, the Company and MTK Asia entered into a Subscription Agreement with LK Asia for the purchase by the Company or MTK Asia of 10,000,000 shares of ordinary B stock of LK Asia for an aggregate purchase price of $1,000,000 (the “Purchase Price”). Such shares were delivered at the closing and the Purchase Price is payable as follows:

-

A payment in the amount of $75,000 is due and payable on or before December 31, 2010;

-

A payment in the amount of $75,000 on or before January 15, 2011;

-

A payment in the amount of $200,000 on or before February 15, 2011;

-

A payment in the amount of $125,000 on or before March 15, 2011; and

-

Seven (7) equal payments of $75,000 payable on first day of each month beginning on or before April 15, 2011.

If the Company defaults on a payment, and fails to cure such default within sixty (60) days from the date of such default, LK Asia is entitled to liquidated damages in the amount of $500 per day for each and every day the Company is in default after the sixtieth (60th) day until such default has been cured. If the default is not cured within ninety (90) days from the date of default, then the Company shall forfeit the right to vote the shares subscribed for and received until the default has been cured. If the default is not cured, along with any other outstanding amounts owed to LK Asia, on or before the date in which the final payment is due and payable then LK Asia shall have the right to rescind the subscription and any and all shares of ordinary B stock received by the Company or MTK Asia, as the case may be, shall be cancelled.

In addition, LK Asia and Language Key Training Ltd., a British Virgin Islands Corporation (“LK BVI”), a former shareholder of LK Asia and a company owned and controlled by Mark Wood and Chris Durcan, entered into a licensing agreement pursuant to which LK Asia granted to LK BVI the right to use, rework and/or publish certain existing training content developed prior to December 31, 2010 owned and held by LK Asia for a term of 88 years.

Acquisition of Majority Interest in Mount Knowledge USA, Inc.

On December 31, 2010, the Company acquired 11,166,690 shares (the “MTK Common Shares”) of common stock and 8,888,888 shares of preferred stock of Mount Knowledge USA, Inc. (“MTK USA”) in exchange for 11,166,690 shares of the Company’s common stock and 8,888,888 shares of the Company’s Series A Convertible Preferred Stock. MTK USA markets, sells and distributes a proprietary real time self learning system software application domestically and internationally to a variety of customers, including individuals, schools, government agencies, and businesses. The Company owns approximately 54% of the outstanding shares of MTK USA’s common stock and all of MTK USA’s Series A Preferred Stock.

3

Company Overview

The Company is a global provider of innovative and proprietary learning products and training solutions. As an educational platform company of corporate training, language learning and technology development companies, the Company currently has offices in 7 major cities in the US, Canada, Hong Kong and Mainland China.

The Company has developed a suite of market specific “real-time self learning” software applications for both corporate and consumer markets worldwide

The Company’s technology stems from an interactive and visual learning system referred to as Syntality™ integrated into a core application known as the “Knowledge Generator™”.

The Company’s software learning tools and teaching methodologies are currently being offered in China to the more than 300 million students, from grade school to university, seeking to learn English, including the vast number of people in the Chinese workplace increasing their English fluency to achieve greater income earning potential.

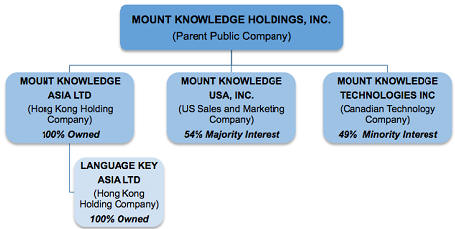

Corporate Structure

The Company is a platform company that exists for purpose of acquiring and operating market-leading global educational corporate training, language learning and technology development companies. The following sets forth our corporate structure.

4

On October 19, 2010, the Company formed MTK Asia for the purposes of facilitating the acquisition of LK Asia and to acquire other business-to-business (B2B) and business-to-consumer (B2C) business interests throughout Asia.

On December 16, 2010, the Company acquired 49% of the ownership interest in MTK Tech formed on June 16, 2010 as a technology development company to oversee new technological advancements of the Company’s Intellectual Property acquired on December 29, 2010. Ucandu owns the remaining 51% of MTK Tech. The ownership structure of MTK Tech enables it to seek small business development incentive programs and other private and public research initiatives available in Canada to corporations owned by Canadian residents.

On December 31, 2010, the Company acquired approximately 54% ownership interest in MTKUSA. During the period from September 2009 to the present, MTKUSA has supported the initial sales efforts in the US, Canada and China, including software development provided by MTKTECH.

On December 31, 2010, the Company acquired, via MT Asia, 100% ownership of LK Asia. LK Asia currently owns and operates several corporate training subsidiaries in Hong Kong and Mainland China and a content provider in Hong Kong.

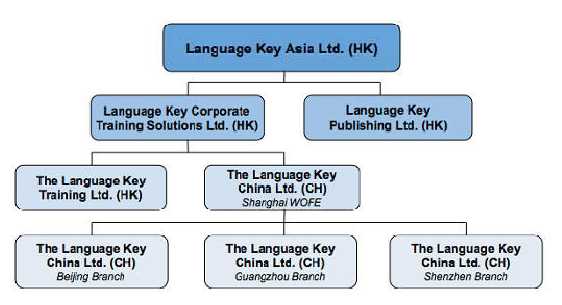

Established in 1994 and headquartered in Hong Kong, LK Asia is a provider of corporate training solutions in Asia through its operational subsidiaries consisting of Language Key Publishing Ltd (Hong Kong) and Language Key Corporate Training Solutions Ltd. (Hong Kong), which owns and operates The Language Key Training Ltd (Hong Kong) and The Language Key China Ltd (China), (collectively, "The Language Key").

Language Key provides custom-tailored business English and communications skills courses, soft skills workshops, executive coaching and other related services to public and private sector clients, including government entities in Hong Kong and Mainland China and Fortune 500 corporations.

As of the date of this filing, Language Key employs approximately 52 full-time employees, as well as 38 part-time trainers in Hong Kong, Shanghai, Beijing, and Guangzhou, China.

The following chart sets forth the structure of Language Key:

5

Vision and Mission

The vision of the Company is to develop learning platforms, which will accelerate the transfer of “information into knowledge”.

Market Overview

The Company’s English language learning market opportunities can be divided into two separate markets:

-

Business-to-Business (B2B) or English Language Training (ELT) - corporate training departments, government agencies, schools and other learning institutions.

-

Business-to-Consumer (B2C) or English as a Second Language (ESL) - general market consumers - teachers, parents, students, etc.

The Company’s primary goal is to target the 1.3 billion Chinese population followed by other countries with a significant population seeking to learn the English language..

We believe that both markets offer significant opportunities:

-

Global learning software market growing at a 15% to 30% year-over-year*

-

Expected to exceed $52.6 billion by year end 2010*

-

Asian market expected to reach CAGR of 25% to 30% through 2010*

-

China’s English language learning industry is estimated at $5.6B in 2010 with potential significant growth over the coming decade*

* Source:China Education Yearbook, Deutsche Bank Research 2010

Product Summary

The Company’s product line currently consists of the products discussed below which are intended for sale to both consumer and business markets.

- Knowledge Generator ™ is a software product (“KG”) that delivers a real-time learning system that easily converts information to knowledge. Data from any source can be quickly imported into KG and converted into meaningful interactive exercises and lessons that involve the critical senses of the user. KG’s English Language Learning module specifically targets the ESL (English as a Second Language) and ELT (English Language Training) markets in China [trademark registered with the Canadian Intellectual Property Office].

6

-

Examatar ™ is closely related to the Knowledge Generator™ and has been engineered to accelerate the learning process of teaching English to Chinese students by focusing on the creation of unlimited quizzes and tests on any imported information, to aid students in passing TOEFL (Test of English as a Foreign Language) exams required in academic venues, as well as TOEIC (Test of English for International Communication) exams for corporate environments [trademark registered with the Canadian Intellectual Property Office].

-

ECO Learning is a Virtual Learning Environment (VLE) dedicated to English communication for the Business-to-Business and Business to Consumer market space (launched in February 2011).

Product Description and Features

Knowledge Generator ™ and Examatar ™

Knowledge Generator™ and Examatar ™ were developed with various software user-interface enablers and interactive tools to promote the utilization of the user’s senses during the learning process; to see (visualize), listen, compose, speak, reply and interact and react to information by keyboard touch, sound and voice.

Knowledge Generator™ and Examatar ™ address learning needs of students from preschool to college and throughout their adult continued education learning cycle. KG assists students learning needs from one phonetic sound to complete pronunciation of phrases, from learning one word to understanding and writing complete sentences, from listening to speaking and comprehension, etc.

Users can import, in various formats (i.e. word document, RTF, Internet documents, etc.), virtually textual content or subject they want to learn and the Knowledge Generator™ software application tools will automatically create interactive subject based learning or skills training lessons, tests and subsequently, scores.

The Company’s product line consists of a proprietary core technology that allows for textual information to be converted into a multi-purpose learning experience with automatically generated interactive lessons, exercises, tests and scores. The software application has more than 240 interactive enabling learning tools that allow users to transform “information into knowledge” quickly, providing an interactive and dynamic alternative to traditional passive (rote) learning methods.

ECO Learning

ECO Learning is a Virtual Learning Environment (VLE) dedicated to English communication for the Business-to-Business (B2B) or corporate market space. ECO Learning is a low-cost mass-market English solution that aligns the English training initiatives of a foreign corporate client by offering the following:

-

Giving administrators both flexibility and control - Know who is studying, what they are studying, and how well they are doing. With the ECO Learning Management System, corporate client’s administrator can manage content and users, track usage, progress, completion, and results all in real-time.

-

Giving users more for less - ECO users benefit from an unlimited flow of learning material, which they can study anytime, anywhere. New content is added every month and we listen to what our users need through in-built feedback features.

-

Giving users what they need - ECO Learning offers popular modular-based courses, which run for 8 or 16 weeks as well as an extensive library of 30-minute ‘bite-size’ lessons. All content is time-sensitive, has clearly defined objectives, measurable outcomes, and is graded using the ALTE framework. Users can develop their skills in the following areas:

| • | General English | • | English for Specific Purposes | |

| • | Business English | • | Soft Skills | |

| • | Practical English | • | Communication Skills |

7

With the ECO Learning Level Check Test, users can gauge their English proficiency anytime. The test provides an approximate ALTE grade and helps users define their personal learning objectives though a selection process. ECO Learning then recommends lessons and courses that are relevant and appropriate to the users’ proficiency and needs. The Personal Learning Path can be studied alongside all other content on the platform giving users complete autonomy over their personal development.

-

Giving users more control - ECO Learning empowers users to control their learning. They can pause their lessons and courses and resume at a later date. ECO Learning stores all progress and results in real-time. User can manage their account, enroll, rate and comment on content, build personal vocabulary lists, chat with other users, and check their learning progress and results on demand.

-

Offering high levels of user engagement - ECO Learning is built with technology that engages learners longer. ECO users can navigate the 3D Virtual Learning Environment, interact with animated menus, be guided by 3D avatars, and be stimulated by professional audio and video lessons. Activities are varied and interactive, ensuring users remain focused and motivated, and completion rates remain high.

-

Offering various levels of accessibility - ECO Learning can be:

| 1. | Accessed online - www.ecolearning.com | |

| 2. | Deployed on a corporate intranet as a web application. | |

| 3. | Integrated into SCORM compliant Learning Management Systems. |

Growth Strategy

We believe the Company is well positioned to become the standard for accelerated learning products and training services. The Company has a four-part strategy for growth:

-

Accelerated Acquisition Strategy – acquiring approximately one or more acquisition target entities before year-end 2011, subject to market conditions, suitable acquisition targets, and available financing. The Company will first target the vast English learning China market and other Asian territories in 2011, with a long-term vision of expanding into other world markets in 2012.

-

Learning Centers and Schools - providing co-marketing and partnership licensing of language learning products and services to existing learning centers and schools in China and throughout Asia offering students the latest in interactive learning technology to create an exceptional educational experience and value to each student.

-

English Language Learning / Training - providing language learning and training services to major corporations, schools and government offices with a blended approach of on-site training and the use of Mount Knowledge software to provide online tools and custom content development in a licensing revenue model (B2B and B2C).

-

Web-based Applications - providing browser-based and mobile software applications to allow online connectivity (ECO Learning) and learning tools to foster interaction among users (online community).

Sales and Marketing Overview

The Company’s sales and marketing strategy combines direct sales and service-based sales techniques.

In certain markets, one-on-one training and product sales in corporately owned or partnered learning centers or schools in conjunction with a monthly residual “web-based” business model and/or a direct internet sales and marketing approach may be the most cost-effective and efficient method.

8

In addition, we expect that marketing channel alliances will play a significant role in our Company’s sales strategy, capitalizing on existing marketing and distribution channels. However, our Company’s long-term strategy is to maximize all sales and marketing channels available, including corporate and direct consumer alliances and co-marketing channels.

Revenues

The Company anticipates generating revenues from the marketing and sale of the Company’s learning products and services. Management foresees the primary source of our revenues in 2011 to come primarily from the sale of its products and services in US, Canada, China and Hong Kong.

Milestones

Our milestones and objectives over the next 12 months are significantly dependent on various factors which the Company may or may not be in control of, including, but not limited to: (a) obtaining adequate financing to sustain and expand our operations; (b) ability to identify suitable acquisition targets; (c) acquiring synergistic business operations to accelerate revenue growth; (d) ability to develop new partnerships and distribution channels in China; (e) launching new marketing and sales strategies; (f) completing market-specific product enhancements; (g) creating new B2B applications, (h) generating adequate cash flow from the sales of the Company’s products and services to sustain its operations.

Our plan of operations for the next twelve months is to complete the objectives described under the heading “Management’s Discussion and Analysis or Plan of Operations”.

Capital & Uses of Proceeds

Capital Needs

To implement our plan of operations, we will need to continue to raise capital in an amount between $2.5 to $5.0 million in equity from restricted stock sales or other acceptable financing vehicles over the 6 month period beginning in the first quarter of 2011 on terms and conditions to be determined. Management may also elect to seek subsequent interim or “bridge” financing in the form of debt as may be necessary.

We anticipate the need to raise additional capital beyond the first 6 months of operations, subject to the successful implementation of our initial milestones over the first 180 days of operations and our revenue growth cycle thereafter. At this time, management is unable to determine the specific amounts and terms of such future financings.

Proceeds

We foresee the proceeds from capital raised to be allocated as follows: (a) consolidation and integration; (b) growth capital; (c) acquisition research and due diligence; (d) business enterprise applications; (e) product enhancements, membership programs and technology partners; (f) new business development and marketing; (g) legal, audit, SEC filings and compliance fees; (h) financing costs; (i) working capital (general and administrative); (j) reserve capital for costs of acquisition and market expansion.

Competition

Competition Overview

The Company conducts its business in an environment that is highly competitive and unpredictable. The Company has identified at least 20 other companies and/or products that compete directly in the same educational/learning market. Its competition may have considerable financial resources at their disposal, which could facilitate their access to the market under more favorable terms than the Company and could allow them faster market penetration.

9

Each of our competitors has existing marketing campaigns, fully developed products and an established customer base, to varying respective degrees.

Competitive Analysis

The following table outlines some of the competition to the Knowledge Generator ™ product line presently in the market*:

| COMPANIES | COMMENTS |

| ETS (English Testing System) | TOEFL test generators |

| New Oriental | TOEFL prep in China |

| KAPLAN | TOEFL prep, SAT, LMAT |

| PRINCETON | Franchises, Web, Books |

| SYLVAN LEARNING CTRE | After school tutoring |

| HOME SCHOOLING | 1.1 Million Home Schooling |

| ROSETTA STONE | Languages – 6 M + users |

| KURZWEIL | Spec Ed |

| INSPIRATION | 25 M users |

| PREDICTION | Writing |

| AUTOSKILLS | 625,000 Users |

| WHITESMOKE | Writing |

| VOCABSTER | Spelling Bee & Vocabulary |

| RIVERDEEP | Bought Houghton $5B |

| Tell Me More Premium | ESL |

| AURORA SYSTEMS | Writing & Speech |

| EVELYN WOOD | Speed Reading |

* The chart above represent comparisons of other companies offering a similar product or services to that of the Company during 2010 and may not be an accurate depiction of their products and services offerings for 2011.

Employees

Currently, we have approximately 64 full-time employees in the Company, including employees in US, Canada, China and Hong Kong.

Intellectual Property

The Company own certain Intellectual Property consisting of software commonly referred to between the parties as the “Real-Time Self Learning Systems” (the “Software”), including all copyrights, patents, trademarks, service marks and trade secrets therein (collectively, with the Software, the “Intellectual Property”) to the Company, it acquired on December 28, 2011 from Erwin Sniedzins, the Chairman of the Company’s Board of Directors, and Ucandu Learning Centres Inc., an Ontario corporation founded and controlled by Mr. Sniedzins.

The Company previously licensed the Intellectual Property from Mount Knowledge Inc., a sales and marketing entity founded and controlled by Mr. Sniedzins (“MTK Inc”), pursuant to a Master Software License Agreement (the “Original Agreement”) dated January 21, 2010 between the Company and MTK Inc. Pursuant to the IP Purchase Agreement, the Company acquired the Intellectual Property and as a result, the Original Agreement was no longer needed.

The purchase price (the “Purchase Price”) for the Intellectual Property is payable in two installments. The amount of the first installment is based upon a post-closing appraisal of the value of the Intellectual Property as of December 28, 2010. Specifically, within six (6) months after December 28, 2001, the Company shall select, in its sole discretion, an independent appraiser or auditor to conduct an evaluation and appraisal of the book value of the Intellectual Property as of December 28, 2010 (the “Closing Date Appraised Value”).

10

The amount of the first installment (the “First Payment Amount”), which is due on the first anniversary of December 28, 2010 (the “First Anniversary Date”), shall be determined as follows:

| (i) | in the event that the Closing Date Appraised Value is equal to or greater than $2,047,339.20 (the “Target Value”), the First Payment Amount shall be an amount equal to $1,023,669.60; | |

| (ii) | in the event that the Closing Date Appraised Value is less than the Target Value but greater than $1,000,000 (the “Threshold Value”), the First Payment Amount shall be equal to the Closing Date Appraised Value less the Threshold Value; and | |

| (iii) | in the event that the Closing Date Appraised Value is less than the Threshold Value, the First Payment Amount shall be equal to zero. |

In lieu of a cash payment, the Company may elect to pay all or part of the First Payment Amount in shares of its common stock based on a price per share equal to the closing bid price of the Company’s common stock on the trading date that immediately precedes the First Anniversary Date. The second installment is payable on the second anniversary of December 28, 2010 by delivery of 2,500,000 shares of the Company’s common stock to the Sellers.

In the event of an “Acceleration Event,” as defined in the IP Purchase Agreement, the then-outstanding portion of the Purchase Price, if any, through the date of such event, shall become, at the Sellers’ election in writing to the Company, immediately due and payable. The IP Purchase Agreement contains customary warranties and representations and indemnification and confidentiality provisions and provides that the Sellers are subject to noncompetition and noninterference covenants.

Patents, Trademarks, and Copyrights

The Company is dependent on the ability to maintain protection of current and future intellectual property, patents, trademarks, and/or copyrights owned by the Company.

Our current intellectual property includes the “Real Time Learning and Self Improvement Educational System and Method™, also referred to as the Real-Time Self Learning Systems™” learning and training method as set forth in the U.S. Provisional Patent Application No. 60/807,028, initially filed on or about July 11, 2006 in the name of Erwin E. Sniedzins, with an updated Utility Patent Application executed on or about June 27, 2007 as set forth Utility Patent Application Transmittal filed on or about July 5, 2007 as set forth in the United States Patent and Trademark Office confirmation receipt dated July 25, 2007, including but not limited to, any and all related computer code, including any and all software products and services derived from said learning and training method and related computer code (e.g. Knowledge Generator™, Examatar™, and Syntality™ learning products and services – trademarks filed with the Canadian Intellectual Property Office), existing now or in the future, along with all trademarks, trade names (e.g. Mount Knowledge, Knowledge Generator™, KG™, Examatar™, Syntality™), technology know-how, marketing materials, owned jointly and severally by Ucandu, corporately and/or Erwin Sniedzins, personally and individually and/or assigned to or used by MTK.

The Company does not require it to obtain any patents for the products developed and owned by Company in order for it to market and sell the products as contemplated, nor does it anticipate any adversity in its ability to generate revenues if such patents are not obtained in the future. However, the approval of one or more patents of the products developed and owned by Company may increase its competitive advantage in the marketplace in terms of proprietary features, functions, and overall value proposition to the customers we intend to serve.

ITEM 1A. RISK FACTORS

Smaller reporting companies are not required to provide the information required by this item.

11

ITEM 2. PROPERTIES.

Executive Offices

The Company’s executive office is located at 39555 Orchard Hill Place, Suite 600, Novi, Michigan 48375, including an offsite office location for the Company’s books and records. However, management anticipates the need for the Company to move their executive offices within the next (12) months to accommodate additional staff members. The increased costs of such new executive offices are currently unknown. We do not own any real property.

Our Asian regional headquarters is located at 10/F, China Merchants Commercial Building, 15-16 Connaught Road West, Sheung Wan, Hong Kong. In addition, the Company has a technology research and development (Mount Knowledge Technologies Inc.) office at 150 Consumers Road, Suite 202, Toronto, Canada M2J 1P9, including shared space for the Company’s sales and marketing support operations in US, Canada and China.

ITEM 3. LEGAL PROCEEDINGS.

We know of no material, active or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. RESERVED.

12

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market for Securities

Our common shares are quoted on the Over-The-Counter Bulletin Board under the trading symbol “MKHD.OB”. Our shares have been quoted on the Over-The-Counter Bulletin Board since October 3, 2007. We began to trade our shares of common stock on May 25, 2010 with an open share price of $.50. For the periods ending July 31, 2010, October 31, 2010, December 31, 2010, we had a per share price high of $.25 and a low of $.20, high $.17 and a low of $.15, and high of $.25 and a low of $.20, respectively,

Our transfer agent is Island Stock Transfer, of 100 2nd Avenue, S, Suite 104N, St. Petersburg, FL 33701; telephone number 727.289.0010; facsimile: 727.289.0069.

Holders of our Common Stock

As of April 8, 2011, there were 50 registered stockholders holding 100,287,123 shares of our issued and outstanding common stock after (a) the previously issued and outstanding balance of 100,080,220 on December 31, 2010, (b) the issuance of 11,166,690 shares of restricted stock to a related party for the purchase of 54.34% controlling ownership interest in Mount Knowledge USA, Inc. on January 10, 2011, (c) the issuance of 206,897 shares of restricted stock for services rendered by a contractor to the Company on February 15, 2011, (d) the issuance of 1,800,000 shares of restricted stock to certain non-related parties for the purchase of 100% ownership interest of Language Key Asia Ltd and its subsidiaries, and (e) the issuance of 480,000 shares of restricted stock to certain employees of Language Key Asia Ltd and its subsidiaries.

Dividend Policy

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| 1. | We would not be able to pay our debts as they become due in the usual course of business; or | |

| 2. | Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Recent Sales of Unregistered Securities

Reference is made to the Company’s Current Reports on Form 8-K dated (i) January 20, 2010, as filed with the SEC on January 27, 2010 and (ii) December 31, 2010, as filed with the SEC on January 7, 2011, as amended by Amendment No. 1 to Current Report on Form 8-K/A, as filed with the SEC on March 25, 2011 for information regarding unregistered sales of equity securities and use of proceeds by the Company during and subsequent to the fiscal year ended December 31, 2010. In addition please note the following issuances:

On August 16, 2010, we issued 1,100,000 shares of restricted stock for services rendered by a contractor to the Company. The issuance of the above referenced shares was completed pursuant to an exemption from registration at Section 4(2) of the Securities Act of 1933.

13

On February 15, 2011, we issued 206,897 shares of restricted stock (113,794 shares to Ed Cabrera and 93,103 to Aegis Capital Corp.) for services rendered by a contractor to the Company. The issuance of the above referenced shares was completed pursuant to an exemption from registration at Section 4(2) of the Securities Act of 1933.

On April 8, 2011, we issued 2,280,000 shares of restricted common stock restricted stock for the purchase of 100% ownership interest of Language Key Asia Ltd and its subsidiaries (1,800,000 shares to the original owners and 480,000 shares to employees of Language Key Asia Ltd and its subsidiaries). The issuance of the above referenced shares was completed pursuant to an exemption from registration at Section 4(2) of the Securities Act of 1933.

Securities Authorized for Issuance Under Equity Compensation Plans

We do not have any equity compensation plans.

ITEM 6. SELECTED FINANCIAL DATA.

Not required for smaller reporting companies.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

The following discussion should be read in conjunction with our audited financial statements and the related notes that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this annual report. Our audited consolidated financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

Company Overview

The Company is a global provider of innovative and proprietary learning products and training solutions. As a holding company of educational corporate training, language learning and technology development companies, the Company currently has offices in 7 major cities in the US, Canada, Hong Kong and Mainland China.

The Company was established for purpose of acquiring and operating market-leading global educational corporate training, language learning and technology development companies.

The Company has developed a suite of market specific “real-time self learning” software applications for both corporate and consumer markets worldwide. The Company’s technology stems from an interactive and visual learning system referred to as Syntality™ integrated into a core application known as the “Knowledge Generator™”.

For more details on the Company and its operations, please refer to “Organization Since Incorporation” and “Company Overview” sections in Item 1. Business section, hereinabove in this filing.

Plan of Operations

Over the 12-month of 2011, we must raise capital and complete certain milestones as described below:

Milestones

The Company anticipates the completion of the following objectives over the next 12 months, beginning in the first quarter of 2011:

14

First 180 Days of Operations (Administrative).

In the first 180 days of operations, beginning in the first quarter of 2011, our primary focus will be to complete necessary administrative functions and consolidations from recent acquisitions, obtain new financing and acquire certain existing marketing and sales agreements in order to properly position the Company execute its business plan. These proposed objectives are as follows:

| 1. | Consolidation of Operations and Integration of Recent Acquisitions. On December 31, 2010, the Company acquired 100% ownership of Language Key Asia Ltd and its operational subsidiaries in Hong Kong and China. In addition, the Company acquired 54% ownership interest of Mount Knowledge USA, Inc. in the US. Lastly, the Company acquired 49% of Mount Knowledge Technologies Inc. in Canada. As a result of these recent transactions, the Company now has operations in Novi, Michigan, Toronto, Canada, Hong Kong, Beijing, Guangzhou, Shanghai and Shenzhen, China. Additionally, the audit financial statements for each acquisition are required to be filed in one or more amendments to the Current Report on Form 8-Ks filed for each acquisition no later than 71 days after the date on which the Current Report on Form 8-Ks were required to be filed. The preparation of the audited financials and the integration of the operation under the management structure of the Company are expected to take approximately 90 days at an estimated cost of $250,000. |

| 2. | Language Key Subscription Agreement (Growth Capital). In connection with the closing of Language Key Asia Ltd., the Company and Mount Knowledge Asia, Ltd., its wholly owned subsidiary, entered into a subscription agreement with Language Key Asia, Ltd. for the purchase by the Company (and/or MTK Asia) of 10,000,000 shares of ordinary B stock of LK Asia for an aggregate purchase price of $1,000,000. Such shares were delivered at the closing and the Purchase Price is payable as follows: |

A payment in the amount of $75,000 is due and payable on or before December 31, 2010;

A payment in the amount of $75,000 on or before January 15, 2011;

A payment in the amount of $200,000 on or before February 15, 2011;

A payment in the amount of $125,000 on or before March 15, 2011; and

| Seven (7) equal payments of $75,000 payable on first day of each month beginning on or before April 15, 2011 | |

| To date, total payments of $80,000 towards the total $1,000,000 commitment by the Company have been made. However, other advances totaling approximately $250,000 were made to one of the Language Key companies in the form of loans from October 1, 2010 and to the closing date, December 31, 2010. Management will re-allocate such loan payments and equity payments per the executed Subscription Agreement in the next financial quarter. | |

| The purpose of the $1,000,000 subscription by the Company was to provide Language Key Asia Ltd an amount of required equity capital (or growth capital) to execute on its accelerated growth strategy and expansion plan throughout the Asia territory over the next 12 months. | |

| 3. | Accelerated Acquisition Strategy. As of 2011, the Company’s management has implemented an accelerated acquisition strategy to acquire synergistic companies in the language learning and training business sector. The Company will first target the vast English learning China market and other Asian territories in 2011, with a long-term vision of expanding into other world markets in 2012. The estimated costs initially of research and due diligence of suitable acquisitions targets is $150,000. There can be no assurance that we will be able to successfully negotiate and consummation and such acquisition with any target that we identify. |

15

| 4. | Secondary Offering and/or Other Financings. We intend to raise between $2,500,000 and $5,000,000 within the next 6 months to finance our operations and acquisition strategy. Such offering may take the form of equity or debt. We make seek additional funding as deemed necessary by our management. There can be no assurance that such financing will be available to us on terms that are acceptable or at all. |

Next 180 days of Operations.

In the next 180 days of operations beginning the first quarter of 2011, we plan to expand our objectives to include new product enhancements, the development of new partnerships and distribution channels, and direct sales opportunities in the form of infomercials and online membership programs, including the option of bundling our product with potential technology partners to increase brand awareness and product reach as follows:

| 1. | Business Enterprise Applications (Corporations, Schools and Government Agencies). With the acquisition of Language Key, we foresee the use of the our products and services as a learning solution for schools, government agencies, healthcare facilities, and corporations to provide an enhanced, interactive learning program to facilitate new job skills training and continual education programs. Therefore, we intend to develop product-specific enhancements to our existing products and services for use in various business applications. It is likely that most of the product enhancements for business applications will be in the form of client-specific modifications based upon requests for customized specifications and functionality. As such, we anticipate that some of the costs for these modifications will be borne by each respective client. Therefore, it is difficult to accurately determine the upfront costs attributable to us for any research and development of business enterprise applications. |

| 2. | Product Enhancements, Membership Program and Technology Partners. Subject to the successful launch of our products and services in the US, Canada, China and Hong Kong, we plan to provide product enhancements consistent with perceived customer requirements for other world markets. Most of these enhancements are believed by management to be in the form of updated graphics, to enhance the fluidity of the user experience and interface, and some market-specific content. In addition, we foresee a web-based e-learning membership program with recurring monthly fee based revenues as being one of the more important and lucrative long-term revenue models for us. It is difficult to accurately estimate the total cost involved in the design and development of this program, including the time required to implement such a program. Furthermore, we will seek to identify and develop relationships with globally recognized technology providers and OEM’s to pursue the possibility of bundling the Mount Knowledge™ products and services with established product platforms, including mobile applications (PDA) to provide the Company with an ancillary revenue stream. We see this as a potentially significant opportunity to generate revenues, if the Company can successfully demonstrated the desirability of the Knowledge Generator™ product with its initial audience and market(s). |

| 3. | New Business Development and Marketing (Additional Partnerships and Distribution Channels). We will also pursue our business development and marketing efforts in other territories of Asian, including North American and European markets. We anticipate an initial budget of approximately $150,000 to seek new partnerships and distribution channels commencing sometime after the first 90 days of operations and continuing for a period of time thereafter as determined by us, subject to the availability of adequate financing and ongoing sales results. |

16

The milestones outlined above represent our objectives for the purpose of obtaining revenues from the marketing and sales of our products and services through various marketing and distribution channels.

Although, we have arranged and specified each respective milestone in a defined order, or timeline, over the next 12 months, beginning the first quarter of 2011, we may find the need to modify any or all of the milestones listed, subject to unforeseen circumstances and other contingences which may require us to alter, in whole, or in part, certain aspects of each respective milestone in order for us to successfully realize revenue and ultimately attempt to achieve profitability.

Each milestone many begin at a different time than indicated and may continue for a shorter or longer period of time than suggested, depending upon if such milestones have successfully resulted in generating revenues for us. Also, each milestone may require more or less capital than anticipated and may need to be adjusted from time to time. Furthermore, any adjustments made to the proposed milestones may adversely affect the revenue potential of each milestone and overall revenues and/or our profitability.

Requirements and Utilization of Funds

To implement our plan of operations, including some or all of the above described milestones (objectives), we will need to continue to raise capital in an amount between $2.5 and $5.0 million over the next 6 month period beginning in the first quarter of 2011 on terms and conditions to be determined. Management intends to raise such capital through the issuance of equity securities. Management may elect to seek subsequent interim or “bridge” financing in the form of debt (corporate loans) as may be necessary.

We anticipate the need to raise additional capital beyond the first 6 months of operations, subject to the successful implementation of our initial milestones over the first 180 days of operations and our revenue growth cycle thereafter. At this time, management is unable to determine the specific amounts and terms of such future financings.

We foresee the proceeds from capital raised to be allocated as follows: (a) consolidation and integration; (b) growth capital; (c) acquisition research and due diligence; (d) business enterprise applications; (e) product enhancements, membership programs and technology partners; (f) new business development and marketing; (g) legal, audit, SEC filings and compliance fees; (h) financing costs; (i) working capital (general and administrative); (j) reserve capital for costs of acquisition and market expansion.

Financial Condition, Liquidity and Capital Resources

As of December 31, 2010, we had $288,872 in the bank and $2,747 of prepaid expenses. We had revenues of $1,901,396 during the twelve-month period ended December 31, 2010. We are illiquid and need cash infusions from investors and/or current shareholders to support our proposed marketing and sales operations.

Management believes this amount may not satisfy our cash requirements for the next 12 months and as such we will need to either raise additional proceeds and/or our officers and/or directors will need to make additional financial commitments to our company, neither of which is guaranteed. We plan to satisfy our future cash requirements, primarily the working capital required to execute on our objectives, including marketing and sales of our product, and to offset legal and accounting fees, through financial commitments from future debt/equity financings, if and when possible.

Management believes that we may generate some sales revenue within the next twelve (12) months, but that these sales revenues will not satisfy our cash requirements during that period. We have no committed source for funds as of this date. No representation is made that any funds will be available when needed. In the event that funds cannot be raised when needed, we may not be able to carry out our business plan, may never achieve sales, and could fail to satisfy our future cash requirements as a result of these uncertainties.

If we are unsuccessful in raising the additional proceeds from officers and/or directors, we may then have to seek additional funds through debt financing, which would be extremely difficult for an early stage company to secure and may not be available to us. However, if such financing is available, we would likely have to pay additional costs associated with high-risk loans and be subject to above market interest rates.

17

At such time as these funds are required, management would evaluate the terms of such debt financing and determine whether the business could sustain operations and growth and manage the debt load. If we cannot raise additional proceeds via a private placement of our common stock or secure debt financing we would be required to cease business operations. As a result, investors in our common stock would lose all of their investment.

The staged development of our business will continue over the next 12 months. Other than engaging and/or retaining independent consultants to assist the Company in various administrative and marketing related needs, we do not anticipate a significant change in the number of our employees, if any, unless we are able to obtain adequate financing.

Our auditors have issued a “going concern” opinion. This means that there is substantial doubt that we can continue as an on-going business for the next 12 months unless we obtain additional capital to pay our expenses. This is because anticipated revenues during the next 12 months will not be enough to satisfy our cash requirements. Accordingly, we must raise cash from sources other than from the sale of our products.

Results of Operations

The following summary of our results of operations should be read in conjunction with our audited financial statements for the year ended December 31, 2010 which are included herein.

Our operating results for the years ended December 31, 2010 and 2009 are summarized as follows:

| SUCCESSOR | PREDECESSOR ENTITY | ||||||||

| ENTITY | |||||||||

| ONE DAY | PERIOD | YEAR | |||||||

| PERIOD ENDED | JANUARY 1, 2010 | ENDED | |||||||

| DECEMBER 31, | TO DECEMBER | DECEMBER | |||||||

| 2010 | 30, 2010 | 31, 2009 | |||||||

| Sales revenue | $ | - | $ | 1,901,396 | $ | 1,478,424 | |||

| Total operating expenses | - | 1,194,024 | 789,744 | ||||||

| Net Income (Loss) | $ | - | $ | (101,933 | ) | $ | 22,655 | ||

18

Revenues

Our revenue results for the years ended December 31, 2010 and 2009 are summarized as follows:

| SUCCESSOR | PREDECESSOR ENTITY | ||||||||

| ENTITY | |||||||||

| ONE DAY | PERIOD | ||||||||

| PERIOD | JANUARY | YEAR | |||||||

| ENDED | 1, 2010 TO | ENDED | |||||||

| DECEMBER | TO DECEMBER | DECEMBER | |||||||

| 31, 2010 | 30, 2010 | 31, 2009 | |||||||

| Sales revenue | $ | - | $ | 1,901,396 $ | 1,478,424 | ||||

| Cost of goods sold | - | 927,428 | 674,441 | ||||||

| Gross profit | - | 973,968 | 803,983 | ||||||

Expenses

Our expenses for the years ended December 31, 2010 and 2009 are outlined in the table below:

| SUCCESSOR | PREDECESSOR ENTITY | ||||||||

| ENTITY | |||||||||

| ONE DAY | PERIOD | ||||||||

| PERIOD | JANUARY | YEAR | |||||||

| ENDED | 1, 2010 TO | ENDED | |||||||

| DECEMBER | DECEMBER | DECEMBER | |||||||

| 31, 2010 | 30, 2010 | 31, 2009 | |||||||

| Selling expenses | - | 14,681 | - | ||||||

| General and administrative expenses | - | 1,179,343 | 789,744 | ||||||

| Total operating expenses | - | 1,194,024 | 789,744 | ||||||

General and Administrative

The increase in our general and administrative expenses for the year ended December 31, 2010 compared to December 31, 2009 was primarily due to: (i) an increase in general operating expenses for the reorganization of LKA, new product development, and sales and marketing efforts.

Professional Fees

Professional fees include our accounting and auditing expenses incurred in connection with the preparation and audit of our financial statements and professional fees that we pay to our legal counsel are included in the General and Administrative expenses. Our accounting and auditing expenses were incurred in connection with the preparation of our audited financial statements and unaudited interim financial statements and our preparation and filing of a registration statement with the SEC. Our legal expenses represent amounts paid to legal counsel in connection with our corporate organization. Legal expenses will be ongoing during fiscal 2011 as we are subject to the reporting obligations of the Securities Exchange Act of 1934.

19

Liquidity and Capital Resources

Working Capital

| Successor | Predecessor | ||||||||

| Company | Company | Percentage | |||||||

| December 31, | December 31, | Increase / | |||||||

| 2010 | 2009 | Decrease | |||||||

| Current Assets | $ | 780,907 | $ | 465,312 | 67.8% | ||||

| Current Liabilities | $ | 1,545,944 | $ | 386,626 | 299.9% | ||||

| Working Capital | $ | (765,037 | ) | $ | 78,686 | 1072.3% |

Cash Flows

| Successor | ||||||||||||

| Company | Predecessor Company | Percentage | ||||||||||

| One Day | Period from | |||||||||||

| Period | January 1, | Year | ||||||||||

| Ended | 2010 to | Ended | ||||||||||

| December | December | December | Increase / | |||||||||

| 31, 2010 | 30, 2010 | 31, 2009 | Decrease | |||||||||

| Cash Flows from Operating Activities | - | $ | (69,022 | ) | $ | 83,701 | 182.5% | |||||

| Cash Flows from Investing Activities | - | $ | (58,881 | ) | $ | (7,379 | ) | 698.0% | ||||

| Cash Flows from Financing Activities | - | $ | 155,286 | $ | 1,234 | 12484.0% | ||||||

| Net change in cash and cash equivalents | - | $ | 38,523 | $ | 87,611 | 56.0% | ||||||

We anticipate that we will incur approximately $250,000 for operating expenses, including professional, legal and accounting expenses associated with our reporting requirements under the Exchange Act during the next twelve months. Accordingly, we will need to obtain additional financing in order to complete our business plan.

Cash Used in Operating Activities

We used net cash in operating activities in the amount of $ (69,022) for the period from January 1, 2010 to December 30, 2010 and $ 83,701 during the year ended December 31, 2009. Cash used in operating activities was funded by cash from financing activities.

Cash Used in Investing Activities

We used net cash in investing activities in the amount of $ (58,881) for the period from January 1, 2010 to December 30, 2010 and $ (7,379) during the year ended December 31, 2009.

20

Cash Provided by Financing Activities

We generated $ 155,286 net cash from financing activities for the period from January 1, 2010 to December 30, 2010 compared to net cash from financing activities in the amount of $ 1,234 during the year ended December 31, 2009. Cash generated by financing activities during 2010 is attributable mainly to related party borrowings.

Disclosure of Outstanding Share Data

As of April 15, 2011, we had 100,287,123 shares of common stock issued and outstanding..

Going Concern

The financial statements accompanying this report have been prepared on a going concern basis, which implies that our company will continue to realize its assets and discharge its liabilities and commitments in the normal course of business. Our company has generated limited revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of our company as a going concern is dependent upon the continued financial support from our shareholders, the ability of our company to obtain necessary equity financing to achieve our operating objectives, and the attainment of profitable operations.

As of December 31, 2010, we had accumulated losses of $79,278 since January 1, 2009 and a working capital deficit of $765,037. We do not have sufficient working capital to enable us to carry out our stated plan of operation for the next twelve months. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should our company be unable to continue as a going concern.

Due to the uncertainty of our ability to meet our current operating expenses and the capital expenses noted above in their report on the financial statements for the year ended December 31, 2010, our independent auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors.

The continuation of our business is dependent upon us raising additional financial support. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

Future Financings

We anticipate continuing to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our planned activities. There is no assurance that the Company will able to obtain financing to carry on our legal, accounting and reporting needs.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Application of Critical Accounting Estimates

The financial statements of our company have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates, which have been made using careful judgment.

21

The financial statements have been prepared within the framework of the significant accounting policies summarized below:

Mineral Property and Exploration Costs

Until abandonment of its mineral property on January 23, 2009, we were an exploration stage mining company and had not realized any revenue from its operations. We were primarily engaged in the acquisition, exploration and development of mining properties. Exploration costs are expensed as incurred regardless of the stage of development or existence of reserves.

Costs of acquisition are capitalized subject to impairment testing, in accordance with ASC Topic 360, “Property, Plant and Equipment – Subsequent Measurement”, (formerly SFAS 144), when facts and circumstances indicate impairment may exist, as defined in Note 3, Newly Adopted Accounting Policies And Recent Accounting Guidance .

We regularly performed evaluations of any investment in mineral properties to assess the recoverability and/or the residual value of its investments in these assets. Also, long-lived assets were reviewed for impairment whenever events or circumstances change which indicate the carrying amount of an asset may not be recoverable.

Management periodically reviewed the carrying value of its investments in mineral leases and claims with internal and external mining related professionals. A decision to abandon, reduce or expand a specific project was based upon many factors including general and specific assessments of mineral deposits, anticipated future mineral prices, anticipated future costs of exploring, developing and operating a production mine, the expiration term and ongoing expenses of maintaining mineral properties and the general likelihood that the Company will continue exploration on such project.

The Company did not set a pre-determined holding period for properties with unproven deposits; however, properties which had not demonstrated suitable metal concentrations at the conclusion of each phase of an exploration program were re-evaluated to determine if future exploration was warranted, whether there has been any impairment in value and that their carrying values was appropriate.

If an area of interest is abandoned or it is determined that its carrying value cannot be supported by future production or sale, the related costs are charged against operations in the year of abandonment or determination of value. The amounts recorded as mineral leases and claims represent costs to date and do not necessarily reflect present or future values.

Recent Accounting Pronouncements

We do not expect the adoption of any recently issued accounting pronouncements to have a significant impact on our financial position, results of operations or cash flows.

[Intentionally Left Blank]

22

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

MOUNT KNOWLEDGE HOLDINGS, INC.

(Formerly Auror Capital

Corp.)

CONSOLIDATED FINANCIAL STATEMENTS

(Stated in US

dollars)

DECEMBER 31, 2010

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Mount

Knowledge Holdings, Inc.

Novi, Michigan

We have audited the accompanying consolidated balance sheet of Mount Knowledge Holdings, Inc. and its Subsidiaries (the “Successor Company” or the “Company”) as of December 31, 2010, and the related consolidated statements of operations and comprehensive income, stockholders’ equity, and cash flows for the one day period from December 30, 2010 to December 31, 2010 for the Successor Company and the accompanying consolidated balance sheet of Language Key Asia Ltd. and its Subsidiaries (the “Predecessor Company” or the “Company”) as of December 31, 2009, and the related consolidated statements of operations and comprehensive income, shareholders’ equity, and cash flows for the year then ended and for the period from January 1, 2010 through December 30, 2010. These consolidated financial statements are the responsibility of the Successor Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Successor Company as of December 31, 2010, and the consolidated results of their operations and their cash flows for the one day period from December 30, 2010 to December 31, 2010 and the consolidated financial position of the Predecessor Company as of December 31, 2009 and the consolidated results of their operations and their cash flows for the year then ended and for the period from January 1, 2010 through December 30, 2010 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Successor Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has incurred losses for the period from January 1, 2010 through December 30, 2010, which raises substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters also are described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

April 15, 2011

F-2

| MOUNT KNOWLEDGE HOLDINGS, INC. |

| (Formerly Auror Capital Corp) |

| CONSOLIDATED BALANCE SHEETS |

| SUCCESSOR | PREDECESSOR | |||||

| COMPANY | COMPANY | |||||

| DECEMBER 31, 2010 | DECEMBER 31, | |||||

| 2009 | ||||||

| ASSETS | ||||||

| Current Assets: | ||||||

| Cash and cash equivalents | $ | 288,872 | $ | 207,566 | ||

| Accounts receivable | 199,287 | 153,904 | ||||

| Unbilled revenue | 188,785 | 77,825 | ||||

| Other receivables | 12,433 | 11,547 | ||||

| Corporate tax recoverable | 10,295 | 9,676 | ||||

| Prepaid expenses | 2,747 | - | ||||

| Due from related parties | 78,488 | 4,794 | ||||

| Total current assets | 780,907 | 465,312 | ||||

| Property and equipment, net | 37,019 | 22,819 | ||||

| Goodwill | 375,292 | - | ||||

| Investment in non-consolidated subsidiary | 490 | - | ||||

| Other assets | 30,285 | 18,115 | ||||

| TOTAL ASSETS | $ | 1,223,993 | $ | 506,246 | ||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||

| Current Liabilities: | ||||||

| Accounts payable and accrued liabilities | $ | 133,521 | $ | 9,489 | ||

| Deferred revenue | 203,970 | 218,926 | ||||

| Tax payable | 60,997 | 35,421 | ||||

| Other payable | 108,321 | 4,542 | ||||

| Due to related parties | 25,537 | 78,842 | ||||

| Wages payable | 78,468 | 39,406 | ||||

| Note payable | 935,130 | - | ||||

| Total current liabilities | 1,545,944 | 386,626 | ||||

| Total Liabilities | 1,545,944 | 386,626 | ||||

| Stockholders’ Equity (Deficit): | ||||||

| Preferred stock, $0.0001 par

value, 100,000,000 shares authorized,

50,000,000 shares, designated as Series A convertible preferred stock, $0.0001 par value, 8,888,888 issued and outstanding (successor) |

889 |

- |

||||

| Common stock,

$0.0001 par value, 200,000,000 shares authorized,