Attached files

| file | filename |

|---|---|

| EX-31.1 - SECTION 302 CERTIFICATION - Cybergy Holdings, Inc. | exhibit31-1.htm |

| EX-32.1 - SECTION 906 CERTIFICATION - Cybergy Holdings, Inc. | exhibit32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 31, 2010

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________to________________

Commission file number ______________

MOUNT KNOWLEDGE HOLDINGS,

INC.

(formerly Auror Capital Corp.)

(Exact name of

registrant as specified in its charter)

| Nevada | 98-0371433 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 39555 Orchard Hill Place, Suite 600 PMB 6096 | |

| Novi, Michigan, USA | 48375 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code 248.893.4538

Securities registered under Section 12(b) of the Act:

| None | N/A |

| Title of each class | Name of each exchange on which registered |

Securities registered under Section 12(g) of the Act:

Common Stock, $0.0001 par value

(Title of

class)

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes [ ] No [X]

Indicate by checkmark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | (Do not check if a smaller | Accelerated filer [ ] |

| Non-accelerated filer [ ] | reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [ X ]

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 97,800,226 shares of common stock as of February 11, 2011.

Revenues for year ended October 31, 2010: $ 0

Aggregate market value of the voting common stock held by non-affiliates of the registrant as of February 11, 2011, was: $9,071,865.00

Documents Incorporated by Reference: None.

MOUNT KNOWLEDGE HOLDINGS, INC.

FORM 10-K

For the Year Ended October 31, 2010

TABLE OF CONTENTS

| PART I | PAGE NO. | |

| ITEM 1. | DESCRIPTION OF BUSINESS. | 2 |

| ITEM 1A. | RISK FACTORS. | 12 |

| ITEM 2. | PROPERTIES. | 13 |

| ITEM 3. | LEGAL PROCEEDINGS. | 13 |

| ITEM 4. | RESERVED. | 13 |

| PART II | ||

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. | 13 |

| ITEM 6. | SELECTED FINANCIAL DATA. | 14 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. | 14 |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. | 22 |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. | 37 |

| ITEM 9A. | CONTROLS AND PROCEDURES. | 37 |

| ITEM 9B. | OTHER INFORMATION. | 38 |

| PART III | ||

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. | 38 |

| ITEM 11. | EXECUTIVE COMPENSATION. | 40 |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. | 42 |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. | 43 |

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. | 46 |

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES. | 47 |

| SIGNATURES | 49 |

Caution Regarding Forward-Looking Information

Certain statements contained herein, including, without limitation, statements containing the words “believe(s)”, “anticipate(s)”, “expect(s)” and words of similar import, constitute forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Such factors include, among others, the following: international, national and local general economic and market conditions; demographic changes; our ability to sustain, manage or forecast its growth; the ability of the Company to successfully make and integrate acquisitions; raw material costs and availability; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; and other factors referenced in this and previous filings.

Given these uncertainties, readers of this prospectus and investors are cautioned not to place undue reliance on such forward-looking statements.

1

PART I

Forward-Looking Statements

This Annual Report on Form 10-K may contain statements which constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Generally, words such as “may,” “will,” “should,” “could,” “would,” “anticipate,” “expect,” “anticipate,” “believe,” “goal,” “plan,” “intend,” “estimate” “continue” or the negative of or other variation on these and similar other expressions and variations thereof, if used, are intended to specifically identify forward-looking statements. Those statements appear in a number of places in this Form 10-K and in other places, and include statements regarding the intent, belief or current expectations of the Company, its directors or its officers with respect to, among other things, our future performance and operating results, our future operating plans, our liquidity and capital resources and our legal proceedings. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking statements are based on current expectations and involve risks and uncertainties and our future results could differ significantly from those expressed or implied by our forward-looking statements. Many factors, including those listed in “Item 1A. - Risk Factors” below, could cause our actual consolidated results to differ materially from those expressed in any of our forward-looking statements.

ITEM 1. BUSINESS

ORGANIZATION SINCE INCORPORATION

Mount Knowledge Holdings, Inc. (the “Company”) was incorporated as Auror Capital Corp. under the laws of the State of Nevada on March 16, 2006.

The Company began as an exploration stage company engaged in the acquisition and exploration of mineral properties. On January 23, 2009, the Company decided to abandon its Katrina mineral claim due to unsuccessful explorations to date and inability to attract investment capital to proceed with further exploration on the claim.

On July 27, 2009, the Company changed its business purpose from a mining and exploration to an educational software development and sales company offering innovative and proprietary learning software products and teaching services. The Company’s principal executive offices are now in Novi, Michigan.

On January 21, 2010, the Company executed a new exclusive Master Software License Agreement with Mount Knowledge Inc., a corporation owned by the Company’s founder and present Chairman and director based in Ontario, Canada, wherein the Company was granted the exclusive world-wide license rights to promote, market and sell any and all of Mount Knowledge Inc.’s products, both existing and future. These existing products consist of patent pending “Real Time Learning and Self Improvement Educational System and Method” software application referred to as “Syntality.” The Agreement supersedes the Master Product License Agreement executed on or before July 27, 2009 and provides updated terms and conditions, including, but not limited to new definitions of duties, responsibilities and costs to be borne by the respective parties.

On January 21, 2010, Ian McBean resigned as President, Secretary, Treasurer, Chief Executive Officer, Chief Financial Officer and Director of the Corporation, effective immediately. Mr. McBean’s resignation was not a result of any disagreement with the any of the Board Members or the operations, policies or practices of the Company, but rather a personal decision.

Also, on January 21, 2010, we completed the following officer and director appointments:

| (1) |

The appointment of Erwin E. Sniedzins as Chairman and Director of the Corporation, effective immediately; | |

| (2) |

The appointment of Daniel A. Carr as President, Treasurer, Chief Executive Officer, Chief Financial Officer and Director of the Corporation, effective immediately; and | |

| (3) |

The appointment of Simon Arnison as Secretary, Chief Technology Officer, and Director of the Corporation, effective immediately; |

On January 25, 2010, the Company filed an amendment and restatement to its Articles of Incorporation with the State of Nevada, which were approved by the Board of Directors on October 20, 2009 by written consent in lieu of a special meeting in accordance with the Nevada Corporation Law, changing its name to Mount Knowledge Holdings, Inc. and increasing the number of authorized common and preferred shares to 200,000,000 and 100,000,000, respectively.

2

On October 5, 2010, the Company executed a definitive agreement (the “Definitive Agreement”), between the Company, on the one hand, and The Language Key Training Ltd., a British Virgin Islands Corporation, Dirk Haddow, Mark Wood, Chris Durcan and/or Jeff Tennenbaum, on the other (collectively the “LK Sellers”) to purchase approximately ninety-five (95%) percent or more of the beneficial ownership of ordinary shares and preferred shares in Language Key Asia, a Hong Kong corporation and a provider of corporate training solutions in Asia through its operational subsidiaries consisting of Language Key Publishing Ltd (Hong Kong) and Language Key Corporate Training Solutions Ltd. (Hong Kong), which owns and operates The Language Key Training Ltd (Hong Kong) and The Language Key China Ltd (China), (collectively, "Language Key"), along with other additional considerations. The Company facilitated the Language Key transaction by the formation of Mount Knowledge Asia Ltd., domiciled in Hong Kong (“MTK Asia”), owned 100% by the Company, which purchased 100% ownership of Language Key Asia Ltd on behalf of the Company.

On October 29, 2010, the Company entered into Amendment No. 1 to Definitive Agreement ("Amendment No. 1" and, together with the Definitive Agreement, the “Amended Definitive Agreement”) with the LK Sellers. Under the Amendment, the Definitive Agreement was modified to reflect a new closing date of December 31, 2010, or such later date as shall be mutually agreed upon by the Company and the Sellers. Section 5.1 of the Definitive Agreement previously provided that the closing date would be October 31, 2010, or such later date as shall be mutually agreed upon by the Company and the Sellers. In addition, Sections 3.3. , 3.4 and 3.5 of the Definitive Agreement was modified as follows: (i) Section 3.3 of the Definitive Agreement has been modified to reflect that the License Revocation/Release Agreement and the Assignment Agreement referenced therein shall be drafted and executed on or before December 31, 2010 (the Definitive Agreement previously provided that such agreements would be drafted and executed on or before October 31, 2010); (ii) Section 3.4 of the Definitive Agreement was modified to reflect that the date on which the first royalty payment of $5,481.33 due to Foxglove International Enterprises Ltd. shall be due on or before December 31, 2010 (the Definitive Agreement previously provided that the first payment was due on or before October 31, 2010); and (iii) Section 3.5 of the Definitive Agreement was modified to reflect that the content licensing agreement referenced therein shall be drafted and executed on or before December 31, 2010 (the Definitive Agreement previously provided that such agreement would be drafted and executed on or before October 31, 2010). The modifications were required in order to timely complete certain regulatory compliance requirements of one or more of the entities represented in the Definitive Agreement prior to a closing.

On December 27, 2010, the Company and MTK Inc. entered into a Master License Cancellation Agreement (the “Master License Cancellation Agreement”) pursuant to which the parties thereto jointly agreed to terminate, effective immediately, the Original Agreement executed on January 21, 2010. The Company did not incur any early termination fees or penalties in connection with the termination of the Original Agreement. As a result, the Original Agreement was no longer needed and the parties thereto agreed to cancel it.

On December 28, 2010, the Company entered into an Intellectual Property Purchase Agreement (the “IP Purchase Agreement”) with Erwin Sniedzins, the Chairman of the Company’s Board of Directors, and Ucandu Learning Centres Inc., an Ontario corporation founded and controlled by Mr. Sniedzins (“Ucandu” and, together with Mr. Sniedzins, the “Ucandu Sellers”), pursuant to which the Ucandu Sellers sold that certain software commonly referred to between the parties as the “Real-Time Self Learning Systems” (the “Software”), including all copyrights, patents, trademarks, service marks and trade secrets therein (collectively, with the Software, the “Intellectual Property”) to the Company. The Company previously licensed the Intellectual Property from Mount Knowledge Inc., a sales and marketing entity founded and controlled by Mr. Sniedzins (“MTK Inc”), pursuant to a Master Software License Agreement (the “Original Agreement”) dated January 21, 2010 between the Company and MTK Inc. Pursuant to the IP Purchase Agreement, the Company acquired the Intellectual Property and as a result, the Original Agreement was no longer needed.

On December 28, 2010, the Company entered into an Independent Contractor Agreement (the “Independent Contractor Agreement”) with Ucandu pursuant to which the Company engaged Ucandu to provide sales and marketing and technology services to the Company. As compensation for such services, the Company shall pay Ucandu an aggregate of $432,000 in equal monthly payments of $12,000 per month on the first business day of each month, which such payments commenced on January 3, 2011. The term of the Independent Contractor Agreement commenced upon execution of the agreement and shall continue in full force and effect through December 31, 2013. The agreement may only be extended thereafter by mutual agreement of the parties. The Company may terminate the agreement at any time upon 30 days written notice. The Company may terminate the agreement, effective immediately; with “Cause” as such term is defined in the agreement. If the Company terminates the agreement without cause on or before December 31, 2011, Ucandu will continue to receive monthly payments of $12,000 for the period of time between the date on which the agreement was terminated and December 31, 2011 and for the eight months thereafter.

If the Company terminates the agreement without cause after December 31, 2011, Ucandu will continue to receive monthly payments of $12,000 for the period of time that is the lesser of (i) eight (8) months after the termination date or (ii) the period of time between the termination date and the end of the term of the agreement.

On December 28, 2010, the Company entered into an Option Agreement (the “Option Agreement”) with Ucandu pursuant to which Ucandu granted to the Company an option (the “Option”) to purchase 510,000 shares of common stock of Mount Knowledge Technologies, Inc., an Ontario corporation (f/k/a 1827281 Ontario Inc.) (“MTK Tech”), from Ucandu. MTK Tech was formed on June 18, 2010 and is jointly owned by Ucandu, which currently holds 51% of MTK Tech’s common stock, and the Company, which currently holds the remaining 49% of the MTK Tech common stock. The shares of MTK Tech’s common stock underlying the Option represent all of the shares of MTK Tech’s common stock held by Ucandu as of December 28, 2010.

3

On December 31, 2010, the Company entered into Amendment No. 2 to Definitive Agreement (“Amendment No. 2”) with the LK Sellers. Amendment No. 2 further amended the Amended Definitive Agreement as follows:

| • | Exhibit A of the Amended Definitive Agreement was replaced with an amended form of subscription agreement. |

| • |

Section 3.1 of the Amended Definitive Agreement was amended and restated in its entirety to read as follows: “Share Exchange. The Parties agree that LK Asia shall have the right to purchase from the Sellers a total of Three Hundred Twenty-Five Thousand Seven Hundred Ten (325,710) Ordinary A Shares of the LK Asia (the “LK “A” Shares”), owned and held by the Sellers, for a purchase price determined at Closing and paid in the form of a share exchange of a total of One Million Eight Hundred Thousand (1,800,000) Shares of common stock of the Mount Knowledge Holdings, Inc. (the “MKHD Shares”), in accordance with the terms and conditions of the Share Exchange Agreement, attached hereto as Exhibit B (the “Share Exchange Agreement”).” |

|

| |

| • |

Section 3.2 of the Amended Definitive Agreement was amended and restated in its entirety to read as follows: “Stock Issuance. Company agrees to, by applicable corporate resolution, issue to LK Asia and/or its assigns at Closing a total of four hundred eighty thousand (480,000) shares of the Common Stock (the “MKHD Shares”) of Mount Knowledge Holdings, Inc. at a par value ($0.001 per share), subject to a twelve (12) month sale restriction from the date of issuance (the “Additional Sale Restriction”). The beneficial holder(s) of said MKHD Shares shall execute a letter of acknowledgment of said Additional Sale Restriction upon the issuance of and prior to the receipt of said MKHD Shares. The purpose for the issuance of the MKHD shares by Company is to provide certain employee stock incentives (signing bonus) for key management personnel of LK Asia. LK Asia shall provide Company with a written notice within ten (10) business days from the date of Closing with clear stock issuing instructions, including a list of names, addresses, passport or other applicable identification numbers and the amounts of each share certificate to be issued.” |

|

| |

| • |

Section 3.2 of the Amended Definitive Agreement was further amended by eliminating references therein to Exhibit C, the Stock Purchase Warrant Agreement. Likewise, Exhibit C was eliminated from the Amended Definitive Agreement. |

|

| |

| • |

Section 3.3 of the Amended Definitive Agreement was amended and restated in its entirety to read as follows: “License Revocation and Assignment. Sellers shall cause the cancellation of the trademark licensing royalty agreement (the “Royalty Agreement”) with Foxglove International Enterprises Ltd, a British Virgin Islands Corporation (the “Licensor”) as set forth in the executed license revocation and release deed agreement dated December 31, 2010, attached hereto as Exhibit D (the “License Revocation and Release Deed Agreement”), in exchange for a cash payment from LK Asia in the amount of Thirty-Three Thousand Four Hundred Eighty and No/100 Dollars (USD $33,480.00), due and payable to Foxglove International Enterprises Ltd. (BVI) on the Closing Date, including the assignment to LK Asia the full and unencumbered rights to the “Language Key” name, trademarks, service marks, and any other intellectual property rights owned by Licensor with no limitations and free and clear any claims against LK Asia, and/or its operation subsidiaries, now or in the future, as set forth in the executed assignment agreement dated December 31, 2010, attached hereto as Exhibit E (the “Assignment Deed Agreement”), in exchange for a cash payment from LK Asia in the amount of Thirty-Three Thousand Four Hundred Eighty and No/100 Dollars (USD $33,480.00), due and payable to Foxglove International Enterprises Ltd. (BVI) on the Closing Date.” |

|

| |

| • |

Section 3.4 of the Amended Definitive Agreement was amended and restated in its entirety to read as follows: “Payment of Royalties Owed. The Parties agree that Foxglove International Enterprises Ltd. a BVI company (the “Licensor”) shall be entitled to receive royalty payments (the “Royalty Payments”) from Language Key Training Solutions Ltd, formerly known as The Language Key Training Ltd., a Hong Kong corporation (a subsidiary of LK Asia), for fiscal years 2008 and 2009 in the amount of Sixty-Five Thousand Seven Hundred and Seventy-Six Dollars (USD $65,776), due and payable in twelve (12) equal payments of Five Thousand Four Hundred Eighty-One and 33/100 Dollars (USD $5,481.33) in the form cash payments (wire transfer), with the first payment due on or before December 31, 2010 and subsequent monthly payments thereafter as set forth in an executed promissory note, attached hereto as Exhibit F (the “LK Promissory Note”). This amount shall be recorded as a current liability due to related parties on the balance sheet of Language Key Training Solutions Ltd. until paid in full.” |

4

| • |

Section 3.5 of the Amended Definitive Agreement was amended and restated in its entirety to read as follows: “Use of Existing Training Content. The Parties agree that The Language Key Ltd. (a BVI company) and/or its successor company would be granted a licensing right to use, rework, and/or publish certain existing training content (excluding, content which would be development from the date of this Agreement) owned and held by The Language Key Training Ltd. (a Hong Kong company) and/or its successor company for a term of eighty-eight (88) years, the terms and conditions set forth in the executed content licensing agreement dated December 31, 2010, attached hereto as Exhibit G (the “LK Existing Content Licensing Agreement”).” |

Subscription Agreement

In connection with the closing under the Definitive Agreement among the Company and the Sellers dated as of October 5, 2010, as amended by Amendment No.1 and Amendment No.2 (the “Definitive Agreement”), on December 31, 2010, the Company and Mount Knowledge Asia, Ltd., its wholly-owned subsidiary (“MTK Asia”), entered into a subscription agreement (the “Subscription Agreement”) with Language Key Asia, Ltd. (“LK Asia”) for the purchase by the Company or MTK Asia of 10,000,000 shares of ordinary B stock of LK Asia for an aggregate purchase price of $1,000,000 (the “Purchase Price”). Such shares were delivered at the closing and the Purchase Price is payable as follows:

| • | A payment in the amount of $75,000 is due and payable on or before December 31, 2010; |

| • | A payment in the amount of $75,000 on or before January 15, 2011; |

| • | A payment in the amount of $200,000 on or before February 15, 2011; |

| • | A payment in the amount of $125,000 on or before March 15, 2011; and |

Seven (7) equal payments of $75,000 payable on first day of each month beginning on or before April 15, 2011.

If the Company defaults on a payment, and fails to cure such default within sixty (60) days from the date of such default, LK Asia is entitled to liquidated damages in the amount of $500 per day for each and every day the Company is in default after the sixtieth (60th) day until such default has been cured. If the default is not cured within ninety (90) days from the date of default, then the Company shall forfeit the right to vote the shares subscribed for and received until the default has been cured. If the default is not cured, along with any other outstanding amounts owed to LK Asia, on or before the date in which the final payment is due and payable then LK Asia shall have the right to rescind the subscription and any and all shares of ordinary B stock received by the Company or MTK Asia, as the case may be, shall be cancelled.

Share Exchange Agreement

In connection with the closing under the Definitive Agreement, on December 31, 2010 the Company and MTK Asia entered into a share exchange agreement (the “Share Exchange Agreement”) with the Sellers pursuant to which the Sellers sold an aggregate of 325,710 shares of ordinary A stock of LK Asia (the “LK Asia Shares”) to the Company in exchange for an aggregate of 1,800,000 shares of the Company's common stock.

Promissory Note

In connection with the closing under the Definitive Agreement, on December 31, 2010 LK Asia executed a promissory note (the “Promissory Note”) in the principal amount of $65,776 (the “Principal Amount”) in favor of Foxglove International Enterprises Ltd. (“Foxglove”) in satisfaction of certain royalty payments owed by The Language Key Training, Ltd., a Hong Kong company and an indirect, wholly owned subsidiary of LK Asia (the “HK Subsidiary”), to Foxglove for fiscal years 2008 and 2009.

The Principal Amount is payable in cash in twelve equal monthly installments. LK Asia may prepay, in whole or in part, the Principal Amount, without payment of any premium or penalty. In addition, LK Asia has a right to set-off and/or apply any and all amounts owed to it, its subsidiaries and affiliates by Foxglove, its subsidiaries and affiliates pursuant to any agreement or arrangement between LK Asia and Foxglove and/or their respective subsidiaries and affiliates, against any all amounts owed by LK Asia to Foxglove under the Promissory Note.

5

As described in Item 2.01 hereof, as a result of the completion of the transactions contemplated by the Definitive Agreement, the Company, through its wholly-owned subsidiary, MTK Asia, owns 100% of the ordinary shares of LK Asia.

Licensing Agreement

In connection with the closing under the Definitive Agreement, on December 31, 2010 LK Asia and LK BVI entered into a licensing agreement pursuant to which LK Asia granted to LK BVI the right to use, rework and/or publish certain existing training content developed prior to December 31, 2010 owned and held by LK Asia for a term of 88 years.

As described in Item 2.01 hereof, as a result of the completion of the transactions contemplated by the Definitive Agreement, the Company, through its wholly-owned subsidiary, MTK Asia, owns 100% of the ordinary shares of LK Asia.

On December 31, 2010, the Company entered into a Definitive Agreement (the “Agreement”) with MTKUSA and Birch First Advisors, LLC (“Birch First”) pursuant to which the Company acquired 11,166,690 shares (the “MTKUSA Common Shares”) of common stock, par value $0.0001 per share, of MTKUSA (“MTKUSA Common Stock”) and 8,888,888 shares (the “MTKUSA Series A Shares”, together with the MTKUSA Common Shares, the “MTKUSA Securities”) of Series A Convertible Preferred Stock (“MTKUSA Series A Preferred Stock”), par value $0.0001 per share, of MTKUSA. In exchange for the MTKUSA Securities, the Company issued 11,166,690 shares (the “Company Common Shares”) of its common stock, par value $0.0001 per share (the “Company Common Stock”) and 8,888,888 shares (the “Company Series A Shares”) of its Series A Convertible Preferred Stock, par value $0.0001 per share (the “Company Series A Preferred Stock”), together with the Company Common Shares and the Company Series A Shares, the “Company Securities”). The Agreement includes representations and warranties and other provisions customary for a transaction of this nature. The Company filed a certificate of designation with the State of Nevada designating the rights and preferences of the Company Series A Preferred Stock on February 4, 2011 and issued the Company Series A Shares to Birch First on the same date.

Company Overview

The Company is a global provider of innovative and proprietary learning products and training solutions. As a holding company of educational corporate training, language learning and technology development companies, the Company currently has offices in 7 major cities in the US, Canada, Hong Kong and Mainland China.

The Company has developed a suite of market specific “real-time self learning” software applications for both corporate and consumer markets worldwide

The Company’s technology stems from an interactive and visual learning system referred to as Syntality™ integrated into a core application known as the “Knowledge Generator™”.

The Company’s software learning tools and teaching methodologies are currently being offered in China to the more than 300 million students, from grade school to university, seeking to learn English, including the vast number of people in the Chinese workplace increasing their English fluency to achieve greater income earning potential.

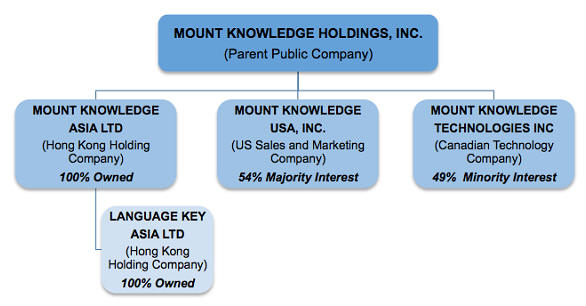

Corporate Structure

The Company is a holding company that was established for purpose of acquiring and operating market-leading global educational corporate training, language learning and technology development companies. The following sets forth our corporate structure.

6

On October 19, 2010, the Company formed Mount Knowledge Asia Ltd, a Hong Kong corporation (wholly owned by Company) for the purposes of facilitating the acquisition of Language Key Asia Ltd and to acquire other Business-to-Business (B2B) and Business-to-Consumer (B2C) business interests throughout Asia.

On December 29, 2010, the Company acquired 49% of the ownership interest in Mount Knowledge Technologies Inc. (formerly known as 1827281 Ontario Inc.) formed on June 16, 2010 as a technology development company to oversee new technological advancements of the Company’s Intellectual Property acquired on December 29, 2010. Ucandu Learning Centres Inc, a company owned by Erwin Sniedzins, the Company’s chairman and director, owns the remaining 51% of Mount Knowledge Technologies Inc. The ownership structure of Mount Knowledge Technologies Inc. enables it to seek small business development incentive programs and other private and public research initiatives available in Canada.

On December 31, 2010, the Company acquired 54% ownership interest in MTKUSA (and, as a fund raising vehicle while Company completed certain regulatory filings - May 2010) to support initial sales efforts in the US, Canada and China, including continued software development until June 2010.

On December 31, 2010, the Company acquired, via Mount Knowledge Asia, 100% ownership of Language Key Asia Ltd., a Hong Kong corporation formed in October 2010 as a holding company for ownership interests in Business-to-Business operations in Asia. Language Key Asia Ltd currently owns and operates several corporate training subsidiaries in Hong Kong and Mainland China and a content provider in Hong Kong.

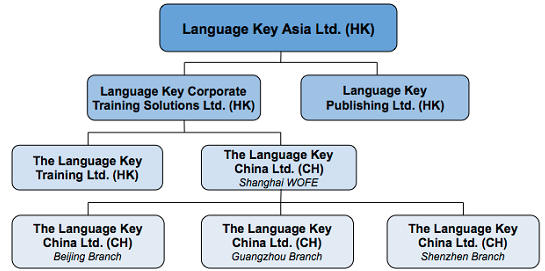

Established in 1994 and headquartered in Hong Kong, Language Key Asia Ltd is a provider of corporate training solutions in Asia through its operational subsidiaries consisting of Language Key Publishing Ltd (Hong Kong) and Language Key Corporate Training Solutions Ltd. (Hong Kong), which owns and operates The Language Key Training Ltd (Hong Kong) and The Language Key China Ltd (China), (collectively, "The Language Key"). The following chart sets forth the structure of Language Key Asia Ltd:

7

Language Key provides custom-tailored Business English and Communications Skills courses, Soft Skills workshops, Executive Coaching and other related services to public and private sector clients, including government entities in Hong Kong and Mainland China and Fortune 500 corporations.

As of the date of this filing, Language Key employs approximately 52 full-time employees, as well as 38 part-time trainers in Hong Kong, Shanghai, Beijing, and Guangzhou, China.

Vision and Mission

The vision of the Company is to develop learning platforms, which will accelerate the transfer of “information into knowledge”.

Market Overview

The Company’s English language learning market opportunities can be divided into two separate markets:

-

Business-to-Business (B2B) or English Language Training (ELT) - corporate training departments, government agencies, schools and other learning institutions.

-

Business-to-Consumer (B2C) or English as a Second Language (ESL) - general market consumers - teachers, parents, students, etc.

The Company’s primary goal is to target the 1.3 billion Chinese population followed by other countries with a significant population seeking to learn the English language..

We believe that both markets offer significant opportunities:

- Global learning software market growing at a 15% to 30% year-over-year*

- Expected to exceed $52.6 billion by year end 2010*

- Asian market expected to reach CAGR of 25% to 30% through 2010*

- China’s English language learning industry is estimated at $5.6B in 2010 with potential significant growth over the coming decade*

* Source: China Education Yearbook, Deutsche Bank Research 2010

Product Summary

The Company’s product line currently consists of the products discussed below which are intended for sale to both consumer and business markets.

-

Knowledge Generator™ is a software product (“KG”) that delivers a real-time learning system that easily converts information to knowledge. Data from any source can be quickly imported into KG and converted into meaningful interactive exercises and lessons that involve the critical senses of the user. KG’s English Language Learning module specifically targets the ESL (English as a Second Language) and ELT (English Language Training) markets in China.

-

Examatar™ is closely related to the Knowledge Generator™ and has been engineered to accelerate the learning process of teaching English to Chinese students by focusing on the creation of unlimited quizzes and tests on any imported information, to aid students in passing TOEFL (Test of English as a Foreign Language) exams required in academic venues, as well as TOEIC (Test of English for International Communication) exams for corporate environments.

Product Description and Features

Knowledge Generator™ was developed with various software user-interface enablers and interactive tools to promote the utilization of the user’s senses during the learning process; to see (visualize), listen, compose, speak, reply and interact and react to information by keyboard touch, sound and voice.

Knowledge Generator™ addresses learning needs of students from preschool to college and throughout their adult continued education learning cycle. KG assists students learning needs from one phonetic sound to complete pronunciation of phrases, from learning one word to understanding and writing complete sentences, from listening to speaking and comprehension, etc.

8

Users can import, in various formats (i.e. word document, RTF, Internet documents, etc.), virtually textual content or subject they want to learn and the Knowledge Generator™ software application tools will automatically create interactive subject based learning or skills training lessons, tests and subsequently, scores.

The Company’s product line consists of a proprietary core technology that allows for textual information to be converted into a multi-purpose learning experience with automatically generated interactive lessons, exercises, tests and scores. The software application has more than 240 interactive enabling learning tools that allow users to transform “information into knowledge” quickly, providing an interactive and dynamic alternative to traditional passive (rote) learning methods.

Growth Strategy

We believe the Company is well positioned to become the standard for accelerated learning products and training services. The Company has a four-part strategy for growth:

-

Accelerated Acquisition Strategy – acquiring approximately one or more acquisition target entities before year-end 2011, subject to market conditions, suitable acquisition targets, and available financing. The Company will first target the vast English learning China market and other Asian territories in 2011, with a long-term vision of expanding into other world markets in 2012.

-

Learning Centers and Schools - providing co-marketing and partnership licensing of language learning products and services to existing learning centers and schools in China and throughout Asia offering students the latest in interactive learning technology to create an exceptional educational experience and value to each student.

-

English Language Learning / Training - providing language learning and training services to major corporations, schools and government offices with a blended approach of on-site training and the use of Mount Knowledge software to provide online tools and custom content development in a licensing revenue model (B2B and B2C).

-

Web-based Applications - providing browser-based and mobile software applications to allow online connectivity (e-portal) to Mount Knowledge™ learning tools and to foster interaction among users (online community).

Sales and Marketing Overview

The Company’s sales and marketing strategy combines direct sales and service-based sales techniques.

In certain markets, one-on-one training and product sales in corporately owned or partnered learning centers or schools in conjunction with a monthly residual “web-based” business model and/or a direct internet sales and marketing approach may be the most cost-effective and efficient method.

In addition, we expect that marketing channel alliances will play a significant role in our Company’s sales strategy, capitalizing on existing marketing and distribution channels. However, our Company’s long-term strategy is to maximize all sales and marketing channels available, including corporate and direct consumer alliances and co-marketing channels.

Revenues

The Company anticipates generating revenues from the marketing and sale of the Company’s learning products and services. Management foresees the primary source of our revenues in 2011 to come primarily from the sale of its products and services in US, Canada, China and Hong Kong.

Milestones

Our milestones and objectives over the next 12 months are significantly dependent on various factors which the Company may or may not be in control of, including, but not limited to: (a) obtaining adequate financing to sustain and expand our operations; (b) ability to identify suitable acquisition targets; (c) acquiring synergistic business operations to accelerate revenue growth; (d) ability to develop new partnerships and distribution channels in China; (e) launching new marketing and sales strategies; (f) completing market-specific product enhancements; (g) creating new B2B applications, (h) generating adequate cash flow from the sales of the Company’s products and services to sustain its operations.

Our plan of operations for the next twelve months is to complete the objectives described under the heading “Management’s Discussion and Analysis or Plan of Operations”.

9

Capital & Uses of Proceeds

Capital Needs

To implement our plan of operations, we will need to continue to raise capital in an amount between $2.5 to $5.0 million in equity from restricted stock sales or other acceptable financing vehicles over the 6 month period beginning in the first quarter of 2011 on terms and conditions to be determined. Management may also elect to seek subsequent interim or “bridge” financing in the form of debt as may be necessary.

We anticipate the need to raise additional capital beyond the first 6 months of operations, subject to the successful implementation of our initial milestones over the first 180 days of operations and our revenue growth cycle thereafter. At this time, management is unable to determine the specific amounts and terms of such future financings.

Proceeds

We foresee the proceeds from capital raised to be allocated as follows: (a) consolidation and integration; (b) growth capital; (c) acquisition research and due diligence; (d) business enterprise applications; (e) product enhancements, membership programs and technology partners; (f) new business development and marketing; (g) legal, audit, SEC filings and compliance fees; (h) financing costs; (i) working capital (general and administrative); (j) reserve capital for costs of acquisition and market expansion.

Competition

Competition Overview

The Company conducts its business in an environment that is highly competitive and unpredictable. The Company has identified at least 20 other companies and/or products that compete directly in the same educational/learning market. Its competition may have considerable financial resources at their disposal, which could facilitate their access to the market under more favorable terms than the Company and could allow them faster market penetration. Each of our competitors has existing marketing campaigns, fully developed products and an established customer base, to varying respective degrees.

Competitive Analysis

The following table outlines some of the competition to the Knowledge Generator™ product line presently in the market*:

| COMPANIES | COMMENTS |

| ETS (English Testing System) | TOEFL test generators |

| New Oriental | TOEFL prep in China |

| KAPLAN | TOEFL prep, SAT, LMAT |

| PRINCETON | Franchises, Web, Books |

| SYLVAN LEARNING CTRE | After school tutoring |

| HOME SCHOOLING | 1.1 Million Home Schooling |

| ROSETTA STONE | Languages – 6 M + users |

| KURZWEIL | Spec Ed |

| INSPIRATION | 25 M users |

| PREDICTION | Writing |

| AUTOSKILLS | 625,000 Users |

| WHITESMOKE | Writing |

| VOCABSTER | Spelling Bee & Vocabulary |

| RIVERDEEP | Bought Houghton $5B |

| Tell Me More Premium | ESL |

| AURORA SYSTEMS | Writing & Speech |

| EVELYN WOOD | Speed Reading |

* The chart above represent comparisons of other companies offering a similar product or services to that of the Company during 2010 and may not be an accurate depiction of their products and services offerings for 2011.

10

Employees

Currently, we have only approximately 64 employees in the Company, including employees in US, Canada, China and Hong Kong. In Company, as the parent, we only have three employees, all of which are Officers and Directors of the Company:

| NAME | OFFICER / DIRECTOR |

| Erwin Sniedzins | Chairman & Director |

| Daniel A. Carr | CEO, President, CFO, Treasurer & Director |

| Simon Arnison | CTO, Secretary & Director |

Other than engaging and/or retaining independent consultants to assist us in various administrative and marketing related needs, we do not anticipate a significant change in the number of our employees, if any, unless we are able to obtain adequate financing. Currently, our officers / directors do not have any employment agreements with us.

The team’s brief biographies follow:

Erwin E. Sniedzins, Chairman, Founder and Chairman of Mt. Knowledge Inc and Mount Knowledge USA, Inc. – Mr. Sniedzins has held senior management positions at Xerox with extensive sales/marketing and business development and new product launch experience. He created Mount Knowledge™, with patent pending Knowledge Generator™, Real Time Self-Learning™; in 2001 he created an unique marketing interactive software product, selling 50,000 CDs to Sears (Eatons) and 30,000 CDs to Unilever (Lipton’s); organized, in 1991, a Mt. Everest expedition to raise International awareness and $1.1 M for Rett Syndrome; created a National Everfitness program that went out to 18,000 schools in Canada; authored, produced and published a best seller, “Who’s Who in Toronto: A Celebration of this City”;

Daniel Carr – CEO and President of Mount Knowledge USA, Inc. and Director of Auror Capital Corp. – Mr. Carr has over 30 years of experience and leadership, including financial positions in over 14 companies providing hi-tech development, manufacturing, wholesale distribution, on-line financial services, and IT infrastructure.

Simon Arnison – CTO and Director of Mt. Knowledge Inc and Mount Knowledge USA, Inc. – Mr. Arnison has over 23 years of executive and management experience in the software, multimedia, educational products and PC marketplace in both Europe and North America, and is former founder and CEO of Classwave Wireless, and former founder and CTO of Innotech. Mr. Arnison has been a pioneer and visionary in the wireless and Java marketplace and has written and presented on these fields for various publications and events.

Subsidiaries

We have one wholly owned subsidiary; Language Key Asia Ltd, a Hong Kong holding company (corporate language training, publishing and technology), a controlled (54%) subsidiary; Mount Knowledge USA, Inc., a Nevada corporation (sales and marketing company - language learning).

In the addition, Language Key Asia Ltd has two subsidiaries; Language Key Corporate Training Solutions Ltd, a Hong Kong corporation (corporate training management holding company), which owns 100% The Language Key Training Ltd., a Hong Kong corporation and The Language Key China Ltd, a Wholly Owned Foreign Entity (WOFE) in Mainland China. Language Key Asia Ltd also owns 100% of Language Key Publishing Ltd, a Hong Kong corporation (publishing).

Separately, we own 49% of Mount Knowledge Technologies Inc., an Ontario, Canada Corporation (technology research and development).

Intellectual Property

On December 28, 2010, we entered into an Intellectual Property Purchase Agreement (the “IP Purchase Agreement”) with Erwin Sniedzins, the Chairman of the Company’s Board of Directors, and Ucandu Learning Centres Inc., an Ontario corporation founded and controlled by Mr. Sniedzins (“Ucandu” and, together with Mr. Sniedzins, the “Sellers”), pursuant to which the Sellers sold that certain software commonly referred to between the parties as the “Real-Time Self Learning Systems” (the “Software”), including all copyrights, patents, trademarks, service marks and trade secrets therein (collectively, with the Software, the “Intellectual Property”) to the Company.

The Company previously licensed the Intellectual Property from Mount Knowledge Inc., a sales and marketing entity founded and controlled by Mr. Sniedzins (“MTK Inc”), pursuant to a Master Software License Agreement (the “Original Agreement”) dated January 21, 2010 between the Company and MTK Inc. Pursuant to the IP Purchase Agreement, the Company acquired the Intellectual Property and as a result, the Original Agreement was no longer needed.

11

The purchase price (the “Purchase Price”) for the Intellectual Property is payable in two installments. The amount of the first installment is based upon a post-closing appraisal of the value of the Intellectual Property as of December 28, 2010. Specifically, within six (6) months after December 28, 2001, the Company shall select, in its sole discretion, an independent appraiser or auditor to conduct an evaluation and appraisal of the book value of the Intellectual Property as of December 28, 2010 (the “Closing Date Appraised Value”).

The amount of the first installment (the “First Payment Amount”), which is due on the first anniversary of December 28, 2010 (the “First Anniversary Date”), shall be determined as follows:

| (i) |

in the event that the Closing Date Appraised Value is equal to or greater than $2,047,339.20 (the “Target Value”), the First Payment Amount shall be an amount equal to $1,023,669.60; |

|

| (ii) |

in the event that the Closing Date Appraised Value is less than the Target Value but greater than $1,000,000 (the “Threshold Value”), the First Payment Amount shall be equal to the Closing Date Appraised Value less the Threshold Value; and |

|

| (iii) |

in the event that the Closing Date Appraised Value is less than the Threshold Value, the First Payment Amount shall be equal to zero. |

In lieu of a cash payment, the Company may elect to pay all or part of the First Payment Amount in shares of its common stock based on a price per share equal to the closing bid price of the Company’s common stock on the trading date that immediately precedes the First Anniversary Date. The second installment is payable on the second anniversary of December 28, 2010 by delivery of 2,500,000 shares of the Company’s common stock to the Sellers.

In the event of an “Acceleration Event,” as defined in the IP Purchase Agreement, the then-outstanding portion of the Purchase Price, if any, through the date of such event, shall become, at the Sellers’ election in writing to the Company, immediately due and payable. The IP Purchase Agreement contains customary warranties and representations and indemnification and confidentiality provisions and provides that the Sellers are subject to noncompetition and noninterference covenants.

Patents, Trademarks, and Copyrights

We are dependent on the ability to maintain protection of current and future intellectual property, patents, trademarks, and/or copyrights owned by the Company.

Our current intellectual property includes the “Real Time Learning and Self Improvement Educational System and Method™, also referred to as the Real-Time Self Learning Systems™” learning and training method as set forth in the U.S. Provisional Patent Application No. 60/807,028, initially filed on or about July 11, 2006 in the name of Erwin E. Sniedzins, with an updated Utility Patent Application executed on or about June 27, 2007 as set forth Utility Patent Application Transmittal filed on or about July 5, 2007 as set forth in the United States Patent and Trademark Office confirmation receipt dated July 25, 2007, including but not limited to, any and all related computer code, including any and all software products and services derived from said learning and training method and related computer code (e.g. Knowledge Generator™, Examatar™, and Syntality™ learning products and services), existing now or in the future, along with all trademarks, trade names (e.g. Mount Knowledge, Knowledge Generator™, KG™, Examatar™, Syntality™), technology know-how, marketing materials, owned jointly and severally by UCANDU Learning Centres, Inc., corporately and/or Erwin Sniedzins, personally and individually and/or assigned to or used by Mount Knowledge Inc. and/or any other third-party prior to the execution of this Agreement.

The Company does not require it to obtain any patents for the products developed and owned by Company in order for it to market and sell the products as contemplated, nor does it anticipate any adversity in its ability to generate revenues if such patents are not obtained in the future. However, the approval of one or more patents of the products developed and owned by Company may increase its competitive advantage in the marketplace in terms of proprietary features, functions, and overall value proposition to the customers we intend to serve.

ITEM 1A. RISK FACTORS

Not Applicable.

12

ITEM 2. PROPERTIES.

Executive Offices

The Company’s executive office is located at 39555 Orchard Hill Place, Suite 600, Novi, Michigan 48375, including an offsite office location for the Company’s books and records. However, management anticipates the need for the Company to move their executive offices within the next (12) months to accommodate additional staff members. The increased costs of such new executive offices are currently unknown. We do not own any real property.

Our Asian regional headquarters (Mount Knowledge Asia Ltd / Language Key Asia Ltd) is located at 10/F, China Merchants Commercial Building, 15-16 Connaught Road West, Sheung Wan, Hong Kong. In addition, the Company has a technology research and development (Mount Knowledge Technologies Inc.) office at 150 Consumers Road, Suite 202, Toronto, Canada M2J 1P9, including shared space for the Company’s sales and marketing support operations in US, Canada and China.

ITEM 3. LEGAL PROCEEDINGS.

We know of no material, active or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. RESERVED.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market for Securities

Our common shares are quoted on the Over-The-Counter Bulletin Board under the trading symbol “MKHD.OB”. Our shares have been quoted on the Over-The-Counter Bulletin Board since October 3, 2007. We began to trade our shares of common stock on May 25, 2010 with an open share price of $.50. For the periods ending July 31, 2010, October 31, 2010, January 31, 2011, we had a per share price high of $.25 and a low of $.20, high $.17 and a low of $.15, high of $.25 and a low of $.20, and high of $.23 and a low of $.18, respectively,

Our transfer agent is Island Stock Transfer, of 100 2nd Avenue, S, Suite 104N, St. Petersburg, FL 33701; telephone number 727.289.0010; facsimile: 727.289.0069.

Holders of our Common Stock

As of October 29, 2010, there were 23 registered stockholders holding 86,633,536 shares of our issued and outstanding common stock after (a) the re-purchase of 110,000,000 shares of the Company’s common stock, (b) the commencement of a 22 for 1 forward stock split (the “Forward Split”) of the Company’s previous total of 8,887,888 issued and outstanding common stock, and (c) the issuance of 1,100,000 shares of restricted stock for services rendered by a contractor to the Company.

Dividend Policy

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| 1. |

We would not be able to pay our debts as they become due in the usual course of business; or | |

|

| ||

| 2. |

Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

13

Recent Sales of Unregistered Securities

On July 27, 2009, we completed a private offering of 6,058,536 shares of our common stock at a price of $0.00046 per share to a total of eleven (11) purchasers for total proceeds of $2,753.88. Also on July 27, we completed a private offering of 33,000,000 shares of our common stock at a price of $0.011 per share to Birch First Trust for total proceeds of $37,500. We completed these offerings pursuant to Rule 506 of Regulation D of the Securities Act.

Also on January 21, 2010, we issued a series of Stock Purchase Warrant Agreements for the purchase of a certain numbers of shares of the Company’s Common Stock. The Stock Purchase Warrant Agreements were executed in order to arrange for necessary future financings of the Company to execute on its business plan as set forth in the Post Effective Amendment, which was effective as of September 28, 2009. The Company completed issuance of the above referenced Warrants was completed pursuant to an exemption from registration at Section 4(2) of the Securities Act of 1933.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

On July 27, 2009, we completed a private offering of 33,000,000 shares of our common stock at a price of $0.0011 per share to Birch First Trust, an affiliate to the Company controlled by Pier S. Bjorklund, an advisor to the Company, for total proceeds of $37,500. We completed these offerings pursuant to Rule 506 of Regulation D of the Securities Act.

Also on January 21, 2010, we issued a series of Stock Purchase Warrant Agreements to Birch First Advisors, LLC, an affiliate of Birch First Trust and an affiliate to the Company for the purchase of 1,000,000 share of shares of the Company’s Common Stock at $0.15 per share and 1,000,000 share of shares of the Company’s Common Stock at $0.20 per share.

Securities Authorized for Issuance Under Equity Compensation Plans We do not have any equity compensation plans.

ITEM 6. SELECTED FINANCIAL DATA.

Not required for smaller reporting companies.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

The following discussion should be read in conjunction with our audited financial statements and the related notes that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this annual report. Our audited consolidated financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

Caution Regarding Forward-Looking Information

Certain statements contained herein, including, without limitation, statements containing the words “believe(s)”, “anticipate(s)”, “expect(s)” and words of similar import, constitute forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Such factors include, among others, the following: international, national and local general economic and market conditions; demographic changes; our ability to sustain, manage or forecast its growth; the ability of the Company to successfully make and integrate acquisitions; raw material costs and availability; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; and other factors referenced in this and previous filings.

Given these uncertainties, readers of this prospectus and investors are cautioned not to place undue reliance on such forward-looking statements.

14

Company Overview

The Company is a global provider of innovative and proprietary learning products and training solutions. As a holding company of educational corporate training, language learning and technology development companies, the Company currently has offices in 7 major cities in the US, Canada, Hong Kong and Mainland China.

The Company was established for purpose of acquiring and operating market-leading global educational corporate training, language learning and technology development companies.

The Company has developed a suite of market specific “real-time self learning” software applications for both corporate and consumer markets worldwide. The Company’s technology stems from an interactive and visual learning system referred to as Syntality™ integrated into a core application known as the “Knowledge Generator™”.

For more details on the Company and its operations, please refer to “Organization Since Incorporation” and “Company Overview” sections in Item 1. Business section, hereinabove in this filing.

Plan of Operations

Over the 12-month of 2011, we must raise capital and complete certain milestones as described below:

Milestones

The Company anticipates the completion of the following objectives over the next 12 months, beginning in the first quarter of 2011:

First 180 Days of Operations (Administrative).

In the first 180 days of operations, beginning in the first quarter of 2011, our primary focus will be to complete necessary administrative functions and consolidations from recent acquisitions, obtain new financing and acquire certain existing marketing and sales agreements in order to properly position the Company execute its business plan. These proposed objectives are as follows:

| 1. |

Consolidation of Operations and Integration of Recent Acquisitions. On December 31, 2010, the Company acquired 100% ownership of Language Key Asia Ltd and its operational subsidiaries in Hong Kong and China. In addition, the Company acquired 54% ownership interest of Mount Knowledge USA, Inc. in the US. Lastly, the Company acquired 49% of Mount Knowledge Technologies Inc. in Canada. As a result of these recent transactions, the Company now has operations in Novi, Michigan, Toronto, Canada, Hong Kong, Beijing, Guangzhou, Shanghai and Shenzhen, China. Additionally, the audit financial statements for each acquisition are required to be filed in one or more amendments to the Current Report on Form 8-Ks filed for each acquisition no later than 71 days after the date on which the Current Report on Form 8-Ks were required to be filed. The preparation of the audited financials and the integration of the operation under the management structure of the Company are expected to take approximately 90 days at an estimated cost of $250,000. | ||

| 2. |

Language Key Subscription Agreement (Growth Capital). In connection with the closing of Language Key Asia Ltd., the Company and Mount Knowledge Asia, Ltd., its wholly owned subsidiary, entered into a subscription agreement with Language Key Asia, Ltd. for the purchase by the Company (and/or MTK Asia) of 10,000,000 shares of ordinary B stock of LK Asia for an aggregate purchase price of $1,000,000. Such shares were delivered at the closing and the Purchase Price is payable as follows: | ||

|

|

A payment in the amount of $75,000 is due and payable on or before December 31, 2010; | ||

|

|

A payment in the amount of $75,000 on or before January 15, 2011; | ||

|

|

A payment in the amount of $200,000 on or before February 15, 2011; | ||

|

|

A payment in the amount of $125,000 on or before March 15, 2011; and | ||

Seven (7) equal payments of $75,000 payable on first day of each month beginning on or before April 15, 2011.

The purpose of the $1,000,000 subscription by the Company was to provide Language Key Asia Ltd an amount of required equity capital (or growth capital) to execute on its accelerated growth strategy and expansion plan throughout the Asia territory over the next 12 months.

15

|

To date, $50,000 of the closing payment of $75,000 has been made. However, other advances totaling approximately $250,000 were made to one of the Language Key companies in the form of loans from October 1, 2010 and to the closing date, December 31, 2010. Management will re-allocate such loan payments and equity payments per the executed Subscription Agreement in the next financial quarter. | ||

| 3. |

Accelerated Acquisition Strategy. As of 2011, the Company’s management has implemented an accelerated acquisition strategy to acquire synergistic companies in the language learning and training business sector. The Company will first target the vast English learning China market and other Asian territories in 2011, with a long-term vision of expanding into other world markets in 2012. The estimated costs initially of research and due diligence of suitable acquisitions targets is $150,000. There can be no assurance that we will be able to successfully negotiate and consummation and such acquisition with any target that we identify. | |

| 4. |

Secondary Offering and/or Other Financings. We intend to raise between $2,500,000 and $5,000,000 within the next 6 months to finance our operations and acquisition strategy. Such offering may take the form of equity or debt. We make seek additional funding as deemed necessary by our management. There can be no assurance that such financing will be available to us on terms that are acceptable or at all.. |

Next 180 days of Operations.

In the next 180 days of operations beginning the first quarter of 2011, we plan to expand our objectives to include new product enhancements, the development of new partnerships and distribution channels, and direct sales opportunities in the form of infomercials and online membership programs, including the option of bundling our product with potential technology partners to increase brand awareness and product reach as follows:

| 1. |

Business Enterprise Applications (Corporations, Schools and Government Agencies). With the acquisition of Language Key, we foresee the use of the our products and services as a learning solution for schools, government agencies, healthcare facilities, and corporations to provide an enhanced, interactive learning program to facilitate new job skills training and continual education programs. Therefore, we intend to develop product-specific enhancements to our existing products and services for use in various business applications. It is likely that most of the product enhancements for business applications will be in the form of client-specific modifications based upon requests for customized specifications and functionality. As such, we anticipate that some of the costs for these modifications will be borne by each respective client. Therefore, it is difficult to accurately determine the upfront costs attributable to us for any research and development of business enterprise applications. | |

| 2. |

Product Enhancements, Membership Program and Technology Partners. Subject to the successful launch of our products and services in the US, Canada, China and Hong Kong, we plan to provide product enhancements consistent with perceived customer requirements for other world markets. Most of these enhancements are believed by management to be in the form of updated graphics, to enhance the fluidity of the user experience and interface, and some market-specific content. In addition, we foresee a web-based e-learning membership program with recurring monthly fee based revenues as being one of the more important and lucrative long-term revenue models for us. It is difficult to accurately estimate the total cost involved in the design and development of this program, including the time required to implement such a program. Furthermore, we will seek to identify and develop relationships with globally recognized technology providers and OEM’s to pursue the possibility of bundling the Mount Knowledge™ products and services with established product platforms, including mobile applications (PDA) to provide the Company with an ancillary revenue stream. We see this as a potentially significant opportunity to generate revenues, if the Company can successfully demonstrated the desirability of the Knowledge Generator™ product with its initial audience and market(s). | |

| 3. |

New Business Development and Marketing (Additional Partnerships and Distribution Channels). We will also pursue our business development and marketing efforts in other territories of Asian, including North American and European markets. We anticipate an initial budget of approximately $150,000 to seek new partnerships and distribution channels commencing sometime after the first 90 days of operations and continuing for a period of time thereafter as determined by us, subject to the availability of adequate financing and ongoing sales results. |

The milestones outlined above represent our objectives for the purpose of obtaining revenues from the marketing and sales of our products and services through various marketing and distribution channels.

16

Although, we have arranged and specified each respective milestone in a defined order, or timeline, over the next 12 months, beginning the first quarter of 2011, we may find the need to modify any or all of the milestones listed, subject to unforeseen circumstances and other contingences which may require us to alter, in whole, or in part, certain aspects of each respective milestone in order for us to successfully realize revenue and ultimately attempt to achieve profitability.

Each milestone many begin at a different time than indicated and may continue for a shorter or longer period of time than suggested, depending upon if such milestones have successfully resulted in generating revenues for us. Also, each milestone may require more or less capital than anticipated and may need to be adjusted from time to time. Furthermore, any adjustments made to the proposed milestones may adversely affect the revenue potential of each milestone and overall revenues and/or our profitability.

Requirements and Utilization of Funds

To implement our plan of operations, including some or all of the above described milestones (objectives), we will need to continue to raise capital (“equity”) in an amount between $2.5 and $5.0 million in equity from restricted stock sales or other acceptable financing options over the next 6 month period beginning in the first quarter of 2011 on terms and conditions to be determined. Management may elect to seek subsequent interim or “bridge” financing in the form of debt (corporate loans) as may be necessary.

We anticipate the need to raise additional capital beyond the first 6 months of operations, subject to the successful implementation of our initial milestones over the first 180 days of operations and our revenue growth cycle thereafter. At this time, management is unable to determine the specific amounts and terms of such future financings.

Proceed

We foresee the proceeds from capital raised to be allocated as follows: (a) consolidation and integration; (b) growth capital; (c) acquisition research and due diligence; (d) business enterprise applications; (e) product enhancements, membership programs and technology partners; (f) new business development and marketing; (g) legal, audit, SEC filings and compliance fees; (h) financing costs; (i) working capital (general and administrative); (j) reserve capital for costs of acquisition and market expansion.

Financial Condition, Liquidity and Capital Resources

As of October 31, 2010, we had $937 in the bank and $70,000 of prepaid acquisition costs. We had limited operations to date and we did not have any revenues during the twelve-month period ended October 31, 2010. We are illiquid and need cash infusions from investors and/or current shareholders to support our proposed marketing and sales operations.

Management believes this amount may not satisfy our cash requirements for the next 12 months and as such we will need to either raise additional proceeds and/or our officers and/or directors will need to make additional financial commitments to our company, neither of which is guaranteed. We plan to satisfy our future cash requirements, primarily the working capital required to execute on our objectives, including marketing and sales of our product, and to offset legal and accounting fees, through financial commitments from future debt/equity financings, if and when possible.

Management believes that we may generate some sales revenue within the next twelve (12) months, but that these sales revenues will not satisfy our cash requirements during that period. We have no committed source for funds as of this date. No representation is made that any funds will be available when needed. In the event that funds cannot be raised when needed, we may not be able to carry out our business plan, may never achieve sales, and could fail to satisfy our future cash requirements as a result of these uncertainties.

If we are unsuccessful in raising the additional proceeds from officers and/or directors, we may then have to seek additional funds through debt financing, which would be extremely difficult for an early stage company to secure and may not be available to us. However, if such financing is available, we would likely have to pay additional costs associated with high-risk loans and be subject to above market interest rates.

At such time as these funds are required, management would evaluate the terms of such debt financing and determine whether the business could sustain operations and growth and manage the debt load. If we cannot raise additional proceeds via a private placement of our common stock or secure debt financing we would be required to cease business operations. As a result, investors in our common stock would lose all of their investment.

The staged development of our business will continue over the next 12 months. Other than engaging and/or retaining independent consultants to assist the Company in various administrative and marketing related needs, we do not anticipate a significant change in the number of our employees, if any, unless we are able to obtain adequate financing.

17

Our auditors have issued a “going concern” opinion. This means that there is substantial doubt that we can continue as an on-going business for the next 12 months unless we obtain additional capital to pay our expenses. This is because we have not generated any revenues and no substantial revenues are anticipated in the near-term. Accordingly, we must raise cash from sources other than from the sale of our products.

Results of Operations

The following summary of our results of operations should be read in conjunction with our audited financial statements for the year ended October 31, 2010 which are included herein.

Our operating results for the years ended October 31, 2010 and 2009 are summarized as follows:

| Years Ended | ||||||

| October31, | ||||||

| 2010 | 2009 | |||||

| Revenue | $ | - | $ | - | ||

| Operating Expenses | 413,282 | 43,464 | ||||

| Net Loss | $ | (413,282 | ) | $ | (43,464 | ) |

Revenues

We have not earned any revenues to date, and do not anticipate earning revenues in the immediate future. Expenses Our expenses for the years ended October 31, 2010 and 2009 are outlined in the table below:

| Years Ended | ||||||

| October 31, | ||||||

| 2010 | 2009 | |||||

| Professional fees | $ | 377,885 | $ | 34,459 | ||

| Filing and transfer agent fees | 23,960 | 8,828 | ||||

| General and administrative | 11,437 | 177 | ||||

| Total Expenses | $ | 413,282 | $ | 43,464 | ||

General and Administrative

The increase in our general and administrative expenses for the year ended October 31, 2010 compared to October 31, 2009 was primarily due to: (i) an increase in general operating expenses.

Professional Fees

Professional fees include our accounting and auditing expenses incurred in connection with the preparation and audit of our financial statements and professional fees that we pay to our legal counsel. Our accounting and auditing expenses were incurred in connection with the preparation of our audited financial statements and unaudited interim financial statements and our preparation and filing of a registration statement with the SEC. Our legal expenses represent amounts paid to legal counsel in connection with our corporate organization. Legal expenses will be ongoing during fiscal 2011 as we are subject to the reporting obligations of the Securities Exchange Act of 1934.

18

Liquidity and Capital Resources

Working Capital

| Percentage | |||||||||

| As of October 31 | Increase / | ||||||||

| 2010 | 2009 | (Decrease) | |||||||

| Current Assets | $ | 937 | $ | - | - | ||||

| Current Liabilities | $ | 257,185 | $ | 20,384 | 1,162% | ||||

| Working Capital | $ | (256,248 | ) | $ | (20,384 | ) | (1,157.% | ) | |

Cash Flows

| Percentage | |||||||||

| Years Ended October 31 | Increase / | ||||||||

| 2010 | 2009 | (Decrease) | |||||||

| Cash used in Operating Activities | $ | (140,980 | ) | $ | (33,675 | ) | 319% | ||

| Cash used in Investing Activities | $ | (70,000 | ) | $ | - | - | |||

| Cash provided by Financing Activities | $ | 212,499 | $ | 36,162 | 488% | ||||

| Foreign Exchange Effect on Cash | (582 | ) | $ | (6,366 | ) | (91% | ) | ||