Attached files

| file | filename |

|---|---|

| EX-99.1 - TRANSCRIPT OF ALCOA INC. FIRST QUARTER 2011 EARNINGS CALL - Howmet Aerospace Inc. | dex991.htm |

| 8-K - FORM 8-K - Howmet Aerospace Inc. | d8k.htm |

1

st

Quarter 2011 Earnings Conference

April 11, 2011

Exhibit 99.2 |

Alcoa

Logo

Cautionary Statement

2 |

Chuck McLane

Executive Vice President and Chief Financial Officer

|

Alcoa

Logo

1

st

Quarter 2011 Financial Overview

Income

from

Continuing

Operations

of

$309

million,

or

$0.27

per

share;

Restructuring

and

other

special

items

totaled

an

unfavorable

$8

million,

or

$0.01

per

share

Revenue

up

22%

versus

first

quarter

2010

and

5%

sequentially

Adjusted

EBITDA

of

$955

million,

up

22%

from

the

fourth

quarter

2010

and

up

60%

from

first

quarter

2010

Alumina:

$71

Adjusted

EBITDA/metric

ton,

8%

better

than

ten-year

average

of

$66/mt

Primary

Metals:

$438

Adjusted

EBITDA/metric

ton,

12%

better

than

ten-year

average

of

$390/mt

Flat-Rolled

Products:

$173

million

Adjusted

EBITDA

was

record

first

quarter

result

Engineered

Products:

18.4%

Adjusted

EBITDA

margin

was

record

result

Days

Working

Capital

two

days

lower

than

first

quarter

2010

Debt

to

Capital

of

33.6%,

130

basis

points

lower

sequentially

Completed

acquisition

of

aerospace

fastener

business

4

See appendix for Adjusted EBITDA reconciliations |

Alcoa

Logo

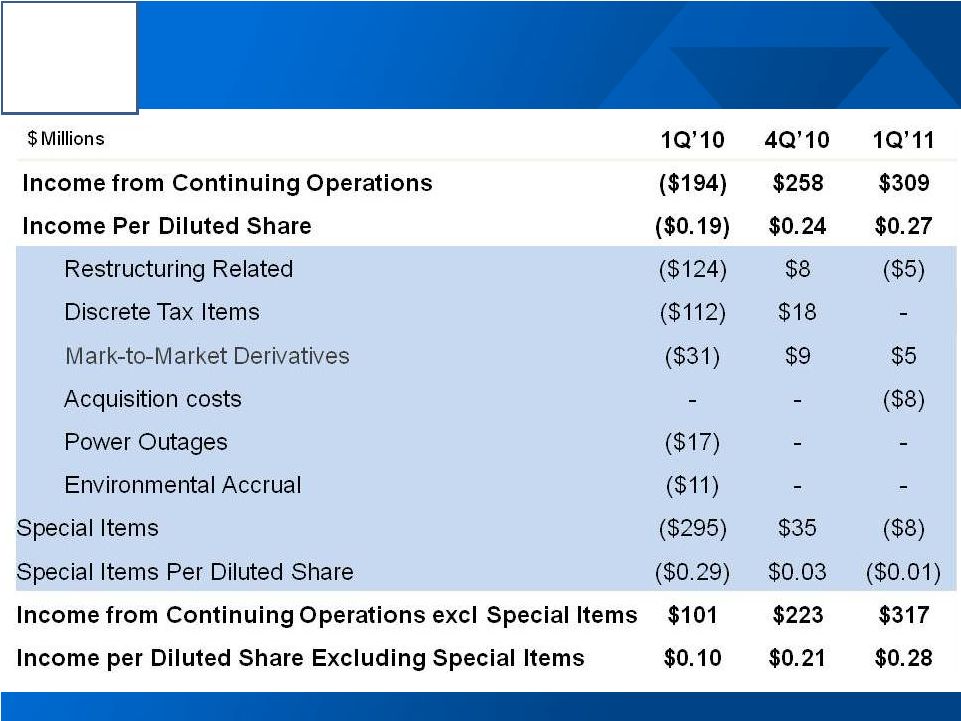

Income Statement Summary

$ Millions

1Q’10

4Q’10

1Q’11

Year

Change

Sequential

Change

Sales

$4,887

$5,652

$5,958

$1,071

$306

Cost of Goods Sold

$4,013

$4,538

$4,715

$702

$177

COGS % Sales

82.1%

80.3%

79.1%

(3.0 % pts.)

(1.2 % pts.)

Selling, General Administrative, Other

$239

$282

$245

$6

($37)

SGA % Sales

4.9%

5.0%

4.1%

(0.8 % pts.)

(0.9 % pts.)

Restructuring and Other Charges

$187

($12)

$6

($181)

$18

Effective Tax Rate

-95.5%

16.1%

27.4%

122.9

% pts.

11.3 % pts.

Income from Continuing Operations

($194)

$258

$309

$503

$51

Income Per Diluted Share

($0.19)

$0.24

$0.27

$0.46

$0.03

5

See appendix for Adjusted Income reconciliation |

Alcoa

Logo

Restructuring and Other Special Items

6

See appendix for Adjusted Income reconciliation |

Alcoa

Logo

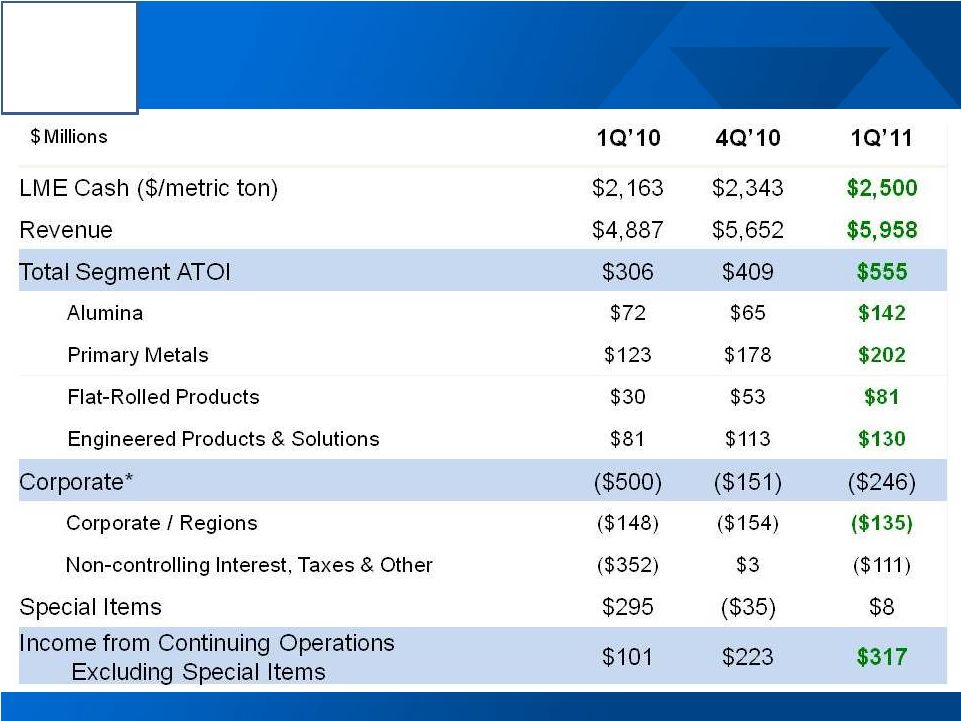

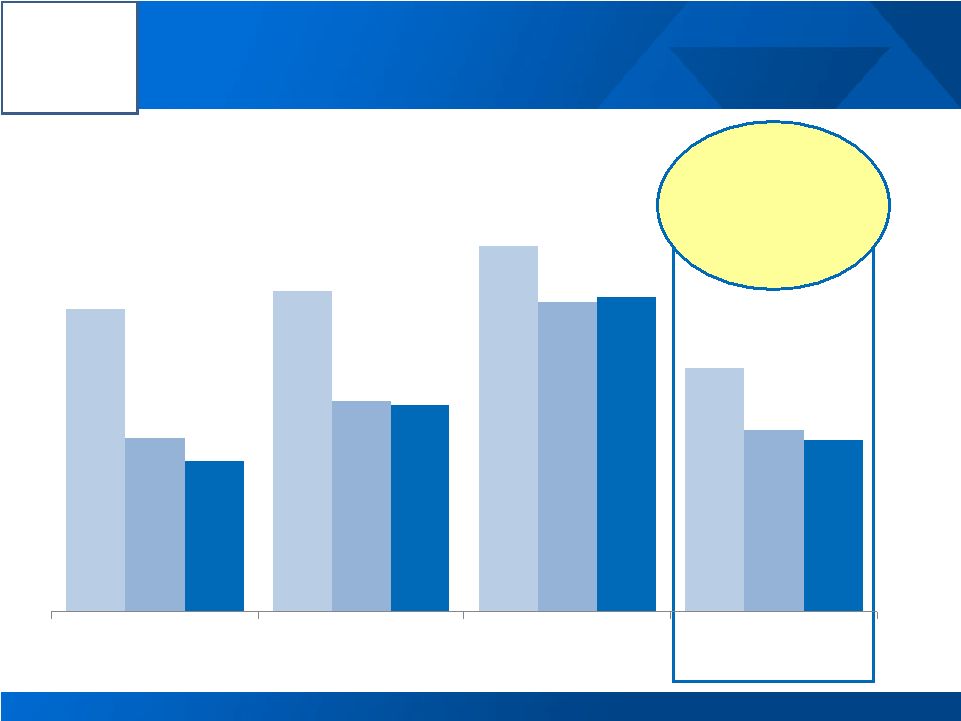

Sequential and Prior Year Improvements in All Segments

7

*

These

amounts

represent

the

sum

of

all

reconciling

items

(excluding

discontinued

operations)

within

the

Reconciliation

of

ATOI

included

in

the

appendix |

Alcoa

Logo

1

st

Quarter 2011 vs. 4

th

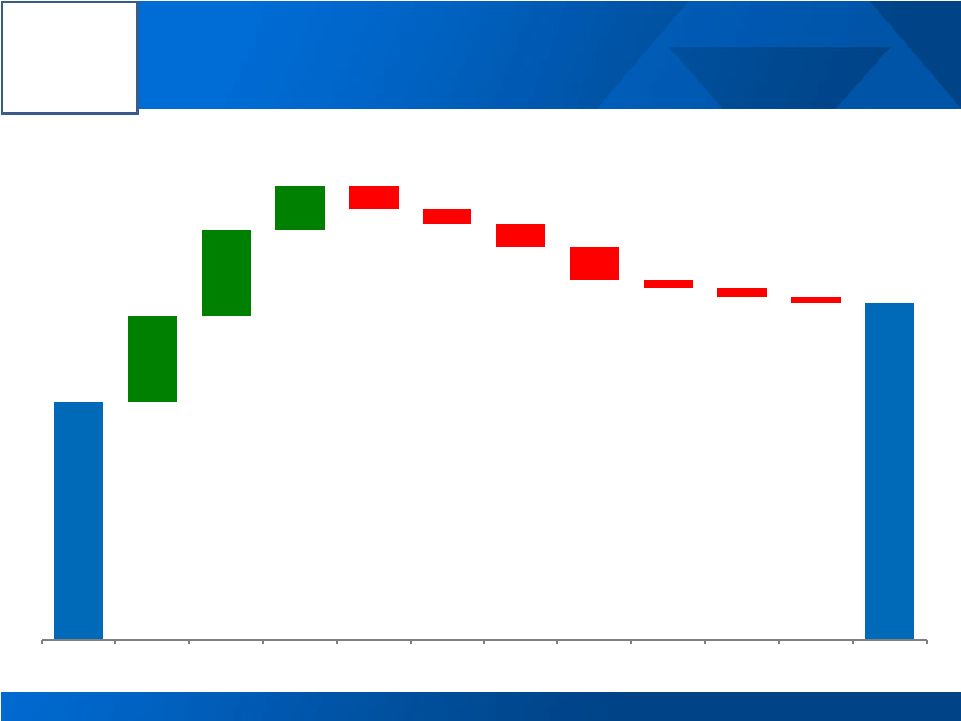

Quarter 2010 Earnings Bridge

Income from Continuing Operations excluding Restructuring & Other Special Items ($ millions) 8

See appendix for reconciliation

$223

$81

$81

$41

($21)

($14)

($22)

($31)

($7)

($9)

($5)

$317

4Q10

LME

Price/

Mix

Productivity

Energy

Currency

Raw

Materials

Taxes

Alumina

Mtce

Restarts

Other

1Q11 |

Alcoa

Logo

1Q 10

4Q 10

1Q 11

Production (kmt)

3,866

4,119

4,024

3

rd

Party Shipments (kmt)

2,126

2,433

2,206

3

rd

Party Revenue ($ Millions)

638

759

810

ATOI ($ Millions)

72

65

142

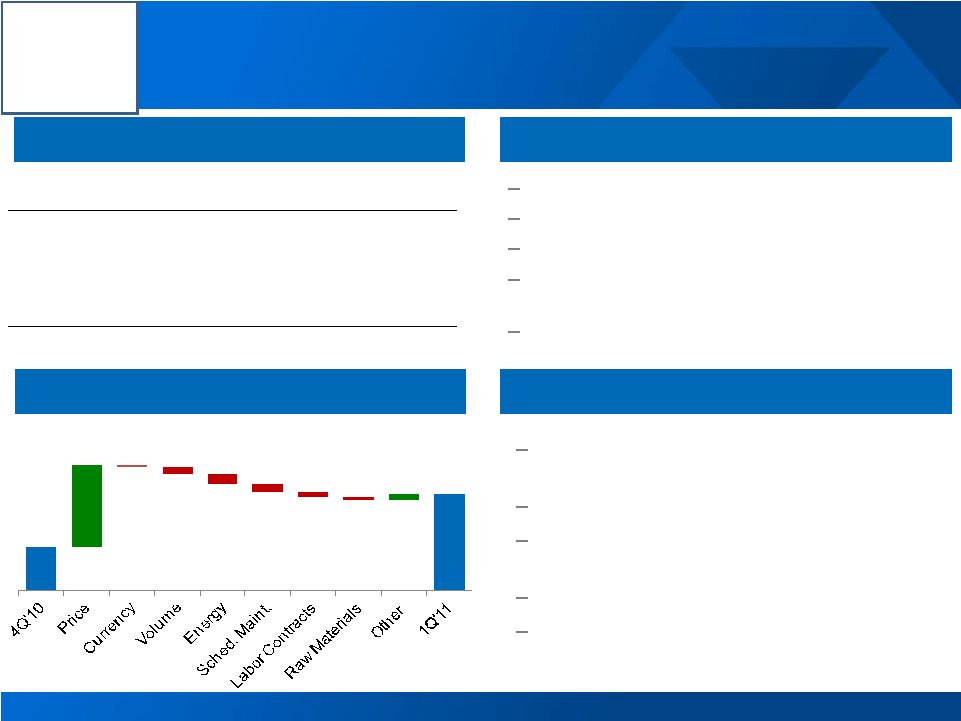

Alumina

1

st

Quarter Highlights

2

nd

Quarter Outlook

1

st

Quarter Business Conditions

9

Realized third-party alumina price up 15%

Higher natural gas, fuel oil, and caustic prices

Higher scheduled maintenance of $12 million

Achieved $71 Adjusted EBITDA/tonne, better than

ten-year average of $66

Impact of labor contract settlement in Australia

of $7 million

20% of 3

rd

party shipments on spot or prior-

month indexed basis

Other pricing to follow two-month lag on LME

Maintenance costs continue in Australia with

similar cost to Q1

Production projected to increase 125 kmt

Higher energy and caustic costs to persist

1

st

Quarter Performance Bridge

$ Millions

See appendix for Adjusted EBITDA reconciliation

$65

$142

$120

($3)

($10)

($15)

($12)

($7)

($5)

$9 |

Alcoa

Logo

1Q 10

4Q 10

1Q 11

Production (kmt)

889

913

904

3

rd

Party Shipments (kmt)

695

743

698

3

rd

Party Revenue ($ Millions)

1,702

1,970

1,980

3

rd

Party Price ($/MT)

2,331

2,512

2,682

ATOI ($ Millions)

123

178

202

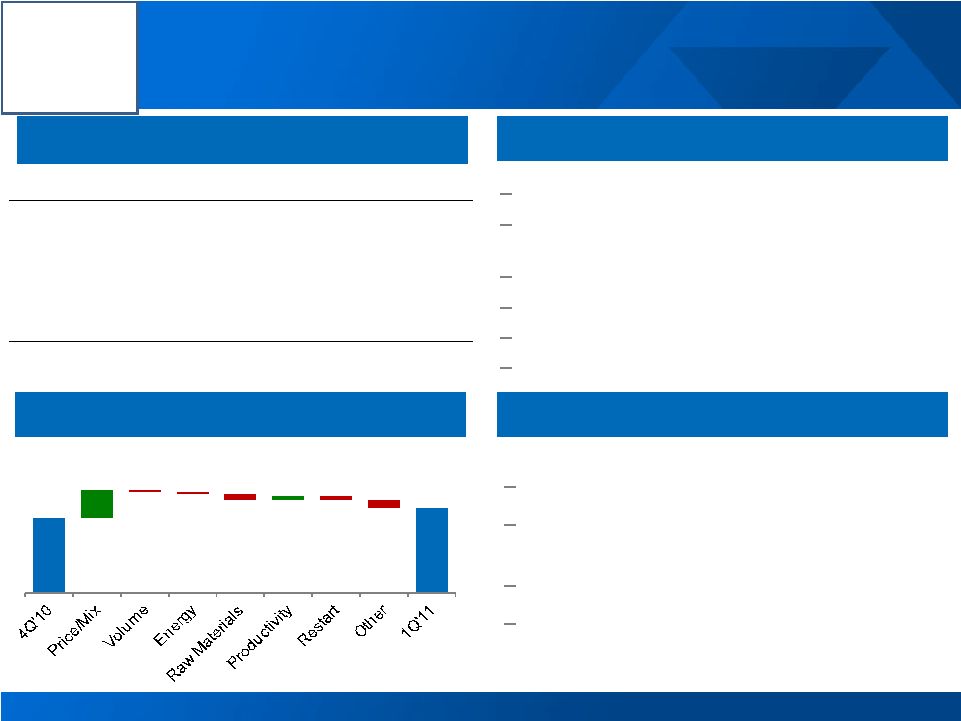

Primary Metals

1

st

Quarter Highlights

1

st

Quarter Business Conditions

2

nd

Quarter Outlook

10

Realized pricing up 7% sequentially

Achieved $438 Adjusted EBITDA/tonne, better than

ten-year average of $390

Productivity benefits continue

Restarts at US locations with cost of $9m

Higher energy and energy-derivative costs

Increasing cost of other raw materials

Pricing to follow 15-day lag to LME

US restarts will turn profitable, with no further cost

expected

50 kmt higher production with restarts

Higher energy and raw materials costs to persist

1

st

Quarter Performance Bridge

$ Millions

($13)

See appendix for Adjusted EBITDA reconciliation

$178

($5)

$202

$66

($4)

$9

($20)

($9) |

Alcoa

Logo

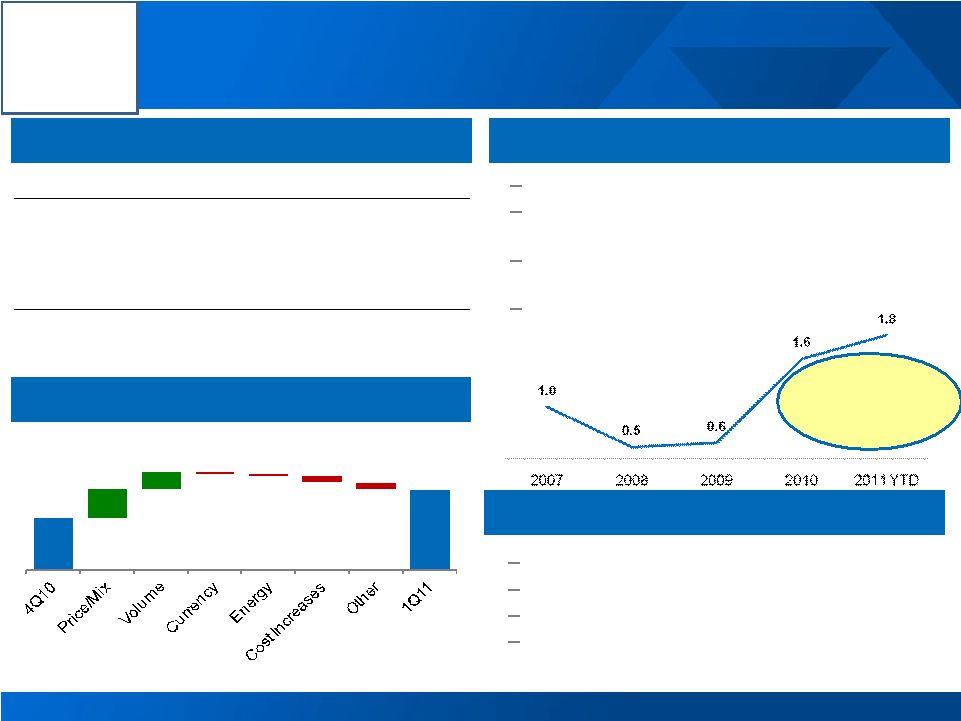

$29

$17

($2)

($2)

($7)

($7)

$53

$81

11

2

nd

Quarter Outlook

1

st

Quarter Business Conditions

1

st

Quarter Highlights

ATOI $ Millions

1Q 10

4Q 10

1Q 11

Flat-Rolled Products,

excl Russia, China & Other

47

55

84

Russia, China & Other

(17)

(2)

(3)

Total ATOI

30

53

81

32% revenue growth from Q1 2010

Record 1

st

Quarter ATOI and Adjusted EBITDA

performance

Strengthened demand in most end markets, and

Improved pricing and mix

Increased cost pressures

Seasonal demand increases

Improving productivity

Cost pressures to continue

Improvement in Russia and China as shipments

increase

1

st

Quarter Performance Bridge

$ Millions

Flat-Rolled Products

17% increase

from 2010

241% increase

from 2008

Adjusted EBITDA/mt

11

See appendix for Adjusted EBITDA reconciliation |

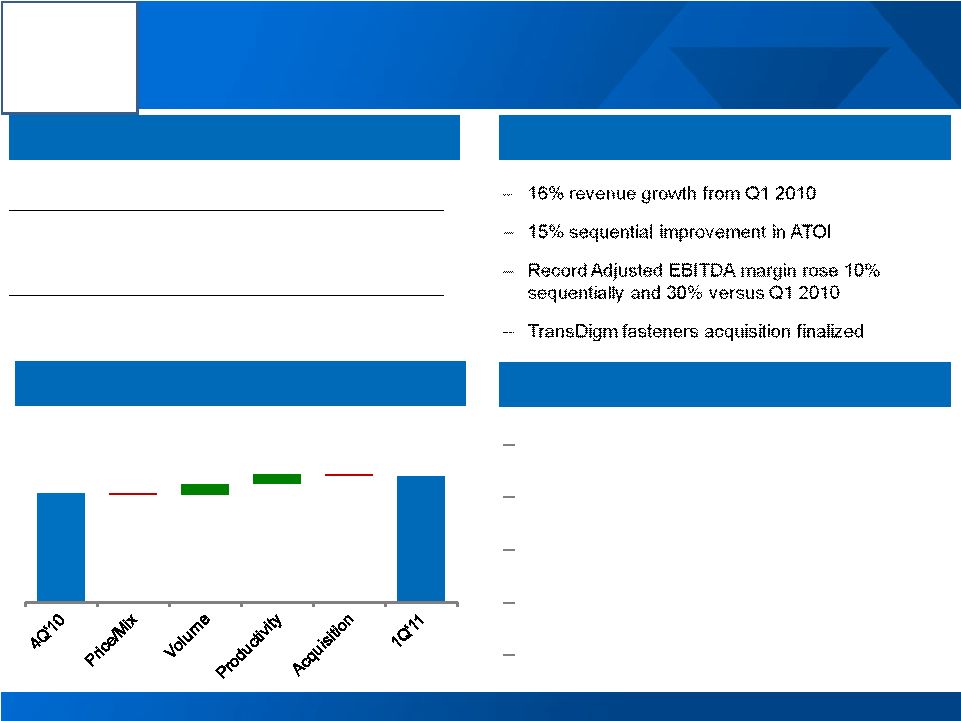

Alcoa

Logo

$ Millions

1Q 10

4Q 10

1Q 11

3

rd

Party Revenue

1,074

1,215

1,247

ATOI

81

113

130

Adjusted EBITDA Margin

14%

17%

18%

Engineered Products and Solutions

12

1

st

Quarter Performance Bridge

$ Millions

1

st

Quarter Business Conditions

1

st

Quarter Highlights

2

nd

Quarter Outlook

Building and construction market with continued

weakness

Markets showing incremental improvements in

line with end market forecasts

Increasing market share in several core

businesses

Product innovations continue to support

aggressive 2011 and 2013 revenue targets

Productivity improvements to continue

See appendix for Adjusted EBITDA reconciliation

$113

($2)

$11

$11

($3)

$130 |

Alcoa

Logo

1

st

Quarter 2011 Cash Flow Overview

13

See appendix for Free Cash Flow reconciliation

1Q’11 FCF

($0.4) billion

$0.9 billion

of cash

Debt-to-Cap

in target

range at

33.6%

DWC better

by two Days

from Q1

2010

($ Millions)

1Q'10

4Q'10

1Q'11

Net Income

($179)

$292

$366

DD&A

358

371

361

Change in Working Capital

(336)

564

(646)

Pension Contributions

(22)

(43)

(31)

Taxes / Other Adjustments

378

186

($286)

Cash From Operations

$199

$1,370

($236)

Dividends to Shareholders

(32)

(31)

(33)

Change in Debt

(42)

(113)

101

Distributions to Noncontrolling Interest

(72)

(102)

(97)

Contributions from Noncontrolling Interest

27

41

121

Other Financing Activities

(61)

4

33

Cash From Financing Activities

($180)

($201)

$125

Capital Expenditures

(221)

(365)

(204)

Other Investing Activities

13

(109)

(348)

Cash From Investing Activities

($208)

($474)

($552) |

Alcoa

Logo Sustainable Reductions in Days Working Capital

14

1Q

2009

1Q

2010

1Q

2011

Sustained

historically low

days working

capital

performance

1Q

2009

1Q

2010

1Q

2011

1Q

2009

1Q

2010

1Q

2011

1Q

2009

1Q

2010

1Q

2011

See appendix for Free Cash Flow reconciliation

67

71

81

54

38

47

69

40

33

46

70

38

GPP

GRP

EPS

Alcoa |

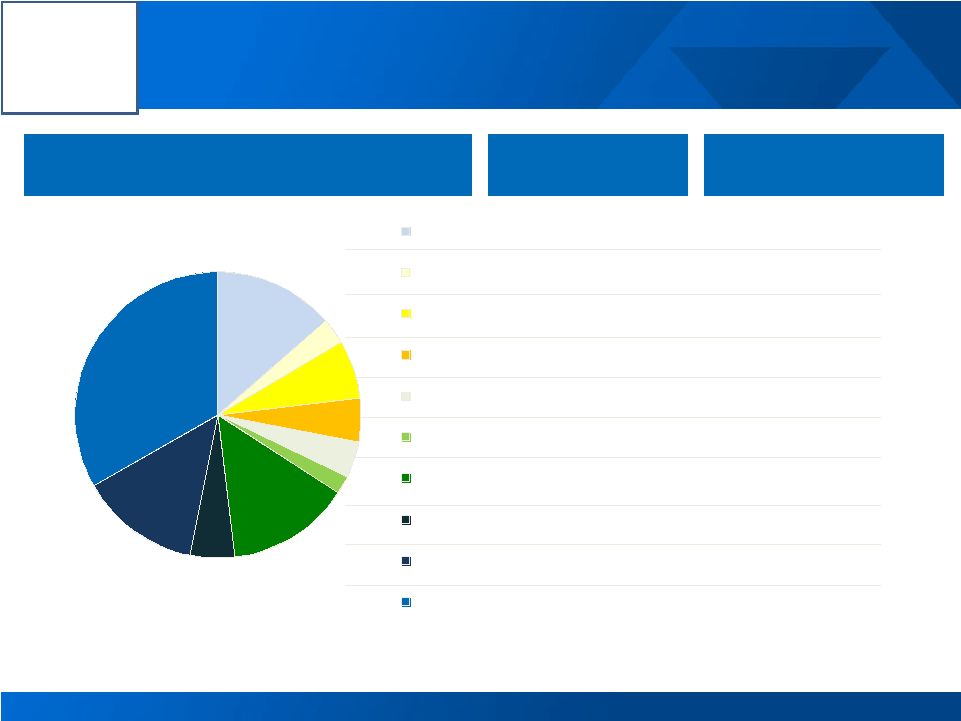

Alcoa

Logo 2011 Cash Sustainability Operational Targets and Actual Performance

15

Sustaining Capital

Growth Capital

Ma’aden

Invest

$400

Debt-to-cap

$ Millions

$197

$ Millions

$ Millions

%

2010

Actual

2011

Target

2011

YTD

$85

35.0%

34.9%

2010

Actual

2011

Target

2011

YTD

33.6%

$500

$445

2010

Actual

2011

Target

2011

YTD

$85

$1,000

$570

2010

Actual

2011

Target

2011

YTD

$119

Free Cash Flow

$ Millions

$0

$1,246

($440)

2010

Actual

2011

Target *

2011

YTD

30.0%

•Target is to be free cash flow positive. See appendix for Free Cash

Flow reconciliation We Are Focused on Achieving Our 2011 Goals

|

Alcoa

Logo A

16 |

Klaus Kleinfeld

Chairman and Chief Executive Officer

17 |

Alcoa

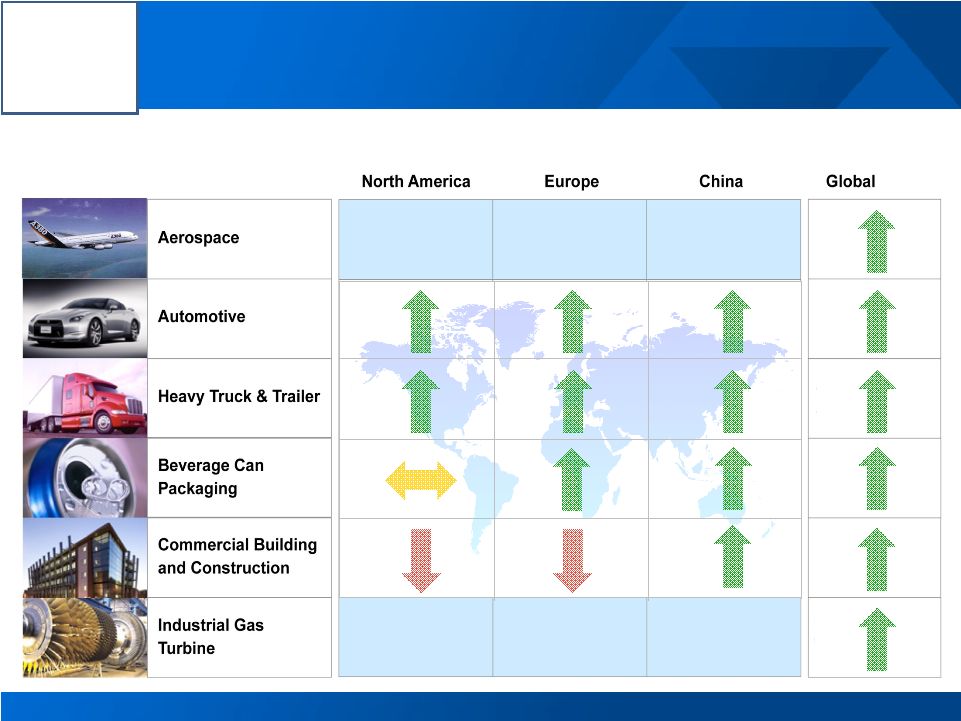

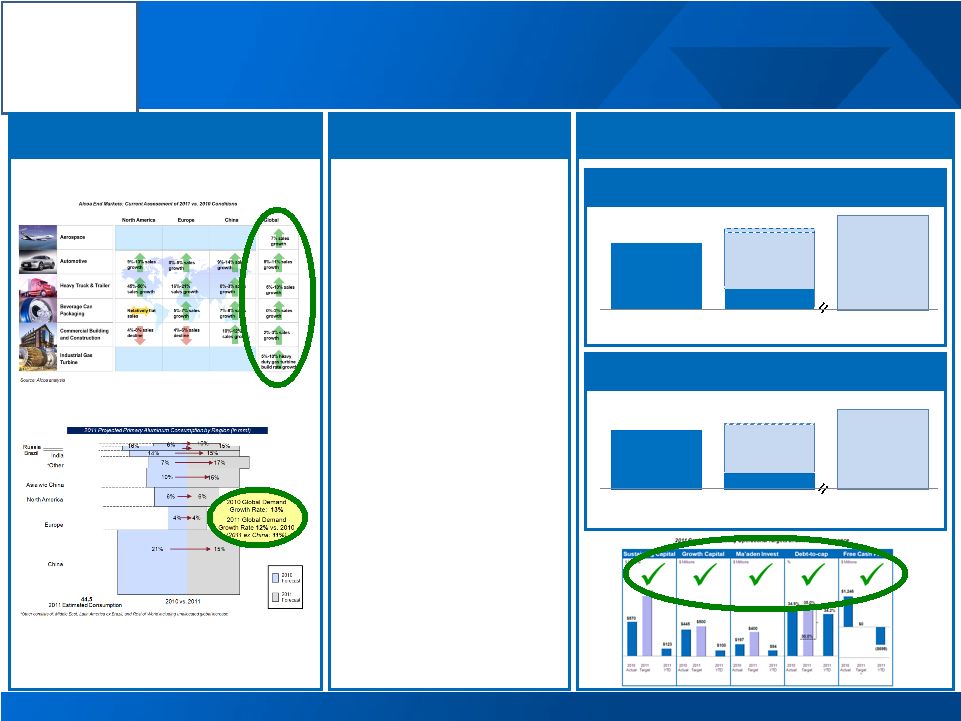

Logo Market Conditions in 2011 Continue to Strengthen

18

Alcoa End Markets: Current Assessment of 2011 vs. 2010 Conditions

Source: Alcoa analysis

9%-13% sales

growth

0%-5% sales

growth

9%-14% sales

growth

5%-11% sales

growth

45%-50%

sales growth

16%-21%

sales growth

0%-3% sales

growth

5%-10% sales

growth

Relatively flat

sales

5%-7% sales

growth

7%-8% sales

growth

0%-2% sales

growth

10%-12%

sales growth

2%-3% sales

growth

4%-8% sales

decline

4%-6% sales

decline

5%-10% heavy

duty gas turbine

build rate growth

7% sales

growth |

Alcoa

Logo

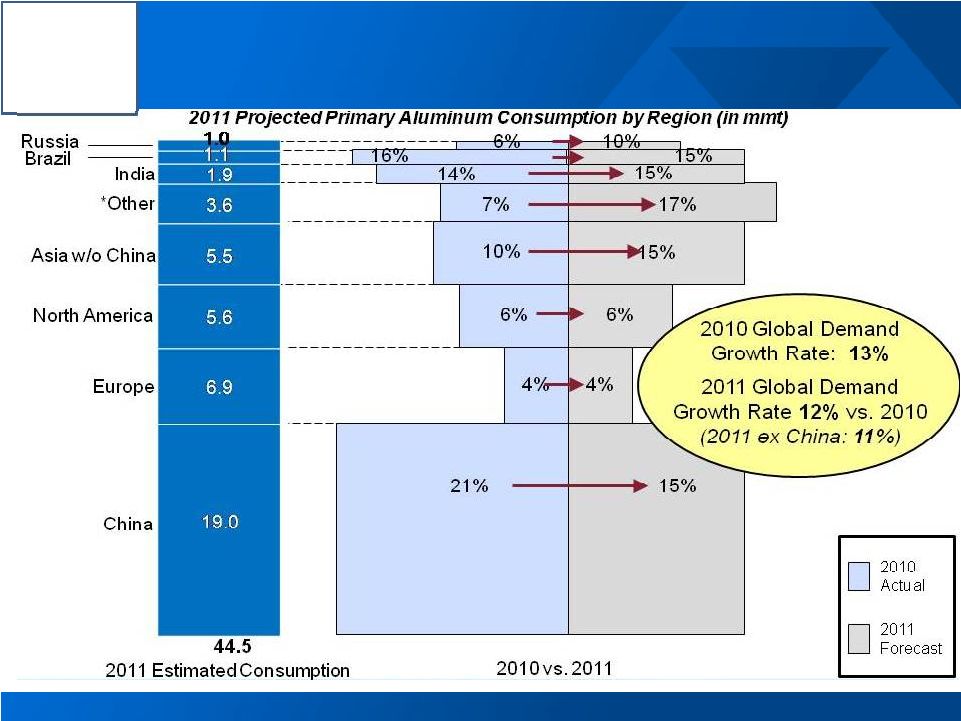

19

*Other consists of: Middle East, Latin America ex Brazil, and Rest of World

including unallocated global increase End Market Developments Support Strong

Demand Growth |

Alcoa

Logo

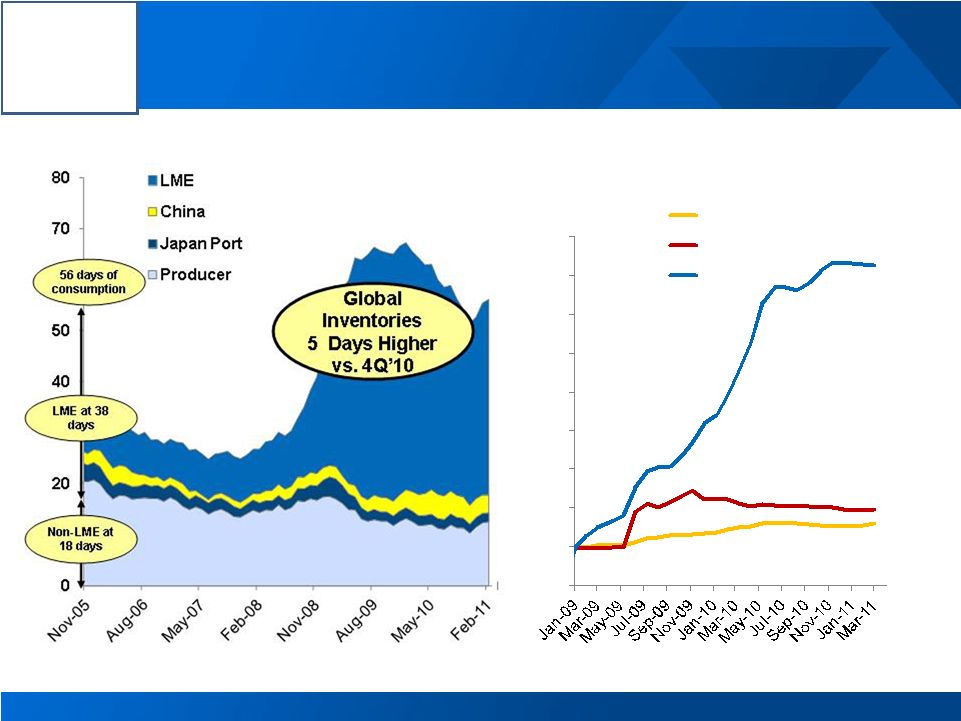

Inventories Increase, but Premiums Attest Physical Tightness

20

Regional Premiums Near All-Time Highs

Global Inventories Increase in Q1 2011

$114 / MT

$204 / MT

$145 / MT

Source: Alcoa estimates, LME, SHFE, IAI, Marubeni, Platt’s Metals Week and

Metal Bulletin 0%

100%

200%

300%

400%

500%

600%

700%

800%

900%

Midwest

Japan

Europe |

Alcoa Logo

4.3

4.6

1.2

1.5

0.2

0.2

0.4

0.4

0.7

0.8

1.8

1.5

1.0

1.0

Q4 2010

Q1 2011

Inventory: Driven by End Markets and Financing Structure

21

Off-warrant

estimate range

(1.5 to 2.5mmt)

China Visible

Japan Port

Producer-held

LME on-warrant

Total Global Inventories (mmt)

Source: Alcoa analysis

Mar-10

May-10

Jul-10

Sep-10

Nov-10

Jan-11

•Improving end-market demand drives

work-in- process and distribution inventories

•Four additional reporting smelters in the

Middle East & India

Growing demand in All Regions

Competing Financing Deals

13

(53)

26

(145)

(32)

42

(75)

(46)

(21)

(8)

248

82

(16)

$31

$30

$29

$30

$19

$3

$32

$32

$26

$16

$16

$24

$33

$0

$5

$10

$15

$20

$25

$30

$35

(200)

(150)

(100)

(50)

0

50

100

150

200

250

300

LME Stock Change (kmt)

Contango (cash to 3 months) ($/mt) |

Alcoa

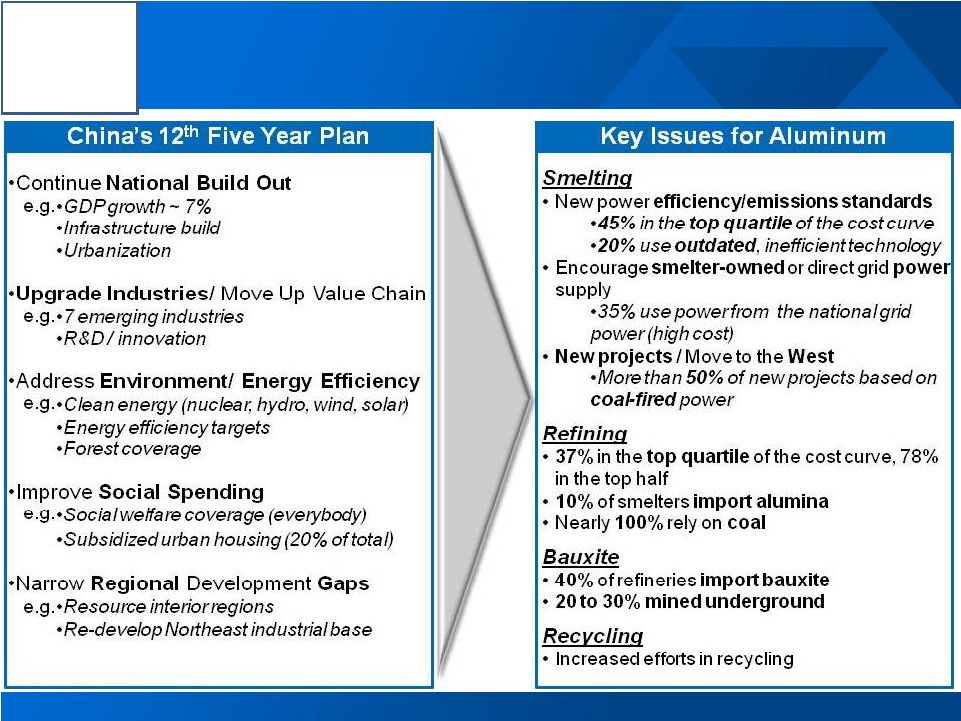

Logo

12

th

Five Year Plan Accelerates Change in Aluminum Industry

22 |

Alcoa

Logo Western World

Annualized Production (Feb 2011)

25,385

Restarts and Expanded Capacity

1,100

Total Supply

26,485

Western World Consumption

(25,540)

(Deficit) Surplus

945

China

Annualized Production (Feb 2011)

15,865

Restarted and Expanded Capacity

2,410

Total Supply

18,275

Consumption

(18,975)

(Deficit) Surplus

(700)

2011 Primary Aluminum Balances Unchanged

23

China

Western World

Production

Demand

Surplus

Source: Alcoa estimates, Brook Hunt, CRU, CNIA, IAI

Deficit

Production

Demand

2011E Aluminum Supply / Demand Balance (in kmt) |

Alcoa

Logo 2011 Global Alumina Balance Unchanged

24

Source: Alcoa estimates, Brook Hunt, CRU, CNIA, IAI

China

Western World

2011 Annualized Production

31,500

Imports from Western World

3,500

Supply

35,000

Demand

(35,000)

(Deficit) / Surplus

0

2011 Annualized Production

55,900

Exports to China

(3,500)

Supply

52,400

Demand

(52,400)

(Deficit) / Surplus

0

Production

Demand

Balanced

2011E Alumina Supply / Demand Balance (in kmt) |

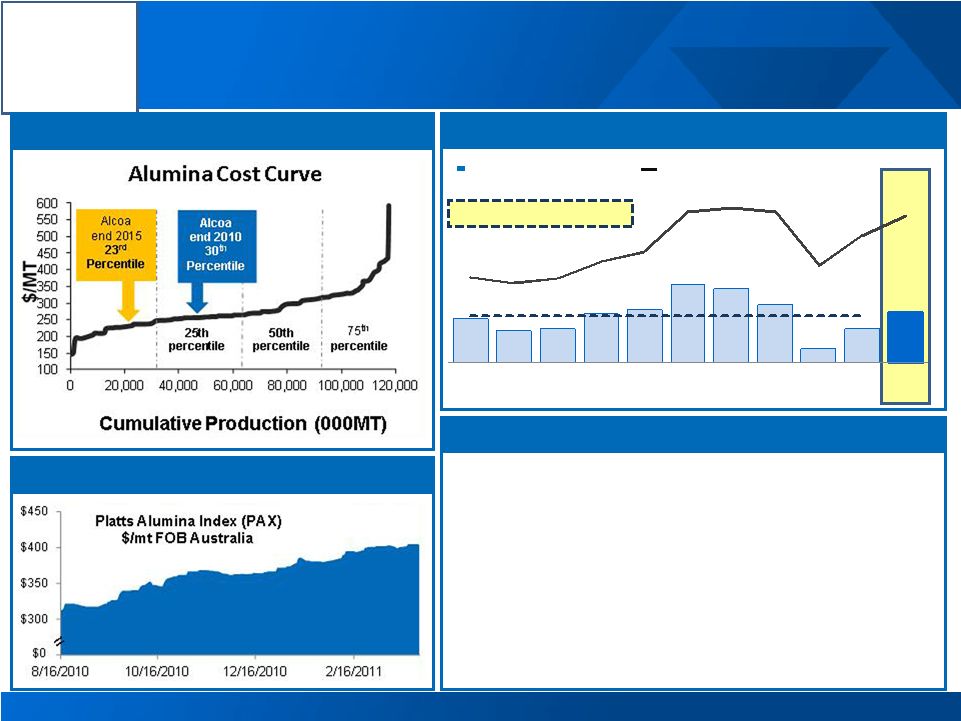

Alcoa

Logo

Alumina: Strong Performance and Strengthening Pricing

25

2015 Cost Curve Targets

Source: CRU; Platt’s Index

Adjusted EBITDA per Metric Ton

–

Sao

Luis

and

Juruti

continue

to

break production

records

–

Volume

increases

at

Suriname

and

Point Comfort

will provide additional exposure to rising spot prices

–

Ma’aden,

lowest

cost

refinery

online

in

2014

–

20%

of

our

customers

now

priced

on

an alumina-

indexed

or

spot

basis

Global Capacity: 18,100 kmt per year

10 Yr Average ~ $66/MT

LME

Adjusted EBITDA/MT

Strengthening Alumina Index Prices

See appendix for Adjusted EBITDA reconciliations

62

44

48

68

75

110

104

81

20

47

71

1,447

1,350

1,433

1,719

1,900

2,570

2,641

2,572

1,664

2,173

2,500

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

YTD |

Alcoa

Logo

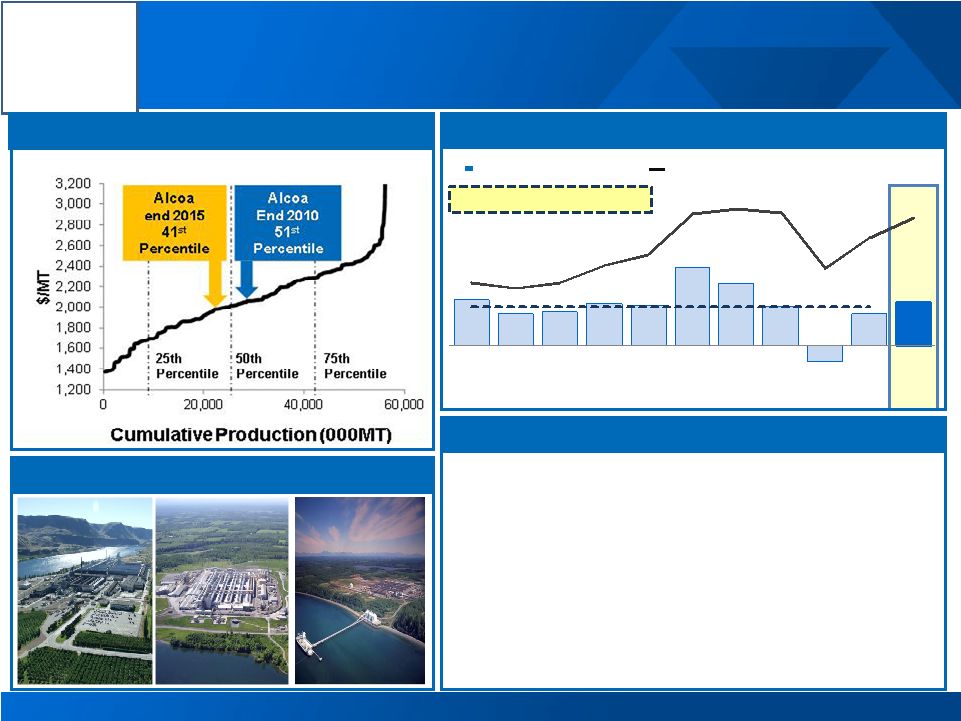

2015 Cost Curve Targets

Aluminum: Continued Strength but Looking to the Future

26

Source: CRU

Aluminum Cost Curve

–

Driving down the cost curve

–

US

restarts

on-track,

increasing

US-based

production and capturing full LME increase

–

Ma’aden,

lowest

cost

smelter

online

in

2013

–

Sustainable cost reductions

–

Repowered

asset

base

–

Capturing optimal value from global casthouses

Global Capacity: 4,500 kmt

Adjusted EBITDA per Metric Ton

LME

Adjusted EBITDA/MT

US Production Captures LME Increase

See appendix for Adjusted EBITDA reconciliations

460

321

336

418

398

784

626

392

(159)

320

438

1,447

1,350

1,433

1,719

1,900

2,570

2,641

2,572

1,664

2,173

2,500

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

YTD

10 YR Average ~ $390/MT |

Alcoa Logo

27

Ma’aden Project is progressing very well

Potline #1

Electrical Switch

Building

Cathode Sealing

Plant

Paste Plant

Port

Rail |

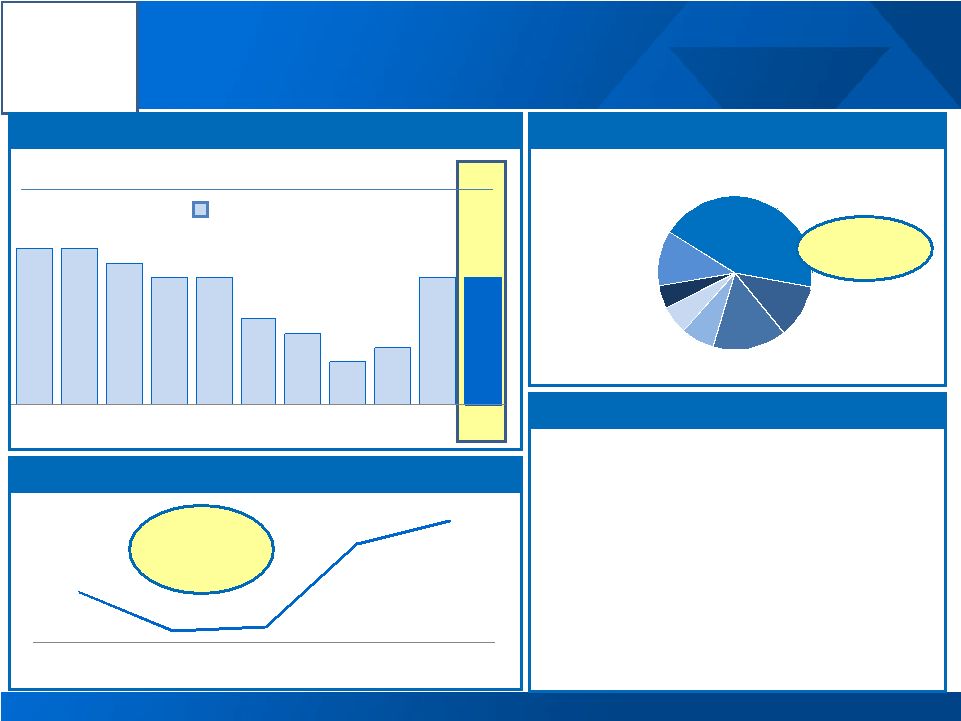

Alcoa

Logo

Distribution

15%

Automotive

7%

B&C

6%

Commercial

Transport

5%

Industrial

/Other

12%

Packaging

44%

Aerospace

11%

Rolled Products: Strong Start to Targeted Revenues & Margin

Adjusted EBITDA & Adjusted EBITDA Margin

28

541

495

479

531

620

536

498

254

224

551

173

Adjusted EBITDA $Millions

Adjusted EBITDA % Sales

2011 YTD 3

rd

Party Sales by Market

80%

Utilization

–

32%

revenue

growth

from

Q1

2010

–

2011 potential of at least 35 to 50% of

$2.5b 2013 revenue growth target

–

Aerospace

growth:

robust

build

rates

–

Russia

and

China

to

capture

growth

in

emerging markets

–

Ma’aden,

lowest

cost

rolling

mill

in

2013

Leveraging our strategic asset base

Strong Growth in Adjusted EBITDA per Tonne

240%

increase

from 2008

See appendix for Adjusted EBITDA reconciliations

11%

11%

10%

9%

9%

6%

5%

3%

4%

9%

9%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

YTD

1.0

0.5

0.6

1.6

1.8

2007

2008

2009

2010

2011 YTD |

Alcoa

Logo

Russia Profitable Since Q2 2010

Solid

Growth

in

all

segments,

especially

can

stock

60% volume growth

from Q1 2010

Improving mix

of products and

customers

drives

higher

realized

conversion revenue

Focus on increasing

aluminum

consumption

and

recycling

in

Russia

29

Solid Progress on GRP Growth Projects in Russia and China

China Ramping Up by 2012

End & Tab Line, Samara

Capacity

utilization

targeted

to

reach

100% by 2012

Key domestic

supplier

of

lithographic

sheet,

brazing

material

and

can

sheet

and

supplier

for

consumer

electronics

90%

volume

growth

versus

Q1

2010

Bohai

ramp-up continues

Bohai

Flat Rolled Products |

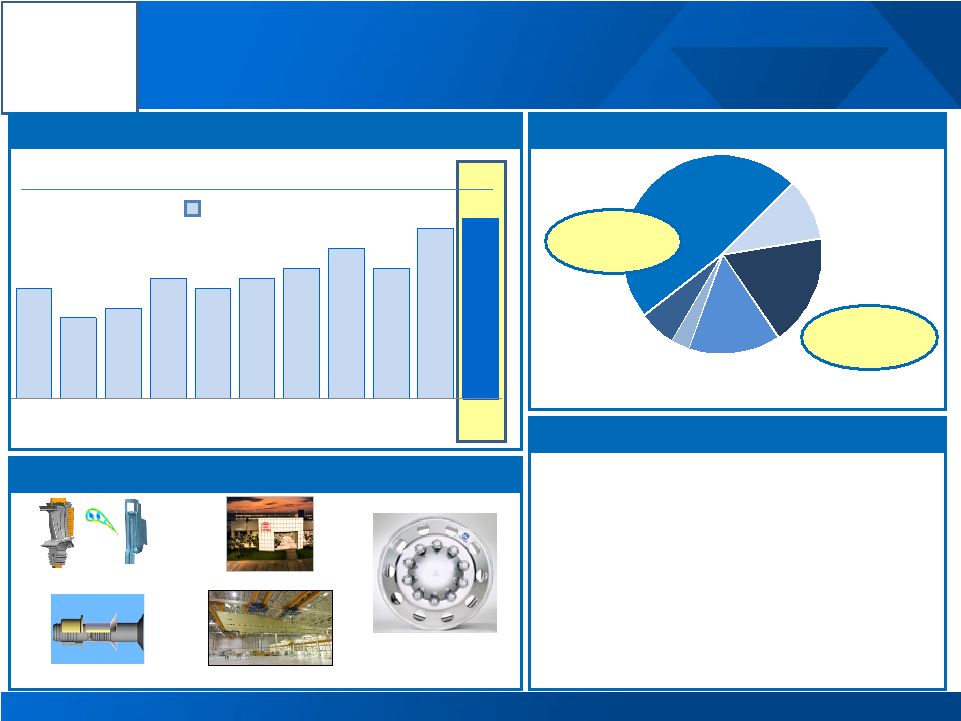

Alcoa

Logo

Aerospace

48%

IGT

10%

B&C

18%

Commercial

Transport

15%

Automotive

3%

Other

6%

Engineered Products: Record Margins and Focus on Growth

Adjusted EBITDA & Adjusted EBITDA Margin

30

436

287

356

495

536

676

783

922

630

762

229

Adjusted EBITDA $Millions

Adjusted EBITDA % Sales

2011 YTD 3

rd

Party Sales by Market

76%

Utilization

67%

Utilization

Strong Platform for Profitable Growth

–

16% revenue growth

from Q1 2010

–

2011 potential of 25 to 30% of $1.6b

2013

revenue

growth

target

–

TransDigm

fastener acquisition

integration

on

track

with

accretive

earnings

in 2011

–

Product

innovations

and

share

gains

accelerate growth

Continued Innovation in All of our Businesses

Building & Construction

Forgings & Extrusions

Fastening Systems

Power & Propulsion

Commercial Wheels

See appendix for Adjusted EBITDA reconciliations

11%

8%

9%

12%

11%

12%

13%

15%

13%

17%

18%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

YTD |

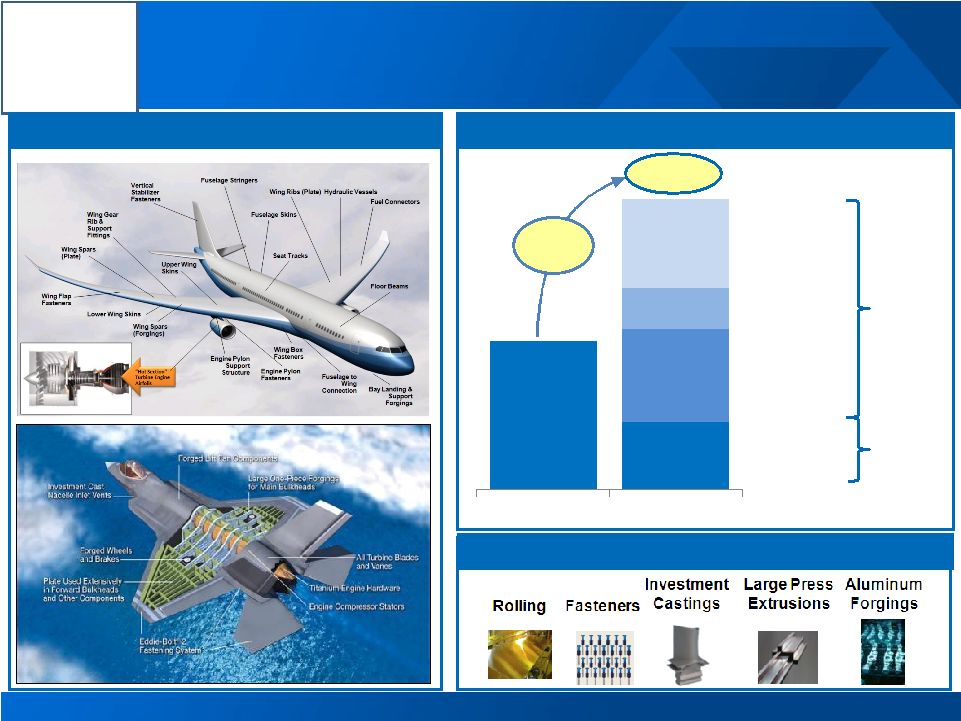

Alcoa

Logo

Alcoa Aerospace: A History of Growth and Innovation

31

Growth in Aerospace Revenue ($b)

Deep Product Breadth

$2.9

Alcoa Content: Tip to Tail –

Wing to Wing

2X

EPS

Fastening

Systems

Forgings &

Extrusions

Power &

Propulsion

Rolled

Products

1 Aerospace revenues are 48% of overall EPS; 2 Aerospace revenues are 11% of

overall GRP GRP

$1.5

$0.7

$0.9

$0.4

$0.9

2002

2010

1

2 |

Alcoa

Logo

Strong Start to 2011 is Just the Beginning

Strengthening Markets

Strong Performance

32

Meeting our Aggressive Targets

EPS: $1.6b in Revenue Growth by 2013 ($b)

GRP: $2.5b in Revenue Growth by 2013 ($b)

Sales

•22% revenue growth from

Q1 2010

Alumina

•$71 Adjusted EBITDA/mt,

8% better than ten-year

average

of $66/mt

Primary Metals

•$438 Adjusted EBITDA/mt,

12% better than ten-year

average

of $390/mt

Flat-Rolled Products

•$173 million Adjusted

EBITDA was record first

quarter

result

Engineered Products &

Solutions

•18% Adjusted EBITDA

Margin was record result

See appendix for Adjusted EBITDA reconciliations

$6.3

$1.9

$8.8

$5.3

to

$5.7

2010

2011

YTD

2013

Target

$4.6

$1.2

$6.2

$3.8

to

$3.9

2010

2011

YTD

2013

Target |

That's why …

That's why …

Alcoa can't wait

Alcoa can't wait

…for tomorrow

…for tomorrow

Alcoa Logo |

Alcoa

Logo Roy Harvey

Director, Investor Relations

A

390 Park Avenue

New York, NY 10022-4608

Telephone: (212) 836-2674

www.alcoa.com

Additional Information

34 |

Alcoa

Logo Annual Sensitivity Summary

35

Currency Annual Net Income Sensitivity

+/-

$0.01 versus USD

Australian $ (USD to AUD)

+/-

$10 million

Brazilian

$ (BRL to USD)

+/-

$ 3 million

Euro €

(USD to EUR)

+/-

$ 2 million

Canadian $ (CAD to USD)

+/-

$ 4 million

+/-

$100/MT = +/-

$200

Million

LME Aluminum Annual Net Income Sensitivity |

Alcoa

Logo Revenue Change by Market

7%

30%

2%

12%

13%

(12%)

14%

(1%)

7%

1%

20%

5%

26%

37%

(2%)

8%

45%

25%

27%

16%

1Q’11 Third Party Revenue

Sequential

Change

Year-Over-Year

Change

36

13%

3%

7%

5%

4%

2%

14%

5%

14%

33%

Aerospace

Automotive

B&C

Comm. Transport

Industrial Products

IGT

Packaging

Distribution/Other

Alumina

Primary Metals |

Alcoa

Logo

Reconciliation of ATOI to Consolidated Net (Loss) Income

Attributable to Alcoa

37

(in millions)

1Q10

2Q10

3Q10

4Q10

2010

1Q11

Total segment ATOI

$ 306

$ 381

$ 328

$

409

$ 1,424

$

555

Unallocated amounts (net of tax):

Impact of LIFO

(14)

(3)

(2)

3

(16)

(24)

Interest expense

(77)

(77)

(91)

(76)

(321)

(72)

Noncontrolling interests

(22)

(34)

(48)

(34)

(138)

(58)

Corporate expense

(67)

(59)

(71)

(94)

(291)

(67)

Restructuring and other charges

(122)

(21)

1

8

(134)

(6)

Discontinued operations

(7)

(1)

–

–

(8)

(1)

Other

(198)

(50)

(56)

42

(262)

(19)

Consolidated net (loss) income attributable to

Alcoa

$ (201)

$ 136

$ 61

$ 258

$ 254

$ 308

|

Alcoa

Logo

Reconciliation of Adjusted Income

38

(in millions, except per-

share amounts)

Income

Diluted EPS

Quarter ended

March 31,

2010

December 31,

2010

March 31,

2011

March 31,

2010

December 31,

2010

March 31,

2011

Net (loss) income

attributable to Alcoa

$ (201)

$ 258

$ 308

$ (0.20)

$ 0.24

$ 0.27

Loss from discontinued

operations

(7)

–

(1)

(Loss) income from

continuing

operations

attributable to Alcoa

(194)

258

309

(0.19)

0.24

0.27

Restructuring and

other charges

119

(8)

5

Discrete tax items*

112

(18)

–

Other special items**

64

(9)

3

Income from

continuing

operations

attributable to Alcoa

–

as adjusted

$ 101

$ 223

$ 317

0.10

0.21

0.28

Income from continuing operations attributable to Alcoa – as adjusted is a non-GAAP financial

measure. Management believes that this measure is meaningful to investors because

management reviews the operating results of Alcoa excluding the impacts of restructuring and other charges, discrete tax

items, and other special items. There can be no assurances that additional restructuring and

other charges, discrete tax items, and other special items will not occur in future

periods. To compensate for this limitation, management believes that it is appropriate to consider both Income from continuing operations

attributable to Alcoa determined under GAAP as well as Income from continuing operations attributable

to Alcoa – as adjusted. * Discrete tax items include the following:

for the quarter ended December 31, 2010, a benefit for the reversal of the remaining valuation

allowance related to net operating losses of an international subsidiary ($16) (a portion was

initially reversed in the quarter ended September 30, 2010) and a net benefit for other small items ($2); and

for the quarter ended March 31, 2010, charges for a change in the tax treatment of federal subsidies

received related to prescription drug benefits provided under certain retiree health benefit

plans ($79), unbenefitted losses in Russia, China, and Italy ($22), interest due to the IRS related to a previously deferred gain associated with the 2007 formation

of the former soft alloy extrusions joint venture ($6), and a change in the anticipated sale structure

of the Transportation Products Europe business ($5). ** Other special items include the following:

for the quarter ended March 31, 2011, costs related to acquisitions of the aerospace fastener business

of TransDigm Group Inc. and full ownership of carbothermic smelting technology from ORKLA ASA

($8) and favorable mark-to-market changes in certain power derivative contracts ($5);

for the quarter ended December 31, 2010, favorable mark-to-market changes in certain power

derivative contracts; and for the quarter ended March 31, 2010, charges related to unfavorable mark-to-market changes in

certain power derivative contracts ($31), power outages at the Rockdale, TX and São

Luís, Brazil facilities ($17), an additional environmental accrual for the Grasse River remediation in Massena, NY ($11), and the write off of inventory related to the

permanent closures of certain U.S. facilities ($5). |

Alcoa

Logo

Reconciliation of Free Cash Flow

39

(in millions)

Quarter ended

Year ended

March 31,

2011

December 31,

2010

Cash provided from

operations

$ (236)

$ 2,261

Capital expenditures

(204)

(1,015)

Free cash flow

$ (440)

$ 1,246

Free Cash Flow is a non-GAAP financial measure. Management believes that

this measure is meaningful to investors because management reviews cash flows

generated from operations after taking into consideration capital expenditures due

to the fact that these expenditures are considered necessary to maintain and

expand Alcoa’s asset base and are expected to generate future cash flows from

operations. It is important to note that Free Cash Flow does not represent the

residual cash flow available for discretionary expenditures since other non-

discretionary expenditures, such as mandatory debt service requirements, are not

deducted from the measure. |

Alcoa

Logo

Reconciliation of Alcoa Adjusted EBITDA

40

($ in millions)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

1Q10

4Q10

1Q11

Net income (loss)

attributable to

Alcoa

$ 908

$ 420

$ 938

$ 1,310

$ 1,233

$ 2,248

$ 2,564

$ (74)

$ (1,151)

$ 254

$ (201)

$ 258

$ 308

Add:

Net income

attributable to

noncontrolling

interests

205

181

212

233

259

436

365

221

61

138

22

34

58

Cumulative effect

of accounting

changes

–

(34)

47

–

2

–

–

–

–

–

–

–

–

Loss (income)

from discontinued

operations

5

101

–

27

50

(22)

250

303

166

8

7

–

1

Provision (benefit)

for income taxes

524

307

367

546

464

853

1,623

342

(574)

148

84

56

138

Other (income)

expenses, net

(295)

(175)

(278)

(266)

(478)

(236)

(1,920)

(59)

(161)

5

21

(43)

(28)

Interest expense

371

350

314

271

339

384

401

407

470

494

118

118

111

Restructuring and

other charges

530

398

(28)

(29)

266

507

268

939

237

207

187

(12)

6

Provision for

depreciation,

depletion, and

amortization

1,144

1,037

1,110

1,142

1,227

1,252

1,244

1,234

1,311

1,450

358

371

361

Adjusted EBITDA

$ 3,392

$ 2,585

$ 2,682

$ 3,234

$ 3,362

$ 5,422

$ 4,795

$ 3,313

$ 359

$ 2,704

$ 596

$ 782

$ 955

Sales

$19,906

$17,691

$18,879

$21,370

$24,149

$28,950

$29,280

$26,901

$18,439

$21,013

$ 4,887

$ 5,652

$ 5,958

Adjusted EBITDA

Margin

17%

15%

14%

15%

14%

19%

16%

12%

2%

13%

12%

14%

16%

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the

following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and

development expenses; and Provision for depreciation, depletion, and amortization. Adjusted EBITDA is a non-GAAP financial

measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA

provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial

obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of

other companies. |

Alcoa

Logo Reconciliation of Alumina Adjusted EBITDA

41

($ in millions, except

per metric ton

amounts)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

4Q10

1Q11

After-tax operating

income (ATOI)

$ 471

$ 315

$ 415

$ 632

$ 682

$ 1,050

$ 956

$ 727

$ 112

$ 301

$ 65

$ 142

Add:

Depreciation,

depletion, and

amortization

144

139

147

153

172

192

267

268

292

406

107

103

Equity (income)

loss

(1)

(1)

–

(1)

–

2

(1)

(7)

(8)

(10)

(3)

(3)

Income taxes

184

130

161

240

246

428

340

277

(22)

60

14

44

Other

(17)

(14)

(55)

(46)

(8)

(6)

2

(26)

(92)

(5)

(3)

–

Adjusted EBITDA

$ 781

$ 569

$ 668

$ 978

$ 1,092

$ 1,666

$ 1,564

$ 1,239

$ 282

$ 752

$ 180

$ 286

Production

(thousand metric

tons) (kmt)

12,527

13,027

13,841

14,343

14,598

15,128

15,084

15,256

14,265

15,922

4,119

4,024

Adjusted

EBITDA/Production

($ per metric ton)

$ 62

$ 44

$ 48

$ 68

$ 75

$ 110

$ 104

$ 81

$ 20

$ 47

$ 44

$ 71

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the

following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and

development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes

gains/losses on asset sales and other nonoperating items. Adjusted EBITDA is a non-GAAP

financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional

information with respect to Alcoa’s operating performance and the Company’s ability to meet

its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

|

Alcoa

Logo Reconciliation of Primary Metals Adjusted EBITDA

42

($ in millions, except

per metric ton

amounts)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

1Q11

After-tax operating

income (ATOI)

$ 905

$ 650

$ 657

$ 808

$ 822

$ 1,760

$ 1,445

$ 931

$ (612)

$ 488

$ 202

Add:

Depreciation,

depletion, and

amortization

327

300

310

326

368

395

410

503

560

571

141

Equity (income) loss

(52)

(44)

(55)

(58)

12

(82)

(57)

(2)

26

(1)

(1)

Income taxes

434

266

256

314

307

726

542

172

(365)

96

53

Other

(8)

(47)

12

20

(96)

(13)

(27)

(32)

(176)

(7)

1

Adjusted EBITDA

$ 1,606

$ 1,125

$ 1,180

$ 1,410

$ 1,413

$ 2,786

$ 2,313

$ 1,572

$ (567)

$ 1,147

$ 396

Production

(thousand metric

tons) (kmt)

3,488

3,500

3,508

3,376

3,554

3,552

3,693

4,007

3,564

3,586

904

Adjusted

EBITDA/Production

($ per metric ton)

$ 460

$ 321

$ 336

$ 418

$ 398

$ 784

$ 626

$ 392

$ (159)

$ 320

$ 438

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the

following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and

development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes

gains/losses on asset sales and other nonoperating items. Adjusted EBITDA is a non-GAAP

financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional

information with respect to Alcoa’s operating performance and the Company’s ability to meet

its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

|

Alcoa

Logo Reconciliation of Flat-Rolled Products Adjusted EBITDA

43

($ in millions, except

per metric ton

amounts)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

1Q11

After-tax

operating income

(ATOI)

$ 253

$ 225

$ 222

$ 254

$ 278

$ 233

$ 178

$ (3)

$ (49)

$

220

$ 81

Add:

Depreciation,

depletion, and

amortization

167

184

190

200

220

223

227

216

227

238

58

Equity loss

2

4

1

1

–

2

–

–

–

–

–

Income taxes

124

90

71

75

121

58

92

35

48

92

33

Other

(5)

(8)

(5)

1

1

20

1

6

(2)

1

1

Adjusted EBITDA

$ 541

$ 495

$ 479

$ 531

$ 620

$ 536

$ 498

$ 254

$ 224

$ 551

$ 173

Total sales

$ 4,868

$ 4,571

$ 4,768

$ 6,042

$ 7,081

$ 8,610

$ 9,597

$ 9,184

$ 6,182

$ 6,457

$ 1,961

Adjusted EBITDA

Margin

11%

11%

10%

9%

9%

6%

5%

3%

4%

9%

9%

Total shipments

(thousand metric

tons) (kmt)

2,482

2,361

1,888

1,755

470

Adjusted

EBITDA/Total

shipments ($ per

metric ton)

$ 201

$ 108

$ 119

$ 314

$ 368

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is

equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative,

and other expenses; Research and development expenses; and Provision for depreciation,

depletion, and amortization. The Other line in the table above includes gains/losses on asset

sales and other nonoperating items. Adjusted EBITDA is a non-GAAP financial measure.

Management believes that this measure is meaningful to investors because Adjusted EBITDA provides

additional information with respect to Alcoa’s operating performance and the Company’s

ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable

to similarly titled measures of other companies. |

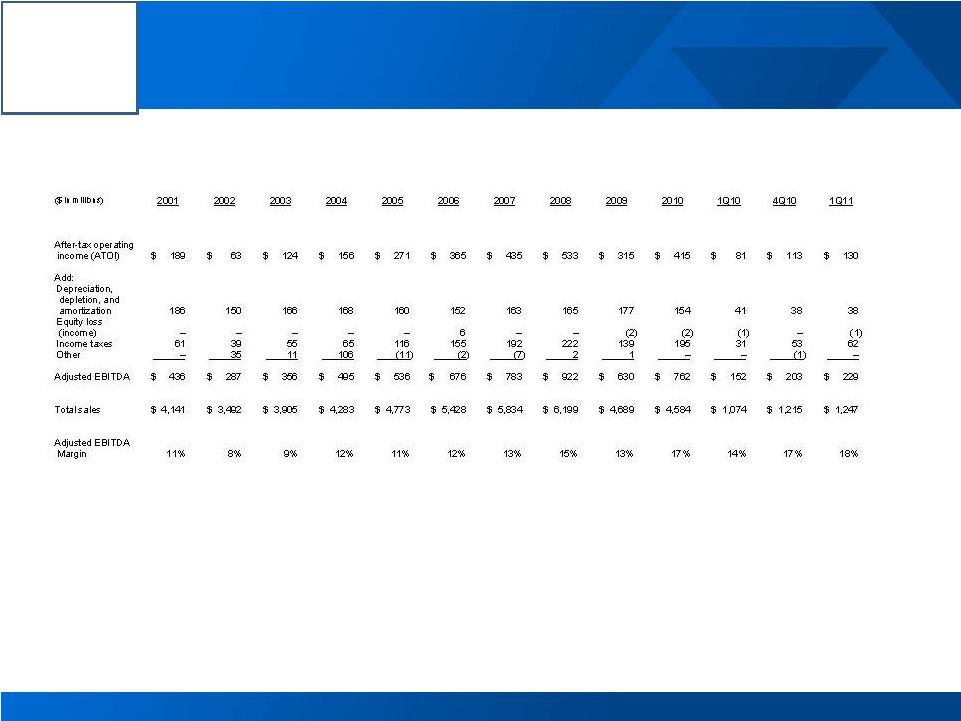

Alcoa

Logo

Reconciliation of Engineered Products and Solutions

Adjusted EBITDA

44

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and

amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold;

Selling, general administrative, and other expenses; Research and development expenses; and

Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other nonoperating items.

Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is

meaningful to investors because Adjusted EBITDA provides additional information with respect to

Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to

similarly titled measures of other companies.

|