Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SmartStop Self Storage, Inc. | d8k.htm |

April 13,

2011 Hosted By

H. MICHAEL SCHWARTZ

Chairman and CEO

2011 First Quarter Report

Exhibit 99.1 |

Disclaimer

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this material, other than historical facts, may be considered

forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”) and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such

forward looking statements to be covered by the applicable safe harbor provisions for

forward-looking statements contained in Section 27A of the Securities Act and

Section 21E of the Exchange Act, as applicable. Such statements include, in

particular, statements about our plans, strategies, and prospects and are subject to

certain risks and uncertainties, including known and unknown risks, which could cause actual

results to differ materially from those projected or anticipated. Therefore, such

statements are not intended to be a guarantee of our performance in future periods.

Such forward-looking statements can generally be identified by our use of

forward-looking

terminology

such

as

“may,”

“will,”

“expect,”

“intend,”

“anticipate,”

“estimate,”

“believe,”

“continue,”

or other similar words. Readers are cautioned not to place undue reliance on these

forward-looking statements,

which

speak

only

as

of

the

date

this

report

is

filed

with

the

Securities

and

Exchange

Commission.

We cannot guarantee the accuracy of any such forward looking statements contained in this

material, and we do not intend to publicly update or revise any forward-looking

statements, whether as a result of new information, future events, or otherwise.

Any such forward-looking statements are subject to risks, uncertainties, and other

factors and are based on a number of assumptions involving judgments with respect to,

among other things, future economic, competitive,

and market conditions, all of which are difficult or impossible to predict accurately. To the

extent that our assumptions differ from actual results, our ability to meet such

forward-looking statements, including our ability

to generate positive cash flow from operations and provide distributions to stockholders, and

our ability to find suitable investment properties, may be significantly hindered.

All forward-looking statements should be read in light of the risks identified in

Part I, Item 1A of our Annual Report on Form 10-K for the Year Ended December 31,

2010. |

Agenda

2010 Financials

Portfolio Update

Property Management

Strategic Vision |

2010

Financials 2010 Year-End

Total Properties: 45

Total Units: 31,640

Net Rentable Sq. Ft.: 3,949,500

Total Assets: $307.4 Million

(As of 3/31/2011)

(61)

(40,750)

(5,072,300)

(approx. $389M) |

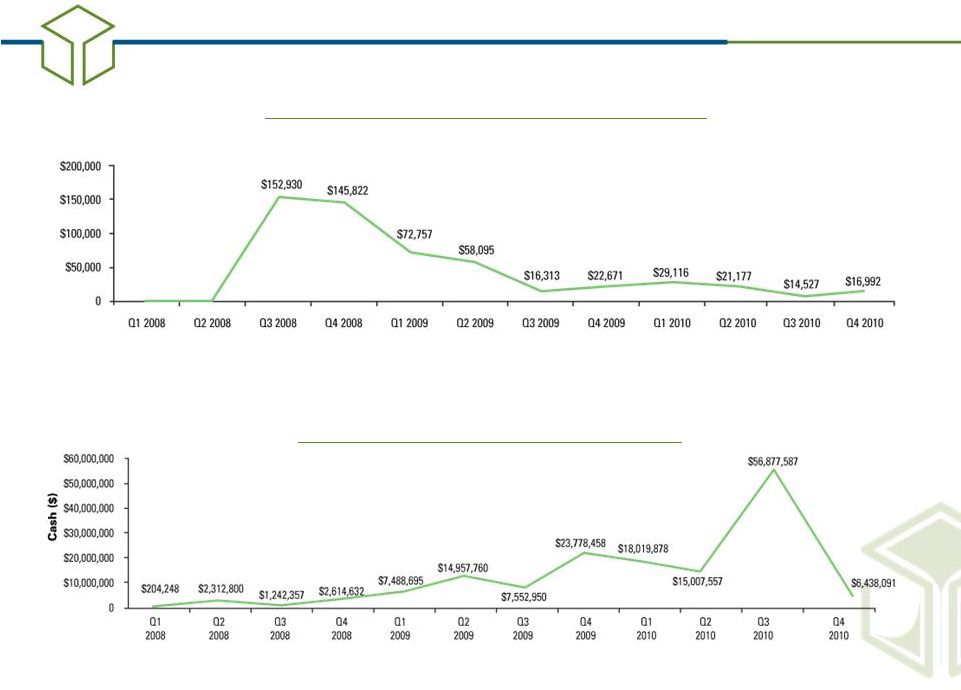

Historical

Annual Distribution Yield* 2010 Financials

* Distributions are declared quarterly by the Board of Directors. During the offering period,

a substantial portion of distributions may be funded by offering proceeds or

borrowings, some of which may constitute a return of capital. Future distribution

declarations are at the sole discretion of the Board of Directors. |

Total Assets

by Quarter 2010 Financials |

Total

Revenues by Quarter 2010 Financials |

G&A Per

Property by Quarter 2010 Financials

Cash on Hand by Quarter |

Debt

Maturities Next 5 Years* 2010 Financials

* Includes Amortization |

Historical

Annual Occupancy 2010 Financials |

Same Store

Occupancy by Quarter 2010 Financials |

Portfolio

Highlights (as of 03/31/2011)

Properties:

61

Net Rentable SF:

5,072,300

Total Units:

40,750

States:

16

Ontario, Canada:

2

Portfolio Update |

Wholly Owned

Properties by Quarter Portfolio Update |

Net Rentable

Square Feet by Quarter Portfolio Update |

Square

Footage

by

State

(as

of

03/31/2011)

9.38%

4.16%

7.3%

4.79%

11.07%

18.4%

2.85%

1.31%

5.18%

1.29%

1.98%

7.91%

.97%

4.95%

3.06%

11.87%

3.53%

Portfolio Update |

2011 First

Quarter Acquisitions Portfolio Update

* Acquired through acquisition of 100% of the ownership interests in Self Storage I,

DST. (1) Amount of units and square footage when construction is completed.

Property

Approx. Units

Approx. Rentable Sq. Ft. (net)

1

Concord –

NC*

530

56,200

2

Hickory –

NC*

600

70,600

3

Morganton –

NC*

450

52,100

4

El Paso II –

TX*

520

72,900

5

El Paso III –

TX*

750

81,200

6

El Paso IV –

TX*

510

67,400

7

El Paso V –

TX*

420

60,500

8

Dallas –

TX *

660

131,000

9

Lawrenceville I –

GA*

500

73,500

10

Lawrenceville II –

GA*

500

60,600

11

Mississauga –

Ontario –

Canada

800

(1)

101,000

(1)

12

El Paso I –

TX

290

(1)

40,800

(1)

13

Las Vegas VII –

NV

720

58,400

14

Las Vegas VIII –

NV

510

60,600

15

SF Bay Area –

Morgan Hill –

CA

490

61,000

16

SF Bay Area –

Vallejo –

CA

860

75,000

Total

9,110

1,122,800 |

Potential

Acquisitions* Portfolio Update

Property

Acquisition Price

Approx. Units

Approx. Rentable Sq. Ft. (net)

1

SF Bay Area –

San Lorenzo –

CA

$2,850,000

640

62,000

2

SF Bay Area –

Gilroy –

CA

$6,560,000

610

63,500

3

Las Vegas V –

NV

$4,600,000

790

69,000

4

Ladera Ranch –

CA

$20,900,000

(1)

980

102,000

5

Neptune –

NJ

$3,760,000

530

54,500

6

Peachtree City –

GA

$5,290,000

670

123,400

7

Buford –

GA

$2,500,000

520

68,900

8

Jonesboro –

GA

$2,440,000

730

106,400

9

Ellenwood –

GA

$2,260,000

300

40,700

10

Marietta II –

GA

$2,620,000

480

61,200

11

Collegeville –

PA

$3,030,000

540

58,400

12

Skippack –

PA

$2,340,000

390

56,300

13

Ballston Spa –

NY

$5,030,000

690

82,800

14

Trenton –

NJ

$7,620,000

660

85,100

15

Fredericksburg –

VA

$4,180,000

630

59,600

16

Sandston –

VA

$6,720,000

680

78,100

Total

$82,700,000

9,840

1,171,900

*There can be no assurance that we will complete the acquisition of any of these properties.

In some circumstances, if we fail to complete the acquisitions, we may forfeit our

earnest money. Other properties may be identified in the future that we may acquire prior to or instead of these properties. Due to the

considerable conditions to the consummation of these acquisitions, we cannot make any

assurances that the closings are probable.

(1) Includes an adjoining parcel of vacant land, which has an acquisition price of

approximately $3,900,000. |

New

Technology to View Updates SSTI Mobile App

Available on Apple, Android and

Blackberry market

Free download (search “SSTI”)

User-friendly and content-rich

Receive the latest updates

1

st

non-traded REIT app on the

iPhone, Android and Blackberry

Portfolio Update |

Property

Management We are an Operating Company

Experienced executive team

Highly skilled district management team

Dedicated training of local on-site staff

Customer-centric approach

Competitive pricing strategy

One-stop shopping experience

Branding, Branding, Branding

Marketing, Marketing, Marketing |

Property

Management Integrated Marketing Strategy

Online, phone and walk-in customers |

Online

New website launch improves customer service

Pay Per Click (PPC) campaign

Generate leads

Improve brand recognition

Search Engine Optimization (SEO) process

Gain dominant position in natural listings

Take advantage of minimal cost per prospect

Social media sites

Mobile-friendly version

Property Management

www.smartstopselfstorage.com |

Phone

New “print”

Yellow Page and “internet”

Yellow

Page campaigns

Partnership with OpenTech Alliance for national

rental call center

Expanded business hours with high quality

agents

Property Management

888-97-STORAGE |

Walk-in

Strategically position brand on building exteriors,

interiors and on available signage

23 Properties are now branded

5 more properties are scheduled to be

completed in the near term

10 additional properties have permits, of these 5

already have temporary signage

Branded our own small fleet of trucks

Property Management |

Economies of

Scale Real economies for self storage

More than any other asset class

Property Management |

Strategic

Vision |

Strategic

Vision Bill Gross, who runs the world's biggest bond fund at Pacific

Investment Management Co. (PIMCO), said Treasuries

"have little value" and the U.S. faces an inflation threat.

–

Bloomberg, March 31,

2011 |

Strategic

Vision $1,080.00

(Million)

$631.58

(Million)

$1,730.00

(Million)

$881.40

(Million)

$953.28

(Million)

$724.22

(Million)

$18,710.00

(Million)

$5,280.57

(Million)

PUBLICLY TRADED SELF STORAGE REITS

PUBLIC NON-TRADED SELF STORAGE REIT

(1) Wall Street Journal 4/7/11

(2) Wall Street Journal 12/31/10

Market Cap

(1)

Book Value

(2) |

Strategic

Storage Holdings, LLC Ranks # 12

Inside Self Storage

2011 Top-Operators List

April, 2011 Issue

Strategic Vision |

H. MICHAEL

SCHWARTZ Chairman and CEO

Strategic Storage Trust, Inc.

Questions and Answers |

April 13,

2011 Hosted By

H. MICHAEL SCHWARTZ

Chairman and CEO

2011 First Quarter Report |