Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TENET HEALTHCARE CORP | d8k.htm |

| EX-99.1 - COMPLAINT - TENET HEALTHCARE CORP | dex991.htm |

Summary of Allegations in the Complaint

Filed by Tenet Healthcare Corporation

Against Community Health Systems

April 11, 2011

Exhibit 99.2 |

2

Additional Information

Tenet Healthcare Corporation (“Tenet”) will file with the Securities and

Exchange Commission (“SEC”) a proxy statement, accompanied by a

WHITE proxy card, in connection with its 2011 annual meeting of stockholders. Any definitive proxy

statement will be mailed to stockholders of Tenet. INVESTORS AND

SECURITYHOLDERS OF TENET ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED

WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and securityholders will

be able to obtain free copies of these documents (when available) and other

documents filed with the SEC by Tenet through the website maintained by the

SEC at http://www.sec.gov. The information contained in this filing is a

summary of allegations made in a complaint filed by Tenet against Community

Health

Systems,

Inc.,

Wayne

T.

Smith,

and

W.

Larry

Cash

on

April

11,

2011,

in

the

United

States

District

Court

for

the

Northern District of Texas. A copy of the complaint has been filed by Tenet

with the SEC and is available through the website maintained by the SEC at

http://www.sec.gov. Certain Information Regarding Participants

Tenet and certain of its respective directors and executive officers are deemed to

be participants under the rules of the SEC. Information regarding

these participants is contained in a filing under Rule 14a-12 filed by Tenet with the SEC on January 7,

2011. This filing and other documents can be obtained free of charge from the

source indicated above. Additional information

regarding

the

interests

of

these

participants

in

any

proxy

solicitation

and

a

description

of

their

direct

and

indirect

interests, by security holdings or otherwise, will also be included in any proxy

statement and other relevant materials to be filed with the SEC if and when

they become available. Legal disclaimer |

3

Overview

CHS has for many years systematically billed cases as higher-paying inpatient

admissions that would have been billed as lower-paying outpatient

observations in most U.S. hospitals. CHS’ strategy specifically focuses on converting

emergency room visits to medically unnecessary inpatient admissions.

When patients present themselves to hospitals, they are either 1) seen and

discharged; 2) placed in

outpatient

observation

status;

or

3)

admitted

as

inpatients.

Doctors

make

the

treatment

decision, with input from hospital employees. Most (>75%) U.S. hospitals

use one of two objective systems as the basis for these determinations. CHS

uses its own set of “Admissions Justifications” called the

“Blue Book.” The difference in Medicare payments between an

outpatient observation stay and an inpatient admission is

substantial. Other payers (e.g., Medicaid and Managed Care) generally pay more for

inpatient admissions than for observations, but actual rates depend on contracts.

Only Medicare fee-for-service data is publicly available.

CHS’

use of observation status is less than half the national average rate for

U.S. hospitals. There is no legitimate explanation for the difference.

No other publicly traded hospital company follows a similar practice.

|

4

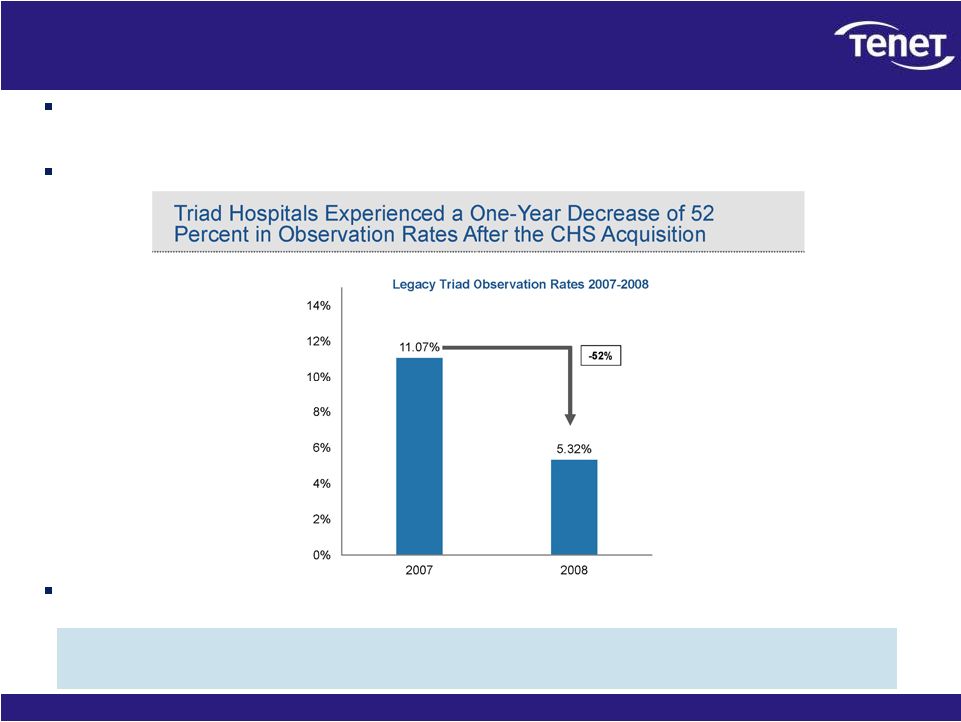

CHS’

strategy

of

driving

up

admissions

and

driving

down

observations

is

unsustainable:

It depends

on

a

continuing

pipeline

of

acquisitions

of

hospitals

with

normal

observation rates that can be driven down. CHS dropped Triad’s observation

rate 52% following the acquisition.

Low observations, one-day stays, and related issues are already a focus area

of government investigators and contractors.

Implications for CHS:

Unwinding the strategy will materially reduce admissions, revenues, profits, and

cash flows going forward.

Potential

liability

is

well

in

excess

of

$1

billion

for

2006

–

2009

for

the

Medicare

fee-

for-service portion of CHS’

business alone.

Serious

questions

are

raised

regarding

the

accuracy

of

CHS’

historical

financial

statements.

Implications for CHS’

$6 proposal to acquire Tenet:

CHS’

stock is worth less than stated.

CHS’

ability to finance the cash portion of the offer may

be impaired. Overview, cont. |

5

What is the nature of this litigation?

The litigation seeks to compel CHS to disclose fully its unique and

non-industry standard patient admissions criteria and billing practices

and the financial and legal implications arising

from

them.

Under

SEC

rules,

CHS’

statements

are

proxy

solicitation

materials

directed toward Tenet’s stockholders.

CHS’

actions have resulted in materially misleading financial reports and

statements: •

Admissions statistics and trends have been overstated.

•

Revenues, profits, and cash flows have been overstated.

•

CHS’

explanations of business trends have been misleading.

•

CHS’

explanations of synergies from acquired hospitals have been misleading and

incomplete. CHS has followed an unsustainable business practice that is

inconsistent with Federal regulations.

Substantial

undisclosed

liabilities

may

exist

to

Medicare,

state

Medicaid

programs,

private

insurance companies, and patients.

The litigation seeks to compel CHS to fully and accurately disclose the

risks and financial impact of its admissions strategy, and to prevent

further misleading statements. |

6

Has CHS violated Medicare requirements?

Medicare reimburses hospitals only for treatment that is “reasonable and

necessary.” 42 U.S.C.

§

1395y(a)(1)(A).

Inpatient care rather than outpatient care is required only if the patient’s

medical condition, safety or health would be significantly and directly

threatened if care was provided in a less intensive setting. Medicare Program Integrity Manual, Chapter 6, Section 6.5.2.

Outpatient observation is a well-defined set of specific, clinically

appropriate services, which include ongoing short term treatment, assessment

and reassessment, rendered before a decision can be made regarding whether a

patient will require further treatment as an inpatient or is able to be

discharged. Observation services are commonly ordered for patients who

present to the emergency department and who require a period of

treatment

or

monitoring

before

making

a

decision

on

admission

or

discharge.

Medicare

Benefit

Policy Manual, Chapter 6, Section 20.6. See also Medicare Claims

Processing Manual, Chapter 4, Section 290. CHS causes patients to be

admitted to its hospitals who should be observed under Medicare

requirements. CHS overbills these cases as inpatient admissions when they

should be billed as outpatient observations.

CHS systematically overbills Medicare and likely other payers.

|

7

How did Tenet learn of these practices?

CHS stated on a December 10, 2010 conference call that a combination with Tenet

would offer opportunities for synergies.

Tenet conducted due diligence to evaluate potential synergies that might be created

through a combination with CHS.

Tenet’s independent consultant, using the American Hospital Directory

database, found significant discrepancies

between admission patterns at CHS and the industry. Tenet

then

engaged

a

second

consulting

firm,

Avalere

Health

LLC,

to

perform

a

second

independent

analysis

using

the

Centers

for

Medicare

&

Medicaid

Services’

Inpatient

Prospective Payment System Standard Analytic Files (which contains source data from

which the MedPAR database is constructed) and Outpatient Standard Analytic

Files. Each analysis found CHS’

observation rate* to be significantly lower than the industry and

its peer companies.

CHS “grew”

admissions by implementing dramatic reductions in observation status at

hospitals it acquired, particularly in the case of Triad.

Two independent consultants have confirmed that

CHS’

observation rate is less than half of the national average.

* A hospital’s “observation rate” is essentially the percentage of patients treated in

a hospital bed that are billed as “observation” rather than “inpatient.”

|

8

CHS’

strategy inflates admissions, revenues,

profits, and cash flows

CHS admitted approximately 62,000 Medicare fee-for-service patients from

2006-2009 (approximately 20,000 in 2009 alone) who would have been

observed as outpatients if CHS’

observation rate were at the national average.

CHS admitted approximately 82,000 Medicare fee-for-service patients from

2006-2009 (approximately 31,000 in 2009 alone) who would have been

observed as outpatients if CHS’

observation rate were the same as LifePoint.

Taking only CHS’

highest volume and lowest acuity Medicare patients, CHS receives, on

average,

over

$3,300

(or

approximately

257%)

more

per

“admitted”

patient than

“observed”

patient.

Medicare

fee-for-service

patients

generated

27%

of

CHS’

net

operating

revenue

in

2010.

The effect of CHS’

admissions strategy on its performance is much greater if the strategy

has been applied across all patient categories.

This practice results in greater profits to CHS, but additional costs to Medicare,

and likely to Medicaid programs, private insurance companies, and

patients. CHS systematically overbills Medicare, and likely other

payers, overstating profits. |

9

These practices may subject CHS to substantial

undisclosed liability

Under the Federal False Claims Act, the government may recover damages of up to

three times the originally billed amount, plus penalties of up to $11,000

per false claim. 31 USC §

3729(a).

As a result of CHS’

admissions practices, it may have overbilled payers for Medicare fee-

for-service patients by approximately $280 million to $377 million in

2006-2009 alone. If treated

as

false

claims,

this

conduct

could

result

in

liabilities

well

in

excess

of

$1

billion

for

2006-2009 alone.

As the Blue Book was copyrighted in 2000, it appears the practice of driving down

observation status has existed for at least ten years.

During this same period, CHS likely overbilled other payers as well, such as

Medicare Advantage plans.

CHS’

hospitals may also be subject to exclusion from participating in Medicare.

CHS may have significant financial exposure and could face exclusion

from participating in Medicare.

* |

10

CHS’

admissions practices are not sustainable

The

Office

of

Inspector

General

of

the

U.S.

Department

of

Health

and

Human

Services (“OIG”) closely scrutinizes medically unnecessary inpatient

admissions.

In late 2010, Medicare Recovery Audit Contractors (RACs) began recovering

overpayments from medically unnecessary inpatient admissions.

Numerous non-CHS hospitals with low observation rates have been

investigated by the U.S. Department of Justice.

In its 10-K, CHS disclosed that the OIG issued a subpoena for documents

related to, among other things, CHS’

admissions criteria, case management,

coding, billing, and compliance in its hospital in Laredo, Texas. CHS also

disclosed that the Attorney General of Texas issued Civil Investigative

Demands for all of CHS’

hospitals in Texas concerning “emergency department

procedures and billing.” |

11

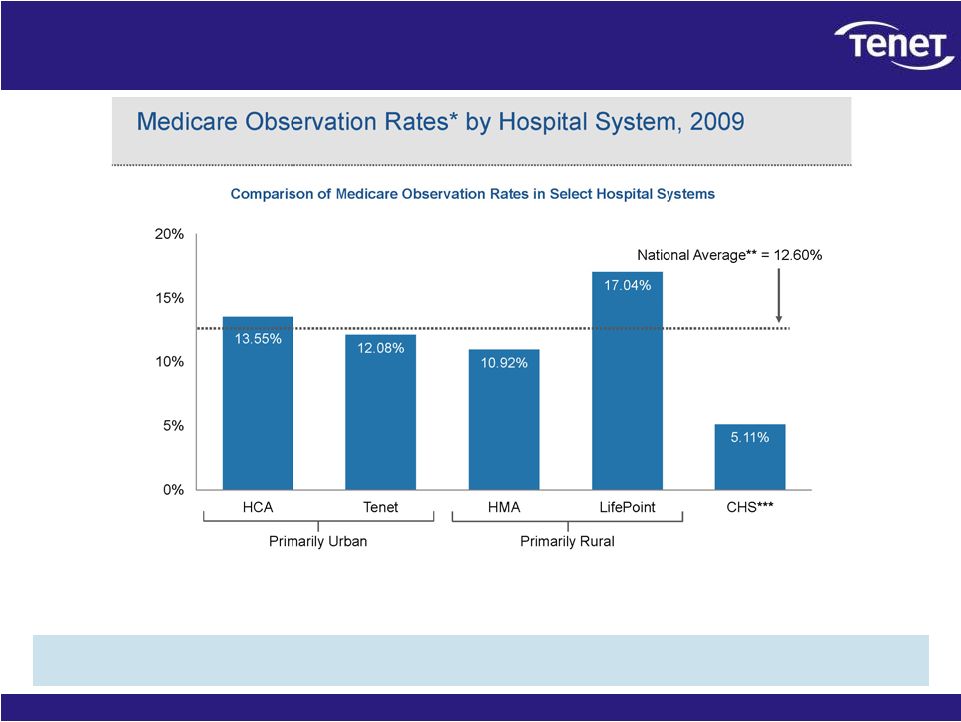

CHS’

observation rate is much lower than other

large hospital groups and the industry as a whole

* Observation rate

is

defined

as

total

unique

observation

claims

divided

by

the

sum

of

total

unique

observation

claims

and

total

inpatient

short-stay

acute

care

hospital

claims.

** National average represents all short-stay acute care hospitals with

emergency departments and observation stays, with the exception of critical access hospital (CAHs); for a total of 3,004 hospitals in 2009.

*** Our analysis

limited

the

130

CHS

hospitals

to

111

hospitals

in

2009,

which

excluded

3

non-inpatient

short-stay

acute

care

hospitals,

4

hospitals

acquired

in

2010,

6

CAHs,

and

6

hospitals

that

did

not

bill

for

ER

visits and/or observation stays.

Source:

Analysis

based

on

the

Centers

for

Medicare

&

Medicaid

Services’

Outpatient

Standard

Analytic

Files

(SAFs)

for

CYs

2006-2009

and

the

Inpatient

Prospective

Payment

System

SAFs

for

CYs

2006-2009;

the

inpatient

SAFs

represent

similar

data

found

in

MedPAR

but

more

granular

since

the

SAFs’

unit

of

analysis

is

the

claim

and

MedPAR

data

is

aggregated

to

the

beneficiary

stay.

Other publicly traded hospital groups have

observation rates near or above the industry average. |

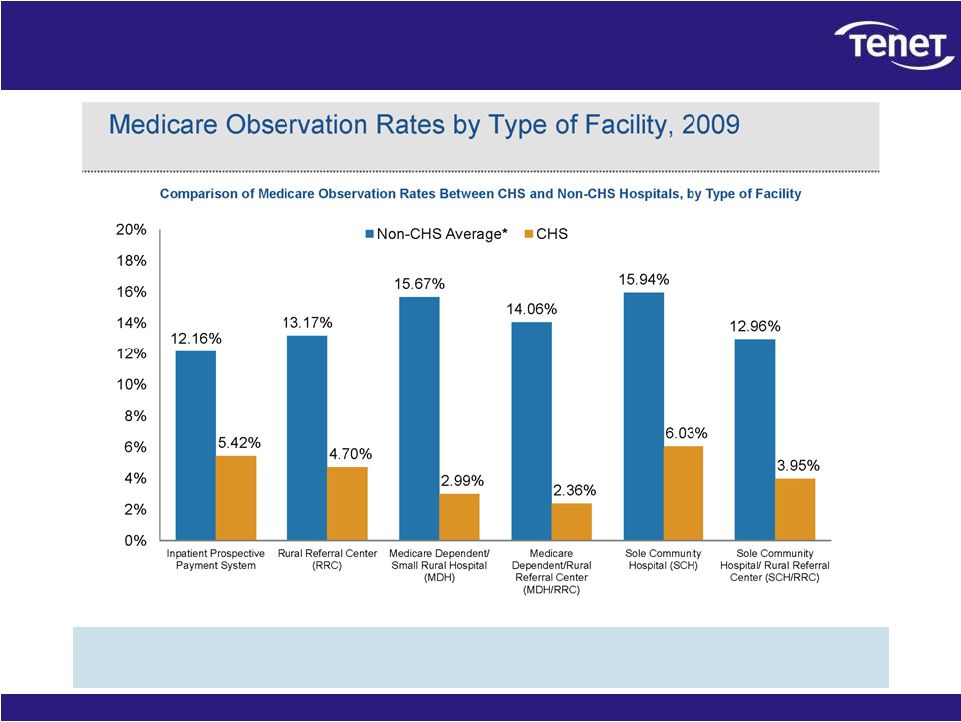

12

CHS’

hospitals, classified by facility type,

have observation rates well below national averages

CHS’

observation rates by Medicare facility type are well below

the rates for similar facilities across the U.S.

* Non-CHS Average is comprised of all inpatient short-stay acute care

hospitals excluding all CHS hospitals. |

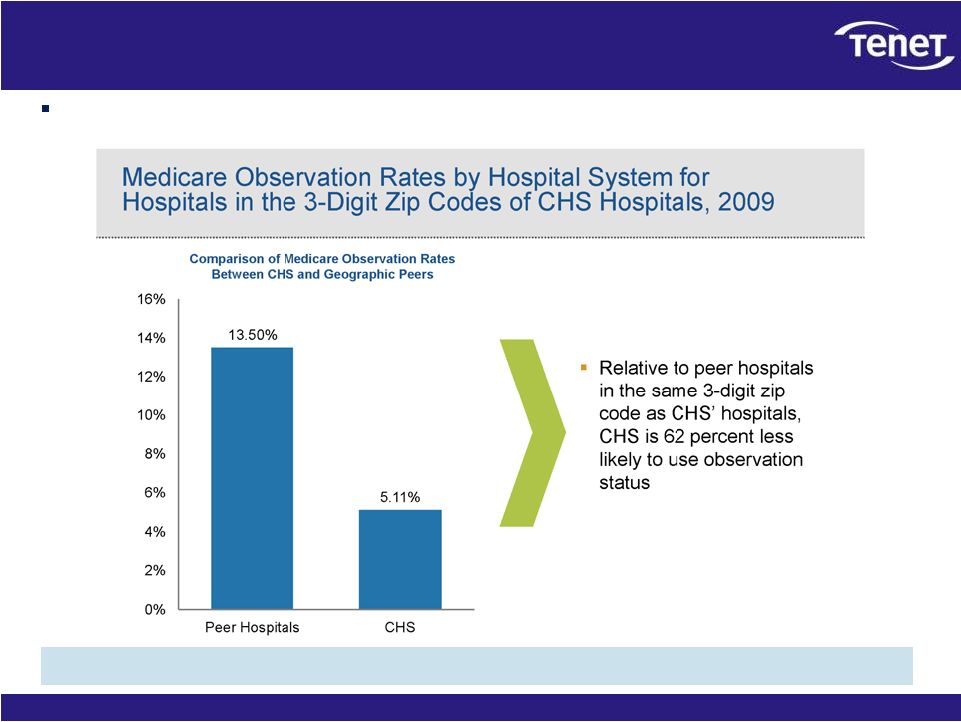

13

CHS’

hospitals have less than half the observation

rate of hospitals in the same markets

Observation rates for hospitals within the 3-digit zip codes of CHS hospitals

are more than two times that of CHS hospitals.

The location of CHS hospitals does not explain their low observation rate.

|

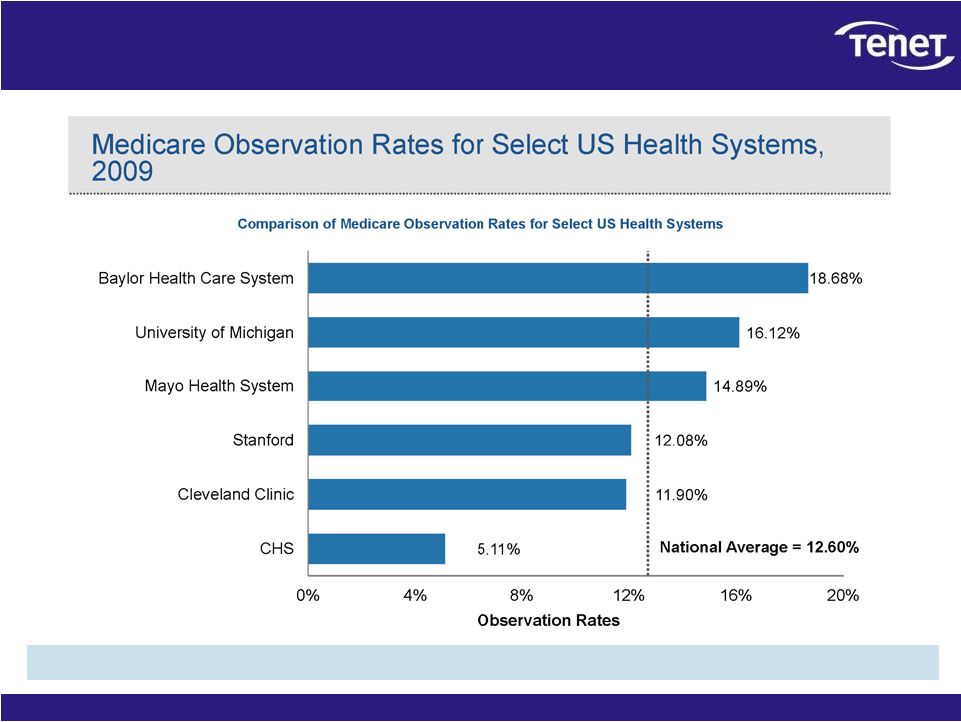

14

Prominent hospital groups do not have low

observation rates

Nationally recognized hospital groups have observation rates well in excess of

CHS’. |

15

The lower acuity mix of CHS’

hospitals does not

explain CHS’

low observation rate

Hospitals with lower acuity –

like CHS –

tend to have higher, not

lower, observation rates.

A hospital’s Medicare “Case Mix Index”

measures the acuity level of its patients.

Hospitals with a higher Case Mix Index see more acutely ill patients that

require more complex or extensive treatments.

Hospitals with a lower Case Mix Index see less acutely ill patients that

require less complex or extensive treatments.

The average CHS hospital has a lower Case Mix Index (1.28) than the average

hospital nationally (1.43).

This makes sense –

CHS’

predominantly rural hospitals tend to see less

acute patients who require less complex or extensive treatments.

Statistical analysis shows that hospitals with a lower Case Mix Index have

higher, not lower, observation rates. |

16

There is no reasonable explanation for CHS’

high

admission rate and low observation rate

It’s

not

the

facility

type:

CHS’

observation

rate

is

well

below

industry

peers with similar facility types including other rural hospitals.

It’s

not

the

location:

CHS’

hospitals

have

less

than

half

the

observation

rate of other hospitals in the same markets.

It’s

not

the

quality

of

care:

CHS’

observation

rate

is

lower

than

hospital

groups known for high quality.

It’s

not

the

acuity

mix:

CHS’

lower

acuity

hospitals

should

result

in

a

higher

observation

rate

–

not

lower. |

17

CHS uses the Blue Book to drive admissions higher

and observations lower

Approximately three-quarters of U.S. hospitals, as well as many Medicare

auditors, utilize one of two sets of independent, evidence-based

clinical criteria to determine whether a patient qualifies for inpatient

admission. •

Approximately

3,700

U.S.

hospitals

use

the

InterQual

Criteria,

developed

by

McKesson

Corporation.

•

Approximately

1,000

U.S.

hospitals

use

the

Milliman

Care

Guidelines,

developed

by

Milliman,

Inc.

•

InterQual and Milliman were developed by independent physicians and contain

thousands of medical references.

CHS uses a 40-page “Blue Book.”

•

The

CHS

Blue

Book

was

developed

by

CHS,

copyrighted

in

2000,

and

lacks

a

single

reference

to

a medical journal or other independent source.

•

The

Blue

Book

is

utilized

only

by

CHS’

hospitals.

Unlike the InterQual and Milliman criteria, the Blue Book criteria are called

“Admission Justifications.”

In

numerous

cases,

including

those

under

scrutiny

by

regulators,

the

Blue

Book

justifies

admission when standard clinical practice and InterQual and Milliman do not.

CHS’

Blue Book is inconsistent with industry standard practice, but

drives higher revenues and profits. |

18

The Triad case study

CHS

has

repeatedly

cited

the

“synergies”

it

achieved

in

the

acquisition

of

Triad

Hospitals,

Inc.

in

2007.

Never has it disclosed that these synergies were based

on driving medically unnecessary admissions and reducing

observations. Prior to its acquisition by CHS, Triad’s hospitals had an

observation rate above the national average. Following CHS’

acquisition, the observation rate of the acquired Triad hospitals dropped by 52%

while observation rates nationally were increasing.

A

potentially

material

portion

of

the

“synergies”

achieved

at

Triad

resulted from driving down observation rates. |

19

Tenet’s lawsuit seeks to compel CHS to disclose its admissions

practices. CHS has increased its revenues and its profits by inappropriately

billing Medicare, and likely

state

Medicaid

programs

and

other

payers,

for

higher-paying

inpatient

admissions

rather than lower-paying outpatient observation stays.

No other publicly traded hospital company follows a similar practice.

CHS’

strategy is unsustainable; unwinding the practice will materially reduce

admissions revenues, profits, and cash flows; and it has exposed the company

to significant potential liabilities.

Improper billings for Medicare fee-for-service patients are estimated at

$280 million to $377 million between 2006-2009 alone.

Revenue

from

Medicare

fee-for-service

patients

represents

only

27%

of

CHS’

net

operating

revenues.

Revenues from other payers are also likely impacted.

Liabilities for this conduct related to Medicare fee-for-service patients

alone could be well in excess of $1 billion.

The

implications

for

CHS’

proposal

to

acquire

Tenet:

CHS’

stock is worth less than stated.

CHS’

ability to finance the cash portion may be

impaired. Summary |