Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TENET HEALTHCARE CORP | d8k.htm |

| EX-99.2 - SUMMARY OF ALLEGATIONS - TENET HEALTHCARE CORP | dex992.htm |

Exhibit 99.1

UNITED STATES DISTRICT COURT

FOR THE NORTHERN DISTRICT OF TEXAS

|

TENET HEALTHCARE CORPORATION,

Plaintiff,

v.

COMMUNITY HEALTH SYSTEMS, INC., WAYNE T. SMITH, and W. LARRY CASH,

Defendants.

|

X : : : : : : : : : : : X |

CIVIL ACTION NO.

COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS |

COMPLAINT

Plaintiff Tenet Healthcare Corporation (“Tenet”), by and through its undersigned attorneys, alleges as follows:

SUMMARY AND NATURE OF THE ACTION

1. This action seeks to compel Community Health Systems, Inc. (“CHS”) to disclose fully its practice of systematically admitting, rather than observing, patients in CHS hospitals for financial, rather than clinical, purposes. Tenet’s shareholders are at risk of being harmed by false and misleading statements and omissions by CHS, a company whose financial performance has, for many years, been driven by the improper and undisclosed practice of systematically admitting patients into CHS hospitals despite no clinical need. CHS’s practice of greatly underusing “observation” status and consequently overusing “inpatient admission” status has served to overstate its growth statistics, revenues, and profits, and has created a substantial undisclosed financial and legal liability to the federal government, numerous state governments, private insurance companies, and patients.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 1

2. By failing to disclose its improper business practices and substantial liabilities, CHS has made false and misleading statements and material omissions to its own shareholders. Now, as CHS attempts to acquire Tenet for $6.00 per share, $1.00 of which would be paid in CHS stock to Tenet’s shareholders, CHS is making false and misleading statements to Tenet’s shareholders in the hope that they will exert pressure upon Tenet to accept an inadequate offer, or elect CHS-nominated directors who will approve a transaction with CHS. Since late 2010, for example, CHS has stated that a combined CHS-Tenet would benefit patients by “improv[ing the] quality of care” and benefit payers and employers by providing “cost-efficient” healthcare services. CHS has also claimed that there was “significant synergy potential” in its proposed acquisition of Tenet, similar to the synergies CHS claims to have achieved through its acquisition of other hospitals. CHS also has called itself an “Industry Leader in Admissions Growth” since January 2011.

3. But what CHS has failed to disclose—and what has made CHS’s proxy solicitation materials1 materially misleading—is how CHS has managed to realize “synergies” from its hospital acquisitions: for at least a decade, CHS has implemented admissions criteria utilized by CHS physicians to systematically steer medically unnecessary inpatient admissions at CHS hospitals. CHS artificially increases inpatient admissions for the purpose of receiving substantially higher and unwarranted payments from Medicare and other sources. This admissions practice is the core “synergy” and driver of CHS’s strategy for acquiring hospitals. Specifically, CHS has managed to improve the performance of its acquired hospitals not by growing the business, but by increasing margins through changing the acquired hospitals’

| 1 | As set forth herein, the proxy solicitation materials at issue in this Complaint are CHS’s SEC filings containing CHS’s public statements made in support of its solicitation of proxies for the election of directors at Tenet’s next annual meeting. |

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 2

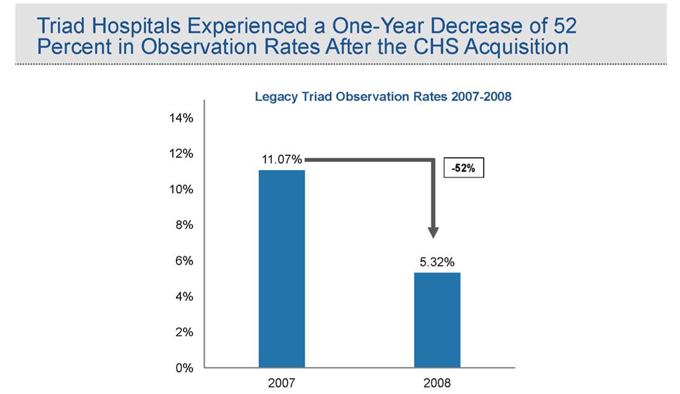

admissions criteria and drastically lowering the rate at which its hospitals utilize “observation” status. To take just one example, CHS trumpets the synergies that it created through its 2007 acquisition of Triad Hospitals, Inc. (“Triad”), but what CHS does not disclose is that it achieved these synergies by slashing the use of observation at the former Triad hospitals by more than 50% in one year, and instead admitting those would-be observation patients, generating far greater revenue for the hospital. This undisclosed conduct violates both Medicare rules and widely accepted standards of clinical care. It also subjects federal and state healthcare programs, insurance companies, local employers, and patients to excessive costs for needless hospital stays.

4. This improper admissions practice, which sets CHS apart from other peer hospital groups in the country, allowed CHS to receive approximately $280 million to $377 million, between 2006 and 2009, by treating Medicare patients on an admitted inpatient basis who should have been treated in observation. As a result, CHS has been paid by Medicare, and likely state Medicaid programs, private insurance companies, and other payers,2 untold hundreds of millions—if not billions—of dollars for unnecessary hospital admissions. CHS may well be subject to liability and damages of well over $1 billion for its practices during the 2006-2009 period, not to mention damages to other payers and to the tens of thousands of patients who should never have been admitted as inpatients in CHS hospitals.3 CHS may even be subject to

| 2 | The information set forth in this Complaint is based on public information relating to Medicare patients alone. There is no public information available on payments by other payers, but there is every reason to believe that patients covered by other payers also are subject to CHS’s improper admissions practices. |

| 3 | As set forth in detail below, if CHS had utilized observation at the same rate as the industry average, over 62,000 CHS Medicare patients would have been treated and billed as observation patients rather than admitted to the hospital and billed to Medicare as inpatients between 2006 and 2009. That number jumps to nearly 82,000 if CHS had observed patients at the same rate of another hospital operator, LifePoint. As a result of CHS physicians |

[Footnote continued on next page]

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 3

exclusion from participating in Medicare altogether, which could threaten the viability of the company entirely.

5. As a result of the revenues generated from these improper admissions, CHS’s stock price has for many years been artificially inflated. CHS now seeks to use its artificially inflated stock price to pay, in part, for the proposed acquisition of Tenet.

6. Tenet, therefore, brings this action to compel CHS to disclose fully its admissions practices and the financial and legal risks inherent in them. Only through full disclosure can Tenet’s shareholders appropriately evaluate the current CHS acquisition proposal or any subsequent proposals by CHS. Tenet also seeks to recover the substantial costs incurred in order to have CHS correct its misleading proxy solicitation materials.

* * * * *

7. This litigation addresses core principles of patient care that CHS—and CHS alone among its peers in the industry—has fundamentally ignored in order to improve its own bottom line. CHS has placed profits before patients, and in so doing has placed its future in peril. In particular, at the center of this litigation is an issue that hospitals and medical staff deal with every day: how a patient is appropriately treated at a hospital, and to the extent that patient is covered by Medicare, how that treatment should be billed to Medicare.

[Footnote continued from previous page]

| improperly admitting approximately 62,000-82,000 patients to CHS hospitals, CHS received approximately $280-$377 million between 2006 and 2009. Because the United States Department of Justice may impose treble damages for false Medicare claims, and the federal False Claims Act imposes a penalty of up to $11,000 per claim for improperly billed claims, CHS may face well over $1 billion in undisclosed liabilities—and this is only for Medicare Fee-for-Service patients, which made up approximately 27% of CHS’s net operating revenue in 2010. These liabilities do not include CHS’s potential liability to other payers who may have been harmed by CHS’s admissions practices, including insurance companies, state Medicaid programs, employers, and patients. |

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 4

8. When a patient visits a hospital, physicians must determine, based on the severity of the patient’s condition and expected treatment, whether the patient should be: i) admitted to the hospital for inpatient treatment; ii) observed as an outpatient for a period typically lasting up to 24 hours, but rarely more than 48 hours, before a decision can be made whether the patient requires hospital admission or may be discharged; or iii) provided treatment for minor conditions on an outpatient basis and then immediately discharged. The decision of whether to admit a patient or treat the patient in outpatient observation status has significant financial ramifications for the hospital.4 Specifically, hospitals are paid substantially more by the Medicare program and certain other payers to treat a patient who has been billed as an admitted inpatient rather than one who has been billed as an outpatient in observation status. According to the Medicare Payment Advisory Commission (MedPAC), the independent Congressional agency that advises the U.S. Congress on issues affecting the Medicare program, for some patients, the Medicare program reimburses hospitals nearly $7,000 more per patient when the patient is admitted to the hospital as compared to treatment for the same patient in outpatient observation status.

9. Under federal law, Medicare reimburses hospitals only for treatment that is “reasonable and necessary for the diagnosis or treatment of illness or injury.” 42 U.S.C. § 1395y(a)(1)(A). In addition, Medicare Administrative Contractors who process Medicare payments are prohibited from using Medicare funds to pay for services if those services were not “medically necessary, reasonable, and appropriate for the diagnosis and condition of the beneficiary.” Medicare Program Integrity Manual, Chapter 6, Section 6.5.2. Similarly, under the Medicare Program Integrity Manual, “[i]npatient care, rather than outpatient care, is required

| 4 | As set forth in this Complaint, the analyses conducted by independent consultants essentially took all patients treated in a hospital bed, and measured which portion were billed as “observation” and which portion were billed as “admissions.” |

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 5

only if the beneficiary’s medical condition, safety, or health would be significantly and directly threatened if care was provided in a less intensive setting.” Id.

10. Despite these Medicare provisions, CHS has developed admissions criteria that systematically steer patients into medically unnecessary inpatient admissions when those patients should be safely and effectively treated as outpatients in observation status. CHS accomplished this increase in patient admissions by implementing, in or around 2000, a home-grown set of patient admission criteria called the Blue Book, which was copyrighted in 2000 and is publicly available at the United States Copyright Office. The purpose of the Blue Book is simple: to provide a mechanism for CHS management to justify to its medical staff criteria for the admission of patients who otherwise could have been observed and released.

11. Approximately three-quarters of hospitals in the country, including many publicly-traded hospital operators other than CHS, as well as nearly all major insurance companies, other payers and Medicare auditors, utilize one of two sets of independent, evidence-based, clinical criteria to determine whether a patient requires inpatient treatment or, instead, can be treated in outpatient observation status and/or discharged shortly after initial treatment at the hospital: i) the InterQual Criteria, developed by McKesson Corporation, which are used by approximately 60% of hospitals, and ii) the Milliman Care Guidelines, developed by Milliman, Inc., which are used by roughly 16% of hospitals. The Blue Book, on the other hand, is used only by CHS hospitals.

12. Rather than utilize the industry standard, objective criteria, however, CHS developed its now 40-page Blue Book, which was internally generated by CHS and lacks a single reference to a medical journal or other source. By way of comparison, the InterQual Criteria were developed by an independent panel of 1,100 physicians and medical providers,

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 6

contain over 16,000 references to medical sources, and are used by 3,700 hospitals across the country. Development of the Milliman Care Guidelines, which have more than 15,000 medical references and are used by over 1,000 hospitals, was overseen by an experienced team of physicians and reviewed by approximately 100 independent doctors.

13. Since they are designed to maximize inpatient admissions, the Blue Book criteria are not even “guidelines,” but are a series of what the Blue Book calls “Admission Justification[s]” that are far more subjective and liberal than the evidence-based clinical criteria used by virtually all major hospital operators in the country. For countless common patient conditions, such as chest pain, syncope, pneumonia, gastrointestinal bleeding, and atrial fibrillation, the Blue Book sets forth far less rigorous (and clinically inappropriate) criteria for admitting a patient to the hospital than the industry standard criteria. Indeed, in many cases the Blue Book contains admissions criteria for which there is no clinical basis to admit the patient.

14. For example, under the Blue Book Admissions Justifications, a chest pain patient with nothing more than hypertension, and either shortness of breath, fatigue, sleeplessness and/or anxiety may be admitted to the telemetry unit of a CHS hospital. The Blue Book also justifies admission of a chest pain patient to the cardiac care unit (“CCU”)—which is reserved for patients with the most critical medical conditions who require intensive and rapid treatment for survival—based on criteria that have no bearing on the severity of the patient’s existing illness, but rather, address only the patient’s medical history or conditions that are common among many chest pain patients. The InterQual Criteria, on the other hand, reject these liberal Blue Book Admission Justifications as a basis for admitting a patient to the hospital.

15. For another example, a patient with an irregular heartbeat, which may be caused by atrial fibrillation, may be admitted to the hospital under the Blue Book merely when the

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 7

patient has high or low potassium levels (common conditions easily treated at home or in observation) or when an X-ray shows increased heart silhouette, which typically results from a faulty X-ray and, in any event, has no bearing on the severity of a patient’s atrial fibrillation. These symptoms and findings would not, under InterQual Criteria, warrant admitting a patient to the hospital.

16. The Blue Book also justifies the admission to CHS hospitals patients suffering from pneumonia even though the patient has nothing more than a cough and “rales” (fluid in the lungs), which exist for every patient with pneumonia. Again, the existence of a cough and rales in a patient gives no indication, standing alone, that it is medically necessary to admit that pneumonia patient to the hospital, rather than treating the patient in observation through IV antibiotics. And once again, a patient with a cough and rales would not, under the InterQual Criteria, be admitted to the hospital.

17. In each of these examples, and many more, the Blue Book Admission Justification criteria are at odds with standard clinical decision-making across the industry.

18. The purpose of CHS’s liberal Blue Book criteria and admissions practices is clear: by admitting patients who, under accepted clinical criteria utilized throughout the hospital industry, should have been treated in observation or sent home, CHS receives substantially more money from Medicare than if the patient had been treated in outpatient observation status—an average of over $3,300—or 257%—more per patient for CHS’s highest volume and lowest acuity inpatient admitted patients. And as a result, taxpayers, insurers, businesses, and individuals have paid CHS hospitals more than they should for medical treatment.

19. According to an analysis of publicly available information on hospital observation rates, CHS’s efforts to increase its revenue by driving up its admissions rate (with a

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 8

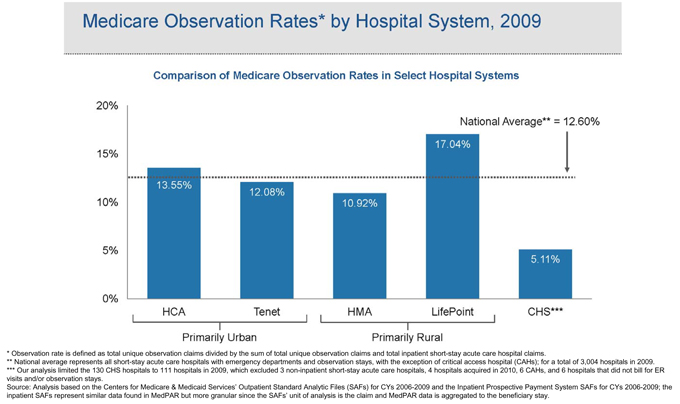

corresponding decreased use of observation status) through the application of the Blue Book criteria have been very effective.5 The analysis also shows that CHS’s admission practices are unique in the hospital industry, as CHS’s observation rate6 is substantially lower than that of other publicly traded hospital systems, well-known non-publicly traded hospital systems, and the hospital industry as a whole.

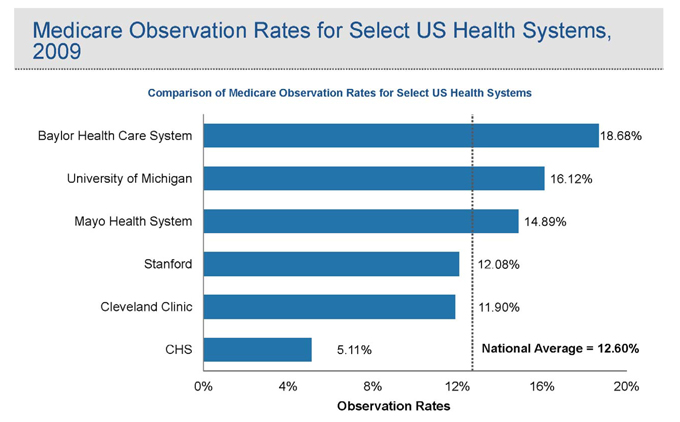

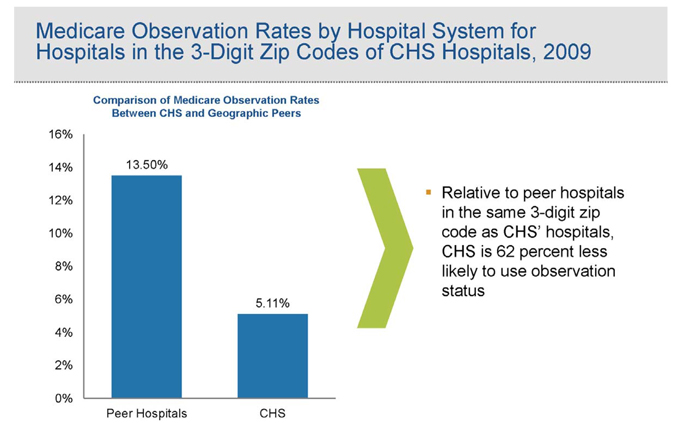

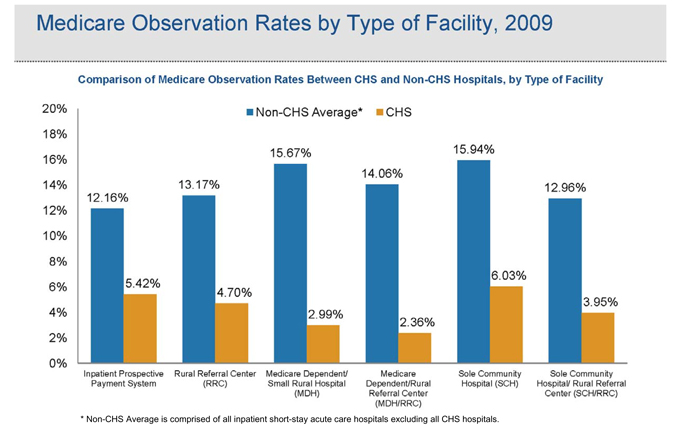

20. Based on an analysis of Medicare claims data, the observation rate at CHS—the number of patients who are treated on an observation basis as a percentage of patients either admitted or observed—is approximately 60% less than the national average, and substantially below other publicly traded hospital systems and well-known non-publicly traded hospital systems. This means that a patient is far more likely to be treated in the higher-paying inpatient admission status, and far less likely to be treated in lower-paying observation status, if the patient visits a CHS hospital than if the patient visited a hospital operated by CHS’s peers.

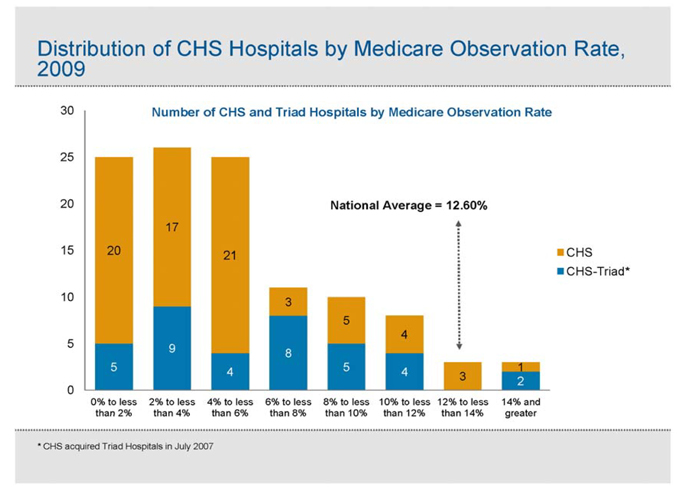

21. CHS’s anomalous observation rate is not driven by a small number of CHS hospitals. Rather, 95% of CHS’s short-term acute care hospitals have observation rates below

| 5 | Following CHS’s proposal to acquire Tenet for $6.00, made up of both cash and CHS stock, Tenet undertook an effort to understand more fully CHS’s business practices and financial results. In particular, Tenet turned to two leading consulting firms, including the healthcare advisory firm Avalere Health LLC (“Avalere”), to study, based on publicly available data, how CHS’s observation rate and related statistics compared to a number of publicly traded hospital systems, well-known non-publicly traded hospital systems, and the hospital industry as a whole. These consulting firms relied on separate data sources. One used data in the American Hospital Directory, while Avalere used the Centers for Medicare & Medicaid Services’ (“CMS”) Outpatient Standard Analytic Files (“SAFs”) and Inpatient Prospective Payment System SAFs, which contains source data from which the Medicare Provider Analysis and Review (“MedPAR”) database is constructed. Using these separate data sources, these consultants reached substantially similar conclusions. The observation data set forth in this Complaint were compiled through Avalere’s analysis, which, again, used only publicly available data. |

| 6 | Observation rate is the number of Medicare outpatient observation claims divided by the sum of Medicare outpatient observation claims plus Medicare inpatient claims. |

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 9

the national average. And, as shown in detail below, CHS’s low observation rate cannot be explained by the type of patients visiting CHS hospitals, by geographic considerations or by isolating specific types of hospital. In fact, when taking these factors into consideration, CHS actually should have an observation rate well in excess of the national average, rather than less than half the national average, but the observation data shows that exactly the opposite is true.

22. The statistical analysis and evaluation of CHS’s business practices lead to a single, inescapable conclusion: patients whose medical needs likely required treatment in outpatient observation status were systematically admitted for higher-paying inpatient treatment at CHS hospitals.

23. CHS has reaped enormous sums through its admissions practices. Avalere, a leading healthcare advisory firm, estimates that, between 2006 and 2009, CHS received approximately $280 million to $377 million from treating inpatient admitted Medicare patients in CHS hospitals who—if CHS utilized observation status at the same rate as the national average or at that of another hospital system, LifePoint—would have been treated in observation rather than admitted to the hospital. As a result of CHS’s admission practices with respect to these Medicare patients, CHS likely will be subject to significant damages. Under the federal False Claims Act, the United States Department of Justice may impose treble damages and a penalty of up to $11,000 per claim for false claims submitted to federal healthcare programs, meaning that CHS has potential exposure of well over $1 billion.

24. Critically, given that CHS’s practices likely also impacted private insurance companies, state Medicaid programs, and other payers, not to mention the tens of thousands of patients who were unnecessarily admitted into a CHS hospital, CHS’s improper revenue received from admitting Medicare patients may be just a fraction of the overall improper revenue received

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 10

by CHS as a result of its admissions practices. To put CHS’s potential liability to non-Medicare payers in perspective, in 2010, CHS earned approximately 27% of its net operating revenue from Medicare Fee-for-Service payments, or $3.4 billion. And moreover, these potential damages do not reflect the risk that CHS, based on its wide-ranging improper billing practices, may be excluded from participating in Medicare altogether.

25. In its effort to take control of Tenet, CHS has made numerous statements to Tenet shareholders in CHS’s proxy solicitation materials that are false and/or misleading in light of CHS’s failure to disclose its admissions practices. One prominent example is CHS’s claims of success in realizing synergies from the acquisition of Triad in 2007, and statements that CHS would realize similar synergies with Tenet. CHS failed to disclose, however, that a potentially material portion of these supposed synergies with Triad were realized through CHS’s systematic reduction in the observation rate at the former Triad hospitals—a stunning 52% drop in one year following the acquisition. CHS’s oft-stated success in boosting profits through the Triad acquisition now appears to have resulted not simply from eliminating redundant overhead, but from implementing the inappropriate admissions criteria contained in the Blue Book.

26. Any similar synergies that CHS expects to realize from acquiring Tenet would, one can assume, be realized in exactly the same way as they were at Triad—by implementing CHS’s Blue Book at the Tenet hospitals. These practices cannot be sustained, as the Department of Justice and Medicare auditors have devoted increased attention to investigating, auditing, and prosecuting hospitals that are improperly billing outpatient observation care as inpatient admissions. As health care fraud in general, and the use of observation status and “short stays” in particular, is a major focus areas for the federal government enforcement agencies and their

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 11

recovery audit contractors (“RACs”) in 2011, the likelihood of CHS’s practices surviving undetected for several more months is remote.

* * * * *

27. In light of CHS’s acquisition proposal, beginning in November 2010, Tenet engaged in extensive analyses to assess the potential sources of operating “synergies,” if any, that could result from combining CHS and Tenet, since such synergies would have a direct bearing on the value of Tenet to CHS. Tenet and its advisors found CHS’s claims of synergies, as described on its December 10, 2010 investor call, difficult to substantiate. Indeed, of the sort of synergies described on that call—increased negotiating power with managed care companies—Tenet could only find one small market in which it believed this synergy might exist. Tenet was then informed by a third party that CHS applied overly-aggressive criteria to justify admitting patients to the hospital rather than having them observed and discharged, which created numerous disputes with payers. This information was consistent with CHS’s recent statements on earnings calls that it had reclassified patients who had been admitted to the hospital for “one-day stays” to observation status. In order to more fully understand this issue, Tenet and its consultants performed the analyses discussed herein, using publicly available data for Medicare claims, of CHS’s use of observation status.

28. Tenet now brings this action to compel CHS to correct its misstatements in its proxy solicitation materials so that Tenet’s shareholders may more fully assess the value and likelihood of completion of CHS’s current or subsequent offers. Absent injunctive relief, Tenet and its shareholders will be irreparably harmed, as any decision by Tenet’s shareholders to approve or reject the slate of directors nominated by CHS to replace the current Tenet Board will be based on less than full information about CHS due to its false and misleading statements and material omissions, which have artificially inflated CHS’s stock price. And, separately, Tenet

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 12

seeks to recover its significant costs incurred in investigating CHS’s business practices and requiring CHS to correct its misstatements.

JURISDICTION AND VENUE

29. This Court has subject matter over this action pursuant to 15 U.S.C. §§ 78aa, 78m(d)(3), 78n(a), 28 U.S.C. § 1331.

30. Venue is proper in this District pursuant to 15 U.S.C. § 78aa and 28 U.S.C. § 1391.

31. Declaratory relief is appropriate pursuant to 28 U.S.C. § 2201 because an actual controversy exists regarding the propriety of Defendants’ statements and disclosures under Section 14(a) of the Exchange Act, and SEC Rule 14a-9.

PARTIES

32. Plaintiff Tenet is a corporation incorporated under the laws of Nevada with its principal place of business at 1445 Ross Avenue, Dallas, Texas 75202. Tenet is a health care services company whose subsidiaries and affiliates operate general hospitals and related health care facilities, including 49 general hospitals and one critical access hospital in 11 states. Tenet employs approximately 57,500 personnel, including nearly 10,000 in Texas, and nearly 3,000 in the Dallas / Ft. Worth area.

33. Defendant CHS is a corporation incorporated under the laws of Delaware with its principal place of business at 4000 Meridian Boulevard, Franklin, Tennessee 37067. CHS provides healthcare services through 130 hospitals that it owns or leases in 29 states.

34. Defendant Wayne T. Smith is the Chairman and Chief Executive Officer of CHS, a position he has held since 1997.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 13

35. Defendant W. Larry Cash is a member of the CHS Board of Directors and serves as the Chief Financial Officer of CHS, a position he has held since 1997.

CHS’S POLICY OF DRIVING ADMISSIONS

GROWTH AND OVERBILLING MEDICARE

36. At the heart of the false and misleading statements in CHS’s proxy solicitation materials is CHS’s eschewal of certain fundamental principles of medical care: to treat patients according to their clinical needs, not the hospital’s bottom line, and to be paid for only those services that are reasonable and medically necessary to serve the patient. The Medicare program operates fundamentally on an honor system yet, for at least a decade, CHS has turned its back on these basic principles and overcharged Medicare and other payers by at least hundreds of millions of dollars, in violation of Medicare regulations and widely accepted standards of patient care.

| A. | Background: Treating Patients According To Clinical Need |

37. When a patient enters a hospital, physicians have three choices when it comes to treating the patient. First, for the most serious cases, a patient may be admitted to the hospital so that the patient may receive care that is expected to last for 24 hours or more. Second, when a patient’s medical status does not necessarily require inpatient treatment, but additional monitoring and assessment is required to appropriately care for the patient, a patient is placed into outpatient “observation” status for care and monitoring that is expected to last less than 24 hours, but which may take as long as 48 hours if the physician is unable to make a determination within a 24-hour period. Observation patients are regularly assessed by hospital staff during the course of their stay—often receiving the identical care or treatment as patients who are admitted to the hospital—until the physician determines that there is no medical need for the patient to remain in the hospital or that the patient should be admitted. Third, for patients with relatively

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 14

minor medical needs, physicians and nurses may provide treatment on an outpatient basis and discharge the patient without that patient being admitted into the hospital or placed into observation.

38. The use of observation status to treat patients is widely recognized as an essential tool for improving clinical decision making and providing cost effective medical care. Under the Medicare Benefit Policy Manual:

Observation care is a well-defined set of specific, clinically appropriate services, which include ongoing short term treatment, assessment, and reassessment before a decision can be made regarding whether patients will require further treatment as hospital inpatients or if they are able to be discharged from the hospital. Observation services are commonly ordered for patients who present to the emergency department and who then require a significant period of treatment or monitoring in order to make a decision concerning their admission or discharge.

Medicare Benefit Policy Manual, Chapter 6, Section 20.6A.

39. There are several types of patients who should be placed in observation status rather than admitted to the hospital.7 For example, observation care is appropriate for patients whose medical conditions (such as chest pain or abdominal pain) require diagnostic evaluation because i) the balance between the probability of the disease and the dangerousness of the disease warrants further evaluation; ii) the patient presents a condition that cannot be readily diagnosed without additional testing; or iii) the physician simply needs more time to evaluate the patient’s symptoms to determine the most appropriate medical treatment.

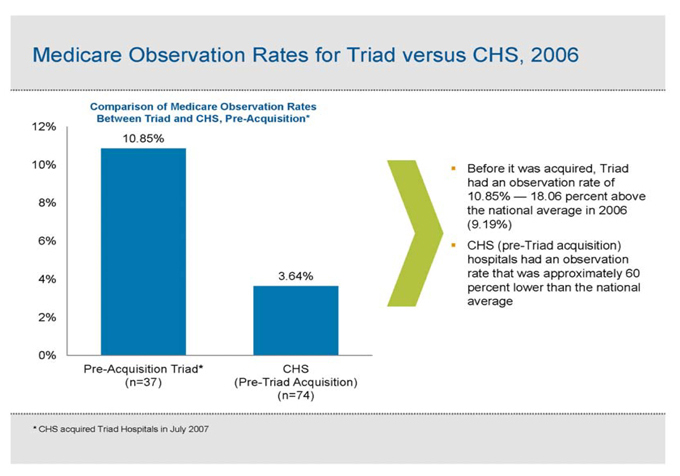

40. Observation care also is appropriate for patients who require short-term treatment of emergent conditions. These are patients with conditions for which there is a high probability of therapeutic success with a limited amount of services, such as patients with asthma,

| 7 | See generally Louis Graff, MD, Principles of Observation Medicine, in Observation Medicine (Louis Graff ed. 2010), available at http://www.acep.org/content.aspx?id=46142&terms=Observation%20Medicine. |

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 15

dehydration, or an infection. In addition, patients who require therapeutic procedures that do not necessitate inpatient admissions, but who nonetheless require some period of hospital care, are best treated in observation. For certain procedures performed for therapeutic (such as transfusions) or diagnostic (such as angiograms) reasons, observation treatment can expedite the performance of these procedures.

41. The clearest beneficiaries of observation treatment are patients. When a patient is in observation, physicians may perform necessary testing or other procedures and then continually assess and reassess the patient’s condition to determine whether the patient should be sent home or admitted to the hospital. Indeed, since many patients’ conditions improve through quick, aggressive treatment, and because testing may eliminate serious risks and allow patients to return home, the vast majority of observation patients are sent home without ever being admitted to the hospital.8

42. The other principal benefit of observation care is its cost effectiveness relative to inpatient treatment. With shorter stays and typically less testing and treatments for observation patients as compared to admitted patients, observation care can be very cost effective for payers. The decision of whether to treat a patient on an inpatient or outpatient observation basis has significant financial ramifications for the hospital. Indeed, according to the independent MedPAC, a hospital may receive Medicare reimbursement of nearly 1000% more (or approximately $7000 more per patient) for treatment and billing of an admitted chest pain patient

| 8 |

See Society of Hospital Medicine’s Expert Panel on Observation Units, Adrienne Green, MD, Chair, The Observation Unit: An Operational Overview for the Hospitalist,, available at http://www.hospitalmedicine.org/AM/Template.cfm?Section=White_Papers&Template=/CM/ContentDisplay.cfm&ContentID=21890; Louis Graff, MD, et al., Impact on the care of the emergency department chest pain patient from the chest pain evaluation registry (CHEPER) study, 80 Am. J. of Cardiology 563 (Sept. 1, 1997). |

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 16

on an inpatient admitted basis as compared to what the hospital would receive by treating an billing the patient in outpatient observation status.9 Accordingly, hospitals have a strong financial incentive to improperly steer patients into admissions rather than treat patients appropriately on an observation basis and must employ safeguards to ensure their billing practices are appropriate.10

43. To combat this incentive, Medicare laws and guidelines prohibit hospitals from billing Medicare for treatment of a patient admitted to the hospital unless a physician, at the time the patient presents to the hospital, determines that the severity of the patient’s condition requires care that the physician expects to meet or exceed 24 hours, and that placing the patient in a less intensive setting would significantly and directly threaten the patient’s safety or health. See Medicare Benefit Policy Manual, Chapter 1, Section 10; Medicare Program Integrity Manual, Chapter 6, Section 6.5.2. In particular, under federal law, Medicare reimburses hospitals only for treatment that is “reasonable and necessary for the diagnosis or treatment of illness or injury.” 42 U.S.C. § 1395y(a)(1)(A). In addition, Medicare intermediaries who make Medicare payments are prohibited under federal law from using Medicare funds to pay for services if those services were not “medically necessary, reasonable, and appropriate for the diagnosis and condition of the beneficiary.” Medicare Program Integrity Manual, Chapter 6, Section 6.5.2. In sum, federal law and applicable Medicare guidelines establish that, absent a medical need to treat the patient on an

| 9 | Presentation, MedPAC, “Recent Growth in Hospital Observation Care” (Sept. 30, 2010), available at http://www.medpac.gov/transcripts/observation%20sept%202010.pdf. |

| 10 | As explained below, extensive analysis of the available data demonstrates that CHS is the only major short term acute care, publicly traded hospital operator in the industry that has engaged in these unscrupulous admissions practices. |

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 17

inpatient basis, rather than in outpatient observation, Medicare is not responsible for payment of inpatient treatment.11

44. How CHS sought to evade these Medicare program requirements through developing and utilizing inappropriate inpatient admissions criteria, which resulted in admitting patients with no medical need for inpatient treatment, is at the heart of CHS’s improper admissions practices.

| B. | CHS’s Strategy Of Increasing Revenue Through Improper Patient Admissions |

| 1. | In Contravention of Medicare Rules, CHS Develops Admissions Criteria That Systematically Steer Medically Unnecessary Inpatient Admissions At Its Hospitals |

| a. | CHS’s Blue Book Criteria Have None Of The Attributes Of Criteria Used Throughout The Industry |

45. Under Medicare regulations, hospitals are required to maintain a set of admissions criteria for determining whether a patient’s condition is serious enough to warrant inpatient treatment. Such criteria are required to support treatment that is medically necessary. 42 C.F.R. § 482.30(c).

46. In or around 2000, CHS developed a set of admission criteria known as the “Blue Book” for CHS physicians and case managers to use in order to justify the admission of a patient into a CHS hospital.

| 11 | For example, one Medicare Contractor states in its coverage policy that “[c]ertain diagnoses and procedures generally do not support an inpatient admission, and fall within the definitions of outpatient observation. . . . Uncomplicated presentations of chest pain (rule out MI), mild asthma/COPD, mild CHF, syncope and decreased responsiveness, atrial arrhythmias and renal colic are all frequently associated with the expectation of a brief (less than 24-hour) stay unless serious pathology is uncovered.” See Highmark Medicare Services, Local Coverage Determination LCD L27548 – Acute Care: Inpatient, Observation and Treatment Room Services, available at https://www.highmarkmedicareservices.com/policy/mac-ab/l27548-r4.html. |

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 18

47. Unlike the Blue Book, which is used only by CHS hospitals, the InterQual Criteria from McKesson Corporation was developed by an 1,100-member panel of independent physicians and medical professionals, and is used by approximately 3,700 hospitals, CMS, state Medicaid programs, Medicare Quality Improvement Organizations in 40 states, and various Medicaid payers and private health plans. The InterQual Criteria are evidence-based, and, thus, contain over 16,000 references to medical literature in support of the clinical criteria by which physicians and other care providers determine whether a patient should be admitted to the hospital or treated on an outpatient observation basis.

48. Similarly, the Milliman Care Guidelines produced by Milliman, Inc. were overseen by an experienced team of physicians and reviewed by approximately 100 independent physicians before being released to the more than 1,000 hospitals and 1,800 Milliman clients, including 25 CMS auditors and seven of the eight largest U.S. health plans, who use them. Like InterQual, the Milliman Care Guidelines are evidence-based, and, as such, include references to over 15,000 medical journals, articles, textbooks, medical databases, and similar resources.

49. Together, InterQual and Milliman are used by approximately three-quarters of all hospitals in the United States, with approximately 60% using InterQual and approximately 16% using Milliman.

50. The Blue Book has none of the attributes of the industry standard InterQual or Milliman criteria. The Blue Book is merely a 40-page document that sets forth the “Admission Justification[s]” for the most common medical conditions presented by CHS patients. The Blue Book is not independent or objective, but rather was developed by CHS and, on information and belief, has never been externally tested by physicians unaffiliated with CHS. And, unlike InterQual or Milliman, which are used by thousands of hospitals and other medical organizations

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 19

across the country, the Blue Book lacks a single reference to a medical journal or other resource and is used only by CHS hospitals.

51. To educate CHS “case managers”—CHS-employed nurses responsible for administering the Blue Book at each of CHS’s hospitals—on how to utilize the Blue Book criteria to “justify” admitting patients into the hospital, CHS developed a training presentation in which CHS acknowledges that its case managers have had reservations about applying the non-standard Blue Book admissions criteria to admit patients into the hospital.

52. For example, in a section of the training presentation entitled “Using The Blue Book,” CHS warns that “[c]ase [m]anagers sometimes become overly concerned because we do not use InterQual criteria,” and that “QIOs, managed care plans, and insurance companies will sometimes attempt to make you think that you must use their criteria.” In these situations, case managers are instructed to “[p]olitely, but firmly, advise them that your hospital has adopted its own criteria and will use the same for its internal reviews.”

53. Given that the Blue Book is designed to justify inpatient admissions, rather than properly equip physicians and nurses to treat patients according to their medical needs, it is of no surprise that this training presentation never once mentions the word “observation.”

| 2. | The Blue Book Admissions Justification Criteria Result In Admission Of Many Patients Who, Under Standard Clinical Practice, Would Ordinarily Be Placed Into Observation Status Or Sent Home |

54. The Blue Book not only lacks medical references, independent testing or use outside of CHS, but its criteria for admitting patients into the hospital are demonstrably more lenient, general, and subjective than the evidence-based criteria used throughout the rest of the industry.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 20

55. The Blue Book is organized around the most common patient conditions presented at CHS hospitals (e.g., chest pain, asthma, and congestive heart failure). For each such condition, the Blue Book presents four categories of criteria to be applied by physicians and case managers at each stage of care: i) Admission Justification; ii) Ongoing Plan of Care; iii) Discharge Readiness; and iv) Documentation Guidelines.

56. The very structure of the Blue Book—with its focus on “Admission Justification”—demonstrates that it is not an objective set of criteria for determining whether it is more appropriate to treat a patient in observation or to admit the patient into the hospital. Indeed, there is but one reference to “observation status” in the entire Blue Book—for “very low risk chest pain.”

57. As set forth below, for many conditions that are common among Medicare patients, the Blue Book includes admission justification criteria that bear little relevance to determining the severity of a patient’s condition, are at odds with standard clinical decision-making for determining the proper level of care for patient, and provide an improper clinical basis for admitting a patient into the hospital. Moreover, in many cases, the Blue Book simply fails to include the core criteria utilized by physicians to determine, for a given condition, whether the patient’s presenting symptoms are serious enough to require admission into the hospital. A few of the more egregious Blue Book deficiencies are set forth below, which highlight the Blue Book’s lack of clinical foundation for its flawed admissions justifications.

Chest Pain

58. The Blue Book’s Admission Justifications criteria include several criteria that either are inappropriate or not relevant for physicians to consider in determining whether it is

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 21

medically necessary to admit a chest pain patient to the hospital, where in the hospital the patient should be admitted and treated, or whether the patient should be treated in observation.

59. Under standard clinical practice, when a patient presents to the hospital with chest pains, there are varying levels of care that may be provided to the patient, depending on the severity of the patient’s condition. Given that chest pain is a very non-specific complaint, meaning that there are many causes of chest pain other than a heart attack, patients often are initially evaluated in observation in order to determine whether or not they are in fact having a heart attack or suffering from a lack of oxygen to the heart. Many chest pain patients are appropriately treated in observation, where standard tests may be run to determine whether the patient has had a heart attack, in which case the patient likely would be admitted to the hospital, and if not, the patient would likely be discharged. Once a decision is made to admit a patient to the hospital, there are varying levels of care in the hospital depending on the severity of the patient’s clinical condition. The initial level of care for stable patients requiring admission is the inpatient general medicine or surgical floor setting. Those requiring a higher level of care may be placed in a telemetry or intermediate care setting. Lastly, those patients that are most critically ill may be placed in the critical care unit.

60. The Blue Book sets forth three levels of care, and two levels of admissions for chest pain patients, each with separate “Admissions Justifications”: 1) “Very Low Risk: Observation or Discharge;” 2) “lower risk/telemetry (Green/Blue cases);” 3) “high and moderate risk levels/CCU (Orange/Red cases).” As set forth below, for each of these categories of care, the Blue Book contains admissions criteria that are both inappropriate and inconsistent with standard clinical decision-making.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 22

Chest Pain Observation

61. When a patient presents to the hospital with chest pain—one of the most common presenting emergency room complaints—it is accepted clinical practice to run two to three sets of blood tests on the patient every six to eight hours to measure the levels of cardiac enzymes (specifically, a cardiac marker known as troponin) in the blood. An elevated troponin level from one test to the next indicates that the patient’s cardiac wall likely has suffered a loss of blood flow, meaning that the patient is at risk of suffering or having suffered a heart attack. If, as is often the case, the patient’s troponin level does not increase from one blood test to the next, the physician may rule out a heart attack and send the patient home. In addition, it is standard practice to perform two electrocardiograms (“ECGs”)—which measure changes in heart rhythm that may be indicative of a heart attack—during the same time period that the cardiac enzymes are measured.

62. Because these cardiac enzyme tests and ECGs may be completed in less than 24 hours, it is standard practice for these patients to be treated in observation, rather than admitted to the hospital. Indeed, treating chest pain patients in observation is so common that some hospitals have observation units dedicated solely to evaluating patients complaining of chest pain.

63. While it is standard clinical practice to run these tests while the patient is in observation, the Blue Book justifies placement of a patient in observation only after the patient has two negative serial ECGs and two negative sets of cardiac enzyme tests. In other words, under the Blue Book, these tests may be run on patients already admitted to the hospital.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 23

Chest Pain Telemetry Admissions

64. The Blue Book Admission Justification criteria for chest pain, lower risk/telemetry are at odds with standard criteria used in practice and justify admissions where, under accepted practice, patients would not be admitted, but rather placed in observation or discharged. For example, a patient with chest pain may be admitted to the telemetry unit rather than placed in observation if he or she merely has a general risk factor for cardiac disease (e.g. hypertension, diabetes, or hyperlipidemia) coupled with only one of the following:

| i. | New chest pain in the presence of a significant history of coronary artery disease; |

| ii. | a recent visit to the hospital with complaints of chest pain; |

| iii. | chest pain that may be reproduced by pressing on the chest; or |

| iv. | “atypical symptoms,” such as shortness of breath, fatigue, sleeplessness and/or anxiety. |

65. These Admission Justification criteria are weighted toward admissions and are inconsistent with accepted clinical standards for inpatient admissions, however, because many patients who present with chest pain have a history of a cardiac risk factor, such as hypertension (a very common diagnosis in the U.S. population and not necessarily indicative of a medical need for inpatient care). Furthermore, the criteria identified in i.-iv. above are very different from the accepted clinical standards for hospital admission, such as having positive cardiac enzymes. For example, a “recent visit to the hospital with chest pain” is considered by the Blue Book to be a criterion for admission. While it is certainly a part of a patient’s history, it is not any indication of a patient’s clinical severity of illness. None of these criteria are representative of standard clinical criteria that physicians consider when deciding whether to admit a patient

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 24

with chest pain to the hospital. Under InterQual, moreover, these Blue Book criteria would not support the admission of a patient to the hospital.

Chest Pain CCU Admissions

66. The same is true for the Blue Book criteria for admission to the CCU. The CCU is reserved for patients with the most critical medical conditions who require intensive and rapid treatment for survival. The Blue Book Admissions Justification criteria, however, include many diagnoses that have no bearing on the severity of the patient’s existing illness, but rather, address only the patient’s medical history or conditions that are common among many chest pain patients—conditions that should have no bearing, under standard clinical practice, on whether a patient should be placed into the CCU rather than simply admitted to the general medical floor. For example, the Blue Book Admission Justification criteria for admission to the CCU include several criteria, two or more of which must be met to justify an admission to the CCU. Several of these criteria, however, are out of line with standard clinical decision-making, including the following:

| i. | A history of smoking, hypertension, hyperlipidemia, or diabetes; |

| ii. | Two or more episodes of pain; |

| iii. | Oxygen saturation less than 90; |

| iv. | Rest angina less than 20 minutes (resolved with rest or nitrates); and |

| v. | Indeterminant CKMB or Troponin. |

67. Each of these criteria is not relevant to the determination of whether care in the CCU is medically necessary. For example, whether a patient is a smoker or has hypertension, for example, has no bearing on the severity of the patient’s condition and certainly does not inform the need for CCU admission. Chest pain patients frequently present with two or more

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 25

episodes of pain, meaning that this criteria is not indicative of the severity of a patient’s chest pain necessary to require the highest level of care. Patients with an oxygen saturation less than 90 is extremely common, not in and of itself life threatening, and easily treatable with supplemental oxygen. When a short period of rest angina occurs and is resolved with rest or nitrate therapy, there is no medical necessity of treating such patients in an intensive care setting, which is reserved for the most critically ill patients. And whether the results of a patient’s CKMB or troponin levels is “indeterminant” is not, under standard clinical practice, a justification for admitting the patient into the CCU, but rather, an indication that further testing should be performed.

* * * * *

68. In sum, in many cases where the Blue Book criteria inappropriately warrant a hospital admission for a chest pain patient, current accepted clinical practice standards justify placing the patient in observation status. In the case where patients present with chest pain, the standard of care through an electrocardiogram and cardiac enzyme blood testing may be used to determine whether or not a patient may be having a heart attack. If so, then patients may then be admitted to the appropriate inpatient setting and appropriate level of care intensity. Patients that are ruled out for an acute heart attack, as the vast majority of “chest pain” patients are, may be discharged home.

Syncope Or Pre-Syncope

69. In addition, the Blue Book’s Admissions Justifications include many criteria that are inappropriate for determining whether a patient with pre-syncope or syncope (dizziness or fainting) should be admitted to the hospital or should instead be treated in observation.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 26

70. Under standard clinical practice, when a patient presents to the hospital complaining of dizziness (pre-syncope) or fainting (syncope), the physician performs several tests to eliminate any critical causes that may be responsible for these episodes, such as the potential for a heart attack, a stroke in the brain, or some form of structural heart disease or acute heart arrhythmia. These tests are standard in most hospital settings and can be performed within a 24-hour period. Such patients typically are placed in observation so that these critical, though rare, causes of syncope may be ruled out. Once they have been, syncope or pre-syncope is often due to dehydration (as determined by measuring a patient’s drop in blood pressure between lying down and standing up) or by a vasovagal reaction (a very common cause of fainting in adults). Both of these etiologies are much less critical and can be treated simply in observation. Patients with dehydration will be rehydrated during their observation stay through IV fluids, and, as long as the syncope does not recur, will be sent home. Patients with vasovagal episodes will follow up with their primary care physician as an outpatient, with further treatment if the episodes recur. Regardless, these patients typically are treated in observation.

71. The Blue Book Admission Justification criteria, however, call for the admission of a patient who has an episode of fainting and is over the age of 60. Age, however, is irrelevant in the case of syncope. Regardless of the etiology, age is not a risk factor for syncope, and all patients, regardless of age, will undergo the same workup and battery of testing discussed in the previous paragraph, which are appropriately conducted in observation. Additionally, the Blue Book admissions criteria include patients who have a “Postural BP greater than 15 mm,” indicating that patients found to have a positive “orthostatic testing” (such as a drop in BP of great than 15 mmHg between a standing and sitting position) may be admitted. However, such a blood pressure drop is due to dehydration, which is something easily treated in an observation

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 27

status with intravenous fluids and rehydration. Once again, this criterion is not a clinically accepted standard of care for determining whether it is medically necessary to admit a patient to the hospital.

72. In comparison, InterQual states that the criteria for observation are, as described above, pre-syncope or syncope of unknown etiology. This is appropriate and consistent with accepted standards of clinical care. Once a patient is found to have a more critical cause of syncope, such as structural heart disease or an arrhythmia, the InterQual Criteria indicate that it is reasonable to admit such patients to the hospital, but the majority of patients are simply dehydrated, treated with IV fluids in observation, and discharged home.

Community Acquired Pneumonia (“CAP”)

73. The Blue Book’s Admission Justifications criteria ignore accepted clinical practices for determining whether a patient presenting with CAP is ill enough to require inpatient treatment, or whether the patient could, instead, appropriately be treated in observation.

74. Admission of a patient with CAP is justified under the Blue Book if the patient presents with a cough and rales (the presence of fluid in the lungs). But many patients who have pneumonia—regardless of severity—have the presence of a cough and rales on exam. Thus, the mere existence of these findings tells the physician nothing about whether a patient presenting with a cough and rales has a clinical picture that correlates with severity of illness requiring admission to the hospital.

75. Similarly, an admission of a patient with CAP is justified under the Blue Book if the patient presents with a cough and infiltrate or atelectasis. Again, the mere existence of a cough and abnormal chest X-ray is only relevant to informing the physician that the patient may have CAP; standing alone, the presence of these findings provides information on a possible

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 28

diagnosis, but does not justify hospital admission. Clinical presentation, a critical component of the decision-making process regarding admission or observation, is not taken into account in the Blue Book.

76. Under the InterQual Criteria, patients presenting with a cough and rales or an abnormal chest X-ray are not, absent other symptoms, admitted to the hospital for treatment. Instead, such patients would be examined to determine whether they have an elevated breathing rate, a fever, or a high white blood cell count, and most importantly, whether the patient is 65 or older. In the absence of serious additional criteria (for example, a breathing rate above 29), the patient would be treated in observation with IV antibiotics and monitored for up to 24 hours for improvement. In the typical case where the patient responded favorably to such treatment, the patient would be sent home, and if the condition worsened, the patient would be admitted to the hospital.

77. Finally, the Blue Book permits the admission of a CAP patient who presents with a cough and a temperature of 102 degrees with a white blood cell count of 15,000 or greater. It is well accepted, however, that a patient’s temperature and white blood cell count—standing alone—do not necessarily have a strong correlation with the severity of disease without consideration of age and presence of co-morbidities. Thus, absent other factors (such as advanced age or a disease that weakens a patient’s immune system), there is no absolute clinical basis for inpatient admission when a pneumonia patient has an elevated temperature and white blood cell count.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 29

Atrial Fibrillation

78. The Blue Book Admission Justification criteria contain non-standard and clinically inappropriate justifications to admit patients with atrial fibrillation, which is an irregular beating of the heart.

79. For example, under the Blue Book, patients with an irregular heart beat may be admitted to the hospital if they also have potassium levels higher or lower than normal, or if a chest X-ray shows an “increased heart silhouette.” But under standard clinical practice, neither of these factors bears any direct relation to determining whether or not a patient’s atrial fibrillation is serious enough to warrant treatment as a hospital inpatient. Accordingly, neither of these criteria is included in the InterQual Criteria as a basis for admitting the patient to the hospital.

80. Patients in the hospital often present with abnormally low potassium levels—a condition that may be easily treated through a potassium supplement. Because, in most patients with normally functioning kidneys, potassium levels typically normalize within a few hours of treatment, atrial fibrillation patients with abnormal potassium levels may often be treated in observation and discharged within a few hours later when their condition improves. Under the Blue Book criteria, however, a patient with an irregular heartbeat and low potassium levels may be admitted to the hospital before receiving a simple potassium supplement. Such patients with only atrial fibrillation and abnormal potassium levels will typically recover within a few hours and be sent home, but will still be billed as an inpatient, as an observation stay.

81. An enlarged cardiac silhouette, another Blue Book criterion for atrial fibrillation admission, provides no basis for determining the severity of a patient’s atrial fibrillation. The appearance of an enlarged heart silhouette is very non-specific and may be artificially

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 30

represented by poor X-ray technique, an overweight patient, or by patients who fail to take a deep breath during the X-ray. Thus, this criterion typically is not reflective of any medical condition, and, in any event, provides no basis for determining whether an atrial fibrillation patient should be admitted to the hospital rather than treated and monitored in observation or discharged to home with outpatient evaluation.

GI-Bleed

82. The Blue Book also fails to consider key criteria that are clinically necessary to determine whether it is medically necessary to admit to the hospital a patient presenting to the hospital with a gastrointestinal bleed (blood in the stool or vomitus).

83. The Blue Book ignores essential testing that, under standard clinical practice, must be performed so that medical staff may determine whether a patient’s gastrointestinal bleeding is serious enough to require inpatient treatment or, instead, whether the patient may be treated with blood products and fluids in observation and monitored for improvement. Many patients who have stable hemoglobin levels over 24 hours of observation may be sent home and followed up as an outpatient with several tests to identify the source of bleeding. Alternatively, some patients may receive these tests within 24 hours of admission and be discharged home from observation once these tests are completed. Furthermore, it is standard for doctors to run tests to measure the patient’s hemoglobin or hemotocrit (the concentration of red blood cells in the body), the rate of decrease of hemoglobin, and to check an International Normalized Ratio (“INR”), to determine the “thinness” of the blood and the risk for further bleeding. Under both the InterQual Criteria and standard clinical practice, these tests largely determine whether a patient with gastrointestinal bleeding should be admitted to the hospital.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 31

84. By ignoring these widely used tests, the Blue Book provides yet another clear, non-standard set of admission justifications to admit patients who, under standard practice, are most appropriately treated in observation with IV fluids and blood products, monitored, and discharged when their condition improves and hemoglobin has stabilized.

Cellulitis

85. The Blue Book’s Admission Justification criteria also are deficient when applied to patients presenting with signs of cellulitis, an infection of the skin that can cause pain, fever, and elevated white blood cell counts.

86. For example, under the Blue Book, a patient presenting with a possible cellulitis and either an elevated white blood cell count and a temperature over 102 degrees, or a “weeping wound,” may be admitted to the hospital. Again, these admission criteria fall outside accepted clinical practice as they individually do not provide evidence as to the severity of a patient’s cellulitis. A patient presenting with only these conditions would not, under InterQual, be admitted to the hospital. Such patients would either be effectively treated with IV antibiotics in observation for 24 hours and discharged when their condition improved, as cellulitis often does with 24 hours of antibiotic treatment, or would be given one dose of IV antibiotics in the emergency room and sent home with antibiotics by mouth and a follow up appointment soon after the ER visit.

87. What the Blue Book Admission Justification criteria altogether ignore is the critical question regarding complexity and severity of cellulitis, a question that doctors often face when determining whether a patient may be treated in observation or admitted to the hospital for treatment, and the length of time that would be required to treat a cellulitis patient with IV antibiotics. This determination is driven by the part of the body that is affected (cellulitis of the

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 32

face, hand, or foot is more difficult to treat than the upper arm, thigh, or calf); co-existing medical conditions of the patient (patients with diabetes face greater risk associated with cellulitis, often supporting inpatient treatment); and signs of sepsis or shock (patients with low blood pressure, acute confusion, or bacteria in the blood are at the highest risk for complications). These widely accepted clinical factors are primary considerations under the InterQual admissions criteria, but under the Blue Book, less clinically relevant factors are considered to justify inpatient admissions.

88. Accordingly, the Blue Book not only presents overly general and non-clinical bases for admitting a cellulitis patient to the hospital, but omits several key criteria that physicians must consider to determine whether a patient’s condition is serious enough to require inpatient treatment. These deficient Blue Book Admission Justifications, therefore, far more readily justify admitting a cellulitis patient as an inpatient than if the patient were evaluated using accepted clinical criteria and practices.

| 3. | CHS’s Practice Of Billing Patients As Admitted Who Should Be Treated In Observation |

89. As set forth above, the Blue Book contains far more subjective and liberal criteria for admitting patients into the hospital than accepted clinical decision-making and the evidence-based, clinical criteria used by peer hospital systems across the country. Thus, a patient who visits a CHS hospital is much more likely to be admitted into the hospital than if the same patient visited any other hospital that admits properly patients on the basis of clinical need.

90. CHS’s underutilization of observation status derives not simply from the application of liberal Blue Book “Admission Justification” criteria. Rather, on information and belief, CHS has adopted a strategy of setting admission targets, incentivizing physicians to meet admission targets, and holding physicians and hospitals accountable for failure to meet those

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 33

targets. For example, CHS sets targets for its hospitals for converting emergency room visitors into admitted patients. Upon information and belief, CHS physicians and Emergency Department (“ED”) doctors working in CHS hospitals also receive bonuses based in part on the number of patients admitted to the hospital—part of CHS’s goal of converting between 17% and 20% of all ED visits to inpatients. In establishing these artificial targets, CHS has ignored that patients should be admitted to the hospital from the ED based on their clinical indications and needs, and not based on maximizing profits.

91. As a result, CHS has created a culture at its hospitals where patients are admitted by default and where observation is highly discouraged, even in cases where diagnostic testing or short term treatment is the medically appropriate and best course of care for the patient.

92. For example, patients who visit a CHS hospital through the ED frequently are inappropriately diagnosed with acute renal failure (and thus automatically admitted as inpatients) when they present with elevated creatinine levels. However, elevated creatinine levels often are present in cases of dehydration, a much less serious condition that does not typically necessitate admission. Thus, the accepted medical practice for patients with elevated creatinine levels is to place them in observation and give them fluids. If, as is typically the case, the patient’s creatinine levels return to normal within 24 hours of receiving IV fluids, the physician can rule out acute renal failure and send the patient home. What CHS physicians often do for such patients, however, is admit them, rather than treat them with fluids in observation. Then, after the admitted patient has been treated with fluids and his or her creatinine levels have returned to normal within 24 hours, the patient is sent home. However, CHS still bills Medicare for an admitted patient under the initial diagnosis of acute renal failure, at a significantly higher cost than if the patient had, under standard clinical practices, been treated in observation.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 34

93. Another example of the practice at CHS hospitals of admitting patients with symptoms best treated in observation status concerns patients presenting to the ED with chest pain, described in the previous section. Because the battery of tests run on virtually all chest pain patients may be completed in less than 24 hours, it is standard practice for these tests to be run on patients in observation status. At CHS hospitals, however, patients complaining of chest pain often are admitted to the hospital rather than treated in observation. If the clinical tests reveal that the patient has not had a heart attack, the patient will be discharged from the CHS hospital after only a short stay at the hospital (often only a single day), but that patient still will be billed to Medicare as an inpatient, at far greater cost than if the same treatment had been provided to the patient in observation.

94. In each of these examples, there is no medical need to admit the patient to the hospital. Indeed, the clinically appropriate decision is to place the patient into observation, run the necessary tests or provide the necessary treatment that will allow the physician to rule out the more serious condition, and then discharge the patient. In the event that the tests or treatment does not eliminate the more serious condition, the physician will then admit the patient to the hospital for further treatment. Through the Blue Book, CHS turns medical practice on its head by steering the admission of these patients immediately, quickly discharging the patients after tests and/or treatment rule out the serious condition, and then billing Medicare for the far more expensive—and wholly unnecessary—inpatient treatment.

95. In short, CHS has ignored Medicare rules by creating criteria and enforcing practices under which the admissions criteria applied by its physicians steer the physicians to inappropriately conclude that a patient’s care requires inpatient admission, thus ignoring a clinically based standard of “reasonable and necessary” or “medically necessary” care.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 35

96. As set forth in the following section, there is no question that, as a result of the admissions practices in place at CHS’s hospitals, CHS has systematically underutilized observation status and, accordingly, CHS physicians have improperly admitted approximately 62,000 to 82,000 Medicare patients into CHS hospitals just in the years 2006-2009, and approximately 20,000 to 31,000 in 2009 alone.

| 4. | CHS’s Admissions Scheme Has Been Enormously Effective At Lowering Observation Rates And Increasing Admission Rates At CHS Hospitals |

97. On its face, the Blue Book—with its non-objective, non-evidence based, and liberal criteria for admitting patients into hospitals—demonstrates that CHS is actively working to drive up inpatient admissions and drive down outpatient observation. When CHS’s observation data is compared to the industry in general and to well-known hospital operators that compete with CHS, the full impact of this conduct is laid bare.12

| 12 | The slides set forth in the remainder of this section of the Complaint were prepared by Avalere based on information contained the CMS Outpatient SAFs and the Inpatient Prospective Payment System SAFs, the latter of which contains source data from which the MEDPAR database is constructed. As set forth in footnote 5 above, the conclusions set forth in these charts were independently reached by a separate consultant utilizing data from the American Hospital Directory. |

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 36

98. In 2009, for example (the last full year for which data are available), CHS’s observation rate was less than half the industry average.13

| 13 | This analysis excluded from the hospital sample (including certain CHS hospitals) non-short term acute care hospitals (i.e., psychiatric, children’s, long term, and rehabilitation), critical access hospitals, and hospitals that did not bill for emergency department visits and/or observation. Because the last full year for which data is available is 2009, the CHS hospitals included in the analysis do not include four CHS hospitals acquired in 2010. |

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 37

99. CHS’s low observation rate relative to the industry and its competitors is not driven by a small sample of CHS hospitals. To the contrary, nearly 95% of CHS’s short-term acute care hospitals included in the analysis have observation rates below the national average, with nearly 70% of CHS’s hospitals falling more than 50% below the national average.

100. CHS’s observation rate also is significantly below the rates at some of the most highly respected not-for-profit hospitals in the country.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 38

101. CHS’s rural hospital base in no way explains its low observation rate relative to the industry, since hospitals in the immediate vicinity of CHS have a substantially higher observation rate than CHS hospitals.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 39

102. CHS’s low observation rate relative to the industry also does not vary based on the type of CHS facility included in the sample.14

| 14 | Inpatient Prospective Payment System (“IPPS”) hospitals receive fixed payments for acute care hospital stays, based on prospectively set rates. A Medicare Dependent Rural Hospital (“MDRH”) is (1) located in a rural area; (2) has no more than 100 beds; (3) is not classified as a Sole Community Hospital (“SCH”); and (4) has at least 60 percent of inpatient days or discharges covered by Medicare. A Medicare Dependent (Non-Rural) Hospital meets criteria 2-4 in the previous sentence. An SCH is (1) 35 miles from a like hospital; (2) between 15 and 25 miles from a like hospital and nearby hospitals have been inaccessible for at least 30 days in 2 out of 3 years due to weather or local topography; or (3) is between 25 and 35 miles from a like hospital and either (a) has fewer than 50 beds, (b) nearby hospitals have been inaccessible for at least 30 days in 2 out of 3 years due to weather or local topography, or (c) no more than 25 percent of all inpatients or inpatient Medicare beneficiaries in its service area are admitted to other like hospitals within 35 miles. A SCH (Rural) is a SCH located in a rural area. Finally, a hospital qualifies as a Rural Referral Center (“RRC”) if it (1) has at least 275 beds; (2) demonstrates that at least 50 percent of Medicare patients are referred from other hospitals or from physicians not on the hospital staff, at least 60 percent of Medicare patients live more than 25 miles away, and at least 60 percent of the Medicare services it furnishes are provided to beneficiaries who live more than 25 miles away; or (3) demonstrates that it has a case-mix index value greater than or equal to the median for all urban hospitals in the same census region, and has at least 5,000 discharges per year (3,000 for osteopathic hospitals) or at least the median number of discharges for urban hospitals in the same region, and either (a) more than 50 percent of its medical staff are specialists; (b) at least 60 percent of its discharges are for inpatients residing more than 25 miles away, and |

[Footnote continued on next page]

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 40

103. CHS’s use of its Blue Book criteria to improperly drive up admissions and drive down observation rates is most apparent through CHS’s acquisition of Triad’s hospitals in 2007. As set forth in the tables below, in 2006—before the acquisition—Triad’s observation rate far exceeded CHS’s rate.

[Footnote continued from previous page]

(c) at least 40 percent of its inpatients are referred from other hospitals or from physicians not on the hospital staff.

PLAINTIFF’S COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS - Page 41

104. But within a year of CHS’s acquisition of Triad, CHS had drastically reduced the observation rate at the former Triad hospitals through the implementation of its Blue Book admissions practices.

105. According to industry data, moreover, CHS sees lower acuity patients than the national average. Specifically, the average CHS hospital has a lower case mix index (“CMI”) (1.28) than the national average inpatient short-stay acute care hospital (1.43). Hospitals with lower CMI are expected to have a higher observation rate, but CHS has a lower than average observation rate and a lower than average CMI. That CHS’s observation rate is so low despite its lower acuity patients further demonstrates the extent of CHS’s improper admissions practices.