Attached files

Exhibit 99.3

|

www.level3.com |

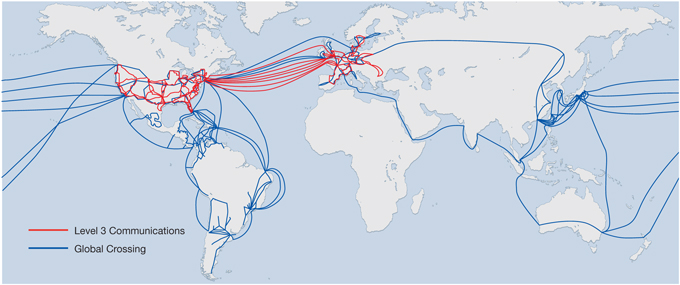

Level 3 Communications, Inc. (NASDAQ: LVLT) is a premier international provider of fiber-based communications services. Our converged voice, video and data solutions serve enterprise, content, government and wholesale customers leveraging a reliable and secure network. We focus on understanding customers’ challenges, providing relevant solutions, and delivering superior service. | |

|

www.globalcrossing.com |

Global Crossing (NASDAQ: GLBC) is a leading global IP and Ethernet solutions provider with the world’s first integrated global IP-based network. The company offers a full range of data, voice and collaboration services with an industry leading customer experience and delivers service to approximately 40 percent of the Fortune 500, as well as to 700 carriers, mobile operators and ISPs. | |

| Level 3 Communications | Global Crossing | |||

| Headquarters | Broomfield, Colorado |

Florham Park, New Jersey | ||

| Employees | 5,500 |

5,250 | ||

| Countries Served | 23 |

70 | ||

| Markets Served | 190 |

700 | ||

| Intercity Fiber Routes Miles | ~57,000 • ~44,000 North America • ~13,000 Europe |

~51,000 • ~18,000 North America • ~23,000 Europe • ~10,000 Latin America | ||

| Metropolitan Fiber Routes Miles | ~27,000 |

~2,000 | ||

| Subsea Routes | Combined company has an extensive subsea footprint, with ~40,000 route miles | |||

| 2010 Consolidated Revenue | $3.651 billion |

$2.609 billion | ||

| 2010 Consolidated Adjusted EBITDA |

$853 million |

$420 million | ||

| Transaction Details | • Under the terms of the agreement, Global Crossing stockholders will receive 16 shares of Level 3 common stock for each share of Global Crossing common stock or preferred stock that they own at closing. Based on Level 3’s closing stock price on April 8, 2011, the transaction is valued at $23.04 per for each Global Crossing common share which together with their net debt of about $1.1 billion is a total consideration of $3.0 billion.

• Level 3 has received committed senior secured and senior unsecured financing at Financing, Inc. for $1.75 billion.

• Subject to regulatory and other approvals; customary closing conditions.

• The transaction is expected to close before the end of 2011. |

| Strategic Positioning/Rationale | • Creates a unique global services platform anchored by extensive facilities-based assets on three continents connected by undersea cables.

• The combined network will serve a worldwide customer set with owned network in more than 50 countries and reach to more than 70 countries.

• Existing customers will benefit from expanded geographic reach and a combination of intercity and metro networks throughout North America, Latin America and Europe, connected by ~40,000 miles of subsea cables.

• Combined business will offer an extensive portfolio of transport, IP and data solutions, content delivery, data center, colocation and voice services, delivered globally.

• Level 3’s premier position with local and regional enterprises, wholesale and content customers combined with Global Crossing’s expertise serving national and multinational corporations provides enhanced growth opportunities.

• Combined service portfolio and distribution channels will allow the business to better address the needs of enterprises, content providers, carriers and governments throughout North America, Latin America and Europe.

• As a result of revenue growth and synergies, over time, Level 3 expects to have significant Free Cash Flow available for investment in high-return opportunities, including U.S. and international network expansion.

• The transaction is expected to improve Level 3’s credit profile as well as significantly strengthen the company’s balance sheet.

| |

| Financial Highlights | • The acquisition creates a combined company with $6.26 billion of revenue, pro forma combined Adjusted EBITDA of $1.27 billion and $1.57 billion of combined Adjusted EBITDA including expected synergies.

• The transaction is expected to be accretive to Level 3’s Free Cash Flow per share in 2013.

• The transaction is expected to improve Level 3’s credit profile as well as significantly strengthen the company’s balance sheet. On a pro forma basis and including the benefit of expected synergies, the ratio of total debt (including capital leases) to Adjusted EBITDA is expected to improve from approximately 7.6x to 5.0x, or from 6.8x to 4.4x on a net debt to Adjusted EBITDA basis in each case as of Dec. 31, 2010.

| |

| Synergy Highlights | • After integration the transaction is expected to result in annualized Adjusted EBITDA synergies of approximately $300 million and annualized capital expenditure reduction of approximately $40 million.

• Net present value of synergies is projected to be $2.5 billion.

• Approximately two-thirds of the run-rate operating synergies are expected to be realized within the first 18 months of closing.

• Of the total synergies, approximately 39 percent are from network expense savings, approximately 49 percent from operating expense savings, and approximately 12 percent are from capital expenditure synergies. | |

Important Information For Investors And Stockholders

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The proposed transaction will be submitted to the stockholders of Level 3 Communications, Inc. (“Level 3”) and the stockholders of Global Crossing Limited (“Global Crossing”) for their consideration. Level 3 and Global Crossing will file a registration statement on Form S-4, a joint proxy statement/prospectus and other relevant documents concerning the proposed transaction with the SEC. Level 3 and Global Crossing will each provide the final joint proxy statement/prospectus to its respective stockholders. Investors and security holders are urged to read the registration statement and the joint proxy statement/prospectus and any other relevant documents filed with the SEC when they become available, as well as any amendments or supplements to those documents, because they will contain important information about Level 3, Global Crossing and the proposed transaction. Investors and security holders will be able to obtain a free copy of the registration statement and joint proxy statement/prospectus, as well as other filings containing information about Level 3 and Global Crossing free of charge at the SEC’s website at http://www.sec.gov. In addition, the joint proxy statement/prospectus, the SEC filings that will be incorporated by reference in the joint proxy statement/prospectus and the other documents filed with the SEC by Level 3 may be obtained free of charge by directing such request to: Investor Relations, Level 3 Communications, Inc., 1025 Eldorado Boulevard, Broomfield, Colorado 80021 or from Level 3’s Investor Relations page on its corporate website at http://www.level3.com and the joint proxy statement/prospectus, the SEC filings that will be incorporated by reference in the joint proxy statement/prospectus and the other documents filed with the SEC by Global Crossing be obtained free of charge by directing such request to: Global Crossing by telephone at (800) 836-0342 or by submitting a request by e-mail to glbc@globalcrossing.com or a written request to the Secretary, Wessex House, 45 Reid Street, Hamilton HM12 Bermuda or from Global Crossing’s Investor Relations page on its corporate website at http://www.globalcrossing.com.

Level 3, Global Crossing and their respective directors, executive officers, and certain other members of management and employees may be deemed to be participants in the solicitation of proxies in favor of the proposed transactions from the stockholders of Level 3 and from the stockholders of Global Crossing, respectively. Information about the directors and executive officers of Level 3 is set forth in the proxy statement on Schedule 14A for Level 3’s 2011 Annual Meeting of Stockholders, which was filed with the SEC on April 4, 2011 and information about the directors and executive officers of Global Crossing is set forth in the proxy statement for Global Crossing’s 2010 Annual Meeting of Stockholders, which was filed with the SEC on May 19, 2010. Additional information regarding participants in the proxy solicitation may be obtained by reading the joint proxy statement/prospectus regarding the proposed transaction when it becomes available.

Cautionary Notice Regarding Forward-Looking Statements

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, (i) statements about the benefits of the acquisition of Global Crossing by Level 3, including financial and operating results and synergy benefits that may be realized from the acquisition and the timeframe for realizing those benefits; Level 3’s and Global Crossing’s plans, objectives, expectations and intentions and other statements contained in this communication that are not historical facts; and (ii) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning.

These forward-looking statements are based upon management’s current beliefs or expectations and are inherently subject to significant business, economic and competitive uncertainties and contingencies and third-party approvals, many of which are beyond our control. The following factors, among others, could cause actual results to differ materially from those expressed or implied in the forward-looking statements: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Agreement and Plan of Amalgamation among Level 3, Global Crossing and Apollo Amalgamation Sub, Ltd. (the “Amalgamation Agreement”); (2) the inability to complete the transactions contemplated by the Amalgamation Agreement due to the failure to obtain the required stockholder approvals, (3) the inability to satisfy the other conditions specified in the Amalgamation Agreement, including without limitation the receipt of necessary governmental or regulatory approvals required to complete the transactions contemplated by the Amalgamation Agreement; (4) the inability to successfully integrate the businesses of Level 3 and Global Crossing or to integrate the businesses within the anticipated timeframe; (5) the risk that the proposed transactions disrupt current plans and operations, increase operating costs and the potential difficulties in customer loss and employee retention as a result of the announcement and consummation of such transactions; (6) the ability to recognize the anticipated benefits of the combination of Level 3 and Global Crossing, including the realization of revenue and cost synergy benefits and to recognize such benefits within the anticipated timeframe; (7) the outcome of any legal proceedings that may be instituted against Level 3, Global Crossing or others following announcement of the Amalgamation Agreement and transactions contemplated therein; and (8) the possibility that Level 3 or Global Crossing may be adversely affected by other economic, business, and/or competitive factors.

Other important factors that may affect Level 3’s and the combined business’ results of operations and financial condition include, but are not limited to: the current uncertainty in the global financial markets and the global economy; a discontinuation of the development and expansion of the Internet as a communications medium and marketplace for the distribution and consumption of data and video; disruptions in the financial markets that could affect Level 3’s ability to obtain additional financing, and the company’s ability to: increase and maintain the volume of traffic on its network; develop effective business support systems; manage system and network failures or disruptions; develop new services that meet customer demands and generate acceptable margins; defend intellectual property and proprietary rights; adapt to rapid technological changes that lead to further competition; attract and retain qualified management and other personnel; successfully integrate acquisitions; and meet all of the terms and conditions of debt obligations.

Additional information concerning these and other important factors can be found within Level 3’s and Global Crossing’s respective filings with the SEC, which discuss the foregoing risks as well as other important risk factors that could contribute to such differences or otherwise affect our business, results of operations and financial condition. Statements in this communication should be evaluated in light of these important factors. The forward-looking statements in this communication speak only as of the date they are made. Except for the ongoing obligations of Level 3 and Global Crossing to disclose material information under the federal securities laws, neither Level 3 nor Global Crossing undertakes any obligation to, and expressly disclaim any such obligation to, update or alter any forward-looking statement to reflect new information, circumstances or events that occur after the date such forward-looking statement is made unless required by law.