Attached files

©

Level 3 Communications, LLC. All Rights Reserved.

Level 3 and Global Crossing

April 11, 2011

Exhibit 99.2 |

©

Level 3 Communications, LLC. All Rights Reserved.

2

Agenda |

©

Level 3 Communications, LLC. All Rights Reserved.

3

Jim Crowe

CEO, Level 3 |

©

Level 3 Communications, LLC. All Rights Reserved.

4

Transaction Structure

Tax-free, stock-for-stock exchange

Exchange Ratio

16 shares of Level 3 common stock for each share

of Global Crossing’s common and preferred stock

Pro Forma Ownership

57% Level 3 stockholders

43% Global Crossing stockholders

ST Telemedia

Largest shareholder of Global Crossing

Pro forma ownership approximately 25%;

standstill at 34.5%

Board of Director seats proportionate to stock

ownership

Transaction Value and

Multiples

$3.0 billion, including Global Crossing net debt of

$1.1 billion

7.1x 2010 Global Crossing Adjusted EBITDA;

4.2x including synergies

Transaction Summary |

©

Level 3 Communications, LLC. All Rights Reserved.

5

Estimated Synergies

NPV of expected synergies of $2.5 billion

$300 million of annualized Adjusted EBITDA

synergies and $40 million of annualized capital

expenditure synergies; once achieved

Financing

Level 3 Financing, Inc. has a $1.75 billion

financing commitment

Closing Conditions

Regulatory and other approvals; customary

closing conditions

Management Team

Chairman

CEO

CFO

Lead Integration Executive

Timing

Expected to close before year end

Transaction Summary

Walter Scott

Jim Crowe

Sunit Patel

Jeff Stroey |

©

Level 3 Communications, LLC. All Rights Reserved.

6

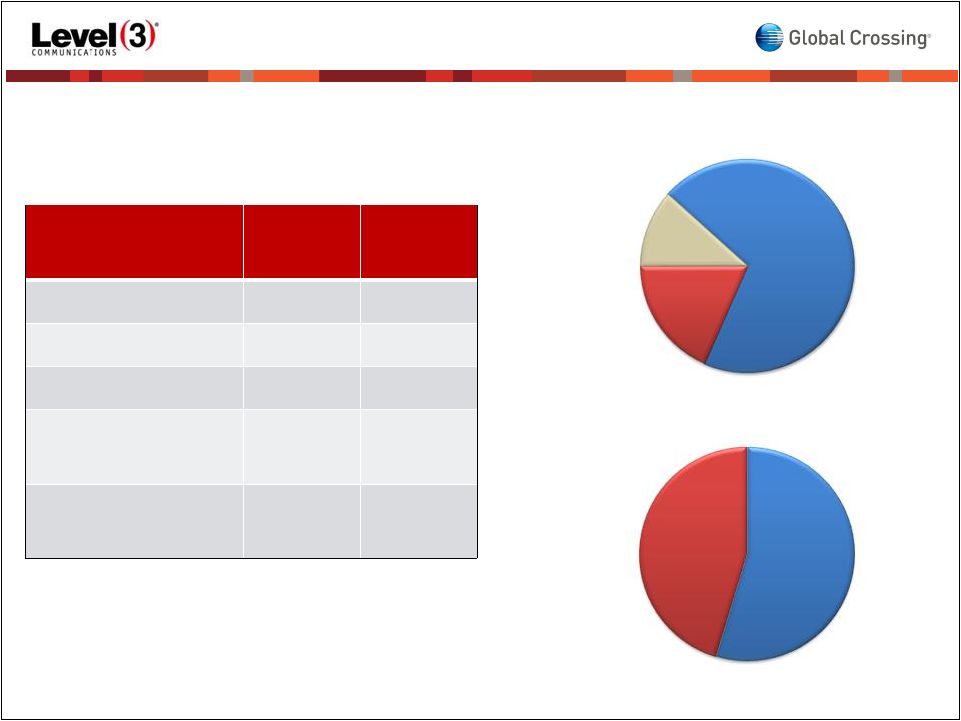

FY 2010 Key Metrics

Pro Forma

(1)

Post

Synergies

(2)

Revenue

$6.26B

Adj EBITDA

(3)

$1.27B

$1.57B

Cash Balance

$988M

Gross Debt/

Adj EBITDA

(3)

6.2x

5.0x

Net Debt/

Adj EBITDA

(3)

5.4x

4.4x

Geographical

Diversification

(4)

(5)

Balanced

Mix

of

Customers

(1)

Latin America

$597

12%

Europe

$939

18%

North America

$3,570

70%

Wholesale

$2,250

44%

Enterprise

$2,856

56%

($ in Millions)

($ in Millions)

(1)

Pro Forma balances represent the combined balances and results of Level 3 and

Global Crossing as of and for the year ended December 31, 2010

(2)

Post Synergies balances represent pro forma balances adjusted for estimated $300

million in network and operating expense synergies post-acquisition,

once achieved (3)

See schedule of non-GAAP metrics for definition and reconciliation to GAAP

measures Combined Company Overview

(4)

2010 Core Network Services plus Invest & Grow Revenue

(5)

Global Crossing Invest & Grow Revenue estimated by Region

|

©

Level 3 Communications, LLC. All Rights Reserved.

7

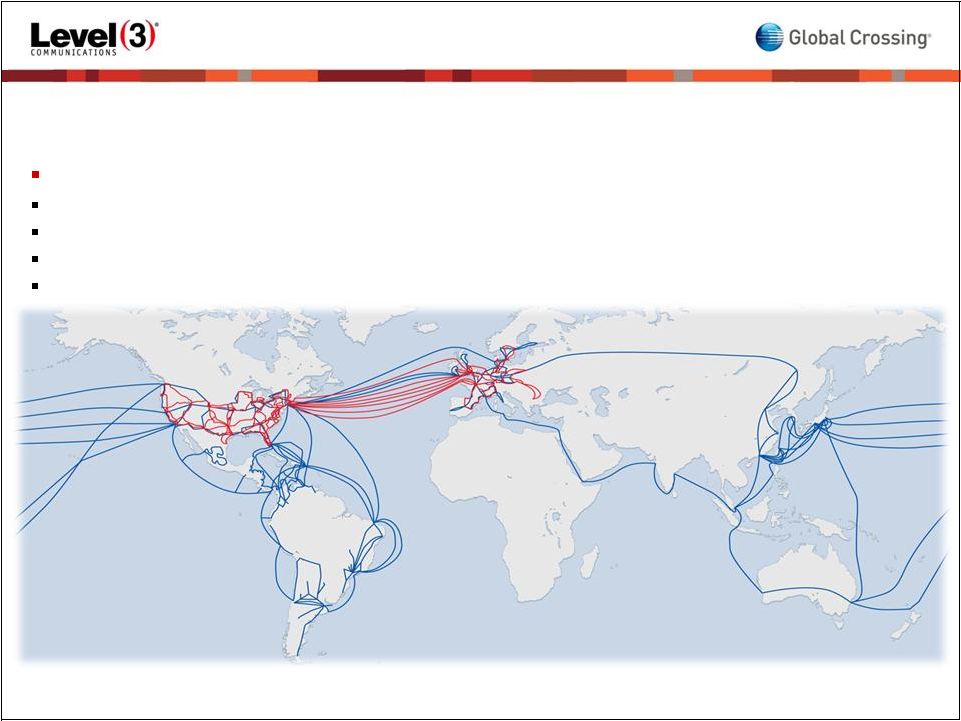

Increased

scale

and

reach

of

the

combined

network

with

intercity

optical/IP

backbones and extensive metro facilities in North America, Europe and Latin

America

Improved service capability and cost structure enhance competitive position of the

combined business Approximately 100,000 intercity and 30,000 metro route

miles on three continents, connected by an extensive global subsea

network Delivering services to approximately 700 markets across 70

countries End-to-end network provides customers with a high level of

reliability and security Extensive global service portfolio

Full portfolio of transport, data, content delivery, data center, colocation and

voice services delivered to customers globally

Global

Crossing

success

with

Virtual

Private

Network

services

is

a

powerful

addition

to

Level

3’s

enterprise

portfolio

Industry leading media delivery capability, including global Content Delivery

Network services and video collection and distribution services

Expanded addressable market

Level 3’s premier position with service providers and content customers

combined with Global Crossing’s expertise serving multinational

corporations provides enhanced growth opportunities Creates a unique global

services platform anchored by extensive facilities- based assets on three

continents connected by undersea cables Strategic Rationale

|

©

Level 3 Communications, LLC. All Rights Reserved.

8

Acquisition creates substantial value for investors

Significant synergies create value

$2.5 billion NPV of expected synergies

$340 million of expected annualized Adjusted EBITDA and capital expenditure

synergies through elimination of duplicative network and operational costs,

primarily in North America Expect to achieve two-thirds of run-rate

synergies within 18 months of closing Provides strong improvement to balance

sheet Stock-based acquisition with substantial synergies provides

significant deleveraging and credit improvement

Level 3 debt to Adjusted EBITDA ratios improve immediately upon transaction

closing, and further improve as synergies are realized

Expected to be accretive to stockholders

Consolidated Free Cash Flow accretive on a per share basis in 2013

Over time, potential for substantial Pro Forma Free Cash Flow generation enables

investment in value accretive opportunities

Strategic Rationale |

©

Level 3 Communications, LLC. All Rights Reserved.

9

John Legere

CEO, Global Crossing |

©

Level 3 Communications, LLC. All Rights Reserved.

10

Power of the Combined Company

A services platform based on a world class set of assets

Multi-conduit, long-haul terrestrial; extensive submarine fiber

networks Metro networks with dense fiber connectivity

Data centers and colocation facilities on three continents

Content delivery technology and intellectual property rights

Level 3

Global Crossing |

©

Level 3 Communications, LLC. All Rights Reserved.

11

Jeff Storey

President and COO, Level 3 |

©

Level 3 Communications, LLC. All Rights Reserved.

12

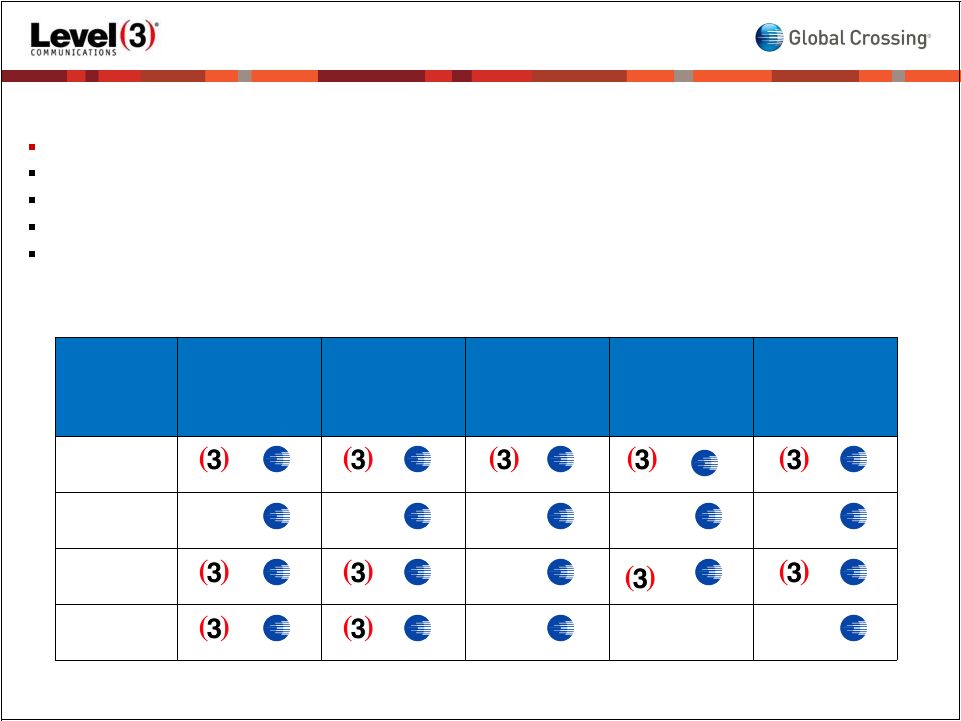

Transport &

Infrastructure

IP Data

Services

Voice &

Collaboration

Services

Colocation

Data Center &

Cloud

Services

CDN &

Broadcast

Services

North

America

Latin

America

Europe

Asia

World-class assets enable robust customer solutions

After closing, a full suite of customer solutions to capture addressable

opportunities. Robust product lines across the full product suite

Broad geographic availability of seamless, high performance customer

solutions Ability to address the complex requirements of integrated

solutions Development capability, intellectual property and resources to

advance the product set |

©

Level 3 Communications, LLC. All Rights Reserved.

13

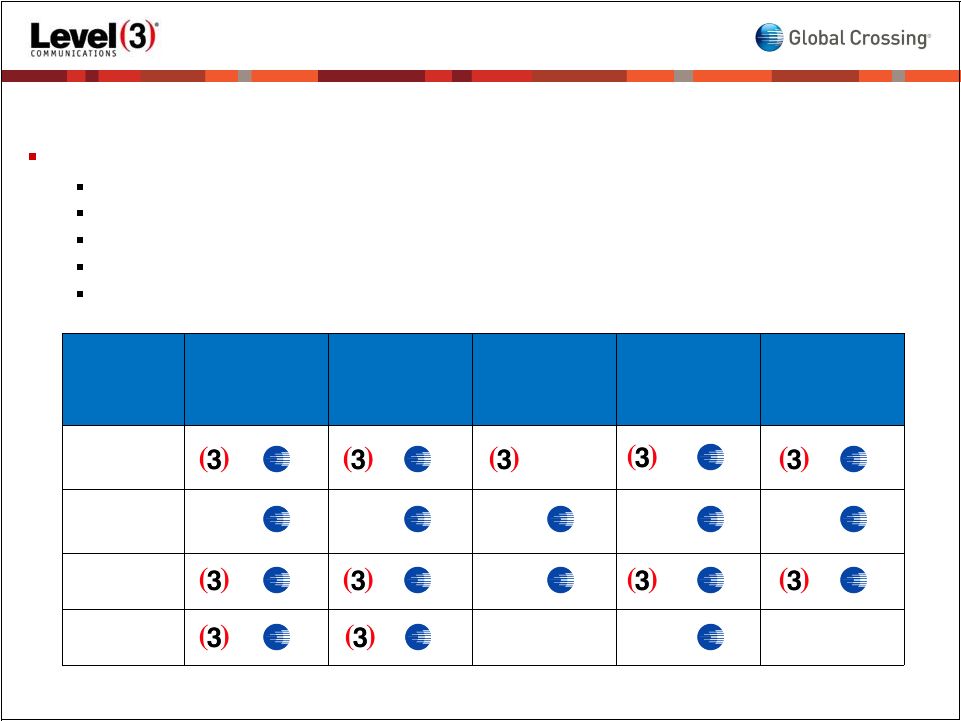

Expanding market opportunity

Strong fundamental demand trends in each market

Sales and service capability with superior market coverage globally

Supported by world class, scalable systems and processes

Customer experience-centric operating philosophy

Strong customer loyalties in each market

Expandable addressable market opportunity should help improve revenue growth

Carrier

Large and

Multinational

Enterprise

Mid-Market

Enterprise

Content

Government

North

America

Latin

America

Europe

Asia |

©

Level 3 Communications, LLC. All Rights Reserved.

14

Integration and Synergy Plan

Integration plan designed to:

Maintain excellent customer service at both

companies

Continue to accelerate revenue growth

Achieve planned synergies

Integration of intercity networks generally

presents less complex issues compared to

previous metro integrations

Joint integration team to develop and execute

a detailed plan

North America and European network focused

Synergy plan is based on milestones

CapEx

Synergies

12%

Note: Synergy percentages are estimates

NetEx

Synergies

39%

OpEx

Synergies

49% |

©

Level 3 Communications, LLC. All Rights Reserved.

15

Sunit Patel

CFO, Level 3 |

©

Level 3 Communications, LLC. All Rights Reserved.

16

Synergies: Create Significant Value

Take advantage of Level 3’s existing asset base, cost structure and

metro access networks

Synergy amounts and timing should be achievable

Network and operating expense synergies represent less than 15% of Global

Crossing’s existing run-rate costs or 6% of combined company costs

Over two-thirds of expected operating and network expense run-rate

synergies expected to be achieved within 18 months of transaction

close Integration costs of approximately $200 to $225 million

NPV of Expected Synergies of $2.5 billion |

©

Level 3 Communications, LLC. All Rights Reserved.

17

2010

Level 3

Combined

Pro Forma

(1)

$ Millions

Stand Alone

Entity

w/Synergies

Revenue

$3,651

$6,260

$6,260

Adjusted EBITDA

(3)

$853

$1,273

$1,573

Adj EBITDA Margin

23.4%

20.3%

25.1%

Capital Expenditures

(2)

$436

$659

$619

Cash Interest Expense

($522)

($677)

($677)

Free Cash Flow

(3)

($97)

($81)

$259

Debt Balance at 12/31

$6,448

$7,909

Cash Balance at 12/31

$616

$988

Gross Debt/Adj EBITDA

(3)

7.6x

6.2x

5.0x

Net Debt/Adj EBITDA

(3)

6.8x

5.4x

4.4x

Combined Company Financials

Both companies expected to

grow Revenue and Adjusted

EBITDA in 2011

Improved credit profile

Ability to reduce cash interest

expense substantially over

time

Net Debt to Adjusted EBITDA

improves from 6.8x to 4.4x

after synergies

Expected improvement in

Free Cash Flow generation

Flexibility to pursue high

return investments in metro,

Europe and Latin America

Continue to target leverage

ratio of 3x-5x

(1)

Pro Forma w/Synergies reflects $300M of network and operating expense synergies

and $40M of capital expenditure synergies

(2)

Capital expenditures include Global Crossing 2010 capital leases

(3)

See schedule of non-GAAP metrics for definition and reconciliation to GAAP

measures |

©

Level 3 Communications, LLC. All Rights Reserved.

18

Summary

Combination creates a premier provider of communications services

meeting the local, national and global needs of enterprises, wholesale

buyers, content owners and governments

Expanded addressable market and service portfolio should help improve

revenue growth

Significant anticipated synergies create stockholder value

Improved credit profile improves financial flexibility

Improves Free Cash Flow generation; expected to be accretive on a Free

Cash Flow per share basis in 2013 |

©

Level 3 Communications, LLC. All Rights Reserved.

Q&A |

20

Important Information For Investors And Stockholders

©

Level 3 Communications, LLC. All Rights Reserved.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any

securities or a solicitation of any vote or approval. The proposed transaction will be

submitted to the stockholders of Level 3 Communications, Inc. (“Level 3”) and the

stockholders of Global Crossing Limited (“Global Crossing”) for their consideration. Level 3 and Global

Crossing will file a registration statement on Form S-4, a joint proxy statement/prospectus and

other relevant documents concerning the proposed transaction with the SEC. Level 3 and

Global Crossing will each provide the final joint proxy statement/prospectus to its respective

stockholders. Investors and security holders are urged to read the registration statement

and the joint proxy statement/prospectus and any other relevant documents filed with the SEC when they

become available, as well as any amendments or supplements to those documents, because they will

contain important information about Level 3, Global Crossing and the proposed

transaction. Investors and security holders will be able to obtain a free copy of the

registration statement and joint proxy statement/prospectus, as well as other filings containing

information about Level 3 and Global Crossing free of charge at the SEC’s Web Site at

http://www.sec.gov. In addition, the joint proxy statement/prospectus, the SEC filings

that will be incorporated by reference in the joint proxy statement/prospectus and the other

documents filed with the SEC by Level 3 may be obtained free of charge by directing such

request to: Investor Relations, Level 3, Inc., 1025 Eldorado Boulevard, Broomfield, Colorado 80021 or from Level

3’s Investor Relations page on its corporate website at http://www.level3.com and the joint proxy

statement/prospectus, the SEC filings that will be incorporated by reference in the joint proxy

statement/prospectus and the other documents filed with the SEC by Global Crossing be obtained

free of charge by directing such request to: Global Crossing by telephone at (800)

836-0342 or by submitting a request by e-mail to glbc@globalcrossing.com or a written request to the

Secretary, Wessex House, 45 Reid Street, Hamilton HM12 Bermuda or from Global Crossing’s Investor

Relations page on its corporate website at http://www.globalcrossing.com. Level 3, Global Crossing and

their respective directors, executive officers, and certain other members of management and

employees may be deemed to be participants in the solicitation of proxies in favor of the proposed

transactions from the stockholders of Level 3 and from the stockholders of Global Crossing,

respectively. Information about the directors and executive officers of Level 3 is set

forth in the proxy statement on Schedule 14A for Level 3’s 2011 Annual Meeting of

Stockholders, which was filed with the SEC on April 4, 2011 and information about the directors and

executive officers of Global Crossing is set forth in the proxy statement for Global

Crossing’s 2010 Annual Meeting of Stockholders, which was filed with the SEC on May 19,

2010. Additional information regarding participants in the proxy solicitation may be obtained

by reading the joint proxy statement/prospectus regarding the proposed transaction when it becomes

available. |

©

Level 3 Communications, LLC. All Rights Reserved.

21

Cautionary Notice Regarding Forward-Looking Statements

This document contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements include, but are not

limited to, (i) statements about the benefits of the acquisition of Global Crossing by Level 3,

including financial and operating results and synergy benefits that may be realized from the

acquisition and the timeframe for realizing those benefits; Level 3's and Global Crossing's plans,

objectives, expectations and intentions and other statements contained in this communication

that are not historical facts; and (ii) other statements identified by words such as

“expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar

meaning.

These forward-looking statements are based upon management's current beliefs or expectations and

are inherently subject to significant business, economic and competitive uncertainties and

contingencies and third-party approvals, many of which are beyond our control. The

following factors, among others, could cause actual results to differ materially from those

expressed or implied in the forward-looking statements: (1) the occurrence of any event, change or

other circumstances that could give rise to the termination of the Agreement and Plan of

Amalgamation among Level 3, Global Crossing and Global Crossing Amalgamation Sub, Ltd. (the

“Amalgamation Agreement”); (2) the inability to complete the transactions

contemplated by the Amalgamation Agreement due to the failure to obtain the required stockholder

approvals, (3) the inability to satisfy the other conditions specified in the Amalgamation

Agreement, including without limitation the receipt of necessary governmental or regulatory

approvals required to complete the transactions contemplated by the Amalgamation Agreement. (4)

the inability to successfully integrate the businesses of Level 3 and Global Crossing or to integrate the businesses within

the anticipated timeframe; (5) the risk that the proposed transactions disrupt current plans and

operations, increase operating costs and the potential difficulties in customer loss and

employee retention as a result of the announcement and consummation of such transactions; (6)

the ability to recognize the anticipated benefits of the combination of Level 3 and Global

Crossing, including the realization of revenue and cost synergy benefits and to recognize such benefits within the

anticipated timeframe; (7) the outcome of any legal proceedings that may be instituted against Level

3, Global Crossing or others following announcement of the Amalgamation Agreement and

transactions contemplated therein; and (8) the possibility that Level 3 or Global Crossing may

be adversely affected by other economic, business, and/or competitive factors.

|

Level 3 Communications, LLC. All Rights Reserved.

22

Cautionary Notice Regarding Forward-Looking Statements

Other important factors that may affect Level 3's and the combined business' results of operations and

financial condition include, but are not limited to: the current uncertainty in the global

financial markets and the global economy; a discontinuation of the development and expansion of

the Internet as a communications medium and marketplace for the distribution and consumption of

data and video; disruptions in the financial markets that could affect Level 3’s ability to

obtain additional financing, and the company’s ability to: increase and maintain the volume of

traffic on its network; develop effective business support systems; manage system and network

failures or disruptions; develop new services that meet customer demands and generate

acceptable margins; defend intellectual property and proprietary rights; adapt to rapid

technological changes that lead to further competition; attract and retain qualified management and other

personnel; successfully integrate acquisitions; and meet all of the terms and conditions of debt

obligations. Additional

information concerning these and other important factors can be found within Level 3’s and Global Crossing’s

respective filings with the SEC, which discuss the foregoing risks as well as other important

risk factors that could contribute to such differences or otherwise affect our business,

results of operations and financial condition. Statements in this communication should be

evaluated in light of these important factors. The forward-looking statements in this

communication speak only as of the date they are made. Except for the ongoing obligations of Level 3

and Global Crossing to disclose material information under the federal securities laws, neither

Level 3 nor Global Crossing undertakes any obligation to, and expressly disclaim any such

obligation to, update or alter any forward-looking statement to reflect new information,

circumstances or events that occur after the date such forward-looking statement is made

unless required by law. |

©

Level 3 Communications, LLC. All Rights Reserved.

23

Non-GAAP Reconciliation |

©

Level 3 Communications, LLC. All Rights Reserved.

24

Pursuant to Regulation G, the company is hereby providing a reconciliation of

non-GAAP financial metrics to the most directly comparable GAAP

measure. The following describes and reconciles those financial measures as

reported under accounting principles generally accepted in the United States

(GAAP) with those financial measures as adjusted by the items detailed below and

presented in the accompanying news release. These calculations are not prepared in

accordance with GAAP and should not be viewed as alternatives to GAAP. In

keeping with its historical financial reporting practices, the company

believes that the supplemental presentation of these calculations provides meaningful non-GAAP financial

measures to help investors understand and compare business trends among different

reporting periods on a consistent basis, independently of regularly reported

non-cash charges and infrequent or unusual events. Management believes

that Adjusted EBITDA and Adjusted EBITDA plus Estimated Synergies are relevant and

useful

metrics

to

provide

to

investors,

as

they

are

an

important

part

of

the

company’s

internal

reporting

and

are

key

measures used by Management to evaluate profitability and operating performance of

the company and to make resource allocation decisions. Management

believes such measures are especially important in a capital-intensive

industry such as telecommunications. Management also uses Adjusted EBITDA and

Adjusted EBITDA plus Estimated Synergies to compare the company’s

performance to that of its competitors and to eliminate certain non- cash

and non-operating items in order to consistently measure from period to period its ability to fund capital

expenditures, fund growth, service debt and determine bonuses. Adjusted

EBITDA excludes non-cash impairment charges and non-cash stock

compensation expense because of the non-cash nature of these items. Adjusted

EBITDA also excludes interest income, interest expense and income taxes because

these items are associated with the company’s capitalization and tax

structures. Adjusted EBITDA also excludes depreciation and amortization

expense because these non-cash expenses reflect the impact of capital

investments which management believes should be evaluated through free cash

flow. Adjusted EBITDA excludes the gain (or loss) on extinguishment of debt

and other, net because these items are not related to the primary operations of the

company. Schedule to Reconcile to Non-GAAP Financial Metrics

|

©

Level 3 Communications, LLC. All Rights Reserved.

25

There are limitations to using non-GAAP financial measures, including the

difficulty associated with comparing companies that use similar performance

measures whose calculations may differ from the company’s calculations.

Additionally, this financial measure does not include certain significant items

such as interest income, interest expense, income taxes, depreciation and

amortization, non-cash impairment charges, non-cash stock

compensation expense, the gain (or loss) on extinguishment of debt and net other

income (expense). Adjusted EBITDA and Adjusted EBITDA plus Estimated

Synergies should not be considered a substitute for other measures of

financial performance reported in accordance with GAAP. Schedule to

Reconcile to Non-GAAP Financial Metrics |

©

Level 3 Communications, LLC. All Rights Reserved.

26

Combined

Total

Revenue

is

defined

as

combined

total

revenue

from

the

Consolidated

Statements

of Operations as

filed in each company’s Annual Report on Form 10-K for the year ended

December 31, 2010. Communications

Revenue

is

defined

as

communications

revenue

from

Level

3

Communications’

Consolidated

Statements of Operations.

Adjusted EBITDA

is defined as net income (loss) from the Consolidated Statements of Operations

before income taxes, total other income (expense), non-cash impairment

charges, depreciation and amortization and non-cash stock compensation

expense. Adjusted

EBITDA

plus

Estimated

Synergies

is

defined

as

Adjusted

EBITDA

plus

the

estimated

synergies resulting

from the combination.

Total Debt,

including

Capital

Leases

is

defined

as

the

current

and

long-term

portions

of

debt

and

obligations under

capital leases as reported in the Consolidated Balance Sheets filed in each

company’s Annual Report on Form 10-K for the year ended December

31, 2010. Cash and

Cash

Equivalents

is

defined

a

the

total

cash

and

cash

equivalents

reported

as

a

component of current

assets in the Consolidated Balance Sheets as filed in each company’s Annual

Report on Form 10-K for the year ended December 31, 2010.

Debt

to

Adjusted

EBITDA

Ratio

is

defined

as

Total

Debt,

including

Capital

Leases

divided

by

Adjusted

EBITDA.

Net

Debt

to

Adjusted

EBITDA

Ratio

is

defined

as

Total

Debt,

including

Capital

Leases

reduced

by

the

Cash and

Cash Equivalents, divided by Adjusted EBITDA.

.

Schedule to Reconcile to Non-GAAP Financial Metrics

|

©

Level 3 Communications, LLC. All Rights Reserved.

27

Free Cash Flow

is

defined

as

net

cash

provided

by

(used

in)

operating

activities

less

capital

expenditures

as

disclosed in the Consolidated Statements of Cash Flows in each company’s

Annual Report on Form 10-K for the year

ended

December

31,

2010.

Management

believes

that

Free

Cash

Flow

and

Free

Cash

Flow

plus

Estimated

Synergies

are

relevant

metrics

to

provide

to

investors,

as

it

is

an

indicator

of

the

company’s

ability

to

generate

cash to service its debt. Free Cash Flow excludes cash used for acquisitions and

principal repayments. There are material limitations to using Free

Cash Flow to measure the company against some of its competitors as

Level

3

does

not

currently

pay

a

significant

amount

of

income

taxes

due

to

net

operating

losses,

and

therefore,

generates

higher

cash

flow

than

a

comparable

business

that

does

pay

income

taxes.

Additionally,

this

financial

measure

is

subject

to

variability

quarter

over

quarter

as

a

result

of

the

timing

of

receipts

or

payments

related to accounts receivable and accounts payable and capital expenditures. This

financial measure should not be used as a substitute for net change in cash

and cash equivalents on the Consolidated Statements of Cash Flows.

Schedule to Reconcile to Non-GAAP Financial Metrics

|

©

Level 3 Communications, LLC. All Rights Reserved.

28

Schedule to Reconcile Non-GAAP Financial Metrics

Combined Revenue

($ in millions)

Level 3

Communications

Global Crossing

Combined

Revenue:

Communications

$3,591

$2,609

$6,200

Coal

60

-

60

Total Revenue

$3,651

$2,609

$6,260

Year Ended December 31, 2010 |

©

Level 3 Communications, LLC. All Rights Reserved.

29

Schedule to Reconcile Non-GAAP Financial Metrics

Adjusted EBITDA Metrics

Global Crossing

($ in millions)

Communications

Other

Consolidated

Consolidated

Combined

Net Loss applicable to common shareholders

($617)

($5)

($622)

($176)

($798)

Preferred Stock Dividends

-

-

-

4

4

Income Tax Benefit

(91)

-

(91)

(5)

(96)

Total Other (Income) Expense

620

3

623

240

863

Depreciation and Amortization

870

6

876

337

1,213

Non-cash Stock Compensation

67

-

67

20

87

Adjusted EBITDA

$849

$4

$853

$420

$1,273

Estimated Synergies

$300

Adjusted EBITDA plus Estimated Synergies

$1,573

Year Ended December 31, 2010

Level 3 Communications |

©

Level 3 Communications, LLC. All Rights Reserved.

30

Schedule to Reconcile Non-GAAP Financial Metrics

Adjusted EBITDA Ratios

($ in millions)

Level 3

Communications

Global Crossing

Combined

Combined with

Synergies

Total Debt, including capital leases

$6,448

$1,461

$7,909

$7,909

Cash and cash equivalents

616

372

988

988

Net Debt

$5,832

$1,089

$6,921

$6,921

Adjusted EBITDA

$853

$420

$1,273

$1,573

Debt to Adjusted EBITDA Ratio

7.56

3.48

6.21

5.03

Net Debt to Adjusted EBITDA Ratio

6.84

2.59

5.44

4.40

Year Ended December 31, 2010 |

©

Level 3 Communications, LLC. All Rights Reserved.

31

Schedule to Reconcile Non-GAAP Financial Metrics

Free Cash Flow

($ in millions)

Level 3

Communications

Global Crossing

Combined

Combined with

Synergies

Net Cash Provided by Operating Activities

$339

$183

$522

$822

Capital Expenditures

(436)

(167)

(603)

(563)

Free Cash Flow

($97)

$16

($81)

$259

Year Ended December 31, 2010 |