Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TPC Group Inc. | d8k.htm |

A

Valuable, Unique & Stable Bridge from Mixed C4 to Purity Products

A Service-Based Intermediary

with Strong Infrastructure

& Logistics Network

Spring Update

Exhibit 99.1 |

Forward-Looking Statements & Non-GAAP Financial Measures

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

securities

laws.

These

statements

include

assumptions,

expectations,

predictions,

intentions

or

beliefs

about

future

events,

particularly

statements

that

may

relate

to

future

operating

results,

existing

and

expected

competition,

market

factors

that

may

impact

financial

performance,

and

plans

related

to

strategic

alternatives

or

future

expansion

activities

and

capital

expenditures.

Although

TPC

Group

believes

that

such

statements

are

based

on

reasonable

assumptions,

no

assurance

can

be

given

that

such

statements

will

prove

to

have

been

correct.

A

number

of

factors

could

cause

actual

results

to

vary

materially

from

those

expressed

or

implied

in

any

forward-looking

statements,

including

risks

and

uncertainties

such

as

volatility

in

the

petrochemicals

industry,

limitations

on

the

Company’s

access

to

capital,

the

effects

of

competition,

leverage

and

debt

service,

general

economic

conditions,

litigation

and

governmental

investigations,

and

extensive

environmental,

health

and

safety

laws

and

regulations.

More

information

about

the

risks

and

uncertainties

relating

to

TPC

Group

and

the

forward-looking

statements

are

found

in

the

Company’s

SEC

filings,

including

the

Transition

Report

on

Form

10-K,

which

are

available

free

of

charge

on

the

SEC’s

website

at

http://www.sec.gov

.

TPC

Group

expressly

disclaims

any

obligation

to

update

any

forward-

looking

statements

contained

herein

to

reflect

events

or

circumstances

that

may

arise

after

the

date

of

this

presentation.

This

presentation

may

also

include

non-GAAP

financial

information.

A

reconciliation

of

non-GAAP

financial

measures

to

the

most

directly

comparable

GAAP

financial

measures,

as

well

as

additional

detail

regarding

the

utility

of

such

non-GAAP

financial

information,

is

included

in

the

Appendix.

2 |

Business Overview

3

•

We manufacture products in high demand that support global

mobilization

–

Rubber, fuel & lube additives = 75% of our end market applications

–

US car ownership 800/1000, Asia car ownership 40/1000

•

…From feedstocks that are in tight supply

–

Light/heavy steam cracker feedstocks = roughly 80/20%

–

Limits C4 availability + butadiene content

•

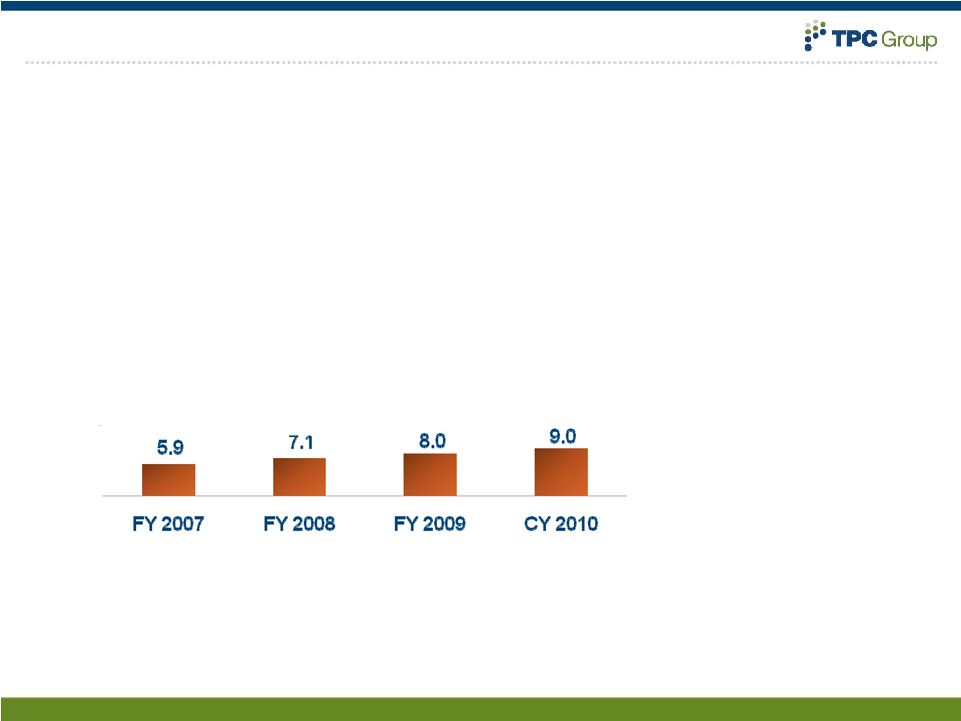

…That produces stable margins*

•

…

And has room to grow

–

$150M Adjusted EBITDA forecasted for 2012 ($107M in calendar

2010) –

Potential impact from dehydrogenation project

In cents/lb

*FY

2009

reflects

the

first

installment

of

the

insurance

claim

of

$10.0

million,

as

well

as

the

unauthorized

freight

payment

recovery

of

$4.7

million.

CY

2010

reflects

the

full

installment

of

the

insurance

claim

of

$17.1

million |

Products Overview

4

Performance Products

Crude C4 Processing

Butadiene

Polyisobutylene

“PIB”

HR-PIB

Conventional

PIB

Gasoline &

Lube

Additives

Isobutylene

Products

Isobutylene

Diisobutylene

Phenolic

Resins

Surfactants

Fuel & Lube

Additives

Propylene

Derivatives

Nonene

Tetramer

Plasticizers

Lube Additives

Surfactants

Antioxidants

Butene-1

Raffinates

& MTBE

Butylenes

Butane

Gasoline

Blendstocks

Synthetic

Rubber

Elastomers

Nylon

Polyethylene

Fuel

Additives

Broad Product Portfolio |

TPC

Group: Substantial & Strategic Asset Value 5

|

Aligned With Industry Growth

6

Goodyear

Lanxess

Invista

Afton / Newmarket

Macro, global market assumptions:

•

Cars in use:

•

2000-2010: +150 million

•

2010-2020: +240 million

•

+50 million tires/year, 2011-2015

•

2010-2013 CAGR:

•

18% in consumer replacables

•

42% in commercial replacables

Source: company reports

•

Hi-performance rubber capacity expansion

•

U.S., Brazil, Germany

•

Hi-performance tire growth globally expected to

be 53% from 2010 to 2015

•

“…[from 2009 to 2010] All business units [within

Performance Polymers] increased prices,

overcompensating higher raw material prices –

especially butadiene

•

Announcement of New Nylon 6,6

Intermediates and Polymer Plant in Shanghai

(2/2011)

•

Commence production in 2014

•

“…

will employ Invista's latest advances in its

proprietary butadiene-based technology.”

Outlook for 2011

•

“We expect 2011 to be more profitable than

2010 as we project an increase in volume,

revenue and net income.”

•

“Our primary focus in the acquisition area

remains on the petroleum additives industry. It is

our view that this industry will provide the

greatest opportunity for a good return on our

investments, while minimizing risk.”

Our customers are experiencing and expecting growth |

Business Segments –

C4 Processing & Performance Products

7

C4 Processing

Performance Products

21% Performance

Products

34% Performance

Products

14.6¢/lb

2.9 Billion lbs.

(CY 2010)

$268.1 Million

(CY 2010)

79% C4 Processing

66% C4 Processing

7.6¢/lb |

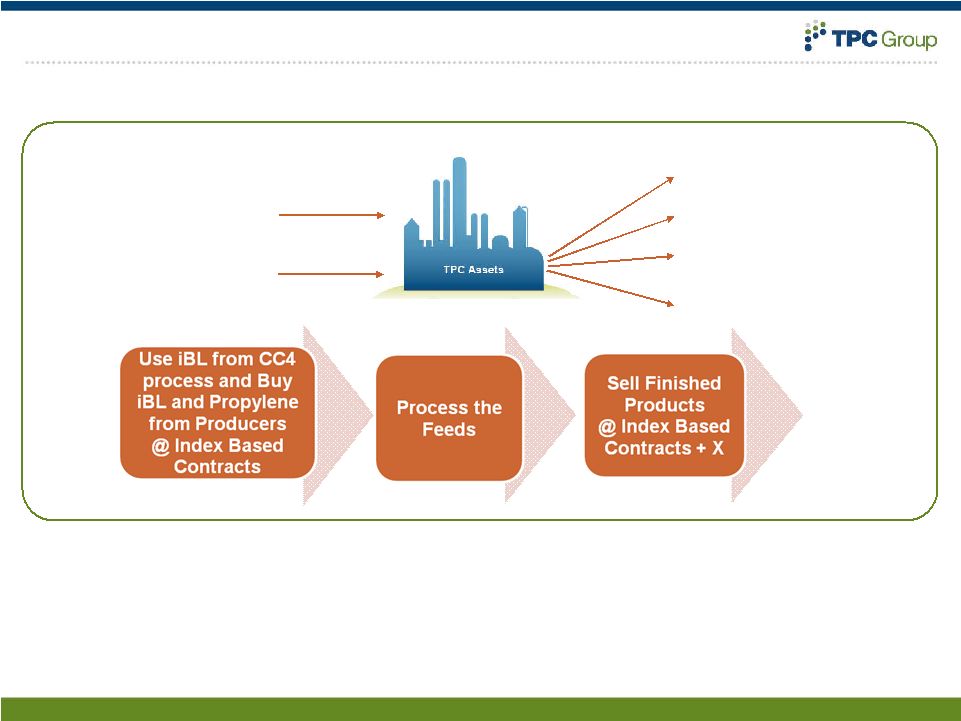

C4

Processing: What We Do 8

•

Relatively

Stable

Unit

Margins

Cash

flow

generation

throughout

the

cycle

•

Service-based contracts and almost 2 inventory

turns/month

Mitigate

Commodity

Risk

•

No exposure to exchange rate movements

Ethylene Plants

Ethylene

Propylene

C

4

‘s

B-1

BD

Raffinates

Isobutylene |

Unique, Long-standing Relationships with Customers and

Suppliers

9

»

Customers and suppliers put their trust in TPC

»

Customers rely on TPC for securing raw materials, which they cannot make or

significantly import »

Suppliers rely on TPC for taking their Crude C4s, which they cannot purify and cannot

store »

Large chemical producing and refining customer base, large established supplier and

customer base »

Long term relationships

Customers

Feedstock Suppliers

•

Premier processing reliability record

•

Major Crude C4 processor for fifteen

ethylene plants

•

Highest Crude C4 processing capacity in

North America

•

Five separate processing units at two

independent sites

•

Processing relationships with ten Crude C4

suppliers that exceed fifteen years

•

Crude C4 processor for every non-

integrated North American ethylene

producer

Critical Component in the Ethylene Value Chain |

Crude C4 Market Fundamentals

10

Source: CMAI; Light: Ethane, Propane Butane / Heavy: Naphtha, Fuel Oil; ytd through

February Ethylene Cracker Rates

B/E Ratio

Source: CMAI

Source: CMAI

Feed to US Steam Crackers |

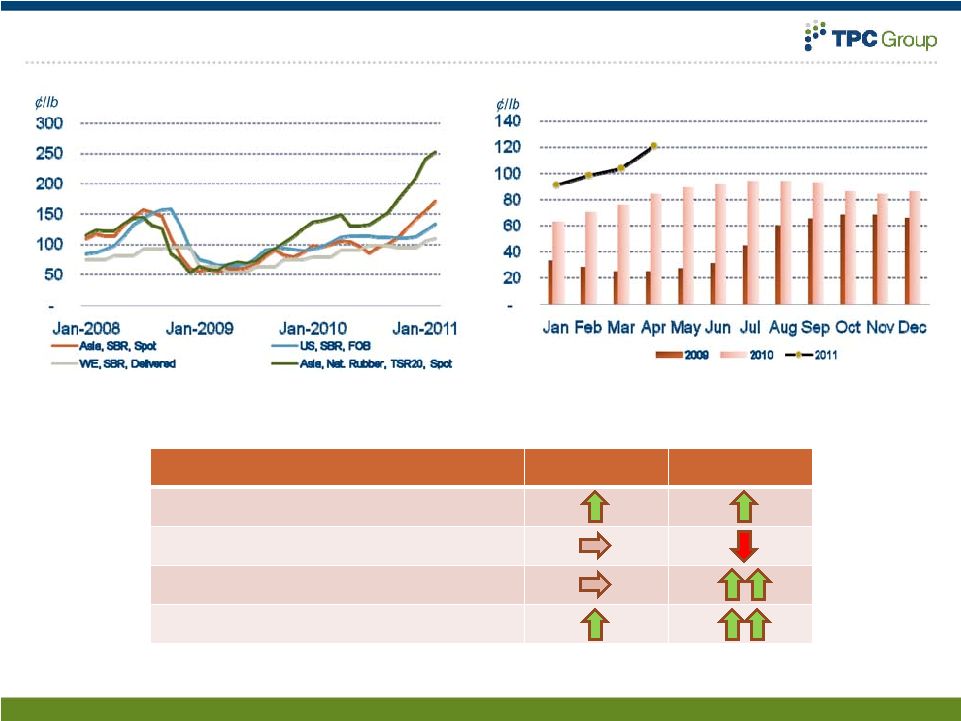

Butadiene Market Fundamentals

11

Source: CMAI

Source: CMAI

Butadiene Market Drivers

Near Term

Long Term

Steam cracker rates

B/E ratio

End-market supply/demand

Global commodity prices

U.S. Butadiene Price

Global Synthetic and Natural Rubber Prices |

Performance Products: What We Do

12

Isobutylene (iBL)

PIB

HPIB

Nonene/

Tetramer

DIB

Propylene |

Performance Products –

Description

13

Market Dynamics

Growth Opportunities

Products

Description

PIB

(polyisobutylene)

HR-PIB

(highly reactive -

polyisobutylene)

•

1/3 of performance

product volume

•

75% of end-market lube

and fuel additives

•

HR-PIB, patent protected

•

Historically highest

margins across product

slate

•

Concentrated fuel and lube

additive end-market users

•

Limited merchant capacity

•

Steady HR-PIB global growth of

5-7%/ yr

DIB

(diisobutylene)

•

70% of end-market lube

and fuel additives

•

Specialized chemical applications

•

Very few producers

•

De-bottlenecking projects

•

Impact of Japan

Propylene

Derivatives

(nonene & tetramer

•

Produced from Baytown

plant; only dedicated

nonene and tetramer

plant in N.A.

•

All product sold to single

customer

•

Follows global growth of end-

markets: plasticizers, detergents,

fuel additives

•

De-bottlenecking projects |

Clear Path To 2012 EBITDA Target of $150 Million

14

Notes:

2009

EBITDA

excludes

fees

associated

with

opportunistic

/

non-recurring

inventory

handling

•

Fee structure enabling continued

improvement in ROIC

•

Margin expansion mainly in performance

products

•

Predominantly sold-out;

limits near term volume

expansion

•

High ROI projects support

margin growth

•

$83/bbl crude oil assumption

2010

2012 |

Dehydrogenation Project

•

Asset

–

Unit was mothballed in 2007, and

predominately manufactured MTBE

•

Opportunity

–

Feedstock: isobutane

–

Output: Isobutylene

–

But flexible

15

•

Rationale

–

Feedstock constrained

–

Construction costs below greenfield

–

NGL economics

•

Current Activity

–

$5 million for engineering study

–

Potentially $10 million more in 2011 |

Dehydrogenation Project

16

Isobutane (iC4)

Dehydro Unit

•

$100-$150 million capital

investment

•

3 years

•

Expected return 18-24%

Isobutylene (iBL)

600-650 mmppy

to Performance Products

•Polyisobutylene

•Diisobutylene

2005-2010

2010

2011 ytd

Isobutane

72

76

71

MTBE

116

114

114

% of Unleaded Regular Gasoline, spot price

Source: Platt’s

to gas blendstock production

•MTBE / ETBE |

Conclusion

Differentiated Service-Based Business Model Following Mobility Megatrend

•

Asia move towards mobility and urbanization driving global demand for our

products •

Long-standing, service-based contracts limit exposure to commodity

prices Feedstock supply secured through multi-year contracts

Positioned for Margin Expansion and Growth

•

Commodity strength and global GDP growth enhancing product need

•

Clear path towards 2012 expectations

•

Capital plan to enhance earnings base

Significant Free Cash Flow

•

Strong focus on operational excellence and cost management

•

Steady cash flow ‘through the cycle’

17 |

Appendix

18 |

TPC

Manufacturing Overview 19

Three World-Scale Facilities

Source: Company data |

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

End of Qtr BD Contract Price ($/lb) (1)

0.86

0.93

0.92

0.76

0.65

Unleaded Gasoline Qtr Avg - USGC ($/gal) (2)

2.18

2.00

2.11

2.06

1.91

US Ethylene Industry Capacity Utilization (%) (3)

88.0

92.3

87.6

85.5

87.3

US BD Production (mm lbs) (3)

813

838

820

795

831

(1) Source: CMAI

(2) Source: Platts

(3) Source: Hodson

Quarter Ended

20

Selected Market Data |

21

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Revenue ($mm)

394.6

$

397.9

$

424.5

$

299.7

$

337.4

$

Gross Profit ($mm)

40.2

47.3

51.4

39.3

35.2

Adj. EBITDA ($mm)*

15.7

23.8

26.1

14.7

12.3

Volume (mm lbs)

597.2

587.1

644.7

531.0

680.6

Gross Profit/lb

0.07

$

0.08

$

0.08

$

0.07

$

0.05

$

Adj. EBITDA/lb

0.03

0.04

0.04

0.03

0.02

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Revenue ($mm)

91.5

$

101.5

$

107.3

$

101.0

$

78.4

$

Gross Profit ($mm)

19.0

24.0

26.4

20.4

13.8

Adj. EBITDA ($mm)*

9.2

14.6

17.2

11.4

4.5

Volume (mm lbs)

141.0

161.6

158.0

153.7

140.8

Gross Profit/lb

0.13

$

0.15

$

0.17

$

0.13

$

0.10

$

Adj. EBITDA/lb

0.07

0.09

0.11

0.07

0.03

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Revenue ($mm)

486.1

$

499.4

$

531.8

$

400.7

$

415.8

$

Gross Profit ($mm)

59.2

71.3

77.8

59.7

49.0

Adj. EBITDA ($mm)*

24.9

38.4

43.3

26.1

16.8

Volume (mm lbs)

738.2

748.7

802.7

684.7

821.4

Gross Profit/lb

0.08

$

0.10

$

0.10

$

0.09

$

0.06

$

Adj. EBITDA/lb

0.03

0.05

0.05

0.04

0.02

C4 Processing

Performance Products

Total Operating Segments (excludes Corporate)

Quarter Ended

Quarter Ended

Quarter Ended

* See slide 24 for discussion of Adjusted EBITDA and slide 25 for a reconciliation

of Adjusted EBITDA to Net Income for all periods presented . Net Income

(Loss) is the GAAP measure most directly comparable to Adjusted EBITDA.

Selected Operating Results |

22

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Sales Volumes (mm lbs) (1)

738.2

748.7

802.7

684.7

821.4

Sales Revenue ($mm)

486.1

499.4

531.8

400.7

415.8

Adjusted EBITDA ($mm)

C4 Processing

15.7

23.8

26.1

14.7

12.3

Performance Products

9.2

14.6

17.2

11.4

4.5

Corporate

(5.9)

(5.3)

(7.8)

(7.0)

(6.7)

Adjusted EBITDA (2)

19.0

33.1

35.5

19.1

10.2

Adjusted EBITDA per pound

0.03

0.04

0.04

0.03

0.01

Operating Segment Adjusted EBITDA per pound (3)

0.03

0.05

0.05

0.04

0.02

(1) Does not include tolling volume.

(2) See footnote on slide 24

(3) Adjusted EBITDA for the C4 Processing and Performance Products

operating segments - i.e. total Adjusted EBITDA less Corporate.

Quarter Ended

(Unaudited)

Selected Financial Data |

23

SEC Disclosure Information

ADJUSTED EBITDA –

REVISION OF PREVIOUSLY REPORTED AMOUNTS

We calculate Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization (EBITDA), which is then adjusted to remove or add

back certain items. Net Income (Loss) is the GAAP measure most directly

comparable to Adjusted EBITDA. As shown in the table below, we have revised

previously reported

Adjusted EBITDA for the C4 Processing segment for the quarter ended December 31,

2009 to remove the effect of the business interruption insurance recovery of

$17.1 million. We have concluded that removal of this item, which we consider

to be non-recurring in nature, enhances the period-to-period comparability of our

operating results and is more useful to securities analysts, investors and other

interested parties in their understanding of our operating performance. Our calculation

of Adjusted EBITDA may be different from the calculation used by

other companies; therefore, it may not be comparable to other companies.

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Adjusted EBITDA - as previously reported ($mm)

C4 Processing

23.8

$

26.1

$

14.7

$

29.4

$

Performance Products

14.6

17.2

11.4

4.5

Corporate

(5.3)

(7.8)

(7.0)

(6.7)

33.1

$

35.5

$

19.1

$

27.2

$

Adjusted EBITDA - current definition ($mm)

C4 Processing

15.7

$

23.8

$

26.1

$

14.7

$

12.3

$

Performance Products

9.2

14.6

17.2

11.4

4.5

Corporate

(5.9)

(5.3)

(7.8)

(7.0)

(6.7)

19.0

$

33.1

$

35.5

$

19.1

$

10.2

$

Quarter Ended

(Unaudited) |

24

(*)

Adjusted

EBITDA

is

presented

and

discussed

herein

because

management

believes

it

enhances

understanding

by

investors

and

lenders

of

the

Company’s

financial

performance.

Adjusted

EBITDA

is

not

a

measure

computed

in

accordance

with

GAAP.

Accordingly

it

does

not

represent

cash

flow

from

operations,

nor

is

it

intended

to

be

presented

herein

as

a

substitute

for

operating

income

or

net

income

as

indicators

of

the

Company’s

operating

performance.

Adjusted

EBITDA

is

the

primary

performance

measurement

used

by

senior

management

and

our

Board

of

Directors

to

evaluate

operating

results

of,

and

to

allocate

capital

resources

between,

our

business

segments.

We

calculate

Adjusted

EBITDA

as

earnings

before

interest,

taxes,

depreciation

and

amortization

(EBITDA),

which

is

then

adjusted

to

remove

or

add

back

certain

items..

These

items

are

identified

above

in

the

Reconciliation

of

Adjusted

EBITDA

to

Net

Income

(Loss),

the

GAAP

measure

most

directly

comparable

to

Adjusted

EBITDA.

Our

calculation

of

Adjusted

EBITDA

may

be

different

from

calculations

used

by

other

companies;

therefore,

it

may

not

be

comparable

to

other

companies.

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Net income (loss)

(0.7)

$

12.8

$

14.4

$

4.1

$

8.4

$

Income tax expense

(1.6)

6.9

7.9

2.7

6.0

Interest expense, net

11.1

3.2

4.0

3.5

3.8

Depreciation and amortization

9.9

9.9

9.8

9.8

9.9

EBITDA

18.7

32.8

36.1

20.1

28.1

Non-cash stock based compensation

0.3

0.3

0.5

-

0.3

Unrealized gain on derivatives

-

-

(1.1)

(1.0)

(1.2)

BI insurance recoveries

-

-

-

-

(17.1)

Adjusted EBITDA (*)

19.0

$

33.1

$

35.5

$

19.1

$

10.1

$

Quarter Ended

(Unaudited, in millions)

Reconciliation of Adjusted EBITDA to Net Income |

25

Adjusted EBITDA would distort comparability between the periods presented.

The following table provides a reconciliation of Adjusted EBITDA to Net Income

(Loss) (in thousands) for the 2010 calendar year ended December 31, 2010 and

the three most recent fiscal years ended June 30, 2010, 2009 and 2008. Net

Income (Loss) is the most directly comparable GAAP measure reported in the

Consolidated Statements of Operations. Reconciliation of Adjusted EBITDA to

Net Income Calendar Year

Ended Dec. 31,

2010

2010

2009

2008

2007

Net income (loss)

31

$

31

$

(23)

$

27

$

21

$

Income tax expense (benefit)

16

19

(12)

15

14

Interest expense, net

22

15

17

19

17

Depreciation and amortization

39

40

42

36

29

EBITDA

108

104

24

96

81

Impairment of assets

-

-

6

-

-

Loss on sale of assets

-

-

-

1

1

Non-cash stock-based

compensation 1

1

6

6

5

Unrealized (gain) loss on derivatives

(2)

(3)

4

(0)

(0)

Adjusted EBITDA as previously reported

107

102

40

104

86

Unauthorized freight (recoveries) payments

-

-

(5)

0

0

Business interruptions insurance

recoveries -

(17)

(10)

-

-

Adjusted EBITDA - current

definition 107

$

85

$

26

$

104

$

86

$

Fiscal Year Ended June 30, |